Either gold shares rise from here or gold prices take a dive.

Source link

catch

Crypto experts during the Next Block Expo conference in Berlin unanimously agreed the crypto bear market is over but emphasized a cautious approach.

Bitcoin (BTC) price has continued to showcase its stability as an investment product in the past few days. After reaching a new yearly high of around $44.5k, Bitcoin price has been ranging in a bullish pennant pattern, which could yield a fresh rally toward $48k before the end of the year. The flagship cryptocurrency has attracted significant attention from institutional investors seeking to diversify their portfolios and balance sheet assets. Trading around $44k on Thursday during the early London session, Bitcoin bulls are in control in the short term, despite the increased risk of a correction toward $32k.

Bitcoin Bulls Take Solace in Upcoming Halving

The Next Block Expo conference in Berlin which concluded on Tuesday, December 5, brought together some of the top crypto experts. During an interview with Cointelegraph, Robby Yung, the Chief Executive Officer of Animoca Brands, Miko Matsumura the managing partner at gumi Cryptos Capital, Binance regional manager Jonas Jünger, and João Leite the Polkastarter business development lead unanimously agreed the upcoming Bitcoin halving has significantly rejuvenated the bullish sentiment.

According to Matsumura, the past three Bitcoin halving events, which have yielded the macro bull markets, have psychologically trained investors to incline on the next halving. Moreover, Jünger highlighted that the Bitcoin halving event has presented a phenomenon that was completely lacking in the fiat market, as most global central banks struggle with high inflation.

“Every four years, we swing the ram, and we smash. Four years is long enough that the people inside the castle think we’ve gone away,” Matsumura noted.

As a result, Yung noted that Bitcoin will continue to play the role of reserve for the web3 industry while alternative coins like Ethereum attract new players. Moreover, Bitcoin provides deep liquidity for all people without discrimination of traditional geopolitical norms.

After all these years, I finally met @mikojava IRL when we got a chance to do a panel today at @nextblockexpo in Berlin. TL;DR? We’re emerging from the bear market, and the honey badger is getting fat (ask Miko). pic.twitter.com/h0PslG3DK9

— Robby Yung ⦿⦿⦿ (@viewfromhk) December 5, 2023

Spot ETF Narrative

The crypto experts also unanimously agreed that the ongoing Bitcoin spot exchange-traded funds (ETFs) narrative in the United States has significantly charged the bulls. Furthermore, Yung believes the potential approval will attract more than $12 billion in subsequent months. Moreover, all the funds trapped in non-performing traditional investment accounts like treasury bonds and retirement packages will gradually tap into the Bitcoin market via spot ETFs.

“All of a sudden, with this ETF vehicle, you will no longer have synthetic financial instruments that reflect the price of Bitcoin. You have an actual spot. It’s all secured. It’s all in custody,” Jünger said.

Meanwhile, the crypto experts cautioned investors to understand that another bear market will happen, hence it is prudent to prepare in advance. Ideally, Leite highlighted that the hype will cool down and only companies with long-term strategies will be rewarded.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Unilever Can’t Catch a Break With Wall Street, but You Might Want to Buy the Stock Anyway

When Alan Jope took over as CEO of Unilever (UL -0.21%), the company was on the cusp of big changes. Jope did an admirable job, and also had to contend with the coronavirus pandemic along the way, but he has now stepped aside. New CEO Hein Schumacher has gotten to know the consumer staples titan and he’s presented investors with a business plan.

Wall Street analysts were unimpressed, but that doesn’t mean it’s a bad plan. Here’s why you might want to own Unilever despite what analysts think.

Unilever is a different company today

When Jope took the helm of consumer staples giant Unilever in early 2019, the company was set for a series of shifts. Notably, it was moving from an unusual dual-listing structure to being based entirely out of the United Kingdom. That was completed in late 2020. Also in the works over that span was the sale of slower-growing businesses like teas, a division sold in mid-2022. Along the way, the company was adding faster-growing brands via bolt-on acquisitions, such as the purchase of Liquid IV in a deal announced in late 2020.

Image source: Getty Images.

