China needs a new economic plan that focuses on domestic services and private consumption.

Source link

Beijing

With Germany in recession and Detroit reeling over ultra-cheap Chinese EVs, Beijing vows to crack down on ‘blind’ construction of new projects

China is making automakers around the world nervous. Its domestic carmakers—helped by generous state subsidies—are churning out alarmingly inexpensive electric vehicles at a relentless pace, saturating their home market and threatening EV manufacturers overseas.

But they might be getting carried away, a high-ranking Chinese official suggested on Friday.

Xin Guobin, vice-minister of industry and information technology, said that Beijing would take “forceful measures” to address what he called “blind” construction of new EV projects—i.e., not justified by demand—by some Chinese carmakers and local authorities, as reported by the Financial Times.

His comments come amid pressure from Europe in particular over a flood of low-priced Chinese EVs hitting its markets.

“Their price is kept artificially low by huge state subsidies. This is distorting our market,” European Commission President Ursula von der Leyen said in September. “And as we do not accept this distortion from the inside in our market, we do not accept this from the outside.”

To be sure, it’s more the threat posed by Chinese EVs in the long run than the current reality that has EU officials concerned. In Germany, the center of EU automaking, Chinese EVs still have just a small sliver of market share. But it’s growing fast, and that has many in Europe’s automotive powerhouse worried amid fresh economic woes, even as German carmakers—who do brisk business in China—have warned against tariffs on Chinese EVs for fear of retaliation by Beijing.

EU probes Chinese subsidies

In the weeks ahead, EU investigators will visit Chinese EV makers BYD, Geely, and SAIC as part of a probe into whether they have an unfair advantage thanks to government subsidies. Their visits—part of an EU probe announced in September and set to run for 13 months—will help determine whether the EU imposes higher tariffs to protect European carmakers.

Of course, more than subsidies are at play. “The Chinese car companies are extremely competitive,” Tesla CEO Elon Musk said at the New York Times Dealbook conference last year. “China is super good at manufacturing, and the work ethic is incredible.”

Musk suggested that Chinese companies will emerge as dominant players in the global automotive industry—a sharp departure from when he laughed about the quality of BYD cars in 2011.

Chinese EV makers also have supply-chain efficiencies that are tough to beat. BYD, for instance, keeps its costs low partly by owning the entire supply chain of its EV batteries, significant since a battery accounts for roughly 40% of an electric vehicle’s price. Backed by Warren Buffett’s Berkshire Hathaway, the Chinese carmaker recently overtook Tesla in global sales of electric vehicles.

Whereas Chinese EV makers face 27.5% tariffs in the U.S., in the EU that’s just 10%. That’s encouraged them to target Europe as their home market gets increasingly crowded, although they’re also expanding quickly elsewhere, including in Southeast Asia and Latin America.

Last year, an Allianz Trade report stated that China’s EV makers pose a significant threat to European carmakers, particularly the “automotive-dependent economies of Germany, Slovakia and Czech Republic.” It called for higher tariffs on Chinese EVs, estimating that by 2030 they could cost Europe’s carmakers 7 billion euros per year in lost profits.

In the EU, Chinese-made EVs typically sell for 20% less than those made in the bloc, and their share of the EV market, which has grown to 8%, could reach 15% by 2025, according to Reuters.

The coming wave of Chinese EVs in America

Last year in China, BYD launched the Seagull, an EV with a cutthroat price of about $11,000. It quickly became one of the best-selling EVs in China. The Seagull and similar models from China could prove to be a disruptive force in overseas markets.

Chinese EVs might also become a common sight on American roads, eventually.

“No one can match BYD on price. Period,” Michael Dunne, CEO of Asia-focused car consultancy Dunne Insights, told the Financial Times earlier this month. “Boardrooms in America, Europe, Korea, and Japan are in a state of shock.”

Made-in-China EVs are sold in more than 100 countries, and the U.S. is the only market where they “have not yet really begun a big assault,” ZoZo Go CEO Michael Dunne, whose advisory firm specializes in the Chinese EV industry, told the Wall Street Journal.

Chinese EV makers are now searching for manufacturing sites in Mexico, which has a free trade agreement with the U.S. and Canada and could serve as a backdoor to those markets, a scenario American lawmakers have warned about.

Meanwhile, U.S. automakers have largely scaled back their EV ambitions—after making large initial investments—as demand has not been as great as anticipated. In a sign of the times, perhaps, all four of America’s largest carmakers passed on running Super Bowl ads this year—the first time that’s happened in 23 years.

But the threat from China has industry leaders on edge. Last summer, Ford executive chairman Bill Ford Jr. warned that American automakers are “not quite yet ready” to compete with Chinese rivals on EVs. “They developed very quickly, and they’ve developed them in large scale, and now they are exporting,” he told CNN. “They are not here, but they will come here we think at some point and we need to be ready.”

This story was originally featured on Fortune.com

Janet Yellen arrives in Beijing on mission to find common ground for U.S. and China

US Treasury Secretary Janet Yellen (R) arrives at Beijing Capital International Airport in Beijing on July 6, 2023.

Pedro Pardo | AFP | Getty Images

Treasury Secretary Janet Yellen landed in Beijing Thursday on a four-day trip aimed at finding common ground as rivalry between the U.S. and China becomes increasingly adversarial.

Yellen’s trip marks a deepening thaw in ties between the U.S. and China and comes weeks after Secretary of State Antony Blinken’s visit to Beijing in last month, which was the first high-level meeting between the two countries after months of tensions.

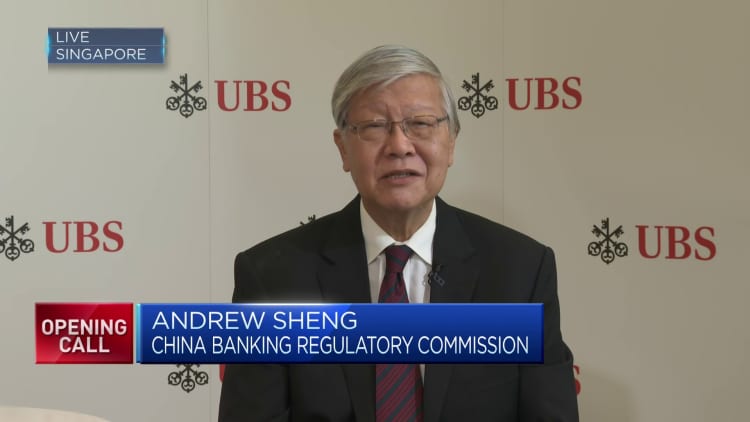

“The two sides are basically talking, trying to find the strategic space for both sides to operate, and this will be very good for the rest of the world,” Andrew Sheng, a distinguished fellow at the University of Hong Kong’s Asia Global Institute, told CNBC Thursday.

Yellen’s trip comes just days after China abruptly imposed export curbs on chipmaking metals and its compounds, escalating Beijing’s technological war with the U.S. and Europe.

Before departing for China, Yellen had a “frank and productive discussion” with Xie Feng, the Chinese U.S. ambassador, according to the U.S. Treasury.

“While in Beijing, Secretary Yellen will discuss with [People’s Republic of China] officials the importance for our countries — as the world’s two largest economies — to responsibly manage our relationship, communicate directly about areas of concern, and work together to address global challenges,” the Treasury Department said Sunday.

In an April speech, Yellen stressed the importance of fairness in the U.S. economic competition with China.

She outlined three economic priorities for the U.S.-China relationship: securing national security interests and protecting human rights, fostering mutually beneficial growth and cooperating on global challenges like climate change and debt distress.

A senior administration official told reporters Sunday that Yellen’s visit will underscore these objectives.

“We do not seek to decouple our economies,” the official said. “A full cessation of trade and investment would be destabilizing for both of our countries and the global economy.”

High Representative for Foreign Affairs Josep Borrell was due to meet Chinese Foreign Minister Qin Gang, pictured on May 23, 2023 in Beijing, China. (Photo by Thomas Peter-Pool/Getty Images)

Pool | Getty Images News | Getty Images

China on Tuesday canceled a planned visit by the European Union’s foreign policy chief that was scheduled for next week without providing a specific reason.

High Representative for Foreign Affairs Josep Borrell was initially due to visit Beijing in April for the annual EU-China strategic dialogue with Chinese Foreign Minister Qin Gang, but that was delayed after Borrell tested positive for Covid-19.

On Wednesday, an EU foreign affairs spokesperson confirmed to CNBC that Borrell’s team had been told by their Chinese counterparts the new dates of July 10-11 were no longer possible and an alternative would need to be found. Topics under discussion were set to include human rights and Russia’s war in Ukraine.

Chinese foreign ministry spokesperson Wang Wenbin declined to provide a reason for the cancellation at a briefing Wednesday, but added: “We welcome High Level Representative Borrell to visit China at the earliest time convenient to both sides,” according to a Reuters report.

CNBC has contacted China’s Ministry of Foreign Affairs for comment.

The cancellation, or possible postponement, comes ahead of a scheduled visit to Beijing by U.S. Treasury Secretary Janet Yellen on Thursday.

China on Monday announced new export restrictions on two metals, germanium and gallium, which are key to the manufacturing of semiconductors and electronics and have uses from military equipment to mobile phones.

The news has driven prices of the metals higher while also pushing companies into a scramble to shore up supplies, according to Reuters.

In recent years, the U.S. has increasingly used export restrictions and trade blacklists against China as it seeks to curb the growth of its technological power.

Former Chinese Vice Commerce Minister Wei Jianguo told the China Daily newspaper the latest measures on Monday were “just the beginning” and that “if the high-tech restrictions on China become tougher in the future, China’s countermeasures will also escalate.”

“It’s weaponizing that rare earth and critical minerals supply chain,” Rebecca Harding, trade and political risk specialist and senior fellow at the British Foreign Policy Group, told CNBC’s “Squawk Box Europe” on Wednesday.

“[There] is an element of mutually assured destruction because you can’t manufacture chips if you haven’t got the supply chains. But these export controls are going to be fairly limited,” she said.

She added the measures could be seen as retaliatory for actions of not just the United States but also the Netherlands, a crucial semiconductor machinery hub, which last week announced new export restrictions on advanced semiconductor equipment. There is unlikely to be “any imminent rowing back,” Harding added.