U.S. benchmark oil prices edged lower Wednesday, pressured after official data from the Energy Information Administration revealed a larger-than-expected weekly rise in U.S. crude supplies.

Source link

fall

The 2024 Buick Envista.

GM

DETROIT — General Motors on Tuesday reported a 1.5% decline in first-quarter U.S. vehicle sales compared to a year ago, as the overall auto industry normalizes after years of disruptions and volatile results.

The Detroit automaker said the decline to 594,233 vehicles sold during the first three months of the year was largely due to a 22.9% year-over-year decline in sales to fleet customers. Retail sales to customers were up 6%, GM said.

GM’s sales were in-line with Cox Automotive estimates but below expectations for the overall industry. The auto data firm forecast U.S. auto industry sales to be up 5.5% from a year earlier.

Buick was the only GM brand to report a sales increase during the quarter, up 16.4% from a year earlier. The GMC truck brand was off about 5%, while Cadillac and Chevrolet were both off about 2%.

GM reported sales of its full-size pickups totaled roughly 197,000 units during the first quarter, up 3.6% from a year earlier, marking its best performance during that time since the first quarter of 2020.

“GM gained retail market share year-over-year with strong mix and pricing, our inventories are in good shape heading into the spring, and production and deliveries of Ultium Platform EVs are rising, led by the Cadillac Lyriq. We’re on plan,” GM North America President Marissa West said in a statement.

Electric vehicle sales

Sales of GM’s all-electric vehicles, closely watched by Wall Street, remained miniscule during the first quarter. EV sales totaled 16,425 units, or 2.8% of the automaker’s overall sales during the period.

GM is in the process of ramping up production of its newest EVs, including the Cadillac Lyriq and the Blazer EV, while winding down sales of Chevrolet Bolt models, which were discontinued in December.

First-quarter sales of the Blazer EV were limited, totaling 600 units, due to a stop-sale that was in effect from late December until early March to resolve software issues.

Hyundai and other automakers

Other automakers reported varying results for the first quarter, as inventories and sales normalize to levels not seen since before the Covid-19 pandemic began.

Hyundai Motor America CEO Randy Parker noted the industry is getting more competitive as automakers attempt to maintain profits of recent years without oversubsidizing sales.

“The market is changing swiftly, and it’s gotten a lot more competitive,” Parker said Tuesday during a media call.

Hyundai reported its best March sales ever last month, at 76,920 vehicles sold, but its first-quarter sales were only up 0.2% compared to a year earlier.

Separately, Hyundai’s Genesis luxury brand reported sales of 14,777 vehicles during the first quarter, up 7.3% year over year.

Here is how other major automakers performed in U.S. sales compared to the first quarter of 2023:

- Toyota Motor reported a 16% increase in sales, including a 16.1% increase in March. The company sold nearly 388,000 vehicles during the first three months of the year.

- Honda Motor reported a 17.3% jump in sales to nearly 334,000 vehicles sold, including a 10.1% increase in March.

- Kia reported sales of 179,621 vehicles during the first quarter, off 2.5% year over year.

- Nissan Group announced first quarter sales of 252,735 vehicles, a 7.2% increase from a year earlier.

- EV startup Rivian Automotive reported vehicle deliveries of 13,588 vehicles during the first quarter, up from 7,946 vehicles a year earlier. The company reaffirmed guidance for annual production of 57,000 total vehicles, including 13,980 during the first three months of the year.

Don’t miss these stories from CNBC PRO:

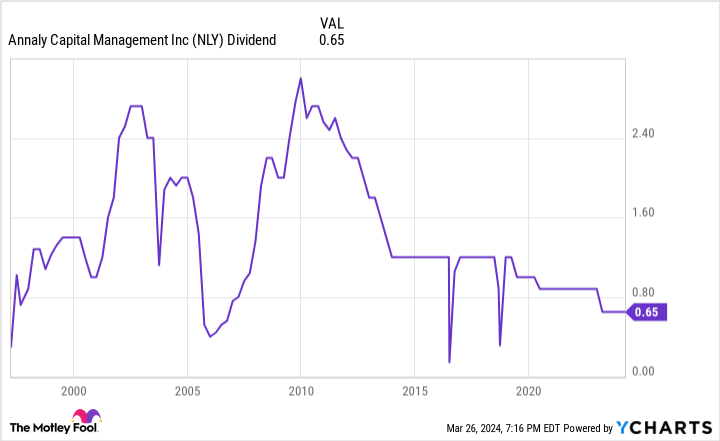

A high dividend yield can be alluring. However, a sky-high payout is often a warning sign that the market believes the company won’t be able to maintain its dividend much longer. Because of that, investors need to be careful when buying stocks with big dividend yields.