During that time period, Jope also had to deal with an activist investor in the form of Nelson Peltz. He was eventually added to the company’s board of directors. Unilever chose not to get into a big battle with the investor, who had previously had a very public fight with competitor Procter & Gamble. And, of course, the larger global backdrop through much of Jope’s tenure includes the coronavirus pandemic and the impact it has had on consumer demand, supply chains, and inflation.

Simply put, Jope had to carry a heavy load. It wasn’t a perfect run, but he saw the company through a transition period and it is now positioned very differently than it was in 2019. This is where Schumacher comes in. He has inherited a business that is more streamlined and shifting in the direction of growth.

Unilever underwhelms Wall Street

Schumacher just held his second earnings conference call. On the first call, he basically introduced himself, explained he was excited to be the CEO and that he’d take some time to figure out what he wanted to do as the new boss. It was a completely reasonable approach and investors were happy to wait for details. That Q3 update came with a long strategic presentation.

Generally speaking, the questions from Wall Street analysts made it very clear that Schumacher’s plan wasn’t enough to impress them. The big takeaway seemed to be that very little about Unilever’s long-term road map was going to change. It boils down to cutting costs, focusing more on the biggest and best brands, pushing product innovation, and streaming line management (including tying pay more closely to performance). As one analyst noted, however, these things sound like business basics.

Indeed, a rapid upturn in performance seems unlikely. But from a long-term investor’s point of view, getting the basics right should probably be a good thing after a period of business upheaval that has significantly altered the company’s operations. Furthermore, Unilever’s blueprint is very similar to the one that Nelson Peltz pushed at Procter & Gamble. That plan proved to be quite beneficial for the company, which has been performing better than peers for several years.

Unilever is a different company (it has more emerging market exposure and sells both food and consumer products), but there’s no reason to think that the steps which helped Procter & Gamble turn its business around would be a mistake here. In fact, after the changes that have already recently taken place, you could argue that slow and steady is the more advisable choice.

No reason to avoid Unilever

Unilever is a giant in the consumer staples space, with a global portfolio of well-known and much-loved brands. The dividend yield is an attractive 3.9%, which is toward the higher side of the company’s historical yield range. While Unilever hasn’t performed as well as some peers like P&G, a lot of change has occurred in a short period of time.

With the new CEO largely sticking with the long-term plan, which Peltz most likely influenced, investors shouldn’t expect a quick change in performance. But you can still collect that historically high yield from an industry leader while you wait for the slow-and-steady approach being taken to play out. For income investors who think in decades, that’s probably a good outcome.

Bitcoin futures data highlight investors’ bullish view, but there’s a catch

Bitcoin (BTC) price surged by 26.5% in October, and several indicators hit a one-year high, including the BTC futures premium and the Grayscale Bitcoin Trust (GBTC) discount.

For this reason, it’s challenging to present a bearish thesis for BTC as data reflects the post-FTX-Alameda Research collapse recovery period and is also influenced by the recent increase in interest rates by the United States Federal Reserve.

Despite the positive indicators, Bitcoin price remains around 50% below its all-time high of $69,900, which was hit in November 2021. In contrast, gold is trading just 4.3% below its $2,070 level from March 2022. This stark difference diminishes the significance of Bitcoin’s year-to-date gains of 108% and highlights that Bitcoin’s adoption as an alternative hedge is still in its early stages.

Before deciding whether the improvement in Bitcoin futures premium, open interest and the GBTC fund premium signal a return to the norm or the initial signs of institutional investors’ interest, it’s essential for investors to analyze the macroeconomic environment.

The U.S. budget issue sparks Bitcoin’s institutional hope

On Oct. 30, the U.S. Treasury Department announced plans to auction off $1.6 trillion of debt over the next six months. However, the key factor to watch is the auction size and the balance between shorter-term Treasury bills and longer-duration notes and bonds, according to CNBC.

Billionaire and Duquesne Capital founder Stanley Druckenmiller criticized Treasury Secretary Janet Yellen’s focus on shorter-term debt, calling it “the biggest blunder in the history of the Treasury.“ This unprecedented increase in the debt rate by the world’s largest economy has led Druckenmiller to praise Bitcoin as an alternative store of value.

