India’s central bank has announced that it will enable non-bank payment system operators to offer central bank digital currency (CBDC) wallets. Noting that “necessary changes will be made to the system to facilitate this,” the Reserve Bank of India (RBI) said the initiative is expected “to enhance access and expand choices available to users.” Non-Bank […]

India’s central bank has announced that it will enable non-bank payment system operators to offer central bank digital currency (CBDC) wallets. Noting that “necessary changes will be made to the system to facilitate this,” the Reserve Bank of India (RBI) said the initiative is expected “to enhance access and expand choices available to users.” Non-Bank […]

Source link

wallets

In the realm of digital riches, XRP wallets stand tall as a secure haven and a gateway to empowerment. These wallets not only offer a safe space for storing, sending, and receiving XRP, but they also grant you the keys to the kingdom. With robust security measures like password protection, encryption, and multi-factor authentication, your holdings are shielded from the clutches of cyber villains. No longer do you need to rely on third-party custodians, as these wallets put you in full control of your investments.

XRP wallets come in various types, each catering to different needs and preferences. Software wallets like XAMAN and TRUST wallet can be installed on your computer or mobile device, providing a convenient way to manage your XRP. Hardware wallets such as Ledger Nano X offer enhanced security by storing your tokens offline. On the other hand, online wallets like Uphold and GateHub allow you to access your XRP through a web browser.

However, convenience doesn’t take a backseat with XRP wallets. Integrated address books and QR code support make sending and receiving XRP a breeze, eliminating the need for laborious manual entry. Transactions can be completed with a simple swipe, ensuring seamless and effortless interactions with your XRP holdings.

In this article, whether you’re an experienced crypto connoisseur or a curious explorer, we will highlight the top 5 XRP wallets that provide a compelling mix of security, control, and convenience, making them an essential tool in your digital asset arsenal.

Essential Factors To Keep In Mind When Picking XRP Wallets

Compatibility

When selecting an XRP wallet, it’s crucial to consider its compatibility with your devices and preferred operating systems. Ensure that the wallet you choose seamlessly integrates with your desktop, mobile, or web-based platforms. By opting for a wallet that aligns with your preferred platforms, you can enjoy a smooth user experience and easily manage your XRP holdings from the devices you use most frequently.

Security

Ensure that the wallet you choose offers robust security measures, such as encryption, password protection, and two-factor authentication. These features help safeguard your holdings from unauthorized access and potential cyber threats.

Private Key Control

It is absolutely imperative to carefully choose wallets that provide you with unwavering and unconditional control over your private keys. Such wallets empower you to retain absolute ownership and sovereignty over your XRP holdings, significantly decreasing your dependency on third-party custodians.

Backup and Recovery

It is essential to verify that the wallet offers reliable backup and storage options for your private keys or recovery phrases. This step is critical to prepare for potential device loss, damage, or unforeseen events. By having a secure and easily accessible backup, you can always recover your funds with peace of mind.

Reputation and Community Support

Conduct thorough research on the wallet’s standing and take into account feedback from the XRP community. Prioritize wallets with a proven track record, favorable reviews, and vibrant development and support communities.

Top 5 XRP Wallets To Use

Ledger Nano For XRP (Hardware Wallet)

The Ledger Nano X is an advanced hardware wallet that offers robust security and offline storage for XRP and other cryptocurrencies. With its user-friendly interface, companion app, and multi-currency support, it provides a convenient and secure solution for managing your XRP funds. The Nano X is designed to be portable and durable, and offers enhanced connectivity options. It is important to obtain the Nano X from authorized sources and prioritize following recommended security practices to safeguard your assets effectively.

Setting Up Nano Ledger:

You connect the Nano X to your computer or use Bluetooth with the Ledger Live app on your smartphone or desktop.

During setup, you’ll create a PIN and a 24-word recovery phrase. This phrase is crucial for backing up and recovering your wallet if needed, so write it down and store it securely offline.

You can then initialize the device and install the app for XRP (or other currencies you want to store). See the image of the Ledger Live App below:

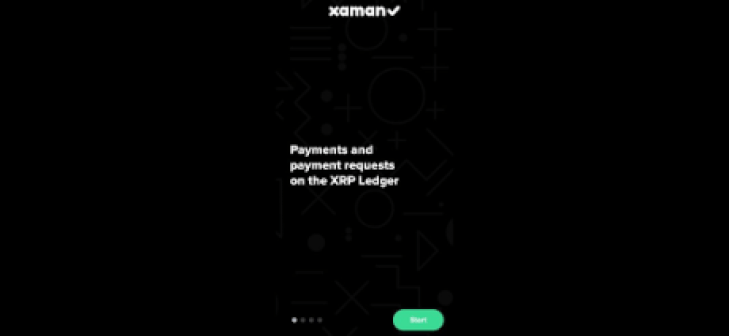

XAMAN Wallet – Formerly XUMM Wallet

XAMAN is a mobile app and wallet created exclusively for the XRP Ledger. It provides a user-friendly interface and a wide range of capabilities for token management and XRP Ledger interaction. With XAMAN, you can securely store, send, and receive XRP, as well as sign transactions, and manage your account.

The app also supports decentralized finance (DeFi) integration and enables the development of personalized XRP-based applications. Security is a top priority for XAMAN, ensuring users have complete control over their private keys. You can download XUMM on iOS and Android devices.

How To Set Up XAMAN XRP Wallets:

To set up the XAMAN wallet, first, download the XAMAN app from the Google Play Store or App Store. Once installed, open the app and select “Create new account” on the welcome screen to begin the setup process. See images from the App Store below:

The app will prompt you to select a secure PIN code to protect your wallet. Make sure the PIN code is unique and not easily guessable.

Next, backup your account by saving a 24-number recovery phrase. It’s important to write down the numbers in the exact order and store them in a safe place. This recovery phrase will be crucial for restoring your wallet if you lose your device or need to recover your funds. Verify the recovery phrase by entering specific numbers from it to ensure accuracy.

Once your XAMAN wallet setup is complete, deposit funds to activate your account, and you can start using it to send, receive, and manage supported assets like XRP.

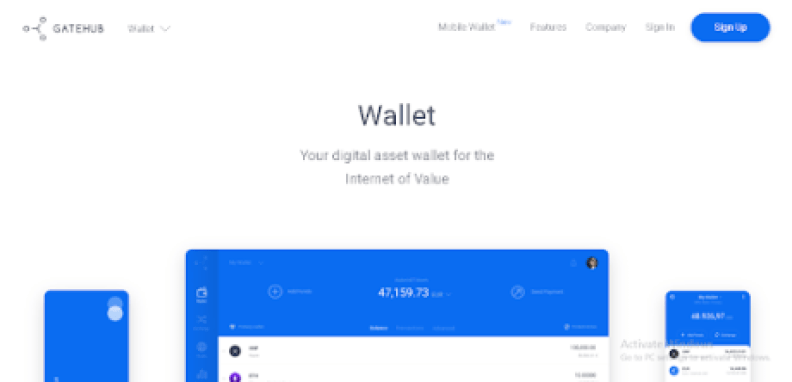

GateHub Wallet

GateHub is a platform that utilizes the capabilities of the XRP Ledger protocol, providing users with a diverse set of features pertaining to the Internet of Value. With GateHub, users can securely send and receive a variety of assets, such as XRP and other supported cryptocurrencies. Additionally, the platform allows for the tokenization and management of different types of assets.

