The chief investment officer at Bitwise Asset Management has explained why the current bitcoin bull market differs from prior bull markets. He doesn’t expect the bull market or the alts season to “end early,” emphasizing that he expects to see “more of an ‘everything season,’” rather than a classic alts season. Bitwise’s CIO Predicts an […]

The chief investment officer at Bitwise Asset Management has explained why the current bitcoin bull market differs from prior bull markets. He doesn’t expect the bull market or the alts season to “end early,” emphasizing that he expects to see “more of an ‘everything season,’” rather than a classic alts season. Bitwise’s CIO Predicts an […]

Source link

wont

Jerome Powell says ‘the housing market is in a very challenging situation right now’ and interest rate cuts alone won’t solve a long-running inventory crisis

The housing market has a problem—millions of them. The country is short between 3.5 and 5.5 million housing units, according to various estimates. The roots of the shortage go back to the aftermath of the Global Financial Crisis, when cautious developers were hesitant to invest in new construction and set a precedent of undersupply that’s continued to now. Jerome Powell.

On Thursday, the Federal Reserve chair testified to the Senate Banking Committee against the backdrop of his recent decision not to cut interest rates, the big question investors and homebuyers are asking. Potential rate cuts have given investors hope about some much-needed relief for the housing market, which has struggled to cope with soaring mortgage and refinancing rates, but Powell testified that the housing market’s real problems run much deeper—and it will take more than just monetary policy to fix them.

“The housing market is in a very challenging situation right now,” Powell said on Capitol Hill on Thursday. “Problems associated with low rate mortgage [lock-in] and high [mortgage] rates and all that, those will abate as the economy normalizes and as rates normalize,” he said, referring to the mismatch between something approaching 90% of homeowners with mortgage rates below 6% and the current market offering above 7%. “But we’ll still be left with a housing market nationally, where there is a housing shortage.”

‘There are a ton of things happening’

Powell explained the current problems facing homebuyers and sellers to the committee: “You have a shortage of homes available for sale because many people are living in homes with a very low mortgage rate and can’t afford to refinance, so they’re not moving, which means the supply of regular existing homes that are for sale is historically low and a very low transaction rate,” Powell said. “That actually pushes up the prices of other existing homes, and also of new homes, because there’s just not enough supply.”

But it’s a bigger issue than buyers and sellers being locked in, he said. “There are a ton of things happening … because of higher rates, and those in the short-term are weighing on the housing market … it’s more difficult [for builders] to get people [labor] and materials,” Powell said. “But as [mortgage] rates come down, and that all goes through the economy, we’re still going to be back to a place where we don’t have enough housing.”

The pandemic only made things worse. High inflation has made materials and labor costs far pricier, and ballooning mortgage rates have pumped the brakes on an already-slow sector. National Association of Realtors data showed that there were only 3.2 months of available housing supply as of the end of last year, about half as much as there should be in a balanced market.

Markets expect the Fed to announce rate cuts this year—but while that will offer some short-term relief, it won’t solve the housing market’s deep–set supply problems.

Powell noted that restrictive zoning laws play an important role in limiting new construction. He also pointed out that rising mortgage rates have discouraged longtime homeowners who locked in lower rates from moving, which has limited the number of existing homes on the market and left new homebuyers struggling to find affordable options.

Powell’s threading a tricky needle—the housing market is a big driver of the domestic economy, and overstressing it by keeping interest rates high for too long could threaten the rest of the economy. On the other hand, cutting rates too soon—or too quickly—in line with the industry’s demands could undermine the Fed’s yearslong attempts to stick a soft landing and keep inflation under control.

“Housing activity accounts for nearly 16% of GDP according to NAHB estimates,” wrote a group of housing industry trade organizations in a letter to Powell last fall. “We urge the Fed to take these simple steps to ensure that this sector does not precipitate the hard landing the Fed has tried so hard to avoid.”

