TBD, a subsidiary of Block, owned by Jack Dorsey, has formed a partnership with Chipper Cash, an Africa-focused fintech company. This partnership aims to expedite consumer remittances and make them more affordable. According to a statement, Chipper Cash plans to use the decentralized exchange protocol of TBD. This will enable trusted transactions that comply with […]

TBD, a subsidiary of Block, owned by Jack Dorsey, has formed a partnership with Chipper Cash, an Africa-focused fintech company. This partnership aims to expedite consumer remittances and make them more affordable. According to a statement, Chipper Cash plans to use the decentralized exchange protocol of TBD. This will enable trusted transactions that comply with […]

Source link

block

Onchain data indicates that a single custodian now manages the coinbase addresses for at least nine prominent mining pools, which collectively account for 47% of Bitcoin’s total hashrate. The analysis shows that substantial miners’ rewards from pools like F2pool, Antpool, Binance Pool, and Braiins are being funneled to this particular custodian. Onchain Data Reveals Single […]

Onchain data indicates that a single custodian now manages the coinbase addresses for at least nine prominent mining pools, which collectively account for 47% of Bitcoin’s total hashrate. The analysis shows that substantial miners’ rewards from pools like F2pool, Antpool, Binance Pool, and Braiins are being funneled to this particular custodian. Onchain Data Reveals Single […]

Source link

Marathon Digital Holdings Unveils ‘M’ Block Art on Bitcoin Blockchain

Bitcoin miner Marathon Digital Holdings has crafted a block that prominently displays the letter “M” by carefully arranging transactions and fee rates within its mining pool. This novel approach introduces a creative twist to block creation in the blockchain realm. Despite this innovative step, Marathon has made it clear that it currently does not offer […]

Bitcoin miner Marathon Digital Holdings has crafted a block that prominently displays the letter “M” by carefully arranging transactions and fee rates within its mining pool. This novel approach introduces a creative twist to block creation in the blockchain realm. Despite this innovative step, Marathon has made it clear that it currently does not offer […]

Source link

AI firm Anthropic has blocked Saudi Arabia from engaging in the sale process of 8% of its shares — currently owned by defunct crypto exchange FTX, CNBC reported on March 22, citing people familiar with the matter.

FTX is selling the stake as part of its bankruptcy proceedings to repay its creditors, who lost billions due to its collapse. Investment bank Perella Weinberg is managing the sale, which has reportedly drawn interest from multiple sovereign wealth funds.

The sale is expected to be completed in the coming weeks.

National security risk

Saudi Arabia, despite its aggressive investment diversification efforts under Crown Prince Mohammed bin Salman’s “Vision 2030 Initiative,” has been barred from investing in Anthropic.

According to the report, Anthropic founders Dario and Daniela Amodei, who have ties to FTX founder and former CEO Sam Bankman-Fried through the effective altruism community, told bankers not to sell the stake to Saudi Arabia. The two are broadly uninvolved in the discussions but retain the right to vet potential investors.

Anthropic’s decision reportedly stems from considerations of national security and geopolitical complexities, including Saudi Arabia’s relations with China and its controversial human rights record, highlighted by incidents such as the alleged assassination of journalist Jamal Khashoggi in 2018.

The AI firm may be wary of selling the shares to Saudi Arabia as AI is considered a “dual-risk” technology that has both civilian and military use cases.

However, the company has not attempted to exclude other countries from participating in the sale — with the UAE’s Mubadala still in the running.

The US government has also raised concerns about the sensitive nature of AI in relation to national security in recent weeks.

The Committee on Foreign Investment in the United States (CFIUS) has the authority to block foreign investments that are deemed a threat to national security and may choose to intervene in the sale process considering the heightened interest from foreign state-backed entities.

Shares now worth $1 billion

Originally purchased by FTX for $500 million in 2021, the stake’s value has significantly increased in the wake of the AI sector’s rapid expansion and is worth more than $1 billion as of press time.

The sale of class B shares, which do not offer voting rights, is priced based on Anthropic’s last valuation of $18.4 billion and amounts to more than $1 billion as of March.