Take Annaly Capital Management (NLY 1.29%) and Medical Properties Trust (MPW -0.42%). The real estate investment trusts (REITs) currently offer double-digit yields. Those big-time payouts are likely too good to be true. Here’s why investors shouldn’t fall for them.

Likely on the cutting board again

Annaly Capital Management currently yields more than 13%, about 10x the S&P 500‘s dividend yield. The mortgage REIT can currently afford its monster dividend. It recorded $0.68 per share of earnings available for distribution (EAD) during the fourth quarter, covering its $0.65 dividend outlay.

The REIT recently declared its next dividend payment, maintaining the $0.65 per-share level for the first quarter. That’s not a surprise. The company’s CEO David Finkelstein stated on the fourth-quarter call that the REIT expected to earn enough to cover the dividend in the current quarter.

However, the dividend’s future beyond that payment remains uncertain. One factor driving that view is that Annaly tightened its return expectations due to the current market conditions. Those market conditions have caused its EAD to fall from $0.89 per share at the end of 2023 to a low of $0.66 per share in the third quarter of 2023.

That decline has already caused the REIT to cut its dividend early last year, from $0.88 per share to its current level. A further deterioration in its EAD would likely force Annaly to cut its dividend again, which it has done many times over the years:

NLY Dividend data by YCharts.

Finkelstein seemed to leave the door open on another dividend cut this year. He stated on the fourth-quarter call that while management’s view at the time was not to recommend a dividend adjustment to the Board of Directors, they would “see how things progress throughout the rest of the year.” If the company’s earnings fall any further, it might need another downward adjustment in the dividend payment.

Still not healthy

Medical Properties Trust currently yields around 15%. The hospital-focused healthcare REIT has already slashed its dividend once in the past year. Last August, it updated its capital allocation strategy, which included cutting its quarterly dividend from $0.29 to $0.15 per share. That move better aligned the payout with its adjusted funds from operations (FFO) following a string of asset sales.

The REIT needed to sell properties to repay debt, which it couldn’t refinance at an attractive rate due to surging interest rates and tenant troubles. It has been working directly with two tenants to help them get back on a firmer financial foundation. Unfortunately, while one tenant has finally resumed paying rent, another only pays some of what it owes the REIT. Because of that and its balance-sheet issues, Medical Properties Trust plans to sell more assets.

The hospital owner’s continued issues could cause it to cut its dividend again. CEO Ed Aldag noted on the fourth-quarter call that maintaining the company’s current dividend level isn’t dependent on its tenant resuming rent since it has a cushion that’s big enough to cover its payout. However, it’s contingent on closing some of the transactions it’s pursuing to boost liquidity. If the company can’t close those deals, it might cut or suspend its dividend to retain additional cash for debt reduction.

Not sustainable income stocks

Annaly Capital Management and Medical Properties Trust might offer enticing yields but unfortunately, they don’t look sustainable. Because of that, income-focused investors should avoid these REITs for now since another round of cuts seems to be coming soon.

Matt DiLallo has positions in Annaly Capital Management and Medical Properties Trust. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Galaxy Digital CEO: Bitcoin Unlikely to Fall Below $55,000 — ‘That’s the New Floor’

Galaxy Digital CEO Michael Novogratz says he doesn’t believe the price of bitcoin will fall back down to the $50K-$55K level. “I think that’s the new floor unless something dramatic happens,” he described. “This has been a wild ride of an asset,” he added, noting that we’re in price discovery mode and if you look […]

Galaxy Digital CEO Michael Novogratz says he doesn’t believe the price of bitcoin will fall back down to the $50K-$55K level. “I think that’s the new floor unless something dramatic happens,” he described. “This has been a wild ride of an asset,” he added, noting that we’re in price discovery mode and if you look […]

