Here’s a key lesson for Financial Literacy month: Be real and study market history.

Source link

youre

Skybridge Capital Founder Advises ‘Act Like You’re Dead With Your Bitcoin and Don’t Sell’

Skybridge Capital founder Anthony Scaramucci has advised bitcoin investors to act like they are dead with their coins and not sell them. “Don’t do anything with it,” he recommended, emphasizing: “The dead people at Charles Schwab do far better than the living people.” Anthony Scaramucci’s Bitcoin Investing Advice Skybridge Capital founder Anthony Scaramucci offered some […]

Skybridge Capital founder Anthony Scaramucci has advised bitcoin investors to act like they are dead with their coins and not sell them. “Don’t do anything with it,” he recommended, emphasizing: “The dead people at Charles Schwab do far better than the living people.” Anthony Scaramucci’s Bitcoin Investing Advice Skybridge Capital founder Anthony Scaramucci offered some […]

Source link

Are You Secretly Doing Better With Your Money Than You Think? Here Are Some Signs You’re Financially Healthy

Many people worry about their finances, stressing over whether they’re saving enough, spending too much or heading toward a debt crisis.

But several often-overlooked signs may indicate that you’re in better financial shape than you realize. While having a significant nest egg or being debt-free are obvious indicators of financial wellness, there are more subtle clues that your money-management skills are on point.

Don’t Miss:

-

Are you rich? Here’s what Americans think you need to be considered wealthy.

-

The average American couple has saved this much money for retirement — How do you compare?

You Have More Than $5,000 In Your Savings

One way to gauge whether you’re in better financial shape than you realize is by looking at your savings account balance relative to national averages. The Motley Fool Ascent survey found that 71% of Americans have $5,000 or less in savings, with 41% having $500 or less set aside.

Specifically, the survey revealed:

-

11% have $0 in savings

-

30% have between $1-$500

-

8% have $500-$1,000

-

22% have $1,001-$5,000

So if your savings exceed $5,000, you are already outpacing most American households in terms of having a financial cushion. And if your balance tops $10,000, you find yourself in the minority of only 21% of people who have managed to amass a five-figure safety net.

Your Net Worth Is Above The Median For Age Group

Looking at net worth, which is the total of all assets (retirement accounts, home equity, investments, etc.) minus total debts, can provide perspective. If your net worth exceeds the median level for your age group, it signals you have accumulated more wealth than the typical household in your cohort.

For example, according to the Federal Reserve’s Survey Of Consumer Finances published in October 2023, the median net worth for ages 35-44 is $135,600. For ages 45-54 it’s $247,200. Having a net worth higher than these medians suggests you are ahead of the curve in building up a financial backbone.

Trending: Breaking records, mortgage loans generated $12.25 trillion of household debt nationwide – What are the other major categories of debt?

Your Mortgage Debt Is Less Than The Remaining Principal

With a mortgage being most families’ largest debt, having paid down more principal than what remains outstanding is an encouraging sign. Once you owe the bank less than your home’s value, you are positioned with some protective equity.

Nationally, the average mortgage debt is around $241,815, according to Bankrate. If your remaining balance is comfortably below this level, it implies you’ve made serious headway in reducing your housing debt burden.

Less Than 15% Of Your Income Is Going Toward Non-mortgage Debt Payments

Experts advise keeping consumer debt payments (student loans, auto loans, credit cards, etc.) below 15% of your gross monthly income. If you meet this threshold, it means you likely have affordable, manageable debt loads that don’t risk putting you in an overly strained cash flow situation.

For the average U.S. household income of around $70,000 per year, 15% would equate to debt payments of less than $875 per month. Lower debt obligations give you more financial breathing room.

You Have Three Months’ Worth of Living Expenses In Cash Reserves

A general personal finance rule of thumb is to have enough readily accessible cash savings to cover approximately three to six months’ worth of basic living expenses in case of job loss or income disruption. If your liquid cash reserves allow you to meet at least the lower three-month benchmark, it demonstrates an ability to weather short-term financial hardships.

Based on the average monthly expenditure of $6,081, three months’ worth of expenses would require cash savings of $18,243 to meet the lower benchmark of the three- to six-month rule of thumb for financial preparedness.

