The United States, United Kingdom, and Germany rank among the top countries holding cryptocurrencies at the government level, according to data from Arkham Intelligence. The crypto analytic firm’s onchain analysis shows that the U.S. government holds 212,847 bitcoins while El Salvador has been purchasing one bitcoin daily as announced by its president. Top Government Holders […]

The United States, United Kingdom, and Germany rank among the top countries holding cryptocurrencies at the government level, according to data from Arkham Intelligence. The crypto analytic firm’s onchain analysis shows that the U.S. government holds 212,847 bitcoins while El Salvador has been purchasing one bitcoin daily as announced by its president. Top Government Holders […]

Source link

among

Over the past week, the stablecoin trueusd (TUSD) experienced a notable decrease in its supply. As of March 19, 2024, the circulation was approximately 1.1 billion TUSD, which then plummeted to just 612 million. Supply Slash Sees TUSD Fall From Top 5 Stablecoin Rankings to 8th Position Previously ranked among the top five dollar-pegged cryptocurrencies […]

Over the past week, the stablecoin trueusd (TUSD) experienced a notable decrease in its supply. As of March 19, 2024, the circulation was approximately 1.1 billion TUSD, which then plummeted to just 612 million. Supply Slash Sees TUSD Fall From Top 5 Stablecoin Rankings to 8th Position Previously ranked among the top five dollar-pegged cryptocurrencies […]

Source link

Retirement is becoming just the ‘third half’ of life. Here are the 4 key mindsets we’ve identified among the new generation of retirees

The idea of retirement as envisioned by our parents is undergoing a radical change. Once viewed as the last chapter before death, it has now morphed into an intermediate phase that is no longer synonymous with old age or complete inactivity. Today, a typical retiree can reasonably expect to live another 20 to 30 years, ideally in good health, provided they continue to exercise both body and mind. In this context, the word “retirement” seems obsolete. It is perhaps more fitting to refer to it as the “third half” of life.

However, retirement often entails a profound change of identity, especially if work played a substantial role in shaping one’s identity. Losing much of what defines us while still possessing the energy and desire for a working life can be profoundly disorienting.

Getting the transition to retirement right is vital for retirees, their colleagues, and organizations. Through our research and interactions with professionals navigating this shift, we have pinpointed four psychological mindsets associated with the transition to retirement.

The switch

Vanessa was a partner in an audit firm in Paris. At the age of 51, she decided to cease her professional activity. “I was getting old and realizing it,” she says. She gave herself two years to organize her succession and slowed down, changing her occupation day by day.

“Things had changed in my head; it had become difficult to stay at 100%,” she says, adding that she was thinking about her “future job.” A year after her retirement, she remains active, but in a different field, now running a bed and breakfast hotel in Marseille. She takes daily walks to the market to source produce for her guests, and winters in the southern hemisphere for two months during the winter lull.

“Switch” professionals like Vanessa describe a natural transition to their “third half” identity. The common feature among them is how carefully they prepare with small incremental changes and open discussions about their plans. They seem to have departed from their former professional identity without regret, moving towards a new identity that they may not idealize but recognize for its positive benefits.

Transcendence

Denis retired a year ago. He is critical of his former professional environment, where he feels there is still a strong “alpha male” culture and excessive professional commitment. Nevertheless, he serves as a non-executive director of various organizations, one of which is a former client of his.

Other aspects of his work, however, are completely new to him. He has learned to cede executive control and take a position of oversight, which is both rewarding and different. Above all, he has adopted a holistic approach to life, leaving more room for what he finds deeply fulfilling and interesting. For instance, he takes pleasure in coaching a junior basketball team in his spare time.

Individuals who are “transcending” share similarities with professionals going through a rapid “switch.” However, the distinction lies in their desire to maintain a professional identity and shift in steps. They exist in a liminal stage, straddling between two places. Even if they are ready to engage in new activities, they do not wish to completely give up their professional lives, whether in terms of activities or the customers they serve. They have one foot in the new and one still in the old, offering a sense of psychological stability and solace.