The surge in Bitcoin futures open interest, reaching its highest level since May 2022 at $15.6 billion, can be attributed to institutional demand driven by inflationary risks in the economy. Notably, the Chicago Mercantile Exchange (CME) has become the second-largest trading venue for Bitcoin derivatives, with $3.5 billion notional of BTC futures.

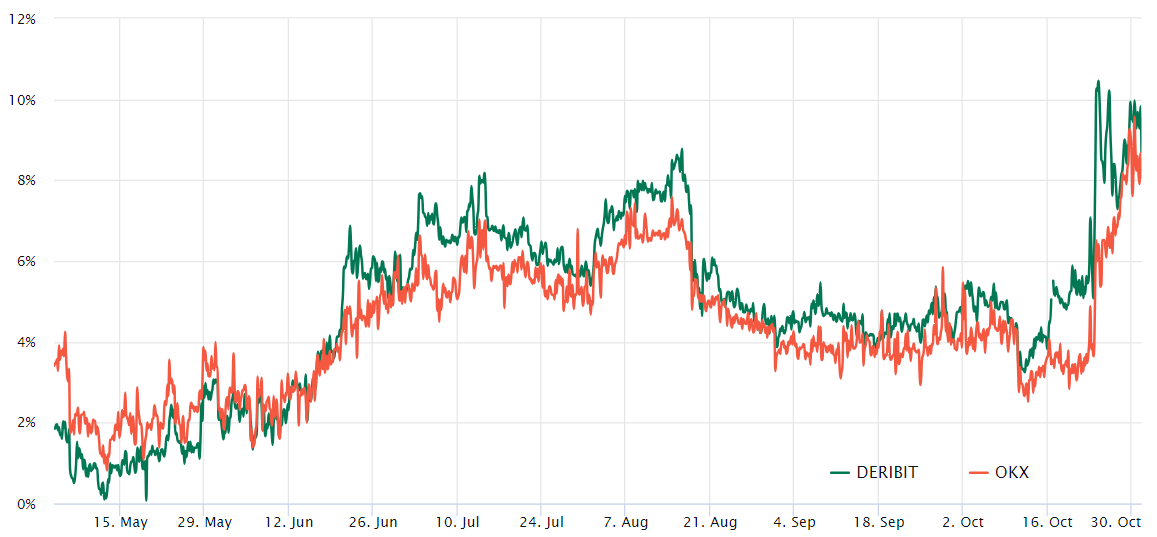

Moreover, the Bitcoin futures premium, which measures the difference between two-month contracts and the spot price, has reached its highest level in over a year. These fixed-month contracts typically trade at a slight premium to spot markets, indicating that sellers are requesting more money to delay settlement.

The demand for leveraged BTC long positions has significantly increased, as the futures contract premium jumped from 3.5% to 8.3% on Oct. 31, surpassing the neutral-to-bullish threshold of 5% for the first time in 12 months.

Further bolstering the speculation of institutional demand is Grayscale’s GBTC fund discount, narrowing the gap to the equivalent underlying BTC holdings. This instrument was trading at a 20.7% discount on Sept. 30 but has since reduced this deficit to 14.9% as investors anticipate a higher likelihood of a spot Bitcoin exchange-traded fund (ETF) approval in the United States.

Not everything is rosy for Bitcoin, and exchange risks loom

While the data seems undeniably positive for Bitcoin, especially compared to previous months, investors should take exchange-provided numbers with caution, particularly when dealing with unregulated derivatives contracts.

The U.S. interest rate has surged to 5.25%, and exchange risks have escalated post-FTX, making the 8.6% Bitcoin futures premium less bullish. For comparison, the CME Bitcoin annualized premium stands at 6.8%, while Comex gold futures trade at a 5.5% premium, and CME’s S&P 500 futures trade at 4.9% above spot prices.

Related: Will weakness in Magnificent 7 stocks spread to Bitcoin price?