The sale of FTX’s Anthropic stake is part of the former company’s bankruptcy case. A court ruled that FTX could sell the stake in February. Sale proceeds will partially go toward compensating investors affected by the collapse of FTX, satisfying a concern that was raised when the court greenlit the sale last month. Estimates from mid-2023 suggest FTX owes customers about $8.7 billion.

Mentioned in this article

Latest Alpha Market Report

Bitcoin Cash Soars 40% in 24 Hours as Market Eyes Upcoming Halving and Adaptive Block Size Upgrade

On Saturday, March 2, the valuation of bitcoin cash witnessed a significant increase, climbing over 40% within a 24-hour span to reach a peak of $451 each. This upward trend is attributed to the anticipated halving event, set to happen in 16 days, and the forthcoming 2024 upgrade, which is expected to implement an adaptive […]

On Saturday, March 2, the valuation of bitcoin cash witnessed a significant increase, climbing over 40% within a 24-hour span to reach a peak of $451 each. This upward trend is attributed to the anticipated halving event, set to happen in 16 days, and the forthcoming 2024 upgrade, which is expected to implement an adaptive […]

Source link

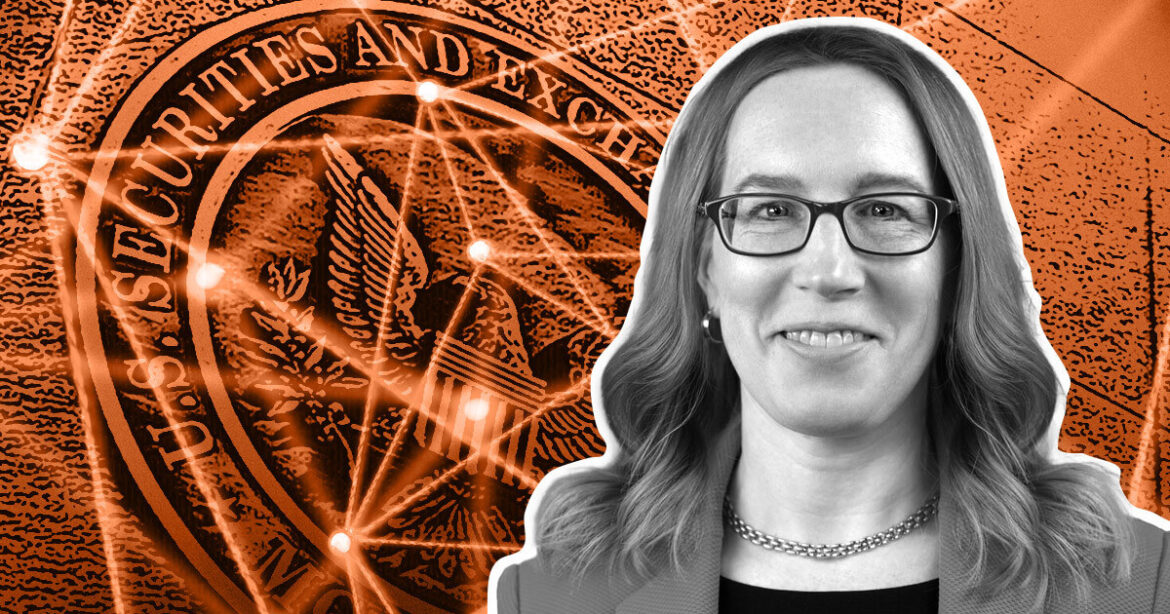

Hester Peirce says SEC shouldn’t block spot Bitcoin ETFs, speaks on Binance resolution

Commissioner Hester Peirce of the U.S. Securities and Exchange Commission (SEC) commented on pending spot Bitcoin ETFs to Bloomberg on Nov. 22.

Peirce said that, although she cannot comment on currently active ETF proposals, she is open to approving such a product. She said:

“I’ve been very transparent that I’ve thought for many years now that there is no reason for us to stand in the way of a spot Bitcoin exchange traded product.”

