On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

Source link

CME

Binance sees 18% Open Interest drop as CME Bitcoin futures hit record levels

Quick Take

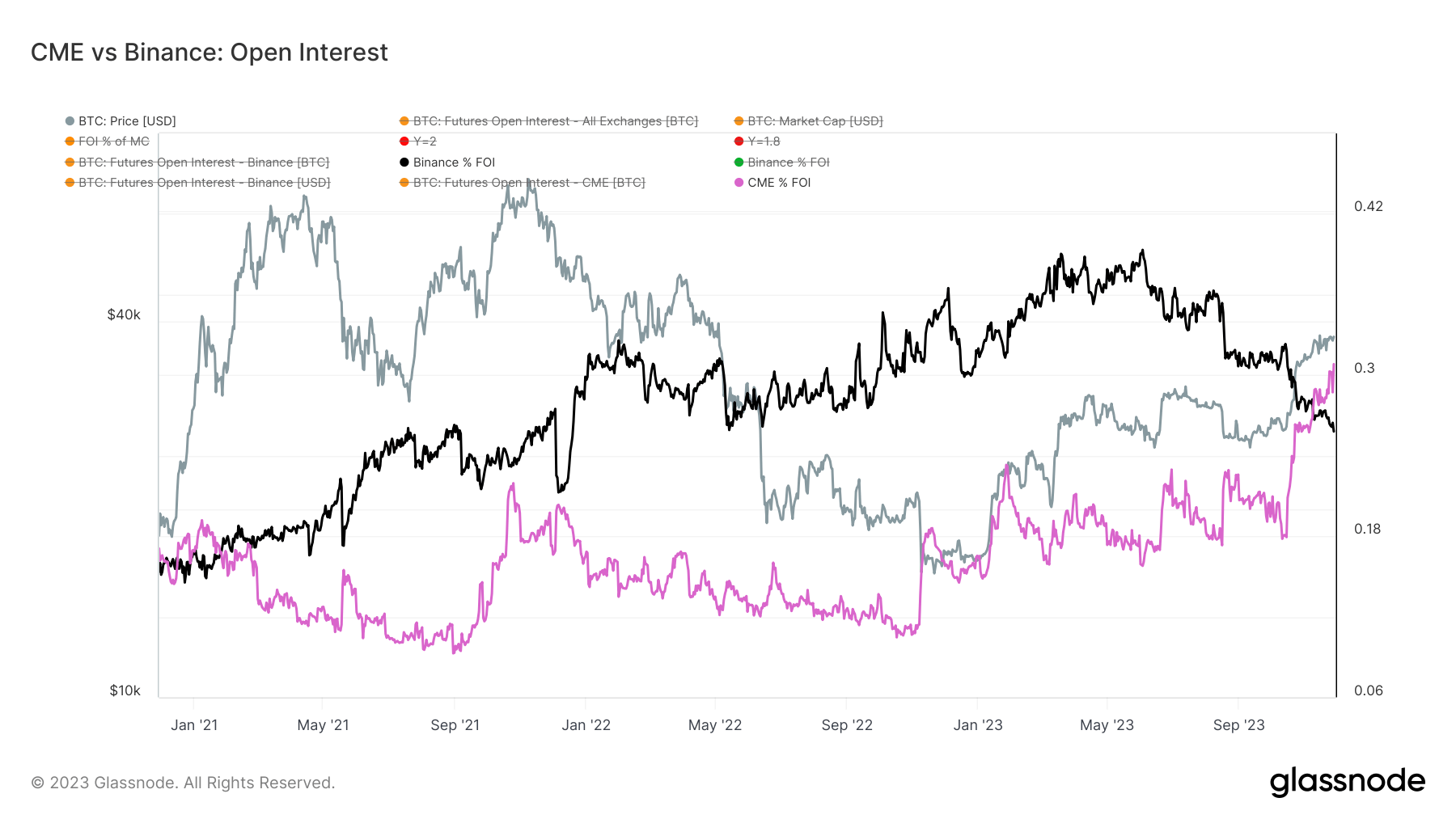

CryptoSlate’s recent analysis paints a vivid picture of Bitcoin futures’ open interest across key exchanges.