The Bitcoin futures premium, in the broader context, is not excessively high, especially considering that Bloomberg analysts give a 95% chance of approval for a spot Bitcoin ETF. Investors are also mindful of the general risks in cryptocurrency markets, as highlighted by U.S. Senator Cynthia Lummis’s call for the Justice Department to take “swift action” against Binance and Tether.

The approval of a spot Bitcoin ETF could trigger sell pressure from GBTC holders. Part of the $21.4 billion in GBTC holdings will finally be able to exit their positions at par after years of limitations imposed by Grayscale’s administration and exorbitant 2% yearly fees. In essence, the positive data and performance of Bitcoin reflect a return to the mean rather than excessive optimism.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Bitcoin On-Chain Data Points To Bullish Outlook, But There’s A Catch

Santiment, a leading blockchain intelligence platform, has recently provided insights pointing to a favorable short-term scenario for Bitcoin (BTC). However, according to other signals that seem ‘hidden,’ there’s a catch.

These on-chain metrics can serve as the north star for investors looking to strategize their next steps. However, according to another metric, though recent revelations by Santiment might hint at continued positive momentum for Bitcoin, there’s also a possible contrary move that could play out.

Bitcoin Sentiments Bullish On-Chain Indications

Santiment’s recent post revealed a positive narrative for BTC’s immediate future. One of the key metrics supporting this bullish outlook is the significant number of active Bitcoin addresses.

It is worth noting that an increase in active addresses can indicate enhanced adoption, investor interest, and overall network health. Furthermore, a surge in previously dormant tokens moving actively hints at a renewed trader interest.

According to Santiment, such activity has often coincided with bullish trends, making this an essential metric to monitor.

👍 If you’re concerned about a #crypto retrace, note that #Bitcoin still maintains a high pace of active addresses. Additionally, the top market cap asset is seeing a high level of dormant tokens now moving, typically synonymous with #bullish conditions. pic.twitter.com/NvxKkQpkg8

— Santiment (@santimentfeed) October 26, 2023

Given these disclosed metrics by Santiment, Bitcoin may still have more rallies to squeeze out. However, to add another layer of intrigue to the current market scenario is the behavior surrounding meme coins, especially PEPE.

According to Onchain Capital co-founder and Crypto Banter host, Ran Neuner, meme coins, with their viral nature and swift price movements, sometimes act as a barometer for market sentiment, albeit unconventional.

PEPE’s Performance: A Market Temperature Check?

While Santiment’s report offers optimism, some market observers utilize unique indicators to sense potential market shifts. PEPE, a meme coin, has recently caught the attention of several prominent crypto figures.

Ran Neuner recently mentioned that PEPE might act as an indicator of an overheated market. The logic? When traders and investors flock to such tokens, and they see significant price pumps, it might be a sign of excessive optimism in the market. An event to walk with caution.

If you want to know when a pull back is coming, just watch $PEPE. It’s literally an index for when the market is getting overheated. When people are confident enough to go there and it pumps, that’s your sign to exit. Works every time. pic.twitter.com/vMcqiddHwp

— Ran Neuner (@cryptomanran) October 26, 2023

Notably, PEPE has surged by more than 80% in the past week. The meme coin has soared from a low of $0.00000650 seen last Friday, to as high as $0.00000118 at the time of writing. Following the recent increase in price, PEPE is currently down 1.1% in the past 24 hours.

Furthermore, in what seems to complement Neuner’s proposed indicator, Bitcoin has seen quite a notable retrace from its recent spike above $35,000. The asset currently trades at $33,620, at the time of writing down by 1.1% in the past hour.

Featured image from ShutterStock, Chart from TradingView

Bankrupt crypto exchange FTX floated an amended proposal to return up to 90% of creditor holdings held at the exchange before it went bust last November.

The debtors’ group, which is currently overseeing the bankruptcy process, will formally file the plan by December 16, 2023, to a U.S. Bankruptcy Court for perusal.

FTX collapsed last year after CoinDesk published revelations concerning the state of its balance sheet. New CEO John J. Ray III has berated financial controls at the company, while founder Sam Bankman-Fried is undergoing trial on criminal charges.

