In an unprecedented surge, crypto funds around the globe registered record inflows totaling $2.45 billion last week, marking a significant uptick in investor interest. This influx has propelled the total assets under management (AUM) back to levels not seen since December 2021, signaling a strong resurgence in the crypto investment space. Record $2.45 Billion Inflows […]

In an unprecedented surge, crypto funds around the globe registered record inflows totaling $2.45 billion last week, marking a significant uptick in investor interest. This influx has propelled the total assets under management (AUM) back to levels not seen since December 2021, signaling a strong resurgence in the crypto investment space. Record $2.45 Billion Inflows […]

Source link

Week

Worldcoin’s WLD Token Skyrockets 142%, Leading Crypto Market’s Week of Surges

This week, WLD token from the Worldcoin project soared by 142.7% against the U.S. dollar, topping the chart as the week’s most significant gainer. Hot on its heels was the digital currency bitget token (BGB), which saw an increase of just over 58% in the past week. Conversely, Astar (ASTR) experienced a decline of 6.4%, […]

This week, WLD token from the Worldcoin project soared by 142.7% against the U.S. dollar, topping the chart as the week’s most significant gainer. Hot on its heels was the digital currency bitget token (BGB), which saw an increase of just over 58% in the past week. Conversely, Astar (ASTR) experienced a decline of 6.4%, […]

Source link

2-year Treasury yield higher for 3rd straight week on signs of inflation trouble

U.S. government debt sold off on Friday, pushing yields to their second-highest levels of 2024, after hotter-than-expected producer-price data created more inflation concerns.

What happened

-

The yield on the 2-year Treasury note

BX:TMUBMUSD02Y

jumped 8.9 basis points to 4.654%, from 4.565% on Thursday. For the week, the rate rose 16.8 basis points for its largest weekly gain since the period that ended on Jan. 19. It is up 28.9 basis points over the past three weeks, the largest three-week gain since the period that ended June 9 of last year. -

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

rose 5.5 basis points to 4.294%, from 4.239% on Thursday. It advanced 10.8 basis points this week. -

The yield on the 30-year Treasury note

BX:TMUBMUSD30Y

rose 2.7 basis points to 4.448%, from 4.421% a day earlier. For the week, it gained 6.8 basis points. - Ten- and 30-year yields have respectively gained 26.4 basis points and 22.2 basis points over the past two weeks, their biggest such advances since the periods that ended on Oct. 6 and Oct. 27 of last year.

- The bond market is closed Monday for Presidents Day.

What drove markets

Data released on Friday showed that the inflation fight isn’t over. The producer-price index rose 0.3% in January, above the 0.1% forecast of economists polled by the Wall Street Journal. It’s possibly another sign inflation won’t slow toward the Federal Reserve’s 2% target as fast as hoped.

The PPI report came three days after a higher-than-expected January consumer-price index sparked concerns the Federal Reserve may push back further on plans to start cutting interest rates this year.

On Friday, San Francisco Fed President Mary Daly said the central bank should take its time before lowering borrowing costs and that patience is needed to finish the job on inflation.

In other data released on Friday, housing starts fell almost 15% in January, to 1.33 million, as builders pulled back on new projects. That’s the sharpest drop since April 2020. Separately, consumer sentiment crept up in early February to the highest since July 21, according to the University of Michigan.

What analysts are saying

“It’s been a wild week with a gut check on Tuesday, when CPI came in higher than expected, and stopped the stock and bond bulls in their tracks,” said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance in Charlotte, N.C.

Friday’s PPI report “only further muddies the waters because two strong inflation reports (CPI and PPI) show why the Fed is going to need to move much more slowly to cut interest rates,” Zaccarelli wrote in a note.

Shares of Blink Charging (BLNK -4.01%) skyrocketed this week, surging 29.7% at their highest point in trading through 10 a.m. ET Friday, according to data provided by S&P Global Market Intelligence. That’s a jaw-dropping one-week rally for a stock that lost 69% value in 2023.

