The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

Source link

volume

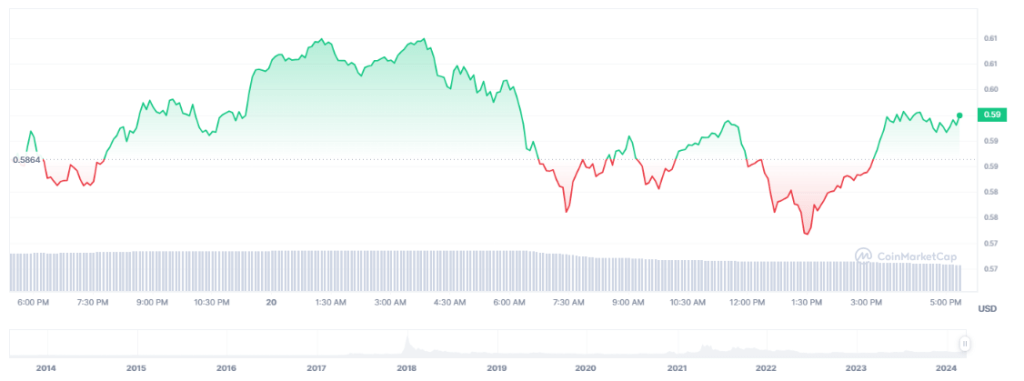

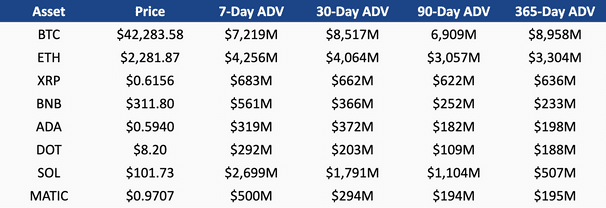

The surge in XRP trading volume has been significant, with multiple sources reporting substantial increases over a short period. On March 19, 2024, CoinMarketCap data revealed an increase in XRP’s trading volume by 130% to over $4 billion within 24 hours.

This surge occurred amidst a general market downturn, where XRP’s trading volume increase helped offset some losses experienced by other assets. Despite a slight decrease in XRP’s price to $0.605, the asset remained in the green over the last month, showing an increase of more than 8%.

Source: CoinMarketCap

Market Developments Trigger Spike

One of the key drivers behind this uptick in trading volume is a favorable court ruling between the US Securities and Exchange Commission and Ripple Labs. This ruling provided much-needed regulatory clarity for XRP, leading to major exchanges like Coinbase, Kraken, Bitstamp, and Binance.US either relisting or announcing plans to resume trading with XRP.

The increase in trading volume also reflects an uptick in investor enthusiasm for XRP. The trading volume spike, which at one point constituted over 22% of XRP’s market capitalization, indicates a strong wave of interest and confidence among investors. Additionally, an impressive price rally in XRP, with the price soaring by nearly 100% at one point, further fueled trading activity as investors capitalized on the price movement.

XRP market cap currently at $32 billion. Chart: TradingView.com

Exchange Listings Boost Trading Activity

The reopening or relisting of XRP on major exchanges post-court ruling played a pivotal role in boosting trading volume. Exchanges like Coinbase, Kraken, Bitstamp, and Binance.US reopening XRP trading provided traders with increased opportunities, contributing to the boost in overall trading volume.

In the past week, the price of XRP has experienced notable fluctuations, reflecting a mix of ups and downs in the cryptocurrency market.

According to Coinbase, XRP’s price has seen a 3% decrease in the last 24 hours and a significant 17% decline over the past week. This downward trend indicates a challenging week for XRP investors as the price struggled to maintain its position.

Varied Price Data From Different Sources

On the other hand, YCharts data presents a slightly different picture, indicating an XRP price of 0.6539 USD on March 19, 2024. This figure represents a 5.61% increase from the previous day and a significant 68% uptick from one year ago, showcasing a more positive outlook for XRP in the long term.

Investors and traders are closely monitoring XRP’s development as it works through the uncertainty in the market. A break below the 200-day moving average at $0.57 could be the first sign of impending market decline.

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

XRP Records Massive 80% Surge In Trading Volume, Can Price Reach A New ATH?

XRP continues to show strength despite largely underperforming during the ongoing bull market. Interestingly, the crypto witnessed a surge in activity last week, with trading volume surging in tandem. Particularly, the trading volume saw an increase of over 80% recently.

However, the boost in activity and trading volume has not necessarily translated into continuous price growth, as XRP is currently on a 13% percent correction from the $0.74 price level on Monday.

XRP Trading Volume Surges, But Will Price Follow?

XRP witnessed a surge earlier in the week which saw it breaking out of a 6-year-long symmetrical triangle, prompting analysts to anticipate a continued price surge.

During this period, the crypto witnessed a surge in trading volume from whales in particular, with large bouts of XRP leaving crypto exchanges.

This bullish sentiment allowed XRP to cross over $0.74 for the first time in eight months, albeit for a short moment. This surge in price was short-lived, as XRP fell as low as $0.6 in the days after.

