Aurora Cannabis Inc. led gains among Canadian cannabis stocks on Wednesday after an industry executive was named president of the Cannabis Council of Canada trade group.

Source link

Cannabis

Roanoke College joins schools offering pot degrees as cannabis jobs beckon

Roanoke College Professor DorothyBelle “DB” Poli typically teaches biology and plant physiology, but she also leads a seminar for freshmen on sex and drugs in music — often influenced by cannabis.

So when the faculty at the 2,000-student school sat down to talk about potential degree programs related to wellness and social policy, cannabis seemed like a logical step.

“The more we looked at it, the more we realized it was a good idea,” Professor Poli told MarketWatch. “College students love this topic. There’s also jobs everywhere for people with skills.”

As a specialist in science and culture, Professor Poli is helping the school become the first institution of higher learning in Virginia to offer a four-year degree in cannabis studies.

The faculty at Roanoke College has OK’d the creation of the program with two potential Bachelor of Science degrees, one in the science of cannabis and the other focusing on social justice and policy.

It’s one of a growing number of cannabis-focused career and educational programs not only at trade schools but also at colleges and other higher learning centers.

At last check, 24 states have allowed adult-use cannabis sales, with more expected. Florida voters may decide a ballot question on the matter in November. Pennsylvania Gov. Pennsylvania Gov. Josh Shapiro has included adult-use pot in his latest budget proposal to the state legislature as a way to generate an estimated $250 million in taxes.

The combined U.S. medical- and recreational-cannabis market was expected to approach sales of nearly $34 billion in 2023, and increase to $53.5 billion by 2027, according to MJBiz estimates.

With this growth, an estimated 1 million jobs in the legal cannabis business are expected to open up in the next few years as more states roll out cannabis programs.

At last check, the legal cannabis business employed 417,493 people, according to the 2023 Vangst Jobs Report. The figure fell 2% from 2022 after a decade of growth, as the industry paused new hiring amid market challenges in more mature states and bumpy start-ups in other states.

California led the pack with 83,593 jobs, followed by 35,405 for Michigan, 29,925 for Illinois, 29,011 in Florida, which is a medical-only state, and 28,370 for Massachusetts.

“A confluence of factors — global inflation, rising interest rates, cooling investor enthusiasm, depressed wholesale cannabis prices, and a shift in post-pandemic consumer demand — challenged the legal industry’s

unrelenting growth,” the report said.

Cannabis-cultivation jobs comprise 31% of the total employment pie, while retail jobs make up 23% of all cannabis positions as the two largest components. Ancillary jobs such as general counsel and marketing, which don’t involve plant-touching, comprise 20%.

A director of cultivation typically makes $100,000 to $150,00 a year, while a retail director makes $100,000 to $130,000 and a general counsel earns up to $225,000, according to the Vangst report.

On the low end, bud tenders make $17 to $28 per hour and trimmers earn $16 to $20 an hour.

Also read: Cannabis stocks gain as Pennsylvania governor prioritizes legalizing adult-use pot

Michael (Mike Z) Zaytsev, a cannabis entrepreneur and academic director since 2022 at New York City’s LIM College, said he knows of 20-to-40 schools and programs now offering cannabis degree programs or cannabis minors. Those offerings range from associate degrees to bachelor’s to master’s degree programs. Zaytsev said there’s no official tabulation of cannabis educational programs offered in many states.

Some studies focus on agriculture and horticulture, while others hone in on science and medical, while others teach aspects of cannabis business.

The University of Maryland’s M.S. in Cannabis Science and Therapeutics is one well-established program, he said. Other widely known training programs are offered by Green Flower and SeedCrest.

Also read: MedMen goes from height of $3 billion valuation to zero as stock draws cease-trade order and top execs leave

In California, which has had an adult-use program for about a decade, Oaksterdam University describes itself as the first cannabis college. The story of Oaksterdam and its founders’ role in California’s legal cannabis movement is told in the 2023 documentary, “American Pot Story: Oaksterdam.”

For his part, Zaytsev helps run undergraduate programs for about 100 students now enrolled at LIM College, founded in 1939 and formerly known as Laboratory Institute of Merchandising.

In 2022, LIM was the first college in the U.S. to offer a master’s of public service (MPS) degree in cannabis after it was approved by the New York State Education Department. LIM also offers a cannabis-based Bachelor of Business Administration (BBA) degree — a first in the United States — and will graduate its first class in 2026.

