As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

Source link

decrease

Quick Take

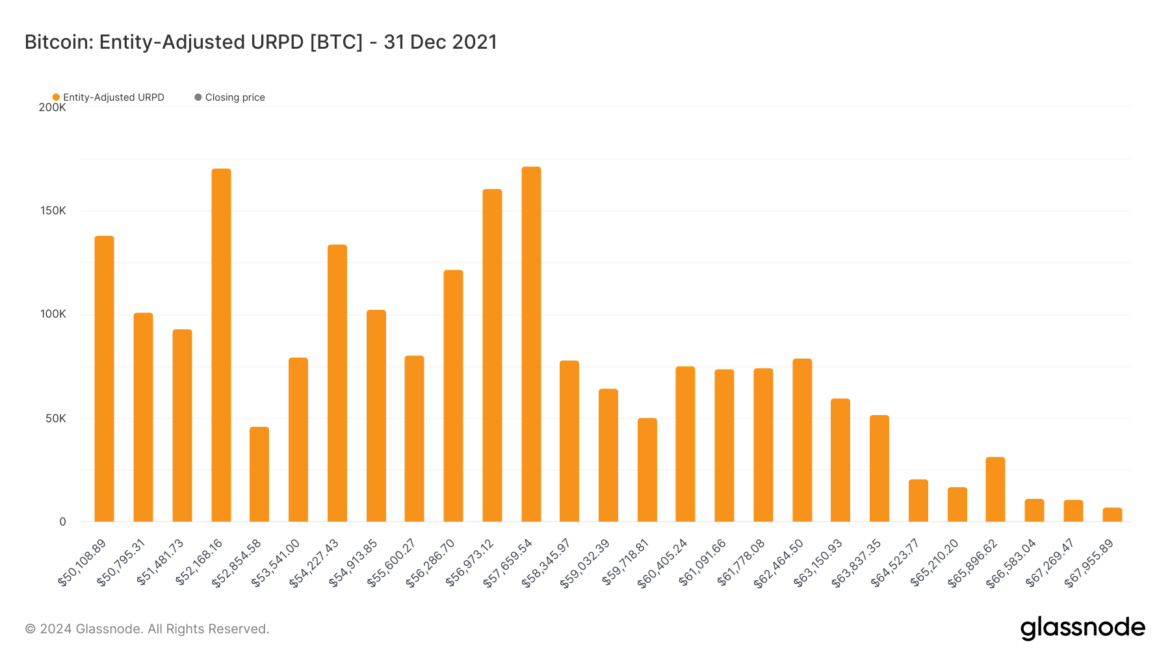

The UTXO Realized Price Distribution (URPD) metric by Glassnode offers a snapshot of the prices at which the existing Bitcoin UTXOs were established. Each bar on the graph represents the Bitcoin in circulation that was last transferred within a particular price range.

Since the bull run of 2021, when Bitcoin reached an all-time high of approximately $69,000, the percentage of total supply sitting above $50,000 has decreased dramatically. As of Feb. 5, 2024, only about 3.5% of Bitcoin’s supply sits in this price bracket, down from around 13% as of Dec. 31, 2021. This data suggests a significant sell-off over the past 24 months, as Bitcoin went as low as $15,500 during the FTX collapse.

Concurrently, a noticeable consolidation is observed around the $40,000-$44,000 price range, accounting for approximately 13% of the current total supply. This indicates an accumulation phase, where investors are holding onto Bitcoin in anticipation of a potential price surge due to the ETFs and an upcoming halving.

The post Dramatic decrease in Bitcoin supply above $50,000 appeared first on CryptoSlate.

Bitcoin Ordinals, once the shining star of the NFT world, is experiencing a significant downturn in both sales volume and transactions, igniting discussions about the lasting appeal of these digital collectibles.

According to a recent report from DappRadar, the fervor that propelled Bitcoin Ordinals to record-breaking heights earlier this year has dwindled, with sales volume plummeting by over 97% from its peak in May 2023.

Ordinals trading and sales volume. Source: DappRadar.

Ordinals: A Rapid Descent In Three Months

The meteoric rise of Bitcoin Ordinals, which saw its sales volume soar to a staggering $452 million in May, has taken a sharp nosedive. This once-flourishing market has seen its sales volume dwindle to a mere $3 million in mid-August, marking a jaw-dropping 97% decline within a span of just three months.

