An eclipse like the one on April 8 won’t happen again until 2044, so millions of Americans are paying to get a glimpse of Monday’s total solar eclipse.

Source link

windfall

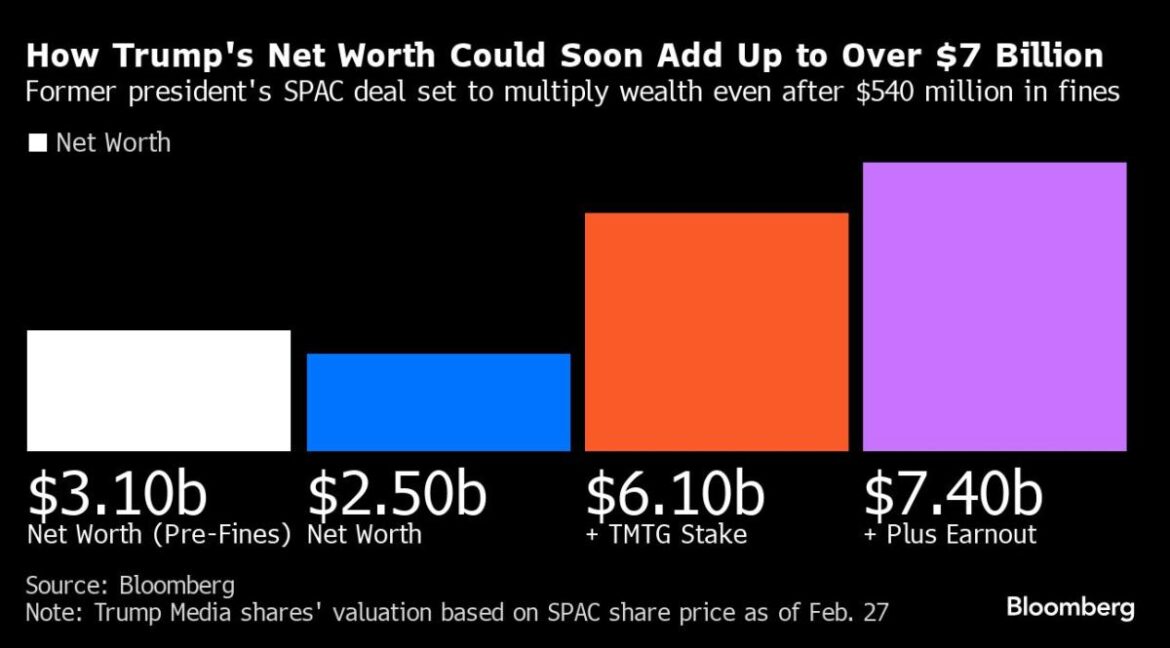

(Bloomberg) — On the financial front, the news has appeared dire for former president Donald Trump this year. Within a span of just a month, two judges in two separate cases ordered him to pay about $540 million in total — a sum so great that pundits have speculated it could erode his campaign finances.

Most Read from Bloomberg

What’s gotten far less attention, though, is this: A frenetic rally in a stock tied to Trump Media & Technology Group — which operates the Truth Social platform he posts on daily — has minted a nearly $4 billion windfall for him.

There are any number of caveats to this figure, including how it’s only a paper profit for now that he’ll have to wait months to monetize, and yet the stock’s surge is a potentially huge financial boost for a billionaire candidate suddenly short on cash.

The type of transaction — known as a de-SPAC or blank-check deal — that would hand Trump this new-found wealth is a complex one that briefly became popular on Wall Street during the stock mania unleashed by pandemic-era stimulus. In this particular deal, Truth Social’s owner would enter the stock market by merging with a publicly traded company called Digital World Acquisition Corp.

Shares of DWAC, as the company is known, have soared 161% this year in anticipation of the merger, which has been green-lit by the Securities and Exchange Commission and is now slated to go to a shareholder vote next month. If it’s approved, Trump will hold a greater than 58% stake. At DWAC’s current price — it closed Tuesday at $45.63 per share — that stake is worth $3.6 billion. Trump could get even more — close to an additional $1.3 billion worth, if the shares meet certain performance targets.

