Following the debut of the Dencun upgrade and Ethereum blobs, enthusiasts have devised methods to embed data akin to how Ordinal inscriptions operate. Since this development, inscription-based activities now account for over 40% of blob transactions, leading to a significant increase in network activity. This uptick has resulted in a congestion of blob transactions, pushing […]

Following the debut of the Dencun upgrade and Ethereum blobs, enthusiasts have devised methods to embed data akin to how Ordinal inscriptions operate. Since this development, inscription-based activities now account for over 40% of blob transactions, leading to a significant increase in network activity. This uptick has resulted in a congestion of blob transactions, pushing […]

Source link

unprecedented

Bitcoin’s Dormant Giants: March Sees Unprecedented Movement of Vintage BTC

In recent times, bitcoin has consistently remained above the $60,000 mark throughout the entire month of March. With its value soaring, many long-standing holders have started to transfer substantial quantities of dormant bitcoins from wallets that have not seen activity for years. March has emerged as a pivotal month for transactions involving these vintage bitcoins. […]

In recent times, bitcoin has consistently remained above the $60,000 mark throughout the entire month of March. With its value soaring, many long-standing holders have started to transfer substantial quantities of dormant bitcoins from wallets that have not seen activity for years. March has emerged as a pivotal month for transactions involving these vintage bitcoins. […]

Source link

The winds of change are blowing through the Bitcoin landscape. On March 14th, 2024, the network witnessed a monumental shift – mining difficulty skyrocketed to a record-breaking 84 trillion hashes. This unprecedented challenge coincides with another significant event on the horizon: the Bitcoin halving slated for April.

According to BTC.com, the rate has risen by nearly 5.80% since the previous modification. The mining hashrate for the original coin has also peaked, indicating that more people are now participating in the mining process. At present, the value stands at 617 EH/s.

Source: BTC.com

Bitcoin Mining: The Difficulty Dilemma

Mining Bitcoin is no easy feat. Miners compete to solve complex cryptographic puzzles, and the difficulty of these puzzles adjusts based on the overall network hash rate. As more miners join the network, the difficulty increases to ensure a steady block production rate (roughly 1 block every 10 minutes).

This recent surge in difficulty signifies an influx of new miners, likely drawn by Bitcoin’s recent price rally that saw it peak at a staggering $73,800 on the same day.

The Halving Effect

The upcoming halving event in April throws another variable into the equation. Every four years, the block reward for miners – the amount of Bitcoin earned for successfully mining a block – is cut in half.

This economic policy is a cornerstone of Bitcoin’s design, aiming to control inflation and maintain scarcity over time. The last halving in May 2020 witnessed a significant price increase in the following months, and many analysts believe the upcoming halving will follow suit.

BTCUSD weakens today and trades at $68,178: TradingView.com

Here’s the logic: with the supply of new Bitcoins being halved, the existing ones become relatively more scarce, potentially driving the price up due to increased demand.

A Balancing Act For Miners

Despite the rising difficulty, the potential for Bitcoin’s price to appreciate after the halving could incentivize miners to weather the storm. This economic incentive is bolstered by the recent spike in mining rewards, which reached nearly $79 million

This suggests that even with the increased difficulty, miners are still reaping substantial profits due to the high Bitcoin price. However, the long-term sustainability of this model is debatable.

As difficulty continues to climb, the energy consumption required for mining will also rise. It raises concerns about the environmental impact of Bitcoin mining, especially considering the reliance on non-renewable energy sources in some regions.

Beyond The Headlines

The narrative surrounding Bitcoin’s recent surge often focuses on its price and the upcoming halving. However, there are crucial underlying factors to consider.

The ever-increasing mining difficulty raises questions about the long-term viability of proof-of-work, Bitcoin’s current consensus mechanism. Alternative, more energy-efficient mechanisms are being explored, but their widespread adoption remains uncertain.

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Futures Market Attracts Unprecedented Open Interest as Derivatives Appetite Grows

