Higher U.S. inflation is dashing investors’ hopes for multiple Federal Reserve rate cuts this year, while opening the door to 5% Treasury yields across the board and cleaving the stock market into distinct categories of winners and losers.

Source link

Winners

This Is the Perfect Vanguard ETF for Investors With a Fear of Missing Out on the Market’s Biggest Winners

Don’t fear: There’s an ETF that will ensure you don’t miss out on any high-flying stocks.

Many people are afraid of heights. Some have a fear of spiders. Others are scared of snakes. But there’s a very different kind of phobia that affects quite a few investors — the fear of missing out, also known by the acronym FOMO.

These individuals absolutely dread the idea of not buying a stock that’s skyrocketing or about to soar. If you’re in that group, fear not. Here’s the perfect Vanguard exchange-traded fund (ETF) for investors with a fear of missing out on the market’s biggest winners.

A mo-mo cure for FOMO

What if you could own nearly every stock that’s performing well in one fell swoop? That’s exactly what you can do with the Vanguard U.S. Momentum Factor ETF (VFMO 1.52%).

This ETF employs a rules-based quantitative model to analyze U.S. stocks. It invests in all stocks with strong momentum (called “mo-mo” by some investors). The fund’s managers don’t care if the stocks are large caps, mid caps, or small caps. They don’t focus on specific sectors or industries. If a stock is taking off, the Vanguard U.S. Momentum Factor ETF buys it.

As you might expect, this Vanguard ETF has itself taken off over the last 12 months, jumping over 30%. Since its inception in February 2018, the fund has delivered an average annualized gain of nearly 13.3%. At that rate, your money would double every five and half years.

Vanguard is known for its low-cost funds. The Vanguard U.S. Momentum Factor ETF is no exception with an annual expense ratio of 0.13%. The ETF’s dividend yield (currently 0.46%) more than covers those expenses.

Loaded with huge winners

The Vanguard U.S. Momentum Factor ETF is loaded with huge winners. It currently holds positions in 574 stocks. Their average earnings growth rate is a hefty 19.2%.

A quick glance at the ETF’s top holdings gives a pretty good picture of what you get with this fund. Its largest largest position is in Meta Platforms, which makes up 1.64% of the ETF’s total portfolio. Shares of the social media giant have soared more than 130% over the last 12 months.

Nvidia comes in a close second to Meta at 1.52% of the fund’s portfolio. The chip stock has vaulted more than 220% higher over the last 12 months thanks to surging demand for its GPUs.

Another artificial intelligence (AI) chipmaker, Broadcom, is the Vanguard U.S. Momentum Factor ETF’s third-largest position. Its shares have more than doubled over the last 12 months.

Don’t think the fund is overly weighted with tech stocks, though. Nearly 70% of the Vanguard ETF’s holdings are in other sectors. For example, healthcare giant Eli Lilly is its fifth-largest position, making up 1.24% of its portfolio. Lilly’s shares have jumped more than 120% over the last 12 months with strong sales growth from its type 2 diabetes drug Mounjaro and new weight loss drug Zepbound.

One legitimate fear

FOMO shouldn’t be an issue if you buy the Vanguard U.S. Momentum Factor ETF. You’ll be virtually guaranteed to own any stock that becomes the next big thing. There is one legitimate fear with the ETF, though.

The main downside to investing in stocks with tremendous momentum is that they can be priced for perfection. The average price-to-earnings ratio of the stocks owned by this Vanguard ETF is a lofty 21.3. It’s possible that this high valuation could limit how much the ETF grows. And if the overall market declines, the fund could fall especially hard.

However, the Vanguard U.S. Momentum Factor ETF model is designed to replace underperforming stocks with others that demonstrate stronger momentum. The turnover rate for the fund (as of the end of its last fiscal year on Nov. 30, 2023) was 73.4%. Just as you don’t have to be afraid of missing out on a big winner with this ETF, you don’t have to be scared of being stuck too long with a big loser either.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

ftNFT International Awards 2024 Announces Winners at a Glamorous Ceremony in Dubai

PRESS RELEASE. Dubai, UAE (March 1, 2024) – The ftNFT Annual International Awards celebrated the 2024 ceremony on February 27 at Dubai’s iconic Armani restaurant, unveiling this year’s winners. The event, known for its exclusivity and commitment to advancing the NFT and blockchain sectors, assembled premier talents and groundbreaking projects. These awards spanned a variety […]

