A report issued by TRM Labs indicated that Tether’s USDT, the largest stablecoin in the cryptocurrency industry, was the preferred stablecoin used for illicit transactions during 2023. TRM Labs alleges that 1.6% of USDT’s volume was linked to illicit activity last year, with $19.3 billion worth of USDT used in illegal transactional flows. TRM Labs […]

A report issued by TRM Labs indicated that Tether’s USDT, the largest stablecoin in the cryptocurrency industry, was the preferred stablecoin used for illicit transactions during 2023. TRM Labs alleges that 1.6% of USDT’s volume was linked to illicit activity last year, with $19.3 billion worth of USDT used in illegal transactional flows. TRM Labs […]

Source link

USDT

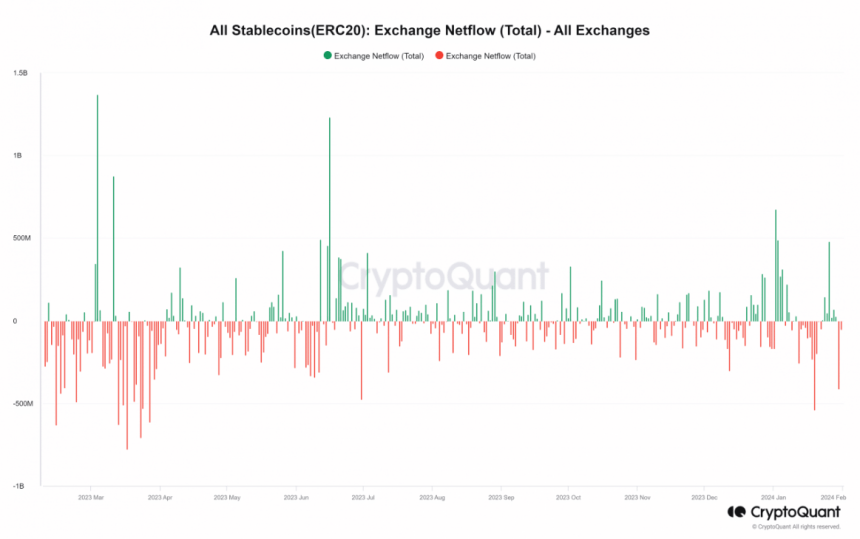

The cryptocurrency industry has witnessed a significant change in the movement of stablecoins, offering valuable observations into the evolving dynamics of the market. Recent data from IntoTheBlock and CryptoQuant has shown a surge in stablecoin inflows into exchanges, reaching record highs in January.

Notable inflows were observed on January 2nd ($478 million), January 3rd ($489 million), and January 26th ($673 million). However, this trend has since reversed, with outflows dominating the market.

On January 30th, there was a substantial outflow of $412 million, marking the second-highest daily outflow recorded in the month, following the $541 million outflow on January 19th.

USDT Leads Stablecoin Rally, But Caution Persists In Crypto Market

An analysis of the 24-hour trading volume of the top stablecoins on CoinMarketCap reveals that Tether (USDT) and USD Coin (USDC) collectively accounted for approximately 90% of the total volume. Tether, in particular, has been dominant in terms of flows, with a 24-hour trading volume exceeding $42 billion, while USDC’s volume stood at around $6 billion.

Taking a closer look at the flow of USDT through CryptoQuant, it was found that there was a substantial inflow of $373 million on January 26th, followed by a prevailing trend of outflows, with over $83.4 million observed at the time of writing.

USDTUSD currently trading at $0.99897 on the daily chart: TradingView.com

Experts suggest that the rise in stablecoin inflows onto exchanges, particularly the $478 million on January 2nd, could indicate traders’ and investors’ readiness to participate in the market or their desire to safeguard their funds during uncertain times.

Conversely, the shift towards outflows may signal caution or preparation for potential market volatility. Additionally, the substantial inflow of stablecoins, especially USDT, could indicate increased buying power and intentions to establish positions in the cryptocurrency space.