Peirce noted that each product should be judged on its unique properties but said that her agency previously received numerous applications that she saw no reason to deny. Nevertheless, the SEC has rejected several of those applications in recent years.

Peirce also alluded to a “nudge from the court” — which the interviewer presumed to be a ruling requiring the SEC to review Grayscale’s ETF application. She said that the SEC and its members will “see where things go” in light of that legal decision.

Peirce also commented broadly on the SEC’s recent legal losses. She said that though she has not observed a decrease in litigation despite those losses, enforcement is just one tool. Peirce argued for a more productive approach, adding that Congressional lawmaking and stances within the SEC itself could impact future SEC action.

Peirce briefly comments on Binance resolution

Hester Peirce briefly commented on a resolution between various U.S. agencies and Binance (and its now-former CEO, Changpeng Zhao). She could not comment in detail due to the SEC’s separate ongoing case against Binance.

However, Peirce noted that it is common for accused parties to handle criminal charges before civil charges. That is reflected in the fact that Binance settled criminal charges with the Department of Justice (DOJ) and others before the SEC’s civil securities charges. She did not directly answer the interviewer’s question, which asked whether criminal settlements could be used as a remedy in civil securities cases.

Peirce broadly stated that, in light of all current cases, regulators should aim to create a regulatory framework that allows crypto companies to operate in the U.S. She said that she hopes that this occurs in the coming months and years.

The post Hester Peirce says SEC shouldn’t block spot Bitcoin ETFs, speaks on Binance resolution appeared first on CryptoSlate.

PayPal versus Block: Here’s HSBC’s preferred stock play on a fintech turnaround

It’s been another tough year for shares of PayPal Holdings Inc. and Block Inc., which have respectively lost 22% and 31% so far in 2023, after recording their worst annual performances on record last year.

Bulls are hoping that both names can stage financial comebacks in the near future, as PayPal

PYPL,

enters its next chapter under newly installed Chief Executive Alex Chriss and Block

SQ,

continues to execute on its expense-control strategy. But PayPal’s stock looks like the preferred turnaround play, according to HSBC analyst Saul Martinez, who initiated coverage on a basket of payments names in a recent note to clients.

“Admittedly, the shine has come off the stock,” Martinez wrote of PayPal in his latest report, but the stock’s “discounted valuation offers opportunity.”

He cheered PayPal’s strong consumer and merchant assets, as well as its potential to ease pressure on transaction margins later this year and into next year. Meanwhile, the company could benefit from continued cost discipline and its capital-return strategy.

PayPal’s transaction margins have been a source of anguish for investors, as the company has been seeing faster growth from its lower-margin unbranded checkout business. But Martinez is upbeat that the branded business can “moderately” reaccelerate on the heels of an improvement in e-commerce trends.

Additionally, PayPal could improve the margins of the unbranded business by selling that service to more small and medium-size businesses, rather than larger enterprises that tend to be able to secure more favorable economics for themselves.

Martinez set a buy rating and $69 price target on PayPal shares.

Read: PayPal skeptics may be making a crucial mistake about the stock, Barclays says

As for Block, Martinez said that the company’s ecosystem is “impressive” but that he still sees the name as a “show-me story.”

“While Block is now breaking even on operating profits, the path to more normalized profitability is likely to be long, in our view,” he wrote.

Block shares are off more than 80% from their all-time closing high achieved in August 2021, but he thinks the stock is “taking time to grow into a reasonable multiple.”

Martinez set a hold rating and $46 target price on Block’s stock.

Don’t miss: Block’s stock has more than 50% upside after a ‘massive pullback,’ BofA predicts

See also: PayPal’s stock has ‘catalysts aplenty’ — but this analyst still feels cautious

Many tech stocks have soared in 2023. Just look at the tech-heavy Nasdaq Composite. It’s up 29% year to date. The Nasdaq 100 has risen an astounding 38%. Yet, somehow, payments company Block (SQ 1.33%), once a Wall Street darling, has suffered a much different fate. Its shares are down about 28% so far in 2023. Making the decline even more painful, it adds to the stock’s 61% decline in 2022.