Turns out, the electric vehicle (EV) charging equipment company is all set to report record-breaking revenues for its fourth-quarter and full-year 2023. And investors aren’t leaving any chances to bet on the languishing stock ahead of earnings.

Blink Charging’s revenue grew more than 100% in 2023

Blink Charging’s revenue has grown at a blistering pace in recent quarters. In its third quarter, the company reported 152% growth in revenue and 167% growth in gross profit, both year over year. A record quarter even encouraged Blink Charging to raise its full-year 2023 revenue guidance up to $128 million to $133 million from $110 million to $120 million.

Blink Charging, however, has surpassed even its upgraded guidance. This week, it announced its preliminary numbers and expects to report revenue above $42 million for Q4 and $140 million for 2023.

Now, those are big numbers, as they translate into at least 85% and 129% revenue growth for Q4 and 2023, respectively, at a time when the industry appears to be reeling. Blink Charging’s rival ChargePoint Holdings, for example, reported a 12% year-over-year drop in its revenue in the third quarter.

It’s no surprise, then, that Blink Charging stock shot higher this week.

Is it time to buy Blink Charging stock?

Blink Charging is yet to turn a profit but is already generating a positive gross profit, meaning it is generating enough sales to cover direct costs related to its EV charging equipment and services. In Q3, Blink Charging said it is targeting a positive gross margin of 30% or more for 2023. That’s a solid number, and a positive gross margin undeniably gives Blink Charging a lead over loss-making peers.

While that could make Blink Charging stock appealing, investors should also be aware of the risks. A prominent one is share dilution — Blink Charging has consistently issued stock to raise funds over the years.

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

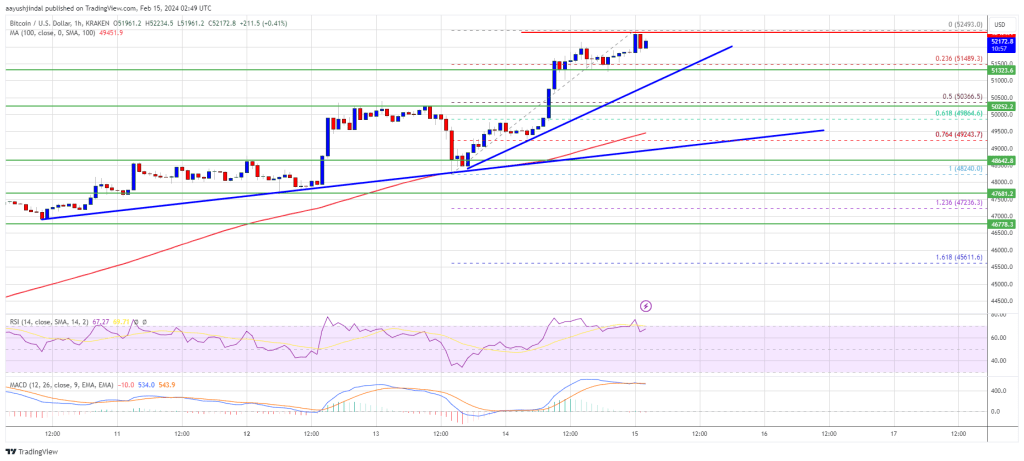

Bitcoin price extended its increase above the $52,000 resistance. BTC is consolidating gains and might aim for more upsides toward the $55,000 resistance.

- Bitcoin price remained in a bullish zone above the $51,000 and $51,200 levels.

- The price is trading above $51,200 and the 100 hourly Simple moving average.

- There are two bullish trend lines forming with support at $51,450 and $49,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to move up if it clears the $52,500 resistance zone.

Bitcoin Price Extends Rally

Bitcoin price started a steady increase above the $50,000 resistance zone. BTC gained strength above the $50,500 and $51,200 levels. It even spiked above the $52,000 resistance zone.

A new multi-week high was formed near $52,493 and the price is now consolidating gains. It is holding gains above the 23.6% Fib retracement level of the recent wave from the $48,240 swing low to the $52,493 high. There are also two bullish trend lines forming with support at $51,450 and $49,200 on the hourly chart of the BTC/USD pair.

