Higher U.S. inflation is dashing investors’ hopes for multiple Federal Reserve rate cuts this year, while opening the door to 5% Treasury yields across the board and cleaving the stock market into distinct categories of winners and losers.

Source link

Uncertainty

Fidelity files registration statement for Ethereum ETF despite regulatory uncertainty

Fidelity Investments has taken another step in its effort to launch a spot Ethereum ETF, filing a registration statement on March 27 despite the uncertain regulatory landscape.

The move follows a previous filing by Cboe, the exchange planned for this ETF, which submitted a form 19b-4 to the SEC on Fidelity’s behalf in November 2023.

Fidelity’s actions, alongside those of other firms aiming to introduce spot ether ETFs, illustrate the growing interest in integrating digital assets into traditional financial products. Yet, obtaining regulatory approval presents a notable challenge, highlighting the evolving and uncertain nature of crypto regulation.

S-1 filing

The company’s recent Form S-1 filing marks an essential step in seeking SEC approval for the Fidelity Ethereum Fund to begin trading. The regulator must approve both the 19b-4 and S-1 forms before the fund can trade,

Fidelity’s latest submission did not disclose the fund’s details, such as the ticker and fees. However, it detailed the fund’s intention to stake a portion of its assets with one or more staking infrastructure providers, anticipating that staking rewards of ether could count as income for federal income tax purposes.

Fidelity Digital Asset Services, serving as the fund custodian, will exclusively maintain the private keys associated with any staked ETH, ensuring security for the fund’s operations.

The regulator is expected to decide on ETFs that directly hold ETH by late May. However, industry experts predict the SEC may not be as open to Ethereum as Bitcoin.

Uncertain landscape

The SEC’s approval of spot Bitcoin ETFs in January led to expectations of a potential opening for other cryptocurrency-based investment products. However, the regulator said at the time that the approval did not mean the regulator had softened its stance toward the digital asset industry.

The Ethereum Foundation recently revealed it was under scrutiny by an unnamed “state authority,” triggering concerns about the impact on Ethereum’s future and the approval of related ETFs.

The inquiry has led to speculation about its implications for Ethereum’s market performance and regulatory status.

Meanwhile, Republican lawmakers are pressing the SEC for clarity on Ethereum’s regulatory classification, highlighting the need for definitive guidance to mitigate market uncertainties.

Despite this, the industry remains optimistic about the approval of Ethereum ETFs, citing previous engagements with the SEC over Bitcoin ETFs as a positive precedent.

The post Fidelity files registration statement for Ethereum ETF despite regulatory uncertainty appeared first on CryptoSlate.

Expedia Group Inc.’s stock on Friday headed for its lowest in nearly three months after Wall Street cast doubt on the online travel company’s immediate future amid a surprise CEO change.

Expedia

EXPE,

late Thursday reported a quarterly beat, but spooked investors by announcing that Chief Executive Peter Kern is stepping down in May. Kern will be replaced by Ariane Gorin, who most recently served as president of Expedia for Business.

The stock is on track for its lowest close since Nov. 14, when it closed at $122.63, and looking at its largest one-day percentage drop since March 16, 2020, when it fell 21.44%. It was the worst performer on the S&P 500 index

SPX.

Ultimately, Expedia has “a lot to work through” in the first half of the year and faces “more uncertainty” this year with the CEO change, BofA Securities analyst Justin Post said in a note Friday. Post downgraded his rating on Expedia’s stock to the equivalent of hold.

“We see a few new overhangs on the stock that could limit multiple expansion and performance vs peers,” he wrote, including a longer-than-expected recovery for Expedia-owned vacation-rental company VRBO, a growth strategy that includes higher marketing spending in international markets where competitors are strongest, and a CEO departure that added to the execution challenges that the company is facing.

“We would look for better evidence of VRBO recovery and One Key benefits to get more constructive on the stock, along with less perceived guidance risk,” Post said.

One Key is Expedia’s new loyalty program, launched last year, that unifies customer rewards for its main brands, including VRBO and Hotels.com.

Other analysts were more sanguine about the CEO change. It came as a surprise, but the transition is likely to be smooth given Gorin’s background and experience, Naved Khan with B. Riley Securities said in his note.

Kern “effected a successful turnaround since taking over as CEO in 2020 and hands over the reins to an experienced [executive],” he said. “Overall, we’re positive on the succession.”