LIM students often pursue a combination of a business of fashion major with cannabis minor or cannabis major with a fashion minor, he said.

“My students have been very interested and highly engaged,” Zaytsev said. “A few have even told me that the only reason they went to college was because they discovered that it was possible to major in the business of cannabis.”

To be sure, the cannabis business continues to face growing pains such as oversupply and layoffs in more established markets, as well as competition from illicit sellers in newer markets such as New York State.

As in any industry, there’s a potential for unscrupulous employers and managers who mistreat their workers.

It’s a challenge for schools to set up programs given that cannabis remains a Schedule I substance under federal law, and colleges must contend with regulations and marketing restrictions, as well as educating people internally about cannabis to overcome nearly 100 years of cannabis prohibition, he said.

For Roanoke College’s Poli, cannabis courses present an opportunity for Virginia to return to its pre-prohibition roots as a major hemp state dating back to 1619, when the first House of Burgesses required all planters in the state to sow the crop for rope, cloth and other uses. Thomas Jefferson and George Washington both grew hemp on their farms, but historians have said it’s doubtful if they smoked the flower, which contains THC.

For now, Roanoke College has no projections on class size for its new cannabis programs, but Poli said she’s already getting indications of interest.

“In the last 24 hours, I’ve gotten 10 emails from students,” she said.

Also read: New York cannabis farmers may have to throw away 250,000 pounds of product due to retail-store bottleneck

Tilray Brands vs. Canopy Growth: Which Cannabis Company Has the Better Long-Term Strategy?

The cannabis industry in Canada is in shambles. Pick a random pot stock and you’re sure to find an investment that is down big over the past few years. Canopy Growth (CGC -1.05%) and Tilray Brands (TLRY -2.79%) are no exception — they’ve fallen more than 50% in just the past 12 months. These businesses are struggling to grow and they are finding it difficult to reach breakeven. Their strategies, however, for fixing their problems vary. Which company is on the better path?

The case for Canopy Growth

Canopy Growth is hunkering down in an effort to streamline its operations and conserve cash as best as it can. The company has been laying off staff this year and it has even sold off its facility in Smiths Falls, Ontario, which served as its headquarters. It has also divested its retail operations in Canada.

Canopy Growth now likes to mention that it’s transitioning to an “asset-light model,” which is a much nicer way of saying that it’s looking to cut whatever it can to bring down expenses. But that’s what it needs to do if it wants to execute on some aggressive long-term plans.

Canopy Growth has been eager to enter the U.S. pot market for years; in 2019 it first revealed plans to acquire multi-state marijuana company Acreage Holdings. And since then, it has announced plans to work with Wana Brands and Jetty Extracts. But it can’t close on those deals with marijuana still not legal in the U.S.

Canopy Growth is effectively in a bit of a holding pattern right now. Legalization doesn’t appear imminent by any stretch, and the Nasdaq has also pushed back on the company’s plans to consolidate and report on the performance of U.S. assets. By trimming its costs and making the business leaner, it can help make its cash last longer, potentially reducing the need to raise capital in the near future.

In the three-month period ended June 30, Canopy Growth burned through 148.7 million Canadian dollars ($108 million) over the course of its day-to-day operating activities. That’s worse than the CA$140.5 million cash burn it reported a year ago. But with the company no longer planning to fund its cash-burning nutritional business, BioSteel, that should slow the rate of cash burn down. As of the end of June, Canopy Growth had cash and cash equivalents totaling CA$533 million, which could last more than a year if its cash burn slows down.

Canopy Growth’s plans to get leaner can help the business at a time when being large in the highly competitive Canadian cannabis industry isn’t necessarily a good thing. And improving its financials can put it in a good position to pursue growth opportunities in the U.S., if and when they open up.

The case for Tilray Brands

While Canopy Growth has been getting leaner, Tilray Brands has been in acquisition mode and diversifying its operations. One area that has been of particular focus for the business is alcohol. In August, the company announced it was going to acquire eight beverage brands from Anheuser-Busch InBev in a bid to expand its presence in the U.S. and its alcohol business. As a result of the deal, Tilray Brands projects it will hold 5% of the market for craft beer in the U.S.

Diversifying into alcohol is a good move for Tilray because it can help improve its bottom line. Here’s a comparison of the company’s gross margin by segment in its most recent quarter, which ended in August:

| Segment | Revenue | Gross Margin |

|---|---|---|

| Cannabis | $70.3 million | 28% |

| Beverage | $24.2 million | 53% |

| Distribution | $69.2 million | 11% |

| Wellness | $13.3 million | 29% |

Data source: Company filings.

Beverages aren’t a big part of the company’s operations right now, but expanding more into that area could be a way for Tilray to improve its financials. Last quarter, the company’s net loss totaled $55.9 million, less than a loss of $65.8 million in the year-ago period. As Tilray’s beverage business grows, its bottom line should improve as well.

Both stocks are risky but Tilray looks better overall

Investing in Canadian marijuana stocks is extremely risky, but if you’re looking specifically at these two pot stocks, Tilray is in a better position right now. The business is at least finding growth opportunities and ways for its operations and financials to improve. Canopy Growth’s obsession with the U.S. market and simply waiting on it to open up is far too risky — legalization could be years away from happening, assuming it happens at all.

Diversifying outside of cannabis is a sound strategy that could help Tilray’s operations become stronger and make the stock a more tenable investment to hang on to (without having to rely on U.S. marijuana legalization), which is why it’s far and away the better investment option today.

If You’d Invested $1,000 in Aurora Cannabis in 2018, This Is How Much You Would Have Today

It has been almost five years since Canada first legalized marijuana for recreational use. At the time, you may have been tempted to invest $1,000 into a top cannabis producer such as Aurora Cannabis (ACB 1.75%) to see how it might do in the future given the promising growth opportunities ahead. Unfortunately, to say that things haven’t gone well for Aurora — or many other Canadian producers — would be a huge understatement. Here’s just how bad things have been since then.

Shares of Aurora were trading at around $7 — before the reverse split

If you look up Aurora’s stock price on Sept. 4, 2018, some websites may say $81.60. That’s adjusted for the massive reverse stock split the company made in 2020, when it consolidated 12 shares into 1. The real price as of the close on that day was $6.80.

If you’d invested $1,000 at the time, that would have given you 147 shares of the pot producer. But with the stock price in a free fall in 2019 and the start of 2020, Aurora was struggling to keep its stock price above $1. That’s a key threshold it has to stay above to remain listed on the NYSE, the exchange where the stock was trading on at the time. In May 2020, in order to boost its share price, it consolidated its shares on a 12-for-1 basis. That means you would have received just 12.3 shares in return for your original 147 that you acquired.

On Monday the stock closed at $0.863, as it faces the prospect of another reverse stock split in its future. For now, you would still own 12.3 shares of the business. A stock split, even if it’s a reverse split, doesn’t alter the value of your investment. But generally, struggling stocks that have suffered significant declines often need to deploy reverse splits to keep their share prices up and maintain listing requirements. Split or not, Aurora investors have incurred deep losses.

At the stock’s current valuation, that original $1,000 investment would now be worth approximately $10.62. Your investment would literally be worth a few cups of coffee at this point.

Investors shouldn’t bet on a turnaround

Aurora has been working on slashing costs, as it has now achieved positive adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for three straight quarters and expects to generate positive free cash flow by the end of next year.

But once the company starts to grow again, costs and overhead will increase, and there is the potential for the business’ financials to deteriorate again. Getting to breakeven is great, but investors also need to see a path for revenue and earnings growth. Focusing on small international cannabis markets isn’t likely to lead to a big pay off for investors. And unfortunately, its home Canadian market is ultra competitive, with too many producers and too many restrictions that weigh down cannabis companies.

Aurora needs more than positive adjusted EBITDA and positive free cash flow — it also needs to achieve that while growing its operations. The recent acquisition of Bevo Farms has boosted Aurora’s top line, but once that effect subsides, the company will once again be back to struggling to generate positive top-line growth.

ACB Revenue (Quarterly YoY Growth) data by YCharts.

Aurora’s stock may be cheap, but it still isn’t a good buy

Aurora Cannabis trades at less than its book value and a multiple of only 1.5 times revenue. It’s also down around 99% over the past five years. There’s no question its valuation is incredibly low, with its market cap around $330 million. But despite the company’s cost-cutting efforts, there’s still much more management would need to do to make this an investable business. Buying the stock might allow you to profit from short-term fluctuations due to various developments affecting the cannabis industry at large that aren’t necessarily specific to the company, but at that point, you’ve become a speculator rather than an investor.

For long-term investors, it’s hard to justify buying the stock. This is a business that still faces significant challenges ahead. The cannabis industry is risky enough as it is; there’s no reason to compound that risk by also investing in Aurora Cannabis.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Aurora Cannabis (ACB 16.57%) has perhaps been the most disappointing pot stock since Canada legalized adult recreational uses of marijuana back in 2018 — and that’s saying something. The company was initially seen as one of the frontrunners in the race to dominate this field, but things haven’t turned out so well.

But could Aurora Cannabis be on the verge of making a comeback? The company recently announced some news that has the market buzzing, not to mention there are some interesting industrywide developments. With all that going on, let’s find out whether investors should consider giving a second thought to the pot grower.

Benefitting from multiple tailwinds

On Sept. 8, Aurora Cannabis announced a move to reduce its debt and interest expense. The company said it had repurchased $9 million worth of convertible debt between mid-August and early September. Aurora Cannabis raised the money to do so by issuing 20.1 million new shares. This is part of the company’s goal to become free-cash-flow-positive next year — something that would be an achievement considering how poorly it has performed in recent years, both financially and on the stock market.

That’s not the only reason Aurora Cannabis has been on fire lately. The company is also benefiting from positive news on the regulatory front. The U.S. Department of Health and Human Services (HHS) recently recommended that marijuana be downgraded from a Schedule I controlled substance to Schedule III. If the agency in charge, the U.S. Drug Enforcement Administration (DEA), decides to follow this recommendation, things will get substantially easier for pot companies.

Schedule III substances are classified as less prone to dependence than those in the first or second category. For context, heroin is a Schedule I drug. Under the new HHS proposal, marijuana would also become recognized as having accepted medical use in the country — a potential game changer for the pot industry. Yes, cannabis would remain illegal at the federal level, but things would get substantially less stringent for Aurora Cannabis and its peers.

Finally, there is a bill making its way through the U.S. Senate right now that could give pot companies easier access to various banking services, which they currently lack due to the legal landscape surrounding marijuana in the country. These are all positive developments for Aurora Cannabis and the rest of the industry, but is that enough to buy the stock?

How long will this momentum last?

Let’s assume the DEA does reschedule cannabis as per the HHS’s recommendation, and lawmakers pass this new bill seeking to grant cannabis companies easier access to traditional means of funding. Even under this scenario, it’s not clear that Aurora Cannabis is a buy. Consider the company’s financial results. In its latest period — the first quarter of its fiscal year 2024, ended June 30 — Aurora Cannabis reported revenue of 75.1 million Canadian dollars (about $55.7 million), up 50% year over year.

That sounds great, at least until one realizes that much of that growth wasn’t organic and was instead due to an acquisition the company made in August 2022. This has been part of Aurora’s strategy for years. The company has sought to dominate the market by making a series of acquisitions. There is nothing wrong with this strategy in principle, but Aurora Cannabis hardly had the financial means to splurge on takeovers, so it often had to issue new shares, diluting existing shareholders in the process.

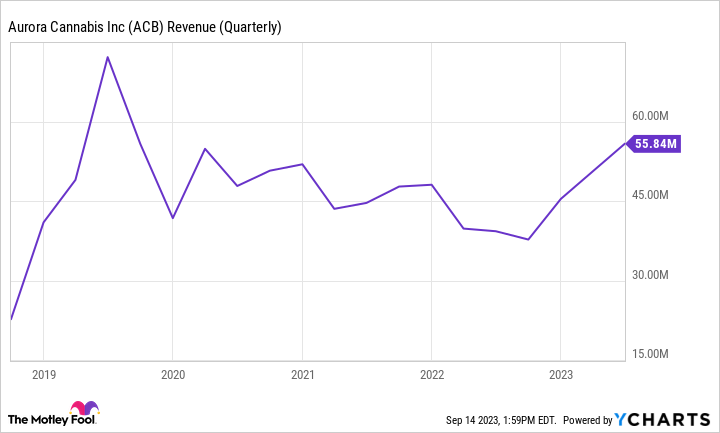

Perhaps that would have been fine if these acquisitions had panned out and the company’s financial results had increased substantially as a result, but that largely didn’t happen. Aurora Cannabis’ revenue growth has been unimpressive in the past five years after initially soaring once pot became legal in Canada.

Data source: YCharts

In fairness, that’s not entirely the company’s fault. The Canadian market had been difficult, with intense competition (including from illicit markets), stiff regulations to obtain cannabis licenses, and other challenges. That’s why there is no reason to think that Aurora Cannabis will suddenly turn things around even if the legal landscape substantially improves in the U.S. That will almost certainly attract plenty of new companies, and, based on the company’s history, I wouldn’t pick Aurora Cannabis to be one of the winners.

