Marathon Digital Holdings, one of the world’s largest public Bitcoin mining companies, has announced its work on Anduro, a multichain, layer two platform on top of Bitcoin. With Anduro, Marathon proposes the creation of several sidechains designed to expand Bitcoin’s standard functionality and attract activity previously directed to other chains. Marathon Announces Anduro to Expand […]

Marathon Digital Holdings, one of the world’s largest public Bitcoin mining companies, has announced its work on Anduro, a multichain, layer two platform on top of Bitcoin. With Anduro, Marathon proposes the creation of several sidechains designed to expand Bitcoin’s standard functionality and attract activity previously directed to other chains. Marathon Announces Anduro to Expand […]

Source link

advance

Edward Snowden Calls Bitcoin ‘Most Significant Monetary Advance Since the Creation of Coinage’

Edward Snowden, a privacy advocate and former National Security Agency (NSA) contractor and whistleblower, says bitcoin “is the most significant monetary advance since the creation of coinage.” He views his statement as “unpopular but true.” Edward Snowden’s ‘Unpopular but True’ Bitcoin Statement Edward Snowden, a privacy advocate, posted about bitcoin on social media platform X […]

Edward Snowden, a privacy advocate and former National Security Agency (NSA) contractor and whistleblower, says bitcoin “is the most significant monetary advance since the creation of coinage.” He views his statement as “unpopular but true.” Edward Snowden’s ‘Unpopular but True’ Bitcoin Statement Edward Snowden, a privacy advocate, posted about bitcoin on social media platform X […]

Source link

EOS Network Ventures Awards NoahArk Tech Group $2.4M to Advance DeFi on EOS

With funding courtesy of ENV in place, Defibox and Noahark will be able to take these features to the next level.

EOS Network Ventures (ENV), the primary steward of the EOS network, has announced a major grant to accelerate DeFi adoption. $2.4 million has been invested by ENV into NoahArk Tech Group to allow decentralized applications on EOS to flourish.

The product of a joint enterprise between Defibox Technology and Hong Kong Noah Technology, NoahArk Tech Group is intent on growing the EOS ecosystem with a particular focus on DeFi. Decentralized finance has been slow to take off on EOS compared to other chains, but over the last 12 months, EOS Network Ventures has been making up for lost time.

More DEX, More DeFi

A good decentralized exchange is the foundation of all DeFi activity. Build it and everything else – lending platforms, liquid staking, perps, prediction markets – will follow. Ethereum has Uniswap. Avalanche has TraderJoe. Now EOS is determined to create some major DeFi protocols of its own which is why ENV has made such a considerable investment in NoahArk.

Funds will be directed at Defibox.io and Noahark.io, two of the leading DeFi platforms on EOS EVM. The EOS EVM, which runs in tandem with the main EOS chain, is ideally suited to decentralized finance thanks to its Ethereum compatibility. This makes it easier for users to bridge ERC20 tokens from other EVM chains. It also makes it easier for Solidity devs to create applications on EOS EVM or to port existing ones.

Bringing Deep Liquidity to EOS

For DeFi to be widely utilized on any network, several properties are desirable. Firstly, liquidity needs to be deep enough for users to trade with size. DEXes that can absorb large market orders without buckling will ensure that prices don’t get significantly out of sync with the rest of the market any time a whale enters the game.

The second property required for DeFi to flourish is good tooling and protocols that allow crypto assets to be used to full effect. Defibox and Noahark have already provided a foundation for economic activity to take place on the EOS EVM. Both platforms support swaps, lending, and flexible EOS staking. With funding courtesy of ENV in place, Defibox and Noahark will be able to take these features to the next level.

As NoahArk Tech Group CEO Eason explains:

“This investment from EOS Network Ventures, coupled with the reorganization of Defibox.io and Noahark.io, marks a transformative phase for the EOS DeFi ecosystem. In this new phase, the EOS EVM will significantly enhance our operational capabilities, making it easier for established products and developers to participate and enabling the fluid movement of various assets through cross-chain bridges.”

This calls for a combination of the right tech and the right talk. In other words, messaging needs to accompany the infrastructure improvements, so that users are aware of what they can do on EOS EVM and how this compares to other EVM chains.