Khan’s optimism on Expedia includes the company’s above-market growth rate and margin expansion projected for this year, reduced costs, strength in the business-to-business segment, and accretion from an “aggressive share” buyback program.

Jed Kelly at Oppenheimer also had a more positive on Expedia, saying that he’d “take advantage of any share price weakness” after the company’s guidance implied bigger margins on higher operating efficiencies and revenue growth of about 10%.

While the CEO change added “an extra layer of complication,” there was something for bears and bulls in the company’s latest quarter and guidance, UBS analyst Stephen Ju said.

“Expedia remains a self-help execution story, with major product updates (such as One Key) rolling out in 2024 that can change its gross bookings, revenue, and profit growth trajectories,” Ju said.

“The likelihood for success or failure of these initiatives in our view depends on management. And the CEO change announced concurrently with earnings … during what is a pivotal year for Expedia as it switches to offense, does give us an additional reason to wait for incremental signs that the company can deliver on guidance parameters.”

Ju kept his rating on Expedia shares at the equivalent of neutral.

On the plus side, Expedia is gathering more traffic and transactions from businesses, making it less reliant on online searchers and bookings, and is being “more agile” in terms of product development, among other positives.

For the bears, however, there’s the fact that the company faces uncertainty regarding the return on investments made on One Key and there’s the likely increase in marketing to drive its global expansion, plus the CEO change “amidst a crucial period for execution and new product rollout.”

Shares of Expedia are up 11% so far this year, compared with an advance of about 23% for the S&P. The stock has had a rough start to the year, down 14% so far, contrasting with gains of more than 5% for the broader equity index.

Fed’s Daly says it makes sense to wait on interest-rate policy given all the uncertainty

The Federal Reserve should wait and see how the economy develops given the high uncertainty surrounding the outlook for the U.S. economy, San Francisco Fed President Mary Daly said Friday.

“When we know where we’re going and it’s important to get there, moving aggressively makes sense,” Daily said in a speech to a banking conference in Frankfurt. But she noted that sometimes a “different type of boldness is required: the boldness to wait.”

Daly added: “When uncertainty is high and the risks to our objectives more balanced, we need to practice gradualism. That means the Fed is saying, We don’t know yet.”

Traders in derivative markets now expect the Fed to remain on hold until next May and that the next move will be to cut rates. The central bank last raised its benchmark rate to between 5.25%-5.5% in July.

Daly said Fed officials are not certain whether inflation is on track to return to 2%. She said the central bank is also not sure whether all the negative effects from past tightening have hit the economy.

“And we are uncertain about whether the dynamics we observe today are cyclical remnants of the post-pandemic recovery or indicators of structural shifts and a new normal for the national and global economy,” Daly added.

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

rose slightly to 4.44% in early trading on Friday.

CME Bitcoin futures hit record high, but uncertainty looms above $36K

Bitcoin futures open interest at the Chicago Mercantile Exchange (CME) hit an all-time high of $3.65 billion on Nov. 1. This metric considers the value of every contract in play for the remaining calendar months, where buyers (longs) and sellers (shorts) are continually matched.

Bullish momentum on CME Bitcoin futures, but cautious BTC options markets

The number of active large holders surged to a record 122 during the week of Oct. 31, signaling a growing institutional interest in Bitcoin (BTC). Notably, the Bitcoin CME futures premium reached its highest level in over two years.

In neutral markets, the annualized premium typically falls within the 5%–10% range. However, the latest 15% premium for CME Bitcoin futures stands out, indicating a strong demand for long positions. This also raises concerns, as some may be relying on the approval of a spot Bitcoin exchange-traded fund.

Contradicting the bullish sentiment from CME futures, evidence from Bitcoin options markets reveals a growing demand for protective put options. For instance, the put-to-call open interest ratio at the Deribit exchange reached its highest levels in over six months.

The current 1.0 level signifies a balanced open interest between call (buy) and put (sell) options. However, this indicator requires further analysis, as investors could have sold the call option, gaining positive exposure to Bitcoin above a specific price.

Regardless of demand in the derivatives market, Bitcoin’s price ultimately relies on spot exchange flows. For instance, the rejection at $36,000 on Nov. 2 led to a 5% correction, bringing the price down to $34,130. Interestingly, the Bitfinex exchange experienced daily net BTC inflows of $300 million during this movement.