However, a recent 80% surge in on-chain activity and trading volume has led to the price of XRP increasing by 4.45% in the past 24 hours and 2.2% in a seven-day timeframe.

Volume spikes of this magnitude often occur before a price rally, therefore, this massive spike in volume has the XRP community speculating that a strong price rally could be on the horizon.

Total crypto market cap currently at $2.5 trillion. Chart: TradingView

Current Price Action: Can XRP Reach A New All-Time High?

At the time of writing, XRP is trading at $0.6398. The crypto’s journey to a new all-time high is definitely not going to be an easy one, as it is now down by 83% from its current all-time high of $3.84.

However, current market dynamics and various predictions from many crypto analysts indicate that the crypto might go on a surge of great magnitude in the near future.

One of these is a prediction from analyst Jaydee, who noted that XRP’s recent breakout from the six-year trendline mentioned earlier could lead to a surge to $3 from the current price level.

The major resistance level to watch is $0.74. XRP tested this level a few days ago but failed to close above it. If bullish momentum continues and volume stays strong, XRP could break through $0.74 decisively in the new week. If it does, the next resistance levels are at $0.82 and $1.5.

One of the few factors that could contribute to a strong price increase is regulatory clarity regarding XRP’s status, which could boost confidence from institutional investors.

Notably, XRP’s non-security status seems to be gaining ground. The European Corporate Governance Institute (ECGI) recently published a research paper acknowledging this non-security status.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