Regret

Gregory, a former accounting partner, retired and became an independent consultant. He left at the mandatory age of 55 years old, relatively disillusioned but in good health. Relieved to have left the political aspects of his former organization behind, he is bitter about his new role, which he expected to have more purpose. He feels alone and lacks administrative support. To Gregory, enforced retirement felt like a schism.

Much like the “transcending” retirees, those in the “regret” mindset find themselves stuck in the middle between their professional and retiree identities. Their choice seems more painful, caught between two identities that they fundamentally dislike. Two common characteristics include a form of pessimism regarding their future and a lack of attachment to their current professional identity.

Although they are often strongly critical of their former role, they would have stayed in their profession if they had been given the choice. In short, they are deeply ambivalent and in a subdued emotional state. The former working identity was known but unwelcome, whereas the anticipated identity as a retiree remains vague and induces anxiety.

The false start

Akiko reached an agreement with their law firm before leaving, allowing them to continue the activity of counsel and work with their team and clients. Knowing that they would remain with their organization, they did not prepare for retirement. “It’s a bit egotistical… What am I supposed to do? Be like the mastermind that liquidates itself?”

Akiko has maintained elements of their prior role, including the pension plan, office, and parking space under the building. People who “false start” struggle to let go of their attachments, move on, make themselves redundant, and properly plan for succession. There seems to be a denial of the need to bring new generations into the mix. They never really leave the starting blocks, hardly shedding their professional identity. Their day-to-day activities are very similar to the ones they have been doing until now. Instead of accepting their status as retirees, they deliberately, and often to their detriment, find themselves incapable of letting go of their profession.

Why retirement matters and what to do about it

Future retirees are often disoriented and relatively anxious about this new phase in their lives. As a result, organizations must carefully consider their approach to dealing with this segment of their talent pool. Should they opt to let them go completely, or do they see an advantage in maintaining a close relationship to benefit from their experience, knowledge, or network? To support and guide them toward the chosen strategy, organizations might consider the following initiatives:

Demystify procedures and guidelines

Given that retirement remains a taboo subject in many organizations, with expectations, procedures, and available options often unclear, it is important to be transparent about the company’s strategy.

Discussing the consequences of retirement together allows both parties to prepare. This can include conversations about financial considerations, access to the workplace, participation in events, and use of email. Financial incentives could be structured to discourage people from “hanging on” indefinitely.

Celebrate and honor the retiree

Organized programs can initiate and support the transition into retirement, as well as an event to say goodbye and honor their legacy. This experience can be positive for both those leaving the organization and their colleagues. Sabbaticals near the end of the executives’ tenures can provide a psychological release to explore new horizons. Assigning people ambassadorial roles at conferences and other visible and high-status events also sends an appropriate signal to the market and the individual.

Provide support

Providing people with time for reflection and creating a space for reflective practice is essential to help them prepare for retirement. Individual coaching or, better still, group coaching, can be invaluable in this regard. This allows them to reflect on their transition, verbalize their feelings and misgivings, and receive the advice and benchmarking they may need.

Despite being laden with anxiety, the so-called third half can be the most glorious chapter of life. Liberated from the shackles of insecurity and aware of their competencies and strengths, people can be empowered to contribute to broader social systems. Rather than perpetuating a taboo, healthy companies address the subject early, identify the specific mindset of each individual, and gently guide them towards a different and more constructive future.

Graham Ward is an adjunct professor of organizational behavior at INSEAD and the director of the Challenge of Leadership program for C-level executives. Isabelle Lebbe is a partner in the investment management practice of Arendt & Medernach.

More must-read commentary published by Fortune:

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

Cardano (ADA) is among the few cryptocurrencies that are still observing loss-taking being the dominant behavior among investors.