PRESS RELEASE. Dubai, UAE (March 1, 2024) – The ftNFT Annual International Awards celebrated the 2024 ceremony on February 27 at Dubai’s iconic Armani restaurant, unveiling this year’s winners. The event, known for its exclusivity and commitment to advancing the NFT and blockchain sectors, assembled premier talents and groundbreaking projects. These awards spanned a variety […]

Source link

The U.S. Has a Housing Crisis — Here Are 2 Stocks That Could Be Big Winners From It

While experts disagree on the exact number of housing units we need, there’s undoubtedly a serious housing shortage in the United States. In this video, Fool.com contributors Matt Frankel, CFP®, and Tyler Crowe each discuss one stock that could be a long-term beneficiary.

*Stock prices used were the afternoon prices of Jan. 12, 2024. The video was published on Jan. 14, 2024.

Matthew Frankel, CFP® has positions in Walker & Dunlop. Tyler Crowe has positions in Green Brick Partners. The Motley Fool has positions in and recommends Green Brick Partners and Walker & Dunlop. The Motley Fool has a disclosure policy.

Matthew Frankel is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through their link, they will earn some extra money that supports their channel. Their opinions remain their own and are unaffected by The Motley Fool.

Opinion: These stocks can be winners in AI because they all share this one quality

While the media would have investors focus on short headline-grabbing cycles such as political elections, central bank actions, and economic expansions and contractions, some investors — including our team at investment manager Alger — believe the ups and downs of such cycles are mostly noise, serving as a distraction for long-term investors.

Wealth creation is driven by innovation, which increases productivity, raises gross domestic product and ultimately boosts living standards. Innovative products and services that provide real value to businesses and consumers by making them more efficient, healthier, or happier, should find strong demand. These innovations reward investors over time, irrespective of elections and whether interest rates are rising or falling.

In its 60-year history, Alger has invested through many recessions and growth scares, as well as periods of such exuberance that capital was extremely cheap and abundant. Looking back at the ups and downs, two important lessons stand out:

- Research shows that innovation has grown through all kinds of economic volatility.

- Strong competitive advantages often translate into expanded market shares, particularly in challenging economic times.

In short, investors should consider investing in equities of innovative companies that aggressively capture market share in order to compound value no matter the macroeconomic environment.

Innovation is resilient

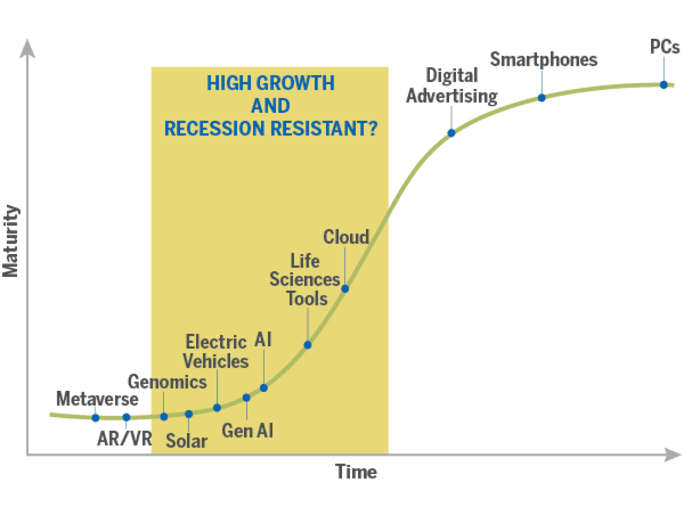

Productivity-enhancing technologies have a history of growing through both good and bad economic times. For example, personal computer use increased through the recession of the early 1990s while digital advertising and smartphones grew through the Global Financial Crisis. These technologies grew through adversity because they were early in their adoption cycle.

Today, these particular industries are mature and more cyclical, as shown in the chart below. However, the chart also shows newer technologies, such as artificial intelligence (AI), that are just coming up the so-called “S” curve. As a result, these newer technologies are more likely to garner an increasing share of business or consumer spending and as such, grow through various economic environments.

Source: Alger

Artificial intelligence

Bill Gates has said that artificial intelligence “is every bit as important as the PC, as the internet.” AI is a mega-theme that will impact business and investing for years to come. Through routine field research, Alger recently spoke with a multi-billion-dollar cloud service consultant who shared that technology solutions, such as AI, may end up feeling like “need-to-haves” because of the vital business importance of digital transformation and the belief that companies will use these tools to reduce costs.

