Bitcoin continues to range trade, and altcoin traders are starting to view BTC’s price consolidation as a positive sign for the rest of the crypto market.

XRP has been one of the trending tokens following the summary judgment which ruled that the token was not a security, giving its parent company, Ripple, a ‘partial victory’ over the United States Securities and Exchange Commission (SEC). That event saw XRP’s price soar to about $0.93.

However, XRP’s price seems to have cooled off, settling at the $0.7 price mark. Despite this, there still seems to be bullish sentiment around XRP’s future price, which is why this Machine Learning tool was consulted to predict XRP’s price.

PricePredictions.com, a site powered by an advanced machine learning algorithm that provides current and futuristic trends about several tokens, was consulted in a bid to get an insight into XRP’s future price and to better position themselves in case of a rally by the token.

According to XRP’s futuristic price action, the AI tool forecasts that there will be an upward trend that will see XRP gain about 1.5% in value from its current price of $0.7. It has also been projected that XRP will hit the price mark of $0.71 by August 26, 2023.

For insight into how the machine learning tool works, the algorithm analyzes current technical analysis (TA) indicators, like moving average convergence divergence (MACD), average true range (ATR), relative strength index (RSI), and Bollinger Bands (BB) to come up with a logical price forecast.

XRP price trending at $0.7 | Source: XRPUSD on Tradingview.com

Ripple Lab’s aforementioned victory over the SEC undoubtedly sparked significant interest in XRP, especially from institutional investors, seeing the token rise above Circle’s USDC and Binance’s BNB to become the fourth-largest cryptocurrency by market cap.

This took XRP’s market capitalization to a yearly high of $46.1 billion at the time of the ruling that it wasn’t a security (XRP’s market currently stands at around $37 billion according to data from CoinMarketCap).

XRP also became the most actively traded altcoin in 2023. The token accumulated over $1 billion in trading volume, outperforming other altcoins like BNB, SOL, MATIC, and DOGE.

Although XRP is still far below its all-time high of $3.84 in 2018, it has undoubtedly had an impressive market trend lately, and it is projected that many more users will continue to pick an interest in the token and ultimately promote wider adoption.

Featured image from iStock, chart from Tradingview.com

The enduring allure of XRP, despite market volatility, may be evidence of its continued relevance, as it has continued to attract the interest of traders and investors equally.

Even as the dust settles after Ripple’s recent victory jubilation, the cryptocurrency market remains keen on XRP. Kaiko, a provider of market data on digital assets, reports that the open interest ratio on XRP futures trades on prominent exchanges remains quite impressive.

Recently, the crypto market has experienced a pervasive price reversal. Despite the pullbacks, traders’ interest in the Ripple cryptocurrency remained remarkably high, according to Kaiko.

At the time of writing, XRP was in the red in all timeframes, trading at $$0.712, down a measly 0.02% in the last 24 hours, and a considerable 8.4% in the last seven days, data from crypto market tracker Coingecko shows. Given these numbers, XRP is still able to shine in another key department.

XRP in crimson in all timeframes during the weekend. Source: Coingecko

Kaiko shows that across numerous markets, XRP’s volume-to-open interest ratio is consistently higher than the median value. This reliability suggests that the XRP coin is actively traded in a healthy market. This percentage is significantly greater than the market average, indicating strong liquidity and sustained interest from traders and investors.

On prominent exchanges, the volume-to-open-interest ratio is also used to measure trading activity. When the interest metric is high, it indicates that more purchasers and sellers are willing to trade the token, which indicates speculative interest. A favorable volume-to-open interest ratio could be a signal for market participants to trade in such a token.

On prominent exchanges, the volume-to-open-interest ratio is also used to measure trading activity. When the interest metric is high, it indicates that more purchasers and sellers are willing to trade the token, which indicates speculative interest. A favorable volume-to-open interest ratio could be a signal for market participants to trade in such a token.

Ripple’s popularity on social media, as assessed by Santiment, has increased dramatically over the previous two months, reflecting the excitement surrounding the cryptocurrency. Its social dominance increased dramatically in late May and early June, peaking at over 4%.