This story was originally featured on Fortune.com

Latam Insights: El Salvador Won’t Sell Its Bitcoin, Bitcoin Spot ETFs Land In Brazil and Peru

Welcome to Latam Insights, a compendium of Latin America’s most relevant crypto and economic news during the last week. In this issue: President Bukele states El Salvador will not sell its bitcoin, Bitcoin ETFs land in Brazil and Peru, and Argentine President Javier Milei aims to criminalize central bank money issuance. El Salvador Won’t Sell […]

Welcome to Latam Insights, a compendium of Latin America’s most relevant crypto and economic news during the last week. In this issue: President Bukele states El Salvador will not sell its bitcoin, Bitcoin ETFs land in Brazil and Peru, and Argentine President Javier Milei aims to criminalize central bank money issuance. El Salvador Won’t Sell […]

Source link

Working longer won’t solve the retirement crisis — seniors need a ‘Gray New Deal’ to retire with dignity, this economist says

The Value Gap is a MarketWatch interview series with business leaders, academics, policymakers and activists on reducing racial and social inequalities.

Most Read from MarketWatch

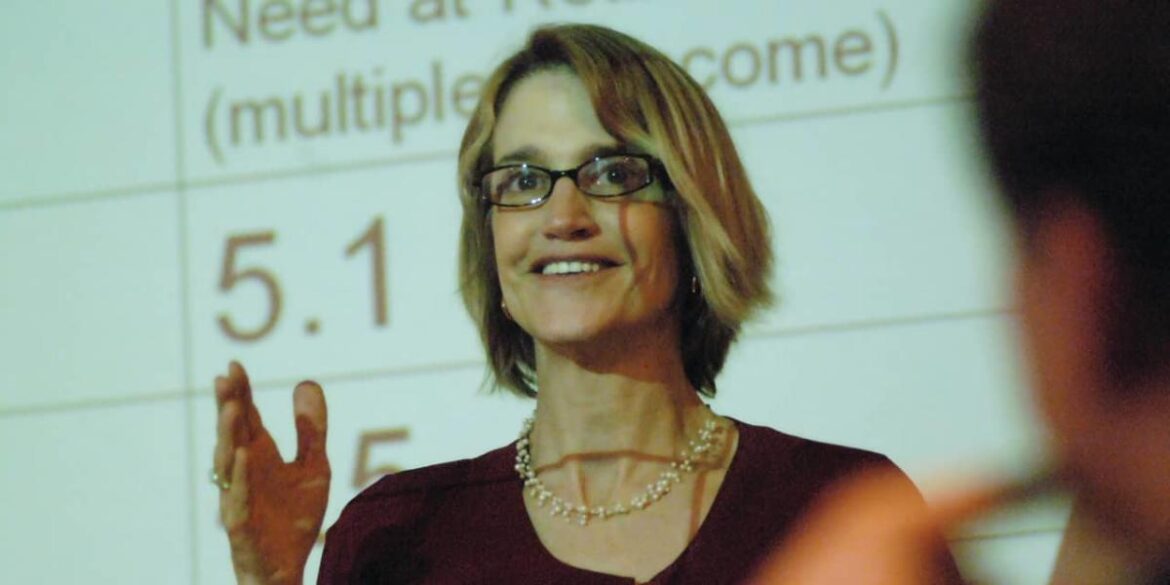

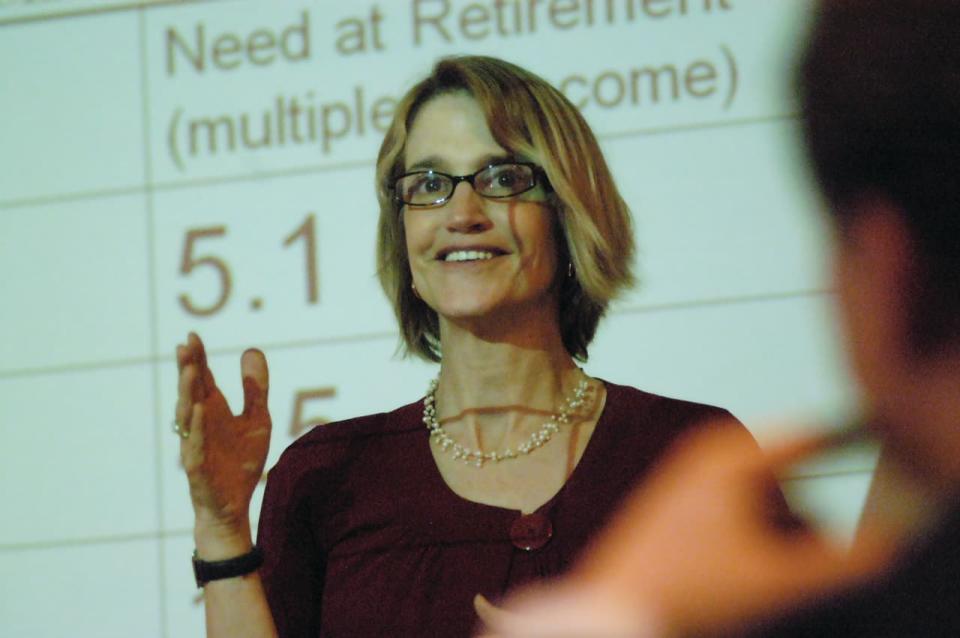

Teresa Ghilarducci thinks older adults shouldn’t have to work in retirement. She wants people to stop feeling shame about the size of their retirement accounts, and envisions a “Gray New Deal” that creates job and pension improvements for older Americans.

Those positions may be surprising for a labor economist.

But Ghilarducci is also a professor at the New School for Social Research and an expert on retirement security who explains complicated subjects in an accessible way. She has authored several books and papers, and her latest book, “Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy,” talks about how employees are laboring in the broken U.S. retirement system.

As American society urges people to work longer, this takes a disproportionate toll on middle- and lower-income people who may not have the ability to work longer in physically demanding jobs, Ghilarducci told MarketWatch in an interview.

Fifty percent of women and 47% of men between the ages of 55 and 66 have no retirement savings, according to the Census Bureau.

Ghilarducci calls for a Gray New Deal as a public-policy imperative. Today’s do-it-yourself retirement system — in which workers fund their retirement through 401(k)s, savings and sheer grit — is not working, she said. This interview has been edited for length and clarity:

MarketWatch: You’ve written several books. What did you still want to say in this new book?

Ghilarducci: My other books really focused on how to have enough money for retirement. This is a different subject about the policy push to work longer. We have a retirement crisis that’s a complex problem and expensive to fix. People retreated to the safe place that we can’t fix it. They say, “We have to work a little longer,” and that’s the solution.

My experience with the rest of the world was that they did not have this sense that working longer was the solution. Other countries have 25- to 30-year work lives and have a dignified old age. This working-longer idea robs us of a dignified old age, which we deserve. There’s a cost to our bodies and our lives in working longer.

MarketWatch: Can you talk about the Gray New Deal, what it entails and how insurmountable it may be to see it come to fruition?

Ghilarducci: We have a responsibility to rethink how people work and retire from that work. If you do not ignore the retirement period — people are entitled to retire — there’s got to be new ways to think about it. It has to be part of public policy. It has to be as encompassing as the original New Deal. Ninety percent of workers have no problem embracing this idea of retirement, but 53% of retired people when surveyed say they didn’t choose when to retire. They were laid off or their bodies wore out. Workers get it that they won’t be able to work until they’re 62, and working to 70 is nearly impossible for most.

Policy makers, meanwhile, have better, easier jobs. No one’s telling them what to do — they are telling other people what to do. It makes them a bit unsympathetic. But if they hear enough from workers — there’s lots of support for Social Security. I’m hopeful.

MarketWatch: The demographic bubble known as Peak 65 is happening this year, with a historic number of people turning 65. What will this mean for society, the economy and our culture?

Ghilarducci: Peak 55 happened 10 years ago, and people got really nervous about their retirement savings. Now it’s Peak 65, and all illusions about what’s possible are gone. There will be 35 million people realizing that their work lives are over and the money won’t stretch. We’ll have a sea change in views on Social Security. There’s no stomach among voters for benefit cuts. There’s a bill in Congress — from [Democratic Sen. John] Hickenlooper, [Republican Sen. Thom] Tillis, [Democratic Rep. Terri] Sewell and [Republican Rep. Lloyd] Smucker — that calls for a government match. It gets the individual employer out of it and focuses on the worker and the government.