The fourth biggest inflow of #Bitcoin to @bitfinex yesterday, was roughly $300M; as soon as the inflow started, #Bitcoin started to trend down.

Extremely bullish, significant sell pressure, and #Bitcoin is still above $34,000 pic.twitter.com/I72N686HfH

— James V. Straten (@jimmyvs24) November 3, 2023

As analyst James Straten highlighted, the whale deposit coincided with the fading momentum of Bitcoin, suggesting a potential connection between these movements. However, the downturn did not breach the $34,000 support, indicating real buyers at that level.

Bitcoin’s latest correction occurred while the Russell 2000 Index futures, measuring mid-cap companies in the United States, gained 2.5% and reached a two-week high. This suggests that Bitcoin’s movement was unrelated to the U.S. Federal Reserve’s decision to maintain interest rates at 5.25%.

Additionally, the price of gold remained stable at around $1,985 between Nov. 1 and Nov. 3, demonstrating that the world’s largest store of value was not affected by the monetary policy announcement. The question remains: how much selling pressure do Bitcoin sellers at $36,000 still hold?

Reduced Bitcoin availability on exchanges can be deceiving

As demonstrated by the $300 million daily net inflow to Bitfinex, merely assessing current deposits at exchanges does not provide a clear picture of short-term sale availability. A lower number of deposited coins may reflect lower investor confidence in exchanges.

Apart from legal challenges against the Coinbase and Binance exchanges by the U.S. Securities and Exchange Commission for unlicensed brokerage operations, the FTX-Alameda Research debacle has stirred more concerns among investors. Recently, U.S. Senator Cynthia Lummis called on the Justice Department to take “swift action” against Binance and Tether for their alleged involvement in facilitating funds for terrorist organizations.

Related: SEC seeks summary judgment in Do Kwon and Terraform Labs case

Lastly, the cryptocurrency market has been impacted by increased returns from traditional fiat fixed-income operations, while the once lucrative cryptocurrency yields vanished following the Luna-TerraUSD collapse in May 2022. This movement has had lasting effects on the lending sector, leading to the collapse of several intermediaries, including BlockFi, Voyager and Celsius.

At the moment, there is undeniable growing institutional demand for Bitcoin derivatives, according to CME futures data. However, this may not be directly related to lower spot availability, making it difficult to predict the supply between $36,000 and $40,000 — a level untested since April 2022.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Geopolitical Uncertainty Puts Bitcoin under Pressure, $100M in Liquidations

Despite the selling pressure, Bitcoin has outperformed the broader crypto market with its market share crossing over 50%.

Bitcoin and the broader cryptocurrency market have come under selling pressure amid rising geopolitical uncertainties and a recent war eruption between Israel and Palestine. The developments led to more than $100 million in bull call liquidations in futures positions. Also, the broader cryptocurrency market slid by a staggering 2%.

Interestingly, in comparison to other tokens, Bitcoin has shown greater resilience. The BTC price is hovering around $27,675 with little volatility and a market cap of $539 billion. Analysts at trading firm FxPro said:

“Technically, Bitcoin remains in an uptrend but ran into resistance at its 200-day moving average over the weekend. All eyes will be on BTCUSD to see if it can successfully consolidate above $28,000, the 200-day moving average. If it does, we can expect a quick rise to as much as $29,500.”

However, on the short-term technical chart, Bitcoin has shown a breakdown under the symmetrical triangular pattern. The next support stands at $26,200.

#Bitcoin has showcased a breakdown from a symmetrical triangle on its 2-hour chart!

Given the triangle’s y-axis height, we might anticipate a 5% correction in $BTC, potentially heading to $26,200. pic.twitter.com/SdrrjcX1hs

— Ali (@ali_charts) October 9, 2023

Bitcoin Market Share above 50% amid Selling Pressure

As said, Bitcoin has performed relatively well in comparison to other top ten altcoins, including Ethereum. In another market development, Ethereum’s native cryptocurrency, Ether, experienced a 3% decline as the Ethereum Foundation executed a sale of tokens worth $2.7 million on Monday.

This move raised apprehensions among traders, and its impact was evident in the ETH futures markets. Ether bulls incurred losses exceeding $30 million on Monday, surpassing losses by traders in other cryptocurrencies.

