Deribit FZE, an entity owned by crypto derivatives platform Deribit, has secured a conditional virtual asset service provider from the Dubai virtual assets regulator. The license, which covers spot and derivative trading, will remain non-operational until Deribit meets the regulator’s localization requirements. Meeting Dubai’s Localization Requirements Deribit FZE, a wholly owned entity of the crypto […]

Deribit FZE, an entity owned by crypto derivatives platform Deribit, has secured a conditional virtual asset service provider from the Dubai virtual assets regulator. The license, which covers spot and derivative trading, will remain non-operational until Deribit meets the regulator’s localization requirements. Meeting Dubai’s Localization Requirements Deribit FZE, a wholly owned entity of the crypto […]

Source link

Virtual

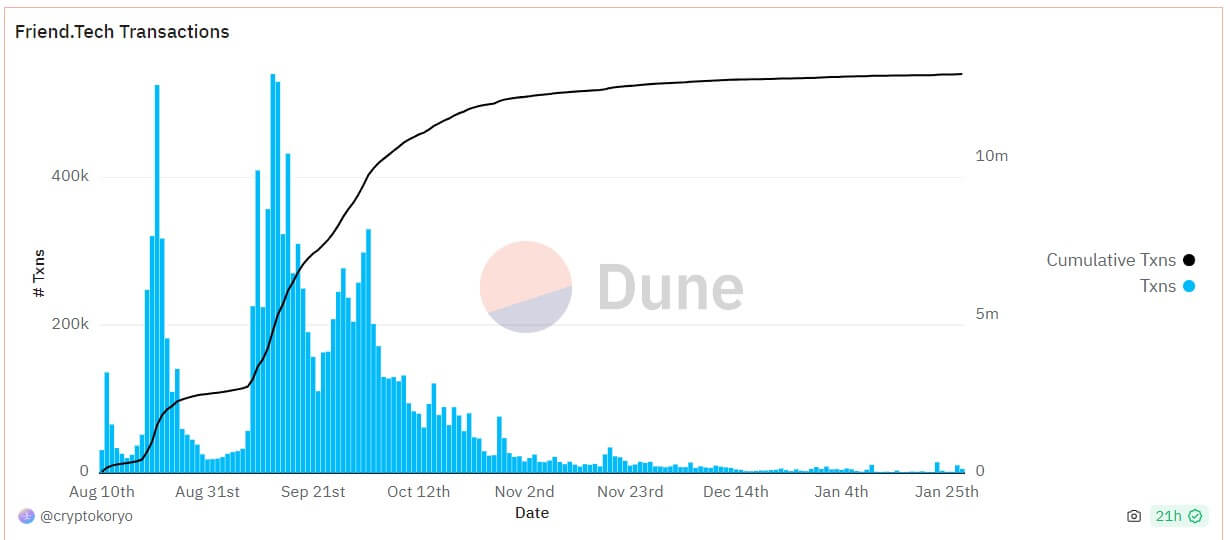

Decentralized social media protocol Friend.Tech captured attention last year but has noticeably faded from the radar recently.

CryptoSlate, using Dune Analytics data compiled by 21.co, discovered a concerning trend – the platform’s failure to attract new users, coupled with indifference from its existing user base. On Jan. 28, the platform garnered a mere 19 new users engaged in at least one transaction, a stark contrast to its peak of over 70,000 users in September.

A separate dashboard by Cryptokoryo sheds light on the extent of the downturn. On the same date, Friend.Tech recorded only 5,544 transactions, signaling a staggering 99% decrease from its peak volume of almost 540,000.

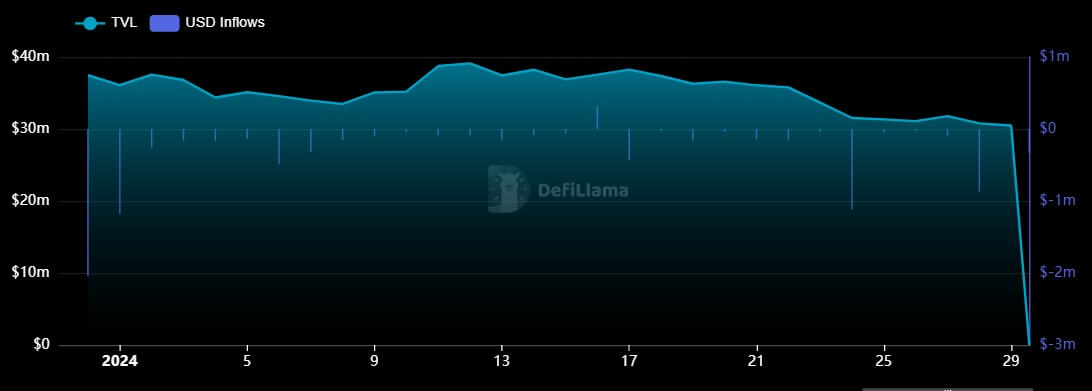

Adding to the downward spiral, DeFillama’s data reveals a consistent negative outflow throughout this month.