Peak 65 shows me that the population is aging, and older people vote. There’s also an electorate that’s younger, and they support Social Security. They’re struggling with student debt and they are financially sophisticated. They’re learning about compound interest in high school. There’s a groundswell of concern about their parents. There’s also women in their late 40s and 50s who are having to take care of older parents. Not only are they taking care of older parents, but a lot of the care costs are coming out of their own retirement savings. They’re also giving a lot of their own time to provide care that they could be using for work, making more money and providing for their own security, and they’re not.

MarketWatch: Does increased longevity mean increased senior poverty?

Ghilarducci: We started charting higher levels of increased poverty years ago — millions of people living in de facto poverty. As the numbers of people go up, the rate and number of people in poverty will go up. The ghoulish good news is that people living in poverty don’t live as long. There’s a real inequality in longevity, in that the people with means are living longer. That inequality is real.

MarketWatch: In your book, you talk about how working longer weakens political pressure to expand Social Security and employer retirement plans. How so?

Ghilarducci: It could cost $1 trillion to bring Social Security up to full benefits. It would be spread out over decades, but it’s still a lot of money. Workers and employers have to set aside money for retirement. Workers also have to pay for emergency savings, housing, student debt. The urgency on the retirement crisis dissipates when people say everyone can work more years, and by working for more time, they won’t draw on Social Security. But that’s like saying, “Hey, we can afford lunch by not having lunch.” And people can just work longer? That’s not realistic. There’s a push to have everyone in the labor pool and a spate of work to end age discrimination. But a lot of that is turning the other way.

It’s also psychological — people making policy didn’t want to think of themselves as useless and facing mortality. It’s appealing to human beings: Never say die. The do-it-yourself retirement system is false that one can do it themselves. There’s this shame that you didn’t save enough. We’re a country of very old baristas — people are doing jobs that are a lot less than they had before because they have to.

But I think people are rising up. People are angry and empowered. There’s all sorts of ways to do that — vote for politicians who pay attention. It’s hard to talk to 55-year-old women who have no retirement. They should be angry.

MarketWatch: What do you see happening to Social Security in 10 years as the trust funds supporting it hit insolvency?

Ghilarducci: Social Security is purely a political problem. The country could afford to put more money into the system. We could have a 3-percentage-point increase in payroll tax. It wouldn’t mean job displacement or funding taken away from other groups. It’s not an economic problem. It’s a political problem that will be solved at the last minute, which will make it even more expensive. Any cuts to Social Security will mean more poor older adults. The last time there was a crisis, in 1983, we went to the brink. This time, I think politically there is the will to get something done because no one wants to see benefits cut.

MarketWatch: Will you ever retire? And what will that look like?

Ghilarducci: I have one of the strangest jobs in the U.S. I’m like a medieval priest or something. I have an endowed chair and I’m tenured. I have no supervisor. I have a really rare job. I’ll only retire when my body or my mind gives out. I’m not typical. And those of us with atypical jobs — and policy makers are not typical — we need to be more humble and realize we are not representative of most people.

MarketWatch: What’s the one lesson you want people to take away from your new book?

Ghilarducci: I want people to realize that they deserve retirement and a dignified retirement. It’s not shameful if they haven’t been able to save. It’s not because they got a divorce or had too much avocado toast in their 20s. It’s not their fault. Every American deserves a retirement, and working longer is not the solution.

Most Read from MarketWatch

Opinion: 5 real risks that could crush stocks in 2024 — and why they won’t

As U.S. stocks flirt with new highs and recession seems less and less likely, the hard-core stock-market bears continue to predict an array of market-tanking disasters just around the corner.

I expect the U.S. market to finish the year up 5%-10%, for three main reasons: No recession; inflation will continue to contract, and cautious investors will come into the market and push stocks higher.

Still, it is always good to understand opposite views. With that in mind, here’s a look at five major fears of the market naysayers — and why they will be wrong. Markets can correct at any time (10% decline), but another bear market (down 20%) is not likely on the horizon.

