The adult-use ballot question could potentially allow cannabis sales in the third-largest U.S. state, with a population of more than 22 million people.

Source link

victory

Bitcoin (BTC) passed $29,500 on Oct. 20 after an eventful 24 hours boosted BTC price trajectory, while XRP’s (XRP) price jumped above $0.50 in response to Ripple’s big legal win.

Hawkish Fed’s Powell fails to dent BTC price

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it edged closer to two-month highs from the start of the week.

The largest cryptocurrency appeared to feed off events surrounding a speech from Jerome Powell, chair of the United States Federal Reserve, the day prior.

Amid a U.S. bond rout, Powell was under pressure to deliver appropriate wording, and analysis even predicted a “very dovish” tone would dominate. In the event, the speech, which was briefly interrupted by protesters, saw Powell as highly conservative on the outlook.

“The stance of policy is restrictive, meaning that tight policy is putting downward pressure on economic activity and inflation,” he said about interest rate hikes.

“Given the fast pace of the tightening, there may still be meaningful tightening in the pipeline.”

Powell said that the Fed acknowledged the potential problems of hiking rates too far.

“Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy,” he continued.

“Given the uncertainties and risks, and how far we have come, the Committee is proceeding carefully.”

Data from CME Group’s FedWatch Tool showed changing tides among market expectations when it comes to future rate decisions.

At its next meeting on Nov. 1, the Federal Open Market Committee (FOMC) is now unanimously thought to hold rates at their current levels, per data from CME Group’s FedWatch Tool. Before Powell, the odds stood at 88%.

Following the speech, news broke that U.S. regulators had dropped criminal charges against executives of blockchain firm Ripple.

XRP’s price responded immediately, trading up over 6% in 24 hours at the time of writing.

Trader suggests Bitcoin “impulse” is here

Amid a backdrop of increasing anticipation over the approval of a U.S. Bitcoin spot price exchange-traded fund (ETF), Bitcoin gained momentum overnight.

Related: Bitcoin metrics ‘improve bullish odds’ as BTC price holds 200-week trendline

At the time of writing, the day’s highs stood at $29,689 — just $200 from the top of a snap volatility wick seen on Oct. 17.

$BTC has launched.

Keeping it as simple as it can get:

The same way 26.8k was the origin of our last impulse, 28.6k is now the origin of the current one. Above that, we are going A LOT higher, FAST.

Drop below 28.6k and the local uptrend will be violated and we may get a bit… pic.twitter.com/CbhLBo133G

— CrediBULL Crypto (@CredibleCrypto) October 20, 2023

“Bitcoin filling the wick, slowly but surely. Let’s go for that $30k tap,” popular trader Jelle wrote in part of an X analysis on the day, having previously argued that Bitcoin looked “eager to fill” the Oct. 17 wick.

“Today it’s going a very interesting day for trading… They have hit exactly $29400 where there were many liquidations,” fellow trader CrypNuevo continued.

In various X posts, CrypNuevo uploaded liquidation data from the past days, warning that long positions outnumbered shorts four to one. Bitcoin, he suggested, could retrace during the U.S. trading session.

Liquidation levels and liquidation heatmaps.

Quick thoughts:

– All our liquidation levels to the upside from yesterday have been hit.

– Delta long liquidations at $15B (mid-high amount and enough to consider a retrace is coming soon).

– Current long-short open positions… pic.twitter.com/dAqbRbaimc— CrypNuevo (@CrypNuevo) October 20, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Grayscale Files for New Ether Futures ETF Following Recent Legal Victory

Grayscale’s decision to file for an Ether futures ETF comes on the heels of a significant legal victory against the US Securities and Exchange Commission (SEC).

Renowned crypto asset manager Grayscale Investments recently filed for a new Exchange-Traded Fund (ETF) that will track Ethereum (ETH) futures, as reported by the Wall Street Journal.

Grayscale’s Unique Approach

In its previous attempt to launch a crypto ETF, Grayscale filed under the Investment Company Act of 1940. This filing, while a significant step forward for the industry, faced regulatory hurdles and delays, a common theme in the crypto ETF space.

In the latest application, Grayscale’s pivot toward the Securities Act of 1933 demonstrates the company’s commitment to navigating regulatory challenges while catering to the surging demand for crypto investment options.

