Old views of traditional retirement are gone. New retirement will look different.

Source link

working

If retirement is all about money, you might not be ready to stop working

Not only is retirement readiness different for each individual, not many of us are even able to describe what that actually looks like.

Successful retirement planning requires a multi-layered exploration of our wants, needs, financial anxieties and risk tolerance, along with sensitivity to what we really mean in addition to what we actually say. There’s a close analogy to psychotherapy.

This is why it’s an exercise in futility for Wall Street firms to conduct their periodic surveys of retirement readiness. Not surprisingly, these surveys often reach widely divergent conclusions.

Wall Street nevertheless keep trying. A half-dozen such firms have reached out to me already this year, publicizing their latest surveys. One published a report on Feb. 13 announcing that the U.S. retirement crisis is worse than ever, with two-thirds of workers not saving enough for retirement — and nearly one in four without enough savings to even pay for their funeral expenses.

Meanwhile, another survey — released two weeks earlier — found that 70% of U.S. workers are confident that they have saved enough for a comfortable retirement.

The inherent weakness in these surveys is that they are trying to quantify the unquantifiable. Take, for example, the survey finding that two-thirds of workers aren’t saving enough for retirement. It reached this conclusion by measuring the size of respondents’ retirement portfolios, then comparing it to a single across-the-board dollar amount that the surveyors claimed was necessary to retire comfortably.

But there is no one-size-fits-all when it comes to a retirement portfolio. Benjamin Graham, the father of fundamental analysis, made this point in his famous book “The Intelligent Investor”: “The best way to measure your investing success is not by whether you’re beating the market, but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

How many of us can answer the question “where you want to go” with more than bromides? This isn’t to say that having a sizeable portfolio is unimportant to retirement readiness. But the relationship between money and happiness is surprisingly inscrutable. Take recent research by Matthew Killingsworth, a professor at the Wharton School, and Princeton University professors Daniel Kahnemann and Angus Deaton.

The researchers found that more money brings more happiness in large part only if you are a happy person to begin with. If you’re an unhappy person, then money helps you only to a limited extent. Even for happier people, the impact of more money is a lot less than you think: A “four-fold difference in income is… less than a third as large as the effect of a headache” on a person’s feelings of happiness on a given day.

Financial advisers can play a valuable role in helping us sort out these thorny questions, Of course there are unscrupulous advisers who take advantage of vulnerable retirees and near-retirees. The presence of such advisers only reinforces the importance of searching for an adviser carefully. Just don’t let the considerable complexity of retirement planning dissuade you from the search.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.

More: These are the two biggest retirement expenses. Start planning for them now.

Also read: I have to take RMDs from multiple accounts. How can I avoid making a mistake?

Working longer won’t solve the retirement crisis — seniors need a ‘Gray New Deal’ to retire with dignity, this economist says

The Value Gap is a MarketWatch interview series with business leaders, academics, policymakers and activists on reducing racial and social inequalities.