Stablecoins Surge, Signal Investor Preparation

The increase in stablecoin inflows onto exchanges can be interpreted in two ways. Firstly, it may indicate that investors and traders are preparing to enter the market. By moving their funds into stablecoins, they can quickly transition into other cryptocurrencies when they perceive favorable opportunities. This suggests a readiness to participate and take advantage of potential market movements.

Secondly, the rise in stablecoin inflows may also reflect a desire to keep funds in a secure manner, particularly during uncertain times. Stablecoins offer stability by being pegged to a specific asset, such as the US dollar, which can be appealing to investors seeking to protect their capital in times of market volatility. This cautious approach can be seen as a way to safeguard funds and mitigate risks in an unpredictable market.

Tether Records Nearly $3 Billion Profit

Meanwhile, Tether announced a “record-breaking” $2.85 billion in quarterly profits as the market capitalization of its main token, USDT, approached $100 billion.

According to a blog post by Tether, the interest gained on the company’s enormous holdings in US Treasury, reverse repo, and money market funds—which support the USDT stablecoin—account for around $1 billion of the earnings in the most recent quarterly attestation report that was released on Wednesday. Everything else was “mainly” due to the growth of Tether’s other assets, like gold and bitcoin (BTC), the stablecoin issuer said.

Featured image from Wccftech, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

In an encouraging development for the crypto space, Tether, the issuer of the world’s largest stablecoin USDT, has doubled down on its Bitcoin investment momentum by acquiring a staggering 8,888 BTC, further diversifying its portfolio.

Tether Increases Its Bitcoin Holdings

Tether has recently made its third largest Bitcoin purchase, as the stablecoin issuer added a total of 8,888 BTC valued at $380 million at the time of purchase. This brings its total BTC holdings to 66,465 BTC, valued at $2.81 billion with an average buy price of $42,353.

This transaction was captured by BitInfoCharts data, which also showed the previous amounts of BTC accumulated by the blockchain-enabled platform. This recent purchase follows Tether’s Bitcoin investment strategy, in line with its vision to continuously strengthen its reserves by accumulating Bitcoin.

Earlier in May 2023, the stablecoin issuer announced in a blog post that it would regularly allocate 15% of its net realized operating profits toward increasing its BTC reserves. As of the end of March 2023, Tether held approximately $1.5 billion worth of cryptocurrency, a $1.3 billion difference from its total BTC holdings presently.

According to reports from Dune Analytics, Tether has become the 11th largest Bitcoin holder, with Microstrategy, an American business intelligence service, surpassing Tether’s holdings with over 189,00 BTC accumulated. The other addresses in the top 10 rankings are owned by major crypto exchanges and governments, including Binance, Bitfinex and the US government.

Tether’s decision to double down on its Bitcoin investments signals its confidence in the cryptocurrency’s future trajectory. It also underscores the blockchain platform’s belief in the long-term potential of BTC as it aims to capitalize on Bitcoin’s potential growth by bolstering and diversifying its digital asset reserve.

BTC price sitting at $41,354 | Source: BTCUSD on Tradingview.com

BTC Accumulation Race Amidst ETF Hype

Tether’s strategic Bitcoin purchase comes at a time when the crypto market is buzzing with excitement over Spot Bitcoin ETFs. Before the approval of Spot Bitcoin ETFs, Tether had steadily increased its BTC portfolio, purchasing substantial quantities of BTC consistently. In March 2023, the stablecoin issuer bought 15,915 BTC and another 4,083 BTC between the months of May and September.

The timing of Tether’s BTC purchase suggests a proactive stance towards potentially seizing the opportunities brought forth by the Spot Bitcoin ETF market and the upcoming Bitcoin halving in April.

In addition to Tether’s large-scale BTC acquisition, Microstrategy is also another major player which has been continually increasing its BTC holdings. The business intelligence software company added a whopping 14,620 BTC to its portfolio in December 2023. At the time, the value of the purchase was about $615.7 million.