The Securities Act of 1933 primarily governs the issuance and sale of securities, providing a regulatory framework that is potentially more suitable for crypto futures ETFs. It allows for the registration of securities offerings, which aligns with the structure of ETFs, making it a potentially smoother process compared to the Investment Company Act of 1940.

Notably, ETFs have gained immense popularity as they provide investors with an accessible and regulated way to gain exposure to cryptocurrencies. These investment vehicles have gained traction among both retail and institutional investors who seek a more convenient way to enter the crypto market.

At least 12 candidates, including Volatility Shares, Bitwise, ProShares, VanEck, Roundhill, and Valkyrie Investments, have filed for Ethereum futures ETFs so far. The increasing number of applicants vying for approval indicates a strong market demand for such investment products. Market participants believe that, if approved, Ethereum futures ETFs could help further legitimize and institutionalize the crypto market.

A Win for Grayscale Over the SEC

Grayscale’s decision to file for an Ether futures ETF comes on the heels of a significant legal victory against the US Securities and Exchange Commission (SEC). In a recent ruling, a judge ordered the SEC to re-evaluate Grayscale’s proposal for a spot bitcoin ETF.

This ruling is seen as a positive development for the crypto industry, as it suggests that the SEC’s stringent stance on crypto-related ETFs may be subject to legal scrutiny and revision. The judge’s decision highlights the evolving nature of crypto regulation in the United States.

While the SEC has traditionally been cautious about approving crypto ETFs, the growing interest and demand from institutional investors and the broader public are compelling regulatory authorities to reconsider their approach.

Grayscale’s legal saga began in late 2021 when it filed an application with the SEC to convert its Grayscale Bitcoin Trust (GBTC) into a Bitcoin spot ETF. However, the SEC rejected Grayscale’s request in June 2022, citing concerns related to anti-fraud and investor protection requirements.

While Grayscale’s legal victory initially had a positive impact on the price of ETH, it’s essential to understand that crypto markets are highly volatile. In the immediate aftermath of the court’s ruling, ETH’s price surged above the $1,700 mark. However, the price rally proved short-lived as it retraced to around the $1,600 level.

next

Altcoin News, Blockchain News, Cryptocurrency News, Ethereum News, Funds & ETFs

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

Bitcoin ETF approval odds increase to 75% following Grayscale’s court victory: Bloomberg analysts

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

According to Bloomberg, in a key development for the cryptocurrency industry, the US Securities and Exchange Commission (SEC) is reportedly set to allow the launch of exchange-traded funds (ETFs) based on Ethereum (ETH) futures.

This move marks a significant win for numerous firms that have long sought to introduce such products. While the SEC has previously hesitated to approve ETFs directly tied to cryptocurrencies, the decision to greenlight an Ethereum futures ETF could have profound implications for Ethereum’s classification as a non-security.

This development also holds potential ramifications for other cryptocurrencies, as the SEC’s stance on where the line between security and non-security lies becomes a subject of litigation.

Ethereum Paradigm Shift

According to Bloomberg’s report, sources familiar with the matter claim the SEC is unlikely to block the ETFs based on futures contracts for Ethereum, which is currently the second-largest cryptocurrency by market capitalization.

Nearly a dozen companies, including prominent names like Volatility Shares, Bitwise, Roundhill, and ProShares, have filed applications to launch these ETFs. While it remains unclear which funds will receive approval, insiders suggest that several may be granted the green light as early as October.

This anticipated approval of an Ethereum futures ETF by the SEC could have far-reaching implications for the regulatory treatment of cryptocurrencies.

The SEC’s reluctance to approve ETFs directly tied to cryptocurrencies has spurred speculation that derivative-based products would offer a potential pathway to market access.

On this matter, crypto analyst Adam Cochran has highlighted that the SEC potentially approving an ETF based on Ethereum futures contracts implicitly acknowledges that Ethereum itself is not considered a security.

This decision challenges the notion that Ethereum should be regulated as a traditional financial security, considering its proof-of-stake mechanism, purpose, and usage.

Cochran further believes that the SEC’s approval of an Ethereum futures ETF bolsters Ethereum’s non-security status and sets a precedent that could impact other cryptocurrencies facing regulatory scrutiny.