Most Read from MarketWatch

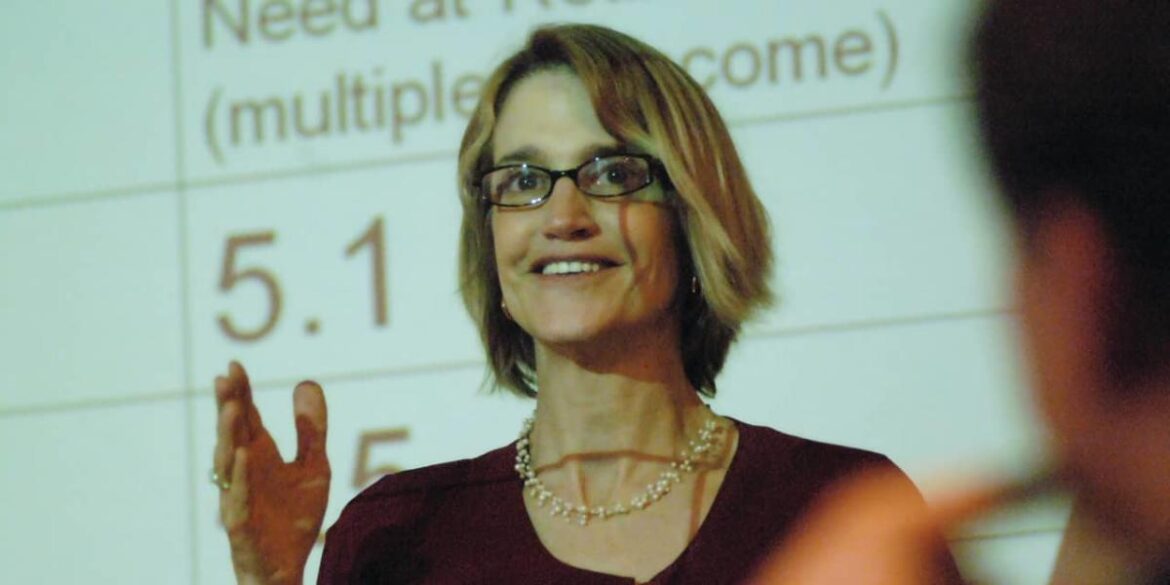

Teresa Ghilarducci thinks older adults shouldn’t have to work in retirement. She wants people to stop feeling shame about the size of their retirement accounts, and envisions a “Gray New Deal” that creates job and pension improvements for older Americans.

Those positions may be surprising for a labor economist.

But Ghilarducci is also a professor at the New School for Social Research and an expert on retirement security who explains complicated subjects in an accessible way. She has authored several books and papers, and her latest book, “Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy,” talks about how employees are laboring in the broken U.S. retirement system.

As American society urges people to work longer, this takes a disproportionate toll on middle- and lower-income people who may not have the ability to work longer in physically demanding jobs, Ghilarducci told MarketWatch in an interview.

Fifty percent of women and 47% of men between the ages of 55 and 66 have no retirement savings, according to the Census Bureau.

Ghilarducci calls for a Gray New Deal as a public-policy imperative. Today’s do-it-yourself retirement system — in which workers fund their retirement through 401(k)s, savings and sheer grit — is not working, she said. This interview has been edited for length and clarity:

MarketWatch: You’ve written several books. What did you still want to say in this new book?

Ghilarducci: My other books really focused on how to have enough money for retirement. This is a different subject about the policy push to work longer. We have a retirement crisis that’s a complex problem and expensive to fix. People retreated to the safe place that we can’t fix it. They say, “We have to work a little longer,” and that’s the solution.

My experience with the rest of the world was that they did not have this sense that working longer was the solution. Other countries have 25- to 30-year work lives and have a dignified old age. This working-longer idea robs us of a dignified old age, which we deserve. There’s a cost to our bodies and our lives in working longer.

MarketWatch: Can you talk about the Gray New Deal, what it entails and how insurmountable it may be to see it come to fruition?

Ghilarducci: We have a responsibility to rethink how people work and retire from that work. If you do not ignore the retirement period — people are entitled to retire — there’s got to be new ways to think about it. It has to be part of public policy. It has to be as encompassing as the original New Deal. Ninety percent of workers have no problem embracing this idea of retirement, but 53% of retired people when surveyed say they didn’t choose when to retire. They were laid off or their bodies wore out. Workers get it that they won’t be able to work until they’re 62, and working to 70 is nearly impossible for most.

Policy makers, meanwhile, have better, easier jobs. No one’s telling them what to do — they are telling other people what to do. It makes them a bit unsympathetic. But if they hear enough from workers — there’s lots of support for Social Security. I’m hopeful.

MarketWatch: The demographic bubble known as Peak 65 is happening this year, with a historic number of people turning 65. What will this mean for society, the economy and our culture?