An essential aspect of GateHub is its seamless integration with the XRP Ledger, which is a decentralized blockchain technology explicitly designed for efficient and rapid asset transfers. Through this integration, GateHub empowers users to execute transactions with minimal fees and nearly instantaneous settlement times.

How To Set Up GateHub:

To set up a GateHub account, begin by accessing the GateHub website. Initiate the registration process by selecting the “Sign Up” button.

Provide the required information, including your email address, username, and password. Ensure that your password is robust and secure.

Validate your email address by clicking on the verification link sent to your registered email. This step is crucial to confirm your account. Upon successful email verification, log in to your GateHub account using the credentials provided during the registration process.

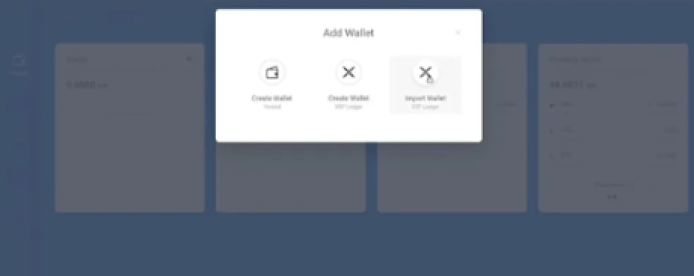

After setting up 2FA, you can create a GateHub wallet by accessing the “Wallet” or “Add Wallet” option in your account dashboard. Choose the desired wallet type, like XRP or other supported cryptocurrencies, and follow the provided instructions to create the wallet.

(See illustrations below)

Click on the wallet drop-down menu in the upper-left corner of your screen:

Then, click on the “Create Wallet” option.

Once your wallet is created, you will be provided with a wallet address. This address can be used to receive XRP into your wallet.

Trust Wallet

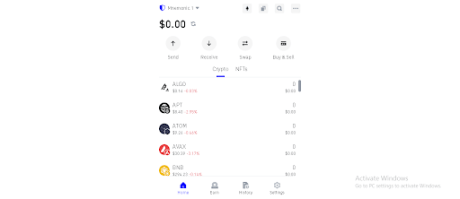

Trust Wallet is a well-known mobile wallet that offers support for various cryptocurrencies, including XRP. It provides users with a secure platform to store, transfer, receive, and manage their XRP tokens.

The Trust Wallet interface is designed to be user-friendly, allowing you to easily monitor your balance, track transaction history, and access other pertinent information. When sending XRP to others, simply input their XRP wallet address and indicate the desired amount for a smooth transaction experience.

How To Set Up Trust Wallet

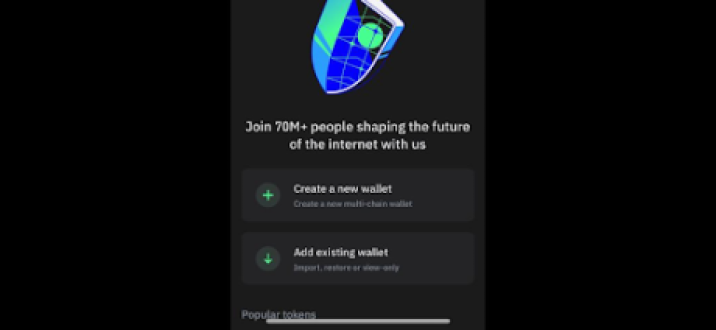

First, download and install the Trust Wallet app from the official app store (available for both iOS and Android).

To begin, launch the Trust Wallet app and initiate the process of creating a new wallet by choosing the option “Create a new wallet”. Alternatively, if you possess an existing wallet, you can opt to import it.

It is of utmost importance to take adequate measures to protect your wallet. Safely backup your wallet’s recovery phrase, as it serves as a crucial means to restore your wallet in the event of loss or device replacement. Take the time to write down the recovery phrase and store it securely in a location that guarantees its preservation.

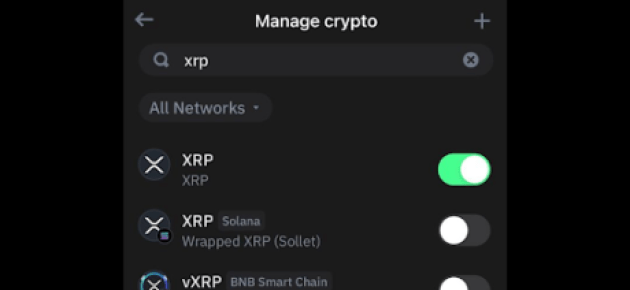

Once your wallet is created, you will be taken to the main interface. Use the “Search” option to add XRP by enabling it, as seen in the image below:

This will make XRP appear in your wallet, displaying its balance. Now, all you have to do is fund your wallet with as minimum as 10 XRP to activate your account, and your tokens will be ready to use.

To receive XRP, simply share your XRP wallet address with the sender. They can use this address to send XRP tokens to your Trust Wallet.

Uphold Wallet

The Uphold Wallet is an extensive digital wallet and exchange platform that caters to multiple cryptocurrencies, including XRP. It delivers a smooth and user-friendly experience, ensuring a secure and convenient solution for managing your XRP funds.

Uphold enables effortless storage, sending, and receiving of XRP, along with seamless currency conversion options. With its swift transactions and intuitive interface, Uphold Wallet stands out as a favored choice among individuals seeking a flexible and trustworthy wallet.

How To Set Up Your Uphold XRP Wallet:

To set up an Uphold Wallet, visit their website and sign up for an account. Verify your email, complete the registration process, and enable two-factor authentication for added security.

Deposit funds into your account and set up your wallet. Once done, you can start using your Uphold Wallet to store, send, receive, and convert XRP within the platform.

Uphold offers a seamless and user-friendly experience, enabling you to effortlessly engage in buying, selling, sending, and receiving XRP, regardless of the transaction size.

You can also diversify your portfolio with a variety of cryptocurrencies and fiat currencies and even link your bank account for convenient and smooth transactions.

Conclusion On XRP Wallets

In conclusion, there is a wide range of options available for managing XRP tokens, each with its own unique strengths and considerations. When choosing an XRP wallet, it is crucial to prioritize factors such as security, user experience, and compatibility with different platforms.

However, when choosing an XRP wallet, prioritize security by downloading wallets from official sources and safeguarding private keys and recovery phrases. A user-friendly interface and intuitive features enhance the XRP management experience. Compatibility with different platforms ensures convenient access, and considering additional features like portfolio diversification and staking can be beneficial.

By carefully evaluating these factors and taking individual preferences into account, one can find the ideal XRP wallet that meets their specific needs. This enables a secure and seamless experience in storing, sending, receiving, and managing XRP tokens, ensuring confidence and peace of mind in the cryptocurrency journey.

Featured image from Dall.E

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Dogecoin, the Shiba Inu-faced cryptocurrency born from a meme, finds itself in an intriguing scenario. Despite a recent 23% price plunge since December, the network is experiencing an unprecedented boom in user adoption, marking a fascinating dichotomy in its current state.

DOGE Frenzy: Wallet Growth Skyrockets 86%

On the bullish side, non-zero wallets, indicating active users holding DOGE, have witnessed a staggering 7.2% growth since January 22nd. This translates to roughly 414,000 new wallets joining the network in just two weeks, representing the fastest growth in Dogecoin’s decade-long history. These new users primarily hold smaller amounts, suggesting potential for future engagement within the ecosystem.