It seems improbable to many analysts that a stake in a money-losing social media company with little revenue and a fraction of its rivals’ user bases could potentially more than double Trump’s net worth. But as Trump began to steamroll his Republican rivals in January, setting up a likely rematch with President Joe Biden in November, retail investors frantically bid DWAC shares up. And when a group on Wall Street known as momentum traders joined the buying frenzy, the conditions for an epic rally were in place. In just six days, the stock jumped 200%.

“This is a meme stock, it’s not the type of thing where you bust out P/E ratios — you can throw that out the window,” said Matthew Tuttle, the chief executive and chief investment officer at Tuttle Capital Management. “DWAC has now become the de facto way to bet on or against Trump,” he added.

But if Trump’s rebound carries him back to the White House — and many polls currently make him the favorite to win — there could be value, in theory, at least, in owning a cut of the mouthpiece that will carry his message.

“The fundamental bull case is that he confines his tweets to the Truth Social platform, which means if you want to see them or interact with them, you need to sign up as well, making advertising all the more profitable,” Tuttle said.

Penalties and Fees

While Trump’s windfall would more than cover the penalties and legal fees he faces — he is appealing New York state’s $454 million civil fraud verdict — he would need to wait at least five months before cashing in shares, unless the company files to expedite that timing.

“He needs the money but he can’t sell too much at once without risking tanking the stock,” said Usha Rodrigues, a professor at the University of Georgia School of Law. “Once the lockup is expired, he could use the shares as collateral for loans in order to access cash without selling the shares.”

And it’s unlikely a bank would lend him a large sum of money against the locked-up shares, according to industry watchers like University of Florida finance professor Jay Ritter.

Read More: Trump’s $540 Million Court Loss Tests His ‘King of Debt’ Claim

Representatives for DWAC, Trump Media and the Trump Organization didn’t immediately respond to requests for comment.

Even the so-called earnout would more than cover it. After the deal closes, if the stock trades above $17.50 for 20 of 30 days, Trump Media holders would be entitled to receive as many as an additional 40 million shares filings show — with the majority earmarked for Trump.

A more troubling question for Trump is whether shareholders will keep the faith for more than five months after the merger is complete. As recently as April, Trump assigned the company a $5 million to $25 million value in a financial disclosure filed with the Federal Election Commission, a fraction of its valuation in the SPAC deal terms as well as in the market.

Read More: Trump Fuels Meme-Like Rallies in Stocks Tied to 2024 Bid

The business has struggled, with Trump Media losing $49 million in the nine months through September while generating just $3.4 million in revenue, according to regulatory filings. As such, the company has warned that it may run out of cash without the merger, filings show.

Trump Media “hasn’t been able to turn the corner and it’s not clear how the company is going to succeed in monetizing its business,” said Ritter.

The deal’s anticipated completion is a feat in itself after more than two years of starts and stops. Skeptics questioned whether Trump Media’s merger could clear a litany of shareholder votes, as well as investigations from the Justice Department and the SEC.

After the completion and during the lockup, the share price – and Trump’s potential windfall – will hinge on how successful he is politically, industry watchers agree. Trump Media has been aiming to “rival the liberal media consortium” and fight against big tech companies like Meta Platforms Inc., Netflix Inc., and Elon Musk’s X.

Shareholders may even choose to hold onto their shares in the hope that because of Trump Media’s alignment with his campaign message, Trump would have a strong incentive not to add Truth Social to the long list of ventures he’s endorsed, then exited from.

“The majority of people who are buying and holding this thing are Trump supporters, “ Tuttle said. “I don’t think it’d be smart for him to entirely blow out of his position and leave them holding the bag.”

–With assistance from Tom Maloney.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

‘I like Warren Buffett’s approach’: I’m 64. How do I invest a $400,000 windfall?

My wife and I are nearing retirement. I’m 64 and my wife is partially retired with full retirement income after 30 years of teaching. We live a modest life and have accumulated nearly $1 million in combined savings and 401(k). In about 8 months, I expect to see a windfall of about $400,000 come my way. I expect both of us to keep working part-time and hopefully to travel some in our retirement years. I am puzzled about how to invest that $400,000 with retirement so close.

“‘I want to live off dividends, pension, Social Security and part-time work. What would be the smartest approach and time frame for investing our windfall?’”

I like Warren Buffett’s approach — keep investing and just believe in America. I want to live off dividends, pension, Social Security and part-time work, and $400,000 is a lot of money to me. What would be the smartest approach and time frame for investing our windfall? What really puzzles me is knowing the economy could slip into a prolonged recession, and cash doesn’t look to dumb to have, especially with a 5% return.