Source: Santiment

Ripple had just roughly 2% of the social market share at the time this story was published. Despite the fact that this number may appear tiny, it demonstrates that the cryptocurrency has a significant presence and impact in the crypto community as a whole.

Despite the fact that Ripple appears to be a minor topic of discussion, it has managed to stand out as a formidable contender, attracting the attention of enthusiasts and experts alike and causing them to discuss it.

XRP market cap currently at $37 billion. Chart: TradingView.com

In the ever-evolving world of cryptocurrencies, where numerous digital assets vie for attention and recognition, Ripple carved out a useful niche for itself, influencing discussions about blockchain technology and financial innovation.

Even though Ripple must contend with other well-known cryptocurrencies, the fact that it has maintained a strong social presence indicates that it has a large number of supporters and investors.

Meanwhile, the loss of nearly 10% of XRP’s value over the past week appeared insignificant to some speculators. Based on figures from Santiment, the funding rate for cryptocurrencies was 0.1%. A positive reading of the funding rate indicated favorable sentiment on average.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Times Tabloid

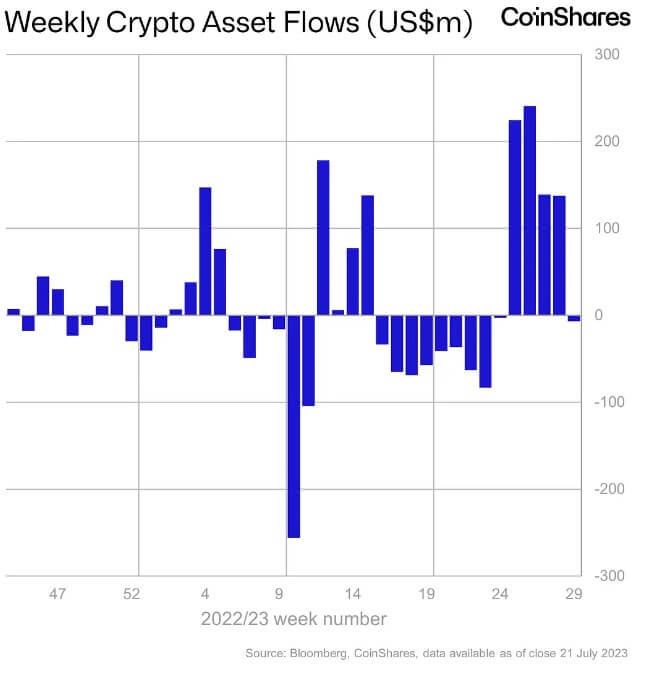

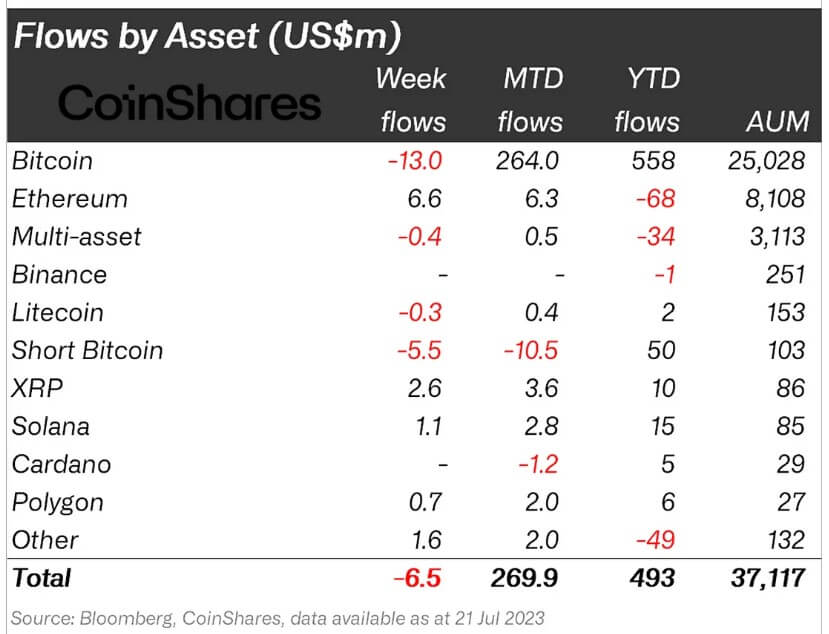

Digital assets investment products recorded $6.5 million in outflows this week after four consecutive weeks of inflows totaling $742 million, Coinshares reported on July 24.