🐶 #Dogecoin‘s value is -23% since its top on Dec. 9th. But the #memecoin‘s wallets with >0 $DOGE coins has been growing at the fastest rate in the network’s decade long history. 413.8K new wallets, mostly holding 0.001-1 $DOGE, have been added in 2 weeks. pic.twitter.com/l6Pv0KvkKW

— Santiment (@santimentfeed) February 6, 2024

Furthermore, Dogecoin adoption has skyrocketed by a mind-boggling 86% in the past week, with over 890,000 new addresses appearing on the blockchain, analysts at IntoTheBlock disclosed.

Analysts attribute this surge to several factors, including the revival of “Doginals” (NFTs on the Dogecoin chain), the recent release of the iconic game Doom on the Dogecoin blockchain, and the growing popularity of Xpayments, a platform enabling DOGE transactions in the real world.

Dogecoin’s Challenge: Balancing Growth And Stability

This price volatility highlights a key challenge for Dogecoin: balancing user growth with sustainable value appreciation. While the increasing user base indicates potential for future adoption, the lack of diverse use cases and inherent inflationary nature might hinder long-term price stability. Unlike Bitcoin with its capped supply, Dogecoin has an inflationary model, meaning new coins are continuously created, potentially impacting its value.

Dogecoin currently trading at $0.07834 on the daily chart: TradingView.com

Major Backers For The Meme Coin

Meanwhile, SpaceX – the leading private space exploration company – threw its weight behind Dogecoin by accepting it as payment for the rescheduled DOGE-1 Moon mission. This endorsement not only adds legitimacy to the meme coin but also injects a dose of excitement into the community.

Geometric Energy Corporation, the mission’s sponsor, revealed they paid SpaceX in DOGE to secure a new launch date following a delay. While the exact timing remains shrouded in mystery, the news has undoubtedly bolstered community sentiment.

However, amidst the user boom, Dogecoin’s price performance paints a contrasting picture. As of February 6th, DOGE is trading at $0.078, reflecting a 0.3% decrease in the last 24 hours and a 3.48% decline over the past week. This dip extends to a 2.77% loss for the month, marking a significant drop from its December peak.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Non-custodial fiat off-ramp now available in crypto wallets via Visa debit

Crypto and NFT payments infrastructure company Transak has partnered with Visa to integrate Visa debit capabilities into its global off-ramp service. This move increases the options for crypto-to-fiat off-ramps, allowing users in over 145 countries to convert their crypto holdings into local fiat currencies.

Using a product called Visa Direct, Transak will allow the fluid conversion of digital assets into fiat currency across the industry. This collaboration addresses a critical gap in the market: the ease of crypto-to-fiat conversion. Historically, the focus has been on facilitating the flow of fiat into crypto, leaving the reverse process, from crypto back to fiat, less developed and often cumbersome.

This has led to a reliance on stablecoins or alternative, less-regulated conversion methods, which could be problematic regarding local compliance. The partnership between Transak and Visa introduces a solution to this challenge, offering real-time card withdrawals through Visa Direct. Yanilsa Gonzalez-Ore, North America Head of Visa Direct, highlighted the significance of this integration, emphasizing its role in providing a more connected and efficient experience for users.

“By enabling real-time card withdrawals through Visa Direct, Transak is delivering a faster, simpler and more connected experience for its users — making it easier to convert crypto balances into fiat, which can be spent at the more than 130M merchant locations where Visa is accepted.”

A key feature of Visa Direct is its real-time transaction processing capability, potentially completing transfers in under 30 minutes—a stark contrast to the often lengthy procedures in traditional banking. Further, most off-ramps today are limited to centralized exchanges, meaning investors are required to undergo at least a momentary move into centralized custody before withdrawing.

The ability to convert crypto to fiat directly from a wallet allows users to retain the self-sovereign aspect of self-custody in crypto. Transak is integrated into more than “350 leading Web3 wallets and games, such as MetaMask, Trust Wallet, Coinbase Wallet, and Ledger.”

Sami Start, CEO of Transak, views this partnership as a pivotal moment for Web3, commenting,

“We believe this partnership is an inflection point for Web3 as a whole. Now, millions across the globe have a straightforward way to cashout their digital asset holdings to their local currency in real-time and intuitively.

They no longer have to walk the treacherous path of compliance uncertainty or face risks of fraud — Transak and Visa have them covered for over 40 cryptocurrencies.”

Testing the wallet-based fiat off-ramp.

However, such a revelation is not without its downside. As of press time, the price of Bitcoin is $43,497. However, withdrawing 0.1 BTC would result in just $4,218 in fiat landing in an investor’s bank account, a 3% haircut on the current value. Transak takes a 1% fee and a nominal processing fee paid to “service providers.” However, an information bubble on the page does indicate that the price listed is an estimate, so it is currently unclear whether there is a spread along with the fee.

The spread between the estimated price and the current market price is around 2% across all assets reviewed. A 2% spread is also shown for the ‘buy’ side trades from Visa Card, ApplePay, GooglePay, Cash App, and bank wire, again with a 0.99% transaction fee.

While the Transak website states a flat 1% fee, the partner docs describe the pricing mechanism in greater detail. The spread is intended to cover network fees and “a small slippage percentage.” Combining fees into a single variable may make such transactions appear more straightforward to non-native crypto users. However, daily users may prefer more finite control over the costs. Ultimately, there is a cost for convenience.

Harshit Gangwar, Marketing Head & Investor Relations Lead at Transak, confirmed to CryptoSlate that the “spread fluctuates based on factors like the complexity of sourcing liquidity and the risks associated with storing different cryptocurrencies.” Specifically, he said,

“[The spread is] variable and determined by our systems and team based on the challenges in storing and sourcing cryptocurrencies.

For example, if a cryptocurrency available for off-ramping suddenly drops significantly, it signals to our team the increased risk of storing it for an extended period, which could affect the spread percentage for that particular cryptocurrency.”

Further, for those hoping that the process would remove the need for KYC steps, this appears not to be the case. Name, address, date of birth, ID, and a selfie are all required when setting up an account for the Transak withdrawal service. Thus, buying or selling through this non-custodial off-ramp will link your personal information to your wallet address.

Those looking for a fully compliant method to buy and sell crypto with fiat without using centralized exchanges now have a method costing between 0.99% and 3%, which may be considerably less than other peer-to-peer options.

Ultimately, the collaboration between Transak and Visa Direct is a decisive step forward in the journey toward the mainstream acceptance of digital currencies. It attempts to simplify converting crypto to fiat and removes barriers of complexity and uncertainty, potentially accelerating crypto adoption among the general populace.

Editor’s Note: I attempted to conduct a transaction to test the process and verify whether there was a 2% spread. I intended to off-ramp $100 worth of MATIC, but this was the screen I was met with after completing the KYC process due to new FCA promotional rules.

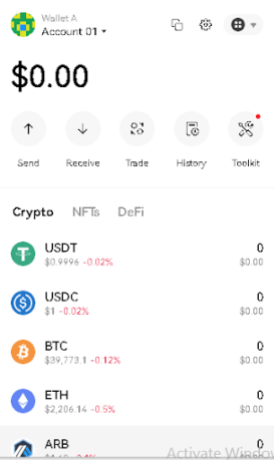

In this article, we will explore the finest Web3 and DeFi wallets that offer substantial advantages to crypto users. While Web3 wallets and DeFi wallets share a strong connection, it’s important to understand their distinctions. By highlighting the top wallets in both categories, we aim to provide users with valuable insights into the wallets that can enhance their Web3 and DeFi experiences.