But some analysts are convinced the sell-off has gone too far. One recent analyst to speak up about the stock’s strong potential from its current level is Bank of America analyst Jason Kupferberg. The growth stock’s pullback is “unjustified,” wrote Kupferberg in a note to analysts this week.

Why have shares been crushed?

A number of factors have driven the stock’s slide in 2022 and 2023. The primary reason is arguably a rotation out of growth stocks. Sure, most growth stocks have rebounded sharply in 2023, but very few have recovered to levels seen in 2021 or early 2022. So they’re still largely out of favor compared to investors’ interest several years ago. But there are some more company-specific factors plaguing Block, too.

Though the payments specialist, which was formerly called Square but renamed Block in 2021, has continued growing in 2023, its gross profit margin has narrowed significantly recently in recent quarters. Specifically, Block’s second-quarter gross profit margin was 27%, down from its recent quarterly high of 40% in the fourth quarter of 2022 and 29% in the year-ago quarter. Until Block’s gross profit margin stabilizes or even grows on a year-over-year basis, investors may worry about the company’s ability to grow its bottom line rapidly enough to live up to the stock’s $28 billion market capitalization.

Perhaps the most recent concern weighing on the stock was the disruption to its merchant services occurring last Thursday and Friday. Outages left many businesses stranded, only able to accept cash as payments.

The bull case

Kupferberg’s bull case is mainly built around the simple premise that the stock’s sharp decline since the end of July (about a 39% pullback as of this writing) is overdone, making shares too cheap relative to their fundamentals.

Addressing the platform outage, Kupferberg believes it will fade into the rearview mirror as a “one-off” incident. Further, the analyst predicts a heightened focus at the company on operating expense discipline will help address profitability. Indeed, Kupferberg anticipates Bock’s adjusted earnings before interest, taxes, and depreciation (EBITDA) for Q3 to be good enough for the company to raise its full-year outlook for the key profitability metric. This would build on Square’s momentum with this profitability metric in Q2. Block raised its outlook for full-year adjusted EBITDA in its second-quarter update, saying it now expects the figure to come in at about $1.50 billion for the year, up from a previous forecast of $1.36 billion.

While Kupferberg’s bull case is worth considering, investors may want to remain cautious. Even though the stock has been hammered, Block is still reporting quarterly losses. Its net loss in the second quarter of 2023 was $123 million. However, this notably improved from a loss of $208 million in the second quarter of 2022. Still, before investors invest in Block, they should be sure there’s a clear path to meaningful profits that live up to the stock’s high valuation. A $28 billion market capitalization is nothing to sneeze at, particularly when the payments specialist is still reporting losses.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Daniel Sparks has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Block. The Motley Fool has a disclosure policy.

By Daniel Wiessner and Dan Whitcomb

(Reuters) -A federal judge in Texas on Thursday rejected a bid by 25 states to block a Biden administration rule allowing employee retirement plans to consider environmental, social and governance (ESG) issues in investment decisions.

U.S. District Judge Matthew Kacsmaryk in Amarillo, Texas, declined to block the rule, which took effect Jan. 30. The judge granted a petition by President Joe Biden’s administration to dismiss the Republican-led states’ lawsuit claiming the rule will jeopardize millions of Americans’ retirement savings.

Kacsmaryk in a 14-page opinion rejected the states’ claim that the rule violates the federal law governing retirement plans. The rule still requires that financial considerations come first, and does not create “an overarching regulatory bias in favor of ESG strategies,” the judge wrote.

The U.S. Department of Justice and the offices of the attorneys general of Texas and Utah, who led the lawsuit, did not immediately respond to requests for comment.

The decision will likely be appealed to a New Orleans-based federal appeals court. A subsidiary of oil drilling company Liberty Energy Inc and an oil and gas trade group are also plaintiffs in the case.

Congress in early March passed a Republican-backed resolution to repeal the rule. Biden, a Democrat, vetoed the proposal on March 20.