The adoption of this technology will persist irrespective of the pace of economic growth. Finding beneficiaries of this trend can generate strong returns for investors. Below are some potentially attractive investments in the AI space.

We refer to the companies that provide the infrastructure for AI services as “enablers.” Some of the most important components of the AI infrastructure are semiconductors. These chips provide the industry with the processing power that is seeing soaring demand.

Consider that one of the main determinants for the intelligence of generative AI programs, like ChatGPT, is the amount of training that they undergo. That training is doubling roughly every four months, much faster than the two years that Moore’s Law has accurately forecasted the number of transistors will be crammed onto computer chips. This difference in speed is so massive that a six-inch plant growing at Moore’s Law would be 16-feet tall in a decade, while if it grew at the speed of AI, it would reach the moon.

Some of the leading chip providers to the AI industry with innovative technologies include Nvidia

NVDA,

Marvell Technology

MRVL,

and Advanced Micro Devices

AMD,

The immense computational demands of AI require the development of groundbreaking chip and server architectures, which together drive greater power consumption per server cabinet within the giant data centers that house the brains of these systems, leading to higher electricity consumption. According to Schneider Electric

SU,

AI power usage will increase more than 30% annually, resulting in a cumulative increase of four times the current usage over the next five years, as measured in gigawatts.

However, higher power densities in AI tasks lead to excessive heat generation, posing cooling challenges for data centers. Today, companies like Vertiv Holdings

VRT,

not only solve this overheating challenge but potentially improve cost and energy efficiency.

As data centers expand to meet the growing demand for AI, lack of transmission and distribution of power could prove to be a key issue. This may necessitate grid modernization, potentially benefiting power management and electrical services companies that work with utilities and commercial customers. Companies like Eaton

ETN,

a diversified global power management company, are working hard to meet growing electricity demand and in the process may generate attractive returns for shareholders.

Driven by data

“If AI is a rocket ship, data is the fuel. ”

In today’s economy, data is the new oil — a very important raw material for digital transformation. To automate and make software work for us, we need our data digitized and organized. Artificial intelligence is particularly dependent on good data. If AI is a rocket ship, data is the fuel. Unstructured data such as text messages, emails, social media, webpages and business documents all need to be accessible by software programs like generative AI.

One company that helps businesses store and organize their unstructured data in a database management system is MongoDB

MDB,

Gartner estimates the data management market may grow 17% annually from 2023 to 2027, making this an attractive investment area.

Prepare for all possibilities

Alger believes investors should aim to position portfolios for a range of economic outcomes by investing in companies that will gain market share within the economy. Companies that enable AI such as chip makers, power management companies and database providers may be good examples of companies that are providing innovative products and services to customers around the world. They can grow through good and bad economic environments, allowing investors to ignore the noise and focus on long-term wealth creation.

Brad Neuman is Alger’s director of market strategy . As of Oct. 31, 2023 (Alger’s most recent reporting date), the firm had positions in MongoDB, Nvidia, Marvell, Advanced Micro Devices, Schneider Electric, Vertiv and Eaton.

More: Intel’s new AI chips for the PC will be widely used, but may not be the most useful

Plus: Whether it amounts to an actual recession is uncertain, but the U.S. is headed for a soft patch, economists say

3 AI Stocks With Tremendous Potential to Be Big Winners Over the Next Decade

Artificial intelligence (AI) took the world by storm last year and has investors pumped up for how it can change everything. OpenAI’s ChatGPT (owned by Microsoft) and Google’s Bard (owned by Alphabet) were released almost a year ago and provided an early glimpse of how AI can shape the future. Wedbush analyst Dan Ives has called AI the fourth industrial revolution and said the technology will transform the tech space over the next two to three decades.

While AI can change life as we know it, it’s still in the early stages of deployment as companies fine-tune their models. With that said, three AI stocks with tremendous long-term potential are Upstart Holdings (UPST -2.09%), Lemonade (LMND -0.36%), and Digital Realty (DLR -0.72%). Before buying, here’s what you should know about these companies’ AI opportunities and possible risks.

Image source: Getty Images.

1. Upstart leverages AI to make lending more accessible

Upstart’s goal is to ensure the lending system is fair and open to everyone. One pain point it aims to solve is providing people previously shut out of the financial system with borrowing opportunities.