You’re Actively Contributing To Your Retirement Savings

Regular contributions to retirement accounts such as a 401(k), individual retirement account (IRA) or another pension plan are indicative of forward-thinking financial planning. Starting early and contributing consistently to your retirement savings can leverage the power of compound interest, significantly impacting your financial security in later years.

A professional advisor can analyze your current savings levels, projected retirement expenses and risk tolerance to determine whether you’re on track to reach your retirement goals or if you need to make adjustments. They can also ensure your investment portfolio is properly allocated and diversified based on your age and retirement timeline.

Making the effort to consult an adviser every few years demonstrates a commitment to objectively assessing your retirement readiness. Small course corrections now can have a significant positive impact down the road versus leaving your retirement planning on autopilot indefinitely.

Read Next:

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Jeannine Mancini has written about personal finance and investment for the past 13 years in a variety of publications including Zacks, The Nest and eHow. She is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Mancini believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Are You Secretly Doing Better With Your Money Than You Think? Here Are Some Signs You’re Financially Healthy originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Grant Cardone Says The ‘Dumbest, Most Selfish Thing A Person Could Do’ Is Start A New Business — You’re Going To Be The Slave And The Master — For Nothing’ — Here’s What He Says To Do Instead

Renowned real estate mogul Grant Cardone sparked controversy with his recent comments on entrepreneurship and business investments. On Feb. 5, Cardone posted a video on Instagram where he expressed strong opinions about the pitfalls of starting a new business.

“I wouldn’t go start a business today. Dumbest, most selfish thing a person could do,” Cardone said, emphasizing the challenges and unrealistic expectations new entrepreneurs face. “You can’t work for somebody else. How are you going to work for yourself? You don’t even know what you’re doing. You can’t even pay rent.”

He also mocked the idea of aspiring to be your own boss thinking you can make all the rules and have the freedom to call the shots.

“You’re going to be the slave and the master — for nothing,” he said.

Cardone, known for his candid and often polarizing advice, elaborated on what constitutes a successful business.

“A good business is a business that cash flows. A good business is a business that scales. … A good business is a business I could walk away from, it’s not dependent upon my ability, my talent, my skill or my body or my time,” he said, highlighting the importance of scalability and independence from the owner’s direct involvement. He pointed to real estate and banking as exemplary sectors where such business models thrive.

“Real estate is a great business,” he said.

For people seeking entry into real estate investment without the complexities of direct ownership, options such as purchasing shares in publicly traded real estate investment trusts (REITs) or engaging with crowdfunding platforms present viable alternatives. These methods allow investors to own a portion of physical properties — from rental units to commercial spaces — providing a pathway to generate income with significantly reduced responsibilities related to property management.

In addition to criticizing the startup culture, Cardone advised against the common entrepreneurial aspiration of starting from scratch. He suggested an alternative route to business ownership: buying an existing business.

According to Cardone, the U.S. market is saturated with small businesses, the majority of which are struggling or not profitable.

“There are 32 million. … And these small businesses in America, with 64% of them breaking even or losing money because it’s being incorrectly run,” Cardone said, advocating for the acquisition of businesses that already have customers, cash flow and operational systems in place.

His stance on “don’t start a business — buy a business” reflects a pragmatic approach to entrepreneurship, focusing on existing opportunities rather than the creation of new ventures. Cardone’s advice resonates with investors and entrepreneurs looking for sustainable business models in a competitive and often unpredictable market.

Regardless of people’s opinions about Cardone, he has demonstrated an ability to generate wealth. He was working as a car salesman when he ventured into his first investment: a single-family home in Houston. This foray into property investment taught him a lesson about the risks of relying on one tenant after he experienced a sudden halt in cash flow when his tenant left after seven months.

Learning from this experience, Cardone decided he would not rely on a single tenant for his income. Five years later, he shifted his focus and invested in a multifamily complex in San Diego. The move marked the beginning of a new strategy for Cardone, where he used the income from his first two properties to finance a third purchase.

Continuing with this strategy, Cardone gradually expanded his real estate portfolio. By 2012, his efforts had paid off significantly, with his company being recognized for conducting some of the largest private-party real estate transactions in Florida, particularly in the multifamily property category.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Grant Cardone Says The ‘Dumbest, Most Selfish Thing A Person Could Do’ Is Start A New Business — You’re Going To Be The Slave And The Master — For Nothing’ — Here’s What He Says To Do Instead originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Quit your New Year’s resolution. Science and social media say you’re right.