The data paints a stark picture: June witnessed a 76.5% plunge, with sales volume hitting $100 million, while July followed suit with a 66.9% drop, settling at $35 million. As August unfolds, a bleak 91.4% drop to $3 million in sales volume underscores the challenges facing Bitcoin Ordinals.

Beyond The Numbers: Transaction Count And Its Implications

While fluctuations in sales volume could be attributed to the ebbs and flows of the market, the report highlights another concerning trend: a consistent reduction in transaction count.

Transactions have dwindled by a staggering 88.1% in August, sinking to a mere 20,571 compared to the robust 832,648 transactions witnessed just three months prior.

This sharp decline in transactions suggests that the interest in trading Bitcoin Ordinals is diminishing, casting a shadow of doubt on its long-term viability and relevance within the competitive NFT landscape.

Bitcoin (BTC) is currently trading at $25.934. Chart: TradingView.com

Looking Ahead: A Temporary Setback Or Systemic Issue?

The coming months are poised to be pivotal in determining whether this downward spiral is merely a temporary setback or indicative of more profound challenges for Bitcoin Ordinals and NFTs tied to the cryptocurrency.

As the NFT ecosystem continues to evolve, the fate of Bitcoin Ordinals hangs in the balance. While its spectacular rise showcased the potential of NFTs within the world of digital art and collectibles, the current slump urges stakeholders to reevaluate strategies and adapt to the shifting dynamics of the market.

The waning sales volume and transaction counts of Bitcoin Ordinals have raised pertinent questions about the enduring allure of NFTs tied to the cryptocurrency.

As the NFT landscape navigates through these challenges, the industry watches closely, eager to discern whether this decline signifies a fleeting setback or signals a more profound reckoning.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Kyodo News/Getty

MicroStrategy made largest Bitcoin purchase since 2021 in Q2 2023 amid slight revenue decrease

In its Aug. 1 financial results, business intelligence firm MicroStrategy said it acquired substantial Bitcoin during Q2 2023.

Andrew Kang, Chief Financial Officer at MicroStrategy, said:

“The addition in the second quarter of 12,333 bitcoins [is] the largest increase in a single quarter since Q2 2021. We efficiently raised capital… and used cash from operations to continue to increase bitcoins on our balance sheet.”

In a separate presentation, the firm said that the 12,333 BTC it bought was purchased for $347 million at an average of $28,136 per Bitcoin.

However, those numbers only represent the company’s latest additions, not the total amount of Bitcoin it acquired. MicroStrategy said that, as of July 31, 2023, it had acquired 152,800 BTC for $4.53 billion or $29,672 per Bitcoin.

Despite those high estimates, the company said that the carrying value (the original cost of the asset, less any depreciation, amortization or impairment costs) of its Bitcoin was just $2.3 billion. That number reflects cumulative impairment losses of $2.196 billion since MicroStrategy’s first purchase and an average carrying amount per Bitcoin of $15,251.

MicroStrategy noted elsewhere that Bitcoin and its own MSTR stock have outperformed numerous other indexes and assets. MSTR has gained 254% since it adopted its Bitcoin strategy in August 2020, while Bitcoin itself has gained 145% since that date.

MicroStrategy otherwise reported total revenues of $120.4 million in Q2 2023, which represents a 1% decrease in revenue year-over-year.

Bitcoin in the bigger picture

Kang also positioned MicroStrategy’s purchases within broader industry developments, such as increasing interest from institutional investors and regulatory clarity around Bitcoin.

Kang also said that MicroStrategy is seeing progress regarding Bitcoin accounting practices. In May, the company submitted a letter to the Financial Accounting Standards Board (FASB) expressing support for a fair value accounting for crypto assets. It said this would allow it to provide a “more relevant view” of its Bitcoin holdings.

In its company profile, Microstrategy called Bitcoin a “dependable store of value” and described Bitcoin acquisition as one of its two main strategies alongside its enterprise software business.

UPDATE: Aug. 2, 2023, 9AM – MicroStrategy announced the sale of up to $750 million of its Class A stock on Aug. 1 potentially to fund additional Bitcoin purchases.

The post MicroStrategy made largest Bitcoin purchase since 2021 in Q2 2023 amid slight revenue decrease appeared first on CryptoSlate.