This week’s outflows break the longest streak of inflows since late 2021, coinciding with the recent market downturn that saw Bitcoin’s (BTC) price dump to its lowest value since June 21.

Coinshares further reported that the trading volume for the week ending July 21 was $1.2 billion, below the year’s weekly average of $1.4 billion and significantly lower than the $2.4 billion recorded in the week ending July 14.

During the past week, Ethereum (ETH) investment products topped the leaderboard for inflows seeing $6.5 million in inflow.

James Butterfill, the head of Coinshares research, wrote that the inflows suggest that sentiments surrounding the asset might change. Since the beginning of the year, ETH has seen outflows of $68 million on the year-to-date metric.

Meanwhile, XRP saw inflows of $2.6 million during the period, taking its year-to-date inflow to $10 million.

Coinshares noted that investors’ confidence in XRP has grown following Ripple’s partial victory against the U.S. Securities and Exchange Commission (SEC). According to the firm, the digital asset investment products saw a $6.8 million inflow over 11 weeks.

Other altcoins, including Solana (SOL), Polygon (MATIC), and Uniswap (UNI), recorded minor inflows at $1.1 million, $0.7 million, and $0.7 million, respectively.

After weeks of dominating inflows, investors withdrew $13 million from Bitcoin investment products. In comparison, the short BTC investment product continued its streak of outflows with $5.5 million flows to mark the 13th consecutive week.

The assets under management for short bitcoin investments now stand at $103 million. At its peak, it accounted for 1.4% of all Bitcoin investment products. It has now dropped to 0.4%.

Coinshares stated that the outflows were primarily due to negative sentiment in the North American market, where 99% of the $21 million outflows came from. But inflows of $12 million in Switzerland and $1.9 million in Germany were able to offset the impact.

The post Bitcoin sees first outflows in a month as Ethereum, XRP enjoy investors’ confidence appeared first on CryptoSlate.

XRP’s price booked an incredible 100% gain on the same day as the landmark ruling in the XRP securities case, but buyers are now struggling to hold on to these gains.

The price surge came after Judge Analisa Torres of the United States District Court for the Southern District of New York ordered that XRP (XRP) sales to retail investors do not qualify the token as a security in the U.S. Securities and Exchange Commission’s (SEC’s) case against Ripple.

While the trading interest in XRP is reviving, the technical and network usage data hint at a short-term pullback.

According to CoinGlass data, the open interest volume for XRP futures contracts, which represents the total value of open bets for the asset, surged to its highest point since November 2021, reaching $1.19 billion on July 20.

XRP’s spot trading volumes topped Bitcoin (BTC) and Ether (ETH), and U.S.-based exchanges like Gemini and Coinbase relisted XRP, boosting the market’s sentiment further.

Despite these positive developments, the network’s activity has not witnessed a similar increase. The number of transactions on the XRP Ledger has remained consistent for over a year, indicating a scarcity of new entities actively participating in the network.

The XRP Ledger is a blockchain-based distributed ledger technology that was created by Ripple Labs. XRP is used as a payment token on the network and also used to secure the blockchain.

Since Ripple’s partial win in the lawsuit against the SEC, the firm has ramped up its efforts for XRP Ledger adoption, starting with participating in a $54 million investment in a metaverse project, Futureverse.

The firm will also seek to reestablish its ties with banks aligning with its original vision of facilitating low-cost global payments. These will likely promote the network growth of XRP Ledger and act as positive catalysts for the market.

Technically, the XRP/USD pair shows resistance from its long-term bearish trendline since the 2018 peak. A weekly close above this level should strengthen investor sentiment and mark an end to the bearish trend.

If buyers fail to maintain the bullish momentum, XRP/USD will likely revisit support around $0.54 before making a move higher.

The XRP/BTC pair is also stuck at a long-term resistance level between 0.00002533 BTC and 0.00003341 BTC. Buyers have failed to make a move above it since 2019. Failure to build support above this level can likely cause the pair to revisit support around 0.00001555 BTC.

