Some exchange-traded funds rallied Wednesday even as stocks and bonds broadly fell, as hot inflation data stoked fears that interest rates will stay elevated for longer than anticipated.

Source link

Bonds

Quick Take

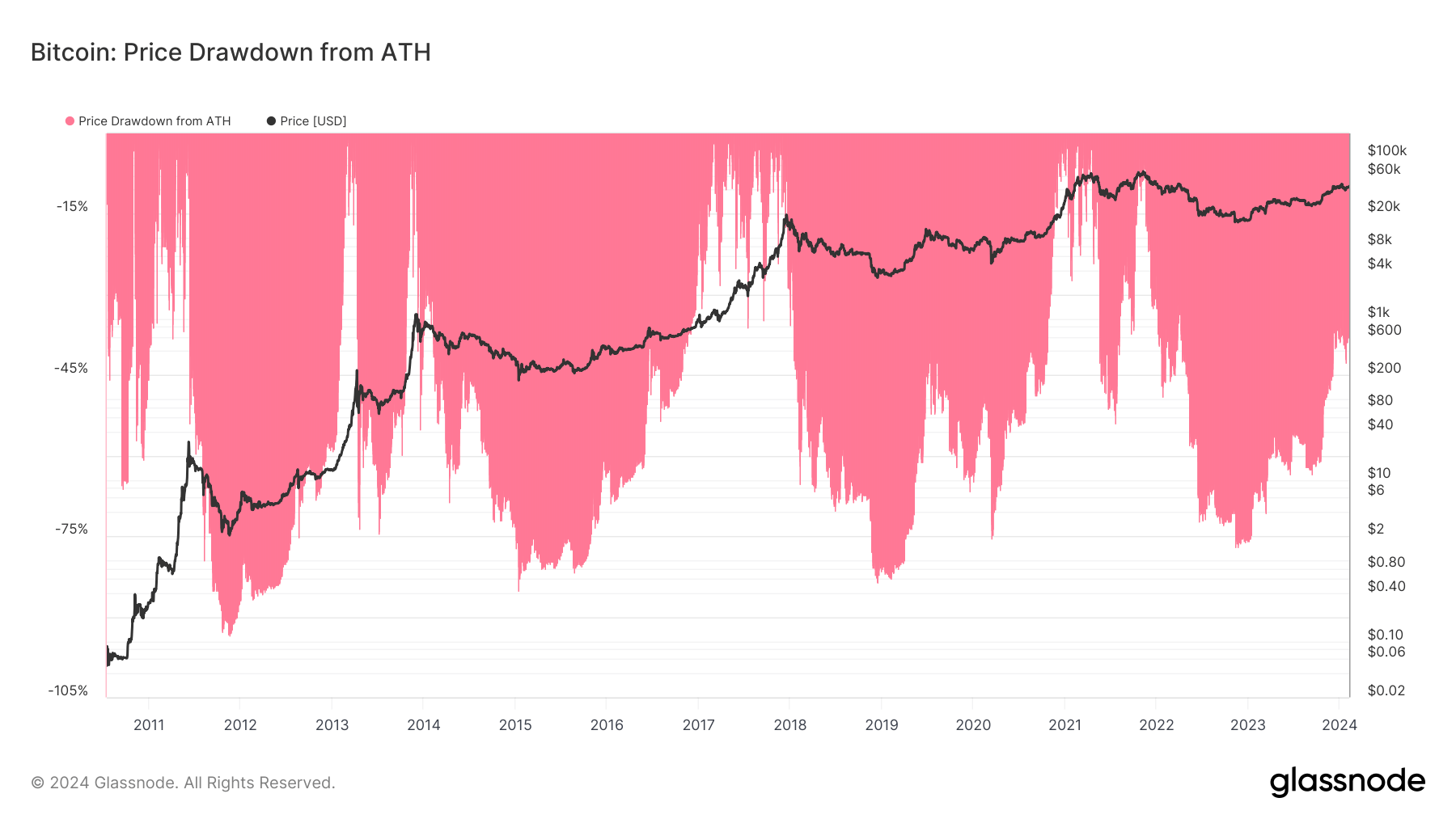

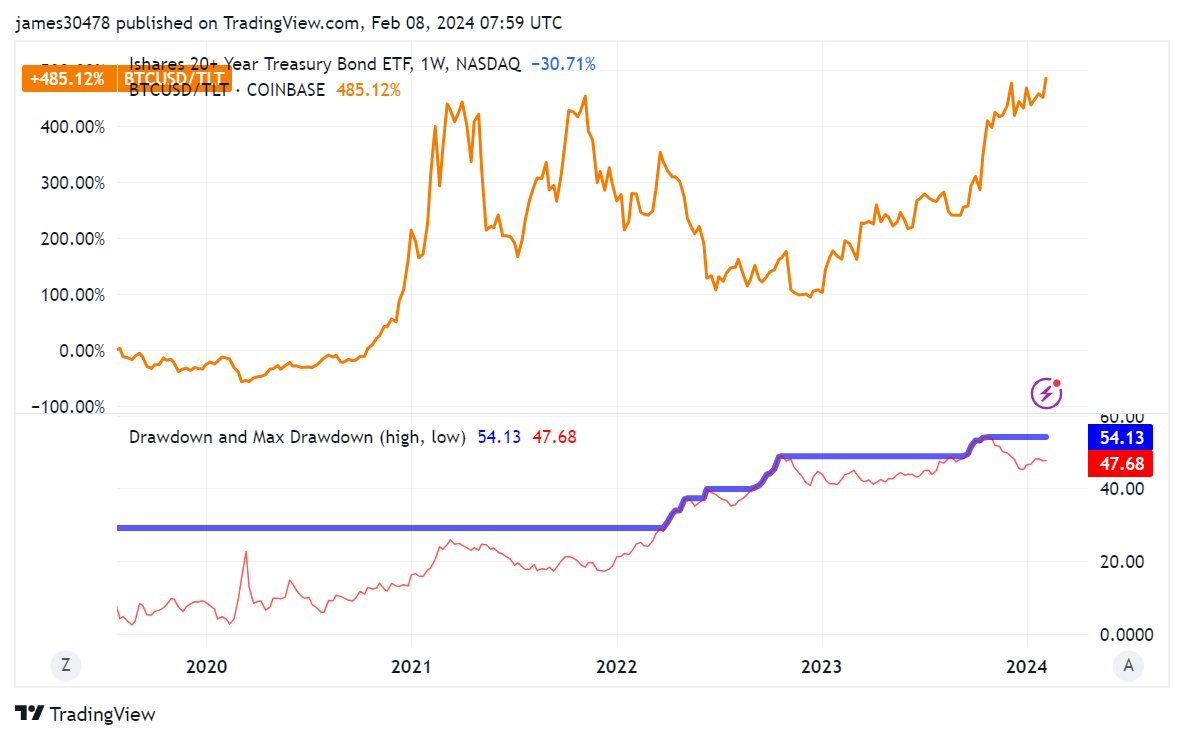

A trend emerged between Bitcoin and TLT, the U.S. long bond ETF, in early December as BTC denominated in TLT hit a triple top level previously seen in 2021.

Bitcoin just rallied above $44,200 and is 36% off its all-time high of $69,000; it has showcased a significant dominance in relation to TLT, which is currently trading around $94 and stands 48% off its peak. This divergence is further highlighted as it currently requires 471 TLT to purchase one Bitcoin, surpassing previous highs of approximately 420 and 440 in March and November 2021, respectively, when Bitcoin was trading well above $50,000.

This trend suggests an interesting aspect of the financial markets, as Bitcoin, traditionally viewed as a risky asset, displays resilience compared to TLT, a global benchmark for relatively safe assets. Notably, BTC ETFs are experiencing substantial inflows, potentially offering tailwinds to Bitcoin’s price.

Contrarily, market forecasts may dampen TLT’s prospects; the CME fed watch tool is currently projecting an 82% chance of a pause by March 2024, contrary to the optimism that prompted TLT to rally in recent weeks.

Compounded by challenges in the banking sector, for example, New York Community Bank stock is nearly down 70% year-to-date, according to The Kobeissi Letter; these developments present a compelling narrative of potential shifts in asset dynamics, worthy of close attention.

The post Bitcoin breakout against US bonds sees it hit new all-time high appeared first on CryptoSlate.

An earlier version of this article included an incorrect reference to yields narrowing on corporate bonds.

Corporate-bond investors have been net sellers of five out of the seven so-called Magnificent Seven components of the S&P 500

SPX,

according to market data in recent days.

Meanwhile, the spreads on yields have tightened between bonds for the Magnificent Seven and 10-year Treasurys

TY00,

(see chart), in a sign of healthy demand.

“Spreads have tightened and investors have chosen to be net sellers into the strength,” a source familiar with the bond market told MarketWatch. “Although spreads have tightened, there have been more sellers than buyers of the bonds.”

Yield spreads between corporate bonds of the Magnificent Seven and 10-year Treasurys have tightened.

BondCliQ Media Services

With the exception of Apple Inc.

AAPL,

and Meta Platforms Inc.

META,

net selling has outpaced buying in corporate bonds for the Magnificent Seven, as the spreads have narrowed.

Microsoft Corp.’s

MSFT,

corporate bonds have drawn the the heaviest selling, followed closely by Amazon.com Inc.’s

AMZN,

Alphabet Inc.

GOOG,

Tesla Inc.

TSLA,

and Nvidia Corp.

NVDA,

have also seen more sellers than buyers (see chart).

Sellers have outnumbered buyers for all but two of the corporate bonds of the Magnificent Seven.

BondCliQ Media Services

The stocks have been in the spotlight for much of 2023 as the biggest contributors to the 24.3% rally in the S&P 500

SPX.

The stocks have remained hot through this season’s Santa Claus rally as expectations build for the U.S. Federal Reserve to start cutting interest rates in the first part of 2024.

Also read: A record share of S&P 500 stocks have underperformed the index in 2023 as ‘weirdest bull market in decades’ marches on

BarnBridge DAO reaches $1.7M settlement with SEC over unregistered crypto bonds

BarnBridge DAO, a decentralized finance (DeFi) platform and its founders have agreed to a $1.7 million settlement with the Securities and Exchange Commission (SEC) for the unregistered offer and sale of their structured crypto asset securities, known as SMART Yield bonds.

The SEC announced the settlement, which includes a cease and desist clause preventing further sales of the crypto bonds, on Dec. 22.

The case reflects the watchdog’s ongoing scrutiny of DAOs in the evolving crypto market, emphasizing legal compliance irrespective of decentralized or autonomous structures.

SEC investigation

Founded in 2019, BarnBridge DAO emerged as a novel player in the DeFi space, aiming to mitigate risks associated with yield sensitivity and asset price volatility in cryptocurrency.

BarnBridge operates as a decentralized organization, meaning it lacks a central authority, and makes decisions through a voting system on the Ethereum blockchain using the BOND governance token.

The SEC started an investigation into BarnBridge DAO’s practices in July. This probe was triggered by the extensive marketing of SMART Yield bonds, which, upon examination, were found to be in non-compliance with securities registration requirements.

The bonds, likened to asset-backed securities, were broadly marketed to the public, including through social media platforms. Founders Tyler Ward and Troy Murray had actively promoted the investment potential of these bonds on various YouTube channels.

The DAO’s attorney Douglas Park disclosed the watchdog’s probe into BarnBridge’s activities to members the same month and advised them to halt product development and compensation.

Subsequently, a critical voting process was initiated within the DAO to decide on compliance with the SEC’s orders, including disgorgement payments and token distribution.

Regulating DeFi

The BarnBridge case is a part of the SEC’s broader regulatory focus on the crypto sector, especially DAOs, highlighting the importance of legal compliance in the rapidly evolving market.

SEC Director of Enforcement Gurbir S. Grewal emphasized that blockchain technology does not exempt organizations from securities laws. The settlement serves as a crucial reminder to entities in the crypto market of their obligations under these laws, regardless of their structure or technological foundations.

The BarnBridge case serves as a pivotal moment in regulatory oversight in the world of cryptocurrency, particularly for Decentralized Finance (DeFi) projects. It emphasizes the importance of compliance with regulatory laws and maintaining transparency in this complex and rapidly evolving sector.

By securing outside funding support through the pioneering Volcano Bonds, El Salvador can continue progressing with Bitcoin integration across governmental services and society.

El Salvador has successfully overcome a significant regulatory hurdle as it pursues the introduction of Bitcoin-backed sovereign debt instruments, referred to as “volcano bonds”. The nation’s Digital Assets Commission has provided the necessary approvals for the bonds to proceed, marking a significant milestone in the path towards their issuance, now slated for 2024.

Volcano Bonds

The Volcano Bonds intend to help El Salvador decrease existing sovereign financing costs and also fund the development of Bitcoin City, a planned metropolis centered around Bitcoin and blockchain innovation. The bonds will debut on the Bitfinex Securities trading platform, which will be in control of the country’s entrance into Bitcoin-backed capital markets under the direction of President Nayib Bukele, who has been an avid crypto advocate.

The Bond is expected to yield an annual return of 6.5% to investors over ten years. The plan is to utilize El Salvador’s plentiful volcanic resources to power mining operations. Additionally, Luxor Technology will be partnered with in this endeavor, and bond repayment will be supported by the mining yield. The regulatory clearance obtained moves the entire plan one step closer to execution. Additionally, the nation has disclosed the existence of a $1 billion Bitcoin mining project that utilizes the geothermal potential of the nation. When combined, these initiatives demonstrate El Salvador’s dedication to national innovation and cryptocurrency adoption.

By securing outside funding support through the pioneering Volcano Bonds, El Salvador can continue progressing with Bitcoin integration across governmental services and society. A statement by The National Bitcoin Office (ONBTC) also confirmed that it is expected to be launched by the first quarter of 2024.

🚨BREAKING NEWS🚨

The Volcano Bond has just received regulatory approval from the Digital Assets Commission (CNAD).

We anticipate the bond will be issued during the first quarter of 2024.

This is just the beginning for new capital markets on #Bitcoin in El Salvador.

🇸🇻🌋🚀

— The Bitcoin Office (@bitcoinofficesv) December 12, 2023

El Salvador Continues to Take the Lead with Crypto Innovation and Development

Recently, El Salvador made headlines by unveiling a freedom visa program that offers individuals who invest in Bitcoin and USDT the chance to obtain citizenship in the country. The program, however, sparked mixed reactions due to its requirement of a $1 million investment. Despite the controversy, the program has already attracted over $150 million worth of investments, surpassing the available spots of 1,000 for the year.

In addition to the visa program, El Salvador has been actively demonstrating its support for cryptocurrencies. The initial announcement about the issuance of Volcano Bonds was made in November 2021, with the country’s finance minister, Alejandro Zelaya, stating that they would be launched in March 2022, although that did not materialize. Subsequently, there were a few postponements. Nevertheless, the recent launch of the bonds reflects the unwavering determination of the country to introduce crypto-related solutions.

Many cryptocurrency experts will be monitoring El Salvador’s Bitcoin-related actions to see how profitable they can become for the nation. If it is successful, it might serve as a springboard for other nations to try out more crypto-related ideas, which would ultimately aid in increased adoption and the development of fresh solutions.

next

Bitcoin News, Blockchain News, Bonds, Cryptocurrency News, Market News

You have successfully joined our subscriber list.

Investors who were savvy enough to buy Apple Inc. bonds in October are now looking at equity-like returns, as prices have climbed while spreads have tightened as Treasury yields tumbled.

Hopes for one or more rate cuts by the Federal Reserve in 2024 have sparked a rally in Treasurys that has seen the Bloomberg US Aggregate Bond Index, a broad-based fixed-income benchmark, surge 4.91% so far in November as of Wednesday’s close. That puts it on pace for the biggest monthly gain since May 1985, when the monthly return was 5.23%.