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

Source link

Year 18 witnessed unprecedented record flows into gold ETFs – Matt Hougan

Quick Take

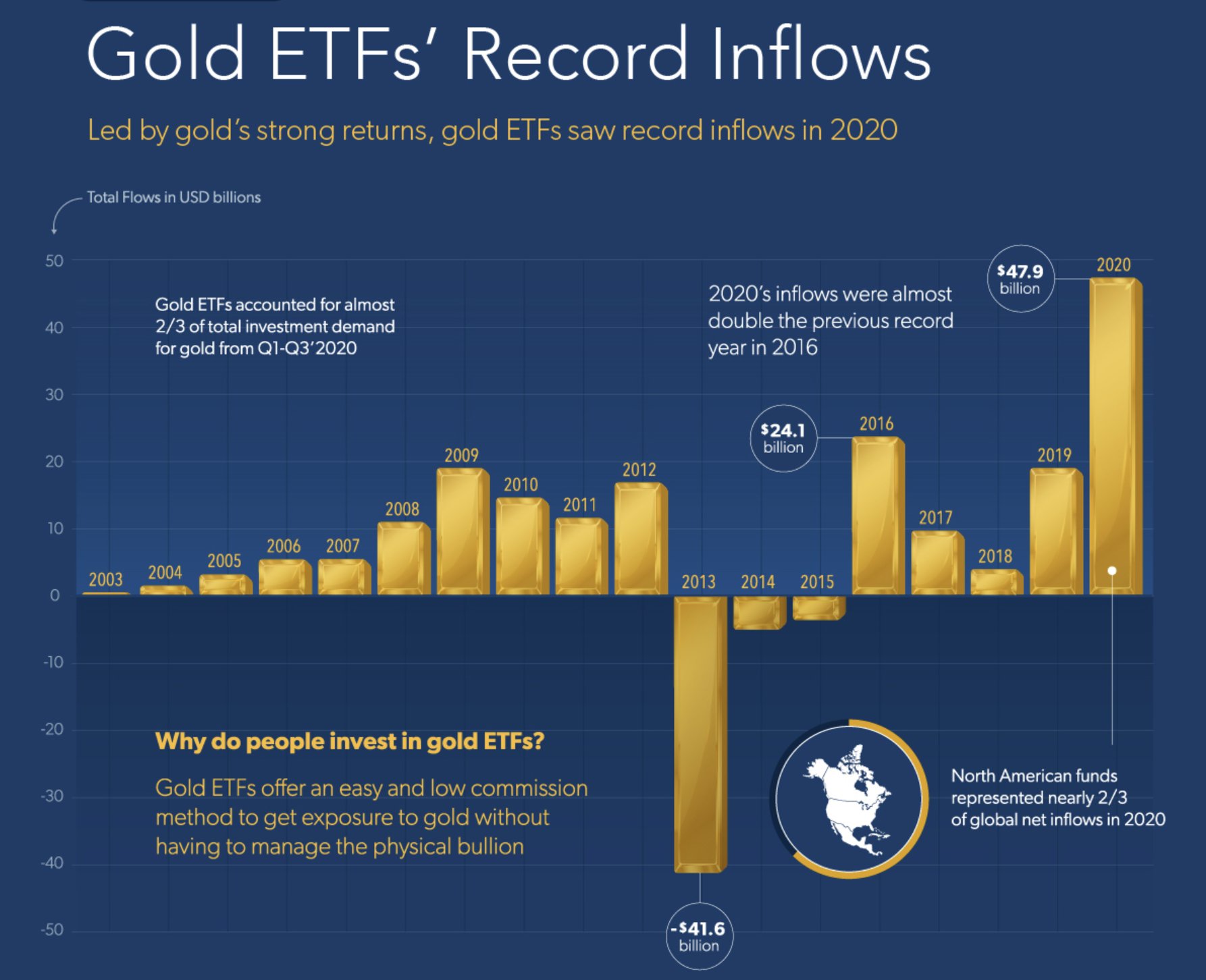

Visual Cap data shared by Matt Hougan, CIO of Bitwise, illustrates the two-decade-long journey of Gold ETFs since the first Gold ETF — GLD — launched in the US in 2004.

The data shows that between 2003 and 2012, Gold ETFs initially attracted substantial inflows due to the convenience they offered over holding physical gold. However, between 2013 and 2015, these funds experienced three consecutive years of outflows.

The trend reversed between 2016 and 2020, with five consecutive years of inflows. North America accounted for almost two-thirds of the global net inflows in 2020, according to Visual Cap.

Interestingly, these significant inflows happened during the COVID-19 pandemic, a period of extreme uncertainty. Despite this, gold only saw a modest increase of 30% since the start of 2020, while Bitcoin has appreciated 535%.

In contrast, Bitcoin, often referred to as digital gold, has seen striking success since spot ETFs connected to the flagship crypto were launched five weeks ago. The ETFs have attracted approximately $4.9 billion in net inflows since they began trading.

Recently, as reported by CryptoSlate, the inflow into Bitcoin ETFs has coincided with an acceleration in the outflows from Gold ETFs, suggesting a possible shift in investors’ preferences.

The post Year 18 witnessed unprecedented record flows into gold ETFs – Matt Hougan appeared first on CryptoSlate.

