Nvidia and Broadcom shares are BofA’s leading ways to play the AI trend within the chip sector, but several other players could carve out a “profitable niche.”

Source link

win

Are Stocks Going to Plunge if Joe Biden Wins a Second Term? Here’s What History Says About Stock Market Returns When Democrats Win.

It’s that time again — and I’m not talking about earnings season.

In a little over seven months, Americans across the country will head to the polls or mail in their ballots to determine who’ll lead the country over the coming four years. Although there are plenty of aspects of politics that have no bearing on Wall Street, fiscal policy changes that originate in Washington, D.C., and are signed into law by the president of the United States, can ultimately impact corporate earnings and the health of the U.S. economy.

With nearly 2,500 delegates in the ongoing primaries, incumbent Joe Biden is the presumptive nominee for president from the Democratic Party. Since Biden took office as the 46th president on Jan. 20, 2021, the ageless Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC), have respectively gained 28%, 36%, and 22%. All three major stock indexes have also achieved fresh all-time highs since the year began.

But could a second term of Joe Biden at the helm cause stocks to plunge? Let’s take a closer look at some of the downside catalysts that could lie ahead and let history be the ultimate judge.

Are stocks going to crash if Joe Biden wins in November?

Regardless of who’s president, Wall Street is always contending with headwinds. Should Joe Biden get the nod from voters in November, a combination of policy proposals (if signed into law) and macroeconomic factors have the potential to push the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite off of their respective pedestals.

One of the more concerning proposals, from an investment perspective, is Biden’s recent call to raise the tax on stock buybacks from the current 1% to 4%. This may not sound like much, but S&P 500 companies are estimated to have repurchased in the neighborhood of $800 billion worth of their common stock in 2023.

For businesses with steady or growing net income, share repurchase programs that lower their outstanding share count can have a positive impact on earnings per share (EPS). In other words, companies enacting buybacks can appear more attractive to fundamentally focused investors. Quadrupling the buyback tax could make share repurchase programs less attractive, thereby slowing EPS growth.

Additionally, President Biden has called for an increase to the corporate alternative minimum tax rate to 21% from the current rate of 15% for businesses with at least $1 billion in profits, and has proposed increasing the peak U.S. corporate income tax rate to 28% from 21%. On paper, taxing corporate profits at a higher rate would be expected to reduce spending on innovation, hiring, and acquisitions.

However, it’s not just policy proposals from President Biden that could give Wall Street the jitters. A couple of money-based metrics and recession-predicting tools suggest a second term for Biden could involve meaningful downside for the Dow, S&P 500, and Nasdaq Composite.

WARNING: the Money Supply is officially contracting. 📉

This has only happened 4 previous times in last 150 years.

Each time a Depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

For example, U.S. M2 money supply is declining by more than 2% from its all-time high for only the fifth time when back-tested more than 150 years, and the first time since the Great Depression, as highlighted in the post above by Reventure Consulting CEO Nick Gerli. M2 money supply accounts for everything in M1 (cash and coins in circulation, along with demand deposits in a checking account) and adds in savings accounts, money market accounts, and certificates of deposit (CDs) below $100,000.

The previous four times M2 money supply notably declined occurred in 1878, 1893, 1921, and 1931-1933. All four of these instances are associated with deflationary depressions and high periods of unemployment. While fiscal and monetary tools make it highly unlikely that we’d see a depression materialize today, a sizable decline in M2 money supply does suggest consumers and businesses will make fewer discretionary purchases.

Other predictive tools, such as the Conference Board’s Leading Economic Index, and the Federal Reserve Bank of New York’s recession probability measure, suggest economic weakness is in the cards.

On paper, a stock market plunge can’t be ruled out, regardless of who’s in the Oval Office come Jan. 20, 2025. But there’s another side to history that should have patient investors excited about the future.

Here’s what history says happens to stocks when Democrats win the presidency

Historically speaking, the stock market has averaged a positive annualized return with both Democrats and Republicans as president. But since 1945, Democrats in the Oval Office have outperformed Republicans.

According to an analysis from independent financial intelligence company CFRA Research in 2020 (i.e., prior to Biden taking office), Democrat presidents have overseen an 11.2% annualized return in the S&P 500, compared to 6.9% for their Republican counterparts. For instance, Bill Clinton and Barack Obama oversaw respective annualized gains of 15.2% and 13.8% during their eight-year terms.