Related: XRP price can fall 40% by September — Fractal analysis

A correction would be considered bullish if the pair finds support at the 50-period moving average (MA) at 0.00002057 BTC or the 200-period MA at 0.00001913 BTC.

As mentioned above, the futures open interest for XRP is at a two-year peak of over $1 billion in notional value. Thus, XRP will likely exhibit significant volatility in the near term.

The funding rate for perpetual swaps, which represents the relative demand for long or short orders for the token, has trended positively since the court’s iconic ruling, suggesting that most traders added long positions, once again raising the possibility of a correction to hunt the liquidation levels for overleveraged buyers.

Given the positive regulatory development, technical progress and the popularity of the token among retail users, it is likely XRP’s long-term negative trend could end in a few weeks with the arrival of positive catalysts relating to XRP’s mainstream adoption.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Bitcoin remains stuck inside a narrow range, making it difficult to predict the direction of the next possible breakout. The U.S. Dollar Index (DXY), which generally moves in inverse correlation to Bitcoin (BTC), dropped below 100, but that has failed to propel Bitcoin higher. This suggests that Bitcoin is charting its own course in the near term.

Therefore, the earnings season from big companies this week may sway equities markets in the United States but may not have the same effect on Bitcoin. It is becoming increasingly difficult to pinpoint the event or the news flow that will cause Bitcoin’s price to escape the range.

The uncertainty about Bitcoin’s next directional move has not deterred the whales. CryptoQuant’s contributing analyst SignalQuant highlighted that one on-chain indicator, the unspent transaction outputs, has been rising in 2023, similar to the increase seen in 2019. If the indicator continues to rise, it will suggest that Bitcoin has room to run and the low made in late 2022 was a long-term bottom.

Could the DXY stage a recovery? Will that limit the upside in Bitcoin and the major altcoins? Let’s analyze the charts to find out.

The S&P 500 Index (SPX) is in a strong uptrend. The price has reached resistance at 4,513, which may act as a minor hurdle. But if bulls do not give up much ground from the current levels, it will suggest that traders expect the rally to continue.

The developing negative divergence on the relative strength index (RSI) has been negated, indicating that the bulls remain in command. If buyers thrust and sustain the price above 4,513, the index could resume its uptrend and reach 4,650. This level may again act as a strong barrier.

On the way down, the 20-day exponential moving average (EMA) of 4,420 is the important support level to watch out for. If this support gives way, it will signal that the bulls may be booking profits. That may sink the price to the 50-day simple moving average (SMA) of 4,293.

The U.S. Dollar Index broke below the moving averages on July 7 and continued its downward spiral. The bears yanked the price below the vital support at 100.82 on July 12, completing a bearish descending triangle pattern.

The sharp fall of the past few days has sent the RSI into the oversold territory, indicating that a minor recovery is possible. If the price turns up from the current level, the index could retest the breakdown level of 100.82.

This remains the key level to watch for. If the price turns down from this level, it will suggest that the bears have flipped the previous support into resistance. That could start a downtrend, which could reach 97 and then collapse toward the pattern target of 93.64.

If bulls want to prevent the decline, they will have to quickly push and maintain the price above 100.82.

Bitcoin bulls have defended the 20-day EMA ($30,173) for the past three days, but a negative sign is that they have failed to start a strong bounce off it. This suggests a lack of aggressive demand at current levels.

The 20-day EMA has started to flatten out and the RSI is just above the midpoint, indicating a balance between supply and demand. That could keep the pair inside the tight range of $29,500 and $31,500 for a while longer.

Buyers will have to shove the price above $32,400 to signal the start of the next leg of the uptrend. The BTC/USDT pair could then surge toward $40,000. Instead, if the price tumbles below $29,500, the pair may skid to the 50-day SMA ($28,671).

Ether (ETH) is trying to maintain above the 20-day EMA ($1,897), suggesting that the lower levels are attracting buyers.

The bulls will try to push the price to the psychological resistance of $2,000. This remains the key level to keep an eye on because a break and close above it will clear the path for a possible rally to the $2,141 to $2,200 zone.

The crucial support to watch on the downside is the 50-day SMA ($1,853). If this level cracks, it will suggest that the ETH/USDT pair may remain inside the large range between $1,626 and $2,000 for some more time.