Other companies with large BTC holdings include Galaxy Digital and Elon Musk’s Tesla, as well as space exploration company SpaceX.

Featured image from Investopedia, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

UN Flags Increased USDT Stablecoin Use in Money Laundering across Asia

Despite the increasing involvement of the USDT stablecoin in criminal activities, the UN has reported that law enforcement authorities have successfully dismantled various money laundering organizations responsible for transferring illegal funds using USDT.

The United Nations (UN) has warned that Tether’s USDT stablecoin has become the preferred cryptocurrency for money laundering schemes and other illicit activities in Asia.

The Financial Times reported Monday, citing a report published by the UN’s Office of Drug and Crime Unit, that nefarious actors in Southeast Asia are using the digital assets to engage in fraudulent activities, including the infamous romance scam known as pig butchering.

Rising Criminal Activities Involving Tether

The UN’s Office of Drug and Crime Unit uncovered that in recent years, the Asian region has been significantly entangled in highly sophisticated, high-speed money laundering and other criminal activities involving Tether’s USDT.

The UN’s report cited an example of a money laundering syndicate that operates in both Myanmar, and Cambodia, displaying a sign on the street advertising USDT and offering to exchange “black” tokens for cash.

These crimes also extend to online gambling platforms operating illegally in the region. According to the Financial Times report, these platforms have become a preferred choice for crypto-related money launderers, especially those using USDT, representing the world’s largest stablecoin.

Jeremy Douglas, an executive at the UN, said that the emergence of cryptocurrencies and new technologies has successfully created an alternative banking system for bad actors.

“Organized crime has effectively created a parallel banking system using new technologies, and the proliferation of loosely or entirely unregulated online casinos together with crypto has supercharged the region’s criminal ecosystem,” said Douglas.

Tether Froze $225 Million in USDT

Despite the increasing involvement of the USDT stablecoin in criminal activities, the UN has reported that law enforcement authorities have successfully dismantled various money laundering organizations responsible for transferring illegal funds using USDT.

In a notable incident last year, Singaporean authorities busted an illegal organization in August, recovering $737 million in cash and crypto.

During the same period, Tether, in collaboration with US authorities and the crypto exchange OKX, froze USDT tokens valued at $225 million. Coinspeaker reported the funds were traced back to a syndicate engaged in unlawful activities related to “pig butchering” and human trafficking in Southeast Asia.

On November 16, Tether, the stablecoin issuer, addressed letters to the US Senate Committee on Banking, Housing, and Urban Affairs and the US House Financial Services Committee, expressing its dedication to combating illicit activities within the digital assets space.

In these letters, Tether disclosed its proactive measures, including implementing a reactor tool obtained from Chainalysis, a blockchain data analytics company. This tool provides reports on all transactions conducted in Tether’s secondary markets.

Additionally, Tether said it established a dedicated Compliance Department equipped with an anti-money laundering (AML) and know-your-customer (KYC) program. The tool aims to assist the company in analyzing blockchain transactions, identifying wallets associated with problematic activities, and preventing funding for terrorist groups.

Up to this point, the stablecoin issuer has frozen more than 1,260 addresses linked to illicit activities, with a combined value surpassing $875 million, according to data from Dune Analytics.

next

Altcoin News, Cryptocurrency News, News

You have successfully joined our subscriber list.

USDT Stablecoin Issuer Tether Eyes Big Move in Bitcoin Mining Market

Tether’s strong financial muscle and deep pockets will help it position strongly among other competitors in the Bitcoin mining space.

In a major revelation, Tether chief executive Paolo Ardoino announced that the company is eyeing a move in the Bitcoin mining market. As per reports, the $87 billion stablecoin operator has already made hefty investments in the Bitcoin mining sector.

