“These interest charges could be astronomical on a big purchase,” says one credit-card expert.

Source link

customers

Ross Stores says that housing and food costs continue to pressure its customers

Ross Stores Inc. late Tuesday blew past expectations for its holiday quarter but spooked investors by saying that higher costs of living continue to pressure its customers.

While inflation has moderated, there is ongoing macroeconomic and geopolitical uncertainty, and “housing, food, and gasoline costs remain elevated and continue to pressure our low- to moderate-income customers’ discretionary spend,” the off-price retailer said.

“As a result, while we hope to do better, we believe it is prudent to continue to take a conservative approach to forecasting our business in 2024,” the company said.

Ross

ROST,

earned $610 million, or $1.82 a share, in the fourth quarter, compared with $447 million, or $1.31 a share, in the year-ago period.

Sales rose to $6 billion from $5.2 billion a year ago, and comparable-store sales were up 7% over the same period last year.

Analysts polled by FactSet expected the retailer to report earnings of $1.66 a share on sales of $5.8 billion. Same-store sales were forecast to be up 3.4%.

“Our above-plan sales were driven by customers’ positive response to our improved assortments of quality branded bargains throughout our stores,” Ross Chief Executive Barbara Rentler said in a statement.

Ross said it expects 2024 same-store sales to grow 2% to 3%, which would come on top of a 5% gain in 2023. It projected 2024 EPS between $5.64 and $5.89. First-quarter EPS was projected to be between $1.29 and $1.35.

The FactSet consensus calls for 2024 EPS of $5.40 a share and first-quarter EPS of $1.26.

Target Corp.

TGT,

earlier Tuesday beat Wall Street expectations for its fourth quarter but said that despite encouraging signs for the U.S. economy, some of its customers feel “stretched.”

Ross’s fourth-quarter operating margin rose to 12.4% from 10.7% year over year, thanks to “strong gains” in same-store sales and lower freight costs, which were partially offset by higher discounts, the company said.

Shares of Ross rose 1.8% in after-hours trading.

Ross said that its board authorized a 10% increase in the company’s dividend, to 36.75 cents a share. The dividend is payable on March 29 to stockholders of record as of March 15, the company said.

“As we move through the coming year, we remain focused on delivering a wide assortment of quality branded bargains for our customers. We believe this will be the most important driver of our ability to gain market share over both the short and long term,” Rentler said.

Binance allows customers to custody trading collateral off exchange as market share recovers

A Binance representative confirmed in a Jan. 30 email statement sent to CryptoSlate that the platform is now allowing institutional investors to secure their trading collateral through a third-party banking partner.

Binance’s solution, described as a “banking triparty” arrangement, has been under development for the past two years and directly addresses the primary concern of counterparty risk, a significant consideration for institutional investors. This model enables investors to manage risk effectively while optimizing capital efficiency by pledging collateral in traditional assets.

While details about the specific banking partners remain undisclosed, Binance emphasized active engagement with various banking entities and institutional investors expressing interest in the arrangement.

The platform introduced the pilot scheme for this solution last November, allowing collateral held with the banking partner to be in fiat equivalents, such as Treasury Bills.

Before this development, Binance clients were limited to holding their assets on the exchange itself or through its custodial service provider, Ceffu. However, concerns arose following the U.S. Securities and Exchange Commission’s lawsuit against Binance, questioning the exchange’s crypto wallet custody practices and its relationship with Ceffu.

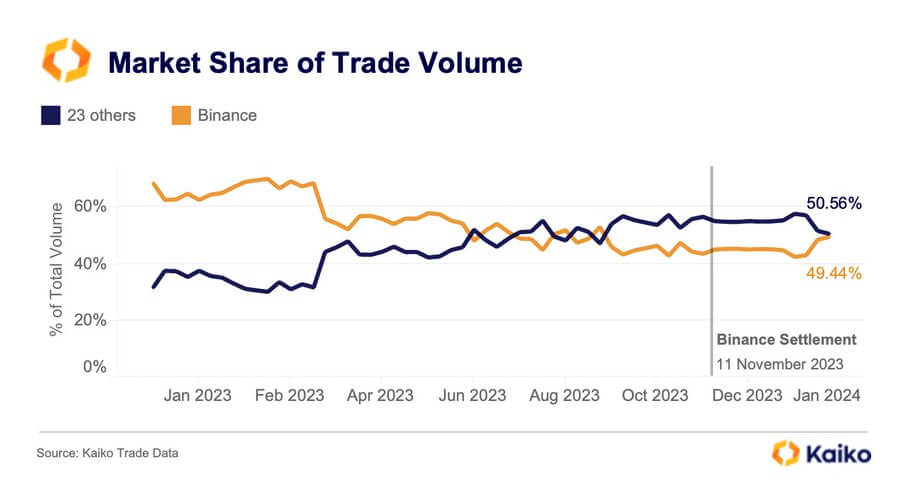

Binance market share recovers.