While there have been a few Republican presidents that have been in office during a rough period for Wall Street — e.g., the S&P 500 shed 5.6% on an annualized basis while George W. Bush was in office — Republican Calvin Coolidge oversaw the best stock market performance of any president. In the roughly 5-1/2 years Coolidge was president during the Roaring Twenties, the market delivered a blistering annualized return of 26.1%!

The point being that, over long periods, it doesn’t matter which party finds itself in the Oval Office. Although budget proposals from presidential candidates can occasionally stir the pot and upset Wall Street, these events tend to be very short-lived.

Widening the lens beyond four- and eight-year presidential terms yields even more encouraging results for patient investors.

Last June, analysts at market insights firm Bespoke Investment Group published a data set that examined the length of bear and bull markets in the S&P 500 dating back to the start of the Great Depression in September 1929. What they found was a milewide disparity between optimism and pessimism on Wall Street.

Over the past 94 years, the 27 bear markets the S&P 500 has worked its way through cleared in an average of 286 calendar days, or about 9.5 months. By comparison, the typical bull market has lasted 1,011 calendar days, or 3.5 times as long.

A separate study conducted by Crestmont Research looked back even further. Since the components of the S&P could be found in other major stock indexes prior to the creation of the S&P in 1923, Crestmont was able to back-test its return data to 1900.

What the researchers at Crestmont did was analyze the rolling 20-year total returns (I.e., including dividends paid) of the S&P 500 since 1900. This yielded 105 unique periods of rolling 20-year total returns (1919-2023).

Here’s the kicker: All 105 rolling 20-year periods produced a positive total return. Regardless of which party controls the White House, hypothetically holding an S&P 500 tracking index for 20 years has been a foolproof investment strategy for more than a century.

To add, these weren’t paltry gains, either. Whereas you can count on one hand how many rolling 20-year timelines produced annualized total returns of between 3.1% and 5%, more than 50 of these 105 rolling 20-year time frames generated annualized total returns of between 9% and 17.1%.

If Joe Biden wins a second term as president, history suggests long-term investors are going to be well-positioned to grow their wealth on Wall Street.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has nearly tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of March 21, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Are Stocks Going to Plunge if Joe Biden Wins a Second Term? Here’s What History Says About Stock Market Returns When Democrats Win. was originally published by The Motley Fool

This Valentine’s Day, PrimeXBT has an enticing new promotion for traders to take advantage of. The platform is offering new users up to $7,000 in bonus funds to bolster your Crypto trading bottom line.

Redeeming the Valentine’s promo

To get the 14% deposit bonus up to $7,000, traders just need to click here and follow the prompts. Then just make a minimum deposit of $500 or more between February 12th and 18th. It’s that easy to begin your love affair with Crypto trading.

Fall in love with PrimeXBT features

There are plenty of reasons why traders love the platform’s features:

For one, PrimeXBT makes it dead simple to short or long major Cryptos like Bitcoin. This flexibility lets traders profit whether flagship assets like BTC and ETH rally or eventually slide. PrimeXBT also aggregates Crypto, Forex, Stock Indices and Commodities together, allowing traders to build a portfolio across asset classes.

Advanced margin tools give traders precision control over risk-taking. Choose between cross margin or isolated margin, as well as how much leverage to use. For those seeking leverage, PrimeXBT fills that need to amplify profit potential on limited capital.

Finally, PrimeXBT lets anyone tap into Crypto riches through its innovative Copy Trading module. By automatically copying skilled traders, beginners circumvent months of frustration and benefit from proven Crypto trading expertise from day one.

Get your heart and Crypto pumping

If you’re seeking excitement, reward and maybe even a little romance this Valentine’s Day, PrimeXBT hits the mark. Don’t miss this limited-time opportunity to fund your ambitions in red-hot Crypto markets.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

5 things next week that could determine if Wall Street win streak continues

People walk by the New York Stock Exchange (NYSE) on December 29, 2023 in New York City.

Spencer Platt | Getty Images

Wall Street wrapped up another positive week, with the S&P 500 closing Friday above 5,000 for the first time ever. The Nasdaq finished less than 0.5% away from its November 2021 record-high close.