Bitcoin Halving 2024 — Grayscale Study Reveals Unprecedented Market Evolution

According to the latest data, the countdown to the Bitcoin network’s halving event shows fewer than 10,000 blocks from becoming a reality. Further analysis suggests that the halving is anticipated to take place between April 19 and April 21, 2024, reducing the block rewards from the existing rate of 6.25 bitcoins per block to 3.125 […]

According to the latest data, the countdown to the Bitcoin network’s halving event shows fewer than 10,000 blocks from becoming a reality. Further analysis suggests that the halving is anticipated to take place between April 19 and April 21, 2024, reducing the block rewards from the existing rate of 6.25 bitcoins per block to 3.125 […]

Source link

You Might Only Have 2 Years Left to Take Advantage of This Unprecedented Retirement Savings Opportunity

For the past six years, savvy retirement planners have benefited from an incredible opportunity to boost their long-term savings, but that opportunity may be closing at the end of 2025.

One of the biggest drags on retirement savings is taxes. If you want to minimize taxes, it pays to plan well in advance of when you’ll need your retirement savings. And one of the best ways to mitigate your tax burden in retirement is with the strategic use of Roth accounts.

For the next two years, it’s still possible to take advantage of Roth accounts in a very specific way that can help your retirement savings go further when you retire. That door will close if Congress doesn’t extend the current tax rules beyond 2025.

Here’s what you need to know.

Image source: Getty Images.

The changing landscape

In 2017, Congress passed the Tax Cuts and Jobs Act. One of the big focuses of the act, as the name implies, is lowering the income tax rates and simplifying the income tax return process for many Americans.

Those rules are set to expire at the end of 2025 when the tax law will revert to the rules in use previously. Here are the tax brackets for 2024.

| Current Tax Rate | Individual Filer AGI | Joint Filer AGI |

|---|---|---|

| 10% | $11,600 or less | $23,200 or less |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 |

| 32% | $100,951 to $243,725 | $383,901 to $487,450 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 |

| 37% | $609,351 or more | $731,201 or more |

Data source: IRS.

Some of the most notable changes for retirement planning come from the 12%, 22%, and 24% tax brackets. If the tax laws aren’t extended, we’ll see those rates move to approximately 15%, 25%, and 28%. Married couples could see income that would currently fall in the 24% tax bracket climb into the 33% tax bracket in 2026.

As such, the ability to lock in current tax rates is very appealing.

Use a Roth account to lock in tax rates

Current retirees or near-retirees can take advantage of the current tax rates through the use of a strategy called a Roth conversion.

A Roth conversion is when you take savings from a traditional retirement account and convert them into a Roth retirement account. When you do so, you’ll pay taxes on the entire amount you convert based on the current tax rates. But when you go to withdraw funds, you won’t owe any additional taxes.

A Roth conversion won’t make sense for everyone, but for individuals or couples that are sitting in the 12% to 24% tax brackets, it could save them a whole lot of money in taxes over the long run.

It’s most advantageous to use the Roth conversion when you can keep your other income low. So if you don’t have any capital gains to report and haven’t started collecting Social Security, now is the most opportune time to use the strategy.

What’s more, Roth conversions could be even more advantageous down the road for a couple of reasons related to your taxes in retirement. First, converting funds from a traditional retirement account to a Roth will reduce your future required minimum distributions. Second, Roth retirement account withdrawals don’t count toward your adjusted gross income, which could impact the taxes you pay on Social Security and capital gains.

Everyone’s situation is different, and what makes sense for one person might not make sense for another. It’s best to consult a professional about the potential to save on your taxes with strategic Roth conversions if you think you might be able to take advantage of the strategy. Their fee could be well worth it if it saves you thousands in taxes over the long run.

There’s no telling what Congress will do in the future. What we do know is the current law is set to expire before 2026, and there’s no indication of its renewal anytime soon. With two years to prepare, it’s worth exploring the potential benefits Roth conversions could have on your retirement finances.

Crypto Payments Soared To Unprecedented Levels In 2023, CoinGate Report Reveals

The year 2023 witnessed a remarkable surge in crypto payments, signaling a significant milestone in adopting digital currencies for retail and e-commerce transactions.

According to a recent report by CoinGate, a crypto payment processor firm, the number of crypto payments processed reached staggering heights, showcasing robust growth and diversification in the crypto landscape.

Massive Surge In Crypto Payments

In 2023, CoinGate processed an astounding 1,294,058 cryptocurrency payments, marking a 39.4% increase compared to the previous record. This exponential growth, equivalent to one payment every 24 seconds, underscores the accelerating pace of crypto adoption.