As Ethereum is ceding ground, Bitcoin’s market share in the broader crypto market has shot past 50%. Ether, the second-largest cryptocurrency by market capitalization, has faced a substantial decline of approximately 18% since June. In contrast, Bitcoin, the leading cryptocurrency, saw a comparatively smaller decrease of around half that amount during the same period.

When considering the year as a whole, Bitcoin has exhibited remarkable growth, with a 66% increase in its value. In contrast, Ether’s performance registers a 32% increase.

Notably, this discrepancy becomes even more pronounced when analyzing data from September 15, 2022, when Ethereum underwent a network upgrade known as the Merge. This event generated significant anticipation and uncertainty among investors for several months. The latest research report from Kaiko notes:

“In fact, Ether has been massively underperforming the broad market since the Merge, with both the ETH/BTC price and volume ratio trending downwards over the past year. Ether’s underperformance is likely due to the ongoing impact of the bear market, which historically has seen traders turn to Bitcoin.”

Read other crypto news on Coinspeaker.

next

Bitcoin News, Blockchain News, Cryptocurrency News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

You have successfully joined our subscriber list.

Subscribe to our telegram channel.

Join

Polkadot (DOT) is making strategic moves to propel its development forward as bearish market conditions continue to cast a shadow over the crypto landscape. In recent weeks, the network has shifted its focus away from speculation, opting instead to double down on its commitment to technological advancement.

This move was evident in the multiple presentations it delivered, shedding light on its ongoing efforts and its ambitious goal of achieving 1,000 parachains.

A Paradigm Shift In Polkadot’s Strategy

In a landscape where various blockchain networks are fiercely vying for cross-chain dominance, Polkadot is emerging as a formidable contender. The Sub0 developer conference served as a platform for the network, reaffirming Polkadot’s commitment to cross-chain integration and the immense potential it holds.

🌞GM diligent #Web3 BUIDLers & #crypto degens!☕️

🔗🌐 #Polkadot is aiming for the stars !🌟!

Announced at #sub0, developers are introducing updates to support 1,000 #parachains, a tenfold increase! 🚀

“Asynchronous backing” will halve block time & augment block space, paving the… pic.twitter.com/74YZv8pcwS— Orbiter One (@OrbiterOne) September 22, 2023

The implications of this move are profound. Polkadot envisions a future where parachains, interconnected through its innovative architecture, foster a thriving ecosystem of decentralized applications, each with its unique use cases and communities. This holistic approach to blockchain interoperability opens up vast opportunities for developers and users alike, promising seamless interactions between disparate blockchain ecosystems.

Navigating Choppy Waters: DOT’s Price And Sentiment

DOT price has been navigating choppy waters since February. As of the latest data, DOT is trading at $4.01, according to CoinGecko, with a 24-hour movement of 0.1% and a seven-day decrease of 4.3%. This downtrend has led many to wonder if DOT can regain its bullish momentum in a bearish market.

DOT reached a market cap of around $5 billion, Saturday. Chart: TradingView.com

On-chain data cited in a report suggests a glimmer of hope, indicating a slight improvement in DOT’s weighted sentiment over the last three weeks. This uptick in confidence among traders suggests that some believe in DOT’s potential for an eventual upswing, though it has yet to manifest in price action.

Looking Ahead: DOT’s Prospects In A Bearish Altcoin Market

As cryptocurrency analyst Benjamin Cowen suggests, altcoins, including DOT, may face challenges throughout the remainder of 2023, a pattern often observed in pre-halving years. Nevertheless, Polkadot’s recently unveiled plans and its unwavering commitment to technological innovation position it favorably for the long run.

The network’s vision of a cross-chain future, with an expanding parachain ecosystem, could serve as a catalyst for renewed investor interest and a potential bullish reversal.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

Qualcomm‘s tech is inside nearly all our smartphones. It pioneered the ability to connect wirelessly in the ’80s, all the way to the 5G modems of today — making licensing fees for every device that communicates using its patented core technologies. And now, it’s working on an entirely new way of using generative AI.

Until last month, Qualcomm was also the world’s biggest fabless chip company. Now Nvidia has taken the title, following its revenue doubling in its most recent earnings report.

The runaway stock’s success has been fueled by the hype around generative artificial intelligence models like ChatGPT, which are trained on Nvidia’s graphics processing units, or GPUs.

That’s why it comes as no surprise that Qualcomm is positioning itself as a key player in the AI space, with announcements today that the company has introduced new in-vehicle generative AI capabilities, expanded into two-wheelers and has a new partnership with cloud computing leader Amazon Web Services.