Or as ENV’s Yves La Rose puts it:

“This move is more than just financial support; it’s a commitment to driving growth and new developments in DeFi. We see NoahArk Tech Group as a key player in enhancing decentralized exchanges and our strategic vision is to support the creation of more interconnected and user-friendly DeFi services, benefiting the entire sector.”

What’s good for NoahArk Tech Group should prove good for EOS users in 2024.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Micron shares advance on ‘better-than-anticipated’ results, strong guidance

Micron Technology Inc.’s stock climbed nearly 5% in after-hours trading Wednesday after the company posted quarterly results that topped analysts’ revenue and earnings estimates.

The maker of computer memory and data storage reported a fiscal first-quarter net loss of $1.23 billion, or $1.12 a share, compared with a net loss of $1.43 billion, or $1.31 a share, in the same quarter a year ago. Adjusted earnings were a loss of 95 cents a share.

Revenue improved to $4.73 billion from $4 billion in the year-ago quarter.

Analysts surveyed by FactSet had expected on average a net loss of $1.01 a share on revenue of $4.58 billion.

“Micron’s strong execution and pricing drove better-than-anticipated first-quarter financial results,” Micron Chief Executive Sanjay Mehrotra said in a statement announcing the results.

Micron provided second-quarter sales guidance of roughly $5.3 billion, while FactSet analysts are forecasting $4.97 billion.

Shares of Micron

MU,

have soared 57% this year, while the broader S&P 500 index

SPX

has increased 22%.

Ordinals-based Tap Protocol Raises $4.2M to Advance Bitcoin Adoption

Tap Protocol seeks to continue building new Bitcoin applications, ranging from fractionalization of Ordinals art and token functions for gaming applications.

Trac Systems, a German-based company and the parent entity of Tap Protocol, recently announced the completion of a funding round where it pulled the sum of $4.2 million from investors. The funding round was led by Sora Ventures and the capital raised is earmarked for the continued development of the company’s initiatives, particularly in the Bitcoin (BTC) ecosystem.

Trac Systems Funding: Ultimate Goal

Trac Systems has been gaining attention for its innovative approach to blockchain technology, and this recent injection of capital is poised to accelerate its efforts. The blockchain startup’s Tap Protocol focuses on leveraging the capabilities of the Bitcoin blockchain through the Ordinals system.

Interestingly, the $4.2 million fund will be instrumental in fostering innovation and contributing to the broader ecosystem of applications built on the Bitcoin blockchain. As highlighted by the firm, the fund will likely empower Tap Protocol to refine its infrastructure, enhance user experience, and explore novel applications within the Bitcoin ecosystem.

Notably, the company has revealed several applications that have seen the light of day in the Ordinals world through the Tap Protocol. Also, Benny the developer and CEO of Trac Systems, noted that the platform will be utilized for tokenization, gamification, and Decentralized Finance (DeFi).

Meanwhile, the decision to develop BTC is noteworthy, considering the cryptocurrency’s reputation as a secure and decentralized network. While many blockchain projects have emerged on alternative platforms, Trac Systems’ focus on BTC underscores a commitment to the principle of security and decentralization.

Bitcoin’s Utility Extends Beyond a Store of Value

While some criticize Ordinals and NFTs as unnecessary congestion on the BTC network, supporters of the move see them as a way to expand the utility of Bitcoin and showcase its possibilities beyond just storing value. Beyond this, Tap Protocol also seeks to continue building new Bitcoin applications, ranging from fractionalization of Ordinals art and token functions for gaming applications.

Recall that in November, Taproot Wizards secured new funding to further develop the BTC ecosystem. The $7.5 million fundraising led by Standard Crypto will help Taproot Wizards bring together developers to build different applications and solutions on top of the Bitcoin Base layer that will maximize the potential of the Taproot upgrade carried out in 2021.

Additionally, the project aims to foster an ecosystem where Bitcoin developers can freely collaborate to push the boundaries of what is possible on the blockchain. It also focuses on enhancing scalability and privacy for the Bitcoin network using innovations like zero-knowledge (ZK) proofs and layer-roll-ups.

As traditional financial institutions and seasoned investors recognize the transformative potential of blockchain, companies like Trac Systems and Taproot Wizards have become beneficiaries of a favorable funding environment. Also, the funds position Trac Systems and its outfit, Tap Protocol, as key players in the evolving world where more utilities are making their way to Bitcoin.

next

Bitcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Fidelity pitches spot Bitcoin ETF model to SEC as regulatory talks advance

The U.S. Securities and Exchange Commission (SEC) disclosed on Dec. 7 that it met with Fidelity regarding the firm’s spot Bitcoin ETF application.