Web3 wallets are specifically crafted to engage with decentralized applications (DApps) on blockchain networks, empowering users with the essential tools to securely oversee their digital assets and participate in the realm of decentralized web.

Essential Aspects To Note Regarding Web3 Wallets

Cross-Chain Support: Most Web3 wallets support multiple blockchain networks, allowing users to access and manage various DApps and different cryptocurrencies from a single interface.

Seamless DApp Interaction: Web3 wallets allow users to seamlessly connect and interact with a wide range of DApps. They provide a convenient way to authenticate with DApps, sign transactions, and manage account balances.

Enhanced Security Features: Web3 wallets optimizes security measures, such as encrypted storage of private keys and protection against phishing attacks. They often offer features like two-factor authentication and recovery options to ensure the safety of user funds.

Essential Features Of DeFi Wallet

DeFi wallets are a specialized category of Web3 wallets designed specifically for the decentralized finance ecosystem. These wallets offer advanced functionalities and specific features essential for engaging in diverse DeFi protocols like lending, borrowing, yield farming, and staking. By catering to the unique requirements of DeFi, these wallets empower users to seamlessly participate in the decentralized financial landscape. These wallets provide supplementary features specifically designed to cater to the needs of DeFi users.

Here are some characteristics of DeFi wallets:

Token Swapping and Yield Farming: DeFi wallets often include built-in features for token swapping and yield farming. Users can swap tokens directly within the wallet interface and participate in yield farming to earn rewards.

DeFi Protocol Integration: DeFi wallets integrate with popular DeFi platforms, enabling users to easily access and interact with lending protocols, decentralized exchanges (DEXs), yield farming platforms, and more.

Gas Optimization: Gas optimization features enable users to estimate and adjust transaction fees, ensuring cost-efficient interactions with DeFi protocols.

Note: DeFi and Web3 share some common features, as they both operate within the broader context of blockchain technology and decentralized applications (DApps).

Examples Of Enhanced Web3 And DeFi Wallets

Metamask Wallet

MetaMask is a popular and user-friendly Web3 wallet that has garnered considerable recognition within the cryptocurrency community. Serving as a browser extension wallet that seamlessly integrates with the Ethereum network, users can easily manage their Ethereum-based assets, including Ether (ETH) and ERC-20 tokens.

MetaMask also features a built-in DApp browser, enabling direct access and interaction with a wide range of Ethereum-based decentralized applications (DApps). The wallet prioritizes security by implementing encrypted storage, password protection, and optional hardware wallet integration.

Additionally, MetaMask supports token swapping through decentralized exchanges (DEXs) like Uniswap and SushiSwap, along with integration with various DeFi platforms for lending, borrowing, yield farming, and other DeFi activities. It also offers compatibility with multiple Ethereum test networks for testing and development purposes.

MetaMask supports various networks in addition to the Ethereum mainnet. A few of the numerous networks supported by MetaMask are Binance Smart Chain (BSC), Arbitrum(ARB) and Polygon (MATIC), among others.

Straightforward Guide On How To Get The Metamask Wallet

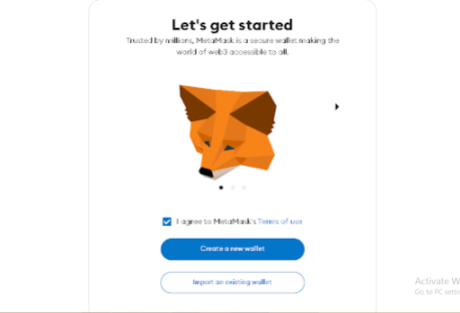

The first step is to visit the authentic Metamask website and click on the “Get Chrome Extension” or “Get Firefox Add-On” button, depending on your browser choice.

See the Chrome browser Illustration below:

After clicking on the “Add to Chrome” button, a popup window will appear, asking for confirmation to add the extension. Click “Add Extension” to proceed.

Once the extension is installed, you will see the MetaMask icon in your browser toolbar. Click on the icon to launch MetaMask. You will be presented with the option to create a new wallet.

Once that is done, follow the on-screen instructions to create a new wallet.

In the final step, MetaMask will provide you with a unique seed phrase consisting of 12 or 24 words. Write it down and keep it securely offline. Confirm your seed phrase as prompted by MetaMask by selecting the words in the correct order, after which you can start using MetaMask to manage your Ethereum-based assets, interact with DApps, and participate in DeFi activities.

Keplr Wallet For Web3

Keplr is a web3 wallet primarily designed for interacting with decentralized applications (DApps) on the Cosmos network. However, it offers support for specific decentralized finance (DeFi) functionalities within the Cosmos ecosystem. The Keplr wallet is known to support networks like Celestia, Osmosis, Terra, and Secret Network.

How To Get And Set Up Keplr Wallet

To begin, you should install the Keplr extension with the appropriate extension store for your browser, such as the Chrome Web Store. To Download, click on the “ Add to Chrome” button as illustrated below:

When creating a new wallet, carefully follow the instructions displayed on your screen to establish a robust password and consent to the terms of use. Remember to store your password securely since it is essential for accessing your wallet (If you have an existing wallet, select the “Import Existing Wallet” option and follow the instructions).

Write down your recovery or seed phrase and store it securely. Remember, it is advisable to never store your seed phrase online due to the risk of being hacked.

After setting up or importing your wallet, connect to the desired network or blockchain supported by Keplr. Once connected, you can start interacting with Cosmos ecosystem DApps. Explore the available DApps and features, and follow on-screen instructions to use them with your Keplr wallet.

Phantom Wallets

Phantom is a widely used cryptocurrency wallet specifically created for the Solana blockchain. It provides an intuitive interface and smooth integration with Solana-based decentralized applications (DApps), enabling users to securely manage, transfer, and receive digital assets within the Solana ecosystem.

How To Get Phantom Wallet

To get started, install the Phantom extension from the relevant extension store for your browser, like the Chrome Web Store. Click on the “Add to Chrome” button, as shown in the illustration below:

To set up your Phantom wallet, simply click on the Phantom icon located in your browser’s toolbar, which will launch the wallet interface. From there, follow the on-screen instructions to either create a new wallet or import an existing one using your recovery phrase or private key.

Set a strong password you can remember and save recovery phrases offline (do not store on the device).

Once your wallet is set up, you can conveniently access it at any time by selecting the Phantom icon in your browser’s toolbar. This grants you the ability to manage your digital assets, engage with Solana-based DApps, and carry out various wallet-related tasks.

UniSat Wallet

UniSat Wallet is an open-source Chrome extension that provides a secure and user-friendly solution for storing and transferring bitcoins and Ordinals on the Bitcoin blockchain. It offers features like immediate access to unconfirmed transactions, enabling faster inscription operations without a full node. Additionally, it supports the storage and transfer of BRC-20 tokens, allowing users to manage both bitcoins and BRC-20 tokens in one wallet.

How To Get UniSat Wallet For Web3

To begin, install the UniSat extension from the relevant extension store for your browser, like the Chrome Web Store. Click on the “Add to Chrome” button, as shown in the illustration below:

For the next step, simply click on the UniSat icon located in your browser’s toolbar, which will launch the wallet interface. From there, follow the instructions to either create a new wallet or import an existing one using your recovery phrase or private key.

Once your wallet is set up, you can conveniently access it at any time by selecting the UniSat icon in your browser’s toolbar.