Bitcoin & Ethereum See Profit-Taking, While Cardano Is Seeing Capitulation

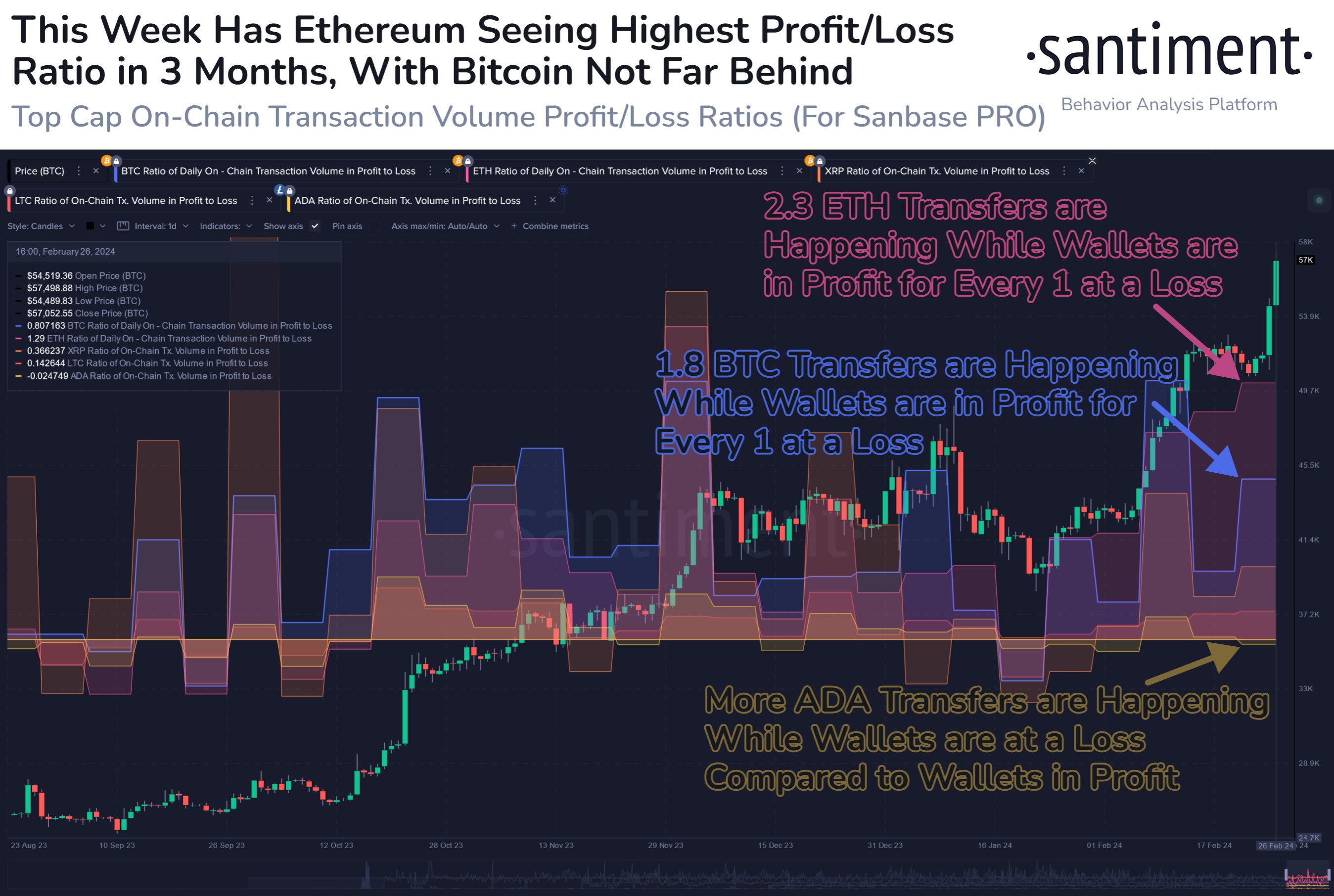

According to data from the on-chain analytics firm Santiment, Bitcoin (BTC) and Ethereum (ETH) have both been seeing the investors majorly selling at profits, while Cardano has seen the loss-taking outweigh the profit-taking.