So far, large language models have relied on immense amounts of data on the cloud to generate text and images. But Qualcomm CEO Cristiano Amon is betting that one day, generative AI will be in high demand off the cloud, too.

“You’re running a massive amount of computation in the data center for every word that is generated,” Amon told CNBC during an interview in June. “I think we have a very unique capability to run those models locally and not only improve performance, but you significantly improve cost.”

Apple is one of Qualcomm’s biggest customers, but uncertainty about the future of that relationship may be another reason driving Qualcomm’s push to diversify. Qualcomm modems are inside all iPhone models currently being made, including the next model set to come out next week. But Amon has been open with investors about how that deal might end soon.

“We don’t have visibility whether we’re going to be in the iPhone in ’24 or not,” he said.

Even as Apple develops its own silicon, Qualcomm remains the top provider for modems in Android phones.

“Apple is actually a smaller and smaller portion of our business,” said Chris Patrick, who heads up Qualcomm’s smartphone division.

Launching the cellular age

Qualcomm has been at the center of smartphones since the very beginning.

In 1985, seven colleagues from a tech startup called Linkabit met in the home of Irwin Jacobs in San Diego, where they thought up the idea for Qualcomm, short for Quality Communications. Jacobs would remain at the helm for 20 years.

In 1989, the company decided to move away from the accepted telecommunications standards at the time, placing the first phone call using Code Division Multiple Access. With CDMA, several transmitters send information simultaneously over a single communication channel, “trying to get enough capacity so everybody in the world could have a cellphone,” Amon explained.

CDMA went on to become the foundation for 3G, 4G and 5G today.

“Nobody believed them. Nobody thought CDMA would work,” said Jay Goldberg of D2D Advisory, who has been covering Qualcomm for 20 years. “Not only did they make CDMA work, but then they went on and made the rest of mobile work better.”

For a short time, Qualcomm made its own cellphones, releasing the first commercial CDMA smartphone in 1998. Its first Snapdragon chipset for mobile phones came out in 2007, and Snapdragon remains the product line Qualcomm is best known for today. Snapdragon processors help power and connect phones, PCs, tablets, cars and more.

“That really is the brains of the device,” Patrick said. “So that’s where a lot of the digital processing is done. That includes the modem that does the communication with the cellular tower, etc. … In the heart of the products that you love, that you use every day, there’s a very good chance Qualcomm’s at the center of it.”

And it’s not just Qualcomm’s hardware that’s involved. The company also makes money from licensing the core technology concepts that shape how we communicate. Today, Qualcomm has more than 140,000 patents.

“One of the things that tends to be misunderstood about Qualcomm is it’s not only a chipmaker, it’s also a company that licenses its intellectual property,” said Daniel Newman, CEO of the Futurum Group. “That creates revenue streams from companies like Apple, from other OEMs that the company makes even if their chipsets aren’t being specifically used in a device.

Newman added, “It’s probably one of the most controversial parts of the Qualcomm business.”

In 2017, Qualcomm faced two major lawsuits, including one from the Federal Trade Commission over potentially unfair patent licensing practices due to its prominent position in the wireless chip sector. In 2020, an appeals court threw out the previous antitrust verdict, translating to a victory for Qualcomm.

The other lawsuit came from Apple, which sued Qualcomm for roughly $1 billion for charging royalties for technologies Apple said Qualcomm had “nothing to do with.” Months later, Qualcomm sued Apple for patent infringement. In 2019, a settlement brought an end to the legal action between the companies.

Also in 2017, Qualcomm faced a $117 billion hostile takeover attempt from Broadcom. The deal was blocked by then-President Donald Trump, citing national security concerns.

“There was a period of time for four or five years where it was just like one thing after the other,” Stacy Rasgon, senior analyst at Bernstein Research, told CNBC. “It was just like whack-a-mole. It was insane. … Effectively, on all the legal stuff, they prevailed on everything.”

Still, such a big focus on licensing the tech behind the curtain has created a separate issue around public awareness.

“The fact that people don’t know it’s Qualcomm often is what is the hindrance,” Newman said. “You don’t know when you buy that GM or that BMW that it’s powered by Qualcomm. You don’t know when you buy that Samsung device that it’s powered by Qualcomm … which I think is often its friction in terms of investors, and why it’s valued at often a much lower level than some of its peers like Nvidia, Apple and others that are building silicon.”