1. 2024 brings a recession: Stock markets hate recessions. So, this would be bad for bulls. It’s a little daunting that no less than seasoned market gurus Jeffery Gundlach and Bob Doll predict this outcome. Their exhibit A: The inverted Treasury yield curve — the difference between yields of 10-year

BX:TMUBMUSD10Y

and two-year

BX:TMUBMUSD02Y

U.S. Treasurys , which invariably forecasts recessions.

But here’s why they’ll be wrong this time. Inverted yield curves forecast recessions because they correctly predict monetary tightening will cause a credit crunch. This in turn sparks a financial crisis that tanks both the economy and stocks.

The thing is, we’ve already had the financial crisis. It was the regional bank sector mini-meltdown in the first half of 2023. And we’ve skated by because the U.S. Federal Reserve handled it. The Fed flooded U.S. banks with liquidity via the Bank Term Funding Program. Now, we’ve moved on – except those who hold on to the economic “hard-landing” scenario.

In the meantime, market interest rates have come down, taking pressure off the credit system. Declining rates are also a form of economic stimulus. The Fed will soon start cutting rates at the short end, continuing this trend.

Outside of a credit crunch, the real canary in the coal mine to watch is business activity, notes Mark Zandi, the chief economist at Moody’s Analytics. “Businesses are the first to signal trouble as they rein in payrolls and investment,” he says. That undermines consumer sentiment, and a vicious cycle of weakening demand and risking layoffs ensues.

“Right now, there is no sign of that,” Zandi adds. “Businesses remain stalwart in their refusal to lay off workers and rein in investment. The economy continues to perform well, and prospects are improving as inflation recedes without an increase in unemployment.”

Moreover, the U.S. in the midst of a productivity boom that will continue due to elevated business investment in new technology and equipment. Higher worker productivity boosts profits and takes the pressure off companies to raise prices (link).

Plus, remember that economies usually benefit from election-year spending by the political party in power.

2. Consumer spending dries up as savings decline: Consumers drive the economy, so if they really do close their wallets because they’ve burned through their Covid pandemic savings, that won’t be good.

But this won’t happen. First, workers cocooned by the “lay low” mentality of the pandemic are circulating again. “The post-pandemic surge in labor force participation has led to a surge in total hours, and supported growth in disposable income,” says Bank of America economist Michael Gapen.

Next, U.S. employment remains high, and jobless claims are low, notes William Blair economist Richard de Chazal. Claims hit their lowest level in over a year, for the week ending January 13. The bottom line here is that consumers tend to keep spending until they lose their jobs.

Other factors also support consumer spending, says Ed Yardeni of Yardeni Research. He points to boomers retiring and spending their cumulative $75 trillion in net worth or passing it along to their heirs. Close to 40% of U.S. homeowners are mortgage-free, and most of the rest were able to lock in record-low mortgage rates.

A “misery index” tracked by Yardeni (the unemployment rate plus inflation) fell to 7.1% during December, well-below its historical average of 9%, Yardeni says. This is one reason the University of Michigan consumer sentiment index jumped in January to 78.8 from 69.4 in December.

3. Inflation makes a comeback: Like generals, stock-market bears often make the mistake of fighting the last war. So, when we learned earlier this month that December inflation firmed up, it supported the bear case that inflation may not be so transitory after all.

But inflation will continue to fall. For one thing, history shows it tends to fall as fast as it went up, after it spikes. Also, there’s a lot of natural downward pressure on price increases. China and Europe are suffering weak economies. Less demand from those regions puts downward pressure on oil prices and the price of goods. “China continues to export deflation to the U.S. and the rest of the world,” Yardeni says.

Rental vacancy rates are on the rise and this puts downward pressure on rent — the sole holdout inflation component, Zandi says.

The hidden gift for stock investors in all this is that that declining inflation pushes down cash yields. This has historically sent more money to stocks from cash, notes Bank of America strategist Savita Subramanian. The tipping point: 5% yields on cash. Below that, people put more cash into stocks. Money market funds have a record $6 trillion in cash. “Both institutional and individual investors are sitting on high cash levels,” she says.

4. Sentiment is too bullish, making the market vulnerable: When bullish investor sentiment gets too high, it makes the market vulnerable to pullbacks, in the contrarian sense. I just don’t see it. Consider these data from the quant analysts at Bank of America.