Read more: Former Top FTX Executive Testifies He Knew $8B of Customer Money Was Missing

The debtors propose dividing missing customer assets into three pools based on circumstances at the start of the Chapter 11 cases: Assets segregated for FTX.com customers; Assets for FTX.US customers; and a “General Pool” of other assets.

The proposal stated that customers with a preference settlement amount of less than $250,000 can accept the settlement without any reduction of claim or payment. Preference settlement is 15% of customer withdrawals on the exchange, nine days before it went under.

Creditors would further receive a “Shortfall Claim” against the general pool corresponding to the estimated value of assets missing at their exchange – estimated to be nearly $9 billion for FTX.com and $166 million for FTX.US, the exchange’s U.S. arm.

However, recoveries could be marred by various factors, such as taxes, government claims, token price fluctuation, etc.

Furthermore, the debtors could exclude any “insiders, affiliates, customers” from the settlement who may have known the commingling and misuse of customer deposits and corporate funds, or those who changed their KYC information to facilitate withdrawals when they were halted.

The debtors said that the payouts for these customers may not reflect the fair value of the FTX Debtors’ claims.

A health worker prepares a dose of the Novavax vaccine as the Dutch Health Service Organization starts with the Novavax vaccination program on March 21, 2022 in The Hague, Netherlands.

Patrick Van Katwijk | Getty Images

Americans can finally get their hands on Novavax‘s newest Covid vaccine after U.S. regulators greenlighted the shot this week.

The vaccine’s arrival comes nearly three weeks after new jabs from Pfizer and Moderna reached the public, and after more than 4 million patients rolled up their sleeves to get a shot in September. But Wall Street analysts aren’t worried about that delay.

They said Novavax appears well positioned to catch up and compete this fall with the other companies in the U.S. Covid vaccine market, particularly after logistical issues hampered the rollout of the other shots and a Food and Drug Administration label that allows for wide accessibility to Novavax’s jab, among other factors.

“I’m really not concerned about the timeline or lag relative to the other shots,” B. Riley Securities analyst Mayank Mamtani told CNBC. He added that regulators cleared Novavax’s new shot only slightly later than what the company had estimated, which was late in the third quarter.

That’s good news for Novavax, which is working to strengthen its financial position after raising doubts about its ability to stay in business at the beginning of the year. The biotech company is banking on sales of its updated Covid vaccine — its only commercially available product — and a broad cost-cutting push to help it stay afloat.

Public health officials see Novavax’s vaccine as a valuable alternative for people who don’t want to take messenger RNA shots from Pfizer and Moderna, which teach cells how to make proteins that trigger an immune response against Covid. Novavax’s shot fends off the virus with protein-based technology, a decades-old method used in routine vaccinations against hepatitis B and shingles.

Silvia Taylor, Novavax’s chief corporate affairs and advocacy officer, told CNBC that the company has collected data showing that 25% to 30% of people prefer a protein-based vaccine.

“We look forward to meeting this demand and more in the wake of new variants and rising COVID cases,” Taylor said in a statement.

Shares of Novavax jumped more than 10% on Tuesday after the FDA cleared its new shot. But the company’s stock is still down more than 25% year to date after shedding more than 90% of its value last year.

Novavax’s shot has a broad authorization label

The FDA authorized Novavax’s updated vaccine — which targets the omicron subvariant XBB.1.5 — for emergency use in people ages 12 and older. Patients previously vaccinated with an older Covid vaccine are eligible to receive one dose of Novavax’s new jab, while unvaccinated people can receive two doses, according to the authorization.

The FDA similarly approved the new shots from Pfizer and Moderna for people ages 12 and older, but the agency also authorized those vaccines for emergency use in children ages 6 months through 11 years old.

Still, Mamtani said the authorization label for Novavax’s new vaccine is “broad and without any notable restrictions for the first time,” which will likely make the shot as widely accessible to teens and adults as the new mRNA jabs. That puts Novavax on more of a level playing field with Pfizer and Moderna this fall, even as a late entrant to the game.