Bitcoin is now trading above $51,200 and the 100 hourly Simple moving average. Immediate resistance is near the $52,500 level. The next key resistance could be $53,200, above which the price could extend its rally.

Source: BTCUSD on TradingView.com

The next stop for the bulls may perhaps be $54,400. A clear move above the $54,400 resistance could send the price toward the $55,000 resistance. The next resistance could be near the $56,500 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $52,500 resistance zone, it could start another downside correction in the near term. Immediate support on the downside is near the $51,500 level and the first trend line.

The first major support is $50,500 and the 50% Fib retracement level of the recent wave from the $48,240 swing low to the $52,493 high. If there is a close below $50,500, the price could gain bearish momentum. In the stated case, the price could dive toward the $49,200 support and the second trend line.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $51,500, followed by $50,500.

Major Resistance Levels – $52,500, $53,200, and $54,400.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

5 things next week that could determine if Wall Street win streak continues

People walk by the New York Stock Exchange (NYSE) on December 29, 2023 in New York City.

Spencer Platt | Getty Images

Wall Street wrapped up another positive week, with the S&P 500 closing Friday above 5,000 for the first time ever. The Nasdaq finished less than 0.5% away from its November 2021 record-high close.

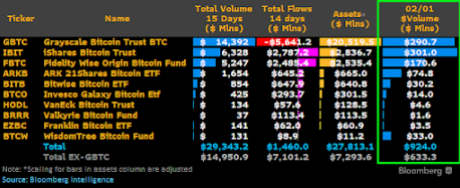

The Spot Bitcoin ETFs have lived up to the hype, as these funds have ramped up institutional adoption of the flagship cryptocurrency, Bitcoin. This is further evident in a recent analysis that captured how much Bitcoin BlackRock and other issuers amassed in this week alone.

Spot Bitcoin ETF Issuers Purchased Over 19,908 BTC This Week

Data from the on-chain analytics platform Lookonchain shows that the Spot Bitcoin ETF issuers combined to purchase over 19,908 BTC ($860 million) this week. Meanwhile, it is worth mentioning that Lookonchain’s data didn’t capture WisdomTree’s BTC purchases in its analysis, suggesting that the figure could be way higher when the asset manager’s purchases are also factored in.

Further data obtained from Arkham Intelligence provided insights into how much Bitcoin Wisdom Tree obtained for its Bitcoin fund this week. 74 BTC is shown to have gone into the asset manager’s wallet address for its Spot Bitcoin ETF. The addition of these crypto tokens means that all Spot Bitcoin ETF issuers combined to purchase almost 20,000 BTC this week alone.

Interestingly, Bitcoin ETFs were recently reported to hold 3.3% of Bitcoin’s circulating supply, underscoring their success since launching. Data from Lookonchain shows that these ETFs currently hold over 657,000 BTC (excluding WisdomTree).

Matt Hougan, Bitwise’s Chief Investment Officer (CIO), also revealed how these funds have seen flows of $1.7 billion after their first 14 trading days. This is more impressive as he made a comparison to Gold ETFs, which saw $1.3 billion in a similar time frame. In another X post, he mentioned how these Spot Bitcoin ETFs have taken $700 million in net inflows this week alone.

BTC price recovers above $43,000 | Source: BTCUSD on Tradingview.com

BlackRock Finally Trumps Grayscale

Bloomberg analyst James Seyffart mentioned in an X post that BlackRock’s IBIT looks to have become the first ETF to trade more than Grayscale’s GBTC in a single day. Before now, Grayscale had continued to record the most daily trading volume, although IBIT had come close on a couple of occasions.

From the data that Seyffart shared, IBIT looks to have recorded $301 million in trading volume on February 1, while GBTC saw $290 in trading volume. However, he further stated that the total trading on the day “was kind of a dud,” with all Spot Bitcoin ETFs combined recording $924 million in trading volume.

Interestingly, that happened to be the first day that the daily volume for Spot Bitcoin ETFs was under $1 billion. The Bloomberg analyst didn’t, however, give any opinion as to what could have caused this relatively sub-par performance.