The company also remains unprofitable, although it has improved on this front in recent years and looks close to profitability.

Data source: YCharts

Aurora Cannabis may or may not become free-cash-flow-positive next year. In my view, it doesn’t matter. The company’s track record is too poor for that to somehow tip the scales in its favor. It should take much more than that for most investors to consider initiating a position. For now, it’s best to stay away and watch how things unfold from a safe distance.

Is TLRY Stock A Buy After Feds Recommend Cannabis To Be Rescheduled?

Canadian cannabis producer Tilray (TLRY) is expanding its product base and improving its bottom line. With new acquisitions and the stock off its 52-week low, is TLRY stock a bargain buy now?

X

Shares of cannabis stocks soared Wednesday in heavy volume on news that the U.S. Department of Health and Human Services is recommending that cannabis be rescheduled from a Schedule 1 to a Schedule 3 substance. Cannabis obtained the classification back in 1970.

Schedule 1 drugs include heroin and LSD and are said to have “no currently accepted medical use and a high potential for abuse,” as defined by the U.S. Drug Enforcement Administration.

Schedule 3 drugs are considered to have “moderate to low potential for physical and psychological dependence,” according to the DEA. The lower-class Schedule 3 drugs also do not have interstate restrictions like Schedule 1 drugs have and come with some business tax advantages.

Germany’s federal Cabinet approved a marijuana legalization bill on Aug. 16, according to Reuters, but the bill still has to pass Parliament.

In separate news, Tilray announced Wednesday its new diamond-infused pre-rolls under its RIFF brand to be sold in select regions in Ontario, Canada.

Markets Continue To Expand

Minnesota became the 23rd state to legalize recreational marijuana after Gov. Tim Walz signed legislation on May 30. It went into effect Aug. 1 and applies to adults age 21 and older.

This follows Maryland’s new recreational legalization that began on July 1, after voters approved recreational cannabis use by those 21 or older on Nov. 8. Maryland will tax recreational pot at a 9% rate, while medical marijuana is tax-exempt.

Meanwhile, Illinois posted a record $140 million in sales of recreational marijuana sales in July. Illinois Gov. J.B. Pritzker boasts that legal cannabis provided 30,000 jobs in Illinois. The state’s taxable pot sales topped $1.5 billion in 2022.

States collectively generated more than $15 billion in adult-use marijuana tax revenue from 2014 to 2022. Pot-legal states raked in about $3.8 billion in cannabis tax dollars in 2022 alone.

TLRY Stock Rallies

Tilray shares soared nearly 11% Wednesday in heavy volume on the news. The stock reclaimed its 200-day moving average.

The stock sank over 9% on Aug. 24, on news that competitor Curaleaf (CURLF) plans to sell recreational marijuana in Germany by the end of 2024, as legalization is on the horizon.

TLRY stock skyrocketed over 30% on Aug. 8 in heavy volume following a deal with Anheuser-Busch, retaking its 200-day moving average for the first time since December. The move was short-lived as it sold off the following two days to fall back below the 200-day line.

The stock soared nearly 15% on July 26 after the company reported a smaller-than-expected loss and higher sales in its May-ended quarter. TLRY retook its 50-day moving average on that move.

TLRY stock hit a 52-week low of 1.50 on June 21.

Its decline has been spectacular. Tilray went public in July 2018 at 17 a share and peaked exactly at 300 in September 2018. It’s now back around 2 a share.

Tilray shares have improved from their lows and are down about 1% on the year after pulling back from their Aug. 8 rally. TLRY stock has fared much better than competitors Canopy Growth (CGC) and Cronos (CRON), which are down about 80% and 26%, respectively.

Tilray Adds New CBD Drinks And Busch Beer Names

On Aug. 24, Tilray debuted its new carbonated CBD drinks under its Solei brand in Ontario, Quebec and Alberta, Canada.

Tilray announced on Aug. 8 that it entered into an agreement to buy eight beer brands from Anheuser-Busch (BUD) for an undisclosed cash amount. Brands in the deal include Shock Top, Breckenridge Brewery, Blue Point Brewing Company, Square Mile Cider Company and HiBall Energy.

The transaction includes breweries and brewpubs associated with the brands, according to the Wall Street Journal. The deal is expected to close sometime this year.