You come back from a holiday spent stuffing yourself with cookies and wondering what day of the month it is, toasting to the new year with big plans: In 2024, you’ll start working out. You’ll attempt a social life. Never again will you eat so many rich foods or wear the same pair of stretchy pants for such an embarrassingly uninterrupted period of time.

Then, a few weeks into January, reality sets in: You wake up for a 5 a.m. jog and it’s pitch black outside, the sidewalk slicked in ice. The droopy, sad-looking supermarket produce spoils your plan to eat more salads. You invite your friends out for drinks and find that no one, including you, is all that interested in leaving the house.

Welcome to the challenge of trying to reinvent your life in the dead of winter. It can be difficult enough to launch ourselves toward new goals at work, in our personal lives or with our finances at any time of year — but few of us account for the additional challenge of doing so as temperatures plunge and sunlight is still scarce.

That can hurt your self-esteem and your wallet. Many of us shell out extra cash in pursuit of a new-and-improved version of ourselves: A 2018 survey from software maker Quicken found that more than half of resolution makers spend money to stay on track — sometimes hundreds of dollars.

But if you’ve already abandoned your own New Year’s resolutions, you might just be onto something: A growing chorus of influencers, authors and experts are calling for a reframing of the way we think about the cold season. Winter is anything but the time to try and become a new you, they say. Instead, it’s the best time of year to rest and take it easy, especially on yourself.

They suggest a different way of thinking about winter, one that better reflects the natural world. Instead of goal-setting and self-discipline, embrace rest and reflection. Skip the 5 a.m. workouts for more sleep and slower mornings. Go ahead and accept that you won’t be leaving the house as much, and stock up accordingly on books, candles and other cozy comforts.

“Plants and animals don’t fight the winter; they don’t pretend it’s not happening and attempt to carry on living the same lives that they lived in the summer,” author Katherine May writes in her best-selling 2020 book, “Wintering: The Power of Rest and Retreat in Difficult Times.” “They prepare. They adapt. They perform extraordinary acts of metamorphosis to get them through.”

“Winter is a time of withdrawing from the world, maximizing scant resources, carrying out acts of brutal efficiency and vanishing from sight; but that’s where the transformation occurs,” she continues. “Winter is not the death of the life cycle, but its crucible.”

‘Acting like it’s summer’

Avoiding the impulse to reinvent yourself could help make the winter months a lot less miserable, said Ally Mazerolle, a yoga and breath-work instructor.

Her video suggesting that people take it easy this season resonated wildly on TikTok, garnering more than 1.2 million views.

In the video, she explains that one of her friends had just reached out to express that despite a packed schedule, he couldn’t escape the winter blues.

“I asked him … are you acting like it’s summer when it’s winter?” she says in the video, posted in early January. “I want to remind you that winter just started. Right now is the time for dreaming, going within, resting and taking it slow.”

Mazerolle told MarketWatch she hadn’t expected the video to strike such a chord, but that it makes sense given the pressure so many of us feel to start the new year strong.

“People are exhausted,” she said. “You get into January and the expectation is so high to reset.”

It wasn’t the only popular post calling to rethink the winter season. Author Heidi Priebe expressed a similar idea on X, the social-media platform formerly known as Twitter, receiving about 73,000 likes.

What does it mean to act like it’s winter? For Mazerolle, it means earlier bedtimes and calmer mornings. It means more nights spent inside reading or crafting vision boards, and skipping some high-intensity workouts for gentle movement like yoga, she said — “moving my body in a way that feels nourishing rather than punishing.”

“It’s not to say that you have to hibernate and not go to work,” she added. “I think we just need a bit more rest.”

“We look to winter as something to get through, and we miss the essence of the season,” she said. “When we do rest in winter, we have way more energy for the rest of the year.”

‘There’s wisdom in slowing down’

Adjusting our habits during winter isn’t a new concept.

For centuries, indigenous people in North America mirrored the cycle of the seasons, said Sarah Sunshine Manning, an indigenous writer and director of communications for the NDN Collective, an indigenous-led advocacy group based in South Dakota.

Pre-colonization, many tribal nations held ceremonies honoring the winter solstice or practiced other ways of honoring the colder season, Manning said.

“There was always intentionality of aligning your daily practice, aligning ceremony with winter — a time when animals hibernate, when the roots of plants rest beneath the soil,” Manning said. “Our lifeways mirrored that.”