Markets ‘complacent’ about the risks of a Trump win, strategist says

Former U.S. President and Republican presidential candidate Donald Trump holds a rally in advance of the New Hampshire presidential primary election in Rochester, New Hampshire, U.S., January 21, 2024.

Mike Segar | Reuters

Markets are “fairly complacent” about the risks of a second Donald Trump presidency, which could trigger a “tantrum” in long-duration bond markets, according to Guillermo Felices, principal and global investment strategist at PGIM.

Wall Street has enjoyed a remarkable rally since November last year, culminating in both the Dow Jones Industrial Average and the S&P 500 hitting record highs on Monday.

Much of the market focus remains on short-term economic data and on what it means for the Federal Reserve’s potential interest rate cutting path this year.

Bullishness in risk assets is driven largely by the consensus that the Fed will begin cutting rates rapidly in the early part of the year, and that the U.S. economy will manage a “soft landing” — bringing inflation back to the Fed’s 2% target without triggering a recession.

Some analysts are also looking ahead through a fiscal and geopolitical lens to November’s U.S. presidential election and beyond.

Trump’s tax reform bill in 2017 cut the top corporate tax rate from 35% to 21%, and he has vowed on the campaign trail to lower it further to 15%, if he is elected to a second spell in the White House.

Risk of a ‘duration tantrum’ in bond market

In an email to CNBC on Monday, Felices said one of the developments that limited PGIM’s optimism versus the market consensus for an economic “soft landing” in the U.S. was that the market has been “fairly complacent about the risks associated with a Trump win, fiscal expansion (e.g. tax cuts, defence budgets) and military conflict escalation.”

“A Trump presidency we think would be positive for the economy in the sense that there would be probably more fiscal stimulus through state tax cuts — the question is what that stimulus does to the bond market, and what’s the backdrop for the economy?”

He explained, “If the economy is still very strong and it doesn’t really require that further fiscal stimulus, the bond market could start getting nervous about debt sustainability and higher interest rates, and therefore we could see higher yields, a bit of a duration tantrum, and risky assets wouldn’t like that.”

The U.S. economy has proven surprisingly resilient in the face of a steep increase in interest rates to combat high inflation over the last two years, with growth and employment remaining robust. Thursday’s fourth-quarter GDP growth estimate will offer further insight into how activity is faring, as the Fed tries to wrestle price increases back to target.

“If the backdrop is one where the economy is a lot weaker, and it deserves that extra fiscal push, then I think the market would be okay and would handle that in a good way — it would be supported. But it really depends on the economic backdrop that the U.S. economy is facing at that time.”

‘Fiscal risk’ at a time of high deficit

The crucial point, Felices acknowledged, is America’s deteriorating fiscal position in recent decades. The U.S. government deficit is projected to run at between 6% and 8% through to the end of the decade, and Fitch projected on Monday that this shortfall would exceed 8% of GDP annually from 2023 to 2025.

This would mean that whoever occupies the White House from January 2025 would have little room for either big government spending pledges or the type of tax cuts Trump is promising, he suggested.

“The market at the moment is not really seeing that two-sided risk. At the moment, the market is pricing in ‘Oh, central banks will save the day again, they will cut rates, and if there is some weakness in the economy, they will cut by more’,” said Felices, a former senior economist at the Bank of England.

“The market is not really focusing too much on the potential upside risks to yields that are associated with this potential repricing of term premia. [Having] fiscal risks with the sort of deficit that the U.S. is running is a really, really important one that the market will have to come to terms with again.”

As such, he suggested that both risk assets and fixed income face a “much choppier” period ahead than investors have experienced over the last year.

As well as the tax cuts, analysts have also flagged risks associated with Trump’s proposed 10% tariff on all U.S. imports, widely criticized as a net negative for the U.S. economy and consumers.

Along with a very different macroeconomic environment, particularly much higher interest rates, the broader geopolitical landscape is also unrecognizable since Trump was last in office.

Felices joined several strategists over the past week, who have argued that the former president’s famously erratic approach to foreign policy decisions carries an added risk to markets and to the economy in the current environment.

Dan Boardman-Weston, CEO of BRI Wealth Management, told CNBC on Monday that Trump’s tendency to “change his mind” on geopolitical alliances — in a world of simmering tensions between China and Taiwan alongside Russia’s war in Ukraine — would lead to “heightened risks” and an added level of uncertainty that would impact market valuations.