Binance market share is steadily growing to previous heights after its run-in with several financial regulators across different jurisdictions impacted its operations last year.

Last year, the platform strategically withdrew from Canada, the United Kingdom, and several European nations, including Austria, Cyprus, and the Netherlands, due to regulatory non-compliance issues.

Furthermore, it faced a substantial $4.3 billion settlement with U.S. authorities, leading to a market share dip to 44.5% by the close of the same year.

However, recent findings from Kaiko Research indicate a noteworthy comeback for Binance this year.

Data reveals that Binance’s trading volume has climbed to 49.44% from its previous multi-year low, while 23 other centralized exchanges collectively account for 50.56% of trading activities.

In response to this significant turnaround, Binance CEO Richard Teng expressed his optimism with a succinct “Keep Building” post on social media platform X.

The post Binance allows customers to custody trading collateral off exchange as market share recovers appeared first on CryptoSlate.

Investors interested in Bitcoin ETFs in the US have been transferring their 401k retirement plans to institutions offering seamless trading in a bid to obtain financial freedom.

The approval of 11 spot Bitcoin exchange-traded funds (ETFs) has received mixed reactions in the past two days. On one hand, the approval of spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC) can be seen as a major event that opens a new era of mass adoption of Bitcoin and the web3 sector. On the other hand, the approval of spot BTC ETFs has been viewed as a violation of the law by undermining the set anti-money laundering laws. Furthermore, US SEC Chair Gary Gensler indicated that the approval of spot BTC ETFs is not an endorsement of the crypto assets.

“While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse Bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto,” Gensler noted.

Notably, US Senator for Massachusetts Elizabeth Warren differed with the SEC’s decision to approve spot Bitcoin ETF amid concerns over anti-money laundering. Nonetheless, the crypto community has reminded Senator Warren that the US justice system paved the way for the approval of spot BTC ETFs.

The @SECgov is wrong on the law and wrong on the policy with respect to the Bitcoin ETF decision.

If the SEC is going to let crypto burrow even deeper into our financial system, then it’s more urgent than ever that crypto follow basic anti-money laundering rules.

— Elizabeth Warren (@SenWarren) January 11, 2024

Major Banks’ Reactions to the Approval of Spot Bitcoin ETFs

Following the approval of spot Bitcoin ETFs in the United States on Wednesday, Vanguard Group indicated that it will not facilitate their buying but only sales. As a result, investors seeking to get Bitcoin exposure to their portfolios have opted to transfer to friendly financial institutions like Fidelity Investments which supports seamless trading of spot Bitcoin ETFs.

Just transferred my 401k from Vanguard to Fidelity. It took about 15 minutes.

If you have an account with a broker currently blocking access to #bitcoin ETFs, close it and get out.

Make these boomers hurt

— Julian Fahrer (@Julian__Fahrer) January 11, 2024

Meanwhile, UBS Group AG (NYSE: UBS), a Zürich-based wealth management firm, has announced that it will allow access to some clients who want to trade spot Bitcoin ETFs. However, people close to the bank indicated that UBS will approve access under several conditions. One of the conditions set is that UBS cannot solicit the trades and accounts with a lower risk tolerance will not be able to buy the spot Bitcoin ETFs.

Similarly, New York-based Citigroup Inc (NYSE: C) intends to offer seamless trading services to the approved spot Bitcoin ETFs to its individual clients. Another financial firm that has already confirmed the support of spot Bitcoin ETFs trading is Charles Schwab Corp (NYSE: SCHW).

The approval of spot Bitcoin ETFs in the United States has significantly increased the crypto bullish sentiments. With Bitcoin halving less than 100 days away, crypto experts expect Bitcoin price to reach a six-figure value within the next few quarters. Moreover, the demand is rising exponentially on a limited supply of Bitcoin and other digital assets.

next

Funds & ETFs, Market News, News

You have successfully joined our subscriber list.