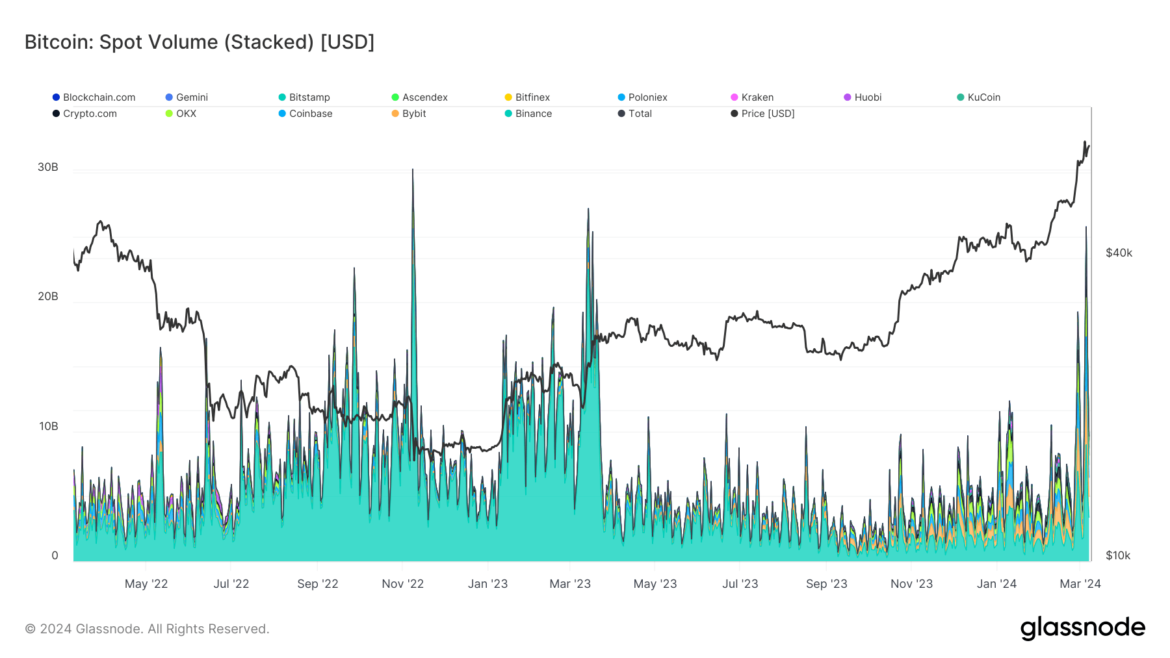

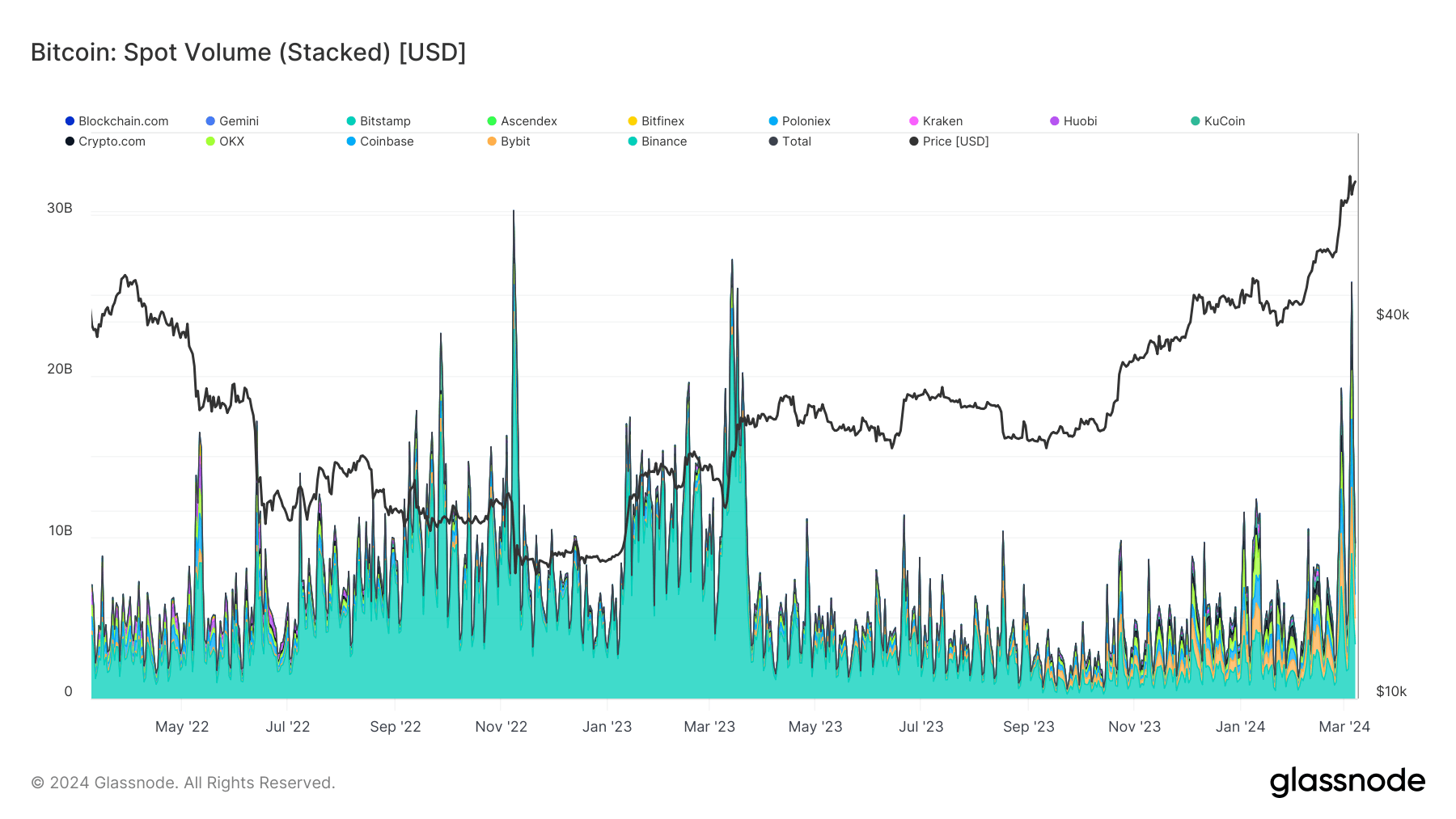

Quick Take

Recent Glassnode’s data captures intriguing shifts in Bitcoin’s spot volume, tracking the aggregate trading volume of Bitcoin against USD-based currencies, both fiat and stablecoin, across various exchanges. On March 5, there was a surge in spot volume to $26 billion across all exchanges, a pinnacle not reached since the SVB collapse in March 2023.

During the SVB collapse, Binance dominated the spot volume, contributing $22 billion of the total $27 billion, as reported by Glassnode. Now, spot volume has again reached a similar level, spurred by Bitcoin’s surge to a record $69,000 and its subsequent 15% drop. In this latest bout of volatility, the exchange landscape was more distributed, with Binance, Coinbase, and Bybit recording spot volumes of $9 billion, $4 billion, and $4 billion, respectively.

The data depicts a stark decrease in Binance’s market share over the year, as its spot volume shrank from $22 billion during the SVB event to $9 billion in the following year’s volatility peak.

The post High volatility drives spot Bitcoin volume to $26 billion appeared first on CryptoSlate.

Ten new U.S. spot bitcoin exchange-traded funds (ETFs) have shattered both inflow and trading volume records. The 10 funds took in $673.4 million, with Blackrock’s Ishares Bitcoin Trust (IBIT) accounting for $612.1 million of the total inflow. The 10 bitcoin ETFs also set a new record for total trading volume. Spot Bitcoin ETFs Set New […]

Ten new U.S. spot bitcoin exchange-traded funds (ETFs) have shattered both inflow and trading volume records. The 10 funds took in $673.4 million, with Blackrock’s Ishares Bitcoin Trust (IBIT) accounting for $612.1 million of the total inflow. The 10 bitcoin ETFs also set a new record for total trading volume. Spot Bitcoin ETFs Set New […]