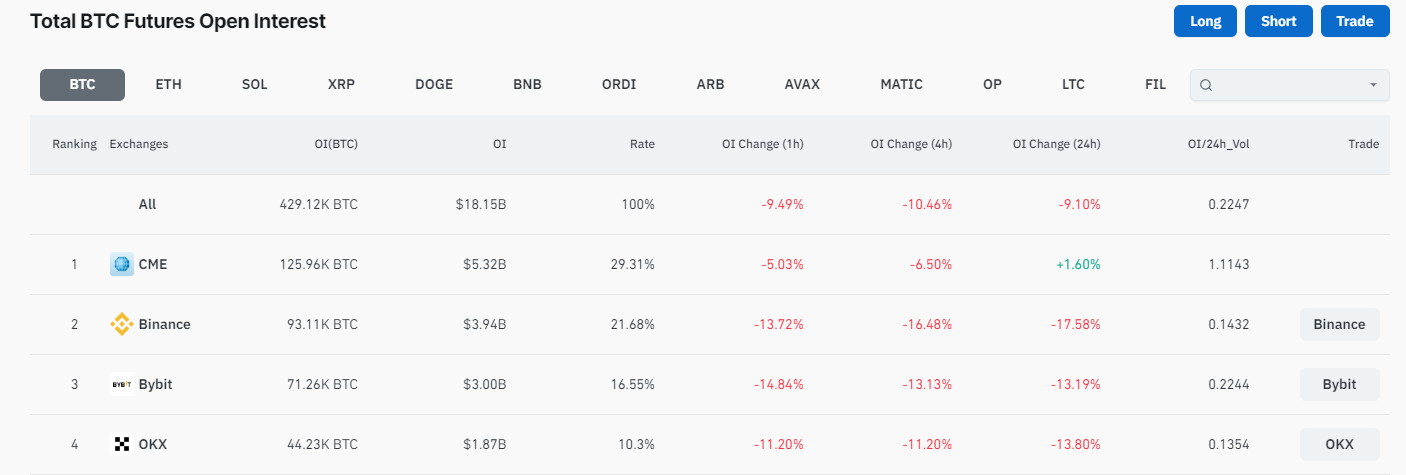

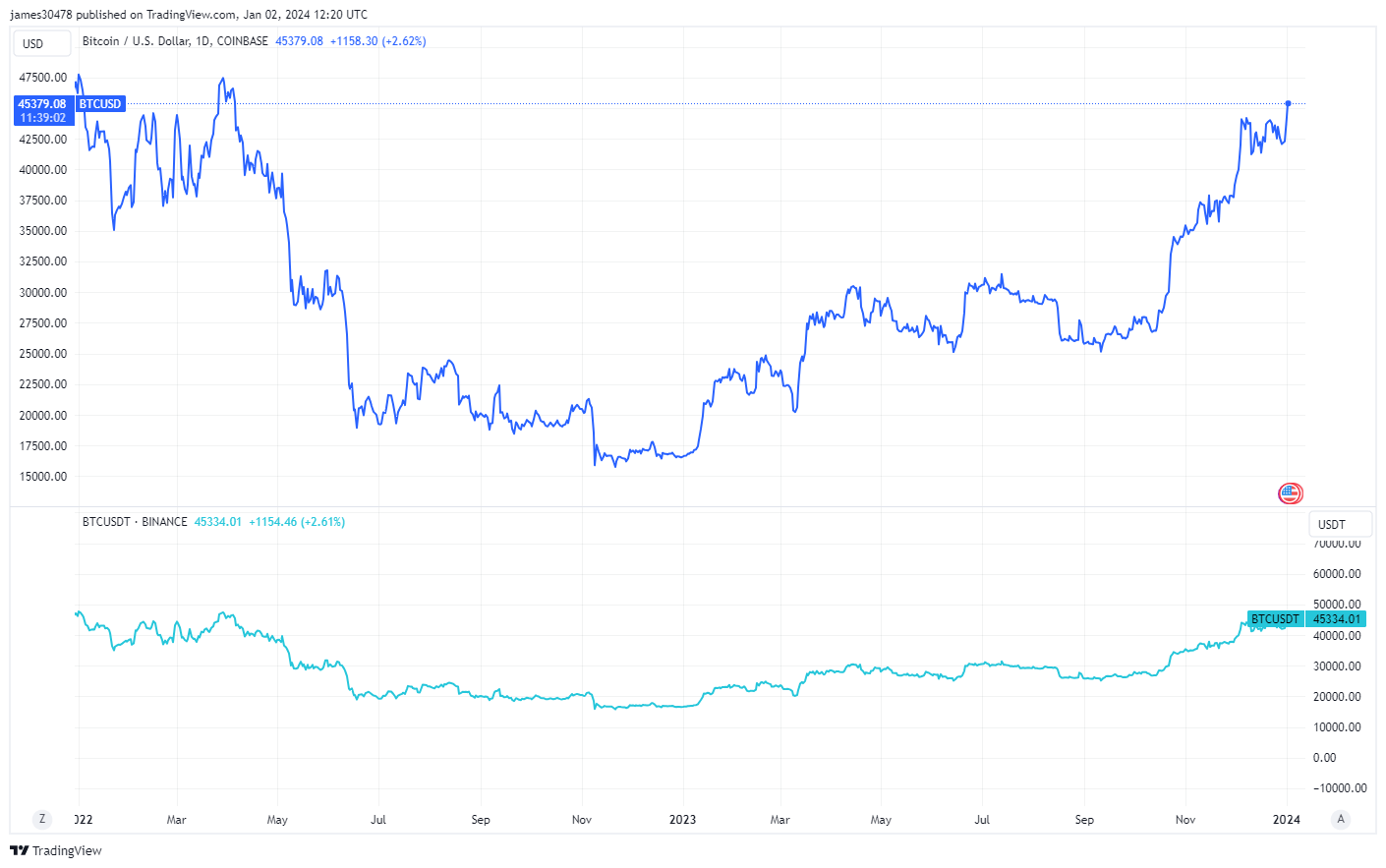

The past 24 hours have seen a significant repositioning of open interest in Bitcoin, with a notable surge and subsequent drop of around 10%. The primary contributor to this fluctuation was Binance, which saw an 18% open interest decrease in the past 24 hours.

This shift has further widened the gap between Binance and the Chicago Mercantile Exchange (CME), the latter experiencing a contrary trend with a 2% increase in open interest in the past 24 hours. Consequently, CME recorded an all-time high of 126,000 Bitcoin in open interest, while Binance has 93,000 BTC.

Amid these dynamics, Coinglass noted a sizable wipeout of nearly $3 billion in Bitcoin open interest, marking the largest long liquidation event in a year, coinciding with Bitcoin’s hovering around the $42,200 mark.

The post Binance sees 18% Open Interest drop as CME Bitcoin futures hit record levels appeared first on CryptoSlate.

Bitcoin CME futures and Coinbase show renewed premiums as institutional interest spikes