Another point of friction comes from geopolitical issues. Mounting tensions with China, and between China and Taiwan, have raised concerns about how much all major chip designers rely on chipmakers in Asia. That’s why Taiwan Semiconductor Manufacturing Co., Samsung, Intel and others are building huge advanced chip fabs in the U.S. They’re aiming to reshore manufacturing, with incentives from the $52 billion CHIPS and Science Act. Some of those plans have already hit delays due to a shortage of skilled semiconductor labor in the U.S.

Qualcomm’s Amon told CNBC it’s committed to “close to half of the capacity” at TSMC’s delayed fab project in Arizona.

Qualcomm’s Snapdragon Digital Chassis powers cloud-connected video and audio, advanced driver assistance systems and more in cars like this Mercedes-Benz. E Class sedan.

Qualcomm

Life beyond Apple

Qualcomm told CNBC the semiconductor side of its business is growing, while licensing has become a smaller portion of revenue. The question remains whether that chip business can continue to grow without Apple.

Apple has indeed made its own A-series of processors for its iPhones and iPads since 2010. When its two-year legal battle with Qualcomm came to a close in 2019, Apple bought Intel’s 5G modem business in a move to develop its own cellular modem, too.

“Apple’s made it very clear that they want to get rid of Qualcomm entirely and go to their own modem, [but it’s] unclear if they can pull that off [or] when they will be able to do it,” Goldberg said. “It’s very different than everything else Apple silicon has built.”

Apple isn’t the only one turning away from Qualcomm silicon. Chinese smartphone maker Huawei currently uses Qualcomm’s 4G chips in all its high-end phones. But it will soon switch to 5G, turning to China-made chips because of export controls on U.S. companies providing advanced tech to China.

Meanwhile, smartphones as a whole are facing an industrywide downturn. Shipments are on track to hit their lowest point in a decade.

In August, Qualcomm reported weaker-than-anticipated revenue for its third fiscal quarter. It’s planning another round of layoffs after letting go of 415 people in June. The company currently employs around 51,000 people.

“The macroeconomics, I think, is not unique to Qualcomm,” Amon said. “A lot of companies have been rightsizing their business, and we’re no different than the rest of our peers.”

With uncertainty in the smartphone market, Qualcomm has shifted much of its focus to chips for other smart devices. Chief among them is cars, which Amon called the “brightest spot in our Qualcomm differentiation strategy.”

Qualcomm calls its package of hardware chips, sensors and software the Snapdragon Digital Chassis. Last week, it demonstrated potential use cases for how this system can enable hands-free assistance from large language models and generative AI. Examples include finding recipes and adding ingredients to a shopping list, or generating a virtual birthday card and sending it to family members.

Currently, Qualcomm’s digital chassis powers cloud-connected video and audio, advanced driver assistance systems and more. It’s in cars like the new Cadillac Escalade IQ and models from Mercedes-Benz, BMW, Stellantis, Hyundai, JLR and Sony Honda Mobility.

“That’s something that’s taking time, but these design wins are indicative of a future,” Newman said. “They do create more predictability in revenue. And the company is seeing more and more of the world’s largest automakers select its technology for at least part of their … connected automotive stack.”

Qualcomm is also diversifying into the connectivity of things, like virtual or augmented reality headsets.

“We’re the partner of choice of Meta,” Amon said. “We’ve been working with Microsoft. We’ve been working with Google and Samsung. … It’s hard to time it when everybody’s going to buy their glasses, but we know that that’s going to be the next computing platform for sure.”

Qualcomm is also trying to break into the competitive world of central processing units for PCs, taking on server giants like Intel and AMD. In 2021, Qualcomm bought CPU startup Nuvia for $1.4 billion — although Arm sued Qualcomm in 2022, saying it only licensed its architecture to Nuvia, not its new owner. Still, Qualcomm says its Arm-based processors will be in PCs by 2024.

“I think with AI and generative AI, if that becomes a feature that consumers really want in their laptops, then Qualcomm actually has a really good solution,” Goldberg said. “And so maybe this is the once-in-a-lifetime opportunity for Qualcomm to break into the PC market.”

AI off the cloud

With Nvidia’s incredible performance since ChatGPT came out in November, Qualcomm’s big push toward AI is no surprise, but it’s also not new. Amon told CNBC that Qualcomm has been working on AI capabilities for about a decade.