Ardoino revealed in an interview that the company intends to invest approximately $500 million in the next six months. This investment will involve the construction of its mining facilities and acquiring stakes in other companies. As part of this strategy, Tether has allocated a portion of the $610 million credit facility it extended to the publicly-traded Bitcoin mining company, Northern Data AG, earlier this month. Tether had previously acquired shares in the Frankfurt-based firm back in September. Speaking on the development, the Tether chief said:

“We are committed to being part of the Bitcoin mining ecosystem. When it comes to the expansions, building new substations and new sites, we are taking them extremely seriously.”

However, stepping into Bitcoin mining will mark a notable departure from Tether’s core business. Considering that Tether has already deep pockets, it will certainly send shockwaves among competitors in the Bitcoin mining industry. Jaran Mellerud, chief executive at Bitcoin mining data and research firm MinerMetrics said:

“A 1% market share would likely make Tether among the world’s 20 largest Bitcoin mining companies. Given Tether’s importance in the crypto ecosystem and its financial muscle, its market share over time will likely grow far beyond its initial 1% goal.”

Tether Raising the Competition Bar

Tether is in the process of establishing Bitcoin mining facilities in Uruguay, Paraguay, and El Salvador, each with a capacity ranging from 40 to 70 megawatts. The goal is to increase Tether’s share of the total computing power required for the Bitcoin network to 1%. However, no specific timeframe for achieving this goal was provided. For context, the largest public Bitcoin mining company, Marathon Digital Holdings, contributes around 4%.

By the end of 2023, Tether aims to reach 120 megawatts in its direct mining operations, with a further projection of reaching up to 450 megawatts by the end of 2025. The company has allocated approximately $150 million for mining opportunities in which Tether is directly involved, with some funds still being deployed across new sites.

The broader Bitcoin mining industry has faced financial challenges following the decline in digital asset prices last year, leading to liquidity concerns. Notably, major players such as Compute North and Core Scientific have filed for bankruptcy.

“Being a private company that generates enormous amounts of cash even in the bear market, Tether is uniquely positioned to make massive anti-cyclical investments,” Mellerud said.

Tether is currently assessing a site with a capacity of 300 megawatts, and its mining operations are already profitable due to the recent increases in Bitcoin prices. To enhance flexibility, the company has established its facilities within large containers, allowing for swift relocation to new locations in case electricity costs become more favorable elsewhere.

“Mining for us is something that we have to learn and grow over time. We are not in a rush to become the biggest miner in the world,” Ardoino said.

next

Bitcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Alameda Research may have minted up to $40B of Tether’s USDT: Report

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

SBF’s Alameda minted $38B USDT to profit off arbitrage trading: Coinbase director

Blockchain data flagged by Coinbase director Conor Grogan indicates that Alameda Research redeemed over $38 billion for Tether (USDT) tokens in 2021 despite not having the equivalent assets under management.

Onchain data shows that Alameda was responsible for minting $39.55B of USDT, a number that is 47% of Tether’s circulating supply today

A previous report by Protoss estimated the number at around $36.7B; I was able to update these figures with additional wallets I found pic.twitter.com/fYBvGAYlFd

— Conor (@jconorgrogan) October 9, 2023

According to Grogan, the total value of USDT creation was higher than Alameda’s total assets on its books at the height of the wider cryptocurrency market bull run in 2021.

Grogan also suggests that FTX-ordered USDT redemptions were likely to have been from Alameda’s tokens, totaling 3.9 billion USDT. The majority of this redemption amount was carried out during the collapse of Terra’s algorithmic stablecoin.

In January 2021, former Alameda co-CEO Sam Trabucco weighed in on prevailing reports of significant USDT mints carried out by Tether and gave inside insights into how Alameda profited off arbitrage opportunities relating to the value of USDT to various trading pairs across different exchanges.

BTW, to connect some dots here — a lot of the people seeking access to a coin like USDT *aren’t* doing so via creation. They’re often doing so via just sorta buying it in the markets — and they’re buying a LOT, and REALLY aggressively. https://t.co/pKRj3AMJ9D

— Sam Trabucco (@AlamedaTrabucco) January 11, 2021

Trabucco described how the premium in which USDT trades to $1 was typically volatile, given that Bitcoin (BTC)-to-USDT trades resulted in a slight deficit in basis points when compared to BTC/USD trades.