XRP (XRP) is finding support in the zone between the 50% Fibonacci retracement level of $0.69 and the 61.8% retracement level of $0.64.

The bulls will try to resume the up move, but they may face formidable resistance at $0.83 and again at $0.93. If the price turns down from this zone, the XRP/USDT pair may remain stuck inside a range for a few days.

Another possibility is that the price turns down from the current level and breaks below $0.64. If that happens, it will signal an urgency among the bulls to exit their positions. That could sink the pair to the 20-day EMA ($0.58).

BNB (BNB) turned down from the 50-day SMA ($253) and reentered the symmetrical triangle pattern on July 14. This shows that the bears are fiercely defending the overhead resistance at $265.

The 20-day EMA ($244) has flattened out and the RSI is just below the midpoint, indicating a balance between supply and demand. The BNB/USDT pair could oscillate inside the triangle for a few more days.

Buyers will have to propel and maintain the price above the triangle to gain the upper hand. The momentum could pick up after the bulls kick the price above the overhead resistance at $265. Alternatively, a break below the triangle will signal that the bears are back in the driver’s seat. The pair could resume its downtrend below $220.

Solana (SOL) formed an inside-day candlestick pattern on July 15 and 16, which suggests short-term uncertainty about the next directional move.

Generally, the tightening of the range is followed by a sharp breakout. If buyers thrust the price above $29.12, the SOL/USDT pair could jump to $32.13. A rally above this level could open the doors for a further rise to $38.

Contrarily, if the price turns down and plunges below $26, it will suggest that the advantage has tilted in favor of the bears. The pair could first slide to $24 and thereafter to the 20-day EMA ($22.53).

Related: Bitcoin ‘full breakout’ not here yet as BTC price spends month at $30K

Cardano’s (ADA) pullback has reached near the breakout level of $0.30. Usually, such a deep correction delays the start of the next leg of the up move.

However, the moving averages are about to complete a bullish crossover and the RSI is in the positive territory, indicating that bulls have a slight edge. If the price turns up from the current level, buyers will again try to drive the ADA/USDT pair to the overhead resistance at $0.38.

It is unlikely to be an easy path higher for the bulls. The bears will try to stall the recovery at $0.34 and again at $0.36. On the downside, a break and close below $0.30 could tilt the advantage in favor of the bears.

Dogecoin (DOGE) is witnessing a tough battle between the bulls and the bears near the overhead resistance at $0.07.

The 20-day EMA ($0.07) has started to turn up and the RSI is in the positive territory. This suggests that the bulls have a slight edge. The bulls will try to propel the price to $0.08, where the bears may again mount a strong defense.

Contrary to this assumption, if the price turns down and breaks below the moving averages, it will suggest that bears continue to sell on rallies. That could keep the DOGE/USDT pair stuck inside the $0.06 to $0.07 range for some more time.

Usually, the price turns down and retests the breakout from a pattern, and Polygon (MATIC) is doing just that. The price could drop to $0.72.

If the price rebounds off $0.72 with strength, it will suggest buying at lower levels. The bulls will then try to push the price above the overhead resistance of $0.90. If they do that, the MATIC/USDT pair could start the next leg of the up move. The first stop could be the psychological resistance of $1 and subsequently $1.20.

This positive view will be invalidated if the price continues lower and plummets below the uptrend line. The pair could then slump to $0.60.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

United States Senator Cynthia Lummis has taken to Twitter to emphasize the significance of a recent court ruling by Judge Analisa Torres, which declared that Ripple’s XRP (XRP) token should not be considered a security when sold on digital asset exchanges. Lummis highlighted that the ruling underscores the urgent need for Congress to establish a comprehensive and unambiguous regulatory framework for cryptocurrencies.

In her statement, Lummis stressed the importance of the court ruling and its impact on cryptocurrency regulation. She stated that the verdict reinforces the immediate requirement for Congress to provide a thorough crypto framework that prioritizes the safeguarding of consumers.

The Wyoming senator, who is a longstanding advocate of Bitcoin (BTC), highlighted the importance of a transparent cryptocurrency framework that would protect investors and foster innovation within the cryptocurrency industry.