Cash at stock mutual funds is one standard deviation above average. That is not elevated sentiment. Hedge fund exposure to discretionary stocks — a bullish bet — is near historical lows. Investment fund exposure to defensive consumer staples remains eight percentage points higher than at the beginning of 2022. Exposure to consumer discretionary is four percentage points lower. Private equity funds have record dry powder (cash). Households have $18 trillion in cash, up from $13 trillion before the pandemic.

Sell-side strategists are equally cautious. Bank of America tracks a sell-side indicator based on strategists’ recommended portfolio allocation to stocks. This indicator is stuck in neutral, in line with the 15-year average. Typically, after readings at this level, the S&P 500

SPX

rises 13.5% in the next 12 months. “Peak recession fears are likely behind us, but positioning still reflects more fear than greed,” concludes B of A.

5. Oil prices spike due to the Middle East war: High oil prices pinch consumers by spiking gasoline prices, and they hit corporate profits. I’m not smart enough to know if the conflict in the Middle East will shut down oil shipping lanes, leading to an oil price spike. But if it does, the disruption will have to last for a long time to create a recession. Oil prices remained above $100 for six months after Russia invaded Ukraine in February 2022, and no recession ensued.

Meanwhile, forces including the weak economy in China and record U.S. production continue to limit upward price pressure on oil. Some analysts even question how long OPEC+ will stay unified on production limits — given that Angola just left the oil cartel.

The bottom line: Markets can correct at any time. But if I’m right that the diehard bears have it wrong, it makes sense to stay in stocks and be overweight cyclical names in consumer discretionary, energy, materials and industry, and discounted small-cap names that stand to do well as market breadth broadens.

Michael Brush is a columnist for MarketWatch. He publishes a stock newsletter called Brush Up on Stocks. Follow him on X @mbrushstocks

Read: Why that $6 trillion pile of cash in money-market funds isn’t heading for stocks

More: Gen X-ers and millennials are poised to inherit trillions in the coming years

In the past month, the Bitcoin price has experienced a significant decline after reaching a 22-month high of $49,000. Currently, the largest cryptocurrency has fallen below the crucial $40,000 mark, raising concerns about the prospects of the ongoing bull run and the overall bullish market structure.

However, there are indications that the bottom of the current downtrend may be near, potentially setting the stage for a potential price reversal.

Bitcoin Price To Avoid Plummeting To Low $30,000s

Market analyst Marco Johanning sheds light on the situation, offering insights into the Bitcoin price movement. Johanning suggests that it won’t be long until Bitcoin reclaims the $41,500 level or potentially rises from a lower level if a specific scenario unfolds.

According to Johanning, Bitcoin will finally encounter significant liquidity on the downside. Notably, the price has touched around below $39,000 multiple times, indicating the presence of substantial liquidity at these lows.

Moreover, Johanning addresses the skepticism surrounding the price of around $37,800, arguing against widespread expectations of a drop into the low $30,000 range.

Johanning emphasizes that the primary liquidity lies below $40,000 and is not in the low $30,000 range. Traders profited from the low $30,000 range have likely adjusted their stop orders to protect their gains, creating a layer of support below the recent equal lows.

As the price starts hitting these stop orders, automatic selling occurs, further down the price until it encounters significant buy pressure. The analyst points out a daily order block at $37,700 and high timeframe (HTF) support at $38,5000, indicating the potential for notable buy pressure in these price regions.

Johanning also highlights the likelihood of filling Chicago Mercantile Exchange (CME) gaps and Imbalances, with the next imbalance anticipated below $33,000.

Short Squeeze Rally Imminent?

According to Johanning, the prevailing sentiment reveals many bears waiting to short a market dump. Johanning predicts that a short squeeze could occur once the price reverses, leading to a rapid price increase.

In terms of Fibonacci retracement levels, Johanning suggests that since the Bitcoin price has already lost the $40,200 level, it could potentially fall to the 0.5% Fibonacci level, which coincides with those above the $37,800 level.

Johanning speculates that the price may briefly touch $37,800 before closing above the HTF support level of $38,500, setting the stage for a potential upward movement.