Featured image from U.S. Global Investors, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Long-term Treasury yields end the week higher despite mild PCE inflation data

U.S. government-debt yields finished mostly higher on Friday after December inflation data reinforced the possibility of a soft landing for the economy.

What happened

-

The yield on the 2-year Treasury

BX:TMUBMUSD02Y

rose 5.3 basis points to 4.365%, from 4.312% on Thursday. For the week, it fell 4.1 basis points. Yields move in the opposite direction to prices. -

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

advanced 2.8 basis points to 4.159%, from 4.131% on Thursday. It rose 1.4 basis points this week. -

The yield on the 30-year Treasury

BX:TMUBMUSD30Y

rose less than 1 basis point to 4.388%, from 4.380% on Thursday. For the week, it rose 3.5 basis points. - Ten- and 30-year rates both ended higher for a second straight week, according to Dow Jones Market Data, while also finishing at their second-highest levels of the year so far.

What drove markets

The PCE price index, the Federal Reserve’s preferred inflation measure, rose a mild 0.2% in December. The core rate, which excludes food and energy, advanced by the same magnitude — in line with the expectations of economists polled by the Wall Street Journal.

Meanwhile, the annual rate of core inflation eased to 2.9% from 3.2%, marking the lowest level in almost three years and suggesting that the disinflation trend is continuing.

Interest-rate expectations were little changed after the inflation report. Fed-funds futures traders saw a 97.4% chance of no action by the Federal Reserve at its meeting next week, which would leave the main policy-rate target between 5.25%-5.5%, according to the CME FedWatch Tool. The chance of no action again by March was seen at 52.6%. Traders mostly expect five or six quarter-point rate cuts by December.

Other data released on Friday showed that pending home sales in December posted their biggest jump since June 2020. With Friday’s data now out of the way, traders have turned their attention to Monday’s release of financing estimates by the Treasury.

See: Wall Street is counting on Treasury’s borrowing needs to trend lower between now and June

What strategists are saying

“For a market that was looking for a ‘high’ +0.1%, the realized figures were very much in line,” said BMO Capital Markets strategist Ben Jeffery, referring to Friday’s PCE report for December.

“We don’t expect December’s data will materially shift March cut odds ahead of the weekend, and instead we’ll look for next week’s supply announcements, FOMC [Federal Open Market Committee] decision, and payrolls print to quickly take the market’s focus as the PCE print is digested,” he wrote in an email.

Shares of D.R. Horton (DHI 1.70%), the nation’s biggest homebuilder, were falling this week after the company posted disappointing estimates in its fiscal first-quarter earnings report.

The news comes after homebuilder stocks like D.R. Horton have seen a dramatic increase in profits over the last year or two due to a shortage of available housing and an unwillingness of homeowners to sell and lose their low-priced mortgages, creating demand for new homes.

However, the company missed estimates on the bottom line in its earnings report, and decelerating revenue growth also seemed to spook the market. As a result, the stock was down 8.8% for the week, according to data from S&P Global Market Intelligence.

Image source: Getty Images.

Horton has a good quarter, but not good enough

Revenue growth is slowing down at D.R. Horton and other homebuilders after an earlier boom, and investors seem to be adjusting their expectations.

Horton said revenue in the quarter rose 6% to $7.73 billion, which beat estimates at $7.6 billion. Other key metrics showed solid growth as well, as homes closed rose 12% to 19,340, or an 8% increase in value to $7.3 billion. Net sales orders jumped 38% to $6.8 billion, showing strong demand, though its backlog fell by 12% as it built more homes than were ordered.

Horton’s margins took a hit in the quarter, which seemed to be due to rising labor and material costs, and its operating income fell slightly from $1.27 billion to $1.25 billion. Though net income was down slightly, earnings per share improved due to a decline in shares outstanding, rising from $2.76 to $2.82. That missed estimates at $2.88.

The company also repurchased nearly $400 million worth of stock in the quarter as it continues to return capital to shareholders through both dividends and share buybacks.