The ongoing legal battle between the SEC and Grayscale Investments over rejecting their Bitcoin trust’s conversion into an ETF highlights the agency’s concerns regarding investor protection, manipulation risks, and price volatility.

However, this approval could provide a compelling argument in favor of distinguishing between the underlying asset and how it is sold, bolstering the Torres Doctrine and potentially influencing the outcome of similar cases, such as the XRP appeal.

The SEC’s approval of an Ethereum futures ETF holds tremendous significance for the cryptocurrency industry. If confirmed, it would mark a pivotal moment for Ethereum’s classification as a non-security, further solidifying its position as a commodity or currency.

The decision also highlights the regulatory challenge of defining clear boundaries between securities and non-securities in crypto.

As the industry evolves, approving an Ethereum futures ETF could shape the regulatory landscape, paving the way for increased adoption and investment opportunities in the cryptocurrency market.

However, the news is not entirely favorable for ETH as it trades at $1,660, following a downward trend similar to Bitcoin and the overall cryptocurrency market. The market has experienced a substantial outflow of liquidity, leading to a significant decline in most digital currencies.

Over the past 24 hours, ETH has declined more than 4% after breaking its previously established range between $1,895 and $1,830. Additionally, it has suffered a notable loss of 10% within the seven-day timeframe.

Featured image from iStock, chart from TradingView.com

Biden is declaring victory on the economy. Wall Street is slowly coming around.

The index of leading economic indicators peaked in February 2022, recession warnings started appearing on Wall Street in the middle of last year, and the yield curve became inverted, for good, by July 2022.

And yet here we are, at the end of the second quarter in 2023, some 5 percentage of Fed rate hikes in the bag and a recession just isn’t here. The Atlanta Fed’s nowcast for the second quarter is that GDP will grow a solid 1.8%.

Neil Dutta, head of economics at Renaissance Macro Research, fired off a note saying “the statute of limitations has now kicked in. There are several reasons to be upbeat on the U.S. economy. The recession clock has been reset.”

Lyn Alden’s Twitter feed

For one, look at that ultimate rate-sensitive sector, housing. Data released Tuesday showed new home sales surging in May, gaining for the third straight month. This meme from strategist Lyn Alden boils it down nicely. People aren’t putting their homes on the market with mortgage rates at 7%, which means the only available supply is coming from new homes. But that’s the part of the housing market which gives the biggest pop to the broader economy.

Dutta noted the housing improvement and pointed out other positives. One is that consumer prices are falling faster than the labor market income. Another is that the current weakness in inventories investment is not sustainable given the growth in household consumption — at some point, firms will have to re-stock their inventories.

Looser financial conditions as well as the Fed “taking its foot of the market’s neck” are other positives, he says. Auto sales also have picked up, as supply chains have improved.

Dutta also attacked some of the bear arguments. Bank lending has been slowing, but he points out this business cycle has been driven by income, not credit. While initial jobless claims have been elevated of late, continuing claims haven’t followed in the way they usually would, perhaps a signal that those who get laid off can quickly find another job.

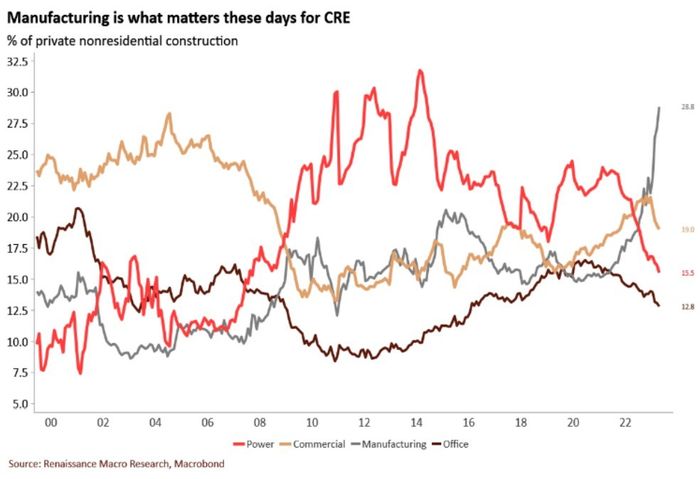

What about commercial real estate? Well, Dutta notes, office construction is just a small part of commercial real estate, and structures investment is only 3% of the economy anyway. Besides, federal stimulus likes the CHIPs Act is “crowding in” private investment.