The indicator of interest here is the “Ratio of Daily On-Chain Transaction Volume in Profit to Loss,” which, as its name already suggests, tells us about how the loss-taking volume of any asset compares against its profit-taking volume.

This metric works by going through the transaction history of each coin currently being moved on the blockchain to see what price it moved at before this. If the previous transfer price for any coin was less than the spot value it is being sold at now, then its sale is contributing towards the profit-taking volume.

Similarly, the coins of the opposite type (that is, those with last price higher than the latest transfer price) add to the loss-taking volume. The indicator takes the total volume of each type and outputs their ratio.

Now, here is a chart that shows the trend in this ratio for a few different top cryptocurrencies over the last few months:

The value of the metric seems to have been greater than one for most of these assets recently | Source: Santiment on X

As displayed in the above graph, all of these assets, except for Cardano, have their Ratio of Daily On-Chain Transaction Volume in Profit to Loss sitting at positive values right now.

Such values of the metric imply the profit-taking volume is currently greater than the loss-taking volume for these assets. Ethereum, in particular, seems to have been observing the most aggressive profit-taking spree recently, as the cryptocurrency has been seeing about 2.3 green transactions for every underwater movement.

Bitcoin is seeing the second-highest ratio, with 1.8 profit-taking transactions taking place for every loss-taking transfer. It’s much more balanced for the altcoins, however, as XRP (XRP) and Litecoin (LTC) have only been witnessing minimally higher dominance of profit selling.

Cardano has outright been seeing the loss-taking volume pulling ahead of the profit-taking one, implying that the investors have been going through capitulation. These loss sellers may be ditching the asset in favor of Bitcoin and others, who have offered greener pastures recently.

Historically, the dominance of profit-taking has been something that has led to tops for cryptocurrencies. Loss-taking, on the other hand, has often facilitated bottoms to form as weaker hands flush out in such events and stronger, more resolute investors take their coins.

As such, Cardano has been behind the other top coins in this metric recently may mean that the coin could still have the potential to rise, whereas the others may be nearing possible tops.

ADA Price

While Cardano has performed worse than the likes of Bitcoin and Ethereum recently, its returns have still not been that bad as the asset is up 8% over the past week and trading around $0.63.

Looks like the price of the asset has been surging recently | Source: ADAUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Quick Take

According to Nate Geraci, President of the ETF Store, 2024 has marked a significant year for Bitcoin Exchange-Traded Funds (ETFs), particularly BlackRock IBIT and Fidelity FBTC. Geraci highlights these two Bitcoin ETFs as standing among the top 8 in terms of ETF inflows this year, a notable achievement considering the diverse ETF landscape.

CryptoSlate data on Feb. 21 reveals that IBIT has experienced net inflows totaling $5.5 billion, while FBTC has witnessed net inflows of $3.7 billion. These impressive numbers are in the company of inflows seen by three S&P 500 ETFs (VOO, IVV, & SPLG), the QQQ, Vanguard Total Stock Market ETF (VTI), and the iShares S&P 500 Value ETF (IVE), according to Geraci.

The success of IBIT and FBTC is further demonstrated by the combined net inflow of all spot US Bitcoin ETFs surpassing the $5 billion inflow benchmark. However, it is vital to quantify this success in a broader context. The aggregated investment across all Bitcoin US ETFs is estimated at around $41 billion.

Their success highlights the growing acceptance of Bitcoin as an asset and the potential future of ETFs in the digital asset space.

The post Two Bitcoin spot ETFs rank among top 8 for ETF inflows in 2024 appeared first on CryptoSlate.

Spot Bitcoin ETFs were among best ETF launches of all time: 21Shares president

Ophelia Snyder, co-founder and president of 21Shares, called spot Bitcoin ETFs a success during an interview with Bloomberg on Jan. 30.

21Shares is responsible for a joint spot Bitcoin ETF with Ark Invest, one of several approved by the U.S. Securities and Exchange Commission (SEC) on Jan. 10.