Quick Take

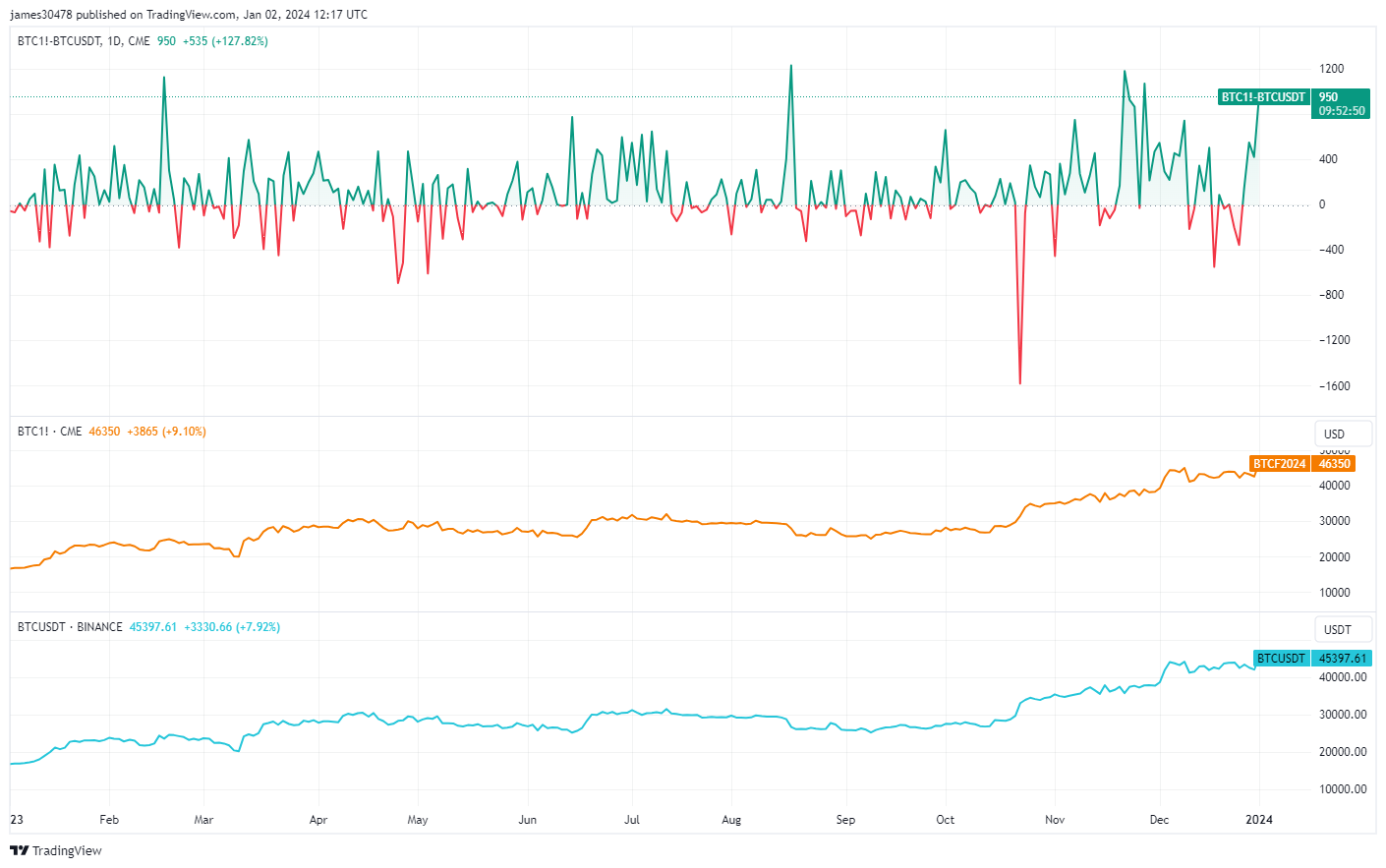

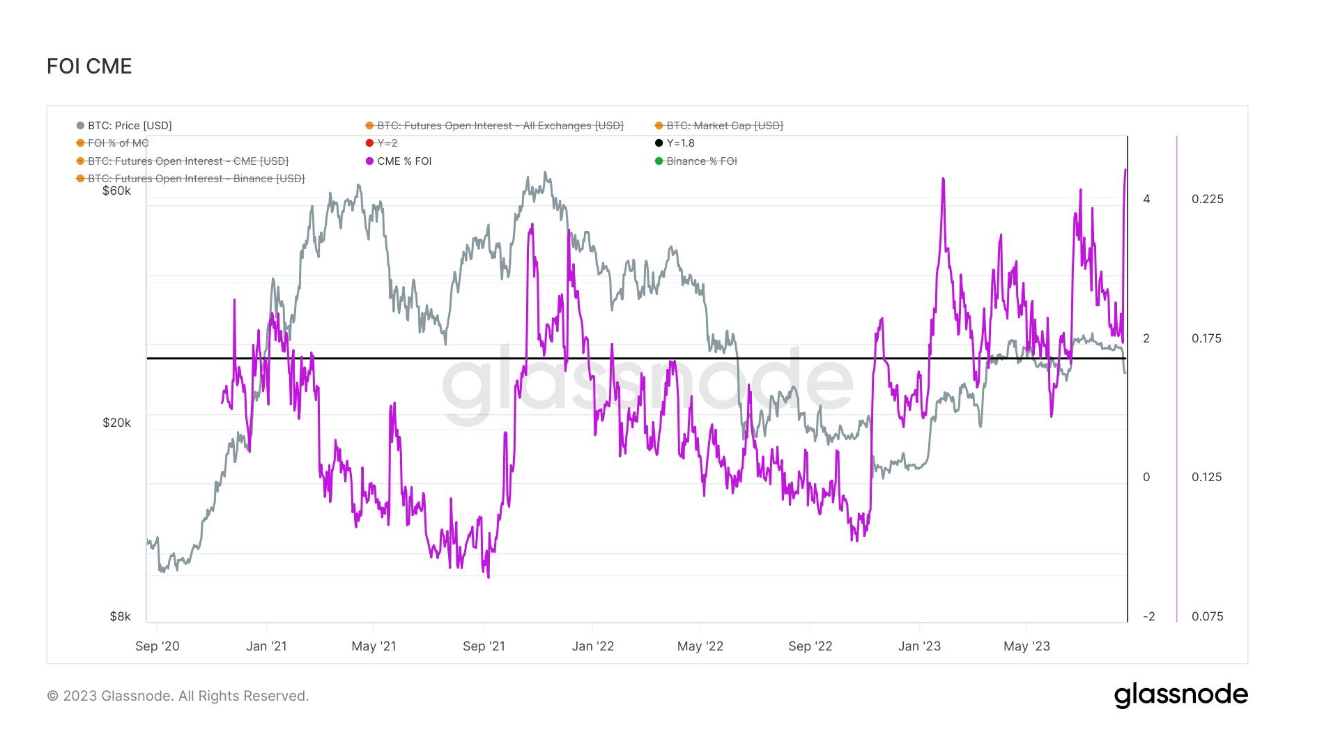

A notable development ensues as Bitcoin enters 2024 with the reappearance of premiums on both Chicago Mercantile Exchange (CME) futures and Coinbase. Data analysis reveals a discernible price discrepancy between CME’s Bitcoin futures, trading approximately at $46,400, and Binance’s BTCUSDT pair, exchanging hands at about $45,300. This almost $1,000 variance emerges as the fifth-largest differential observed in the past year.

Further, the Coinbase premium, too, has made a comeback. The BTCUSD pair on Coinbase is seen trading for $45,400, in contrast to the BTCUSDT pair, set at $45,300. This evolving landscape indicates a resurgence in institutional interest, primarily from the United States, coinciding with the potential approval of a Bitcoin spot Exchange-Traded Fund (ETF).

While the dynamics of this resurgence are multifaceted, it is clear that the potential approval of the spot ETF may have a major role in this shift.

The post Bitcoin CME futures and Coinbase show renewed premiums as institutional interest spikes appeared first on CryptoSlate.

CME Bitcoin futures volume spikes to $70B amid shifting market dynamics

Quick Take

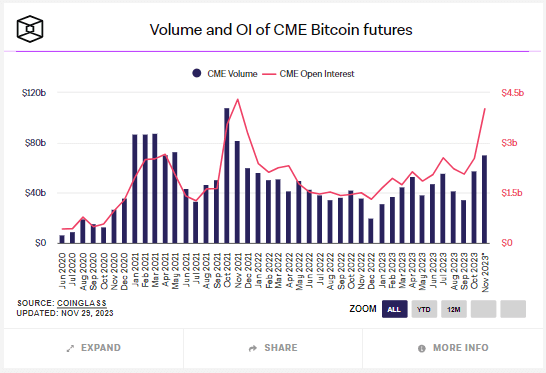

This November, the aggregated monthly trading volumes of CME Bitcoin futures have spiked to an impressive $70 billion. This considerable surge, denoting a heightened investor interest, parallels the top of the bull market for Bitcoin observed in Nov. 2021 when the trading volume touched $80 billion.