“We talk often about this hybrid AI,” Amon said. “You’re going to run things on the device because sometimes the device has unique things in real time from you, or you can give the cloud a head start. But at the end of the day, I think the power of combining the cloud with the device is very big.”

In May, Microsoft announced plans for offline AI models that will run on Qualcomm’s Snapdragon processors. And in July, Meta announced its ChatGPT competitor, Llama 2, will run on Qualcomm chips on phones and PCs in 2024.

“The company’s biggest opportunity is to figure out what are those AI applications, whether it’s tied to augmented reality, whether it’s tied to intelligent vehicles, whether it’s tied to next-generation gaming, whether it’s tied to productivity tools and apps — its ability to put chipsets into these devices that can handle and process those different workloads and of course, being able to monetize that,” Newman said.

For now, the business of on-device AI remains unproven. Large language models currently run off server farms filled with cloud GPUs that can handle their huge computational and data needs.

“Is Qualcomm going to be able to upsell a premium for each one of its licensees and each one of its chipsets for having these advanced AI capabilities?” Newman asked. “That particular answer will be the biggest determinant in just how successful Qualcomm can be in AI.”

Watch the video for more.

Surge in Bitcoin-margined futures signals gambler’s rush amidst market uncertainty

Quick Take

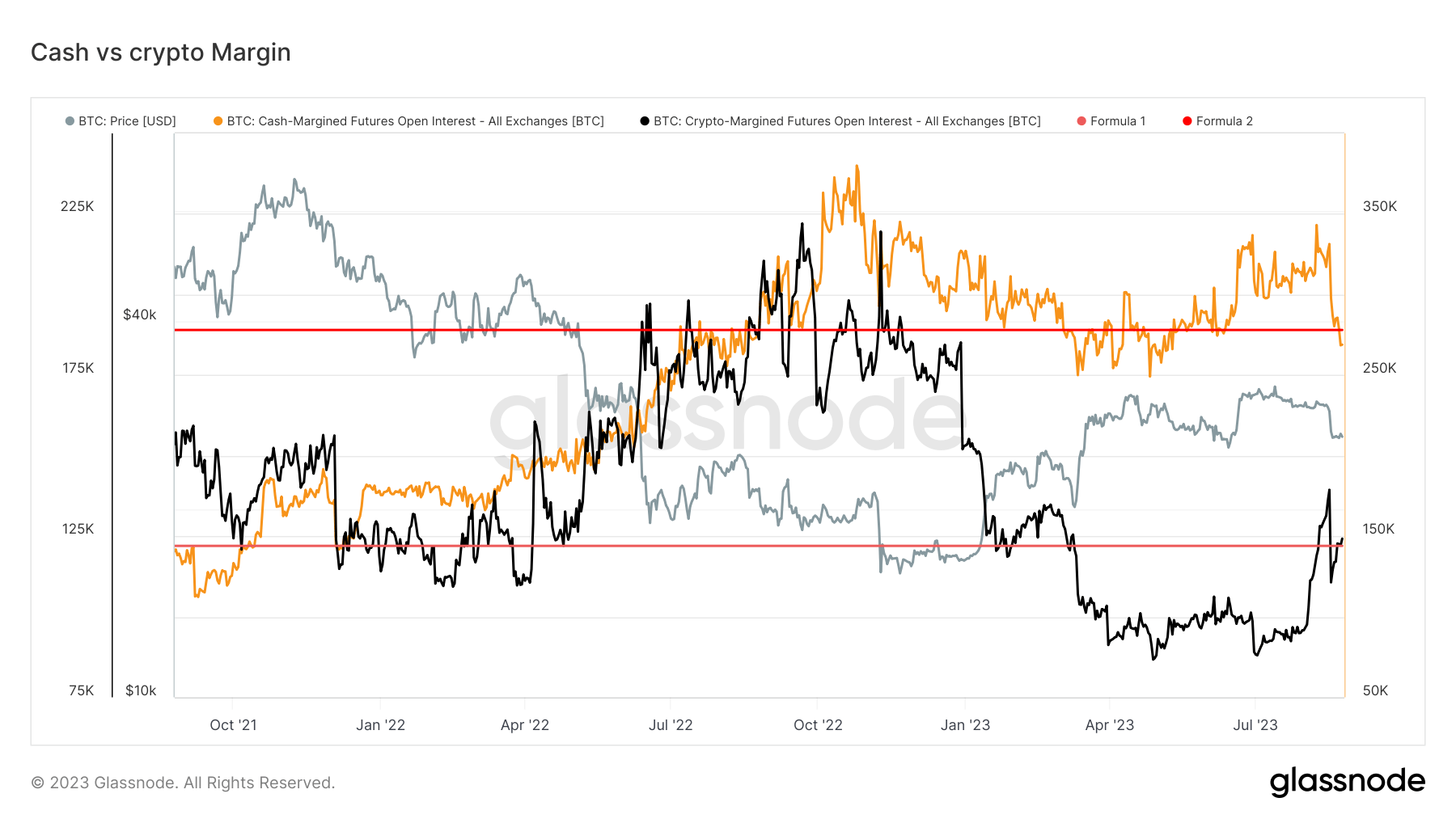

A notable divergence in futures contracts open interest, margined in USD or USD-pegged stablecoins versus those margined in native coins like Bitcoin, is beginning to emerge. Stablecoins in question include USDT and BUSD. The growing chasm shows contrasting preferences and risk assessments by players in the crypto space.

Crypto margin, underpinned by collateral such as Bitcoin, is surging to year-to-date highs, indicating an increased willingness among traders to take on greater risks. In contrast, cash margin, linked to USD or USD-pegged stablecoins, is edging towards year-to-date lows. This trend signifies a defensive stance, likely in response to perceived uncertainty or volatility.

Interestingly, the crypto margin as a percentage stands at 32%. With each spike in this figure, Bitcoin has historically registered a new local low, hinting at a potential correction or price consolidation in response to increased margin trading activity.

The post Surge in Bitcoin-margined futures signals gambler’s rush amidst market uncertainty appeared first on CryptoSlate.

US exodus as Revolut now ‘suspends’ crypto access in country amid regulatory uncertainty

Amid the evolving landscape of crypto regulation in the United States, financial technology company Revolut has announced it is “suspending” crypto services in the US.