Ghilarducci: Peak 55 happened 10 years ago, and people got really nervous about their retirement savings. Now it’s Peak 65, and all illusions about what’s possible are gone. There will be 35 million people realizing that their work lives are over and the money won’t stretch. We’ll have a sea change in views on Social Security. There’s no stomach among voters for benefit cuts. There’s a bill in Congress — from [Democratic Sen. John] Hickenlooper, [Republican Sen. Thom] Tillis, [Democratic Rep. Terri] Sewell and [Republican Rep. Lloyd] Smucker — that calls for a government match. It gets the individual employer out of it and focuses on the worker and the government.

Peak 65 shows me that the population is aging, and older people vote. There’s also an electorate that’s younger, and they support Social Security. They’re struggling with student debt and they are financially sophisticated. They’re learning about compound interest in high school. There’s a groundswell of concern about their parents. There’s also women in their late 40s and 50s who are having to take care of older parents. Not only are they taking care of older parents, but a lot of the care costs are coming out of their own retirement savings. They’re also giving a lot of their own time to provide care that they could be using for work, making more money and providing for their own security, and they’re not.

MarketWatch: Does increased longevity mean increased senior poverty?

Ghilarducci: We started charting higher levels of increased poverty years ago — millions of people living in de facto poverty. As the numbers of people go up, the rate and number of people in poverty will go up. The ghoulish good news is that people living in poverty don’t live as long. There’s a real inequality in longevity, in that the people with means are living longer. That inequality is real.

MarketWatch: In your book, you talk about how working longer weakens political pressure to expand Social Security and employer retirement plans. How so?

Ghilarducci: It could cost $1 trillion to bring Social Security up to full benefits. It would be spread out over decades, but it’s still a lot of money. Workers and employers have to set aside money for retirement. Workers also have to pay for emergency savings, housing, student debt. The urgency on the retirement crisis dissipates when people say everyone can work more years, and by working for more time, they won’t draw on Social Security. But that’s like saying, “Hey, we can afford lunch by not having lunch.” And people can just work longer? That’s not realistic. There’s a push to have everyone in the labor pool and a spate of work to end age discrimination. But a lot of that is turning the other way.

It’s also psychological — people making policy didn’t want to think of themselves as useless and facing mortality. It’s appealing to human beings: Never say die. The do-it-yourself retirement system is false that one can do it themselves. There’s this shame that you didn’t save enough. We’re a country of very old baristas — people are doing jobs that are a lot less than they had before because they have to.

But I think people are rising up. People are angry and empowered. There’s all sorts of ways to do that — vote for politicians who pay attention. It’s hard to talk to 55-year-old women who have no retirement. They should be angry.

MarketWatch: What do you see happening to Social Security in 10 years as the trust funds supporting it hit insolvency?

Ghilarducci: Social Security is purely a political problem. The country could afford to put more money into the system. We could have a 3-percentage-point increase in payroll tax. It wouldn’t mean job displacement or funding taken away from other groups. It’s not an economic problem. It’s a political problem that will be solved at the last minute, which will make it even more expensive. Any cuts to Social Security will mean more poor older adults. The last time there was a crisis, in 1983, we went to the brink. This time, I think politically there is the will to get something done because no one wants to see benefits cut.

MarketWatch: Will you ever retire? And what will that look like?

Ghilarducci: I have one of the strangest jobs in the U.S. I’m like a medieval priest or something. I have an endowed chair and I’m tenured. I have no supervisor. I have a really rare job. I’ll only retire when my body or my mind gives out. I’m not typical. And those of us with atypical jobs — and policy makers are not typical — we need to be more humble and realize we are not representative of most people.

MarketWatch: What’s the one lesson you want people to take away from your new book?

Ghilarducci: I want people to realize that they deserve retirement and a dignified retirement. It’s not shameful if they haven’t been able to save. It’s not because they got a divorce or had too much avocado toast in their 20s. It’s not their fault. Every American deserves a retirement, and working longer is not the solution.