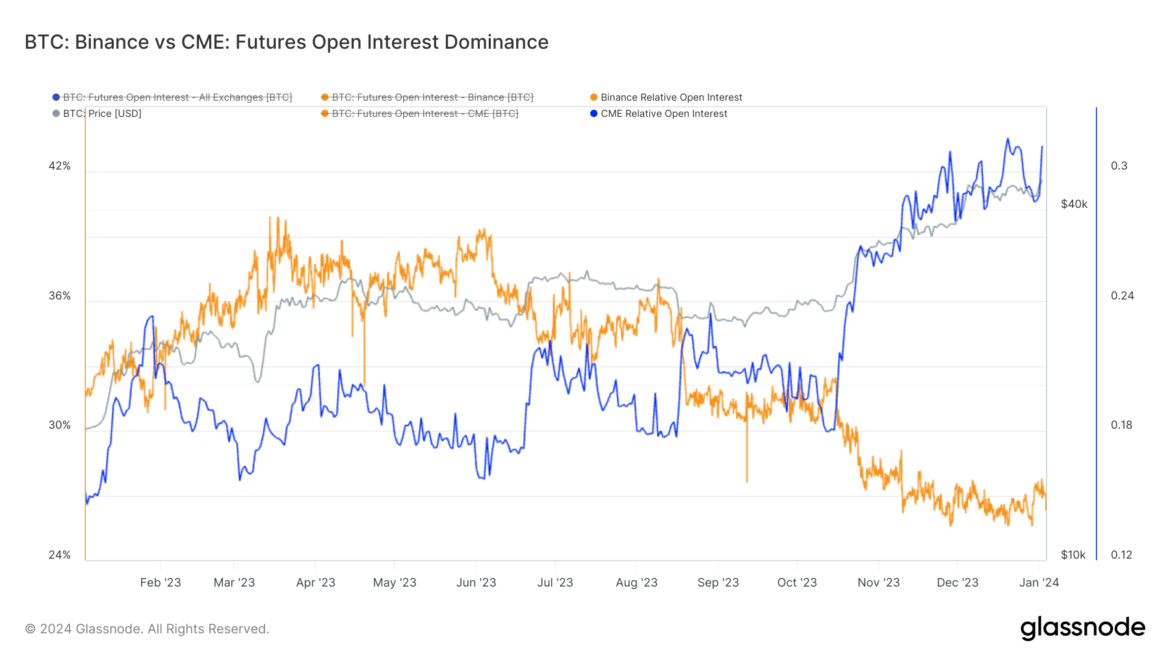

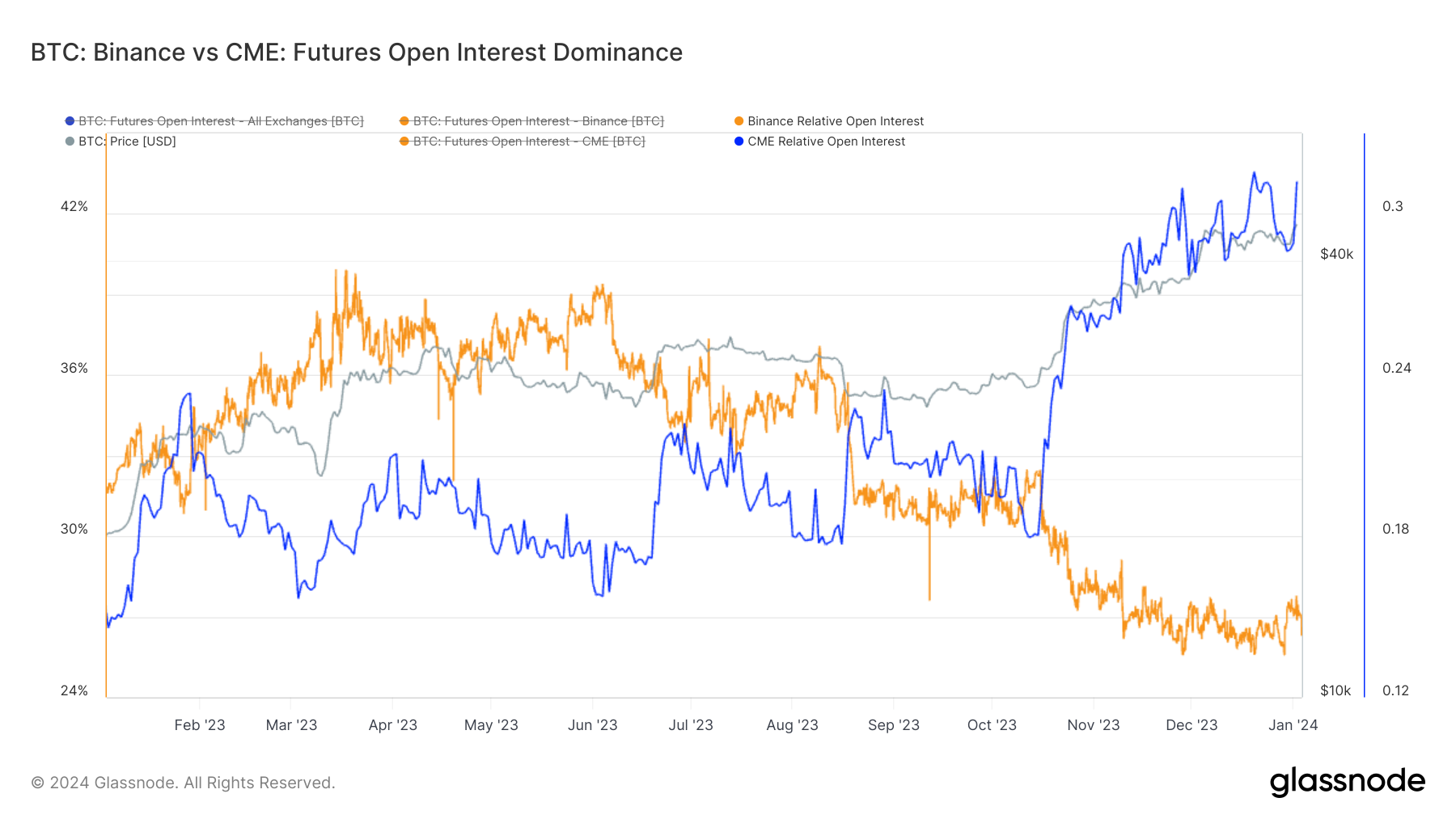

As per the analysis, CME currently commands roughly 31% of the futures market with 116,000 BTC in open interest contracts—an increase of 7% within the past 24 hours. This notable growth in open interest is occurring concurrently with a decline in Binance’s market share. The dominant cryptocurrency exchange has seen its market share plummet to an all-time low since Dec. 2021, nearing 25%.

Curiously, a significant premium to Bitcoin futures CME price over the spot has been observed, signaling potential market anticipations of an upward trajectory.

The post CME Bitcoin futures volume spikes to $70B amid shifting market dynamics appeared first on CryptoSlate.

CME overtakes Binance to grab largest share of Bitcoin futures open interest

Binance’s dominance of Bitcoin (BTC) futures open interest has been toppled by traditional derivatives marketplace heavyweight Chicago Mercantile Exchange (CME), following Bitcoin’s first move past the $37,000 mark in over 18 months.

A number of analysts highlighted the “flippening” of Binance by CME, with the latter overtaking the global cryptocurrency exchange for the largest share of Bitcoin futures open interest.

Wow, the real flippening that no one is talking about:

CME just flipped Binance for the largest share of Bitcoin futures open interest.