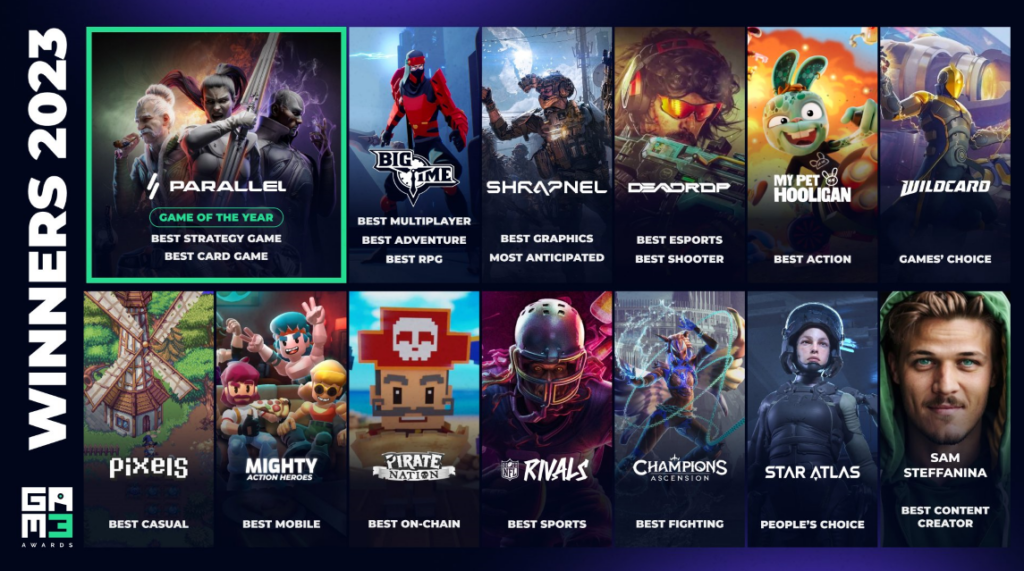

Parallel dominates Gam3 Awards with triple win including Game of the Year

The second annual Gam3 Awards has concluded, with Parallel earning top honors in several categories, including Best Strategy Game, Best Card Game, and the prestigious Game of the Year award. The event, celebrating the hard work of development teams in web3 gaming, showcased the diverse potential of blockchain technology in gaming.

The Gam3 Awards, hosted by GAM3S.GG, formerly Polkastarter Gaming, had a total of 40 finalists from 214 nominated games. The other Game of the Year finalist nominees were My Pet Hooligan, Wildcard, Big Time, Deadrop, and last year’s winner, Big Time.

Parallel, which is yet to be officially released, is a science fiction trading card game (TCG) that blends traditional gaming mechanics with the advanced capabilities of blockchain technology. Developed by Parallel Studios on Ethereum using the Echelon Prime ecosystem, it completed a closed alpha phase earlier this year, where participants had the opportunity to explore all game modes, experiment with different cards, and contribute feedback to refine the game. Players are currently engaging with a closed beta, which includes a $25k tournament, and the full, on-chain version is expected to ship in 2024.

The game is rooted in a dystopian future narrative. It unfolds in a world where Earth, devastated by a cataclysmic event using anti-matter, forces humanity to colonize space, creating distinct civilizations, each with unique capabilities and backgrounds.

The game’s universe is marked by five parallels – the Earthen, Marcolian, Augencore, Kathari, and Shroud, each representing different factions that have evolved over thousands of years. These groups converge in a quest to harness Earth’s newfound energy, resulting in conflicts and alliances, providing an immersive storytelling canvas for players.

Parallel’s gameplay allows players to collect and use NFT-based cards, creating decks to engage in strategic battles against others. These decks can represent a single faction or a combination of universals applicable across factions. The game operates on a play-and-earn model, where players genuinely own their digital cards and earn PRIME tokens, the utility currency within the Echelon ecosystem.

PRIME tokens serve multiple functions, including value transfer, rewards, and governance participation. The token, which lives on the Ethereum network, is up 58% over the past 30 days, reaching an all-time high following the awards ceremony. It has since retraced 13% along with the broader market, according to CryptoSlate data.