“And note, *these* are the best markets to use to determine where USDT is trading — the combo of BTC/USDT and BTC/USD markets, e.g., are WAY more liquid than any exchange’s USDT/USD market, so the prices from these (even though its a two-leg trade) matter way more.”

Trabucco went on to explain that other United States dollar stablecoins like USD Coin (USDC) had a less volatile premium due to the creation and redemption process involved with USDT. Given that select firms have the ability to create and redeem USDT, most market players acquire and trade USDT from markets themselves and not directly from Tether’s treasury.

“And when USDT gets above $1? A sophisticated firm like Alameda with great setups on all the exchanges and bots to execute more than one leg at a time is gonna want to sell! And we do — a LOT.”

Trabucco added that Alameda was able to “safely put on big bets” due to its ability to do USDT creations and redemptions when it needed to. The former Alameda CEO described it as a “win-win” situation for the trading firm and the stability of USDT’s dollar peg:

“Obviously we’re making money because we can, e.g., selling above where we create, but we’re also bringing the price in line so that when aggro buyers come in, it sticks close to $1.”

As a result, Alameda profited by collecting the premium on arbitrage opportunities through its ability to create USDT tokens. Sam Bankman-Fried himself also chimed in on the debate in 2021, stating that Alameda actively redeemed USDT for U.S. dollars.

It’s sort of funny hearing people claim that you can’t create/redeem USDT for $.

Like, I don’t know what to tell you, you can, and we do. https://t.co/8XthTsk1xr

— SBF (@SBF_FTX) January 12, 2021

Cointelegraph has reached out to Tether to confirm the amount of USDT tokens that had been minted at the request of Alameda.