FTX faces backlash after proposed estimation of customers’ Bitcoin at $16k

Bankrupt FTX seeks court approval to estimate its customers’ digital asset claims in U.S. dollars, according to a Dec. 27 court filing.

The exchange clarified that the action was essential to prevent any hindrance in the bankruptcy proceeding, adding that:

“The liquidation of every individual Claim in respect of a Digital Asset is impractical and unnecessary and would unduly delay these Chapter 11 Cases.”

As such, the defunct crypto platform proposed estimating Bitcoin’s value at $16,871, Ethereum’s price at $1,258, and Solana’s SOL at $16. The firm also estimated Avalanche’s AVAX at $14.19, stablecoins USDT, TUSD, and BUSD a few cents less than their usual $1 peg.

The value of many of these digital assets, bar the stablecoins, has rapidly increased amid the significant market rise of the past year. For context, BTC is trading above $40,000 presently, while ETH’s value has also exceeded $2,200. SOL is also trading at more than $100 as of press time.

However, FTX argued that its valuations represent a “fair and reasonable” value of these digital assets as of the petition date—Nov. 11, 2022.

FTX creditors want to ‘fight’ motion

Meanwhile, the motion has attracted criticism from FTX creditors, who describe it as another theft and urge people to object to the plan.

Sunil Kavuri, one of the most prominent creditors of the bankrupt firm, noted the motion grossly undervalues the value of the digital assets and urges customers to “fight.”

“Alameda research claims prices are up by 40%. Alameda, FTX VCs, claim buyers of unsecured non-customer claims are getting this extra value. FTX creditors must fight,” he added.

The FTX 2.0 Coalition, a group of FTX creditors, advised customers who want to object to the motion to write a letter to the judge in charge of the bankruptcy case.

“Anyone can send a signed letter addressed to the Delaware bankruptcy court. No lawyer needed,” the group said.

Simon Dixon, the CEO of BnkToTheFuture, chimed in that FTX customers “should fight this hard.”

Customers who disagree with the motion have until Jan. 11 to object to the plan.

‘It’s low risk, high reward’: Small businesses are learning to use AI to boost profits and attract customers

Arion Herbert and his wife, Erica, started their recreational sports-league business in 2016. What started off as a way to gather friends and family outdoors quickly turned into a league with players and teams from all around Charlotte, N.C.

The company, called Main Attraction Recreational Sports or “MARS,” has since grown to making close to $500,000 in annual revenue, and Herbert said he believes the success is, in part, due to generative artificial-intelligence tools.

Herbert hired assistance through the online freelance marketplace Fiverr to create AI-generated marketing materials for their events. He said the use of AI marketing has helped MARS stand out and attract more customers than when they were merely relying on word-of-mouth marketing and a homemade logo.

“It’s a no-brainer for us,” he said.

Approximately 23% of small businesses in the U.S. are using AI technology to produce goods and services, according to a recent survey carried out by the U.S. Chamber of Commerce.

Researchers typically define AI as computer systems and software able to perform tasks normally requiring human intelligence, like decision-making, speech recognition, and language processing.

Small businesses that have taken the leap and are now experimenting with AI tools — like MARS, which used a freelancer to specifically create marketing materials using AI image-generation tools — are learning that it’s helping them complete tasks that they wouldn’t otherwise be able to afford.

An AI-generated ad created for MARS’ kickball festival for $19.66.

The freelancer hired by Herbert’s company to create images used text-to-image AI tools like Microsoft Bing’s

MSFT,

image creator and Midjourney. These have helped Herbert save money. Images that cost $50 would have previously cost the company $250 to create.

“It’s low risk, high reward because the prices that we pay for this content are so feasible in terms of what you would spend to get content like this created [by a human],” Herbert said.

Roughly 60% of small businesses in the U.S. that currently use AI in their marketing say they have saved time, with 33% estimating that they save more than 40 minutes per week on marketing by using AI, according to an August 2023 survey of 486 small-business decision-makers by Constant Contact, a small business-focused digital-marketing platform. More than 25% of those respondents expect AI to save them at least $5,000 over the next 12 months.

A challenging business environment

But as the cost of labor, rent and raw materials have risen — along with interest rates — it’s been a tough time for tech companies more broadly that provide services to small- and medium-sized businesses. It’s made it all the more critical for small businesses to find cheaper alternatives to traditional business-to-business services.