Trust Wallet

Trust Wallet is a versatile wallet that serves as both a decentralized finance (DeFi) and a Web3 wallet. It enables users to interact with decentralized applications (DApps) and protocols within the DeFi ecosystem, including decentralized exchanges, lending platforms, and yield farming protocols. Additionally, it integrates with the Web3 ecosystem, allowing users to interact directly with blockchain networks, sign transactions, and securely manage their digital assets on platforms like Ethereum and other compatible networks.

How To Get Trust Wallet For Web3

First, users can download the Trust Wallet app or install the Trust Wallet extension from the relevant extension store for their browser or mobile device, like the Chrome Web Store. Click on the “Add to Chrome” button, as shown in the illustration below:

Next, simply click on the Trust Wallet icon located in your browser’s toolbar, which will launch the wallet interface. From there, follow the instructions to either create a new wallet or import an existing one using your secret phrase as instructed in the image below:

Once you have meticulously set up your password and safely stored your secret phrase offline, you will gain access to your Trust Wallet. With these security measures in place, you can securely and confidently log into your Trust Wallet account and manage your digital assets.

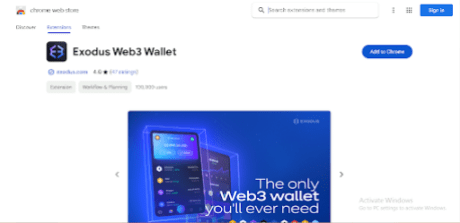

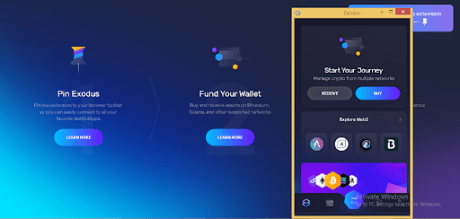

Exodus Wallet

Exodus Wallet is a widely used software wallet for cryptocurrencies, offering users a secure means to store, manage, and trade various digital assets. It is accessible as a desktop application compatible with Windows, Mac, and Linux systems, along with a mobile app for iOS and Android devices. Exodus Wallet provides support for multiple blockchain networks, enabling users to effectively handle and engage with diverse cryptocurrencies. Among the networks supported are Litecoin (LTC), Stellar (XLM), Ripple (XRP), and Bitcoin (BTC).

How To Set Up Exodus Wallet

To begin, download and install the Exodus Wallet extension from the appropriate extension store based on your browser, such as the Chrome Web Store. Locate the “Add to Chrome” button, as depicted in the accompanying image, and click on it to initiate the installation process.

To proceed, just click on the Exodus icon situated in the toolbar of your browser. This action will open the wallet interface, where you can then follow the provided instructions to either generate a new wallet or import an existing one using your recovery phrase or private key.

For new wallets, do not forget to write down your recovery phrase in a safe place and do not store it online. Additionally, it is advisable to not take screenshots as well.

Next, Click on the “Create New Wallet” and carefully set up your password or “I Have A Wallet” button using your secret phrase to get started.

Then, you can connect Exodus wallet to a network of your choice and start your trading journey:

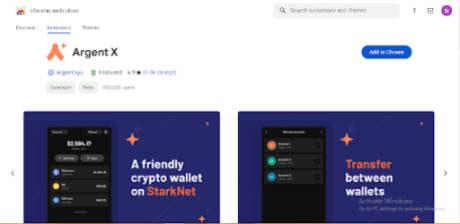

Argent Wallet For DeFi

Argent Wallet is a popular non-custodial cryptocurrency wallet that prioritizes simplicity, security, and usability. It serves as a Web3 wallet, offering users a convenient and user-friendly interface to engage with decentralized applications (DApps) and the broader Web3 ecosystem.

By integrating with Ethereum and compatible networks such as xDai, Polygon (MATIC), and Ethereum (ETH), Argent Wallet empowers users to manage their digital assets and actively participate in various Web3 activities. With its focus on user experience and compatibility with multiple networks, Argent Wallet provides a versatile solution for individuals seeking a seamless and secure Web3 wallet experience.

How To Get And Set Up Argent Web3 Wallet

To get started, you’ll need to install the Argent extension for your browser by visiting the appropriate extension store, such as the Chrome Web Store. Look for the “Add to Chrome” button, which is depicted in the accompanying illustration. Click on that button to initiate the installation process.

Next, if you’re a new user, click on “Create a new wallet,” and you will be prompted to create a password.

To securely manage and interact with digital assets, decentralized applications (DApps), and the Web3 ecosystem, save your recovery phrase (write it down. do not store it on your device), and your Argent wallet will be ready to use.

OKX Wallet For DeFi

OKX Wallet is a prominent non-custodial wallet that provides users with the ability to securely manage their cryptocurrencies, non-fungible tokens (NFTs), and digital assets within a unified platform.

With OKX Wallet, users have the capability to purchase, trade, earn, and oversee their digital assets across more than 50 blockchains, including Bitcoin, Ethereum, OKT Chain, Solana, BSC, and Aptos, all available in over a dozen languages.

How To Set Up OKX Wallet

To set up using the Chrome browser extension, click on the ‘Add to Chrome” button in the top right corner, as shown in the image below:

Next, select the “Create Wallet” option as shown below:

OKX will present users with the option of creating wallets with either seed phrases or hardware wallets. In the absence of hardware wallets, as in this case, select the “seed phrase” option.

Set the password, verify the seed phrase, and your OKX wallet will be ready to use. Write down your seed phrase and store in a safe place. Do not store online.

Downloading DeFi And Web3 Wallets On Mobile Phones

The wallets listed in this guide also have mobile versions which are available on the app stores of your mobile phone. Navigate to the Apple App Store for iOS or the Google Play Store for Android, input the name of the wallet you want to download in the search bar, make sure you have the correct app and click “Download.”

To set up the wallets on mobile phones, follow the same steps outlined in this guide to get started, and your wallets will be set up.

Conclusion

In conclusion, Web3 and DeFi wallets offer users enhanced digital asset management and participation in decentralized applications. Web3 wallets provide cross-chain support, seamless DApp interaction, and enhanced security features, while DeFi wallets cater specifically to the decentralized finance ecosystem with functionalities like token swapping and yield farming. Understanding these unique characteristics helps users make informed choices.

Examples of enhanced Web3 and DeFi wallets worth exploring have been mentioned in this article. Staying informed about the latest developments in this evolving technology is crucial for unlocking the full potential of decentralized applications and ensuring asset security.

Featured image from Blockbuild.africa

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Stablecoin issuing company Tether has announced a new security policy aimed at protecting the crypto ecosystem from bad actors. In addition, the USDT issuer is looking to enhance its cooperation and relationship with law enforcement agencies.

Tether Freezes 41 New Wallets Following New Security Policy

In a blog post on December 9, Tether stated it would be introducing a voluntary wallet-freezing initiative designed to counter the transactions associated with Sanctioned Persons on the Office of Foreign Assets Control (OFAC) Specially Designated Nationals (SDN) List.

According to Tether, the company currently has a wallet-freezing policy, but it is only applicable to wallets on its platform. Moving forward, the stablecoin issuer now offers its sanctions control on the secondary market, as it aims to improve its collaboration with governmental agencies in ensuring the safe use of stablecoins.