The company believes that FICO credit scores designed by Fair Isaac in 1989 fail to identify risk accurately because of their simple rules-based systems that only consider a limited set of variables. To solve this problem, Upstart utilizes AI to evaluate 1,500 variables and over 44 million repayment events to assess customer risk more accurately, allowing it to approve more loans at lower interest rates.

Investors must remember that Upstart operates in a highly cyclical consumer lending market. Over the past couple of years, demand for consumer loans by both consumers and banks has become constrained due to the higher interest rate environment. Not only that, but delinquencies on consumer loans are slowly ticking higher, and Upstart’s lending models could face a big test in the near term.

The company has expanded its model to chase a $3.6 trillion lending market opportunity across personal, automotive, home, and small business lending. According to a report by Allied Market Research, the global personal lending market alone could balloon to $719 billion by 2030 — a 32% growth rate annually. If Upstart’s models can ride out these near-term headwinds and prove they perform better than legacy lending models, its long-term potential is staggering.

2. Lemonade uses AI to streamline insurance buying and claims processing

Lemonade aims to streamline insurance with its AI models, from shopping for policies to processing claims. The company leverages AI to create personalized quotes, reduce customer onboarding time, and expedite customer claims.

The AI-powered insurance company is going through growing pains right now. In recent years, it has expanded from renters’ insurance into homeowners, pet, life, and automotive insurance. The company has achieved impressive growth, but that has come at the cost of higher losses on its policies and it continues to be a money-losing operation.

It had done a good job improving its net loss ratio, which is the ratio of losses plus adjustment expenses, minus amounts paid to reinsurers, to its net premiums collected. However, it must continue dialing in its models as it gathers more data and adjust its premiums accordingly.

According to a report by Global Market Insights, the property and casualty market is expected to grow 5.5% through 2032. If Lemonade can achieve consistently profitable policies, its growth, coupled with industry tailwinds, could power excellent long-term growth for the company.

3. Digital Realty provides essential infrastructure for AI developers

Digital Realty differs from Upstart and Lemonade because it is a more stable business that caters to companies creating AI products. As a real estate investment trust (REIT), Digital Realty provides companies with colocation, interconnection, cloud services, and other solutions. The company has 316 data centers across 25 countries, focusing on regions with major internet and data communication hubs.

The company benefits from the growing demand for data centers in the ever-expanding digital economy. As the amount of data grows exponentially and AI becomes more prevalent, companies will need more data centers to keep up with this growth. According to a study by McKinsey & Company, demand for data centers will grow by 10% annually through 2030 — putting Digital Realty in an excellent position to capitalize long term.

Investor takeaway

Digital Realty is a more established business, and the runway for growth is solid. As demand for data centers grows, Digital Realty should grow with it.

Upstart and Lemonade, on the other hand, face a little more risk in the near term. These companies will need time and more data points across different economic environments to dial in their models, and the stocks will likely continue to experience volatile moves as they figure things out.

Investors should understand these are higher-risk stocks, and consider the risk-to-reward ratio to decide if they are appropriate. With that said, if things go right, the long-term possibilities for these AI-driven companies are excellent.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Courtney Carlsen has positions in Alphabet and Microsoft. The Motley Fool has positions in and recommends Alphabet, Digital Realty Trust, Lemonade, Microsoft, and Upstart. The Motley Fool has a disclosure policy.

Finding stocks that are huge winners is easy, in retrospect. Doing so before they take off is an entirely different story. However, it’s not an impossible task.

Three Motley Fool contributors think they’ve identified stocks that could be monster winners in 2024. Here’s why they picked CRISPR Therapeutics (CRSP -2.64%), Madrigal Pharmaceuticals (MDGL -1.11%), and Verona Pharma (VRNA -1.39%).

It pays to be an innovator

Prosper Junior Bakiny (CRISPR Therapeutics): It’s been a great year for the field of gene editing. Several companies that specialize in this area have made important progress. However, the most significant milestone arguably came from CRISPR Therapeutics, which, together with its partner Vertex Pharmaceuticals, earned approval for Casgevy.

This treatment for sickle cell disease and beta-thalassemia (two rare blood diseases) is the first gene-editing therapy on the market that uses the CRISPR technique, which earned its pioneers a Nobel Prize in chemistry. While CRISPR Therapeutics’ shares haven’t performed particularly well since Casgevy’s U.S. approval in early December, next year could be different.