Notably, approximately one-third (32.35%) of all transactions processed by CoinGate in the last ten years occurred in 2023, emphasizing the surge in the popularity of digital currencies.

Per the report, integrating Binance Pay wallet into CoinGate’s payment services in March 2023 played a significant role in driving this growth.

Binance Pay accounted for 8.2% of all crypto payments in 2023, showcasing a steady increase in usage throughout the year. This upward trend, from 4.5% in March to 13% in December, indicates the growing adoption and usage of Binance Pay as a preferred payment method.

Lightning Network Surges In Popularity

Moreover, CoinGate’s report highlights the increasing maturity and acceptance of the Lightning Network, an essential component of Bitcoin payments.

In 2023, the Lightning Network facilitated 7.8% of all Bitcoin payments processed by CoinGate, representing a notable increase from previous years.

Furthermore, the overall number of Lightning Network payments grew by 35.9% compared to the previous year, indicating a growing reliance on this technology.

However, Bitcoin, long considered the dominant cryptocurrency for payments, saw a decline in its share of total transactions processed by CoinGate. While Bitcoin accounted for 54.8% of all transactions in 2021, its share dropped to 35.6% in 2023.

Stablecoins, particularly Tether’s USDT, emerged as a popular choice for crypto payments in 2023. The usage of USDT increased from 15.1% in 2022 to an average of 25.4% in 2023, indicating a shift towards stablecoins due to their perceived stability and reliability.

Alternative Payment Solutions

According to CoinGate’s report, crypto-friendly merchants experienced remarkable success in 2023, with a significant portion of their sales attributed to cryptocurrency payments.

Eldorado.gg, a gold and accounts marketplace for gamers, reported crypto payments contributing to 3% of their total sales. IPRoyal, a proxy service provider, saw over 30% of their payments made in cryptocurrencies.

Hostinger, a web hosting provider, captured nearly one-fourth of all crypto-paying customers, showcasing the effectiveness of alternative payment solutions in catering to diverse customer needs.

Overall, 2023 demonstrated a paradigm shift in the adoption of cryptocurrency payments. The surge in transactions processed by CoinGate, the increasing usage of Binance Pay and the Lightning Network, and the diversification of cryptocurrencies used for payments all point towards a new era of acceptance and trust in digital currencies.

As crypto-friendly merchants reap the benefits of embracing these payment methods, it becomes evident that cryptocurrency payments offer sales growth, solutions for the unbanked population, and global accessibility.

With the stage set for further expansion in 2024, the transformative power of cryptocurrency payments continues to reshape the retail and e-commerce landscape.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Chiliz Propels SportFi to Unprecedented Growth, Setting New Milestones

Aside from the Chiliz Chain which attracted many people to the SportFi sector, the company said its Chiliz Labs Incubator and Accelerator Program also contributed to the sector’s growth this year.

Chiliz, a crypto firm that provides infrastructure solutions for sports and entertainment companies, experienced a monumental year for SportFi and Fan Tokens, propelling the industry to new heights in 2023.

Despite challenges faced by many blockchain sectors in the first half of the year, SportFi stood out as a success story fueled by the launch of Chiliz Chain, the company’s layer 1 protocol with a sequence of other strategic initiatives.

Chiliz Inks Over $437 Million in Revenue

In a press release shared with Coinspeaker, Chiliz highlighted a series of events that helped bolster the SportFi adoption this year. The launch of Chiliz Chain ushered in a remarkable year for SportFi, witnessing an influx of international sporting organizations tapping into Web3 for fan incentivization and community building.

The company said it generated $437 million in revenue from the sector following the official debut of its protocol. The platform has also processed over three million transactions this year.

The Chiliz Chain, which serves as a fundamental building block for the creation of SportFi applications supports various other SportFi use cases, including minting non-fungible tokens (NFTs). The protocol is also used to create fan tokens and other decentralized finance (DeFi) products including innovative games, and Web3-ready ticketing.

Fueling SportFi’s Growth

Aside from the Chiliz Chain which attracted many people to the SportFi sector, the company said its Chiliz Labs Incubator and Accelerator Program also contributed to the sector’s growth this year. According to the release, the incubator and accelerator program launched a $50 million initiative to nurture early-stage blockchain projects in the sports space.

Another event that contributed significantly to the SportFi growth in 2023 is the company’s acquisition of a 20% stake in MatchWornShirt. The move sought to leverage the blockchain technology to enhance the authenticity of sports collectibles.

Chiliz also mentioned it secured over 25 key partnerships this year to create a diverse SportFi ecosystem with projects such as Blockasset, FanFest, LiveLike, Football at AlphaVerse, TopGoal Footballcraft, and Lillius.