The label for Novavax’s last Covid booster was far more restrictive. Last year, the FDA authorized it as a first booster dose for people ages 18 and older who couldn’t receive a new mRNA shot for accessibility or clinical reasons. That “basically disqualified a lot of people” from getting it last fall, according to Mamtani.

A health-care worker administers a dose of the Novavax Covid-19 vaccine at a pharmacy in Schwenksville, Pennsylvania, US, on Monday, Aug. 1, 2022.

Hannah Beier | Bloomberg | Getty Images

“Finally, after three years, Novavax has a label that puts its vaccine at parity with the mRNA shots,” Mamtani said. “I think the most powerful words on that label was that people can get it regardless of their previous Covid vaccination history.”

Logistical issues slowed down Pfizer, Moderna

Novavax’s vaccine is entering the market after Pfizer and Moderna had a bumpy start to the rollout of their shots. Insurance and supply-related issues left many Americans unable to find or access the new mRNA vaccines for free, which may give Novavax an opportunity to catch up and get more people to take its shot.

“We know that a lot of people have tried to get an mRNA vaccine, but they aren’t able to because of logistical challenges of access and distribution,” Jefferies analyst Roger Song told CNBC. “So, that’s one reason why the two or three weeks delay won’t necessarily be a hurdle for Novavax.”

There’s no way of knowing whether the rollout of Novavax’s new shot will see similar logistical snags or if it will have a smoother launch. The federal government shifted Covid vaccine distribution and coverage to the private market for the first time this fall. That has proved to be a tricky transition for the U.S. health-care system.

A sign advertises COVID-19 (coronavirus) vaccine shots at a Walgreens Pharmacy in Somerville, Massachusetts, August 14, 2023.

Brian Snyder | Reuters

However, health-care providers and pharmacies have signaled that they are ironing out logistical issues and will be better equipped to handle them in the future.

Last week, a group of insurers told the Biden administration they were “largely, if not completely,” done with fixing delays in insurance coverage for the new Covid shots. Those delays had resulted in some patients getting charged up to $190 for a shot at pharmacies.

“Should further issues arise, we stand ready to swiftly implement system improvements,” the insurers said in a letter.

Some pharmacies, like Walgreens, also appear to be resolving supply disruptions, which left many stores without any new Covid shots for patients to receive.

Covid vaccinations could peak later this fall

What’s more, Novavax’s new shot might actually be arriving at just the right time: a month before Covid vaccine demand is expected to peak in the U.S. this fall and winter.

Jefferies’ Song said the peak could follow a similar pattern as last season when most Covid boosters were administered in November. That’s partly because there is “less urgency” among Americans when it comes to Covid shots compared to early on in the pandemic, which could cause them to get vaccinated later rather than earlier.

“During the first season of Covid, everyone rushed to get vaccinations because it was really an emergency state. But now people have a mindset where they’re saying, ‘OK, I will wait and see how bad Covid really gets,'” Song said.

By November, Novavax’s new shot will likely be as widely available as shots from Pfizer and Moderna at pharmacies, doctor’s offices and other vaccine distribution sites.

But the biggest uncertainty this fall for all three companies is how many Americans will decide to get another Covid vaccine, Song said.

Last year’s uptake was already feeble: Only about 17% of the U.S. population — around 56 million people — received last year’s boosters, according to the Centers for Disease Control and Prevention.

“We don’t know how big the overall pie will be because we’ve never been in a commercial market for Covid vaccines,” he told CNBC. “This fall will set a new benchmark for the entire Covid vaccine space.”

Bitcoin (BTC) soared by over 5% on Tuesday to trade above $26,000 for the first time this week. A major contributor to this price rise was an increase in positive sentiment around the token as a result of Franklin Templeton, a $1.45 trillion asset manager, filing for a spot bitcoin ETF with the US Securities and Exchange Commission (SEC)

However, as the market euphoria dies down, the premier cryptocurrency has experienced some market recorrection, with many investors now speculating on the token’s next movement. On this note, popular crypto analyst Ali Martinez has discovered a buy signal for BTC investors. However, there are certain conditions to be met.

$28,350 or $31,800, How High Can Bitcoin Go?

According to an X post on Tuesday, Ali Martinez states that the TD sequential indicator has produced a buy signal on Bitcoin’s weekly chart. Therefore, BTC could be set for a price rally after losing about 10.85% of its market value in the last 30 days.

#Bitcoin | As we navigate a week with key financial events, it’s crucial to highlight that the TD Sequential indicator has signaled a ‘buy’ on the $BTC weekly chart.

For this to be validated, #BTC needs to close above the week above $25,600. If confirmed, targets could be… pic.twitter.com/0S06I5AndB

— Ali (@ali_charts) September 12, 2023

For context, the Tom Denmark (TD) sequential indicator is a technical analysis tool used to identify the exact time of trend exhaustion and price reversal. However, Martinez notes there is a clause to his latest prediction.

In order to confirm the buy signal generated by the TD sequential indicator, Bitcoin must close this week trading above $25,600. Upon fulfilling this condition, the analyst predicts that BTC could trade as high as $28,350-$31,800 in the coming weeks.

CPI Report Incoming: What Could This Mean For BTC Market?

In other news, many BTC investors and crypto investors are likely on high alert, waiting for the United States to publish its monthly CPI data report, which is slated for release on Wednesday.

The Consumer Price Index, which measures the percentage change in the price of a basket of goods and services, is a popular indicator of inflation.

Related Reading: Bitcoin Price Signals Another Bearish Formation and Could Revisit $25K

If the upcoming CPI report presents a rise in inflation for the month of August, it may prompt the US Federal Reserve to hike interest rates, which is popularly known to induce a dip in the demand for risk assets such as Bitcoin and other cryptocurrencies.

At the time of writing, Bitcoin is trading at $26,136.30 with price gains of 1.64% in the last seven days, respectively. Meanwhile, the token’s daily trading volume declined 24.19% and is now valued at $14.83 billion.

Bitcoin trading at $26,135.86 on the hourly chart | Source: BTCUSDT chart on Tradingview.com

Featured image from CNET, chart from Tradingview.

Student-loan payments are pouring in weeks before freeze ends. Here’s the catch.

There’s signs some people aren’t waiting to receive a federal student-loan bill in October to start paying down their debt.

Yet after a more than three-year pause on interest, payments and collections, the early start isn’t necessarily a sign that borrowers are flush with cash and ready to extinguish their loans.

Department of Education deposits to Treasury Department coffers during the final week of August were blowing past the department’s monthly deposits throughout the pandemic, Bank of America

BAC,

researchers said in a Wednesday note.

Education Department monthly deposits have averaged $1.2 billion during the last 12 months. August’s deposit surpassed $6 billion, the note said. Deposits were over $600 million each day in the last three days of the month, researchers said.

The operating cash deposits in focus do not solely come from student-loan collections, but researchers said their increase is “the main driver of the uptick in payments in August.”

“Student-loan payments have already begun in earnest,” they wrote.

Goldman Sachs

GS,

researchers also pointed out “the surprising jump in payments,” in a note last week.

The Education Department did not immediately respond to a request for comment.

Why the uptick in payments?

Analysts offered multiple theories on why the payments are coming back before borrowers receive their student-loan bills next month.

The “main explanation” is that “a small share of borrowers” are paying down principal before interest started accruing on balances in September, according to Goldman researchers.

Bank of America researchers say the uptick likely includes payments to beat the start of interest — but loan refinances on larger amounts “by some borrowers seems more likely than a large number of borrowers making a monthly payment, in our view.”

In a refinance, borrowers bring their federal student-loan balances to a private lender, in the hopes of a better interest rate or better repayment terms. The federal sum is paid in full by the private lender.

Borrowers may be able to shave their interest rates through a refinance, but they’ll need to have a solid credit score and steady income, experts say. Refinancers also need to understand they are giving up chances at loan forgiveness and income-driven repayment programs.

There’s approximately 40 million federal student loan borrowers who owe $1.7 trillion in debt. Payments are resuming without mass loan forgiveness after the Supreme Court blocked the Biden administration’s debt cancellation plan.

Whether borrowers are ready to restart payments remains an open question amid signs of trouble for consumers’ wallets. Credit card debt surpassed $1 trillion while delinquency rates for credit cards and car loans are climbing. The number of consumer bankruptcies are bouncing off pandemic lows.

More people would fall behind on their loans without cancellation that carved up to $10,000 and $20,000 off balances, the Biden administration argued. After the Supreme Court decision, President Joe Biden announced a one-year grace period preventing defaults and debt collection referrals for borrowers who are not making payments.

In the wake of the court’s ruling, the President also announced a new repayment plan aimed at making student-loan bills more manageable. Around 4 million people have signed up for the new income-drive repayment plan, called SAVE, that will shield more money from the calculations on monthly payments, administration officials said Tuesday.

‘Little information about the impact of payment restart on borrower behavior’

The people who are either refinancing or making payments ahead of time are probably on solid financial footing already. So there’s a limit on what the ahead-of-schedule payments are showing about student-loan borrowers as a whole.

“If one-off principal payments are behind the recent surge, it provides little information about the impact of payment restart on borrower behavior,” the Goldman note said.

Polls indicate problems ahead. Nearly half of borrowers, 45%, expect they will fall behind on payments, according to an August poll from Credit Karma

INTU,

More than half of these borrowers say it’s already difficult to pay other bills, according to the survey from the website helping users look for financial products based on their credit data.

Seven in ten borrowers said at least some of the money that would have gone to their loans paid for necessities instead, according to a different poll last month from the personal finance website NerdWallet.

“My guess is we are probably seeing some pre-payment behavior,” said student-loan and higher education financing expert Mark Kantrowitz.

He’s skeptical the surveys will foreshadow widespread problems once bills start coming due. “What people say and what people do are two entirely different things,” he said.

Instead, Kantrowitz anticipates a quick wave of confusion and adjustment as people get in a new repayment routine, likely with a different and understaffed loan servicer.

“I’m expecting two, three months of chaos and then things settle down,” he said.

Shibarium hits 1M wallets amid meteoric growth, SHIB yet to catch up

The total number of wallets on Shiba Inu’s newly launched layer-2 blockchain, the Shibarium network, has surpassed the 1 million mark in a meteoric rise since its relaunch.

The milestone — announced in a Sept. 3 blog post by the official Shibarium team — means there were at least 900,000 wallets added since Shibarium’s relaunch on Aug. 28, and only two weeks after the Shibarium network first went live — albeit with some technical hiccups.

According to data from the Shibarium blockchain explorer, nearly 100,000 transactions have occurred as of 5:04am UTC Sept. 3, with a peak activity of 132,000 transactions being set on Aug. 25.

While network activity has surged, the total value locked (TVL) on the Shibarium network has yet to surge in response. At the time of publication, Shibarium’s TVL stands at just $1.06 million, suggesting that users are only deploying very small amounts of capital on the network.

In their blog post, Shibarium developers noted that they are currently collaborating with a number of third-party bridges to assist investors with bridging other tokens over to the new blockchain.

Additionally, the team announced plans to renounce the contract for its governance token Bone (BONE) and added that they are looking to add more validators to the network in the coming weeks.

As of Sept. 1, Shibarium users have been able to utilize Shiba Inu (SHIB), Bone (BONE), Leash (LEASH) and many of the other tokens available on the Shibarium network to lend, borrow and stake tokens to earn rewards.

While many Many Shiba Inu holders had hoped for a sharp uptick in the price of the various Shiba Inu ecosystem tokens following the launch of Shibarium, the overall price action for SHIB, BONE and LEASH tokens hasn’t seen the expected uplift.

Related: Shibarium wallets surpass 100K after SHIB devs relaunch bridge

Though it witnessed some moderate gains in the leadup to the launch of Shibarium, the price of SHIB has since fallen a touch over 20% since the botched launch on Aug. 16, according to data from CoinGecko.

The respective values of the remaining Shiba Inu ecosystem tokens have not fared much better. The price of BONE has fallen 15% over the past 14 days while LEASH has dropped 14.2% within the same timeframe.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Asia Express: Thailand’s national airdrop, Delio users screwed, Vietnam top crypto country