The high-grade and highly liquid bonds issued by the iPhone maker have gained up to 15% in price depending on duration, while spreads have tightened up to 22 basis points, since mid-October, as the following charts from data-solutions provider BondCliQ Media Services show.

In comparison, Apple’s stock

AAPL,

has rallied about 10%

Since MarketWatch wrote on Oct. 18 that investors were flocking to bonds issued by (almost all) of the Magnificent Seven companies for their juicy yields, the bonds have rallied.

At the time, Apple’s 10-year bonds were yielding about 5.2%, while the stock’s implied dividend yield stood at 0.54%.

Price performance of select Apple Inc. bonds

BondCliQ Media Services

The following chart shows the movement in spreads in the same time frame.

Spread performance for select Apple bonds from Oct. 18.

BondCliQ Media Services

Given those strong returns, the bonds have seen net selling in the last 10 days, most likely due to profit-taking as the month draws to a close and fund managers seek to lock in some gains.

Most active Apple Inc. issues with net customer flow (last 10 days).

BondCliQ Media Services

Bonds issued by Apple and other household name companies had fallen in price as yields climbed during the rate-hiking cycle the Federal Reserve started in March 2022. That’s because of the inverse relationship between bond prices and yields and not because of any credit-quality issue.

But the move meant investors could add high-yielding, high-quality names to portfolios at a discount.

Apple has issued billions of dollars of bonds with maturities out to 50 years, much of it intended to raise the funds for shareholder returns. In 2013, for example, it issued $17 billion of bonds in a six-part deal, its first bond issuance since a convertible offering in 1996. At the time, most of the company’s cash was parked overseas, and would have been subjected to a 35% tax if the company had repatriated it.

After 2013, the company kept issuing bonds to take advantage of rock-bottom borrowing rates at the time.

For Apple investors, there’s just one stock, but there are many bonds in circulation to choose from.

Outstanding Apple Inc. debt (USD) by maturity year

BondCliQ Media Services

Read also: Corporate bonds are on sale. How to add cheap Apple, Disney and Microsoft bonds to your portfolio.

Have I Bonds from Last Year? Dec. 2 Could Be Your Sweet Spot for Cashing Out

Key Takeaways

- I bonds were extremely popular between May 1 and Oct. 31 of last year, when their initial rate was 9.62%. But for those who bought during this time, the return has since dropped to 3.38%.

- Meanwhile, CD rates have surged, with dozens of the best nationwide CDs offering record rates between 5% and 6% APY. That makes it a smart move to trade in I bonds for a federally insured CD.

- Timing your I bond withdrawal can significantly impact your earnings. Though you can cash out any time after one year, it’s financially smarter right now to wait just a little bit longer.

- We can tell you the best month to withdraw, based on your I bond’s issue date. After determining that, the best day to cash in is always the 2nd of the month. For many current I bond holders, the ideal withdrawal date will be Dec. 2.

Why 2022 I Bonds Were So Popular—But Are Less Appealing Now

Last year was a historic period for I bonds. That’s because the U.S. Treasury-issued bonds were paying returns of almost 10%, the highest rate they had ever offered. Since that looks more like a stock market return than what you can usually expect from a safe, risk-free investment, legions of Americans snapped up these bonds.

Anyone who bought between May 1 and Oct. 31 of 2022 was lucky to enjoy a 9.62% rate for the first six months. That was then followed by six months paying 6.48%. But I bond rates are indexed to inflation (hence the name), and with inflation cooling significantly this year, the current rate for I bonds purchased during this period has fallen to 3.38%.

It is true that if you cash in any I bond that’s less than five years old, you’ll pay a penalty. But we can help you time it right to minimize the penalty and maximize the gains from moving the money elsewhere.

You may have read early this month that the next 6-month I bond rate had been announced. Though the headline rate was 5.27%, that only applies to newly issued I bonds. For anyone who bought last year between May 1 and Oct. 31, the actual rate for the next 6-month period will be 3.94%.