Tilray Brands subsidiary Montauk Brewing announced on Aug. 2 that its craft beers will be available in Philadelphia, Scranton and the Lehigh Valley in Pennsylvania.

Losses Getting Smaller While Sales Grow

Tilray posted an adjusted loss of 1 cent per share in its fiscal Q4 earnings release July 26, which equaled last year’s same quarter. This beat FactSet’s forecast of a four-cent loss.

Quarterly sales rose 20%, a huge improvement over the 4%, 7% and 9% declines in the prior three quarters. Revenue got a boost from the company’s strong 43% alcohol beverage net revenue increase, while cannabis net revenue grew 21% vs. the prior year’s same quarter.

The company has saved $22 million out of its $30 million cost optimization plan that it announced in Q4 2022.

Tilray’s $43 million adjusted free cash flow far exceeded the negative $24 million in the prior year’s quarter.

“During the 2023 fiscal year, we delivered on our commitment to generate positive adjusted free cash flow across all business segments, and executed against our strategic plan to grow revenue, drive operating efficiencies, and improve margins and profitability, all while investing in our industry-leading brands,” said Irwin D. Simon, Tilray Brands’ chairman and CEO.

Tilray expects to achieve full-year fiscal 2024 adjusted EBITDA targets of $68 million to $78 million, representing growth of 11% to 27% as compared with fiscal year 2023, with positive adjusted free cash flow in 2024.

Tilray held on to its top spot in the Canadian cannabis market with an 8.5% market share in a recent report.

Some States Climb On Board, Others Slow To Warm Up

Connecticut adult-use marijuana shops opened their doors for the first time on Jan. 10 for recreational and medical use. The shops are open to adults age 21 and over.

Hundreds waited in line as New York opened its first recreational dispensary on Dec. 30

Kentucky State Senate President Robert Stivers hinted that he may approve limited use of medical marijuana for patients at the end of their lives, but he remains skeptical of its effectiveness.

Missouri passed a law to legalize recreational-use cannabis, after it passed on the Nov. 8 ballot. Marijuana companies will be able to deduct business expenses on their Missouri state tax returns for the first time, benefiting startup cannabis companies.

Virginia also legalized pot but is not expected to have dispensaries until 2024.

Tilray’s chief strategy officer and head of international business, Denise Faltischek, sees favorable cannabis regulation in Europe ahead, but not until 2024.

Tilray Adds Partnership, Products

With the company not expecting U.S. legalization of cannabis on a federal level anytime soon, it is bolstering its alcoholic beverage presence and new products for additional growth.

Its strategy is to leverage its brands, infrastructure, expertise and capabilities to drive market share. Tilray’s growth plan focuses on new products and new geographies.

Tilray subsidiary SweetWater Brewing scored a big win with its partnership with ATLive concert series and Mercedes-Benz Stadium. SweetWater Brewing launched its gummies craft ale, containing 9.5% alcohol, on July 6.

Meanwhile, Tilray’s RIFF cannabis brand launched two new THC summer beverages in Canada on July 12. Lastly, its Breckenridge Distillery partnered with local Colorado artist Sandra Fettingis on a limited-release 96 proof whiskey.

TLRY Stock Fundamental Analysis

Earnings growth is a staple of top stocks. But the EPS Rating of TLRY stock stands at a weak 37 out of 99. Other Canadian marijuana stocks also have mediocre or weak profit ratings, as they continue to lose money.

Tilray’s Composite Rating has improved but is still a low 45, according to MarketSmith analysis. IBD research says investors should focus on stocks with Composite Ratings of 90 or higher.

The company’s SMR Rating — which measures sales, profit margins and return on equity — is a suboptimal D.

Is TLRY Stock A Buy?

Shares of TLRY are not in a base or in buy range, so TLRY stock is not a buy right now.

In addition, look for Tilray’s fundamentals to continue to improve, including a return to profitability.

IBD advises investors to focus on stocks with stronger fundamentals that are moving into buy zones. TLRY is trading around 2 a share. Institutional investors also typically avoid low-priced stocks.

Follow Kimberley Koenig for more stock news on Twitter @IBD_KKoenig.

YOU MAY ALSO LIKE:

Get Free IBD Newsletters: Market Prep | Tech Report | How To Invest

What Is CAN SLIM? If You Want To Find Winning Stocks, Better Know It

IBD Live: Learn And Analyze Growth Stocks With The Pros

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

Want More IBD Insights? Subscribe To Our Investing Podcast