Paycom, a payroll services software company, saw its stock decline more than 37% year-to-date with lower-than-expected revenue growth. Bill, a software company that automates back-office financial services “powered by artificial intelligence,” has seen its shares plummet over 35% year-to-date.

Bill’s Chief Financial Officer John Rettig said, in a recent earnings call, that their business is “operating in an environment of increasing economic choppiness and small businesses are under increasing pressure to adjust to the current realities.”

ZoomInfo, which helps sales and marketing teams track leads and customers, has also seen shares decline over 45% year-to-date, with CFO Cameron Hyzer telling analysts that it’s a “tough world out there”.

ZoomInfo, Bill, and Paycom did not respond to requests for comment.

Macroeconomic challenges, however, haven’t stopped some small-business owners from experimenting with AI tools in an effort to grow their businesses faster and, hopefully, with lower costs.

Marsha Guerrier, founder and CEO of HerSuiteSpot.

AI as an office assistant

Marsha Guerrier, founder and CEO of HerSuiteSpot, a Long Island, N.Y., boutique consulting firm and digital platform for women in business, said she relies on generative AI programs for several day-to-day tasks.

“It has been a game changer for me,” she said.

She uses it to generate newsletters, and even to help her respond to emails with potential business partners. Guerrier currently pays $20 a month for ChatGPT, and also hired an AI freelancer to help her learn how to use AI prompts.

AI prompts are natural-language commands used as inputs in AI programs to get a desired result. The more specific and well-formed a prompt, the more useful the result. For example, asking ChatGPT to “come up with topics for a newsletter for women in business” might not display as useful as a result as asking it to “come up with topics for an email newsletter for women in business interested in starting their own company with no seed money.”

“In our newsletter we share articles on a subject that is important to entrepreneurs,” said Guerrier. “AI helps me create content ideas for the newsletter based on trending topics that are relevant and important to women of color entrepreneurs.”

Currently, her small business annually brings in $50,000 in revenue, approximately $5,000 of which she sets aside to allocate to AI services. In order to keep a lid on costs and because she’s still experimenting with the technology, Guerrier tries not to spend more than 10% of the expected revenue of a project on AI, she said.

Guerrier says that there are also challenges that arise with using AI tools — answers aren’t always accurate, and can be misleading.

“I say do your research. You know, don’t trust the data, but use it as a tool,” she said. “I didn’t always get it right. And the one thing that I strongly believe, and it’s something that I talk about all the time, is that AI is only as smart as the people that are using it right now.”

While Guerrier isn’t able to measure the exact return on her investment yet, other businesses have seen immediate results.

Fiesta Texas Pawn, an independently-owned pawn shop in Arlington, Texas, began offering designer handbags, thanks to a subscription to Entrupy, a handbag-authentication software that uses machine learning to scan thousands of images of a handbag to verify authenticity.

Carey Delaney, the store manager, says he pays a subscription fee of $119 a month to scan five handbags, with additional costs for each handbag after that. Since starting to use the service in 2019, handbag revenue has increased “well over 1,000%,” he told MarketWatch. The store didn’t offer many handbags before this tool became available because it was too expensive to authenticate every handbag individually.

Breakthroughs in generative AI could potentially drive a 7% — or close to $7 trillion — increase in global GDP and increase productivity growth by 1.5 percentage points over the next decade, according to a Goldman Sachs estimate. Research from Forrester predicts that 2.4 million jobs in the U.S. are expected to be replaced by generative AI by 2030.

For many small-business owners, AI tools provide a service in lieu of a human employee, which could come at a higher cost.

Herbert, who owns the recreational-sports league business, compares AI to a virtual assistant. “I would certainly encourage small-business owners to look and lean on AI as another employee,” he said.

Verizon CEO Hans Vestberg Says Netflix-Max Bundle ‘Resonates With Customers’

Verizon is the latest company to release a bundle of streaming services. Yesterday (Dec. 7) the wireless carrier announced a $10 (per line per month) bundle that includes ad-supported tiers of Netflix (NFLX) and Warner Bros. Discovery (WBD)’s Max. The deal is part of Verizon’s myPlan package, which offers a variety of customizable subscription services.

“…myPlan is resonating with our customers,” Verizon CEO Hans Vestberg said at the UBS Global Media & Communications Conference in New York City on Dec. 4. “We have seen a very high degree of our customers selecting the premium network but also now that the perks are still growing.”

Vestberg stressed that Netflix and Max, two of the most popular streaming services in the market, “never have been bundled before for that price,” and that he hopes it will result in customer retention. Netflix starts at $7 a month and Max starts at $10.

According to Vestberg, Verizon has found success in offering additional benefits whenever customers purchase more products. The strategy leads to lower “churn,” a term that describes the rates at which a company loses subscribers.

“In all studies, we have an enormous database of consumers. The more assets you have with us, the more devices you have, the more perks you have, the lower the churn is,” Vestberg said.

One of the other myPlan packages that Vestberg boasted at the UBS conference is one that combines five streaming services: the ad-free Disney+ and the ad-supported tiers of Hulu, ESPN+, Netflix and Max—all for just $20 a month.

Other companies have started teaming up on similar bundle plans and advertising the savings to their customers. Last week (Dec. 1), Apple (AAPL) and Paramount (PARA) Global discussed selling a subscription package that would include Apple TV+ and Paramount+ at a discounted rate. The Walt Disney Company also launched a one-platform experience this week that combines Disney+ and Hulu. These bundles are being introduced at a time when major streamers, including Apple+, Paramount+ and Disney+, have hiked prices for their individual plans recently.

Trending Observer Stories

Read the original story Verizon CEO Hans Vestberg Says Netflix-Max Bundle ‘Resonates With Customers’ and others by Nhari Djan at Observer.

Lightning Network app Wallet of Satoshi ends support for U.S. customers

Wallet of Satoshi, a popular wallet for use with with Bitcoin’s Lightning Network, announced the end of U.S. support on Nov. 24.

The company said that it had decided to remove its app from the U.S. and Google app stores and stop serving American users going forward.

The announcement only broadly described the reasons for the change, stating:

“This decision doesn’t come lightly. Our commitment to providing a secure, user-friendly, and compliant platform globally is unwavering. Our top priority is the safety and interests of our customers and our company.”

Wallet of Satoshi otherwise said that it hopes to eventually resume U.S. operations in the future. It added that U.S. users will continue to have access to funds that currently exist in their wallet, allowing for transactions and withdrawals.

Regulatory risk may be reason for takedown

Many members of the crypto community have speculated that, because of the U.S.-specific policy change, the decision is a response to American regulations.

Wallet of Satoshi is a custodial wallet, meaning that the provider centrally holds and manages funds on behalf of wallet customers. By contrast, the official Bitcoin wallet and various other Lightning Wallets are non-custodial wallets, meaning that they allow users to maintain complete control of their cryptocurrency balance on-chain.

Wallet of Satoshi’s centralized and custodial model likely puts the company at risk of regulatory enforcement, similar to cryptocurrency exchanges that manage funds on behalf of their users. Many such exchanges have recently faced regulatory action.

Prior to the announcement, some community members speculated that Google and Apple had banned the wallet from their respective app stores. However, Wallet of Satoshi’s latest update, combined with the fact that the app is available on international versions of each app store, suggests that the stores did not impose a ban.

Another commentator, Kevin Rooke, observed that the app recently experienced high volumes, handling over 1.1 million of Lightning transactions November.

SiriusXM to launch new app and streaming plan to target younger customers

(L-R) Scott Greenstein, Kevin Hart, Ashley Flowers, and Kelly Clarkson speak onstage during the SiriusXM Next Generation: Industry & Press Preview at The Tisch Skylights at The Shed on November 08, 2023 in New York City.

Bryan Bedder | Getty Images Entertainment

SiriusXM announced Wednesday that it will launch a revamped app and a newly priced streaming plan as it pushes to attract younger customers.

The company will launch the offerings on Dec.14, first on streaming, and later in car interfaces. It will price the new plan at $9.99 per month.

“Our growth audience is millennials and younger, who are willing to pay for an experience,” CEO Jennifer Witz said during an event Wednesday where the company unveiled the new services. The star-studded event included appearances by Howard Stern, Conan O’Brien, Andy Cohen and Kevin Hart, and a performance by Kelly Clarkson.

The satellite radio company, home to big-name hosts like Howard Stern and Andy Cohen, is hoping its new app interface will make the millennial and younger generations, many of whom are used to Spotify or Apple Music, feel right at home. The move comes as Sirius looks for a jolt to pull it out of stagnant sales and a 20% decline in its share price this year.