Per the data, Friend.Tech experienced positive USD flow only on Jan. 16, with $313,000 entering the platform. However, more than $5 million flowed out on other days, significantly dropping the total value of assets locked on the platform to $30 million.

Moreover, this decline is further reflected in the fees generated by the network, plummeting from a daily average of nearly $1 million to a mere $50,000 in the last two days.

‘Biggest lowlight’

Several reasons could be blamed for Friend.Tech’s falling numbers. However, issues began when multiple users suffered sim-swap attacks due to the platform’s lax security. CryptoSlate reported that at least $20 million in the platform users’ assets were vulnerable to these attacks.

While efforts to address security concerns were made promptly, this incident reflected the platform’s challenges in keeping pace with bug fixes and implementing essential policies for its rapidly expanding user base.

The platform’s viral success also spawned copycats like Stars Arena on other blockchain networks, including Avalanche. DeFillama data shows these protocols are also struggling for adoption and use.

Teng Yan, Head of NFT Research at Delphi Digital, called Friend.Tech’s setback the “biggest lowlight” of the past year. He highlighted the project’s potential to make crypto mainstream but criticized its team’s execution.

“[Friend.tech] could have been a top consumer app bringing crypto mainstream. An on-chain reputation layer built on top of existing social graphs. Great idea but poor execution,” Yan added.

Friend. Tech’s viral growth

Friend.Tech introduced an innovative way for users to monetize their popularity in the crypto space, allowing users to buy and sell “keys.” These keys enabled buyers to send private messages to sellers.

As a result, several high-profile figures, both from the cryptocurrency world and the broader entertainment industry, used Friend.Tech to connect to their community, and the platform was driving transactions on Base, the layer2 network it was built on.

Despite this initial success, the blockchain-based social network faced a rapid decline, losing 95% of its activity within a month of launch. Yet, a revival occurred in September, with daily trading volumes nearing $10 million. At its peak, the protocol boasted a TVL exceeding 30,000 ETH ($50 million), outperforming giants like Uniswap and the Bitcoin network in fees generated.

Chinese court contradicts government’s stance on virtual currencies, declares them to be legal property

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

China court declares virtual assets legal properties protected by law: Report

A People’s Court in China published a report on the legality of virtual assets, analyzing the criminal law attributes of these digital assets. The court noted in its report that virtual assets under the current legal policy framework are still legal property and protected by law.

The People’s Courts of the People’s Republic of China exercise judicial power independently and are not subject to interference by an administrative or public organization. These courts try criminal, civil and administrative cases as well as economic disputes.

The report titled “Identification of the Property Attributes of Virtual Currency and Disposal of Property Involved in the Case” acknowledged that virtual assets have economic attributes and thus can be classified as property, reported a local daily. Although China has deemed all foreign digital assets illegal by imposing a blanket ban, the report argues that virtual assets held by individuals should be considered legal and protected by law under the current policy framework.

The report also added suggestions to deal with crimes involving virtual assets and noted that since the money and property involved in the case cannot be confiscated, it should be based on the unification of criminal and civil law. Such cases should be treated separately to achieve a balanced protection of personal property rights and social and public interests.

China imposed a blanket ban on all crypto-related activities and banned foreign crypto exchanges from offering their services to mainland customers. However, despite a hostile national policy on digital assets, the Chinese courts have offered a contrasting stance on Bitcoin (BTC) and other digital assets over the years.

Related: China announces plans for new national financial regulator

The first instance of such difference arose in September 2022, when a lawyer suggested that crypto holders in China are protected by the law in case of theft, misappropriation or breach of a loan agreement despite the ban on crypto. Later in May 2022, a Shanghai court affirmed that Bitcoin qualifies as virtual property and thus is subject to property rights.

China’s hostile stance against Bitcoin and other cryptocurrencies has been a long-drawn one. However, over the past few years, the government seems to have softened its stance. This was evident from the rise in China’s Bitcoin mining share, which dropped to zero post-blanket ban but rose to take the second spot within a year.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: DeFi faces stress test, DoJ fears run on Binance, Hong Kong’s crypto trading: Hodler’s Digest, July 30–Aug. 5

Oman financial regulator seeks feedback on proposed virtual asset framework

The Sultanate of Oman is inching closer to launching its own virtual asset regulations, with its financial markets regulator seeking public comments on its proposed regulatory framework governing digital assets, such as cryptocurrencies.

The Capital Market Authority of Oman is currently in the process of drafting a comprehensive regime for the virtual asset sector, which includes various business requirements and market abuse prevention, it said in the consultation paper published on July 27.