Source link

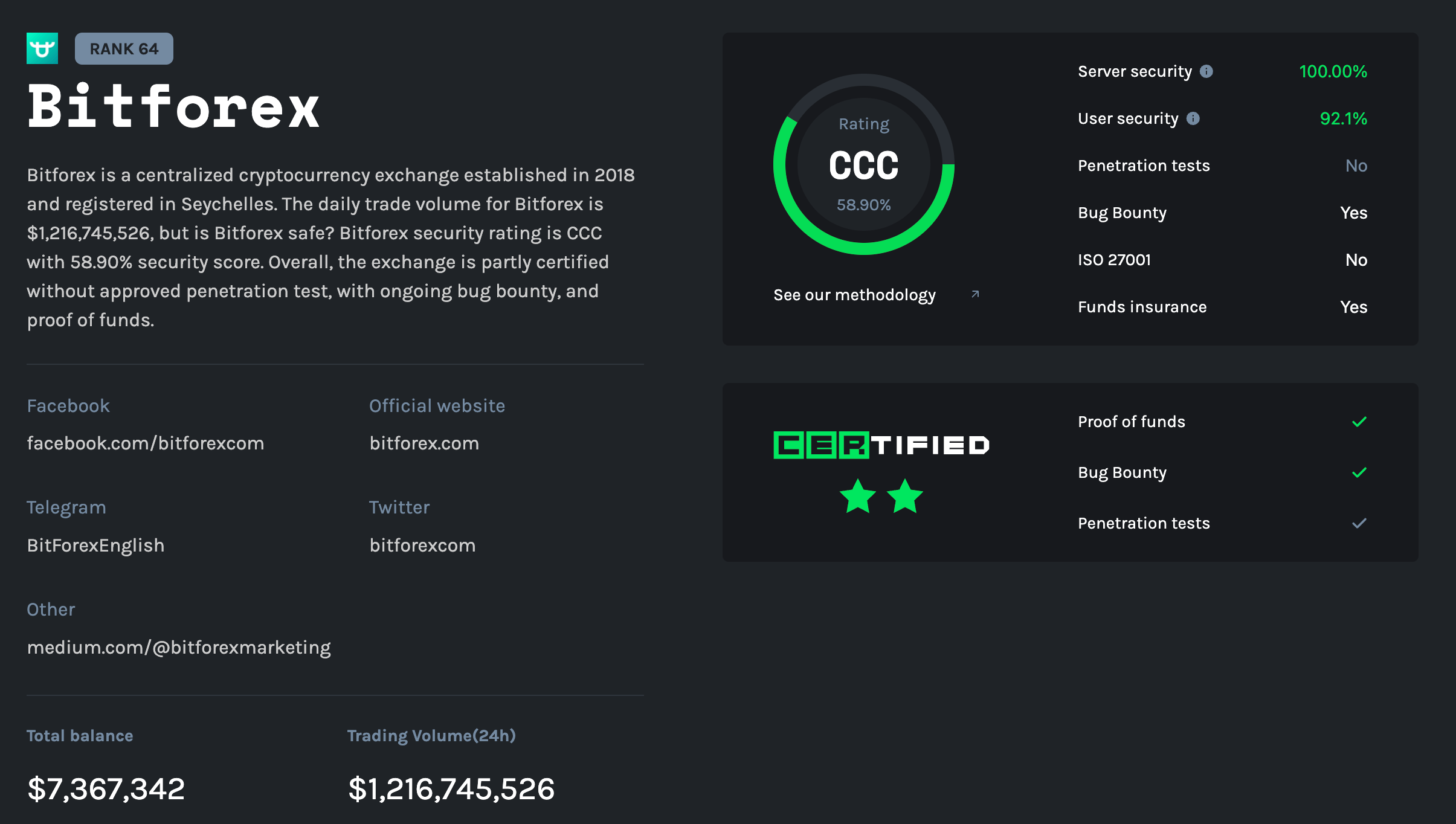

BitForex alleged $2.5 billion volume flatlines as exchange abruptly goes offline

Hong Kong-based crypto exchange BitForex appears to have gone entirely dark following the suspension of its website and trading application on Feb 23. Users have been unable to initiate withdrawals or access the exchange for several days, which boasted over $2 billion in trading volume as recently as Feb 24.

Data from CoinGecko shows trading volume decreasing from $2.5 billion to $1 billion between Feb 22 and Feb 24 before flatlining. However, normalized data suggests the exchange may have inflated its volumes by up to 100 times. The normalized data is where “web traffic statistics are considered when considering the trading volume,” which was reported at just $25 million for Feb 22.

On Feb 23, crypto investigator ZachXBT reported outflows of approximately $56.5 million from BitForex’s hot wallets. Withdrawals subsequently ceased without official communication from the exchange. Further analysis of Bitforex’s holdings raises flags. The exchange possesses a significant portion of TRB and OMI token supplies, specifically 18% of TRB and 7% of OMI.

As users seek answers via platforms like Telegram, the timing of the company’s CEO stepping down a month ago raises additional suspicion. On Jan 31, CEO Jason Luo stated,

“Today, I have decided to step down from the position of CEO, but my heart remains deeply rooted in the BitForex family. A new leadership team is poised to take the reins, and I believe they will guide BitForex towards even greater horizons. I will continue contributing my wisdom and strength to BitForex because this is my eternal commitment to this home.”

The abrupt leadership change at BitForex, in conjunction with the recent events, now casts extreme doubt on the company’s stability.