The recent downtrend in Bitcoin’s price has raised concerns about continuing the bull run. However, market analyst Marco Johanning presents several key arguments supporting the possibility of a price reversal.

With Bitcoin’s current price at $38,900, there is a possibility of increased buying pressure in this region. The support wall at $38,5000 has demonstrated resilience thus far, and its performance will be closely observed.

If the support wall fails to hold, the market will observe how the $37,800 price level performs and whether it aligns with the analyst’s thesis.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Fool.com contributor Parkev Tatevosian evaluates Apple (AAPL -0.56%) across several financial metrics, including valuation, to determine if the stock is a buy for 2024.

*Stock prices used were the afternoon prices of Dec. 20, 2023. The video was published on Dec. 22, 2023.

Parkev Tatevosian, CFA has positions in Apple. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

The CEO of investment management firm VanEck says he can’t see a world where Bitcoin (BTC) is overtaken as the leading store of value on the internet.

“I think it’s impossible for me to imagine some other internet store of value [will] leapfrog Bitcoin,” Jan van Eck said in a Dec. 16 interview with CNBC.

“There’s 50 million users of Bitcoin, so it’s got network effects.”

The CEO — $76.4 billion in assets under management — also crushed accusations that Bitcoin is in a “bubble,” — explaining that no asset has ever been in a bubble that continues to outperform itself every market cycle. He added:

“Bitcoin is the obvious asset that is growing up in front of our eyes.”

Meanwhile, Van Eck expects Bitcoin to see all-time highs in the next 12 months.

VanEck CEO @JanvanEck3 expects Bitcoin all-time-high in the next 12 months. “It’s an asset that’s growing up in front of our eyes.” Also some good notes on the spot Bitcoin ETF effort and macro cycle. pic.twitter.com/02qZOVBPyx

— Gabor Gurbacs (@gaborgurbacs) December 16, 2023

The VanEck CEO said he and his late father, John van Eck — who founded the firm in 1955 — have store of value investing in their DNA and that he sees Bitcoin becoming an accompaniment to gold.

VanEck launched the first gold fund in the United States under John van Eck’s leadership in 1968.

VanEck is one of 13 applicants gunning for an approved spot Bitcoin exchange-traded fund in the United States.

Related: VanEck files 5th amendment to spot Bitcoin ETF under ‘HODL’

The firm’s CEO expects all spot Bitcoin exchange-traded fund applications to be approved on the same day.

ETF analysts predict the Securities and Exchange Commission will issue a decision on several pending spot Bitcoin ETF applicants sometime between Jan. 5–10, with BlackRock, Grayscale, Bitwise, WisdomTree, Invesco and Galaxy, Fidelity, Hashdex and others also waiting for a final decision by the SEC.

Magazine: BlackRock revises BTC ETF filing, El Salvador’s crypto citizenship trending, and more: Hodler’s Digest, Dec. 10-16

Boomers Interested In Bitcoin, Market Won’t Allow BlackRock To Buy BTC Below $60k

As institutional interest in Bitcoin grows, Fidelity and BlackRock’s proposed spot Bitcoin Exchange-Traded Fund (ETF) faces an unexpected hurdle: the crypto market’s unwillingness to let go of the coin at bargain prices.

Bitcoin To $60,000 In Progress?

According to Mike Alfred, who claims to be a value investor and a board director, the market will “unlikely” allow BlackRock to purchase BTC below $60,000. Taking to X on December 4, Alfred said BlackRock and other Wall Street players keen on issuing spot Bitcoin ETFs would have to “buy for Boomer’s 401k plans for at least $60,000.”

This preview stems from the rapidly growing demand among institutional investors, as seen by the number of Wall Street players willing to issue complex derivatives tailored for, among other investors, “baby boomers,” most of whom are “approaching retirement.” With their substantial retirement savings, baby boomers increasingly recognize BTC’s potential as a hedge against inflation and a store of value.

Following Federal Reserve intervention during the COVID-19 pandemic, inflation rose to multi-year levels in 2021. To preserve purchasing power, the central bank began hiking interest rates. Although inflation has fallen and the economy stabilized, it remains higher than the target of 2%. The Fed continues to track this metric and may further intervene by raising rates to lower inflation. This might impact Bitcoin prices, as seen in the past months.