Magazine: The truth behind Cuba’s Bitcoin revolution: An on-the-ground report

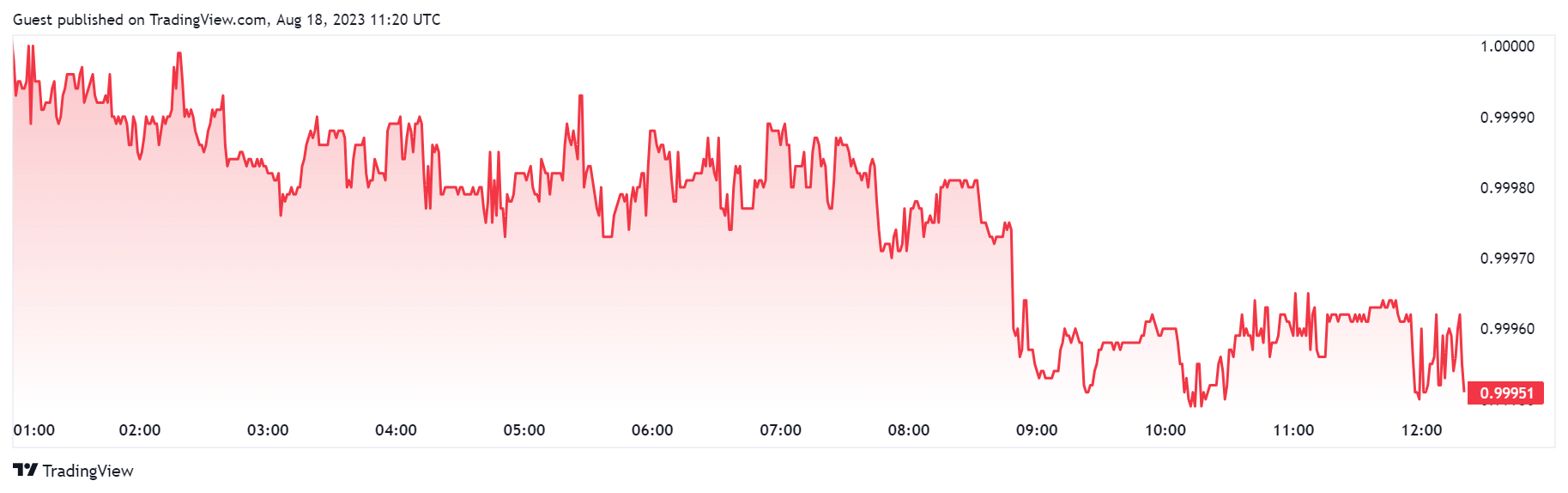

Tether’s USDT stablecoin value wobbled from its $1 peg amid the market carnage that wiped nearly $100 billion from the crypto market on Aug. 17.

Typically, cryptocurrency traders resort to stablecoins as a hedge against the inherent market volatility within the industry. These assets are designed to consistently maintain their pegged value, irrespective of prevailing market conditions.

USDT, however, failed at that during the last 24 hours as its value oscillated between $0.99847 during the thick of the carnage on Aug. 17 to as high as $1.0007 during the early hours of today, according to Tradingview data.

Data from CryptoSlate shows that USDT has recovered but has yet to fully regain its $1 peg as of press time. The stablecoin was trading for $0.99951 at the time of writing.

Tether’s USDT is the largest stablecoin by market cap, controlling more than 60% of the entire market, according to CryptoSlate’s data. Per its quarterly attestation, the stablecoin issuer has an excess reserve of up to $3.3 billion.

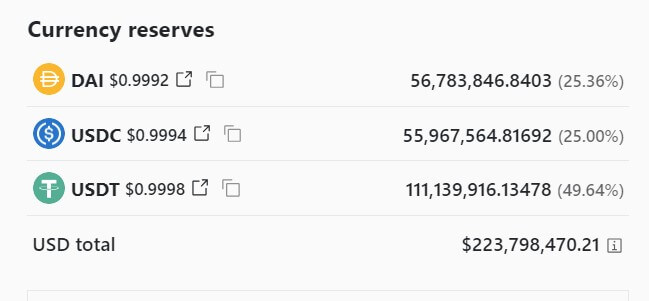

However, a look at 3Pool’s dashboard — the largest liquidity pool on Curve —shows that crypto investors favored rival stablecoins options over USDT during the market situation. According to the dashboard, USDT accounts for nearly 50% of the reserve, while USD Coin (USDC) and DAI make up the 50% balance.

This means traders have likely been selling USDT for DAI and USDC, as the pool is supposed to contain an equal amount of 33.33% of each of the three stablecoins.

Additionally, Tether’s market cap saw a slight decline from a peak of $83.08 billion to its current balance of $82.8 billion, according to CryptoSlate’s data. This further indicates how the market situation impacted USDT as traders sought refuge in other assets.

Notwithstanding these challenges, USDT emerged as the most traded stablecoin in the past 24 hours, boasting a trading volume exceeding $50 billion. This figure is six times higher than its rival, USDC, recorded during the same period.

The post Tether USDT stability tested amid crypto market shakeup appeared first on CryptoSlate.

PayPal and Paxos dominated the news cycle on Monday with the announcement of the launch of the PayPal (PYUSD) stablecoin, but concerns have been raised about the possibility of user assets being frozen in their wallets, as is the case with USDT.

Crypto Community Adverse to Paxos Wallet Freeze Feature

The PYUSD stablecoin issued by Paxos has a condition that is not too welcomed by the crypto community, which has dulled the initial excitement for the launch of the PayPal stablecoin. According to reports, Paxos, a blockchain infrastructure firm that issued the PYUSD has several centralization issues which give them a certain amount of control over user’s wallets.

Information published on its GitHub account reveals that Paxos can freeze or suspend users’ wallets and transfer functions on PYUSD authorization in the case of a security threat. The Paxos freeze feature is quite similar to Tether’s USDT which is able to freeze/blacklist users’ addresses involved in fraudulent activities. Additionally, Paxos can withhold users’ funds and assets, as well as wipe the account clean if the law requires it.