Bittersweet — there will soon be more suits than hoodies here.

(h/t @VidiellaLaura) pic.twitter.com/SIPRLMlFcy

— Will (@WClementeIII) November 9, 2023

Open interest is a concept commonly used in futures and options markets to measure the total number of outstanding contracts. The metric represents the total number of contracts held by traders at any given point in time. The difference between the number of contracts held by buyers (longs) and the number of contracts held by sellers (shorts) determines open interest.

Bloomberg Intelligence exchange-traded fund (ETF) research analyst James Seyffart followed up an initial X (formerly Twitter) post from Will Clemente, questioning whether CME’s growing amount of Bitcoin futures open interest would appease the United States Securities and Exchange Commission’s historical concerns over the depth of Bitcoin markets and the potential for market manipulation.

Okay this is interesting… Does this constitute ‘market of significant size’ now? haha https://t.co/eQb7QXvO3H

— James Seyffart (@JSeyff) November 9, 2023

This has long been a point of contention, which has led to the SEC holding back from approving several spot Bitcoin ETF applications over the past few years. The regulator previously told the likes of BlackRock and Fidelity that their filings were “inadequate” due to the omission of declarations relating to the markets in which the Bitcoin ETFs will derive their value.

Related: Bitcoin puzzles traders as BTC price targets $40K despite declining volume

In July 2023, the Chicago Board Options Exchange (CBOE) refiled a submission for Bitcoin spot ETFs following feedback from the SEC. Fidelity intends to launch its Bitcoin ETF product on CBOE, while BlackRock, the world’s largest asset manager, grabbed headlines for its proposed Bitcoin ETF, which is set to be offered on Nasdaq.

CBOE’s amended filing with the SEC highlighted its efforts to take additional steps to ensure its ability to detect, investigate, and deter fraud and market manipulation of shares in the proposed Wise Origin Bitcoin Trust.

“The Exchange is expecting to enter into a surveillance-sharing agreement with Coinbase, an operator of a United States-based spot trading platform for Bitcoin that represents a substantial portion of US-based and USD denominated Bitcoin trading.”

CBOE’s filing adds that the agreement with Coinbase is expected to carry the “hallmarks of a surveillance-sharing agreement.” This will give CBOE supplemental access to Bitcoin trading data on Coinbase.

The stock exchange also added that Kaiko Research data indicated that Coinbase represented roughly 50% of the U.S. dollar-to-Bitcoin daily trading volume in May 2023. This is pertinent, given the SEC’s misgivings over the depth of BTC markets to back ETF products.

A surveillance-sharing agreement is intended to ensure that exchanges and regulators are able to detect whether a market actor is manipulating the value of stocks or shares.

Magazine: US gov’t messed up my $250K Bitcoin price prediction: Tim Draper, Hall of Flame

CME Bitcoin futures hit record high, but uncertainty looms above $36K

Bitcoin futures open interest at the Chicago Mercantile Exchange (CME) hit an all-time high of $3.65 billion on Nov. 1. This metric considers the value of every contract in play for the remaining calendar months, where buyers (longs) and sellers (shorts) are continually matched.

Bullish momentum on CME Bitcoin futures, but cautious BTC options markets

The number of active large holders surged to a record 122 during the week of Oct. 31, signaling a growing institutional interest in Bitcoin (BTC). Notably, the Bitcoin CME futures premium reached its highest level in over two years.

In neutral markets, the annualized premium typically falls within the 5%–10% range. However, the latest 15% premium for CME Bitcoin futures stands out, indicating a strong demand for long positions. This also raises concerns, as some may be relying on the approval of a spot Bitcoin exchange-traded fund.

Contradicting the bullish sentiment from CME futures, evidence from Bitcoin options markets reveals a growing demand for protective put options. For instance, the put-to-call open interest ratio at the Deribit exchange reached its highest levels in over six months.

The current 1.0 level signifies a balanced open interest between call (buy) and put (sell) options. However, this indicator requires further analysis, as investors could have sold the call option, gaining positive exposure to Bitcoin above a specific price.

Regardless of demand in the derivatives market, Bitcoin’s price ultimately relies on spot exchange flows. For instance, the rejection at $36,000 on Nov. 2 led to a 5% correction, bringing the price down to $34,130. Interestingly, the Bitfinex exchange experienced daily net BTC inflows of $300 million during this movement.

The fourth biggest inflow of #Bitcoin to @bitfinex yesterday, was roughly $300M; as soon as the inflow started, #Bitcoin started to trend down.

Extremely bullish, significant sell pressure, and #Bitcoin is still above $34,000 pic.twitter.com/I72N686HfH

— James V. Straten (@jimmyvs24) November 3, 2023

As analyst James Straten highlighted, the whale deposit coincided with the fading momentum of Bitcoin, suggesting a potential connection between these movements. However, the downturn did not breach the $34,000 support, indicating real buyers at that level.

Bitcoin’s latest correction occurred while the Russell 2000 Index futures, measuring mid-cap companies in the United States, gained 2.5% and reached a two-week high. This suggests that Bitcoin’s movement was unrelated to the U.S. Federal Reserve’s decision to maintain interest rates at 5.25%.

Additionally, the price of gold remained stable at around $1,985 between Nov. 1 and Nov. 3, demonstrating that the world’s largest store of value was not affected by the monetary policy announcement. The question remains: how much selling pressure do Bitcoin sellers at $36,000 still hold?

Reduced Bitcoin availability on exchanges can be deceiving

As demonstrated by the $300 million daily net inflow to Bitfinex, merely assessing current deposits at exchanges does not provide a clear picture of short-term sale availability. A lower number of deposited coins may reflect lower investor confidence in exchanges.

Apart from legal challenges against the Coinbase and Binance exchanges by the U.S. Securities and Exchange Commission for unlicensed brokerage operations, the FTX-Alameda Research debacle has stirred more concerns among investors. Recently, U.S. Senator Cynthia Lummis called on the Justice Department to take “swift action” against Binance and Tether for their alleged involvement in facilitating funds for terrorist organizations.

Related: SEC seeks summary judgment in Do Kwon and Terraform Labs case

Lastly, the cryptocurrency market has been impacted by increased returns from traditional fiat fixed-income operations, while the once lucrative cryptocurrency yields vanished following the Luna-TerraUSD collapse in May 2022. This movement has had lasting effects on the lending sector, leading to the collapse of several intermediaries, including BlockFi, Voyager and Celsius.