The securities regulator said that several members of its Division of Corporate Finance met with members of Fidelity on the day of the notice’s publication. Several members of CboeBZX also attended the meeting as well.

The focal point of the meeting was a proposed rule change, allowing CboeBZX to list and trade shares of Fidelity’s Wise Origin Bitcoin Trust.

Fidelity’s ETF model provides exposure to the cryptocurrency through a structure involving industry players with distinct roles. Authorized participants and broker-dealers interact with issuers and custodians to create and redeem ETF shares, facilitating market flow. Unregistered crypto affiliates hold and transfer the actual bitcoin tied to the ETF per creation/redemption orders. This intermediary setup allows market participants to gain price exposure without directly handling cryptocurrency.

SEC has met with other ETF firms

Recent reports suggest that talks between the SEC and applicants are now in advanced stages that concern “key technical details.” Unnamed sources, who asked to speak anonymously, told Reuters that the SEC is likely to approve the relevant ETF applications soon.

The SEC itself has disclosed meetings with other spot Bitcoin ETF applicants in recent weeks. The agency’s latest meeting with BlackRock also compared cash and in-kind models.

Statements from Bloomberg ETF analyst Erich Balchunas in November suggested that cash models may be preferable to in-kind models because some brokerages may find it difficult to carry out Bitcoin transactions under current U.S. regulations. However, more recent reports from Bloomberg ETF analyst James Seyffart suggest that some proposals will allow both options.

Balchunas and Seyffart also estimated a 90% chance that a spot Bitcoin ETF will be approved by January 2024.

The post Fidelity pitches spot Bitcoin ETF model to SEC as regulatory talks advance appeared first on CryptoSlate.

Binance representatives tipped off VIP traders about impending DOJ settlement in advance: Bloomberg

30As negotiations between Binance and U.S. authorities over legal violations came to a head in September, select high-value traders got an inside look at what was to come, according to new reporting from Bloomberg.

According to unnamed attendees of a Binance-hosted dinner in Singapore, company representatives suggested to VIP traders that Binance would likely pay around $4 billion to settle and survive its legal troubles with the Department of Justice. These personnel allegedly suggested the firm could afford to pay the penalty.

Binance has disputed these characterizations of the event but declined to clarify further.

Reckoning

In November, just two months later, Binance CEO Changpeng Zhao entered a guilty plea in a U.S. federal court for charges related to money laundering. Zhao stepped down as CEO as part of his plea agreement, while the company was fined $4.3 billion.

According to the U.S. Department of Justice (DOJ), Binance committed numerous financial crimes over the years, including failing to register as a money transmitter despite significant U.S. operations. It further alleged that Binance violated sanctions requirements, anti-money laundering rules, and know-your-customer protocols. Though Binance claimed to block U.S. users in 2019, the DOJ said it secretly kept providing services to critical high-net-worth traders.

The $4.3 billion settlement with the DOJ closes just one chapter of Binance’s ongoing legal saga. The Securities and Exchange Commission has filed separate charges against Binance, its U.S. affiliate BAM Trading, and founder Changpeng Zhao. The SEC alleges that Binance and its U.S. affiliate, BAM Trading, operated unregistered exchanges, broker-dealers, and clearing agencies while selling unregistered securities, including the BNB token and stablecoin BUSD, among other violations.

Zhao was succeeded as CEO by Richard Teng, who has held a number of leadership roles in the Binance organization since 2021. In a letter to VIP clients, incoming Teng expressed plans to deepen relationships as Binance enters its “best days” ahead. However, with some lawsuits still pending, storm clouds remain on the horizon.

Bitcoin-Focused Project Taproot Wizards Raises $7.5M to Advance BTC Innovation

Taproot Wizards seeks to bring together developers to build different applications and solutions on top of the Bitcoin Base layer that will maximize the potential of the Taproot upgrade carried out in 2021

To strengthen the innovations in the world of Bitcoin, Taproot Wizards secured new funding to further develop the BTC ecosystem. The successful raise shows increasing momentum and interest in expanding Bitcoin’s capabilities beyond being only a store of value.