Nonetheless, the potential influx of boomer money into Bitcoin via a Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) approved derivatives product is a big boost for the coin. Though the SEC has yet to authorize multiple spot Bitcoin ETFs, the crypto and Bitcoin market expects the strict regulator to greenlight the first product in the next few weeks.

BlackRock And Company To Buy BTC At A Premium

Accordingly, ahead of this milestone development for the Bitcoin and crypto market, Alfred thinks BlackRock, Fidelity, and other players won’t secure Bitcoin at spot rates. Instead, the market anticipates that BlackRock, one of the world’s largest digital asset managers, will make their “bi-weekly purchases at prices above $60,000.”

The coin is trading at April 2022 levels, ripping above $40,000 over the weekend as bulls step up. Looking at the BTC candlestick arrangement on the daily chart, the first clear resistance is around $48,000.

The coin trades within a bullish breakout formation following gains above $32,000. As buyers step up and investors anticipate the SEC approving the first batch of spot Bitcoin ETFs, the coin will likely continue increasing toward all-time highs of around $70,000.

Feature image from Canva, chart from TradingView

Bitcoin Unbreakable Floor? Analyst Predicts BTC Won’t Fall Below $35,000 Ever Again

Controversial Stock-to-Flow (S2F) model creator PlanB has recently made a bold prediction about Bitcoin (BTC) that’s captured the crypto community’s attention.

Via his social media handle X, PlanB stated that Bitcoin’s price would never plummet below the $35,000 threshold again. PlanB supported his claim with a chart illustrating Bitcoin’s valuation trend about its intrinsic hash rate. According to PlanB, this relationship is a critical indicator of the digital currency’s enduring value.

Despite acknowledging potential black swan events or short-term market volatility, PlanB insists that based on the current fundamentals, particularly the cost of electricity ($/kWh) used in mining Bitcoin, the asset’s market value is “unlikely” to retract below the mentioned support level – $35,000.

Mining And Market Arbitrage: A Key Factor

The crux of PlanB’s argument lies in the unique arbitrage opportunity that exists between Bitcoin miners and everyday users. Miners, who invest heavily in electricity to mine the digital asset, and users, who typically purchase Bitcoin with fiat currency on exchanges, create a dynamic market environment.

According to PlanB, this arbitrage might become even more pronounced with the advent of a potential launch of a spot Bitcoin Exchange-Traded Fund (ETF) in the US.

🚨BREAKING: Bitcoin valuation based on difficulty (hashrate) increased to $35k yesterday. IMO this could mean that, apart from possible black swans or short term volatility, based on $/kWh-arbitrage fundamentals … BTC will never go below $35k ever again. pic.twitter.com/JPLkXieQAP

— PlanB (@100trillionUSD) November 27, 2023

PlanB suggests that miners, equipped with specialized knowledge about the market and the actual cost of producing Bitcoin, might begin to demand a premium when selling the cryptocurrency. This shift could fundamentally alter the way Bitcoin is traded and its perceived value.

The introduction of BTC spot ETFs, in particular, is expected to bring a new level of mainstream acceptance and investment into Bitcoin, potentially solidifying its price floor as predicted by PlanB.

Bitcoin Hash Rate And Market Dynamics

Delving deeper into the concept of Bitcoin’s hash rate, it’s essential to understand its role in securing the network and validating transactions. The hash rate basically measures the computational power being used to mine and process transactions on the blockchain.

A higher hash rate indicates more robust security and efficiency in the network, often correlating with increased investor confidence and, consequently, a higher asset valuation.

PlanB’s analysis posits that Bitcoin’s valuation will follow suit as the hash rate continues to rise, driven by technological advancements and increased mining activities. This relationship forms the basis of his prediction that Bitcoin will maintain a strong market position, unlikely to fall below the $35,000 mark.

Currently, BTC is trading above $37,000, marking an increase of over $2,000 from the support level PlanB mentioned. Specifically, at the time of writing, Bitcoin’s price stands at $37,605, reflecting a 2% rise in the last 24 hours.

Featured image from Unsplash, Chart from TradingView