“You cannot talk about late cycle dynamics with housing turning up and inventories likely to follow. There will be no recession in the next six months, and it is increasingly likely that we’re not seeing one in the next year either,” he says.

Dutta, in a follow-up email with MarketWatch, addressed why traditional recession signals didn’t work this time around. The leading indicators data is composed of manufacturing-intensive numbers. “That normally makes sense but given the dynamics of the pandemic it might make a lot less sense now. People are conflating a normalization of activity in manufacturing with an economy wide recession,” says Dutta.

And what about the inverted yield curve? “Is it the yield curve inversion that signals recession or the bull steepening of the curve that does,” he replies. “That is, when the Fed starts aggressively cutting we know we’re in recession. An inverted curve doesn’t necessarily mean financial conditions are tight.”

President Biden is due to give his speech on “Bidenomics” at 1 p.m. Eastern in Chicago. Ahead of that, he told a fundraiser that the economy is “strong now” and that he doesn’t expect a recession.

The markets

U.S. stock futures

ES00,

were weaker, with the Nasdaq 100 contract

NQ00,

down on microchip sector concerns. The dollar

DXY,

inched higher.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Nvidia

NVDA,

and Advanced Micro Devices

AMD,

shares fell on a Wall Street Journal report the White House might ban a sale of AI chips to China. Also in chips, Micron Technology

MU,

reports fiscal third-quarter results after the close.

Federal Reserve Chair Jerome Powell will appear along with other top central bankers in a panel discussion at the European Central Bank forum on central banking at 9:30 a.m. Eastern from Sintra, Portugal.

General Mills

GIS,

shares fell as the cereal maker’s sales missed estimates, even though earnings were better than anticipated.

The U.S. Supreme Court could issue a ruling on student-debt relief as early as Wednesday.

The Federal Reserve will release the results of its stress tests on the biggest banks after the close. Read a preview of stress test impact.

UBS

UBS,

may cut half of the staff from the acquired Credit Suisse, according to a report.

Best of the web

The drugs that power Silicon Valley.

Traders are scooping up bets on volatility.

Here’s the best time to take a nap.

Top tickers

Here are the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

MANU, |

Manchester United |

|

AMC, |

AMC Entertainment |

|

AMD, |

Advanced Micro Devices |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon.com |

The chart

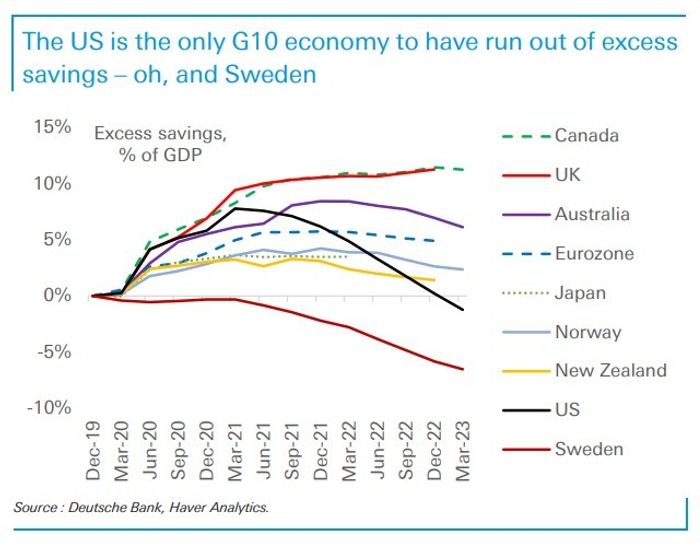

So when are those pandemic savings due to run out? Apparently, per Federal Reserve research, that happened in the first quarter. Deutsche Bank ran a similar analysis and agreed that the U.S. has run out of exceed savings, as well as Sweden, which of course never locked down in the first place so didn’t send money to households. The better news for the world economy is how many countries still have those buffers.

Random reads

A janitor turned off a freezer making annoying alarms — ruining some 20 years of scientific research. Now there’s a lawsuit.

Talk about really oven-fired pizza — archaeologists have found a painting from Pompeii depicting a precursor to the Italian dish.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.