On-chain activity for the exchange’s native BF token has been limited, with roughly $2,000 moved within the past 11 days. The last update to CoinmarketCap’s data for the exchange was over 65 hours ago, showing around $280 and $175 million in Ethereum and Bitcoin trading volume, respectively.

The exchange’s X account has had no activity since Feb 21, when it posted, “What are the top encryption projects in 2024?🤔.”

A security ‘CCC’ rating by Certified suggests the exchange had an insurance policy, but no specific details are available.

The company’s official Telegram channel continues to run without any activity from admins. One admin, referred to as Hazel_BitForex, has deleted their account. Other admins have not replied to any posts since at least Feb 21 as of press time. The group, with 23,413 members, currently has over 1,000 users online awaiting a response from the exchange.

Data available at this stage suggests a dark reality for BitForex users. The lack of communication across several platforms, such as its website, X, and Telegram accounts, means users with funds stuck on the exchange may have just reason to worry.

Weekly NFT Sales Rise 17% With Bitcoin Climbing Back to Second in Volume

Based on the most recent international standings and weekly figures, sales of non-fungible tokens (NFTs) have surged by 17.66% in the past week, amassing slightly more than $306 million in sales. This uptick marks a jump from last week’s 16.8% rise in NFT sales, with the leading blockchains in terms of volume — Ethereum and […]

Based on the most recent international standings and weekly figures, sales of non-fungible tokens (NFTs) have surged by 17.66% in the past week, amassing slightly more than $306 million in sales. This uptick marks a jump from last week’s 16.8% rise in NFT sales, with the leading blockchains in terms of volume — Ethereum and […]

Source link

A recent report released by Ripple in its Q4 2023 XRP Markets Report unveiled that XRP experienced a substantial increase in daily trading volume, hitting roughly $600 million this quarter. According to the report, this surge represented a 75-100% growth compared to the lower trading volumes observed in Q3.

Notably, the Ripple report suggests a rejuvenation in investor interest and market activity for the altcoin, marking a notable shift from the previous quarter’s performance.

Ripple’s XRP Holdings And Other Crypto Volume In Q4 2023

Ripple’s Q4 report also provided insights into the company’s XRP holdings. As of September 30, 2023, Ripple’s total XRP holdings were more than 5.25 billion, stored in its wallets, plus another 41.3 billion XRP secured in on-ledger escrow.

However, by the close of December 2023, Ripple’s wallet holdings had slightly reduced to about 5.08 billion of this token, and the XRP in on-ledger escrow had also decreased to approximately 40.7 billion.

According to the report, Ripple’s access to the escrowed XRP is restricted until scheduled monthly releases occur, a mechanism that ensures the controlled release of tokens into the market.

Meanwhile, in addition to the surge in XRP’s trading volume, the Ripple markets report also revealed that other major cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), saw considerable increases in their trading volumes.

BTC volumes rose by 88% quarter-on-quarter (QoQ), while ETH recorded a 140% increase over the same period. These trends indicate a broader recovery and bullish sentiment across the crypto market during the quarter.

XRP’s Market Performance And Future Outlook

Despite the recent surge in trading volume, XRP’s market price has shown varying trends. In the last quarter of 2023, the altcoin traded above $0.60, but as of the latest price action, it hovers just above $0.5, indicating a decline.

Although there has been a 3.7% increase in the past week and a 2.2% rise in the past day, the asset is currently trading around $0.52.

Nevertheless, the community and analysts remain optimistic about its future potential. Crypto analyst Jaydee recently pointed out a historical pattern suggesting an imminent parabolic move for XRP. According to Jaydee, the altcoin is currently testing a 10-year trendline, similar to previous instances that led to significant price increases.

#XRP – Last two times we tested the 10-year trendline, $XRP 39x – 650x in price w/in a year! We are now testing multi-year trendline!

Can we bounce off trendline to finally break structure?! Do NOT “KNOW WHAT YOU HOLD”, 🤦♂️🤣we taking “calculated profits!”

RT/Like for updates!… pic.twitter.com/flIQcDh4Ls

— JD 🇵🇭 (@jaydee_757) February 3, 2024

Additionally, Crypto Patel, another analyst, shared his forecast, emphasizing XRP’s potential to shine and go parabolic, drawing parallels to past market trends.

Patel also referred to the legal developments involving Ripple and the US Securities and Exchange Commission (SEC), suggesting that the recent legal victory for Ripple could open doors for XRP’s breakout in the next bull run.

The analyst drew attention to a specific chart pattern from 2017 that preceded a massive rally for altcoin. If this trend repeats, Patel posits, the asset could witness an ‘extraordinary’ surge, potentially reaching over $10.

🔥 Is This Finally XRP’s Time To SHINE, WIll hit $10 ?

🔹Last bull #XRP seriously underperformed while stuck fighting the #SEC

🔹 BTC hit new highs while XRP failed to pass 2017’s $3.30 ATHBut with the SEC case now won – the floodgates may finally BE OPEN!

🔹 Similar… pic.twitter.com/joWLvBnadp— Crypto Patel (@CryptoPatel) February 7, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Quick Take

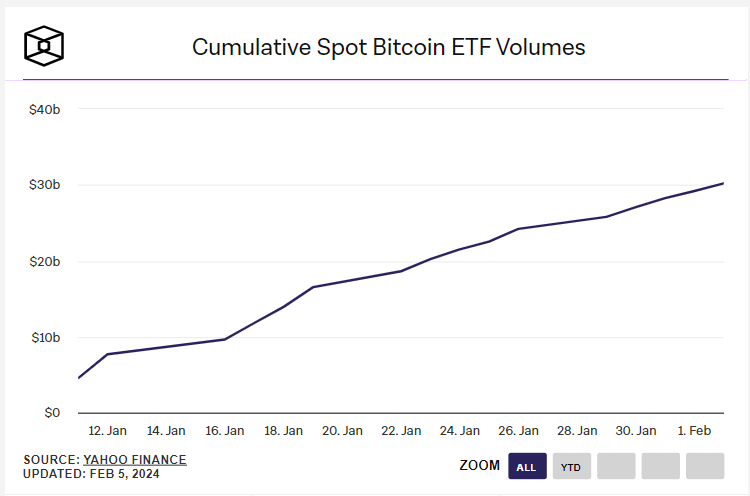

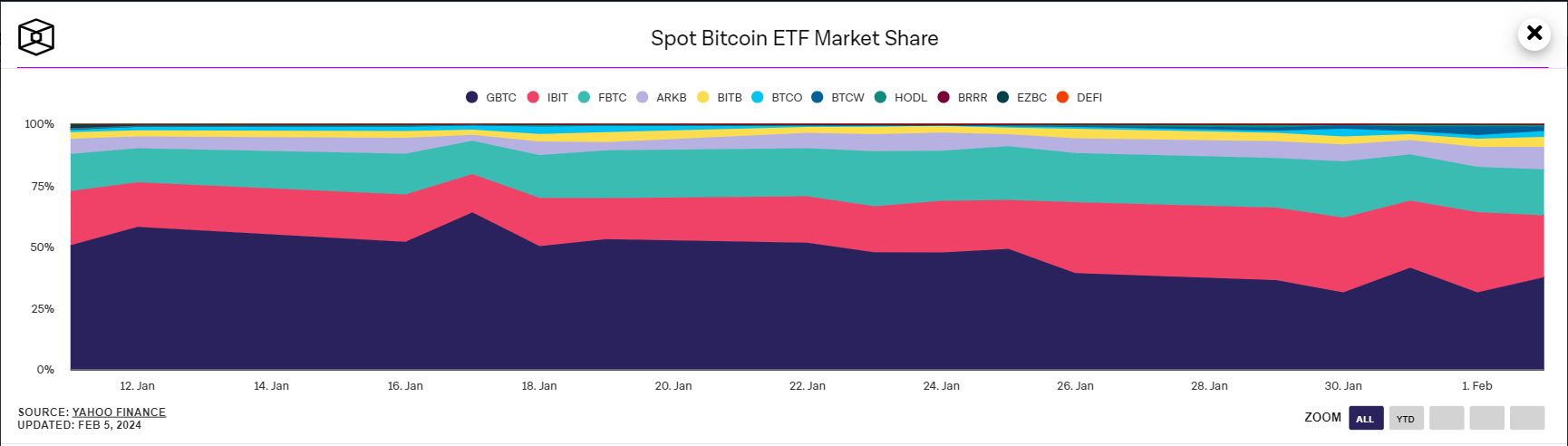

In the nascent arena of spot Bitcoin ETFs, competition is swiftly evolving. The first month saw a noteworthy $1.5 billion net inflow, representing about 32,000 Bitcoin, according to BitMEX Research. Moreover, the aggregated volume of these ETFs overpassed a landmark $30 billion threshold, according to The Block.

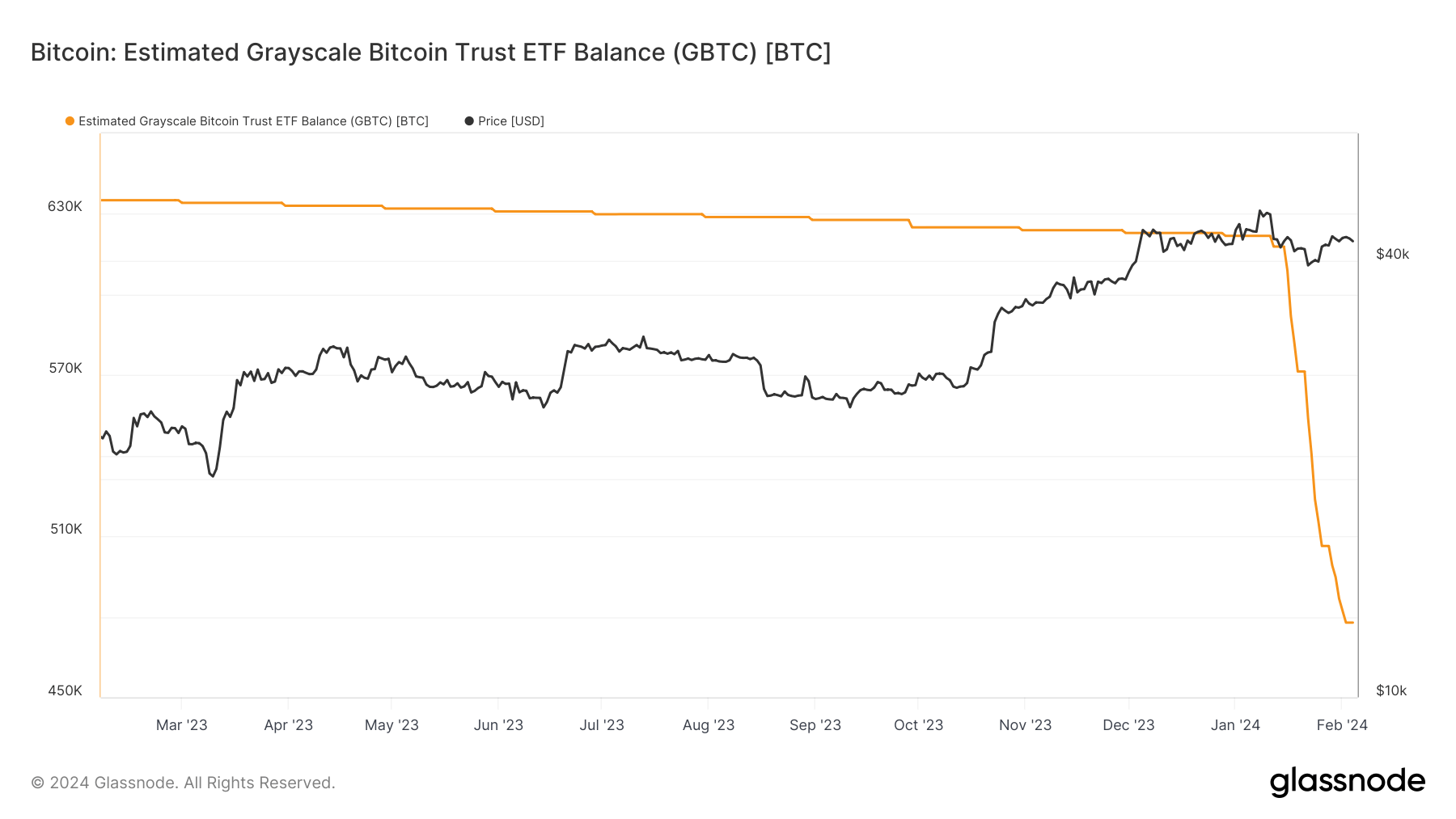

A shift in dominance among these Bitcoin ETFs was recorded. The initial supremacy of the Grayscale Bitcoin Trust (GBTC), which accounted for nearly 50% of the volume on its opening day, dwindled to 38% on Feb. 2.

Conversely, BlackRock’s IBIT and Fidelity’s FBTC ETFs have observed their shares grow by approximately 25% and 20%, respectively. This shift is primarily due to the competitive fee structures; GBTC’s fees are 1.5%, whereas FBTC and IBIT are set at a more attractive 0.25%.

GBTC, which initially held 620,000 BTC before the ETFs started trading, now has approximately 477,000 Bitcoin, a 26% drop from the top.

This substantial decrease represents the enduring sell-off pressure within GBTC, even though the outflows are gradually decelerating. Furthermore, the potential for these coins to shift into the more cost-effective ETFs is occurring. Specifically, Bloomberg ETF analysts estimate that one-third of GBTC outflows are redirected into these spot ETFs.

The post Spot Bitcoin ETFs’ cumulative trading volume exceeds $30 billion appeared first on CryptoSlate.