CRISPR Therapeutics and Vertex are now launching this medicine. With a price tag of $2.2 million in the U.S., its boasts massive, multibillion-dollar potential.

It won’t happen overnight, though. Gene-editing treatments are challenging to administer, and the process takes some time. However, the two partners will use the next 12 months to set a solid foundation for Casgevy’s long-term success.

The exercise will include getting third-party payers on board — something Vertex Pharmaceuticals has plenty of experience with — and activating authorized treatment centers where the medicine can be safely and effectively administered. In the meantime, CRISPR Therapeutics will make progress on other CRISPR-based gene-editing treatments.

With the approval of Casgevy, the company’s work no longer looks hypothetical. The rest of CRISPR Therapeutics’ lineup uses the same CRISPR gene-editing technique with which Casgevy was developed. For all those reasons, CRISPR Therapeutics could be a major winner in 2024 — and beyond.

A rebound that could soon gain momentum

Keith Speights (Madrigal Pharmaceuticals): With a market cap hovering around $4.7 billion, Madrigal Pharmaceuticals isn’t a monster stock right now. The company’s shares fell by a double-digit percentage in 2023 while the overall stock market soared. However, this biotech stock began to bounce back in late October, and I think this rebound could soon gain momentum.

I’m not the only one who’s bullish about Madrigal. The consensus 12-month price target for the stock reflects an upside potential of over 30%. All three of the analysts surveyed by LSEG in December who cover Madrigal rated the stock as a buy.

There’s a simple reason behind this optimism. Madrigal hopes to win U.S. Food and Drug Administration (FDA) approval for resmetirom in treating nonalcoholic steatohepatitis (NASH) by March 14, 2024. The clinical data for the drug looks solid. Importantly, there are currently no FDA-approved therapies for treating NASH, which has quickly become the top cause of liver transplants in the U.S.

Madrigal appears to be in a good financial position to fund the potential commercial launch of resmetirom. The company raised $500 million via a public stock offering in October.

SVB Financial Group analysts think that resmetirom can generate peak annual sales of around $2.5 billion. Jefferies Financial Group projects even higher peak sales of $3 billion. Whatever the actual amount is, Madrigal could soon begin to rake in significant revenue.

I look for new CEO Bill Sibold to channel some of its newfound riches into expanding the pipeline. Sibold’s experience at Sanofi should give him a good foundation to lead Madrigal in its next stage of growth.

A small-cap stock with a significant runway in 2024

David Jagielski (Verona Pharma): One stock with tremendous potential heading into 2024 is Verona Pharma. It’s a risky business to invest in as it doesn’t have an approved product, revenue is inconsistent, and it has incurred net losses of just under $51 million over the trailing 12 months.

But Verona’s financials and its prospects could soon get a big upgrade. That’s because the company has a promising treatment in its pipeline for chronic obstructive pulmonary disease, or COPD. Ensifentrine is an investigational drug that has demonstrated safety and efficacy in phase 3 trials, showing improvements in lung functions.

There are an estimated 380 million patients with COPD, which is the third-leading cause of death worldwide. While there are treatments available in the market, many patients are dissatisfied with the current options, and the majority continue to have symptoms even when they’re receiving treatments. Ensifentrine gives patients a new alternative and has scored well in reducing symptoms for patients and improving their quality of life.

The FDA is reviewing the drug, with a PDUFA date set for June 26, 2024. If ensifentrine obtains approval, it would be a huge win for Verona. The drug could generate close to $1.5 billion in annual revenue by 2033. Approval could be a game changer for Verona, as it would give it a source of consistent revenue.

If you’re willing to take a chance on this small biotech stock, the gains could be massive next year. The consensus price target is just under $33, implying a potential upside of close to 60% for investors who buy now. It’s admittedly risky, but Verona offers an incredibly promising upside.

3 Growth Stocks That Could Be Huge Winners in the Next Decade and Beyond

The best growth stocks to invest in right now are ones with high chances of becoming huge winners in the next decade and beyond, driven by their competitive advantages in large industries and growth moves targeted to ride powerful megatrends. If things continue to work in their favor as they have so far, such stocks could hugely outperform the markets and magnify your returns in the coming years. Having studied several growth stocks, I believe the following three right now are true winners in the making.

Riding the digital shift

Visa (V 0.34%) is the kind of growth stock that has it all to win: a solid business model, clout, big margins, and massive growth opportunities in an evolving market.