How I Bonds Work

The interest rate on U.S. Treasury I bonds is adjusted once every six months and is based on current U.S. inflation rates. When inflation climbed to decades-high levels after the pandemic, this pushed up the I bond rate, registering its highest-ever rate of 9.62% on May 1, 2022.

What you personally earn on any I bond is linked to the issue date of that bond. All I bonds issued between May 1 and Oct. 31, 2022, earned that peak rate of 9.62% for their first six months, and it’s why so many Americans poured money into I bonds during this historic window of opportunity. Your issue date also determines the best date to cash out.

Bought I bonds before May 1, 2022? Or after Oct. 31, 2022? The rates you earn are somewhat different than those presented here. And your timing considerations for the best time to withdraw also vary. To find out the details for different issue dates between 2021 and 2023, see our handy I bond tables.

An important rule of I bonds is that they cannot be cashed in for any reason during the first 12 months. But once you’ve reached that one-year mark, you can withdraw any time you like. It’s true you’ll incur a penalty equal to the last three months of interest if your bond is less than five years old. But we’ll explain how you can reduce the hit significantly by carefully choosing your withdrawal date.

The Best CDs Pay More than Current I Bond Rates

With I bond rates now down to the 3% range, they’re no longer as attractive a savings vehicle. Though it’s certainly possible that future I bond rates could rise, I bond rates can never be predicted more than a few weeks before the next semi-annual announcement. Add to this that the Federal Reserve remains committed to bringing inflation further below the current level, and it’s a reasonable expectation that I bond rates in 2024 and 2025 are more likely to decline than to rise.

Fortunately, you can benefit from some lucky timing right now, as certificate of deposit (CD) rates have soared in 2023—and are likely to stay elevated into the new year. Dozens of nationally available certificates are paying rates of 5.00% or more, with the nationwide leader offering as much as 6.00% APY.

This means you could cash out your I bonds and move the money into a top-paying CD to instantly boost your interest rate 1 to 2 percentage points, or even more. Unlike an I bond’s unpredictable future rates, CD rates are locked in and guaranteed for the full duration of the certificate’s maturity term.

The Best Month and Day to Cash in Your I Bonds

If you like the idea of cashing out your I bond, you may be tempted to withdraw as soon as you hit your one-year anniversary. But don’t jump too quickly, as it turns out you’re better off waiting a few months.

Here’s why. The I bond penalty policy (for all bonds older than a year but not yet held for five years) is based on the last three months of interest. As we’ve discussed above, I bond purchasers from May to Oct of last year earned 9.62% for six months, then 6.48% for the next six months, and then 3.38% beginning in Month 13.

If you cash out as soon as you hit 12 months, you’ll forfeit the last three months of interest, when your rate is 6.48%. As that’s an excellent return, it’s worth holding onto instead of giving up. So if you can wait three more months—cashing out at Month 15—your interest rate will only be 3.38% for those last three months. This means you’ll not only be forfeiting a much lower rate, but also one that’s easy to beat with a CD.

To determine the best month for you to withdraw, look up your particular bond’s issue date and in the table below, identify when it will reach Month 15. As you can see, if you bought your I bonds in September last year, Dec. 2 is your sweet spot for cashing out with minimum penalty.

Still holding I bonds you purchased in May, June, July, or August? It’s also worth waiting at this point for Dec. 2, so that you can collect your December interest payment before withdrawing.

Best Date for Minimizing Withdrawal Penalty on I Bonds Issued from May to Oct. 31, 2023

| I Bond issued on any date in this month | Date you reach 15 months and minimize your penalty |

|---|---|

| May 2022 | Aug. 2, 2023 |

| June 2022 | Sep. 2, 2023 |

| July 2022 | Oct. 2, 2023 |

| Aug. 2022 | Nov. 2, 2023 |

| Sept. 2022 | Dec. 2, 2023 |

| Oct. 2022 | Jan. 2, 2024 |

You’ll notice above that the date listed for minimizing your penalty is the 2nd of each month. The reason is that the U.S. Treasury always pays interest for the month right away on the 1st, and not again until the 1st of the next month. So once you’ve been paid your interest for the month, there’s no reason or additional earnings to be gained by holding the funds longer during that month.