“The CMA is seeking to provide an alternative financing and investment platform for issuers and investors while mitigating the risks associated with the [virtual asset] class.”

The consultation paper includes 26 questions, with which industry stakeholders could provide their opinion. It includes proposals on regulatory and licensing requirements for virtual asset service providers (VASPs), corporate governance, risk management and virtual asset issuance.

It revealed that the proposed framework encompasses utility tokens, security tokens, fiat-backed and asset-backed stablecoins, and other digital currencies that fall under the Financial Action Task Force’s definition of virtual assets. However, the issuance of privacy coins might get banned, pending public feedback.

Related: UAE emerges as a pro-Bitcoin mining destination in the Middle East

The CMA might also require VASPs to establish a local presence in Oman through a legally established entity and physical office and impose minimum capital requirements on them. If finalized, virtual asset firms might also be required to hold only a low percentage of assets in hot wallets, conduct audits of safeguarded assets and show proof of reserves.

The public must submit their feedback to the consultation paper by Aug. 17, with key opinions potentially getting posted on the CMA website.

Following the consultation phase of the development of the virtual asset regime, the CMA will draft and finalize the regulatory framework.

Although the CMA publicly announced launching a regulatory framework on Feb. 14, discussions on regulating the virtual asset industry in Oman began much earlier. In November 2020, the country’s National Committee for Combating Money Laundering and Terrorist Financing decided to launch a task force comprising CMA and Central Bank of Oman officials to study whether to ban or permit virtual asset activities. Consultants were then enlisted in December 2022 to assist in setting up the new regime.

Lacoste Unveils Exclusive Ethereum-Based Virtual Store For NFT Holders

Fashion brand Lacoste has unveiled an exclusive Ethereum-based virtual store for NFT holders as the brand aims to give its NFT holders an immersive experience for the summer. The virtual store, created by retail technology developer Emperia, will integrate the traditional retail experience with digital innovations exclusive to users holding Lacoste’s UNDW3 NFT passes.

An Insight Into UNDW3 & Lacoste’s Virtual Store

Lacoste’s UNDW3 NFT holders will have exclusive access to the virtual store. UNDW3 is an NFT-based loyalty program the French brand released in June (similar to that of Starbucks).

Holders will access the virtual store through Lacoste’s e-commerce platform. The digital store gives an immersive experience right from the beginning; Shoppers enter through Lacoste’s iconic crocodile, which will lead them to a tiled boutique. These shoppers also get to enjoy the beach view in the digital store from its outdoor pool area.

Related Reading: Singaporean Judge Declares Crypto Is Personal Property In ByBit Case

Lacoste’s summer apparel collection will also be on display throughout the experience, and visitors can make a purchase at any time. There is also a crocodile-themed scavenger hunt game these shoppers can participate in.

Additionally, there is an exclusive underwater VIP space that only UNDW3 holders can access. These users will need to unlock this space by an email login or by connecting the digital wallet which contains the NFT. Furthermore, Lacoste’s exclusive UNDW3 apparel collection is available on sale in the VIP space.

There is more to it as it exemplifies the growing Phygital trend among fashion brands. Each piece from the exclusive UNDW3 apparel collection has a tokenized equivalent (in the form of an NFT). Holders can scan a QR code that unlocks an augmented reality (AR) feature, adding a more immersive angle to the shopping experience.

Lacoste & Emperia’s Collaboration

It is worth mentioning that this isn’t the first time Lacoste and Emperia have collaborated on a virtual shopping experience. Emperia had previously helped Lacoste build a token-gated gamified experience for UNDW3 NFT holders. This shoppable activation, which launched in December 2022, won a Webby Award earlier this year.

Speaking on the blissful relationship with Lacoste, Emperia’s co-founder, and CEO Olga Dogadkina said:

Our ongoing work with Lacoste and its advanced view of e-commerce and customer loyalty has given birth to new technologies that yield an improved user journey which connects the dots between virtual and physical retail.

The phygital trend continues to grow in the fashion world and has become one of the biggest benefits of Web3 to the industry. Fashion brands like Nike have also in the past launched projects that help give their customers a feel of the physical and digital realms together.

Total market cap now above $1.15 trillion | Source: Crypto Total Market Cap on Tradingview.com

Featured image from Awwwards, chart from Tradingview.com

Kuwait Authorities Impose Ban on Bitcoin and Other Virtual Asset Transactions

The ban crypto transactions in Kuwait is reportedly part of a broader regulatory initiative that involves multiple supervisory authorities, including the Ministry of Commerce and Industry, the Central Bank of Kuwait, and the Insurance Regulatory Unit.