Snyder commented on those approvals, stating:

“At the end of the day, these flows have been really promising. It’s one of the best ETF launches of all time. We’ve seen north of $600 million in assets come into our product just in the last couple of weeks.”

Snyder added that this trend is “really exciting” because it originates from a diversified base. She suggested that the new products bring advisors into the crypto community and that the trend will shape the ecosystem in the future.

Bloomberg additionally identified inflows across all spot Bitcoin ETFs as $1 billion. When asked whether that number is relatively low given the massive hype leading up to approval, Synder responded that it is “very early.” She said it will take time for ETFs to be added to more platforms and become more available among advisors, noting that the full process takes about three months.

Synder discusses ETH ETF approval chances

Snyder also commented on pending spot Ethereum ETF applications. On the likelihood that those funds will gain approval in the coming months, she said:

“I think it’s really hard to say at this stage. It’s going to come down to how the arguments that were made in support of a spot Bitcoin product actually translate into Ethereum and what the maturity of that market looks like.”

Synder added that 21Shares is nevertheless optimistic about spot Ethereum ETFs and said that her firm looks forward to engaging with regulators.

Other sources are similarly divided on approval chances. One Polymarket prediction market places 47% odds on a spot Ethereum ETF approval by May 31. Bloomberg ETF analyst James Seyffart has predicted 60% odds of a May approval, while a JP Morgan member has predicted 50% odds of a May approval.

Standard Chartered Bank believes a May approval is likely, while TD Cowen believes an approval at any time in 2024 is unlikely.

The post Spot Bitcoin ETFs were among best ETF launches of all time: 21Shares president appeared first on CryptoSlate.

Median Net Worth Among Older Americans Is Surprisingly Low. Here’s How You Can Do Better.

Net worth is the sort of thing not everyone thinks about. You may be aware of how much money is in your savings account or what your IRA balance looks like. But getting at your net worth requires further digging.

Net worth is calculated as your total assets minus your various liabilities. So let’s say you have:

- A savings account with $12,000

- An IRA worth $84,000

- A home with a value of $340,000

- A mortgage balance of $214,000

- A credit card balance of $2,000

All told, that puts your net worth at $220,000.

Image source: Getty Images.

Recent Motley Fool data reveals that the median net worth among Americans aged 65 to 74 is $410,000. But given that many people in that age range have already kicked off retirement, that’s actually not so great.

A troubling number

At first, a median net worth of $410,000 might seem impressive. And it’s worth noting that Americans aged 65 to 74 have a considerably higher median net worth than those aged 55 to 64. The latter group’s median net worth is $364,270.

However, the reason $410,000 is a bit troubling is that for many people, that figure includes the value of what’s likely a paid-off home. Zillow puts the average U.S. home value at about $343,000. So when we subtract that from $410,000, we get $67,000. And what this tells us is that older Americans who are of retirement age might have as little as $67,000 in retirement savings.

Of course, this makes certain assumptions — that there’s a home in the mix incorporated into net worth, and that its value is comparable to that of the average U.S. property. The point, however, is that the $410,000 figure isn’t as high as one might expect. And you may want to set yourself up with a higher net worth for retirement — particularly in the form of a more robust nest egg.

Start saving early on

A big reason some older Americans may not have the largest net worth is that a lot of people in that boat were late to the personal savings game. It used to be common to get a pension from a long-term employer and rely on that in retirement. The rules changed midway through a lot of older Americans’ careers, leaving them to scramble to catch up on the savings front.

If you want to enter retirement with a nice amount of savings, start funding a retirement plan early in your career. If you contribute $300 a month over a 40-year period and your investments in your retirement plan generate an average annual 8% return, which is a bit less than the stock market’s average, you’ll end up with a nest egg worth about $933,000. That would automatically put your net worth at more than double the median net worth for Americans aged 65 to 74 today.

Of course, there are other ways to increase your net worth over time, like buying a home and hoping it appreciates in value. But all told, a larger retirement nest egg is apt to contribute to a higher net worth. And a larger nest egg is something you’re apt to be grateful for later in life.