Interestingly, Tether’s latest policy is in direct opposition to its stance in 2022 when it stated it would not willingly restrict sanctioned Tornado cash addresses, barring a direct order from security agencies. With its announcement, the stablecoin issuer has now begun implementation of its new policy and ordered a wallet-freeze of all 41 wallets associated with persons and companies on the OFAC-SDN list.

Commenting on this development, Pablo Ardonio has expressed much excitement towards user safety and forming stronger ties with regulators worldwide.

He said:

This strategic decision aligns with our unwavering commitment to maintaining the highest standards of safety for our global ecosystem and expanding our close working relationship with global law enforcement and regulators. By executing voluntary wallet address freezing of new additions to the SDN List and freezing previously added addresses, we will be able to further strengthen the positive usage of stablecoin technology and promote a safer stablecoin ecosystem for all users.

Meanwhile, some crypto enthusiasts have welcomed this development as they believe it could exert some positive effect on stablecoin adoption in terms of regulations and general usage.

Breaking: @Tether_to public statement to comply with regulators demand to have freezable wallets for security. This is bullish meaning @Tether_to and the US government are working together, this will bring in the US Stable Coin Act and global adoption.#Tether#USDT… pic.twitter.com/E0eCC1skxf

— MartyParty (@martypartymusic) December 9, 2023

Mystery USDT Transaction

In other news, the Tether Treasury transferred $60 million worth of USDT to a “mysterious fund/institution” on December 8.

This development was revealed by blockchain analytics firm Lookonchain, which also stated that Tether had transferred a total of $1.76 billion USDT to this fund/institution since October 20, which has been further dispersed to other exchanges.

Being the issuer of the world’s largest stablecoin, large-scale transactions of this size are bound to draw attention to Tether due to its importance in the crypto ecosystem.

At the time of writing, USDT maintains its spectacular performance in 2023, having attained a $90 billion market cap value. This value represents over 70% dominance in the stablecoin market.

Total crypto market cap valued at $1.592 trillion on the daily chart | Source: TOTAL chart on Tradingview.com

Featured image from CNBC, chart from Tradingview

Cybersecurity team claims up to $2.1B in crypto stored in old wallets is at risk

While the crypto community is still weathering the effects of the recent $100 million Poloniex hack, another cybersecurity threat that could affect billions worth of crypto assets has been discovered by a team of blockchain security experts.

On Nov. 14, cybersecurity company Unciphered released information on a vulnerability that it called “Randstorm,” which it claims to affect millions of crypto wallets that were generated using web browsers from 2011 to 2015.

Today we release our work on Randstorm: a vulnerability affecting a significant number of browser generated cryptocurrency wallets

Reporting @washingtonpost https://t.co/OzYDq2tH4W

Technical write-up: #Bitcoin #blockchain pic.twitter.com/aN7CZh9sv4

— Unciphered LLC (@uncipheredLLC) November 14, 2023

According to the firm, while working to retrieve a Bitcoin (BTC) wallet, it discovered a potential issue for wallets generated by BitcoinJS and derivative projects. The issue could affect millions of wallets and around $2.1 billion in crypto assets, according to the cybersecurity company.

The firm also believes that multiple blockchains and projects could be affected. Apart from BTC, the company highlighted that Dogecoin (DOGE), Litecoin (LTC) and Zcash (ZEC) wallets could also potentially contain the vulnerability.

Related: Hackers claim to have stolen user data from defunct crypto ATM firm Coin Cloud

In addition, the company said that millions have already received an alert about the problem. For those using crypto wallets generated within the 2011 to 2015 time frame, the company recommends transferring their assets to wallets generated more recently. It wrote:

“If you are an individual who has generated a self-custody wallet using a web browser before 2016, you should consider moving your funds to a more recently created wallet generated by trusted software.”

While the company said that not all impacted wallets are affected equally, it also confirmed that the vulnerability is exploitable. However, the company did not provide any details about exploiting the vulnerability to avoid providing more information to bad actors in the space.

Magazine: $3.4B of Bitcoin in a popcorn tin: The Silk Road hacker’s story

Gaming corners 62% of active wallets in ‘Uptober’ as DappRadar reveals wall of bullish metrics

Web3 has shown signs of resurgence in this ‘Uptober,’ according to DappRadar’s latest industry report, suggesting the dApp market may have finally found its footing after a long bearish trend. The analysis points towards a potentially imminent bull run, as crucial metrics have either stabilized or recorded growth.

| Chain | Unique Active Wallets (Sep) | Unique Active Wallets (Oct) | Average dUAW, % change MoM |

|---|---|---|---|

| Near | 641K | 687K | 7% |

| BNB Chain | 446K | 433K | -3% |

| Wax | 328K | 313K | -5% |

| ZKsync | 302K | 242K | -20% |

| Polygon | 194K | 199K | 3% |

NEAR Protocol continues to lead with the most daily average unique active wallets (dUAW), growing by 7% to 687,000. Gaming dApps have seen a notable increase in activity, with their industry dominance rising to 62%. This sector now accounts for 1.66 million dUAW, a 17% increase from September.

The Decentralized Finance (DeFi) landscape, while seeing a 14% rise in Total Value Locked (TVL), has experienced a 13% drop in dUAW. Ethereum maintains its stronghold in the DeFi space, with a 10% increase in TVL, but Solana outpaces all with a 40% surge.

The NFT market has broken its year-long decline, with trading volumes spiking by 32% to $405 million, nearing August levels. Notably, Ethereum dominates this uplift, while other chains have seen reductions in sales volumes.

Security within web3 has improved significantly, with a 93% reduction in funds stolen via hacks and exploits. The reported $800,000 average loss per incident in October is the lowest in the year, hinting at a growing savviness among web3 users.

DappRadar’s analysis underscores a cautious optimism for the dApp industry’s future, linking positive trends in gaming and NFT trading with potential market recovery. This bounce-back in web3 is paralleled by the fall in exploit cases, suggesting an overall maturation of the space. However, consistent growth across several months is needed to confirm a true market turnaround.

The full report is available on the DappRadar website.

FTX and Alameda Research wallets send $13.1M in crypto to exchanges overnight

The crypto wallets linked to the now-defunct crypto exchange FTX and its sister trading firm, Alameda Research, have sent over $13 million in different altcoins to numerous crypto exchanges as of Nov. 1.

According to data from on-chain analysis firm Spotonchain, the FTX wallet first transferred $8.12 million worth of altcoins to Coinbase. The assets include 46.5 million of The Graph’s GRT (GRT) ($4.85 million), 972,073 Render (RNDR) ($2.3 million) and 708.1 Maker (MKR) ($967,000).

The wallet addresses of FTX and Alameda Research made another $5.49-million transfer after three hours to Binance and Coinbase. The top three assets with the highest value in this transaction are 1.14 million dYdX (DYDX) ($2.64 million), 192,888 Axie Infinity (AXS) ($1.05 million) and 5,858 Aave (AAVE) ($522,000).

#FTX and #Alameda Research further deposited $5.49M worth of 6 assets $AAVE, $ALICE $AXS, #C98, $DYDX, $ZRX, to #Binance and #Coinbase ~30 mins ago.

Top 3 include:

1.14M $DYDX ($2.64M)

192,888 $AXS ($1.05M)

5,858 $AAVE ($522K)Overall, #FTX and #Alameda Research have… pic.twitter.com/JPbIXZJPzv

— Spot On Chain (@spotonchain) November 1, 2023

Related: FTX’s Sam Bankman-Fried will testify at criminal trial, say defense lawyers

Prior to the movement of $13.1 million in funds on Nov. 1, crypto analytic firm Nansen flagged several FTX-linked wallet movements over the past week, which saw the deposit of millions in various cryptocurrencies on different crypto exchanges. First, a batch of $8.1 million worth of altcoins was moved to Binance; Nansen estimated that another $24.3 million worth of assets that have left wallets linked to FTX and Alameda were deposited into Binance and Coinbase.

Separate from the initial $8.6M moved:

– 2.2M USD LINK

– 1M USD AAVE

– 2M USD MKR

– 3.4M USD ETHWe have discovered a further $24.3M that has left wallets linked to FTX and Alameda which has been deposited into Binance and Coinbase

But that’s not all… pic.twitter.com/Dru4MysxfQ

— Nansen (@nansen_ai) October 27, 2023

On Oct. 31, FTX linked 1.6 million Solana’s SOL (SOL) tokens worth $56 million that were unstaked and sent to an unknown wallet. Another 930,000 SOL worth $32 million linked to FTX and Alameda were moved to another unknown wallet speculated to be linked to Galaxy Digital, the official firm designated for the liquidation process.

930k $SOL moves from @FTX_Official and @AlamedaResearch Solana wallets over last 3 days to wallet 5RAHK.

Is this @novogratz wallet at @galaxyhq Galaxy Investment Partners?

930k $SOL from FTX and Alameda passed through this wallet to wallets:

-3ADzk

-5sTQ5

-Ca469

-8CAAy… pic.twitter.com/LXecevHUqz— MartyParty (@martypartymusic) October 31, 2023

Data aggregated by Spotonchain suggests a total of $78 million worth of assets have been sent to crypto exchanges from FTX and Alameda wallets over the past week.

FTX-linked wallets have continued to send their stash of altcoins to crypto exchanges over the past month after a court-ordered phased liquidation process. The court order permits FTX to sell digital assets worth over $3 billion through an investment adviser in weekly batches in accordance with the pre-established rule.

The phased-out liquidation process will allow FTX to sell $50 million worth of assets weekly, followed by a $100-million cap in the succeeding weeks. The cap can be increased up to $200 million per week with the previous written consent of the creditors’ committee and ad hoc committee after court approval.

Magazine: The truth behind Cuba’s Bitcoin revolution: An on-the-ground report

In the shadowy corners of the digital world, where the glow of computer screens illuminates faces with eerie light, there exist tales of lost fortunes. These tales act as a terrifying reminder of the unpredictable nature and volatility present in the cryptocurrency markets and the need to adopt stringent security measures.

1. James Howells and the lost 7,500 BTC

A British man named James Howells unintentionally threw away a hard drive in 2013 that contained 7,500 Bitcoin (BTC), currently valued at over $258 million. The hard disk is still buried; he can’t figure out where it is, even after making several desperate attempts to retrieve it from the landfill in New Port, Wales. Howell’s story serves as a reminder that digital gold could be turned into digital dust.

James Howells makes a fresh plea to excavate the landfill site where his discarded hard drive containing 7,500 #Bitcoin likely resides. https://t.co/93AYMQEnrn

— Cointelegraph (@Cointelegraph) January 14, 2021

2. Stefan Thomas and the 7,002 BTC conundrum

San Francisco-based programmer Stefan Thomas (formerly the chief technology officer at Ripple) was plunged into a Kafkaesque nightmare after he lost the password to his digital wallet. Thomas was left with just two password attempts before the security system would encrypt his fortune forever, rendering them unusable and unreachable, with 7,002 BTC at stake.

The hard drive, named the Iron Key, boasts an impenetrable design engineered to withstand all types of attacks. Users are granted only ten wrong password attempts before the drive permanently locks out.

“I would just lay in bed and think about it,” Thomas told The New York Times. “Then I would go to the computer with some new strategy, and it wouldn’t work, and I would be desperate again.”

On Oct. 25, crypto recovery firm Unciphered extended an open letter, offering to unlock an IronKey hard drive owned by Thomas, which holds 7,002 BTC. Despite the offer, Thomas has not taken any action on this matter yet.

A painful memory. I hope others can learn from my mistakes. Test your backups regularly to make sure they are still working. An ounce of foresight could have prevented a decade of regret.

That said, I’ll do what I always do which is focus on building things, e.g. @Interledger. https://t.co/pCgObeAf4Z

— Stefan Thomas (@justmoon) January 12, 2021

3. Mt. Gox’s mysterious 850,000 BTC vanishing act

Mt. Gox — the largest Bitcoin exchange in the world at the time — declared bankruptcy in 2014 after a hacker stole 850,000 BTC, estimated to be worth $450 million at the time. The catastrophic collapse, veiled in intrigue, sent shockwaves throughout the crypto community, making investors and enthusiasts fearful and hopeless.

The unexplained circumstances surrounding the loss further added mystery to the story of Mt. Gox’s collapse. For a very long time, it was unknown exactly how the Bitcoin was stolen and who was behind the hack. The incident sparked investigations, legal disputes and rampant speculation within the crypto community.

On Oct. 9, the United States Justice Department charged Russian nationals Alexey Bilyuchenko and Aleksandr Verner with laundering around 647,000 BTC from the Mt. Gox hack. Bilyuchenko is also charged with operating the illicit exchange BTC-e from 2011 to 2017.

Almost 10 years later, the victims of Mt. Gox are still waiting for compensation.

4. Gerald Cotten and the $215 million puzzle

In December 2018, Gerald Cotten, the CEO of QuadrigaCX, embarked on his honeymoon in India with his wife — a trip that would take a tragic turn. While in India, Cotten, who suffered from Crohn’s disease, faced complications from his illness and passed away, leaving the crypto world in shock.

Cotten was the only individual who held the keys to QuadrigaCX’s crypto vault, meaning he had sole access to millions of dollars worth of customer funds.

Unlike other cryptocurrency exchanges, Cotten had not set up a fail-safe mechanism to ensure the transfer of these assets to others in case of his demise. This meant that, when he died, users were left with their funds stranded in the exchange’s wallets.

The public remained unaware of Cotten’s death for 36 days until January 2019, when the news surfaced. Following Cotten’s death, QuadrigaCX filed for creditor protection, acknowledging the exchange’s dire financial situation, with debts totaling $215 million in cash and Bitcoin owed to its 115,000 investors. Investors, already concerned about their investments, were now faced with a grim reality: their funds might be irretrievably lost due to the lack of access to the exchange’s holdings.

As investigations unfolded, suspicions regarding the authenticity of Cotten’s death arose. However, the emerging truth was equally shocking: the Ontario Securities and Exchange Commission revealed that before his demise, Cotten had depleted most of the funds through fraudulent trades. This revelation shattered investor trust.

5. The enigmatic journey of the $1.06 billion Bitcoin heist

In 2018, the seventh-largest Bitcoin wallet at that time, containing a substantial 69,000 BTC, was unexpectedly discovered in a less explored corner of the internet.

The Bitcoin had been dormant since April 2013. The wallet’s origins were traced back to the shuttered Silk Road darknet market. The marketplace was closed in late 2013 due to illicit activities, and in 2015, its founder, Ross Ulbricht, received a double life sentence plus 40 years with no chance of parole.

Notably, the funds had remained inactive for years after their initial deposit. Then, for the first time in seven years, the billion-dollar worth of BTC witnessed movement in 2018 out of the Bitcoin address 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx.