As one of the world’s largest payments processing companies, Visa simply facilitates transactions between third parties and earns fees on them. Those transactions run into billions of dollars and its payments volume into trillions of dollars each year, and Visa is making a lot of money on them, year after year. This chart is proof.

V Revenue (TTM) data by YCharts

Despite concerns of an economic slowdown and currency headwinds, Visa expects low-double-digit net revenue growth and mid-teens earnings-per-share growth in its fiscal 2023, which ends Sept. 30.

Visa is exploring more growth avenues now that extend beyond its traditional consumer payments services revolving around its co-branded credit, debit, and prepaid cards. For example, Visa is aggressively launching products and services to capture the flow of money among various parties, including businesses and governments. Visa is also expanding its value-added services, which include consulting, analytics, and artificial intelligence (AI)-driven data solutions.

It’s easy to see where Visa’s growth will come from in the coming years. E-commerce is booming, and more and more economies are trying to bring their unbanked population into the fintech space through digital products and payments. As this transition to a cashless society gains momentum, Visa stock could soar in the coming years.

Exceptional growth in a red-hot industry

Electric cars are in huge demand globally, with the industry selling nearly 2.3 million cars in the first quarter of this year alone. That’s up 25% year over year, according to the International Energy Agency, which also expects a 35% growth in sales for the full year. China leads the pack, accounting for a whopping 60% of global electric-car sales in 2022. Betting on a Chinese electric-vehicle (EV) growth stock now, therefore, is a good idea.

Although BYD (BYDDY -4.35%) is still behind Tesla (TSLA -1.70%) in sales of battery-electric vehicles (BEVs), it became the world’s largest EV maker in the first quarter of 2023 by selling more BEVs and plug-ins combined than Tesla.

Between January and July this year, BYD was the top-selling brand in China’s new energy vehicle (NEV) market, with its retail sales surging nearly 75% year over year. BYD’s China NEV market share of 37% was way ahead of Tesla’s market share of 8.7%, according to data from the China Passenger Car Association. BYD recently rolled out its 5 millionth NEV, becoming the world’s first automaker to hit the milestone.

That’s not all. BYD is also the world’s second largest manufacturer of the most critical component of EVs — batteries — just behind CATL. BYD’s power battery installations between January and June 2023 jumped 102%, according to NEV-focused website CnEvPost.

These numbers not only reveal BYD’s clout in the booming EV industry but also reflect its growth potential. BYD, in fact, is hungry for growth. After securing a leadership position in China’s affordable NEV market, BYD is now foraying into the premium segment with SUVs, offroad EVs, and sports cars under several sub-brands, including Denza, Fang Cheng Bao, and Yangwang.

BYD is an ambitious company that’s already taking the EV world by storm, and at this pace, it could be one of the biggest-winning growth stocks in the coming decade.

This high-flying growth stock could run much higher

Salesforce (CRM 0.49%) is another growth stock that could score big in the next decade and beyond, thanks to its leadership position in the steadily growing global customer relationship management (CRM) market. Through CRM, Salesforce helps companies build relationships with customers and prospects, and it stores data of all interactions on a cloud that can be accessed from anywhere for tracking and analysis to boost sales and service.

2022 was a forgettable year for Salesforce, as growth declined in the wake of rising interest rates, foreign currency headwinds, and decelerating demand on macroeconomic fears. The stock is back in the game, though, as investors expect growth to stabilize.

In May, Salesforce projected a 10% growth in revenue and an operating margin of 11.4% for fiscal 2024 (its fiscal year ends Jan. 31), driven partly by its ongoing restructuring efforts. Salesforce also expects 16% to 17% growth in free cash flow this fiscal despite the headwinds.

Another important number is its remaining performance obligation (RPO), or contracts that haven’t converted into revenues yet. In other words, RPO reflects Salesforce’s future potential revenue, and it grew 11% year over year in Q1 to $46.7 billion.

Salesforce is now exploring deeper uses of AI to stay in the game, and it recently launched the AI Cloud and expanded its partnership with Alphabet‘s Google on that front. Its AI moves, in particular, could only help Salesforce stay ahead of the competition but also hugely work in the stock’s favor over the next decade or so.

A McDonald’s restaurant near Times Square, NYC on July 29th, 2023.

Adam Jeffery | CNBC

Restaurant companies navigating some of the same challenges in the second quarter fell into two categories: winners and losers.