HOLD ON TO YOUR WIZARD HATS!

Today we are announcing a $7.5M seed round, led by @standardcrypto, to Make Bitcoin Magical Again

We broke the chain, we danced on stage, we took showers

We heard about bitcoin 10 years ago. And WE’RE HERE TO FIX IT

More in the thread below 🧙♂️ pic.twitter.com/xoNho6EKhs

— Taproot Wizards (@TaprootWizards) November 16, 2023

Taproot Wizards has been burdened with moves encouraging innovation in the Bitcoin protocol since its inception. The project’s NFT collection features whimsical wizard characters as a nod to the early “magic internet money” meme from Bitcoin’s cypherpunk days. The just-concluded $7.5 million funding round was led by Standard Crypto, a venture capital firm focused on Bitcoin development. Several other leading crypto investors, including StarkWare, Collider Ventures, and UTXO Management, also participated in it.

Taproot Wizards seeks to bring together developers to build different applications and solutions on top of the Bitcoin Base layer that will maximize the potential of the Taproot upgrade carried out in 2021 to enhance BTC’s privacy, security, and efficiency. Taproot introduces the ability for complex smart contracts to execute on the Bitcoin blockchain in a privacy-preserving manner.

Taproot Wizard co-founder Udi Wertheimer, commented about the move as he said:

“We went for a larger seed round of $7.5 million because we feel time is of the essence. We’ve been bullish on bitcoin for a decade, but we genuinely believe that the best time to build in bitcoin is now. We’re focusing on adopting the best breakthroughs in broader crypto research to advance bitcoin and ordinals, for example, the open-source rollup work we’ve shared a couple of months ago, and will use this funding to build a team of top-notch bitcoin builders.”

A key focus area for this project is enhancing scalability and privacy for the Bitcoin network using innovations like zero-knowledge proofs and layer-2 rollups. These solutions can carry out private and complex transactions on Bitcoin without burdening the base layer. Taproot Wizards has already released open-source rollup code to advance scalability.

Additionally, the project aims to foster an ecosystem where Bitcoin developers can freely collaborate to push the boundaries of what’s possible on the blockchain. They view the early Ordinals movement as having reignited innovation in Bitcoin, which had stagnated recently as Bitcoin focused mostly on its “digital gold” narrative.

Bitcoin’s Utility Can Go Beyond Being a Store of Value

While some criticize Ordinals and NFTs as unnecessary congestion on the Bitcoin network, supporters of the move see them as a way to expand the crypto’s utility and showcase its possibilities beyond just storing value. Beyond this, Taproot Wizards also seeks to continue building new Bitcoin applications, ranging from NFTs and decentralized identities to private payments and smart contracts.

With its strong technical team and good funding, Taproot Wizards is ready to accelerate innovation on Bitcoin. As the protocol continues to mature and more developers build on the blockchain, the next phase of Bitcoin’s evolution may be driven by builders expanding its utility beyond just a digital asset.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

This is reprinted by permission from .

When Conner Smith saw an Instagram ad in early 2021 from the mobile app EarnIn offering to let him access up to $100 from his paycheck before payday, he thought it would be a convenient way to pay for a night out.

About a year and a half later, the Georgia resident says, he was in a “vicious cycle”…