The reactions from the crypto community were instant and not too favorable as investors’ anxiety spiked at the thought of possibly losing their substantial digital assets or having their wallets on lock.

Centralization has always been a touchy subject for the crypto community as decentralized networks are often believed to be more secure and distribute control among network participants rather than a central body.

Paxos has stated that freezing accounts is unlikely to happen often, and the company itself would not execute the process.

Stock price holds above $62 following stablecoin launch | Source: PayPal Holdings, Inc. on Tradingview.com

PayPal Launches PYUSD Stablecoin

Global payment giant PayPal recently unveiled its latest innovation, the PayPal USD (PYUSD) stablecoin, on August 7, in collaboration with Paxos, a New-York based blockchain infrastructure company. The news comes as a significant development for the Paxos ecosystem, as the integration of cryptocurrencies into the financial industry continues to grow.

The crypto community has largely welcomed this new development, as investors and traders are gearing up to take advantage of the token and its conveniences. Analysts also predict that popular cryptocurrencies like Bitcoin and Ethereum prices will also benefit significantly from the new stablecoin.

The PYUSD is an ERC-20 token developed on the Ethereum blockchain backed by the US dollar. Launching PayPal’s stablecoin is expected to help make crypto trading and offerings easily accessible on the payment platform.

With PayPal’s user base reaching 400 million in 2022, the PYUSD stablecoin launch will also help facilitate crypto adoption and awareness, exposing a significant portion of the global population to digital currencies.

President and CEO of PayPal, Dan Schulman, commented, “The shift toward digital currencies requires a stable instrument that is both digitally native and easily connected to fiat currency like the U.S. dollar. Our commitment to responsible innovation and compliance, and our track record delivering new experiences to our customers, provides the foundation necessary to contribute to the growth of digital payments through PayPal USD.”

Featured image from HowStuffWorks, chart from Tradingview.com

Paulo Ardoino said the Tether “attack” was a good stress test but is now “dying off.”

Tether (USDT) moved from a low of $0.99579 on June 15, reaching a local top of $0.99976 later in the day – recovering its de-pegged position.

As reported by CryptoSlate, the brief de-peg was attributed to mass Tether selling within DeFi protocols. This presented as heavily skewed USDT balances within certain liquidity pools.

Tether CTO: Attack lacked power

Tether CTO Paolo Ardoino labeled the event an attack that lacked power and is now “dying off already.” He added:

“This attack is a good stress test for us, nothing more. We’ll demonstrate, as we did several times in the past, that Tether is strong, liquid and ready to protect its community.“

The incident coincided with CoinDesk winning a legal struggle to access reports on enforcement action by the New York Attorney General (NYAG) against Tether.

In February 2021, following an investigation that centered on claims Tether is 1-to-1 backed with U.S. dollars, the NYAG ordered Bitfinex and Tether to cease trading activity in the state of New York and to submit regular reports about its collateral reserves.

Commenting on the legal battle, Ardoino said Tether dropped its opposition to CoinDesk’s freedom of information request “because transparency matters” – more so in the current bear market climate.

He added that Tether has nothing to hide – explaining that previous opposition to the information request was based on “ring-fencing of our private information,” which is less relevant today.

The information from the report obtained by CoinDesk revealed extensive disclosures, including small regional banking partners, making third-party loans, and exposure to Chinese commercial papers.

On June 16, Tether released a post responding to the disclosures, saying it “is in a completely different position compared to 2 years ago.” It added that the company’s exposure to commercial papers was reduced to zero in 2022, and it aims to bring its secured loans portfolio to zero soon. Furthermore, per its latest attestation statement, Tether is holding a $2.4 billion surplus.

At the time of the NYAG case, Tether’s market cap was $34 billion. Today, it is $83.5 billion.

The post Tether CTO calls USDT depeg ‘good stress test’ for company appeared first on CryptoSlate.