Chairman Donald R. Horton said, “We are well-positioned to meet changing market conditions with our affordable product offerings and flexible lot supply and are focused on turning our inventory to maximize returns and capital efficiency in each of our communities.”

What’s next for D.R. Horton

The company raised its revenue guidance modestly for the year, calling for $36 billion to $37.3 billion, up from a previous range of $36 billion to $37 billion. However, that forecast implies revenue growth will continue to slow, increasing just 3%.

While there wasn’t anything particularly disappointing about the report, the stock seems to be returning to its mean valuation. Still, the estimated shortage of 4 million homes in the U.S. should fuel continuing demand for D.R. Horton’s services.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Cathie Wood Goes Bargain Hunting: 3 Stocks She Just Bought This Week

There never seems to be a bad time for Cathie Wood to reshape her portfolios. The founder, CEO, and main stock-picker for the Ark Invest family of exchange-traded funds has been busy adding to some of her positions this week. She has also been pruning some of her holdings, but let’s talk about the buys.

Wood added to existing positions in Meta Platforms (META 0.64%), Recursion Pharmaceuticals (RXRX -1.25%), and Ginkgo Bioworks (DNA 1.61%) this week. Let’s take a closer look.

1. Meta Platforms

One of last year’s biggest winners was Facebook parent Meta Platforms. The stock nearly tripled last year, up 194%. I know I wasn’t the only investor who shook my head when Facebook changed its corporate moniker to Meta in the fall of 2021. I guess CEO Mark Zuckerberg is getting the last laugh now.

The social media giant’s dream of embracing the virtual realm of the metaverse hasn’t exactly been fulfilled. The Meta Quest virtual reality headset remains a niche product. However, its family of apps that includes Facebook, Instagram, and WhatsApp remains ridiculously magnetic, attracting 3.96 million monthly active users.

Image source: Getty Images.

Revenue rose 21% to a whopping $34.2 billion in constant currency in its latest quarter. A 31% jump in ad impressions across its offerings was the biggest driver, even if the average revenue per ad took a 6% dip.

Despite the stock’s surge since bottoming out in late 2022, Wood believes that it can keep going higher. Why else would she have bought more shares of Meta on Monday? She wasn’t the only one feeling more bullish about Meta. Citi raised its price target on the shares a day later.

Citi analyst Ronald Josey is bumping the stock’s price target from $425 to $440, naturally sticking to a bullish buy rating. Josey’s read is that the online advertising market got stronger in the fourth quarter, and that bodes well heading into Meta’s financial update next week. The successful monetization of Facebook’s Reels, promising new ad products, and its overall sticky engagement make the stock Citi’s top internet stock for 2024.

2. Recursion Pharmaceuticals

If you follow Wood’s daily market transactions it’s obvious that she’s warming to Recursion Pharmaceuticals in a major way. She has added to her position for 12 consecutive trading days through Wednesday of this week. Unlike Meta — a household name and one of just six stocks with market caps north of $1 trillion — Recursion is a small stock with a $2.2 billion market cap.

Recursion is a clinical stage techbio company. It offers an operating system that leverages machine learning algorithms and searchable biology and chemistry relationships to help speed up the development of potential treatments. It has just $47 million in trailing revenue, and it’s understandably years away from profitability. However, it’s been striking deals to expand the reach of its Recursion OS platform and beef up its artificial intelligence goals. Wood’s fresh purchases now find her owning more than 10% of Recursion’s outstanding shares.

3. Ginkgo Bioworks

Many of Wood’s stock purchases have been in the biotech space. She has now added to her Ginkgo Bioworks stake for six straight trading days. The biosecurity and biofoundry specialist posted mixed financial results in its latest quarter, but it comforted investors earlier this month by announcing preliminary financial results for fiscal 2023.

It continues to expect to report between $250 million and $260 million in revenue for all of last year, based on preliminary unaudited estimates. Ginkgo Bioworks is encouraged by its strong performance in cell engineering revenue and cash-rich balance sheet. Wood is a believer. She now owns nearly 11% of the stock’s total shares.

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Rick Munarriz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.