Maurie Backman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Zillow Group. The Motley Fool has a disclosure policy.

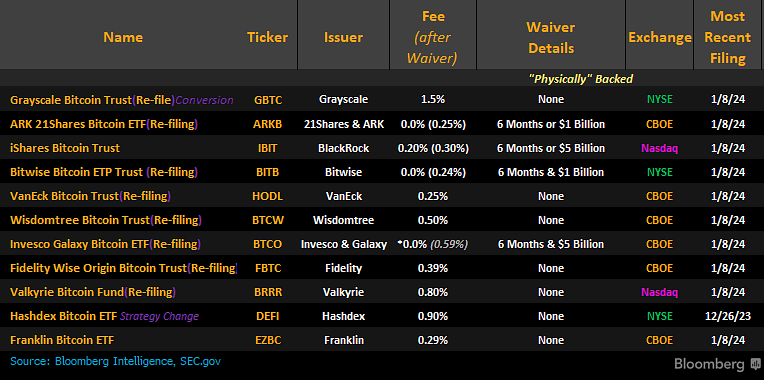

Grayscale to slash fees to 1.5% after spot Bitcoin ETF conversion, still highest among rivals

Prominent digital asset manager Grayscale will slash its management fees to 1.5% from 2% for its proposed spot Bitcoin exchange-traded fund (ETF), according to an updated S3 filing submitted to the U.S. Securities and Exchange Commission on Jan. 8. The asset manager said the fees are payable in the top cryptocurrency.

The filing further revealed that the asset manager added Jane Street, Virtu Americas, Macquarie Capital, and ABN AMRO Clearing as authorized participants (APs) for its proposed ETF. It also named Jane Street, Virtu Flow Traders, and Flowdesk liquidity providers for the ETF.

High fees

Despite Grayscale’s fee cut, the firm’s rate remains notably higher than the proposed fees by ETF issuers like BlackRock and others, who have mostly charged under 1%.

Ark and 21 Shares reduced its fees to 0.25% from 0.8% earlier today while waiving its fees for the first six months or $1 billion. Another asset manager, VanEck, also plans to charge 0.25%.

In contrast, BlackRock has outlined a fee structure starting at 0.2% for the initial 12 months and $5 billion of its ETF, which will increase to 0.3% later. Bitwise opted for a 0% charge during the first six months, followed by a 0.24% fee thereafter.

Others, like Wisdomtree, Invesco Galaxy, Fidelity, Valkyrie, Hashdex, and Franklin Templeton, charge between 0.39% and 0.9%, respectively.

Grayscale stands out among ETF applicants by strategically targeting the transformation of its Bitcoin Trust into a spot ETF. This unique approach positions Grayscale favorably against competitors due to its substantial existing holdings of BTC. The firm holds nearly 620,000 units of BTC, worth almost $27 billion.

Ryan Selkis, Messari founder and CEO, further explained why the firm might be maintaining a high fee, pointing out that:

“The new ETF issuers are racing to the bottom on fees where every BILLION dollars in AUM leads to $3-5 MILLION in annual revenue. Grayscale’s head start means starting ARR [annual recurring revenue] of $420 million.”

Eric Balchunas, Bloomberg’s ETF analyst, also noted that reducing Grayscale’s fees might kill their margins.

Durable-goods orders tumble and show little sign of recovery among manufacturers

The numbers: Orders for durable or long-lasting goods sank 5.4% in October because of fewer contracts for Boeing passenger planes, but most other manufacturers also reported somewhat weaker demand.

Economists polled by the Wall Street Journal had forecast a 3.4% decline.