The company also collaborated with sports charity Common Goal for the “One Shirt Pledge”. The move allowed Chiliz to facilitate athletes’ donations of match-worn shirts authenticated on the Chiliz Chain for charity auctions, blending sports heritage with philanthropy.

Socios.com App and Achieves Major Milestones

The introduction of Chiliz Chain complemented the existing Socios.com app, a platform used by global sporting organizations to drive enhanced fan engagement.

Following the integration of the app into the protocol, Socios.com achieved significant milestones in 2023, experiencing a 30% increase in users across 160 countries.

The company has also witnessed other significant achievements, including onboarding major clubs like Tottenham Hotspur from the English Premier League. Socios.com also introduced the Locker Room feature, allowing users to obtain unique digital collectibles.

Furthermore, the platform rolled out over 3,000 Fan Polls, enabling users to vote on various aspects such as kit designs, squad numbers, and celebration songs of their favorite sports clubs.

Chiliz said Socios.com rewarded 50,000 fans this year with signed merch, match tickets, and once-in-a-lifetime VIP experiences. Additionally, Chiliz claimed that Socios.com’s achievements were only possible through the launch of its layer 1 blockchain platform.

Looking ahead to 2024, the protocol aims to build upon these accomplishments and intensify efforts to mainstream SportFi for the mutual benefit of clubs and fans globally.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Amount of Bitcoin held for a decade or longer nears unprecedented milestone of 3 million coins

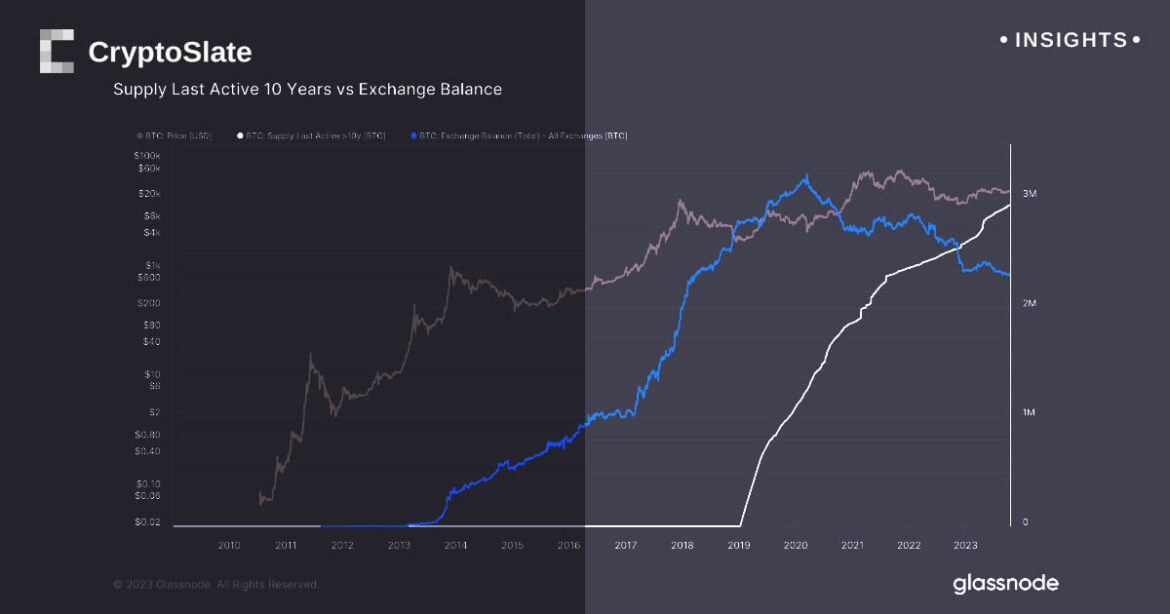

Quick Take

The Bitcoin landscape is witnessing an unprecedented event, as the number of Bitcoins that haven’t been moved for over a decade is nearing the 3 million mark. This represents approximately 15% of the current circulating supply of about 19.5 million Bitcoin.

The trajectory of these unmoved coins has seen steady growth, hitting its first million milestone in November 2019, followed by the second in March 2021. Projections suggest we may see the 3 million mark being surpassed by the close of Q4 2023 or the onset of Q1 2024.

This remarkable trend underscores an interesting contrast when compared to the amount of Bitcoin present on exchanges, currently numbering around 2,294,000. This quantity is outstripped by the growing supply last active over a decade ago, highlighting a significant shift.

This crossover initially occurred in November 2022, and the divergence has only been widening at an increasing rate since then.

The post Amount of Bitcoin held for a decade or longer nears unprecedented milestone of 3 million coins appeared first on CryptoSlate.