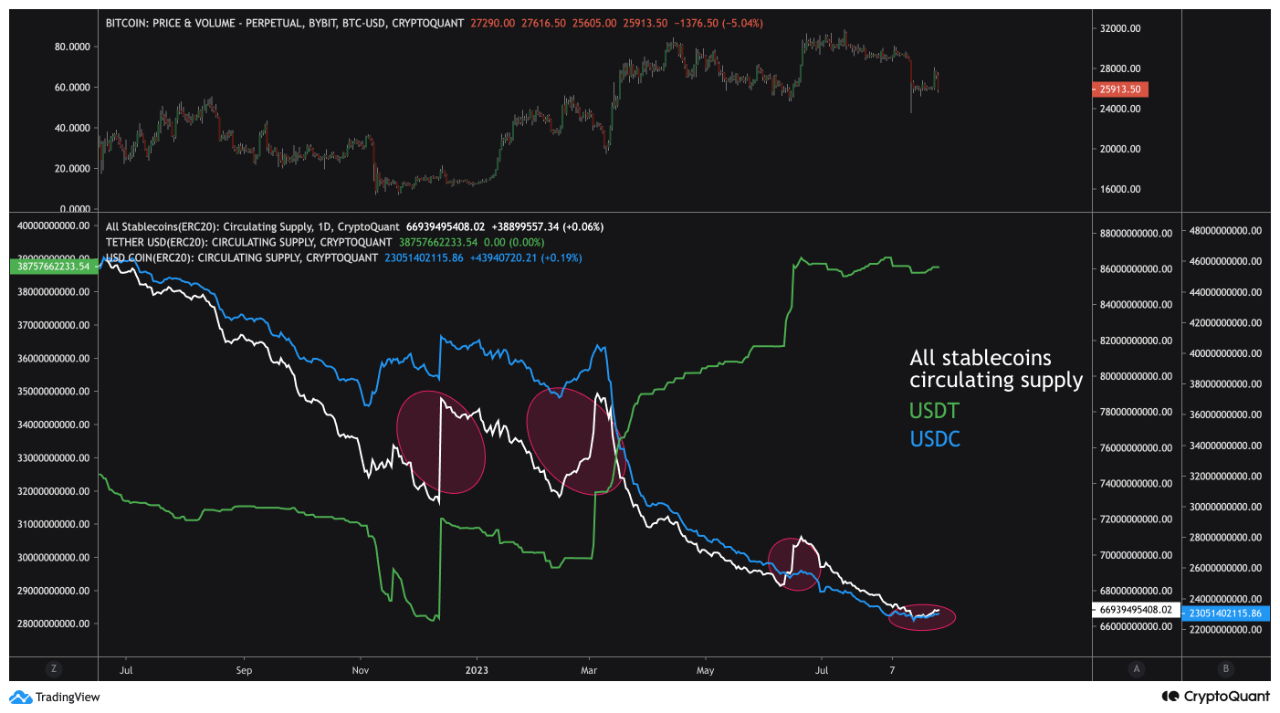

The trend in the total supply of the stablecoins may have hinted in advance that the Bitcoin rally wouldn’t last too long.

Bitcoin Stablecoins Supply Hasn’t Moved Much Recently

An analyst in a CryptoQuant Quicktake post explained that the latest news has been unable to make the stablecoins supply budge. The “stablecoins supply” here refers to the total circulating supply of all stablecoins in the sector.

Generally, investors use stables to escape the volatility associated with most coins in the rest of the cryptocurrency sector. Thus, whenever this metric rises, new tokens of the stablecoins are being minted because there is a demand for converting to them from the other assets or fresh demand is coming into the market.

Such investors who seek safety in these fiat-tied tokens usually do so because they don’t want to exit the cryptocurrency sector completely; they only require a temporary place to station their capital.

When these holders eventually find that the prices are right to jump back into the volatile coins like Bitcoin, they swap their stablecoins into them, thus putting buying pressure on their prices.

Now, here is a chart that shows the trend in the stablecoins supply over the past year:

The value of the metric seems to have been heading down in recent days | Source: CryptoQuant

In the graph, the quant has marked a specific correlation between the Bitcoin spot price and the stablecoin supply. It would appear that all the major increases in the former during the past year have come following rises in the latter metric.

There are three instances of this trend in this period: the first formed before the January rally, the second before the March rebound, and the third before the June surge.

From the chart, it’s apparent that the price increase in the asset wasn’t caused by the increases in the supply of the stables but rather the decline in them that followed afterward.

The increases in the supply of the stablecoins likely occurred because of fresh capital injections. When this new capital was deployed into Bitcoin and the others (when the indicator declined), the assets obtained the fuel for their rallies.

With the most recent rally in the asset instigated by the news of Grayscale’s victory against the US SEC, there was no such pattern in the supply of these fiat-tied assets.

This may have been one of the early signs that the rally wasn’t backed by constructive market growth, as the stablecoins supply has only been moving sideways. The Bitcoin retrace below the $26,000 level may have only been a natural consequence of this weak structure.

BTC Price

Bitcoin had earlier fully retraced the gains of the Grayscale rally, but it would appear that the decline isn’t over just yet, as the asset has now gone below the $26,000 level it had been at before the surge.

BTC has plunged during the past couple of days | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, CryptoQuant.com