Most Read from MarketWatch

Opinion: Working a second job or thinking about it? Consider this investment instead.

“A few key considerations as you evaluate which ‘hustle’ is right for you.”

In the world of financial literacy, a few items and actions have emerged as meme-level villains: daily Starbucks coffee, eating avocado toast, renting an apartment instead of buying a home.

Gurus demonize these behaviors while wagging their fingers and criticizing personal decision-making. Yet while there is more than enough emphasis placed on scrimping and saving, we rarely talk enough about the other half of the equation: maximizing your take-home income.

My mentor once told me, “You can only save as much as you earn, but you can always earn more money.” Some may see getting a second job as their only option, but more and more people read this quote and immediately think of two words: “side hustle.”

The idea of pursuing your passion is something that older generations didn’t necessarily focus on when choosing a career path. Many chose jobs that paid the bills while allowing for some fun outside of work. But a side hustle has become more conventional in recent years — not least due to the rise of social media making it easier for our casual gigs to become full-blown money-making entrepreneurial endeavors.

Whether you are saving for a short-term goal like a wedding or a down payment, or you’re looking for longer-term supplementary income, side hustles can be a valuable path to extra cash. But take it from someone who has navigated the transition from passion project to side hustle to full-time career, there are a few key considerations as you evaluate which “hustle” is right for you.

When I think about a side hustle, I think about something that makes you money relatively quickly. This is different from a passion project, a hobby that acts as a mental recess and sparks your creativity: painting; reading, needlepoint, or even playing video games. The moment you introduce money into a hobby, the stakes change. There are paying customers on the other side, creating deadlines and the need for new ideas, products and services. You can’t just take a break for a month if you owe someone a good or a service.

So while it may still look like the fun activity you once loved, responsibility and obligation can change that. Acknowledging that you don’t have to monetize every passion is step one in ensuring that your side hustle doesn’t burn you out. Some things are sacred and should be kept that way.

“Your side hustle needs to fit into your life.”

The next consideration may seem obvious, but is essential: your side hustle needs to fit into your life. Whatever you choose, it must be complementary to the life you are already living. While it will cause some short term discomfort (this is work, after all), you shouldn’t take on too much stress or rearrange your entire life to make it happen. I like to tell people to look at their full-time job and evaluate what skills they aren’t utilizing. Maybe you’re a data analyst and you want to be more creative, or maybe you’re on your feet all day and you don’t mind sitting at a desk at night. Let that guide you.

“Don’t go into debt for your side hustle. ”

As you narrow your search, consider the costs associated with your side hustle. First of all, it should have a low startup cost. The hope of course is that you love your side hustle and it sticks, but if not, we don’t want you in a worse financial position than when you started. Don’t go into debt for your side hustle (we’re looking at you, MLMs).

Beyond startup costs you’ll want to consider your business expenses, your time, and your energy. Just as corporations have margins, so does your side hustle, and the higher the margin, the better. Think you’re too old to babysit? Perhaps you’ll reconsider when you realize that babysitting doesn’t require anything but your time and minimal transport costs — nearly a 100% profit margin. On the other hand, something like an Etsy shop is going to require raw materials and web hosting and shipping and handling. Those “hidden expenses” could add up and leave you wondering if your side hustle is even worth it.

“The best investment anyone can make.”

Lastly, it’s important to make the distinction between a side hustle and a second job, because the use of both terms has become more all encompassing over time. People often clock in for two or more shifts a day to make ends meet. That is a second job: the hours are less flexible and you’ve signed a piece of paper saying “Yes, I work here and I’ll show up on time.” A second job can strain your first job, as you’ll need to juggle both schedules.

Conversely, side hustles take more time to nurture, and aren’t as consistent in what they pay, especially not at the start. But they typically provide more freedom since you set your work hours.

Ultimately, whatever path you choose to create supplemental income is your choice. If your side hustle becomes lucrative, be sure to reflect on your intentions, goals, and what success looks like to you. When I began to post content across social media and consistently make money from it, I made a concerted effort to test out my newfound side hustle for 15 months before diving in full time. I needed to be sure I liked what I was doing and that it could sustain me year after year.

After juggling a full-time job and my content creation for 15 months, I still liked it enough to keep going, so I finally chose to go all-in. Ultimately, the decision to commit full-time was no different from any commitment. After a long trial period, I thought through the pros and cons and I bet on myself — the best investment anyone can make.

Vivian Tu is the author of RICH AF: The Winning Money Mindset That Will Change Your Life (Portfolio, 2023). Tu, a former Wall Street trader, is founder and CEO of the financial equity platform Your Rich BFF. She also helms the podcast, “Networth and Chill.”

More: Looking for a remote job? Your chances of finding one are dropping, Indeed says

Also read: Remote work offers less scope for advancement but also less stress, survey finds

I’m 77 and Still Working. Is it True That I Don’t Have to Take RMDs?

I’m 77 years old and I requested my 401(k) fund administrator to prepare my RMD. I was told I do not have to withdraw my money if I am still employed. Please confirm if this in fact an IRS rule or that of the fund management company?

-Bea

That is correct, Bea. If you are still employed, you do not have to take a required minimum distribution (RMD) from your current 401(k) regardless of your age, as long as your employer doesn’t require it. That is in fact an IRS rule.

RMD requirements depend on your age, the account type and whether or not you are still employed. There have been some changes to these rules recently, so let’s review the minimum distribution requirements. (And if you need help with retirement planning, including RMDs, consider speaking with a financial advisor.)

What Are RMDs and When Are They Mandated?

The IRS won’t let you leave your retirement savings in tax-deferred accounts indefinitely. Instead, the government requires you to withdraw a certain amount of money from your accounts each year. How much you’re mandated to withdraw is based on your age and how much money was in your account at the end of the previous year.

Before the SECURE Act of 2019, RMDs started at age 70 ½. However, the law increased the RMD age to 72.

That increase was short-lived, though. The SECURE Act 2.0 raised the RMD age to 73 beginning in 2023 and set it to increase to 75 in 2033.

You are required to take an RMD from most tax-advantaged retirement accounts with the exception of Roth IRAs.

Under prior law, designated Roth accounts within employer-sponsored plans like Roth 401(k)s and Roth 403(b)s were still subject to RMD rules. However, the SECURE Act 2.0 addressed this shortcoming, and beginning in 2024 no Roth accounts will be subject to age-based RMDs. I specify “age-based” here to acknowledge the fact that inherited Roth accounts are still subject to the 10-year rule. (And if you have other retirement-related questions, this tool can help match you with potential financial advisors.)

Are You Still Working?

Here lies the exception that applies to you. If you are still employed then you don’t have to take RMDs from the plan that your current employer sponsors.

However, even if you are still working then you must still take RMDs from:

So, if you have a 401(k) from a former employer, you’ll need to make sure that you’re taking RMDs from that account. A good workaround for avoiding RMDs for an old account is to simply roll those funds over into your current plan if you are allowed. (And if you need help planning your RMDs, consider working with a financial advisor.)

Bottom Line

Since you are still employed, you are not required to take an RMD from your current employer’s retirement plan. RMDs also don’t apply to Roth accounts. However, you still need to take an RMD if you still have a retirement account from a former employer.

Tips for Finding a Financial Advisor

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have free introductory calls with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Consider a few advisors before settling on one. It’s important to make sure you find someone you trust to manage your money. As you consider your options, these are the questions you should ask an advisor to ensure you make the right choice.

Brandon Renfro, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Brandon is not a participant in the SmartAdvisor Match platform, and he has been compensated for this article.