ESG investing involves weighing companies’ records on environmental, social justice and labor issues, as well as corporate governance matters such as board diversity and executive compensation, along with traditional financial considerations.

The rule, finalized in November, reversed restrictions adopted by former President Donald Trump’s administration on considering ESG factors in making investment decisions. The rule covers plans that collectively invest $12 trillion on behalf of more than 150 million people.

The Biden administration has said the rule was needed to replace improper limitations on ESG investing imposed by the Trump administration, because issues such as climate change and social justice can impact companies’ long-term financial health.

Kacsmaryk, a Trump appointee, in March rejected the Biden administration’s claim that the states were improperly “judge shopping” by filing the lawsuit in Amarillo, where Kacsmaryk is the only judge.

(Reporting by Daniel Wiessner and Dan Whitcomb; Editing by David Gregorio and Lincoln Feast.)

Quick Take

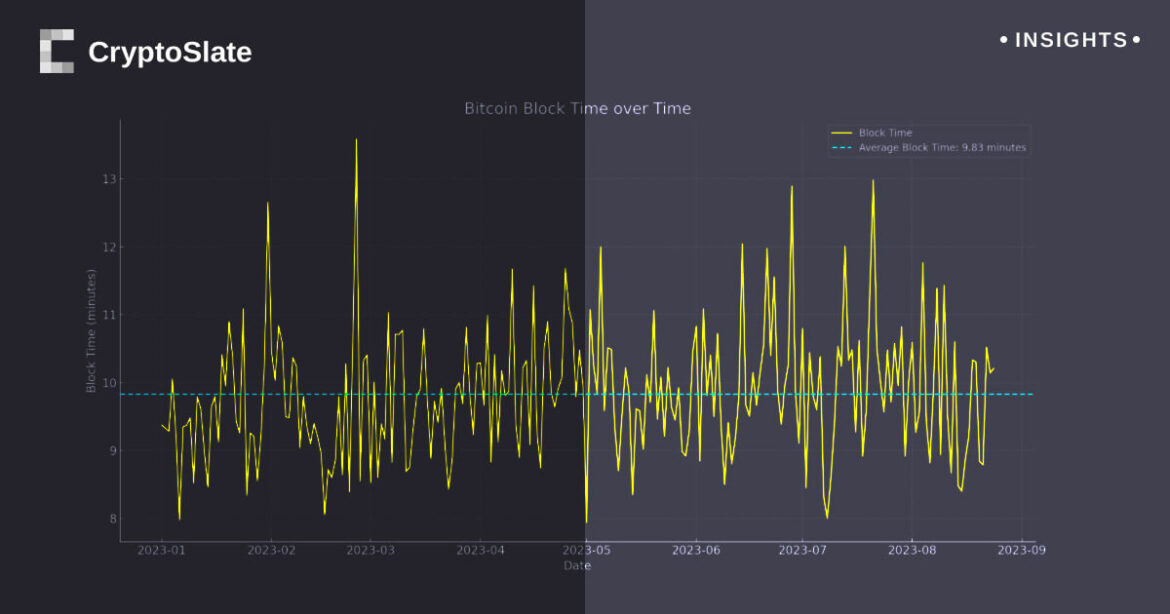

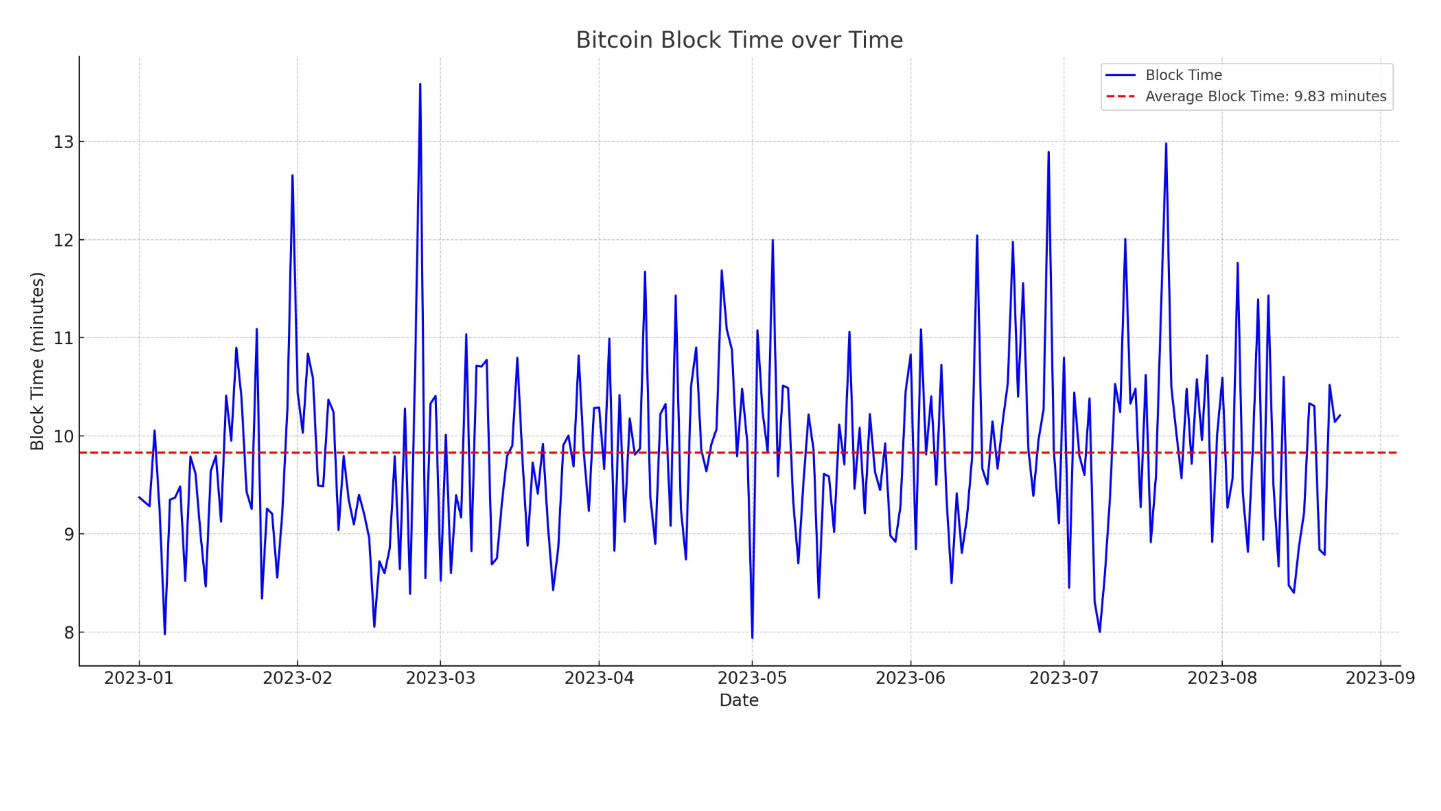

Based on the latest data analysis, Bitcoin’s current block production rate indicates an intriguing trend for the year 2023.

At present, the pioneering cryptocurrency is generating one block approximately every 9.83 minutes. This pace, which is determined by the current hash rate and difficulty projections, underlines the robust processing power of the Bitcoin network and the competitive mining landscape.

If this trajectory persists, the Bitcoin community should prepare for the next halving event predicted for 21st April 2024. A halving event is a significant milestone in the Bitcoin lifecycle as it reduces the rewards for mining a new block by half, typically leading to an increase in the price of Bitcoin due to decreased supply.

While this projection offers an engaging perspective, it’s essential to acknowledge that Bitcoin’s hash rate and difficulty are subject to fluctuations influenced by multiple factors, including mining efficiency, global energy costs, and regulatory changes.

These elements can accelerate, delay, or even sustain the current block generation rate, consequently affecting the anticipated halving date.

The post Bitcoin block production trend suggests early 2024 halving event appeared first on CryptoSlate.