Some chains said their higher menu prices alienated diners, while others said consumer behavior hasn’t changed even as their food and drinks grow more expensive. Promotions drove customers to certain restaurants — or fell flat as diners focused on value. And low-income customers visited some restaurants more frequently, but skipped visits at other eateries.

Broadly, foot traffic to restaurants has fallen. Sales growth has slowed as many eateries hold off on another round of the price hikes that drove strong revenue a year ago. Customers have become more selective about how they spend their money, including where they eat, leading to a sharpening divide in chains’ performance.

While most restaurant companies crushed earnings expectations, a number of them fell short of Wall Street’s estimates for their quarterly revenue. McDonald’s and Wingstop both reported second-quarter earnings, revenue and same-store sales growth that topped analysts’ expectations, a rarity this quarter for restaurant companies.

On the other end, Papa John’s, Wendy’s, and Chipotle Mexican Grill were among the flock of companies that disappointed investors with weaker-than-expected sales. All three companies’ stocks haven’t recovered yet.

Here are three trends that defined the quarter and determined its winners and losers:

Restaurant traffic

Two metrics shape a company’s same-store sales growth: how much customers spend on every order, and how often they visit the restaurant chain.

As eateries delay more price hikes and customers watch their wallets, restaurants have to rely on the second benchmark — traffic — to bolster their same-store sales. And Wall Street is watching closely.

“Investors certainly want lots of traffic as a sign of health for the concepts,” TD Cowen analyst Andrew Charles told CNBC.

McDonald’s, Chipotle, Texas Roadhouse and Wingstop were among the few chains that reported U.S. traffic growth in the latest quarter.

On the other end, Restaurant Brands International said U.S. traffic slipped for three of its chains: Popeyes, Burger King and Firehouse Subs. Rival Wendy’s reported its domestic transactions fell 1% in the second quarter.

Looking ahead, traffic could fall even more in the second half of the year.

“And as we move through 2H23, menu pricing will likely fall fast as inflation no longer justifies the prices, and barring a rapid traffic reversal, the comps should optically fall just as fast,” Barclays analyst Jeffrey Bernstein wrote in a note to clients Aug. 11. “This does not bode well for restaurant stock performance in coming months, in our view.”

Value perception

Inflation is cooling, and more economists are predicting a “soft landing” rather than a recession. But consumers are still looking for value.

Broadly, the fast-food sector has benefitted from consumers trading down from fast-casual restaurants into their cheaper burgers and tacos. But consumer perception of value differs across chains.

For example, McDonald’s CEO Chris Kempczinski said the chain is performing well with consumers who make less than $100,000, and with those who make under $45,000. On the other hand, Wendy’s CEO Todd Penegor said the burger chain saw diners who make less than $75,000 pull back on their purchases.

Likewise, Wingstop said its customers’ perception of its value is improving, coinciding with falling chicken wing prices.

“We are seeing positive trends in value scores with guests, in an environment where many brands are measuring decline,” Wingstop CEO Michael Skipworth told analysts.

Fast-casual rival Chipotle has also benefited from diners’ perception of its burrito bowls’ value. Chipotle has seen low-income consumers return to its restaurants more than they were a year ago, CFO Jack Hartung told analysts.

Still, Chipotle’s low-income customers aren’t visiting as frequently as they were before inflation began accelerating. The chain has paused price hikes for now, but will decide closer to the fourth quarter if it will raise them again.

One fast-casual chain has struggled with consumers’ value perception. Noodles & Company said its traffic cratered by double digits in the first part of the quarter as customers pushed back against its higher prices, which rose 13% from the year-ago period. In response, Noodles dropped its prices by 3% and pivoted its marketing to focus on value.

Promotions

As restaurants and customers focus on value, discounts and combo meals have stolen most of the marketing thunder. Limited-time menu items also helped some restaurants’ sales — but weren’t enough to offset weakness for others.

On one end of the spectrum was McDonald’s. The burger chain’s Grimace Birthday Meal fueled buzz on social media and traffic to its restaurants.

“This quarter, the theme was, if I’m being honest, Grimace,” CEO Kempczinski said on the company’s conference call.

The promotion featured the limited-time purple Grimace milkshake and core menu items, like the choice of a 10-piece McNugget or a Big Mac. It leaned on nostalgia for the mascot.

But not all promotions helped restaurants’ top line.