Colonization and assimilation efforts severed some communities from those traditions, she added, though some continue practicing them today.

Manning, a citizen of the Shoshone-Paiute Tribes of the Duck Valley Indian Reservation, continues her own version of that custom by acknowledging the winter solstice each December. She honors the shortest day of the year by slowing down, spending time with loved ones and tending to her home.

No two tribal nations are the same, but many indigenous religions have long shared the belief that humans are not an exception to the rhythms of nature, but a part of them, Manning said. That may not be how many people operate today, but it doesn’t mean the idea is obsolete, she added.

“It was not a primitive thing to follow the seasons. It was pragmatic and spiritually sophisticated,” she said.

“As humans, we need rest,” Manning continued. “There’s wisdom in slowing down.”

The psychological argument for slowing down

That approach may in fact have a biological basis, said Michael Varnum, an associate professor of psychology at Arizona State University who has studied the impact of the seasons on human behavior.

Perhaps one of the most well-known side effects of winter is seasonal affective disorder, a type of depression that correlates with changes in the season. But many people find their moods and energy levels dropping as the temperature does, Varnum said — not just those who meet the clinical criteria for SAD.

“A fair chunk of the population will experience declines in mood: negative emotions, less energy,” Varnum said, adding that it’s likely linked to decreased exposure to sunlight.

The season shapes our behavior in other ways, he noted. Research shows that many people have a higher sex drive in the winter months, and they also tend to be more charitable, according to one study showing people offer more generous tips in cold weather.

The risk of infectious diseases also increases this time of year, and some research shows we’re more avoidant of strangers and less willing to try new things.

It’s hard to say which of these phenomena are biological versus cultural, Varnum said, but they clarify that the shift in the seasons can have a larger impact on our behavior than we realize.

“Even with all these ways we can buffer and insulate ourselves [from the weather], we still see these ebbs and flows,” he said. “These basic aspects of our behavior and how we think seem to follow these seasonal patterns. We maybe don’t take them quite as seriously as we ought to.”

The case for ditching your resolutions

If you’re still self-flagellating for leaving your 2024 goals by the wayside, it may help to know that very few New Year’s resolutions actually pan out.

That’s because setting such high-stakes, long-term goals often brings us head-to-head with a number of common missteps, said Ayelet Fishbach, a professor at the University of Chicago and the author of “Get it Done: Surprising Lessons from the Science of Motivation.”

For example, we’re often too ambitious, she said. We don’t ask for help. We slip up once — by skipping a workout, or blowing our budget — and shame ourselves into oblivion, abandoning our ambitions altogether.

Most of the time, Fishbach said, we just don’t take the time to think seriously about what it might take to change our habits — waking up early, rearranging our schedules or recruiting loved ones to support us — and therefore don’t set ourselves up for success when the going gets tough.

“When you have a long drive ahead of you, you don’t just get in the car,” Fishbach said. “You’re going to be very tired; it’s going to be hard. You need to plan the rest stops. … You need to be empathetic to your future self.”

And if you’ve ditched your New Year’s goal already, rest assured: It was “probably the wrong one,” Fishbach said. It’s time to move on to a new way of thinking about that goal, she said — one that acknowledges there will be days when you won’t feel up to giving your best effort.

“I believe that any [sustainable] change starts with loving yourself and wanting to be good to yourself,” she said.

From Mazerolle’s point of view, you might as well push the process back to the springtime.

“It’s efficient for trees to conserve their energy; for bears to hibernate. For you to push yourself at the beginning of the year is not smart,” she said. “It’s actually more efficient to rest.”