At the moment, there is undeniable growing institutional demand for Bitcoin derivatives, according to CME futures data. However, this may not be directly related to lower spot availability, making it difficult to predict the supply between $36,000 and $40,000 — a level untested since April 2022.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

CME Bitcoin futures spike to unprecedented 23% amid overall market de-leveraging

Quick Take

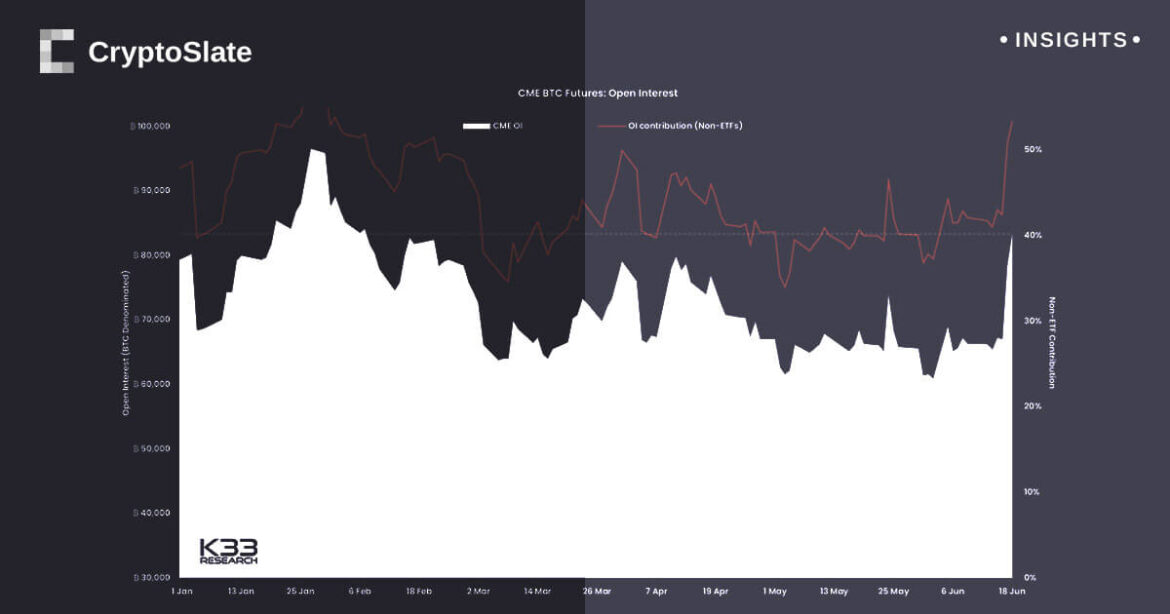

The futures market has always been a significant barometer of investor sentiment and speculation in the cryptocurrency arena. Recent data analysis suggests noteworthy trends in Bitcoin futures, particularly on the Chicago Mercantile Exchange (CME).

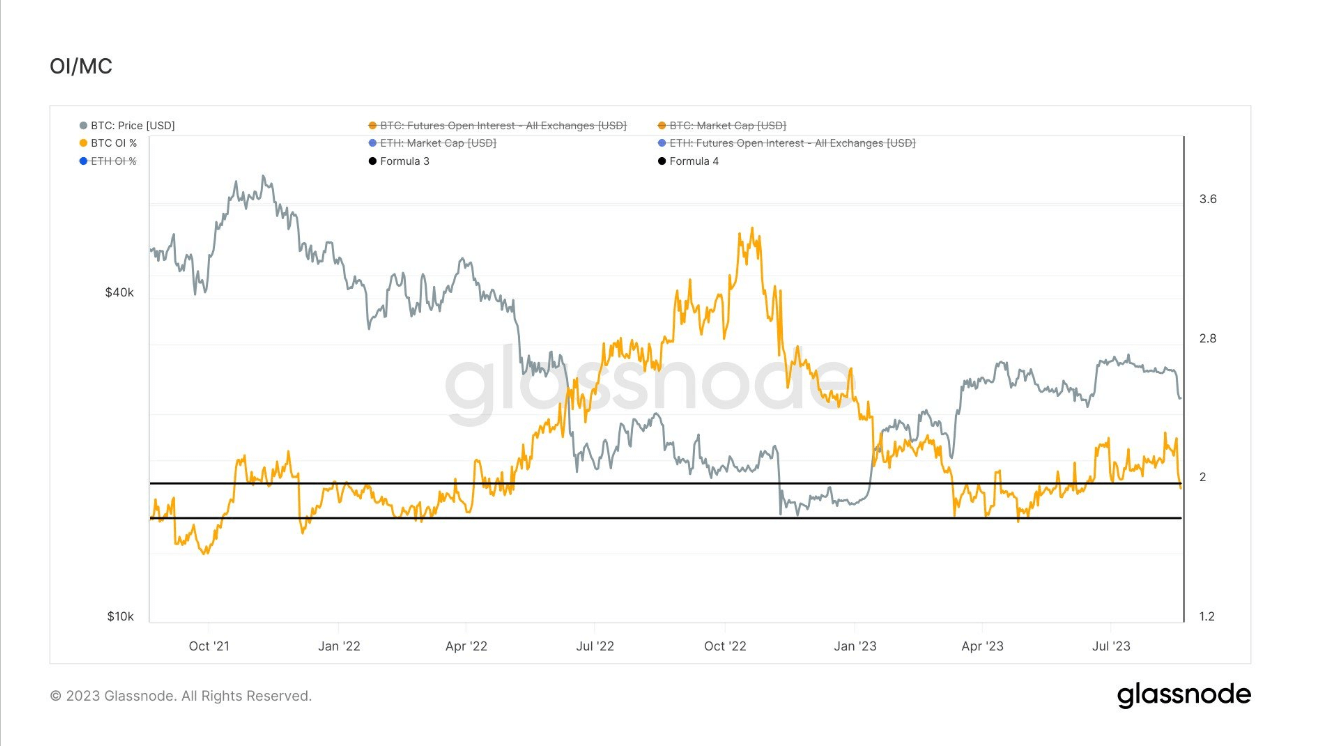

Open interest, the aggregate of outstanding futures contracts yet to be settled, has seen the CME’s share in Bitcoin futures spike to an unprecedented 23% (equivalent to 85K BTC). This is the highest percentage ever recorded for the exchange, indicating a possible shift in institutional preference or strategy.

Contrarily, open interest as a percentage of the Bitcoin market capitalization has dipped below the 2% threshold. This is a significant respite, considering this metric has consistently been above 2% since May/June.

This lowered ratio reflects a healthier, less leveraged market, reducing the likelihood of large-scale liquidations that could destabilize the market. This shift suggests a more sustainable engagement of investors with Bitcoin futures, possibly pointing to a maturing market.

Despite the surge in CME’s market share, the overall reduction in open interest relative to market cap is a positive sign, indicating that the Bitcoin futures market might be moving towards more balanced and less risk-prone operations.

The post CME Bitcoin futures spike to unprecedented 23% amid overall market de-leveraging appeared first on CryptoSlate.

This strategic collaboration aims to provide market participants with accurate and timely pricing information, fostering greater transparency and confidence in the evolving digital asset space.

The world’s leading derivatives platform, CME Group Inc (NASDAQ: CME) has partnered with CF Benchmarks to launch Bitcoin (BTC) and Ethereum (ETH) reference rates, cementing crypto’ growing significance in the Asia-Pacific (APAC) region.