Source link

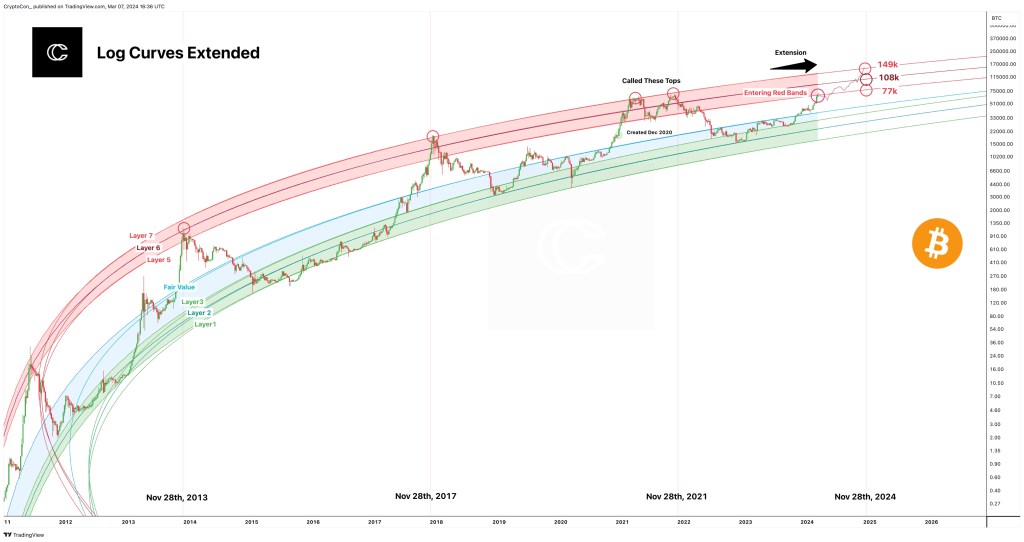

Amidst widespread bullish sentiment surrounding Bitcoin, one analyst on X thinks the leg up won’t be as strong as it was in the past few weeks. Pointing to developments in the Bitcoin log curves, the analyst expects the coin to find resistance as it attempts to break higher.

Bitcoin Uptrend To Slow Down

The analyst doubts the current excitement around the uptrend, and technical formations advise the contrarian view. Many in the industry think Bitcoin will not only ease past $70,000, a round number nearly tested this week, but also float to $100,000 in the next few weeks.

On X, the analyst remains confident about the coin’s prospects. However, based on the Bitcoin log curve assessment, the leg up will likely be labored. The analyst compares the current price formations with the Bitcoin log curves. In 2021, the tool was used to identify price peaks.

Based on price formation, the analyst notes that if BTC peaks in 2024, then prices will likely turn around from between $77,000 and $149,000. These prospective peaks’ upper and lower bands represent layers 5 and 7 of the log curve.

Even with BTC possibly rising to $149,000, at least from the tool, the Layer 7 target is relatively lower. By factoring in a one-year slowdown in growth, the predicted peak is revised downwards from $180,000 to $149,000.

When writing, the “red band” of the log curve has been breached earlier than usual. Looking back, Bitcoin prices tend to peak three months after this breakout.

That likely places Bitcoin’s peak at around the $77,000 level but below $100,000. Nonetheless, this is hard to predict, considering the volatile nature of prices and the dynamic nature of fundamental factors.

The community remains optimistic about what lies ahead. So far, Bitcoin prices have been trending at historical highs, but there has been a sharp drop in the momentum of upside.

BTC Bears In A Commanding Position

The daily chart shows that prices are still inside the bear bar of March 5. The candlestick had a high trading volume and was wide-ranging. For the uptrend to be valid, prices must break above $70,000, based on rising trading volume.

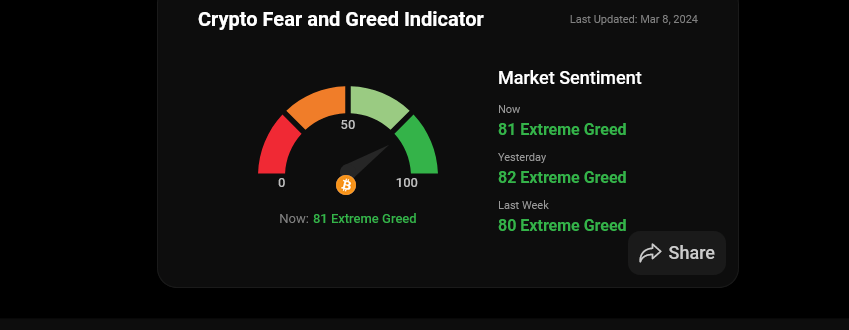

Lower prices incentivize issuers to spot Bitcoin exchange-traded funds (ETFs) to load up on dips. Their actions have spurred demand over the past few weeks, lifting sentiment and prices. According to Coinstats’ Fear and Greed Index, “extreme greed” exists in the market.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Markets count on consumer-price index to fall below 3% for first time since 2021

Tuesday has the potential to bring investors something they haven’t seen in almost three years: A U.S. inflation rate based on the consumer-price index that looks more like 2%.

In the run-up to January’s CPI data, stocks finished near a record close, with the S&P 500 index

SPX

ending above 5,000 on Monday — helped by growing confidence that inflation is improving. Treasury yields ended little changed, following a steep climb over the past few weeks that’s been driven by stronger-than-expected U.S. economic data.

Economists now expect an annual headline CPI rate of 2.9% for January, which would be the lowest level since March 2021 and down from 3.4% in December. Any upside surprise in Tuesday’s report that shows inflation remaining unexpectedly sticky, however, is likely to shake up the bond market the most, according to analysts.

Read: The first big inflation report of 2024 is coming out. Here’s what the CPI is likely to show.

Tuesday’s data is likely to “just confirm what the market already knows: that inflation is falling,” said Adam Turnquist, chief technical strategist for LPL Financial in Green Bay, Wis. “Anything outside of that is going to lead to some volatility on a short-term basis, but it’s also not going to detract from investors’ confidence on inflation.”

“Stocks should do well if inflation is in line or below expectations and, in the event that it isn’t, investors might be willing to withhold judgment by focusing on individual components of the report that are expected to fall, like shelter,” Turnquist said via phone. “Fixed income will be moving the most if inflation comes in hotter than expected, following a string of upside surprises to the economy. If you throw in a high inflation print, that’s going to add to the upside we’ve seen in terms of yields. And the dollar is highly correlated to the 10-year rate.”

On Monday, 2 –

BX:TMUBMUSD02Y

and 10-year Treasury rates

BX:TMUBMUSD10Y

settled not far from their highest levels since mid-December. Yields had finished Friday with their biggest weekly advances since the period that ended on Jan. 19, after minor revisions were made to past CPI reports.

The ICE U.S. Dollar Index

DXY

has advanced roughly 1.9% for the year. Meanwhile, stocks ended mixed, with the S&P 500 losing an earlier gain to finish lower at 5,021.84 while the Dow Jones Industrial Average closed up by 125.69 points, or 0.3%.

“Stocks are pricing in a baseline expectation that inflation is largely improving, and it’s now more about monetary policy and when — not if — the Fed is going to cut rates and by how much,” Turnquist said. “The inflation hysteria around these prints has deteriorated.”

The annual headline rate of CPI reached a peak of 9.1% in June 2022 and has since steadily fallen, holding around 3% for seven straight months. While Federal Reserve policymakers prefer to rely on another gauge known as the PCE and the core readings that exclude food and energy, officials also pay attention to annual headline CPI because of its ability to affect household expectations.

See also: Why Americans Are So Down on a Strong Economy

“Anything under 3% offers some sort of assurance,” said strategist Will Compernolle at FHN Financial in New York. “But I think tomorrow won’t give as much as definitive clarity on inflation as the markets hope for.”

“January was full of disruptions, with weather and illness. Consumer spending patterns changed and companies couldn’t operate at full capacity. How those two ingredients combine, I’m not sure,” Compernolle said via phone. “But with lower demand, inflation could look cooler, on net, and January’s data may not be representative of the longer-term trajectory on inflation.”

The report “will probably be seen as ‘good enough,’ and might provide a sense of relief that inflation is not moving any faster,” he said on Monday.

Leading indicators fall again, but U.S. appears no closer to recession

Breaking news. Check back for updates.

The numbers: The leading indicators for the U.S. economy fell again in December to mark the 21st decline in a row, but a widely predicted recession still appears no closer than when the long losing streak first began.