Kuwait, a country in West Asia, has taken a stringent step in its regulatory stance on cryptocurrencies by imposing a comprehensive ban on all transactions involving crypto and other digital assets in the nation. The country’s financial regulator, the Capital Markets Authority (CMA) of Kuwait, released a circular on July 18, enforcing the absolute prohibition on major activities related to virtual assets, including Bitcoin (BTC), following in the footsteps of other nations such as Pakistan, Argentina and China which have already implemented similar restrictions on virtual assets in their various jurisdictions.

The ban covers crucial aspects of the crypto ecosystem, such as payments, trading, making investments in crypto, and engaging in mining operations. The move aims to address the potential risks associated with virtual assets and to safeguard the interests of consumers and investors.

CMA Claims Cryptocurrencies Lack Legal Status

While the ban prohibits crypto traders in the country from engaging in any digital assets-related activities, the new rule does not extend to traditional financial products in the country. According to the circular, the restriction does not apply to securities and other financial instruments regulated by the Central Bank of Kuwait and the CMA.

In its circular, the CMA cited the lack of legal status for cryptocurrencies as part of the reasons for the ban, emphasizing that digital assets are not issued or supported by any central authority.

In addition to the prohibition, the authorities have warned the public about the potential risks involved in engaging with digital assets, noting that prices or values of these assets are often driven by speculative trading, making them highly volatile and susceptible to sharp price fluctuations.

“It is not linked to any asset or issuer, and the price of these assets are always driven by speculation that exposes them to a sharp decline,” said CMA in the circular.

Crackdown on Money Laundering and Terrorist Financing

The financial authorities said in the circular that the recent regulatory changes align with the country’s dedication to combating money laundering and illicit activities related to cryptocurrencies within the nation. In line with its commitment to tackling money laundering and terrorist financing, the regulator emphasized that any violations of the country’s Anti-Money Laundering (AML) laws may result in penalties under Law No. 106 of 2013. These measures reinforce Kuwait’s efforts to maintain financial integrity and security.

The CMA also pointed to a study in the circular conducted by the National Committee for Combating Money Laundering and Financing of Terrorism regarding the commitment to implementing the Financial Action Task Force’s (FATF) Recommendation (15).

For clarity, the FATF Recommendation 15 is a regulatory framework that requires crypto exchanges and other virtual asset service providers (VASP) in the country to implement AML rules for money laundering and countering the financing of terrorism.

Meanwhile, the ban on Bitcoin and other crypto transactions in Kuwait is reportedly part of a broader regulatory initiative that involves multiple supervisory authorities, including the Ministry of Commerce and Industry, the Central Bank of Kuwait, and the Insurance Regulatory Unit. This coordinated effort ensures a consistent and unified approach to address the challenges posed by the rapidly growing cryptocurrency market.

next

Altcoin News, Bitcoin News, Blockchain News, Cryptocurrency news, News

Chimamanda is a crypto enthusiast and experienced writer focusing on the dynamic world of cryptocurrencies. She joined the industry in 2019 and has since developed an interest in the emerging economy. She combines her passion for blockchain technology with her love for travel and food, bringing a fresh and engaging perspective to her work.

You have successfully joined our subscriber list.

The state of Kuwait is the latest jurisdiction to ban virtually all operations involving cryptocurrencies like Bitcoin (BTC).

On July 18, Kuwait’s main financial regulator, the Capital Markets Authority (CMA), issued a circular on the supervision and issuance of virtual assets in the country.

In the circular, the CMA confirmed the commitment to “absolute prohibition” on major use cases and operations involving cryptocurrencies, including payments, investments, and mining.

The circular also bans local regulators from issuing any licenses allowing firms to provide virtual asset services as a commercial business.

In the meantime, securities and other financial instruments regulated by the Central Bank of Kuwait and the CMA are excluded from the latest prohibitions, the announcement notes.

Apart from the prohibitions, the CMA also required customers to be cautious and aware of the risks associated with virtual assets. The regulator particularly flagged cryptocurrencies, arguing that they “don’t carry a legal status and are not issued or supported.”

The CMA added:

“It is not linked to any asset or issuer, and that the prices of these assets are always driven by speculation that exposes them to a sharp decline.”

The penalties for violating Kuwait’s Anti-Money Laundering laws are stipulated in Article 15 of Law No. 106 of 2013, the regulator noted.

Related: UAE emerges as a pro-Bitcoin mining destination in the Middle East

Kuwait’s new regulations align with the country’s measures to combat money laundering and terrorist financing, the regulator stated. The CMA also referred to the conclusions of a study by the National Committee for Combating Money Laundering and Financing of Terrorism regarding the commitment to applying recommendation 15 by the Financial Action Task Force.

According to local reports, the CMA’s crypto restrictions are part of a new inter-departmental crypto ban involving several supervisory authorities in Kuwait. Similar circulars have reportedly been issued by the Central Bank of Kuwait, the Ministry of Commerce and Industry and the Insurance Regulatory Unit.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Tokenizing music royalties as NFTs could help the next Taylor Swift