CME Group stated in a press release that the two new reference rates, CME CF Bitcoin Reference Rate APAC and the CME CF Ether-Dollar Reference Rate APAC will go live on September 11. These reference rates will offer a once-a-day snapshot of the US dollar price of Bitcoin and Ethereum, respectively, at 4 p.m. Hong Kong/Singapore time.

Giovanni Vicioso, Global Head of Crypto Products at CME Group, emphasized the importance of these reference rates in the context of the crypto ecosystem. “These new reference rates are designed to meet the ever-evolving needs of global participants in the growing digital asset space,” Vicioso stated.

It is worth mentioning that CME Group and CF Benchmarks have earlier solidified their partnership by introducing three new Metaverse reference rates.

The three Metaverse reference rates introduced features Axie Infinity (AXS), Chiliz (CHZ), and Decentraland (MANA). These tokens are key players in the metaverse landscape, each contributing unique aspects to the virtual realm. With their inclusion in reference rates, CME Group and CF Benchmarks acknowledge the increasing influence and potential of the metaverse space.

CME Group in APAC Market: Core Benefits

The introduction of Bitcoin and Ethereum reference rates in the APAC region is a significant step forward for the cryptocurrency ecosystem. APAC has been at the forefront of crypto adoption and innovation, with countries like Japan, South Korea, and Singapore leading the way.

Vicioso pointed out that 37% of crypto volume at CME Group year-to-year has been traded during non-US hours, with a noteworthy 11% of trades originating from the APAC region. Therefore, providing accurate reference rates tailored to this region’s trading hours and market dynamics is essential for attracting institutional investors and further legitimizing the crypto market.

One of the primary advantages of these reference rates is the potential for improved risk management and hedging strategies. Institutional investors, who frequently require precise and trustworthy data, will be able to make more informed judgments concerning their Bitcoin exposure.

Additionally, these rates are anticipated to significantly impact the risk management methods of institutions entering the crypto space, improving their ability to mitigate possible market swings. This partnership couldn’t come at a better time as the crypto market is expanding rapidly, with popular usage increasing as complemented by growing institutional interest.

Furthermore, the introduction of these reference rates contributes to the ongoing process of legitimizing the crypto market within the regulatory framework. As governments and financial watchdogs increasingly engage with the crypto space, these reference rates can be seen as a responsible step towards meeting regulatory expectations.

next

Altcoin News, Bitcoin News, Cryptocurrency News, Market News, News

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

On June 29, the Chicago Mercantile Exchange (CME) Group announced its plans to introduce Ether/Bitcoin Ratio futures. The launch of these futures contracts is slated for July 31, subject to regulatory review.

Efficiently capture the relative value of ether and bitcoin in a single trade with Ether/Bitcoin Ratio futures, launching July 31. https://t.co/WDFhIt5rJ7

— CME Group (@CMEGroup) June 29, 2023

According to the announcement, the settlement of Ether/Bitcoin Ratio futures will be in cash, based on the final settlement price of CME Group’s Ether (ETH) futures divided by the final settlement price of CME Group’s Bitcoin (BTC) futures. Moreover, this new contract will adhere to the identical listing cycle observed in CME Group’s Bitcoin futures and Ether futures contracts.

Giovanni Vicioso, CME Group’s global head of cryptocurrency products, emphasized the potential for relative value trading opportunities between Ether and Bitcoin. Vicioso highlighted that while these two assets have historically displayed high correlation, their market dynamics may now vary, making it possible to capitalize on their performance differences. He added:

“With the addition of Ether/Bitcoin Ratio futures, investors will be able to capture ether and bitcoin exposure in a single trade, without needing to take a directional view. This new contract will help create opportunities for a broad array of clients looking to hedge positions or execute other trading strategies, all in an efficient, cost-effective manner.”

CME Group made its initial foray into the cryptocurrency market by introducing the first Bitcoin futures contract in December 2017. This was followed by the introduction of an Ether futures contract in February 2021. Recognizing the growing demand for cryptocurrency investment opportunities, CME Group further expanded its offerings in 2022 by introducing micro BTC and ETH futures contracts, providing traders with additional options to engage in these digital assets.

Related: CME Group to launch 3 metaverse reference rates

On April 17, CME Group announced plans to expand its cryptocurrency options by introducing new options for standard and micro-sized Bitcoin and Ether contracts. These new contracts were set to become available from May 22, pending regulatory review.

The expansion included daily expiries from Monday to Friday, allowing traders to better manage short-term price risks. This move aimed to offer market participants increased precision and flexibility in managing Bitcoin’s and Ether’s short-term price risks amid heightened volatility in the digital asset sector.

Magazine: How to resurrect the ‘Metaverse dream’ in 2023

Quick Take

Bitcoin’s Open Interest Reaches a Four-Month High

Open interest in Bitcoin has escalated to a four-month peak as approximately 418,000 Bitcoin are held in open interest contracts, marking a significant upturn in investor engagement.