For anyone moving their I bond funds elsewhere, withdrawing on the 2nd enables you to collect the I bond interest payment on the 1st—and then as quickly as possible start earning interest on that money elsewhere, such as a CD or high-yield savings account. Even if you simply want to cash out and use your I bond funds, there’s no financial gain from waiting beyond the 2nd for your withdrawal.

Rate Collection Methodology Disclosure

Every business day, Investopedia tracks the rate data of more than 200 banks and credit unions that offer CDs and savings accounts to customers nationwide and determines daily rankings of the top-paying accounts. To qualify for our lists, the institution must be federally insured (FDIC for banks, NCUA for credit unions), and the account’s minimum initial deposit must not exceed $25,000.

Banks must be available in at least 40 states. And while some credit unions require you to donate to a specific charity or association to become a member if you don’t meet other eligibility criteria (e.g., you don’t live in a certain area or work in a certain kind of job), we exclude credit unions whose donation requirement is $40 or more. For more about how we choose the best rates, read our full methodology.

Nearly three years into the worst crash in the modern history of the U.S. bond market, ordinary investors hardly need to be told that bonds are far less “safe” and “secure” than many financial experts have claimed.

But bold new academic research, drawing on financial history going back to the 1890s, goes even further than that.

Bonds in general…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

Philippines’ state-owned Development Bank of the Philippines and Land Bank of the Philippines serve as the issue managers for the tokenized treasury bonds.

The Philippines aims to boost its domestic debt market by introducing tokenized treasury bonds, with an initial offering of at least 10 billion pesos ($179 million). This marks the country’s first foray into the issuance of tokenized bonds. However, the government retains flexibility in adjusting the issue size.

The move aligns with the broader trend in Asia, where blockchain and tokenized securities are gaining traction for fundraising. Hong Kong set a precedent in February with a successful offering of HK$800 million in tokenized green bonds, leveraging distributed ledger technology (DLT) to enhance liquidity and transparency in debt markets.

Both state-owned, the Development Bank of the Philippines and Land Bank of the Philippines serve as the issue managers. Deputy Treasurer Erwin Sta. Ana expressed the intent to explore tokenized bonds further, stating, “We will continue to study the technology and test its limits.”

The Bureau of the Treasury plans to issue tokenized bonds due in November 2024, with a minimum denomination of 10 million pesos for institutional buyers. The final interest rate will be determined through book-building, and the announcement is scheduled for November 20.

Asian Countries Embrace Asset Tokenization

Singapore recently initiated real-world asset tokenization pilots in collaboration with JPMorgan, DBS Bank, BNY Mellon, and investment firm Apollo. The United Arab Emirates, in partnership with HSBC, is also working on the tokenization of bonds.

This reflects a broader trend of governments globally exploring blockchain-based real-world asset tokenization. Israel’s Tel Aviv stock exchange joined this movement, completing a proof-of-concept for tokenizing fiat and government bonds. The surge in interest is notably fueled by financial giants such as JPMorgan and HSBC, signifying the increasing popularity of this technology.

In a recent development, HSBC Holdings (LSE: HSBA) is gearing up to introduce a digital assets custody service in collaboration with Ripple Labs’ subsidiary Metaco. Targeted at institutional clients, the service will provide custody for tokenized securities and also has a scheduled launch next year. This offering will complement HSBC’s existing Orion digital assets issuance platform and its recently unveiled gold tokenization platform, creating a comprehensive digital asset solution tailored for institutional clients.

Digital asset management firm 21.co forecasts that the market for tokenized assets may expand to reach up to $10 trillion in the coming decade. This projection is over the ongoing adoption of blockchain technology by traditional financial institutions (TradFi).

next

Business News, Market News, News

You have successfully joined our subscriber list.