The leading index slid 0.1% last month, but it was smaller than the 0.3% drop forecast by economists polled by the Wall Street Journal.

The losing streak is the third longest on record

The two other times the index was negative for so long, a recession took place. Yet the economy has not followed the usual patterns since the 2020 pandemic.

Key details: Six of the 10 indicators in the survey were positive in December, a big improvement compared to prior months.

The leading index is a gauge designed to show whether the economy is getting better or worse. The report is published by the nonprofit Conference Board.

Big picture: The economy has continued to expand through a period of high inflation and rising interest rates orchestrated by the Federal Reserve to get prices back under control.

The U.S. grew at a rapid 4.9% annual pace in the third quarter and gross domestic product is estimated to have expanded by almost 2% in the recently ended fourth quarter.

Economists are split on whether a recession is likely, but if the Federal Reserve cuts interest rates this year it could help the U.S. to avert a downturn. Central bank officials have signaled they are probably done raising rates.

Looking ahead: The Conference Board is sticking to its forecast.

“Overall, we expect GDP growth to turn negative in [the second and third quarters] of 2024 but begin to recover late in the year,” said Justyna Zabinska-La Monica, senior manager of business cycle indicators.

Market reaction: The Dow Jones Industrial Average

DJIA

and S&P 500

SPX

rose in Monday trading.

Recently, cryptocurrency analytics platform Lookonchain reported activities of Bitcoin (BTC) and Ethereum (ETH) whales amid the ongoing market downturn. These whales appear to have been capitalizing on the recent decline in the crypto prices to bolster their holdings.

According to Lookonchain, amid the market dip, a newly established wallet withdrew 700 BTC, valued at roughly $29.36 million, from the Binance exchange.

These BTCs were purchased at an average price of $41,948 each.It is worth noting that, according to the analyst, such a move during a market downturn demonstrates a bullish sentiment on the future of BTC.

It seems that a whale is buying $BTC!

In the recent market drop, a new wallet withdrew 700 $BTC($29.36M) from #Binance at an average price of $41,948. pic.twitter.com/Fj1thu4C6x

— Lookonchain (@lookonchain) January 19, 2024

Ethereum Whales Joining The Fray

The narrative of strategic accumulation isn’t limited to Bitcoin. Lookonchain’s subsequent tweet highlighted similar activities in the Ethereum market.

A whale took advantage of the decreased Ethereum prices, buying 3,600 ETH, worth around $8.9 million. Lookonchain highlighted that this investor’s history of buying ETH at lower prices and selling at higher valuations has resulted in substantial profits, estimated at around $25.8 million.

After the price of $ETH dropped today, this smart whale bought 3,600 $ETH($8.9M) back at a lower price 5 hours ago.

This whale is very good at buying $ETH at low prices and selling $ETH at highs.

The profit is ~$25.8M currently! pic.twitter.com/DannZzsQVk

— Lookonchain (@lookonchain) January 19, 2024

These whale movements are worth noting, especially considering the increasing bearish sentiment in the cryptocurrency markets. Ethereum, for instance, has seen a 1.9% decline in the past 24 hours and a 7.8% drop over the past week.

The asset is currently trading at around $2,475. Bitcoin is experiencing a similar trend, with a nearly 3% decrease in the past 24 hours and a 10% fall over the past week, bringing its price to $40,819 at the time of writing.

This market downturn is also reflected in the asset’s trading volume. Bitcoin’s daily trading volume fell from over $40 billion last Friday to about $26 billion.

Bitcoin Market Analysis And Future Predictions

In light of these developments, renowned crypto analyst Jacob Canfield has cautioned that Bitcoin might face further corrections in the short term.

Canfield notes that the upcoming Bitcoin halving could play a crucial role in rebalancing the market dynamics, potentially tipping the scale towards demand over supply. However, his analysis of Bitcoin’s 4-hour chart indicates the formation of a trend that has historically been an indicator of negative short to mid-term price movements.

For Bitcoin, critical levels include $48,700, marked by the 61.8% Fibonacci retracement, weekly resistance, and a significant support level to watch at $38,700. Earlier this month, Bitcoin traded at the $48,700 zone before retracing.