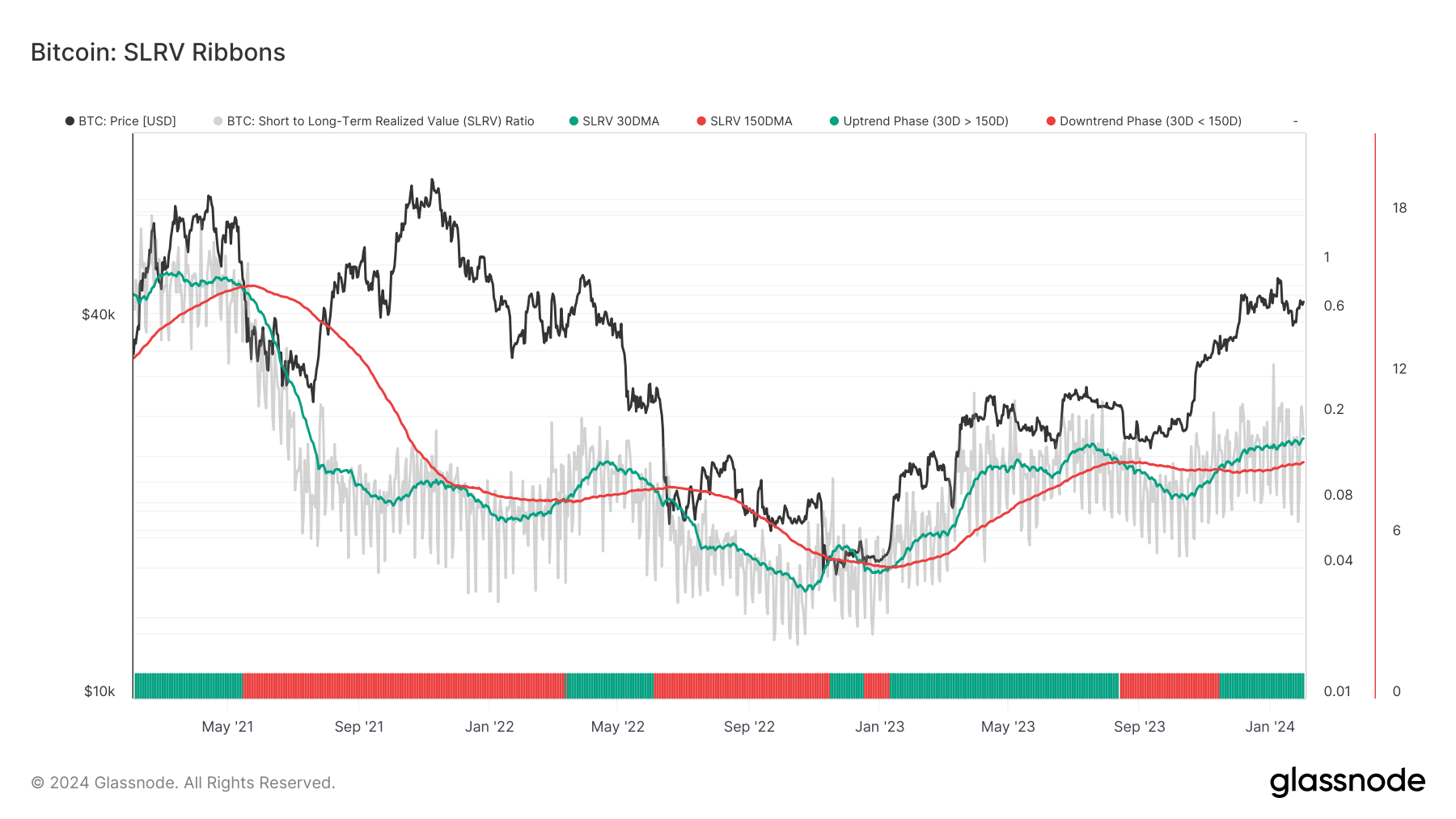

The short-to-long-term realized value (SLRV) ratio is an often-overlooked metric that provides nuanced insights into investor sentiment. The ratio compares the percentage of Bitcoin that was last moved within a short timeframe (24 hours) against the percentage moved in a longer timeframe (6-12 months) to show whether the market leans more towards hodling or trading.

However, the SLRV ratio alone usually isn’t enough to identify broader trends, as there are significant daily variations in the metric. Applying and analyzing the ratio through moving averages, especially the 30-day simple moving average (SMA) and the 150-day SMA, allows us to get a clear picture of sustained market trends.

On Feb. 1, the SLRV 30D SMA reached its highest level since July 2021 as Bitcoin’s price crossed $43,000. This peak represents a continuation of a positive uptrend that began on Nov. 14, 2023, when the SLRV 30D SMA crossed above the 150D SMA.

The SLRV 30D SMA reaching levels not seen in two and a half years shows a significant increase in short-term transactional activity relative to long-term holding. This could be attributed to a myriad of different factors, but it’s usually a result of price volatility. The rise in short-term transactional volume often correlates with heightened market speculation as investors and traders rush to capitalize on price movements. It can indicate a market driven by bullish sentiment or increased speculative interest spurred by recent market developments.

The introduction and adoption of spot Bitcoin ETFs in the U.S. most likely played a significant role. The highly-anticipated trading product has pushed Bitcoin into the mainstream, bringing institutions and advanced investors from tradfi into the market. Aside from having a psychological effect on the market and boosting investor confidence in BTC, these ETFs also provide liquidity to Bitcoin. This increased liquidity can cause higher trading volumes, as investors can enter and exit their positions in Bitcoin through the ETFs more quickly, causing spikes in the SLRV 30D SMA as a result.

It’s not just the rise in the SLRV 30D SMA that shows a change in market sentiment. Its sustained position above the 150D SMA since mid-November shows that short-term transactional activity not only spiked but maintained a higher level over an extended period.

The durability of this trend, which is on its way to enter its third consecutive month, shows that market activity isn’t a short-lived speculative burst but a more entrenched behavior pattern among investors.

Historically, short-term SMAs crossing above long-term SMAs have been used as a technical indicator for positive momentum and potential bullish trends in various assets, including Bitcoin. The extended period where the SLRV 30D SMA remains above the 150D SMA could show a broader market transition from risk-off to risk-on allocations, where investors are more willing to engage in speculative investments or allocate a larger portion of their portfolio to Bitcoin.

The post Short-term trading volume peaks as Bitcoin crosses $43,000 appeared first on CryptoSlate.