Listeners will now have “always-on” curation and a personalized library featuring four new stations on the app landing page: Music, Talk & Podcasts, Sports, and For You. The app will also bring features like enhanced search, improved podcast listening and greater content discovery, the company said in a press release.

“The current app only put our radio on the phone,” Chief Product and Technology Officer Joe Inzerillo told CNBC. “This new app will offer more which will then be mirrored in the car.”

With the new platform, listeners will be able to pick up where they left off across devices, including the car, phone, or Fire TV. This means those tuning into a podcast, interview, or sports game can go listen on another device without losing their place.

“Typically, we see [the improved listening experience] supporting lower churn and higher conversion, driving net adds and higher customer lifetime value over time,” Morgan Stanley wrote in a Thursday note.

SiriusXM has shed subscribers recently, as it reported a loss of 94,000 satellite radio subscribers in the third quarter.

The company hopes that what Witz called its “human touch” will set SiriusXM apart from other streaming competitors. Music superstars Dolly Parton, Kelly Clarkson and John Mayer are launching new year-round SiriusXM channels this month that will feature their handpicked curation of songs.

The company is also simplifying its pricing structure, offering its new Streaming All Access Plan for $9.99 a month, a dollar cheaper than its current all-inclusive streaming plan. The cheaper price tag is another bid to attract millennial and younger customers, who may already pay for another streaming service.

“We see this as a supplemental product,” Witz told CNBC on Wednesday. “We know people already have a separate music library, but we’re here for discovery.”

Morgan Stanley analysts believe the changes could help the company bring in younger listeners.

“We see the opportunity for the new product to help broaden the base, to younger, more often streaming-only consumers,” they said in the note Thursday. “The newly announced $9.99 per month price point may help. We note the product will have to compete against stiffer competition (e.g., Spotify, Apple, Amazon) relative to its in-car product vs. AM/FM radio.”

The company also continues to make headway on its satellite radio compatibility in new cars. Select-model 2024 Polestar vehicles will come equipped with SiriusXM 360L technology, which combines satellite and streaming features, the company announced Wednesday.

CommEx to onboard 1 million Russian customers from Binance amid increased competition

CommEX, the company that acquired Binance’s Russian operations, anticipates approximately a million customers to transition to its platform, Russian media Kommersant reported Wednesday, Oct. 4.

However, not all of Binance’s Russian customers will likely migrate to CommEx. According to Dmitry Stepanin, CEO of Satoshkin, pointed out to Kommersant that crypto traders primarily turned to the ByBit exchange, which has shown significant marketing activity recently. Other exchanges such as Huobi, Bitget, Kucoin, and Gand ate.io, offering similar functionality to Binance, are also expected to see a surge in user inflow. This observation is corroborated by the P2P service Army, which has reported a steady increase in active ads for other crypto exchanges.

Anton Toroptsev, CommEX CEO, told Kommersant that he estimates the influx to his platform will be about 1 million users. In contrast, independent financial analyst Andrey Barkhota estimates that at least 700 thousand Russians were registered on Binance.

However, Binance has refrained from disclosing the exact number of its Russian customers. The user transition from Binance to CommEX, according to Toroptsev, will occur in phases. Initially, users can log in to CommEX using a Binance account with only basic Know Your Customer (KYC) information and login details being transferred. However, full KYC data is expected to be transferable within a week.

The pullout of Binance from Russia, according to Roman Nekrasov, co-founder of the ENCRY Foundation, is primarily due to pressure from US regulators who have accused the exchange of money laundering and evading sanctions, Kommersant reported. Moreover, Binance had gradually introduced restrictions for Russian users, including a ban on holdings exceeding $10,000 in their wallets and limiting transactions to rubles only. Yet, Binance reportedly made between $2 – $4 billion annually from its Russian clientele.

Nevertheless, Sergey Mendeleev, the head of the InDeFi Smart Bank, also told Kommersant that Binance is merely rebranding for a smoother operation in Russia. While CommEX, despite its Russian acquisition, maintains its registration in Seychelles and focuses on Asia and the CIS. The relative anonymity of CommEX’s owners and the platform’s nascent status represent potential risks of scams, hacker attacks, or security loopholes, warns Nekrasov.

As the crypto trading landscape continues to evolve in response to regulatory pressures and market dynamics, the metamorphosis of Binance’s operations in Russia offers a case study in adaptation and resilience.