Players can experience various game modes in Parallel, such as The Ladder, where they compete in one-on-one battles, and Sectors, where they start with a 30-card deck and modify it as they progress. The rookie queue provides a training ground for newcomers, offering immutable rookie decks that evolve with player experience.

You can learn more about Parallels on Gam3s.gg, including guides and reviews from players participating in the test releases.

Information on the winners from other categories at The Gam3 Awards is available on the awards website.

An epic court win by the maker of Fortnite could upend the multibillion-dollar app-store economy. It almost assuredly will set into motion a legal skirmish that will ultimately land in the U.S. Supreme Court.

Epic Games Inc.’s triumphant verdict in its high-profile antitrust trial with Alphabet Inc.’s

GOOGL,

GOOG,

Google, in which Epic claimed the Play app store operated as an illegal monopoly, is reverberating throughout the software industry. For years, developers led by Epic have alleged they were at the mercy of Google and Apple Inc.

AAPL,

both of which commanded commission fees of up to 30% on digital goods and services sold exclusively through their online stores.

The jury’s verdict late Monday “proves that Google’s app store practices are illegal and they abuse their monopoly to extract exorbitant fees, stifle competition and reduce innovation,” Epic Games said in a blog post late Monday.

Legal experts said the decision, reached after only a few hours by a nine-person jury in San Francisco, will disrupt increasingly profitable business segments for Google, Apple, Sony Group Corp.

SONY,

Samsung Electronics Co.

005930,

and others.

At the very least, the verdict proves that the definition of a market is shifting through technology advances, according to Michael Santoro, an ethics professor at the Leavey School of Business at Santa Clara University.

“The jury thought the relevant market was the Android app-distribution market and not the app-distribution market that includes Apple,” Santoro said in an interview.

More broadly, the decision “will definitely change some practices, but redefine app stores? I don’t think so,” tech attorney Abiel Garcia said in an interview.

One outcome would force app stores to work more with one another to establish consistent terms of agreement with app developers, down to commission fees and other rules, Garcia said. Meanwhile, developers are trying to figure out what opens up for them, he added.

Read more: Epic Games is the latest to take on Google in court over antitrust charges

U.S. District Judge James Donato will decide what remedies Epic will be awarded in January. Epic did not seek monetary damages.

Google plans to appeal, setting into motion a potentially years-long conflagration that will end up in the nation’s highest court.

“The trial made clear that we compete fiercely with Apple and its App Store, as well as app stores on Android devices and gaming consoles,” Wilson White, vice president of government affairs and public policy for Google, said in a statement. “We will continue to defend the Android business model and remain deeply committed to our users, partners, and the broader Android ecosystem.”

As with Epic’s historic lawsuit with Apple, the Google case is likely to trudge through the appeals-court system. “This is one of a series of cases wending their way through the appeals process,” Santoro said.

When Epic went to court with Apple in 2020, challenging the iPhone maker’s stranglehold on the App Store and a commission fee of up to 30% for digital goods and services sold through the App Store, Apple largely prevailed.

Apple won nine out of 10 claims in the Epic suit in late 2021. However, federal judge Yvonne Gonzalez Rogers did rule against Apple on its anti-steering policies under the California Unfair Competition Law and prohibited Apple from barring developers from informing users of other payment systems within apps.

Both companies asked the U.S. Supreme Court to review the ruling.

As Google prepares its appeal of the Epic ruling, it is also bracing for the conclusion of the Justice Department’s antitrust case against Google’s dominant search-engine business.

The government’s case has homed in on what Google did to maintain its search and search-ads monopolies, and on how those allegedly illegal practices harmed consumers and advertisers.

The most egregious tactic is that Google spent billions of dollars to maintain its search-engine monopoly on mobile and web browsers, including $26.3 billion in 2021, according to a Justice Department exhibit. Justice Department lawyers said Google paid Apple and other tech platforms more than $10 billion a year.

Why invest in U.S. stocks when the safest investment in the world—U. S. government debt—pays the most it has since 2007? That is the new question facing investors now that the yield on the 10-year Treasury note is approaching 5%.

Rock-bottom interest rates and record money-printing from the Federal Reserve shifted the picture of what successful investing looked like since the 2008 financial crisis. Roughly 15 years of nearly free cash spurred a tech boom, exponential gains by venture capitalists, and an investing mania tied to digital tokens and stocks on the brink of bankruptcy.

Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Federal Reserve Chairman Jerome Powell continues to communicate that the Fed plans to keep interest rates elevated until inflation stabilizes around its 2% annual target. Higher rates often drive lower stock markets, making it tough to find investments that look capable of thriving in what may very well be an extended period of higher-cost borrowing.

Still, the best companies out there are able to thrive, even when money gets more expensive. With that in mind, three Motley Fool contributors went looking for businesses that look capable of winning in a period of higher interest rates. They picked JPMorgan Chase (JPM 0.34%), Berkshire Hathaway (BRK.A 0.60%) (BRK.B 0.63%), and Upstart (UPST 2.42%). Read on to find out why, and decide for yourself whether one or more of them deserve a spot in your portfolio to help you fight through these higher-interest-rate times.

Image source: Getty Images.

You can bank on this monster bank

Eric Volkman (JPMorgan Chase): One obvious target sector for taking advantage of meatier interest rates is banking. After all, when interest rates rise, lenders can charge more for their No. 1 product — loans. Meanwhile, they can keep the interest paid to their depositors extremely low. It isn’t hard to push up the profits in such an environment.

And JPMorgan Chase really knows how to capitalize on the situation. Rising rates helped the bank grow its net revenue by a whopping 34% year over year in its second quarter, and headline net income a stupendous 67% skyward.

Yes, the company was helped by the opportunistic acquisition of tottering lender First Republic in May, but even without that big asset, its top line would have expanded by 21%. And profitability would have leaped higher, at almost 40%.

JPMorgan Chase was better prepared than most for the sharp rise in interest rates. Its highly liquid “fortress” balance sheet gives the bank the flexibility to take quick advantage of opportunities — like, say, the fire sale of a troubled peer such as First Republic.

It also provides plenty of scratch to pay out a relatively generous dividend — at the moment, the bank’s quarterly distribution of $1 per share yields 2.7%. Management has indicated that it will enact a dividend raise, to $1.05. That would bump the yield up to a theoretical 2.8% on the most recent closing share price.

Meanwhile, we can expect more interest rate increases; Federal Reserve officials strongly indicated that the current spate of increases isn’t quite at an end. Look for JPMorgan Chase to reap the benefits of this and post more jumps on the top and bottom lines.

When keeping cash pays off in multiple ways

Jason Hall (Berkshire Hathaway): Warren Buffett has for years extolled the virtues of keeping a significant amount of cash on Berkshire’s balance sheet. Whether as “bullets” for his “elephant gun” to make acquisitions, or as a margin of safety against catastrophic loss in its insurance operations, Buffett has made sure the company has kept between $30 billion in cash and equivalents and more than $80 billion in cash and short-term treasuries on hand for more than a decade.

Here’s the rub: For most of that decade, cash hasn’t been a productive asset. With interest rates at 40-year lows for most of that time, the yield that cash earned was actually less than inflation. In other words, Berkshire’s money lost spending power the longer it was held. Yet Buffett, along with investing lieutenants Todd Combs and Ted Weschler, are nothing if not disciplined. And the primary purpose of Berkshire’s cash is more important than chasing a higher return that may not be as safe as cash or U.S. Treasuries.

But the worm has turned, and Berkshire’s penchant for making sure it always had plenty — maybe excessive — cash is now favorable. With short-term treasuries now yielding more than 5%, Berkshire’s $50 billion in cash and equivalents will kick out over $2.5 billion in interest in a year. With another $100 billion or so in short-term investments that can be rolled over into higher-yield instruments as they mature, Berkshire’s cash hoard has now turned into a cash cow of its own, capable of kicking out between $6 billion and $8 billion in cash yield every year, just for running a conservative balance sheet. So now, Berkshire investors benefit from that cash in three ways: as a margin of safety, as dry powder for timely acquisitions, and as a billion-dollar cash generator in its own right now. Talk about putting your cash to work for you.

A company that can better pick out people who will pay back their debts

Chuck Saletta (Upstart): One of the big challenges with higher interest rates is that it makes borrowing money more expensive. That makes it tougher for people to qualify for loans. Say, for instance, you wanted to borrow $30,000 to buy a car. At 2% interest, a five-year loan would cost you around $526 per month. At 8% interest, that same loan would instead cost you around $608 per month.

That extra $82 per month adds nearly 16% to the cost, making the higher-interest-rate loan a tougher one to pay, and thus a tougher one to qualify to get in the first place. That’s where Upstart comes into the picture. Upstart uses artificial intelligence to try to figure out who will pay their loans as agreed, even when more traditional lending practices will either reject or penalize those people as higher risks.

By being better able to find those borrowers who will pay but are otherwise shut out of being able to borrow at reasonable rates, Upstart and its lending partners can potentially profit. As higher rates go hand in hand with higher payments and tougher qualification for loans, a larger number of otherwise worthwhile borrowers face the risk of being shut out by traditional lenders.

Rates have risen substantially over the past year, and throughout that time, Upstart indicates that its risk ratings have continued to outperform traditional borrowers’ risk profiling methods. That its methods are still showing up well in a tougher overall lending market gives good reason to believe that it really can find good borrowers with otherwise tougher credit scores. And that’s why Upstart looks like a potential winner in the high interest rate war.

Businesses that make it through the tough times often can thrive once things improve

At some point, either interest rates will fall or companies will be forced to adapt to the new, higher-for-longer rate conditions they find themselves in. In either case, those that are strongest when times are tough are likely those best able to thrive as conditions stabilize to whatever the new reality looks like. If you think JPMorgan Chase, Berkshire Hathaway, or Upstart is among those best positioned today, then now is a great time to consider whether one or more of them may be a decent fit for your portfolio.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Chuck Saletta has the following options: long January 2024 $80 calls on Upstart, short January 2024 $60 puts on Upstart, short January 2024 $80 puts on Upstart, and short January 2024 $85 calls on Upstart. Eric Volkman has no position in any of the stocks mentioned. Jason Hall has positions in Berkshire Hathaway and Upstart. The Motley Fool has positions in and recommends Berkshire Hathaway, JPMorgan Chase, and Upstart. The Motley Fool has a disclosure policy.

Institutional XRP Holdings Rise Rapidly Following Ripple’s Win Over SEC

Now that Ripple has prevailed over the SEC in court, major players are eager to get their hands on XRP. According to recent data, institutions have been getting their hands on the cryptocurrency at a steady rate, as reflected in the digital asset fund flows report.

Institutional XRP Holdings Rise Rapidly

In the days following Ripple’s partial victory in the SEC lawsuit, XRP volumes and prices rose dramatically as crypto traders rushed to the cryptocurrency in anticipation of a continued bull run. However, price metrics from Coinmarketcap show that the euphoria has subsided, with XRP now down 13.39% in a monthly time frame. On-chain data has also shown whales dumping the token to take profits, increasing the selling pressure on the token.

On the other hand, the tide is turning for the once embattled crypto among institutional investors as inflows into XRP digital asset funds are increasing steadily. According to the weekly report on the digital asset fund flows by CoinShares, XRP saw $0.5 million in inflows last week.

Over the past 16 weeks, XRP has seen consistent inflows into crypto investment funds, making up 12% of all digital assets under management. In total, XRP’s assets under management have risen 127% since the beginning of the year, outpacing the growth of other popular altcoins like Polygon and Cardano.

XRP price returns to $0.6256 | Source: XRPUSD on Tradingview.com

Investor Attitude Toward Crypto Funds Is Growing

Crypto funds, in general, have seen a shift to positive sentiment from investors. In the first week of the month, digital asset investment products saw outflows, with investors taking profits in recent weeks. Bitcoin alone saw outflows totaling $111 million, its highest since March. XRP, however, did witness inflows of $0.5 million during this period.

The latest report would see digital asset investment products receive inflows of $29 million throughout the week. Bitcoin would also return as the primary focus, seeing $27 million of inflows after three prior weeks of $144 million outflows.

With the recent inflows, institutional investors are signaling their faith in XRP’s future by increasing their asset holdings. In July, many digital asset funds saw a 57% increase in their XRP Exchange Traded Products (ETPs). Fineqia, for instance, saw its XRP AUM increase from $49 million to $76.8 million.

The price of the token appears to have weakened in momentum in recent weeks, much like the rest of the crypto market. At the time of writing, XRP is down by 0.60% in the last 24 hours and is trading at 0.625. Even so, the mood around XRP feels decidedly more optimistic as investors expect a final decision in the Ripple-SEC lawsuit.

Featured image from iStock, chart from Tradingview.com