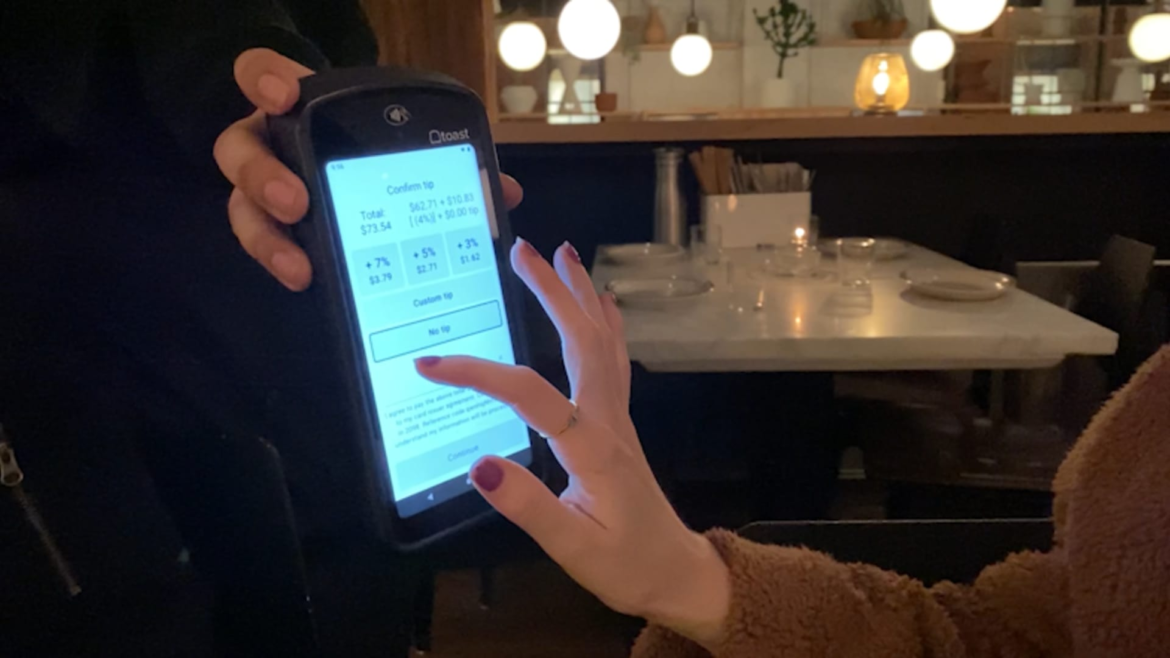

Tipping once rewarded good service. Now it predicts how you’re treated

Instacart operates similarly; shoppers see a list of batches that are available to them in their area, as well as the expected customer tip, and they may select the one they want to shop, according to the company.

Uber drivers may not see the expected tip in advance, but at one point they could see a rider’s tip history, or whether they were a “top tipper,” which may have factored into who drivers chose to pick up.

“It was a wonderful tool for a driver,” said Sergio Avedian, a driver and senior contributor at The Rideshare Guy, a blog aimed at helping rideshare drivers earn more money.

Uber phased out the top tipper rider designation earlier this year. The company did not immediately respond to a request for comment.

“Drivers depend more and more on tips these days,” Avedian said. Still, his tips average only about 12% to 13% of the fare, he estimated.

‘Tip fatigue’ is real

In most cases, consumers face more opportunities to tip for a wider range of services than ever before, a trend also referred to as “tip creep.” But recent surveys show shoppers are experiencing “tip fatigue” and starting to tip less — while resenting tipping prompts even more.

Two-thirds of Americans have a negative view of tipping, according to a report by Bankrate, especially when it comes to the predetermined point-of-sale options.

“Consumers are dissatisfied with the current state of tipping, and a lot of it has to do with being asked to give tips before service rather than after,” Lynn said.

However, tipping in advance is not entirely new, he added. “People have long given bartenders generous tips as a bribe for future services, like getting a more generous pour.”

Where to start if you’re overwhelmed by paying back your student loans

Federal student loan borrowers had payments due on their loans this October for the first time in over three years.

While many borrowers have experienced problems with repayment, like inaccurate billing statements or trouble contacting their loan servicers, most borrowers should be settling back into repayment by the end of the month.

Although some borrowers may remain optimistic their loans will one day be forgiven, financial experts say you should still be making your payments while you’re hoping and waiting.

“We’ve seen many instances where there has been partial forgiveness or some forgiveness, but by and large, really no forgiveness [for most borrowers],” Douglas Boneparth, founder and president of Bone Fide Wealth told CNBC’s Frank Holland on Tuesday during the CNBC Make It: Your Money virtual event.

“We have to take control over our student loans,” Boneparth said.

It can be stressful to think about making those payments again, especially if you were struggling to cover them before the pandemic pause or if you have other expenses now. But avoiding your student debt will only land you in more trouble down the road.

Here’s the first step to take if you’re overwhelmed by paying back your student loans, and where to go from there.