Photo credit: ©iStock.com/LumiNola, ©iStock.com/FG Trade

The post Ask an Advisor: I’m 77 and Still Working. Is it True That I Don’t Have to Take RMDs? appeared first on SmartReads by SmartAsset.

TikToker ‘so upset’ by working a 9-to-5 job. ‘I don’t have time for anything.’

A TikTok user received nearly 2 million views of a video she posted expressing frustration about how little time was left after her long commute and eight-hour workdays at her traditional, in-person 9-to-5 job.

“I know I’m probably just being so dramatic and annoying, but this is my first job,” TikTok user Brielle, who asked that only her first name be used due to privacy concerns, said in the video. “I don’t have time to do anything!”

Brielle, a 21-year-old recent college graduate who works in marketing, explained that, after the workday and a two-hour commute each way between her home in New Jersey and her office in New York, she was surprised and “so upset” by how little time and energy she had left to work out, see her friends or even cook dinner.

“How do you have friends? How do you have time for dating?” she said in the video, posted Oct. 17. “There’s no way I’m going to be able to afford living in the city right now… If I was able to walk to work it’d be fine, but I’m not.”

The video received nearly 15,000 comments, many from users sympathizing with Brielle’s feelings and voicing their own criticisms of the traditional office schedule.

“The 40 hour work week is beyond outdated and your feelings are totally valid,” read the top comment, with more than 39,000 likes.

“The 40 hour workweek was designed with a homemaker to take care of house tasks,” another user wrote about the traditional work week. “(There’s) no time for anything.”

Another commenter was more blunt: “It’s so repetitive and depressing. I feel you girl.”

Americans are questioning the traditional workweek

The response to the video points to just how quickly many Americans have turned against the five-day commute to the office that was once considered the default mode of working.

For example: a whopping 81% of Americans who work full-time would prefer a four-day workweek, an August survey from Bankrate found. The vast majority of respondents also said they would sacrifice something to make those shorter hours a reality.

One study of 61 U.K. companies that tried a shorter workweek found that those firms reported more revenue and less staff attrition, while most workers in the trial experienced less burnout and more satisfaction with their work-life balance.

For those that are headed into the office, the commute remains a huge drawback. A 2023 survey found that employees who work from home save an extra 72 minutes a day. Non-commuters devoted 40% of that extra time to their job, 34% to leisure and 11% to tending to their children or to others.

New York Federal Reserve researchers have also found that people who work remotely and don’t commute have more time for leisure and sleep.

But some Americans don’t see anything wrong with the traditional way of working. An article about Brielle’s video published by Insider received dozens of comments on Facebook

META,

many from users poking fun at the waning work ethic of younger generations.

“Welcome to the real world,” one user wrote.

‘I can’t even imagine working parents out there.’

Brielle told MarketWatch that the coverage and commenters seemed quick to criticize her, rather than examine the issue she was trying to raise in the original video.

“A lot of the news right now is all about painting me as a spoiled (member of) Gen Z, rather than calling out policies to be reevaluated,” she told MarketWatch via email.

And in a Tuesday video responding to the Insider article, Brielle said she’s grateful to be employed at all — and that she’s not the only worker struggling with the rigid structure of a traditional office job.

“I can’t even imagine working parents out there,” she said. “I give so much grace to them because it’s incredibly hard in America to be emotionally and mentally stable when your days are structured like (this).”

“Pretty much what I’m saying is yes, America needs to reform the 9 to 5 schedule,” she continued. “It’s not fair that the only people that are benefiting are the people that either run the corporations… or people that are just extremely rich, or influencers that don’t have to work a regular schedule.”

See also: Why does TikTok hate the 401(k) so much?

Biden administration rumored to be working on executive order requiring disclosure of outsized power consumption

An executive order from the Biden administration could compel cloud computing companies to report excess power usage to the U.S. government, Semafor reported on Sept. 27.

Based on statements from anonymous sources, the expected order will require cloud computing companies like Microsoft, Google, and Amazon to disclose when a customer rents a certain amount of computing power.

Semafor noted that this reporting model involves treating computational power as a national resource. It also drew comparisons to other existing practices, such as know-your-customer policies that require banks and financial services to monitor and report transactions above a certain limit (and, in the U.S., cash transactions above $10,000).

The upcoming rules are reportedly meant to allow the U.S. government to determine when certain actors, including foreign companies, are using computer power to develop artificial intelligence (AI) projects that could pose a security threat.

Anticipated rules make few distinctions

Although the policy is intended to control AI development, Semafor noted that non-AI applications including video game development and Bitcoin mining similarly require large amounts of resources.

The quantity-based approach to usage monitoring could also fail to make distinctions within AI development and could overlook certain applications. The reporting noted that, although large language models (LLMs) currently require extensive computational power, the amount of power needed could decrease in the future. Furthermore, some AI tools, such as facial recognition algorithms, already require minimal computational power.

Sources told Semafor that the order is not finalized and may change. Furthermore, if the executive order comes into effect, it will not immediately introduce reporting requirements. Rather, it would likely task the U.S. Department of Commerce with creating rules that would in turn require companies to report the relevant information.

The post Biden administration rumored to be working on executive order requiring disclosure of outsized power consumption appeared first on CryptoSlate.

Meta Working on More Powerful AI System that Will Surpass OpenAI’s GPT-4

According to those familiar with the matter, the new AI system developed by Meta will allow companies to develop services that produce sophisticated text, analysis, and other output.

Meta Platforms Inc (NASDAQ: META) is reportedly developing a new open-source AI system that is expected to be more powerful and advanced than the GPT-4 model offered by OpenAI. Besides, its capacity will be twice as high as Llama 2 – the latest AI model released by Meta and Microsoft Corporation (NASDAQ: MSFT) in July.

As reported by the Wall Street Journal, the training of the new system is expected to start as early as 2024. Recently, Meta increased its investment in AI chips made by Nvidia Corporation (NASDAQ: NVDA), which means it is going to train the new model using Nvidia’s H100s chips. The latest are often described as the world’s first “generative” artificial intelligence chips that serve as catalysts for AI technologies.

According to those familiar with the matter, the new AI system developed by Meta will allow companies to develop services that produce sophisticated text, analysis, and other output. Compared to Llama 2 which was launched on Microsoft’s Azure cloud computing platform, the new Meta’s system will run its own infrastructure. The system will be free of charge.

Meta’s Shift to AI Innovation

With the ongoing work on an AI system, Meta is making a strategic move, shifting to AI innovation. Its upcoming system is expected to challenge not only OpenAI but also the broader AI community where the competition is extremely high.

Just a few weeks after OpenAI released ChatGPT, Google and Microsoft jumped onto the generative AI bandwagon with the release of their own AI chatbots – Bard and Bing respectively. Months later, Apple Inc (NASDAQ: AAPL) started working on AI tools, reportedly spending millions of dollars a day on AI development.

For Meta, working on a new AI model is the next step to achieve its AI ambitions, especially at a time when effective generative AI tools are in demand by most businesses and firms.

Among the latest Meta’s AI innovations was SeamlessM4T – an AI-powered model that allows users to communicate effortlessly through speech and text across different languages. Besides, in August, Meta launched Code Llama – a large language model (LLM) for using text prompts to generate and discuss code.

This month, Meta is reportedly planning to release a new range of AI chatbots with distinct personalities. These AI-powered tools, known internally as “personas”, will feature various characters and provide users with a new and exciting search function with customized recommendations.

Meta CEO Mark Zuckerberg did not respond when asked to comment on the news. However, it is known that on September 13, Zuckerberg will attend a tech forum organized by Senator Chuck Shimmer to discuss the development of artificial intelligence and its regulation. The forum will address such issues as the protection of workers, national security and copyright, and defense against “doomsday scenarios”.

next

Artificial Intelligence, News, Technology News

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

You have successfully joined our subscriber list.