Additionally, Lummis highlighted the significance of maintaining the Howey test — the legal standard used to assess whether an investment qualifies as a security. She specifically referenced the Responsible Financial Innovation Act, known as the Lummis-Gillibrand bill, a legislative initiative co-introduced by herself and Senator Kirsten Gillibrand.

My statement in response to the Southern District of New York’s ruling in Securities and Exchange Commission v Ripple Labs, Inc. pic.twitter.com/bmIxR0AmhT

— Senator Cynthia Lummis (@SenLummis) July 14, 2023

The purpose of the bill is to provide clarity and establish regulatory guidelines for digital assets, aligning them with the interpretation of the Howey test.

Lummis’s plea for congressional action holds significant merit, particularly considering the extensive implications of the legal dispute between Ripple Labs and the U.S. Securities and Exchange Commission. The outcome of this case could establish a precedent that shapes the regulatory landscape for digital assets within the United States.

The absence of well-defined guidelines leaves entrepreneurs and investors in a state of uncertainty, impeding innovation and economic expansion.

Related: US senators reintroduce crypto bill aimed at comprehensive regulation

With the ruling partially in favor of Ripple, it remains uncertain how Congress will address Lummis’s appeal for regulatory clarity in the cryptocurrency market. Nonetheless, her endeavors indicate a growing acknowledgment among legislators that the crypto industry necessitates a progressive regulatory strategy to unleash its complete potential.

Magazine: Pro-XRP lawyer John Deaton ‘10x more into BTC, 4x more into ETH’: Hall of Flame

Exchanges that delisted XRP back in 2020 in the wake of the lawsuit filed by SEC are now exploring the opportinities for XRP relisting. Among them are Gemini exchange, Kraken exchange, and Bitstamp.

On Thursday, US District Judge Analisa Torres concluded that Ripple Labs Inc violated rules when offering XRP in institutional sales, while programmatic sales were not found to constitute an unregistered securities offering.

The ruling reads:

“Based on the totality of circumstances, the Court finds that reasonable investors, situated in the position of the Institutional Buyers, would have purchased XRP with the expectation that they would derive profits from Ripple’s efforts.”

Further, it states:

“Having considered the economic reality and totality of circumstances, the Court concludes that Ripple’s Programmatic Sales of XRP did not constitute the offer and sale of investment contracts.”

In the ruling, a US judge has officially clarified that Ripple XRP does not fall under the classification of security, thus resolving the long dispute between XRP and the SEC.

Following the court’s decision that marks a milestone for the crypto industry, various crypto exchanges that suspended XRP trading and delisted the coin announced their plans to bring the currency back to their platforms. As we have reported, one of the first crypto exchanges to relist Ripple’s token is Coinbase Inc (NASDAQ: COIN). As soon as there is enough liquidity for the XRP token on its platform, it will resume trading in XRP-USD, XRP-USDT and XRP-EUR pairs.

A few other exchanges followed Coinbase, exploring the opportinities for XRP relisting. Among them are Gemini exchange, Kraken exchange, and Bitstamp. All of them withdrew their XRP listings in the wake of the lawsuit filed by the US Securities and Exchange Commission (SEC) against Ripple over its XRP sales back in 2020.

For example, Gemini delisted XRP back in December 2020. Now, the exchange is looking to bring XRP for both spot and derivatives trading. The company has taken to Twitter to make an official announcement:

Given today’s ruling that the sale of XRP on exchanges is not a security, @Gemini is exploring the listing of XRP for both spot and derivatives trading.

— Gemini (@Gemini) July 13, 2023

Further, Kraken also announced relisting of XRP on its trading platform. The exchange noted that XRP would be tradable against all fiat currency and the pairs of Bitcoin (BTC), Ethereum (ETH), and USDT.

📢 New token available for USA 🦅🇺🇸

✔️ $XRP @ripple

✔️ Trading is now LIVELearn more 👉 pic.twitter.com/qGIqqvP9FZ

— Kraken Pro (@krakenpro) July 13, 2023

Bitstamp has also resumed XRP trading, users in the US are already able to buy, sell, and trade XRP on the Bitstamp USA platform. Notably, Ripple owns a minority stake in Bitstamp.