1. Find your loan servicer

“The first thing you’ve got to do is get organized,” Boneparth said. How can you repay your loans if you don’t know who’s managing them?

Federal student loans can be confusing because you take the loan out from the government, not a specific bank or private lender. But once the loan is disbursed, you’re assigned one of several federal loan servicers. So instead of getting a statement from the Department of Education each month, you get one from Nelnet, Missouri Higher Education Loan Authority or one of the other servicers.

Additionally, your servicer may change over the life of your loans. Earlier this year, millions of federal borrowers had their servicers changed when the government signed new contracts.

If you’re not sure who your loan servicer is at any point, you can log into the Federal Student Aid website to find out. Generally, you only have one servicer handling all of your loans, but there is a chance you could have multiple, according to FSA.

2. Get to know your loans

Once you know who’s servicing your loans, you can start managing them.

Boneparth recommends putting everything into a spreadsheet so you can “get to know how many loans you have outstanding and all the information around them.”

When you have multiple loans at a single servicer, you have the option to make payments individually or as a group. Your minimum monthly payment will be the total owed across all your loans. In general, your payment is applied first to any outstanding fees, then to the accrued interest, then to the principal balances.

If you pay more than your minimum payment in a month, the excess payment will generally go toward the loan with the highest interest rate first, unless you provide alternate instructions for your servicer.

3. Pick a repayment strategy

If you’re trying to get out of debt quickly though, you may explore debt payoff strategies like the debt avalanche or debt snowball methods.

With the debt avalanche, you focus on paying down the loans with the highest interest rate first. This is where that spreadsheet Boneparth mentioned comes in handy. You’d continue making your minimum monthly payments, but when you put extra money toward your debt, make sure your servicer applies it to the loan with the highest APR, if it’s not doing so automatically.

With the debt snowball method, start small by putting any extra payments toward the loan with the smallest balance first. Once it’s paid off, move to the next-largest loan. This strategy helps you build momentum to keep going.

Both are great strategies to help keep you motivated, but the debt avalanche will likely save you more money in over the long term because you focus on reducing the principal balance of the debt that’s growing the fastest. The faster you pay it off, the less interest accrues and the less you pay back in total.

Once you have a strategy in mind, you can determine if there’s a repayment plan best suited for you. The standard repayment plan will divide your loans and anticipated interest evenly over 10 years of the same monthly payment.

If your monthly payment is too high on the standard plan, you might consider an income-driven repayment plan like the new Saving on a Valuable Education plan. IDRs mean your monthly payment will change if your income changes, but they’re designed to be as affordable as possible.

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

As technology reshapes business expectations, some leaders are embracing change and transforming their organizations for the future. Join the CNBC Evolve Global Summit on November 2 to hear strategies to adapt, innovate and succeed in this new era of business. Buy your ticket here.

Leave a legacy: Use planned giving to control wealth now and give to charity after you’re gone

For those with philanthropic interests, charitable giving can be beneficial to the charity and to you as the donor. In today’s tenuous world, everywhere we turn in our country, a fire, flood, landslide or other disaster is leaving families homeless. Youth are avoiding higher education because of the cost. Disease is breaking apart families. Houses of worship are facing financial straits. Needs seem endless.

Making contributions everywhere is impossible, but did you know that with a planned giving strategy you can donate beyond your lifetime to causes that matter most to you?

People who want to give to charity but fear running out of money have options. If you are resisting giving now because you worry about needing cash, planned giving is a way to act on your interests. Planned giving can fulfill your wishes after your death while potentially receiving benefits during your lifetime — and you can still leave money to family or friends.

What if you do not feel you have the cash to donate, even post-death? You are not alone — 93% of American wealth is held in noncash assets. These types of assets include retirement investments, real estate, life insurance and privately held stock.

With some well-informed planning, however, these assets can be donated to a charity, while possibly generating additional income, receiving an income tax deduction, avoiding capital-gains taxes and saving on estate taxes.

Also see: Do you want to preserve your land? Cut taxes, not trees with conservation-based estate planning.

First, understand your options

“Planned giving should be a thoughtful process that allows someone to ponder their philanthropic passions, while considering the needs of loved ones,” said David Chadwick, a member of the gift planning team at the University of Colorado.

A variety of planned giving strategies exist, such as designating a charity through a bequest in your will or as a beneficiary to a retirement account, a life insurance policy, a charitable trust or a gift annuity.