Gen Z intern shocks recruiter with list of demands including working no more than 5 hours, a start-up culture and an above average salary

Everyone has a list of wishes for their next job—perhaps it’s a generous pay packet, a more senior title or unlimited vacation days. For Gen Z, it’s apparently working for less than five hours a day.

One recruiter was left so shocked after interviewing a young job seeker who said he was looking for work-life balance (which tips heavily on the side of life) that she wrote about her experience on Twitter.

“I was interviewing a Gen Z intern today and he says he is looking for work-life balance with not more than 5 hours of work. Doesn’t like the MNC [multinational corporation] culture so wants to work at a start-up,” wrote India-based Sameera Khan, a director of people success at InFeedo, an employee-experience platform.

Khan also stipulated that the job seeker wanted to be paid around 50,000 Indian rupees for his brief time on the job. At around $600 that might not sound like much, but it’s more than eight times the average monthly salary for an Indian Gen Zer. According to Forbes, a 24-year-old should expect to earn around INR 5,905 a month.

Khan concluded: “God bless the future of work.”

It wasn’t long until the post went viral, racking up over 780,000 views and sparking fierce debate about Gen Z’s attitude to work.

Many were quick to call his list of demands unrealistic, given his lack of experience: “He needs to work 100 hours a week for 5 years and get to a senior position in big tech. Then he can get 40-50 lakhs with less work than that,” one user commented.

Others disagreed, praising the youngest generation to enter the workforce for prioritizing work-life balance.

“This hustle culture started with baby boomers and got passed on to millennials. Thanks to Gen Z, they understand life is not all about working for someone else,” another user wrote.

The cost of work-life balance shouldn’t be the working day

Khan commented on her post to add her take on the debate.

“Prioritising work-life balance early on is great but while looking for the first few internships one should look for learning, growth, good projects and peers,” she wrote. “Balance gets struck eventually.”

“If you want to do well in life, you’ve got to work hard to get there,” echoed Lewis Maleh, CEO of the global executive recruitment agency Bentley Lewis. What’s more, he doesn’t see why balance and wellness should come at the cost of working hours.

“I think you can work hard and have a really successful career, and also take care of yourself—they’re not mutually exclusive,” he told Fortune. “For me integrating your work and life is making sure that you’re working on yourself—I go to the gym six days a week, I eat well and I try to sleep well—and working hard.”

Work-life balance should be an integrated approach, not as Maleh puts it, “trying to get away with working less”.

Job seeker doesn’t reflect the attitudes of all Gen Z workers

There’s seemingly a tale of two worlds when it comes to Gen Z workers: Those who are posting their 5 a.m. morning routines on TikTok and holding down multiple jobs. And others who are embracing “lazy girl jobs”, calling out capitalism for the toll it takes on their mental health, and walking out on jobs that don’t conform to their expectations.

The difference between the divided cohort is “privilege”, Maleh said, while adding that he sees hard-working Gen Zers get a bad rep because of the occasional unrealistic worker.

“I know a lot of younger folks that are working their ass off,” he insisted. “That gets derailed by people who are saying, I’m going to do five hours work and get paid a million pounds.”

“To engage Gen Z team members, we need to eliminate the false belief that they all want to work less hours,” echoed Monica McCoy, CEO and founder of the global consultancy Monica Motivates.

She told Fortune that gimmick generational group nicknames, buzzwords and judging an entire group of workers based on the Gen Z intern’s viral list of demands do more harm than good.

“It can lead to biases, misunderstanding, and a real lack of insight into what influences the thinking and behavior of members of various generations,” she added. “All generations challenge the one that came before them—and all generations tend to be skeptical about the one that follows.”

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

Looking to make extra cash? This CD has a 5.15% APY right now

Buying a house? Here’s how much to save

This is how much money you need to earn annually to comfortably buy a $600,000 home