For example, Papa John’s released Doritos Cool Ranch-flavored Papadias for $7.99 in May. The limited-time menu item also drove social media buzz and traffic to restaurants, according to executives. However, the new Papadias couldn’t compete with the chain’s pepperoni-stuffed crust pizza it released a year earlier for $13.99.

“That traffic increase wasn’t enough to offset check decline, and therefore you had weaker same-store sales,” BTIG analyst Peter Saleh said.

AMD stock rises 3% after earnings beat, CEO predicts ‘multiple winners’ in AI race

Advanced Micro Devices Inc. shares surged in the extended session Tuesday after the chip maker’s results topped Wall Street estimates, and the company’s chief executive said there will be “multiple winners” in the AI arms race.

AMD

AMD,

shares rose 2.7% after hours, following a 2.9% gain to close the regular session at $117.66. AMD’s earnings follow those from Intel Corp.

INTC,

last week, when the chip maker reported a data-center beat, and strong PC sales.

Santa Clara, Calif.-based AMD forecast revenue for the third quarter of $5.4 billion to $6 billion on adjusted gross margins of about 51%. Analysts are forecasting adjusted third-quarter earnings of 73 cents a share from AMD on revenue of $5.82 billion, a 4.6% increase on the top line.

AMD Chief Executive Lisa Su told analysts on the conference call that the better-than-expected results in PC sales, following pandemic highs and then inventory write-downs, stems from “the strength of our product portfolio.”

In the second quarter, AMD’s data-center revenue declined 11% to $1.3 billion, while the Street expected $1.37 billion; PC sales fell 54% to $998 million, while analysts expected $843.3 million; gaming sales declined 4% to $1.6 billion, compared with a Street estimate of $1.6 billion; and embedded sales rose 16% to $1.5 billion, while the Street forecast $1.49 billion.

The company reported second-quarter net income of $27 million, or 2 cents a share, compared with $447 million, or 27 cents a share, in the year-ago period. Adjusting for stock-based compensation and other one-time items, AMD reported earnings of 58 cents a share, compared with $1.05 a share last year.

Second-quarter revenue fell to $5.36 billion from $6.55 billion a year ago, and gross margins fell to 50% from 54% a year ago. Last quarter, AMD forecast a strong showing from its AI and data-center products for the second half of the year but admitted it will take a rebound in the PC market to improve gross margins.

Analysts surveyed by FactSet expect adjusted second-quarter earnings of 57 cents a share on revenue of $5.32 billion. AMD had forecast $5 billion to $5.6 billion in revenue and second-quarter gross margins of about 50%.

Read: Will AI do to Nvidia what the dot-com boom did to Sun Microsystems? Analysts compare current hype to past ones.

On a conference call with analysts, Jean Hu, AMD’s chief financial officer, forecast that client, or PC-related, sales will rise year over year, data-center sales will be “flattish” and that both gaming and embedded sales will decline year over year. Analysts forecast a 7.3% rise in data-center sales to $1.73 billion in the third quarter from a year ago, and a 2.6% rise PC sales to $1.05 billion.

Sequentially, Hu said the company expects client and data-center sales to grow by double-digit percentages, and a decline in gaming and embedded sales, compared with the second quarter.

Read: Nvidia gets more good news from Big Tech, even as AI spending ‘may not lift all boats’

When asked how AMD will stand out against competition from the likes of Nvidia Corp.

NVDA,

in the AI field, CEO Su told analysts on the call that many AI-centric organizations, like Meta Platforms Inc.

META,

spinoff PyTorch and Onyx, are working closely with the company to optimize higher-level AI models.

“The key is we’re getting significant real-time feedback from some of these lead customers so we’re learning at a very fast pace,” Su told analysts.

Read: Nvidia ‘should have at least 90%’ of AI chip market with AMD on its heels

“I think there will be multiple winners and we will be first to say that there are multiple winners, but we think our portfolio is actually a fairly unique in the sense that we do have CPUs, GPUs, we have the accelerator technology with Ryzen AI on the PC side as well as in the embedded side with our Xilinx portfolio,” Su said. “I think it’s a pretty broad and capable portfolio.”

Read: Open-source AI: AMD looks to Hugging Face and Meta spinoff PyTorch to take on Nvidia

Year to date, AMD shares have gained 81.6%, while the PHLX Semiconductor Index

SOX,

has surged 52.4%, the S&P 500 index

SPX,

has risen 19.2%, and the tech-heavy Nasdaq Composite

COMP,

has gained 36.5%.