A Revolut spokesperson told CryptoSlate, the company, together with its US banking partner, will suspend access to cryptocurrencies for its US customers starting Sept. 2, 2023, specifically,

“As a result of the evolving regulatory environment and the uncertainties around the crypto market in the US.”

This suspension will result in Revolut’s US customers being unable to place buy orders for cryptocurrencies. From Oct. 3, 2023, they will no longer be able to buy, sell, or hold any cryptocurrencies.

This decision comes after widespread uncertainty reflected in several other cryptocurrency exchanges tailoring their strategies.

US crypto regulatory hurdles

eToro has limited access to specific cryptocurrencies for its US users, citing regulatory developments as the primary cause.

Similarly, Coinbase is embroiled in a lawsuit with the Securities and Exchange Commission (SEC), pushing back against the notion that its assets and services qualify as investment contracts under securities law.

In the first quarter of 2023, Coinbase CEO Brian Armstrong and Gemini Co-Founder Cameron Winklevoss both commented that they had seriously considered pulling back from the US for the UK over the same issues.

At the time, Armstrong poured cold water on the idea of an imminent U.S. departure, saying this is only an option if U.S. regulatory clarity does not happen in “a number of years.” While Winklevoss commented, “In order to keep building our business and invest in hiring, we have to look elsewhere,” citing the UK as a potential second headquarters for operations.

Further, crypto exchange Nexo exited the US, citing regulatory uncertainty, in late 2022.

Uphold also ended staking for US customers in March this year following guidance from the SEC.

Revolut exit to affect limited users

The Revolut spokesperson clarified that this suspension will affect less than 1% of its global crypto customers, stating,

“This suspension does not affect Revolut users outside of the US in any way, and impacts less than 1% of Revolut’s crypto customers globally. Revolut customers in all other markets can continue to sign up and enjoy using our crypto services.”

In this challenging interaction between cryptocurrency platforms and regulatory agencies, the company’s move mirrors a broader trend of digital currency providers navigating the complex waters of regulatory scrutiny.

The Revolut spokesperson confirmed,

“Crypto customers in the US will find all relevant information regarding the suspension in the email communication they received from Revolut.

Our dedicated support team is available to address any concerns and questions our US crypto customers may have via our in-app chat.”

Revolut’s decision underscores the broader implications of US regulatory uncertainty on the global crypto market.