Canfield warns that following a tap of the 61.8% level, Bitcoin often experiences an 18-22% sell-off, potentially bringing it back to the $38,700 support level.

#Bitcoin update – If you’ve been following me for a while, you’ll know my local top on $BTC was $48.7k (as per my playbook posts)

The question that everyone is asking now is ‘where do we go from here?’

The current narrative is that the ETF approval unlocked the GBTC investors… pic.twitter.com/MayIZp5vEY

— Jacob Canfield (@JacobCanfield) January 18, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin dropped below $41,000 in the last 24 hours before making a recovery to rise above that level once again. This has become the current reality of the flagship crypto token’s price, which has continued to decline since the Spot Bitcoin ETFs were approved. This is surprising considering that these funds were projected to help boost Bitcoin’s price upon launch.

Why Bitcoin’s Price Could Be Dipping

Bloomberg analyst James Seyffart provided insight into what could be the reason for Bitcoin’s declining price as he revealed that Grayscale’s GBTC has experienced an outflow of $2.2 billion since its conversion to a Spot Bitcoin ETF. Crypto analytics platform Arkham Intelligence also revealed that Grayscale had moved 9000 BTC from their wallets to Coinbase, suggesting an imminent sale.

A sell pressure of such magnitude would no doubt affect Bitcoin’s price, and that seems to be a plausible explanation for why Bitcoin’s price has declined as of late. The CEO of Jan3 and Bitcoiner, Samson Mow, also echoed similar sentiments as he mentioned that the GBTC sell pressure was pushing prices down.

However, Mow believes that this trend “won’t be a long drawn out process,” as he predicts that many of GBTC’s investors won’t be able to offload their stocks because the “tax hit is too big.” JP Morgan will, however, beg to differ as a research report by the bank estimates that up to $3 billion could exit from the GBTC fund with many investors looking to take profit.

Crypto analyst Ash Crypto also recently elaborated on how profit-taking is one of the reasons that GBTC is seeing this significant amount of outflows. He explained that a lot of GBTC investors bought shares in the fund when it was trading at a 40% discount from Bitcoin, and now they are exiting their positions since that discount is now at 0%.

BTC bulls make a play for control | Source: BTCUSD on Tradingview.com

Spot Bitcoin ETFs Are Actually Living Up To Hype

While Grayscale’s GBTC continues to bleed, other Spot ETFs look to be living up to the hype, with there being an impressive demand for these funds. Nate Geraci, the President of the ETF Store, revealed that two (IBIT and FBTC) out of the nine Spot ETFs (excluding GBTC) already hit $1 billion in assets under management (AUM) just after five trading days.

Specifically, BlackRock’s IBIT (iShares Bitcoin Trust) was the first to achieve this milestone in just four trading days. Commenting on how impressive this was, Bloomberg analyst Eric Balchunas noted that only two other ETFs ($GLD and $BITO) had done this before now, and none of those funds faced such competition as IBIT did on launch day.

The demand for Spot ETFs is evidently there, seeing that two spot Bitcoin ETFs have already achieved a record that was held by only two other ETFs before now.

Featured image from Yahoo Finance, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

By Amina Niasse

NEW YORK (Reuters) – U.S. mortgage rates fell this week to the lowest since May 2023, Freddie Mac reported on Thursday, providing a possible boost to buyer traffic in the housing market.

The average fixed-rate 30-year mortgage fell to 6.60% as of Thursday from 6.66% the week prior, Freddie Mac said in its weekly report on home loan borrowing costs.

“This is an encouraging development for the housing market and in particular first-time homebuyers who are sensitive to changes in housing affordability,” Sam Khater, Freddie Mac’s chief economist, said. “However, as purchase demand continues to thaw, it will put more pressure on already depleted inventory for sale.”

Mortgage rates began easing from two-decade highs during the fourth quarter after the Federal Reserve left its policy benchmark unchanged for three consecutive meetings. The Fed’s pivot away from rate hikes stoked a rally in the bond market, driving yields on mortgage-backed securities down.

High interest rates discouraged homeowners from selling last year, shortening inventory and pricing out prospective buyers. Buyers may be leaving the sidelines as rates ease, with mortgage applications increasing 10% for the week ended Jan. 12, the Mortgage Bankers Association said.

(Reporting by Amina Niasse; editing by Barbara Lewis)