Crypto.com and BitGo have also congratulated Ripple on the victory, expressing enthusiasm about bringing XRP back. XRP trading is already live on both the platforms.

The news had a notable effect on the price of XRP, resulting in a 30% surge immediately after the court’s ruling. The coin has rocketed by over 77% in the last 24 hours, highest since April of last year. As of the press moment, XRP is trading at $0.7814.

next

Altcoin News, Blockchain News, Cryptocurrency news, News

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

You have successfully joined our subscriber list.

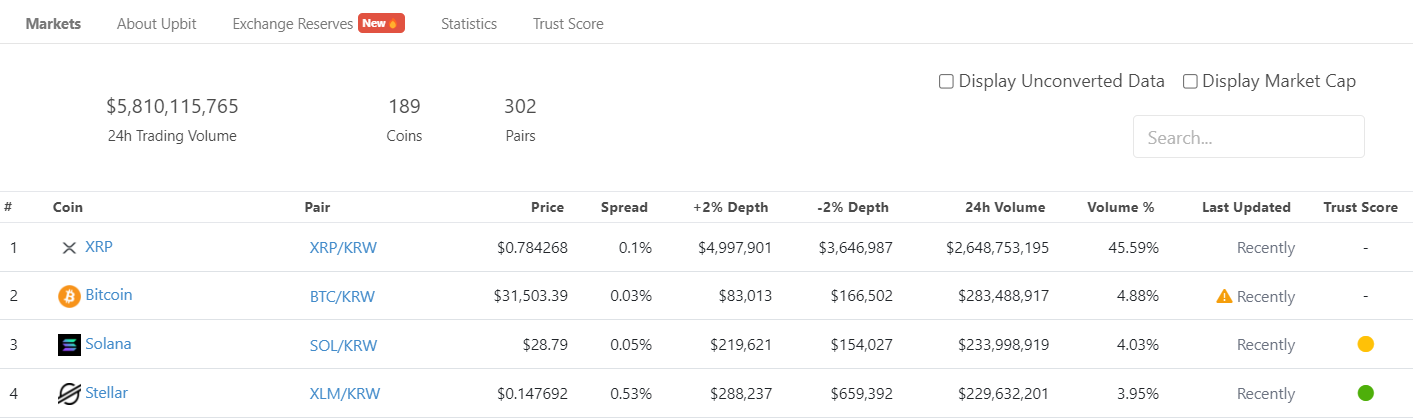

Trading volume of XRP (XRP) tokens on the South Korean crypto exchange Upbit has surpassed Bitcoin (BTC) in the past 24 hours. The XRP/KRW trading pair saw $2.6 billion in trading volume in the last 24 hours following Ripple’s partial win against the United States Securities and Exchange Commission (SEC) in its long-running court battle.

The XRP buying frenzy saw the token account for 46% of all trading volume on Upbit, followed by Bitcoin with just 5% of the total share. XRP led the bullish momentum in the crypto market in the past 24 hours, helping other altcoins hit double-digit surges.

The buying frenzy was not just limited to South Korea. XRP price saw a 92% surge on July 13, reaching a new one-year high of $0.91. This surge helped XRP to climb to fourth place in the crypto market cap rankings. Within hours of the court ruling, XRP’s market cap soared by as much as $21.2 billion to reach a new yearly high of $46.1 billion.

Related: Why is XRP price up today?

On July 13, Judge Analisa Torres issued a summary judgment in favor of Ripple Labs, ruling that the XRP token is not a security. However, the ruling refers only to the token’s sales on digital asset exchanges. The judgment was greeted with relief by the XRP community, as the SEC lawsuit filed in 2020 forced several crypto exchanges in the U.S. to delist the XRP token. Coinbase, Kraken, OKX, Gemini and other exchanges have already announced relisting plans.

The crypto community celebrated the win, with many describing it as a watershed moment, while others cautioned it was only a partial victory. Stephen Palley, a lawyer, noted that the summary judgment is only partial and that the ruling by Torres may not set a precedent. He also reminded the crypto community that the SEC may very well appeal the judgment.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: How smart people invest in dumb memecoins — 3-point plan for success