If airplanes and cars are stripped out, new orders were flat last month,…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

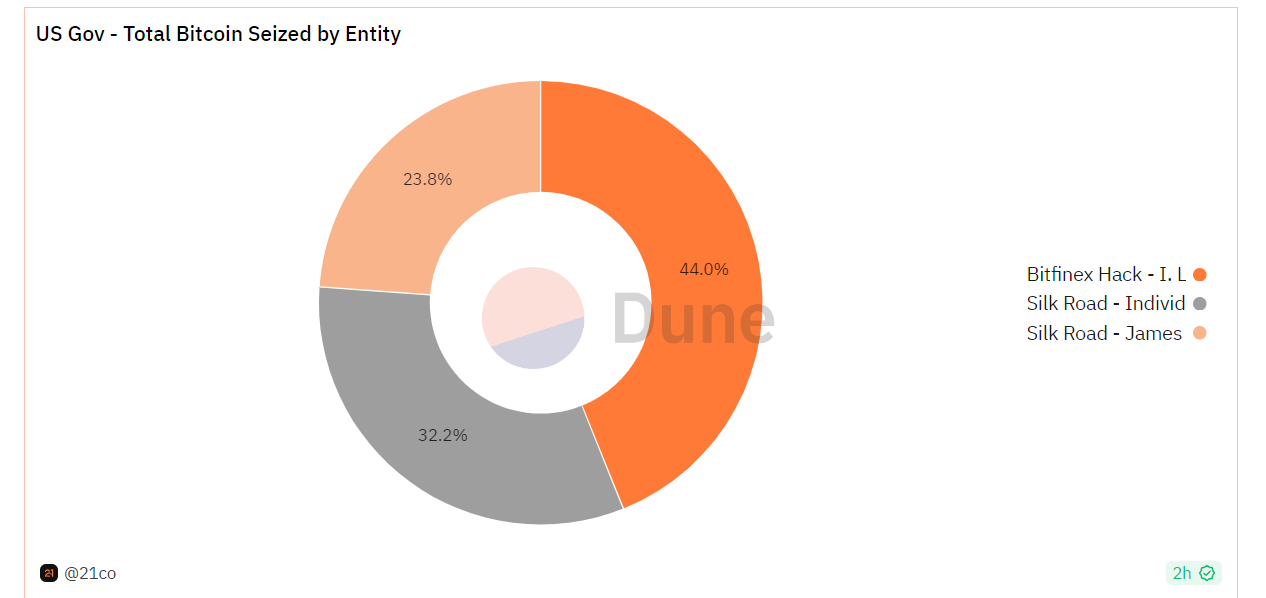

US government among largest Bitcoin hodlers with over $5B in BTC: Report

The United States government has become one of the largest Bitcoin (BTC) holders, with over 200,000 BTC worth more than $5 billion despite selling a few thousand BTC worth millions earlier this year.

According to a data analysis based on public filings, crypto firm 21.co estimated that the U.S. government still holds 194,188 BTC, estimated to be worth $5.3 billion. The firm noted in its analysis that these are “lower-bound estimations of the U.S. government holdings based on publicly available information.”

The analysis tracked the Bitcoin movement of the U.S. government wallets associated with the three largest BTC seizures since 2020, namely the Silk Road seizure of 69,369 BTC in November 2020, the Bitfinex Hack seizure of 94,643 BTC in January 2022, and the James Zhong seizure of 51,326 BTC in March 2022.

The government Bitcoin stash is kept primarily offline in encrypted storage devices known as hardware wallets kept under the Justice Department and the Internal Revenue Service. The U.S. government made two significant seizures in 2022.

Related: US government plans to sell 41K Bitcoin connected to Silk Road

Seized assets do not instantly belong to the government. The U.S. Marshals Service, the principal agency charged with selling seized property, only receives possession of the seized Bitcoin after a court issues a definitive forfeiture judgment.

The U.S. government also sells a portion of the seized Bitcoin from time to time through an auction system based on court liquidation orders. The most notable government auction dates back to 2014, when billionaire Tim Draper bought 30,000 BTC from U.S. government auctions in 2014.

However, in recent years, the U.S. government has turned to crypto exchanges to sell seized Bitcoin over public auctions. One such sale came in March earlier this year when the government sold 9,118 BTC on Coinbase, as confirmed through a public filing.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: US enforcement agencies are turning up the heat on crypto-related crime