How long should one hold on to cash before investing? If I invest the money, would it be best to invest over a certain time frame?

Buffett Fan

Dear Buffett Fan,

There are no psychics when it comes to the future of the U.S. economy. A majority of economists in a poll from the National Association for Business Economics have been predicting a recession this year, but that has not happened (yet). We are still waiting. So keep calm, carry on and, yes, take Warren Buffet’s approach and keep your eye on your goal.

I have some questions: Will you be living off your own Social Security income, or does your wife also receive Social Security? Do you have any outstanding debt? If so, pay that off first. Have you and your wife paid off your mortgage? Have you planned for long-term care? Do you have an emergency fund?

You hold the answer to the $400,000 question. Robert Seltzer, founder of Seltzer Business Management in Los Angeles, suggests quantifying your sources of income and the timing of when you plan to receive your retirement income, but he warns that you shouldn’t try to time a recession or the market. “That is a fool’s errand and is almost impossible to get correct,” he says.

“‘Where CDs and high-yield savings accounts are concerned, don’t stare the proverbial gift horse in the mouth.’”

— The Moneyist

Where certificates of deposit and high-yield savings accounts are concerned, don’t stare the proverbial gift horse in the mouth. With interest rates still high, high-yield savings accounts, Treasury bills, money-market funds and CDs are increasingly popular. A 5% return on fixed income “is not something that should be casually dismissed, as we have not seen these types of rates for many years,” Seltzer says.

But, he cautions, you may wish to be more conservative if you intend for these funds to supplement your income until your pension and Social Security kick in. If not? “You could actually afford to be slightly more aggressive with that cash if you are not dependent on it for monthly expenses and it becomes more of a long-term investment,” Seltzer says.

But again, don’t try to time the market. “It makes sense to consider the dollar-cost averaging approach to investing,” says Larry Pon, a CPA based in Redwood City, Calif. “This means transferring a set amount from your cash to investments. Please make sure you have a low-cost, broadly diversified portfolio.”

Down to brass tacks

Pons also has a gentle word of warning. “You will need to make sure your savings and 401(k) are properly allocated based upon your financial plans and risk tolerance,” he says, and “you will need to get realistic about the amount of dividends and interest your portfolio may generate to fund your cash-flow needs.”

And now, down to brass tacks. Assuming you can afford to live without access to that cash, how should you invest that $400,000? Paul Karger, co-founder and managing partner of TwinFocus, a wealth advisory firm in Boston, suggests a balanced approach across globally diversified equity and fixed-income mutual funds.

“We recommend an allocation of 70% fixed income and 30% equities, and we would invest these funds over time, perhaps 12 to 18 months, through a dollar-cost averaging program where you systematically move a portion monthly out of cash and into the portfolio allocation,” he says.

“‘You’re in a stronger position than many people who are facing retirement.’”

— The Moneyist

For the equity portion, Karger recommends dividend-paying stocks and dividend-growth funds. For the fixed-income part of your portfolio, he suggests intermediate- to longer-term bond funds. Dollar-cost averaging helps you avoid putting your funds to work at the wrong time and allows you to take advantage of any downside volatility, he adds.

“Once the funds have been fully invested at the end of the dollar-cost averaging period, we would recommend rebalancing your entire portfolio back to the intended allocations a few times per year,” he says. Note that dollar-cost averaging can help create good investing habits, but advisers have differing opinions about its long-term benefits.

Finally, you’re in a stronger position than many people who are facing retirement. Given your age, you should take a conservative approach to how you invest that $400,000. Most Americans believe they will need $1.3 million to retire, according to Northwestern Mutual. So congratulations on accumulating that first $1 million.

Readers write to me with all sorts of dilemmas.

By emailing your questions, you agree to have them published anonymously on MarketWatch. By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

The Moneyist regrets he cannot reply to questions individually.

More from Quentin Fottrell:

‘Index funds didn’t provide much income’: My brother is a combat veteran with PTSD. How do I invest his savings?

My husband is still paying his ex-wife alimony after 25 years. Will it finally end when he dies?

I live in my late father’s home. He left it to me and my two siblings, but my late brother’s wife wants me to sell it. Can she force me?