You will likely read and hear a lot about more complex structures such as charitable gift annuities (CGA), charitable remainder unitrusts and annuity trusts (CRUT and CRAT), charitable lead annuity trusts (CLAT), among others, but do not get lost in the acronyms. The specific planned giving vehicle can be determined once you have decided on your goals. The bottom line is knowing you can give in many diverse forms and ways.

Plus: I want to give over $600,000 to my adult children. How do I ensure they don’t lose that money in the event they divorce?

Second, be realistic about giving

Cash is not “king” when it comes to supporting worthy causes. Stocks, mutual funds, real estate and retirement assets are also commonly accepted donations. Other more complex assets like life insurance and closely held business interests can be donated as well, even post-life.

With a broad range of your assets available to donate to charity, review what your expected financial needs are today and until the anticipated end of life. What income do you need annually? Are you preparing to sell a privately held business and would benefit from a tax deduction and avoidance of capital gains? Do you have a highly appreciated stock? Are you willing to part with real estate but not its income?

Once you have answers to these questions along with the details of your financial life, the potential assets and vehicles for gifting will become clear. You always get to decide what and when to give with planned giving.

Third, work with qualified experts

Your lawyer and tax professional can offer solutions and options that best serve your tax situation and assets.

“Donors with philanthropic intent can benefit at both the income and the estate-tax level,” Chadwick said. “Some of the most effective giving is made with highly appreciated assets if those assets are not needed.”

One man told his lawyer he wanted his home to go to a housing charity. He showed his estate plan to his certified financial planner, who read it carefully. That charitable point was nowhere in the plan documents. When shown the discrepancy, the lawyer responded that “his executor could take care of that” and “it is easier this way.” The gentleman got a new lawyer.

A good lawyer follows your wishes and offers perspective, but you have to read the documents before you sign them. Verify what you are signing.

Also on MarketWatch: ‘My family is dealing with a significant shock’: My father secretly married his caregiver, who is 40 years his junior. She’ll inherit $80 million. What can we do?

Fourth, involve charities you choose

Being transparent with your plan will allow you to work with the charity’s staff to fully understand that your wishes and the charity’s needs can be met.

“Non-cash assets like a limited liability company or some other closely held business interest may feel like the right thing to give, but Chadwick said, “charities usually have guidelines and policies detailing what can be accepted based on the resources and expertise available to evaluate and manage the proposed gifts.”

Ruth Henry, the senior philanthropic adviser at Vermont Community Foundation, adds, “Plus, the donor wants to be sure the organization can fulfill their intentions.”

A charity may be restricted in how it distributes the money flowing through its doors. You want to be sure your charitable mission is possible. In addition, charities may have pre-existing strategies to improve upon your ideas.

Henry encourages working with a philanthropic adviser whose expertise can ease the way in planning for your bequest. This more holistic approach allows you to work with an expert and develop an estate plan that will benefit a range of the causes you wish to benefit.

The flexibility this approach offers includes the ease of changing charities over time and your adviser’s knowledge of the industry and charitable tools to meet your needs.

Don’t miss: I’m retiring at 65 with $2 million, an $850,000 home and $3,500 a month in Social Security. Should I follow the 4% rule if I don’t want to leave an inheritance?

Finally, tell your heirs about your plan

Your philanthropic interests and plans should not be a surprise to family after your death. They need to know why you decided to do this and what the overall process is. Otherwise, if they want to challenge the bequest they can, tying up your assets and reducing the charity’s financial benefit. Numerous donors’ families have been known to challenge bequests after death. Even if you think, “This will never happen to my family,” have this conversation before finalizing any bequest or other planned giving structure.

Donating post-death through one’s estate plan accomplishes three basic goals:

- Keeps money in your control during your lifetime.

- Allows your assets to benefit a charity of your choice at your death.

- Creates a vehicle to save estate taxes for your heirs.

Planned giving is a beneficial way to leave a positive legacy. Giving wisely and strategically is not difficult but does require thought, time and professional assistance. With the right commitment, your donation will benefit others long after you have passed from this world. If you plan now.

C.D. Moriarty, CFP, is a Vermont-based financial speaker, writer and coach. She can be found at MoneyPeace.com.

This article is reprinted by permission from NextAvenue.org, ©2023 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue: