The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

Source link

bitcoin

Severe Impact Expected for Miners With Outdated Hardware in Upcoming Bitcoin Halving

Following the downturn in bitcoin’s price on Friday, the hashprice of bitcoin has declined from slightly above $119 per petahash per second to marginally over $116 per PH/s on a daily basis. Should the prices remain low leading up to the forthcoming halving event scheduled for next week, certain mining devices may only be viable […]

Following the downturn in bitcoin’s price on Friday, the hashprice of bitcoin has declined from slightly above $119 per petahash per second to marginally over $116 per PH/s on a daily basis. Should the prices remain low leading up to the forthcoming halving event scheduled for next week, certain mining devices may only be viable […]

Source link

Waiting For The Bitcoin Bull Run To Resume? Here’s The Indicator To Watch For

The bullish momentum of the Bitcoin price has dwindled over the past few weeks, putting the progression of the crypto bull cycle into question. On Friday, April 12, the crypto market witnessed a flash crash, causing the premier cryptocurrency’s value to drop from $70,000 to below $67,000.

This latest downturn underscores the struggle of the Bitcoin price to return to its recent all-time high of $73,737, which was forged in mid-March. On-chain analytics platform Santiment has identified a particular Bitcoin metric that may signal the resumption of the bull run.

Bitcoin Bull Run May Resume If This Metric Falls

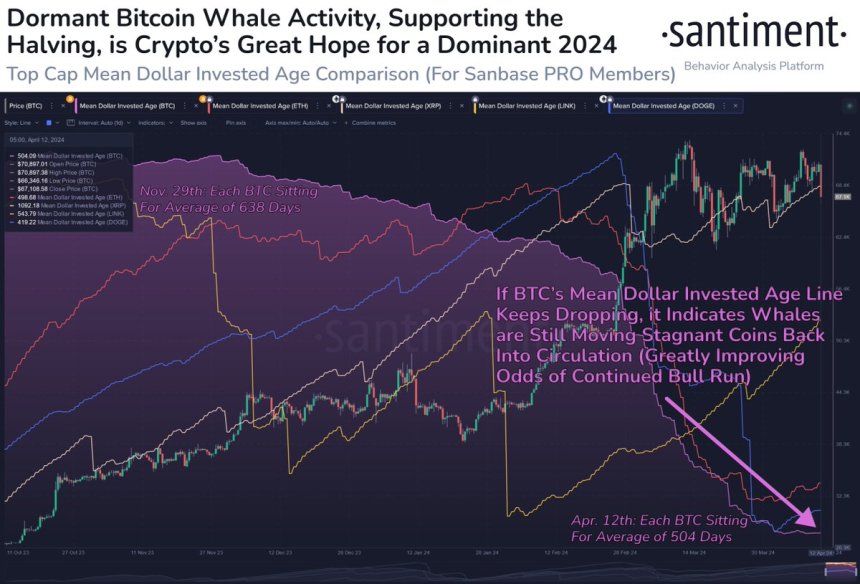

In a recent post on X, blockchain intelligence firm Santiment provided an exciting insight into the current cycle and the price performance of Bitcoin. The firm pinpointed the Mean Dollar Invested Age metric as one of the indicators to watch as the market leader moves sideways.

According to Santiment, the Mean Dollar Invested Age metric tracks the average age of investment in an asset that has sat in the same wallet. When this indicator is rising, it means that investments are getting more stagnant and old coins are being held in the same wallets.

Conversely, a decreasing Mean Dollar Invested Age metric implies that investments are flowing back into regular circulation. This “falling line” also suggests an increase in network activity.

A chart showing Bitcoin's Mean Dollar Invested Age | Source: Santiment/X

From a historical perspective, Bitcoin exhibited a falling Mean Dollar Invested Age line during the previous bull cycles. According to Santiment, this has been the case for the premier cryptocurrency in the current bull run, which kicked off in late October 2023.

The on-chain analytics platform, however, noted that Bitcoin’s Mean Dollar Invested Age line has been moving sideways over the past couple of weeks. This phenomenon is even more shocking, considering that the highly-anticipated halving event is about a week away.

The Bitcoin halving will see the miners’ reward slashed in half (from 6.25 BTC to 3.125 BTC). It is a bullish event that has contributed to the optimistic outlook – borne by most investors – for the premier cryptocurrency in 2024.

From Santiment’s latest report, investors might want to keep their eyes peeled for the Bitcoin Mean Dollar Invested Age metric. And the bull run is likely to continue if the BTC’s Mean Dollar Invested Age line resumes its fall, which would imply that major stakeholders (like whales) are back to moving coins into regular circulation.

BTC Price At A Glance

As of this writing, Bitcoin is trading around $66,548, reflecting a notable 6% price decline in the past 24 hours.

Bitcoin price falls below $67,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin, Altcoins Price Decline As Crypto Liquidations Approaches $900 Million In The Past Day

The crypto market took an unexpected hit on April 12 as a spontaneous decline in the price of Bitcoin and prominent altcoins resulted in massive liquidations. The origin of this widespread price dip remains largely unknown, among a plethora of plausible reasons, including a recent price correction in the US stock markets.

Almost $500 Million Liquidated In An Hour Amidst Crypto Flash Crash

According to data from CoinMarketCap, Bitcoin slipped by 4.49% in the last day, falling as low as $66,052. As expected, BTC’s decline reverberated through the market, with prominent altcoins Ethereum and Solana recording daily losses to the tune of 8.12% and 12.16%, respectively

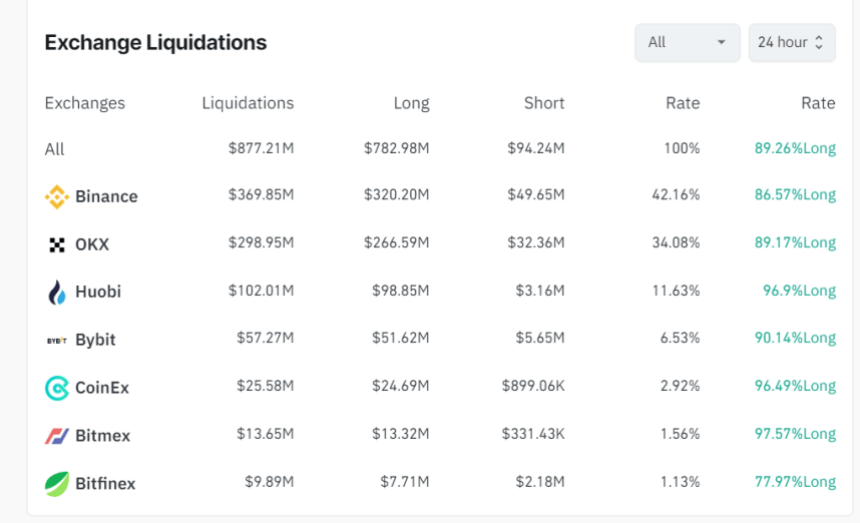

As earlier stated, these losses translated into 277,843 traders losing their leverage positions as total crypto liquidations reached $877.21 million in the last 24 hours based on data from Coinglass. Of these figures, long positions accounted for $782.98 million, with short traders losing only $94.24 million.

Notably, $467 million in leverage positions were closed within an hour as a result of a general price decline. The highest amount of liquidations at $369.85 million was recorded on Binance, while the single largest liquidation order valued at $7.19 million occurred in the ETH-USD market on the OKX exchange.

Source: Coinglass

Source: Coinglass

Interestingly, Bitcoin’s price decline correlated with a dip in the US stock market as the S&P 500 index declined by 1.6% to trade as low as $5,108. This market crash was preceded by recent CPI data, which showed that the inflation rate rose to 3.5% year over year in March.

Such reports only indicate that the US Federal Reserve (Fed) could not be implementing any rate cuts soon as it aims to force inflation down to its annual target of 2%. This prediction is quite bearish for the crypto market generally as Fed rate cuts allow investors to comfortably seek risky assets such as BTC with a potential of high yields.

Bitcoin Experiences Network Growth As Halving Approaches

On a more positive note, Bitcoin has recorded a rise in non-empty wallets on its network ahead of the Halving event on April 19. Blockchain analytics platform Santiment reported an increase of 370,000 BTC wallets holding active coins over the last six days. Interestingly, the analytic team is backing investors to maintain this accumulative trend all through the Bitcoin halving event.

At the time of writing, Bitcoin was trading at $66,882, with a 44.80% increase in its daily trading volume, which is currently valued at $43.80 billion. However, Bitcoin’s price has generally been unimpressive in recent times, with a decline of 1.33% and 6.20% in the last seven and 30 days, respectively.

Bitcoin trading at $66,499.00 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Bitcoin trading at $66,499.00 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured image from The Independent, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Cleanspark to Upgrade Mining Fleet With 100,000 S21 Pro Bitcoin Miners From Bitmain

The publicly traded bitcoin mining company Cleanspark has exercised its option to acquire 100,000 bitcoin mining machines from Bitmain. The firm initially secured the option last year, and the agreement has now been enhanced to include the latest S21 Pro model from Bitmain, which offers 15 joules per terahash (J/T). Bitmain and Cleanspark Seal Deal […]

The publicly traded bitcoin mining company Cleanspark has exercised its option to acquire 100,000 bitcoin mining machines from Bitmain. The firm initially secured the option last year, and the agreement has now been enhanced to include the latest S21 Pro model from Bitmain, which offers 15 joules per terahash (J/T). Bitmain and Cleanspark Seal Deal […]

Source link

Bitcoin holds steady against economic headwinds, outshining Ethereum

Quick Take

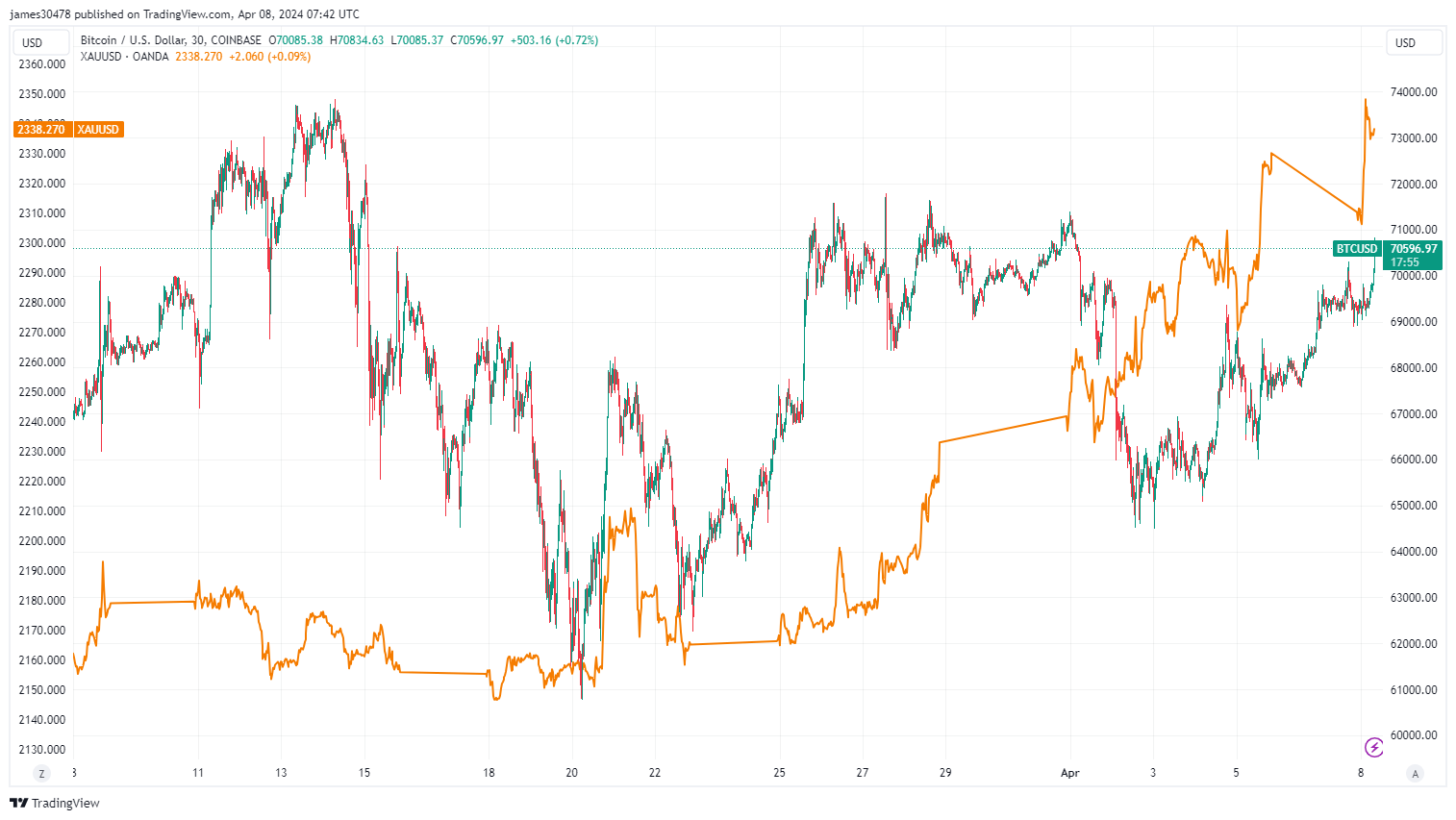

In the midst of economic uncertainty, Bitcoin continues to dance around the crucial $70,000 level, demonstrating its resilience despite the DXY index steadily climbing towards 106 and US yields on the rise. As investors seek safe-haven assets, many are looking to gold for guidance, hoping that Bitcoin, often referred to as “digital gold,” will follow suit.

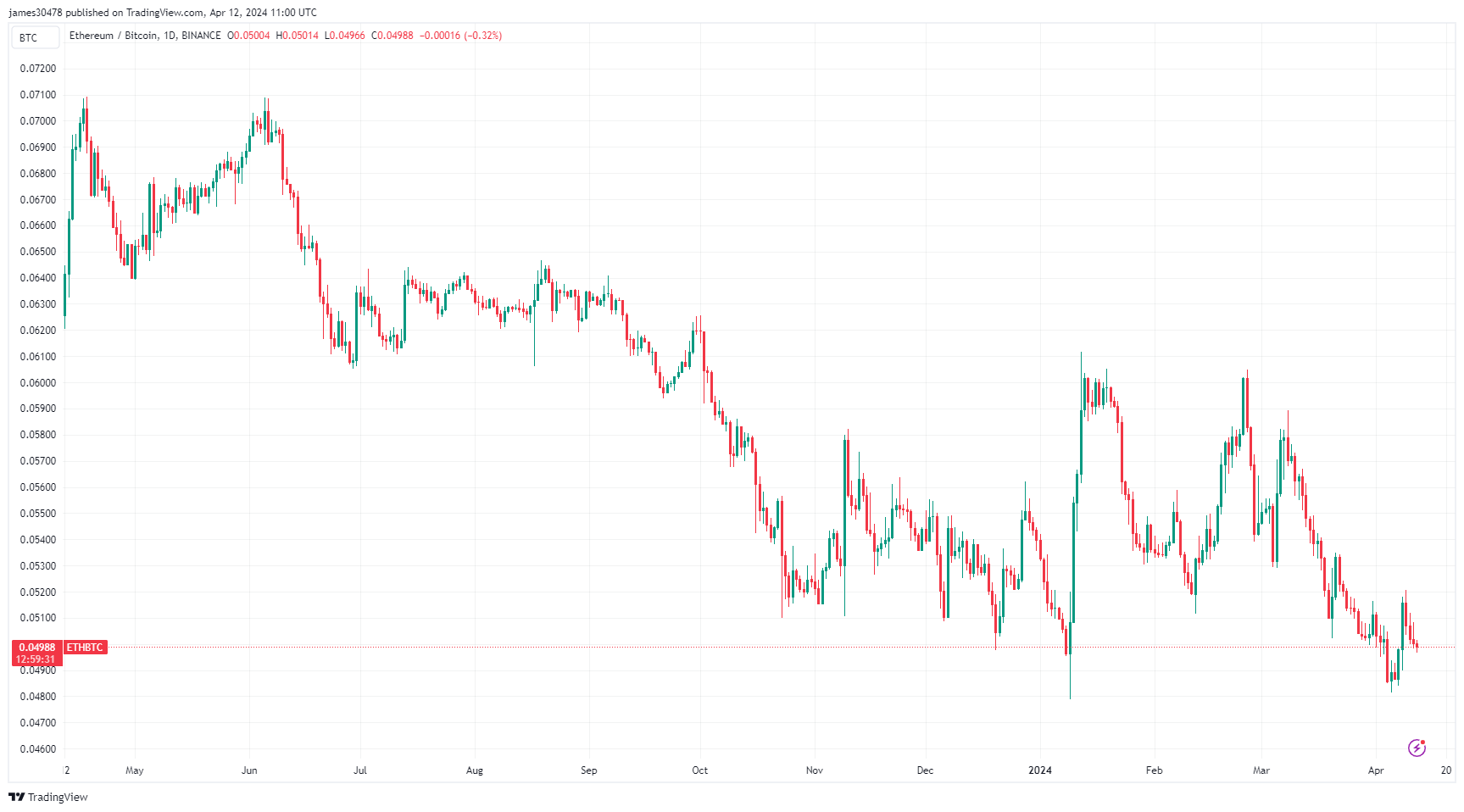

Despite a slight dip at the beginning of April, Bitcoin’s dominance in the digital asset market remains strong, currently at 54.6%, just below the cycle highs of 55.2%. This growth in dominance, up 6% year-to-date, indicates that investors, on aggregate, are favoring Bitcoin over other digital assets.

Another noteworthy trend is the ETH/BTC ratio, which remains below the critical 0.05 threshold, suggesting that Bitcoin is outperforming Ethereum. The ETH/BTC ratio has declined by 6% year-to-date and 20% over the past year. As the DXY index continues to surge, market observers are keeping a close eye on Bitcoin and gold, anticipating that they may continue to hold their ground or even follow the upward trend, providing a potential hedge against economic instability.

The post Bitcoin holds steady against economic headwinds, outshining Ethereum appeared first on CryptoSlate.

PRESS RELEASE. [Singapore, April 12th 2024] Yala, a liquidity and stablecoin protocol, is excited to unveil its new vision for the future “to create a thriving, open ecosystem that unlocks the full potential of DeFi on Bitcoin”. This ambition reflects Yala’s dedication to catalyzing mass adoption of decentralized finance on the world’s most resilient blockchain, […]

PRESS RELEASE. [Singapore, April 12th 2024] Yala, a liquidity and stablecoin protocol, is excited to unveil its new vision for the future “to create a thriving, open ecosystem that unlocks the full potential of DeFi on Bitcoin”. This ambition reflects Yala’s dedication to catalyzing mass adoption of decentralized finance on the world’s most resilient blockchain, […]

Source link

Rich Dad Poor Dad Author Robert Kiyosaki Believes Bitcoin Price Will Reach $2.3 Million

Rich Dad Poor Dad author Robert Kiyosaki says he believes that the price of bitcoin will reach $2.3 million, citing a prediction by Ark Invest CEO Cathie Wood. Meanwhile, he said stock, bond, and real estate markets are “set to crash,” and he expects the U.S. to go bankrupt. Robert Kiyosaki Foresees Bitcoin Hitting $2.3 […]

Rich Dad Poor Dad author Robert Kiyosaki says he believes that the price of bitcoin will reach $2.3 million, citing a prediction by Ark Invest CEO Cathie Wood. Meanwhile, he said stock, bond, and real estate markets are “set to crash,” and he expects the U.S. to go bankrupt. Robert Kiyosaki Foresees Bitcoin Hitting $2.3 […]

Source link

Bitcoin Difficulty and Hashrate Reach Record Highs as Halving Draws Closer

Bitcoin’s network difficulty climbed to an unprecedented peak on April 10, 2024, at block height 838,656, increasing by 3.92% to reach 86.39 trillion. This escalation in difficulty will make it increasingly challenging to mine blocks as the fourth halving event nears, with fewer than 1,250 blocks remaining until block 840,000 is mined. Block 838,656 Marks […]

Bitcoin’s network difficulty climbed to an unprecedented peak on April 10, 2024, at block height 838,656, increasing by 3.92% to reach 86.39 trillion. This escalation in difficulty will make it increasingly challenging to mine blocks as the fourth halving event nears, with fewer than 1,250 blocks remaining until block 840,000 is mined. Block 838,656 Marks […]

Source link

Bitcoin Tumbles on Hot CPI Data, But This Analyst Stays Ultra Bullish: Here’s Why

The better-than-expected United States Consumer Price Index (CPI) released on April 10 is already sending shock waves through the financial market. Bitcoin and most crypto assets are trading lower, extending losses recorded on April 9, weighing negatively against optimists.

United States CPI Data Came In Hot

According to Trading Economics data on April 10, CPI, a key economic metric for gauging inflation, rose 0.4% in March, pushing the annual inflation rate to 3.5%. Notably, this surpassed economist predictions and, most importantly, dashed hopes for the United States Federal Reserve (Fed) to slash rates aggressively this year.

However, amidst the market jitters, Matt Hougan, the CIO of Bitwise Asset Management, offered a contrarian perspective as fear permeated the Bitcoin and crypto market. In a post on X, Hougan downplayed the influence of the CPI data on Bitcoin’s long-term trajectory.

The executive argues that investors and traders should track other market factors like spot Bitcoin exchange-traded fund (ETF) inflows and rising government deficits. In Hougan’s assessment, these can strongly influence price, even lifting Bitcoin higher since they are currently aligned.

Time To Buy The Bitcoin Dip?

As such, even with the fall in BTC, the drop could offer potential buying opportunities for long-term holders. Some supporters believe the “hot” CPI data only exposes the vulnerabilities of fiat currencies. This would potentially drive investors to use Bitcoin as a hedge.

Moreover, this upbeat sentiment is backed by solid demand for gold, a store of value asset preferred by traditional finance investors. Analysts anticipate Bitcoin will follow a similar path as investors seek to protect value amid rising inflation.

Further bolstering the bullish sentiment is the possibility of a spot Bitcoin ETF launch in Hong Kong before the end of April.

The Hong Kong Securities and Futures Commission (SFC) has been assessing various applications. Leading Chinese asset managers have submitted some. If the product is approved, it could further channel more capital to BTC, boosting inflows from the United States.

When writing, BTC is steady but under pressure. April 9’s losses have been confirmed. The coin might track lower if bulls fail to push prices above all-time highs of around $74,000.

Bitcoin remains in a broader bullish formation, technically moving inside a rising wedge. This bullish outlook will only be invalidated if prices tank below $61,500 in the sessions ahead.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.