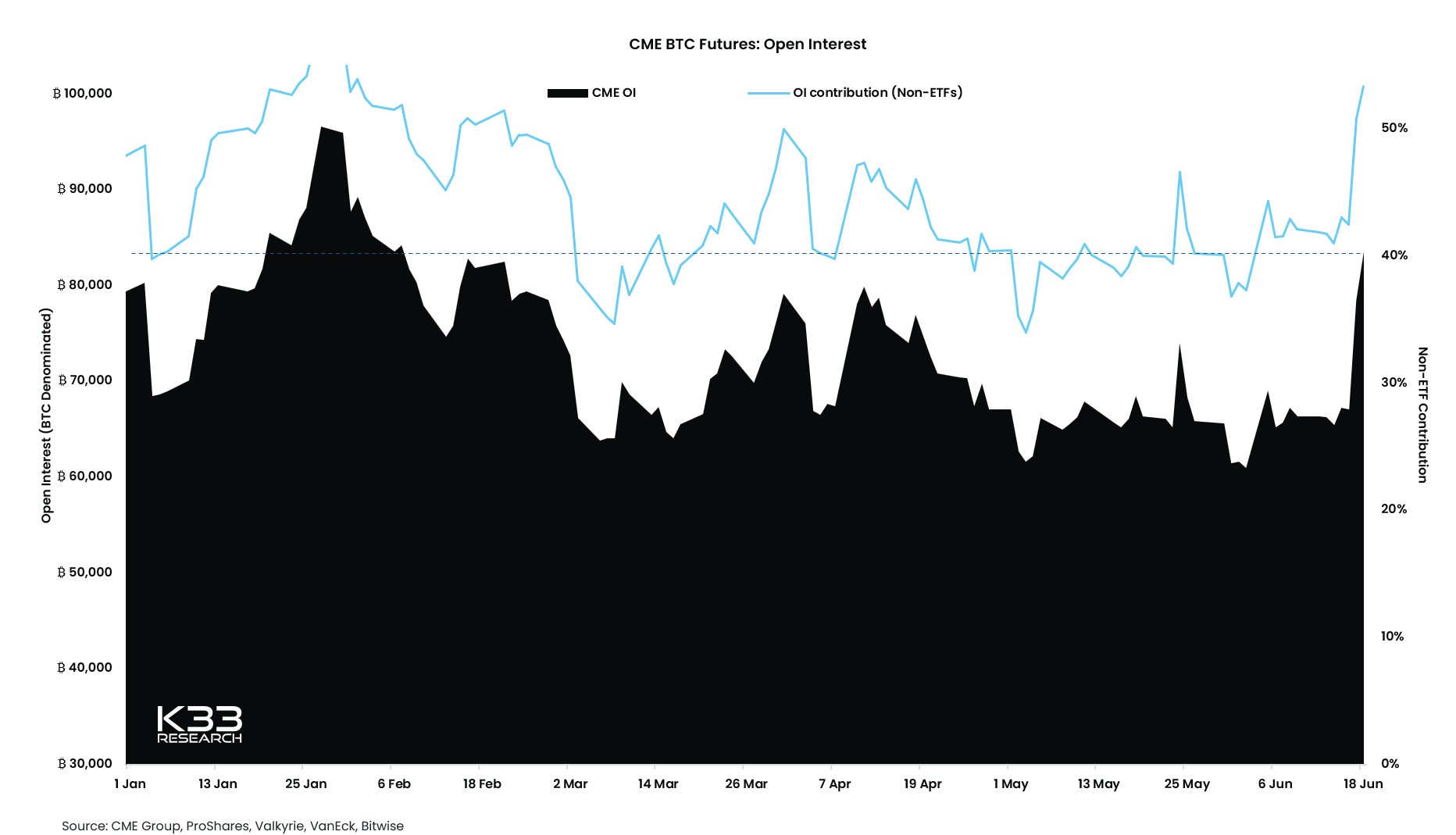

CME Emerges as a Key Player

An important catalyst behind this growth appears to be the Chicago Mercantile Exchange (CME). Currently, CME holds 83,560 Bitcoin in futures open interest contracts. This level of engagement is an all-time high since January and indicates a significant return of investor interest in Bitcoin futures.

Analyst Insights on the Current Market Situation

Vetle Lunde, a research analyst at K33, supports this viewpoint, highlighting that despite the recent growth on an annualized basis, trailing returns remain comfortably above 10%.

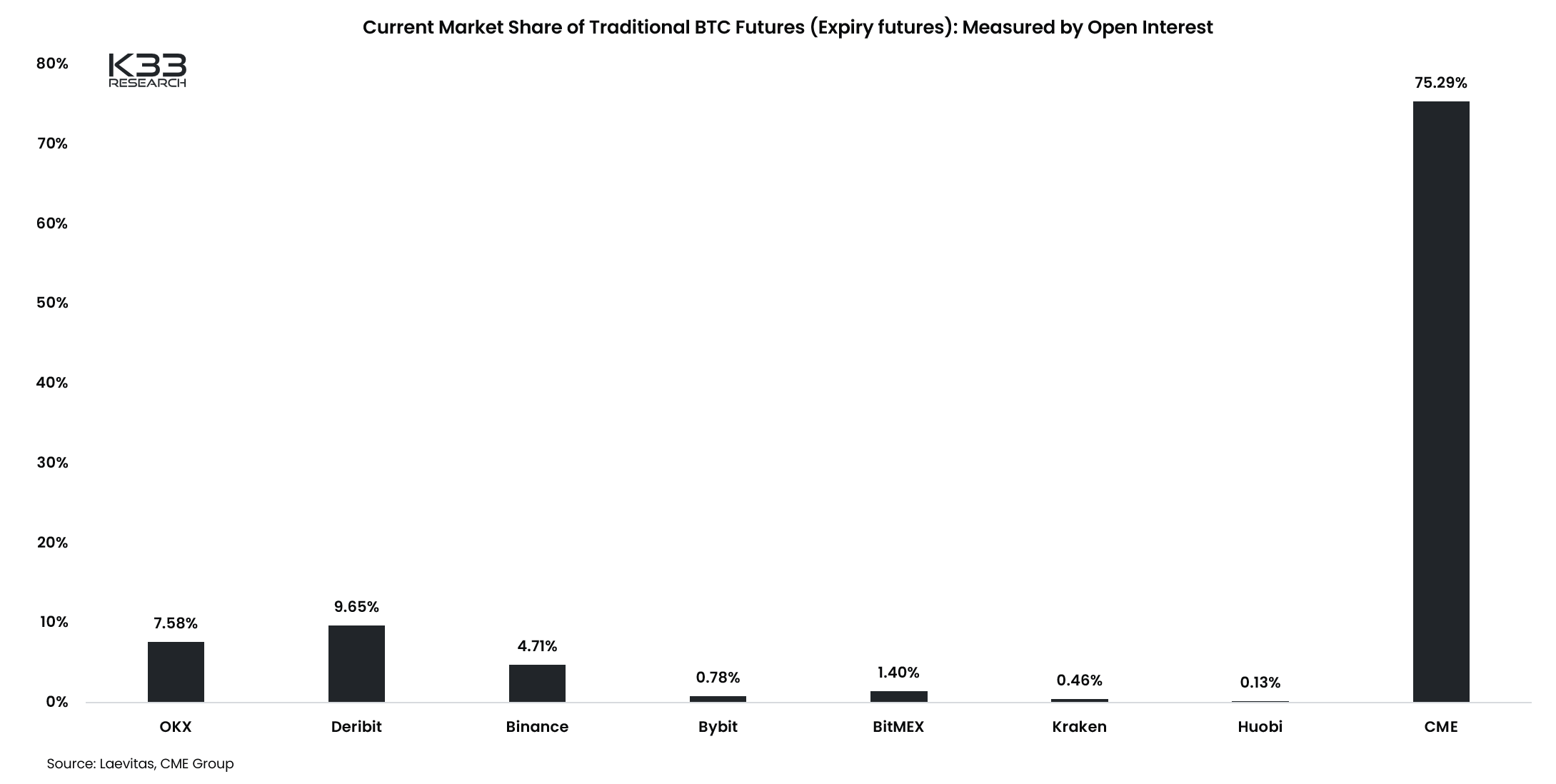

Expanding further on this topic, Lunde pointed out that among all derivatives exchanges, CME experienced the most significant daily growth in Bitcoin’s open interest. In terms of overall open interest, Binance remains the largest exchange, followed by Bybit and then CME.

However, when considering expiring futures, the landscape is quite different. CME dominates with a market share of 75%, rendering offshore futures relatively insignificant.

Implications for the Market

Given that CME is one of the world’s largest derivatives exchanges and is primarily used by institutional investors, this surge of activity indicates a noteworthy entry of large players into the Bitcoin market.

The implications of this could be significant, suggesting a possible stabilization and increased acceptance of Bitcoin among traditional financial institutions.

The post CME sees Bitcoin open interest grow by over 5k appeared first on CryptoSlate.