According to Tom Robinson, chief scientist and co-founder at Elliptic, an encrypted file had been circulating on hacker forums since its discovery, purportedly containing the cryptographic keys required to seize the BTC at this address. If genuine, cracking the password on this file would have allowed the BTC to be moved.

Apart from this movement, 101 BTC were sent to BTC-e in 2015, a cryptocurrency exchange notorious for being favored by money launderers that was subsequently taken down by U.S. law enforcement in 2017.

According to Robinson, the transfer of the BTC could have been initiated by Ulbricht or a Silk Road vendor accessing their funds. However, the possibility of Ulbricht conducting a Bitcoin transaction from prison seemed unlikely. Alternatively, the encrypted wallet file might have been genuine, and the password could have been successfully cracked, enabling the BTC to be moved.

Upon deeper scrutiny of the Bitcoin address, the United States Attorney’s Office and Internal Revenue Service criminal investigation agents discovered its connection to Individual X (individual’s identity known to concerned authorities), who was found to have hacked funds from Silk Road. Subsequently, following the investigation into the hack, law enforcement confiscated several thousand Bitcoin on Nov. 3, 2020, valued at around $1.06 billion at that time.

6. The cryptocurrency conundrum of Brad Yasar

Brad Yasar, an entrepreneur residing in Los Angeles, has spent numerous hours trying to regain access to his wallets that contain thousands of Bitcoin he mined during the technology’s early days, now valued at hundreds of millions of dollars. Unfortunately, he lost the passwords long ago and has stored the hard drives in vacuum-sealed bags, keeping them out of sight.

“Through the years I would say I have spent hundreds of hours trying to get back into these wallets,” Yasar told The New York Times. “I don’t want to be reminded every day that what I have now is a fraction of what I could have that I lost,” he said.

7. Gabriel Abed’s 800 Bitcoin loss in a laptop mishap

In 2011, Gabriel Abed, founder and chairman of Abed Group and co-founder of Bitt, suffered a significant loss when a colleague accidentally reformatted his laptop. This laptop held the private keys to a Bitcoin wallet, resulting in the loss of approximately 800 Bitcoin.

“The risk of being my own bank comes with the reward of being able to freely access my money and be a citizen of the world — that is worth it,” Mr. Abed told The New York Times.

Mr. Abed said that the incident had discouraged him, stating that the transparent nature of Bitcoin granted him complete access to the digital financial realm for the very first time.

Like many in the industry, I have made a lot of mistakes with my keys in the early days. In this latest New York Times article about persons who lost their keys, I recap a story of how a reformatted computer would result in a loss,… https://t.co/cmzxufUWsi

— Gabriel Abed (@Gabriel__Abed) January 12, 2021

8. The unfortunate erasure of Davyd Arakhmia’s cryptocurrency fortune

Davyd Arakhmia, a Ukrainian politician, accidentally deleted an encrypted file from his hard drive containing 400 BTC, unknowingly discarding his private key. Before his political career, Arakhmia ran a business that accepted Bitcoin payments. In an attempt to create more storage space on his hard drive, he deleted the file along with a few movies.

Cryptocurrency security: The key to digital wealth protection

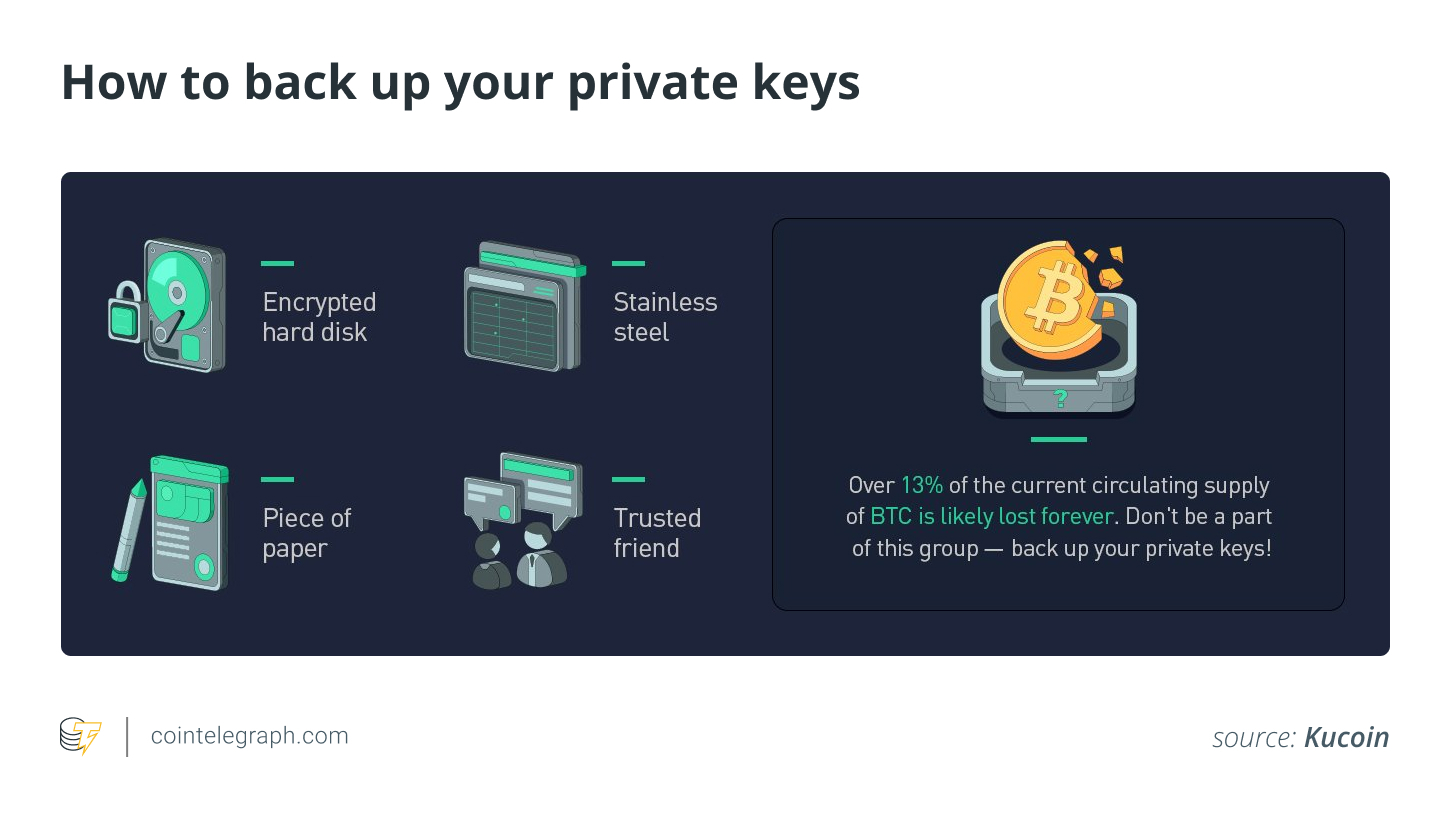

In the volatile cryptocurrency world, digital asset protection is critical. The tales of lost Bitcoin fortunes highlight how important it is to implement strong security measures. Safeguarding cryptocurrency holdings and ensuring private key accessibility should be top priorities for all investors.

Essentials include secured connections, frequent backups and a trustworthy, self-custodial wallet. Moreover, two-factor authentication provides an additional line of protection, while distributing assets among several wallets protects against losses. Also, it is equally important to remain vigilant against phishing efforts and keep up with the latest developments in security procedures.