The U.S. economy reaccelerating or mildly contracting is more likely than a “soft landing.”

Source link

Fed

Why China, Japan and the Fed are shaking up the $26 trillion U.S. Treasury market

When investors think of the financial markets, the first thing that likely comes to mind is the stock market.

But there is a bigger, less-flashy counterpart to the equity market: the bond market. At the heart of the fixed income space lies U.S. Treasurys, one of the safest investments in the world.

“We have not paid attention to the Treasury market because it was a market for foreigners or for the Fed,” said Priya Misra, fixed income portfolio manager at J.P. Morgan Asset Management. “Now it’s a market for all of us, and it’s giving you better yield. So it’s something which we should not ignore.”

Buyers of U.S. Treasurys have been changing, with major players including China, Japan and the Federal Reserve seeing their respective holdings decline in recent years. The shift could have broad implications for the U.S. economy.

“What we’re observing is that [the new buyers] are a lot more price sensitive,” said Anders Persson, global fixed income chief investment officer at Nuveen. “They’re just not quite as sticky.”

Watch the video above to find out more about why major buyers are fleeing the U.S. Treasury market, the impact on yields and the economy at large, and how investors can best navigate the market going forward.

A hard-landing recession is guaranteed as the full impact of Fed rate hikes have yet to hit the economy, Morgan Stanley’s chief economist says

-

A hard landing is guaranteed for the US, Morgan Stanley’s chief US economist has said.

-

She said the full impacts of the Federal Reserve’s tightening hadn’t been fully felt in the economy.

-

It could take 18 months after the last rate hike to feel the full weight of higher rates.

A hard-landing recession is certain to come for the economy, and high rates are to blame even as markets start positioning for the Federal Reserve to loosen monetary policy this year, says Ellen Zentner, Morgan Stanley’s chief US economist.

Speaking to CNBC on Monday, Zentner responded to Jamie Dimon’s recent comments on the economy, in which the JPMorgan boss warned that the chance of a soft landing was about half of the 70% to 80% odds other forecasters were predicting. He said that was because of several risks still facing the US, including the Fed’s tightening campaign, geopolitical conflict, and interest rates, which central bankers have said could remain higher for longer.

Zentner said she was expecting the US to avoid a recession this year as there was no data to support a soon-to-come downturn. But she warned that a hard landing was unavoidable.

“We will have a hard landing at some point. I guarantee you that. We’re all wondering: When does that come?” she said. “The point that Dimon makes is that there are these cumulative impacts that build over time, and we are in the camp that we haven’t yet seen all of the tightening impacts from monetary policy,” she added, referring to the impact of Fed rate hikes.

Fed officials raised interest rates a whopping 525 basis points in 18 months to tame inflation, a move that’s taken borrowing costs in the economy to their highest level since 2001.

Economists have warned that high interest rates could spark a recession as financial conditions become restrictive and that the full impact of rate hikes probably hasn’t been felt, as they typically take about 18 months to fully work their way through the economy.

Signs of stress are beginning to show in parts of the financial system. Corporate defaults soared last year to their highest level since the pandemic, according to Moody’s Analytics. Bank lending has fallen for three straight quarters, according to Fed data.

Still, signs point to the Fed keeping interest rates elevated as it keeps an eye on inflation. Consumer prices came in hotter than expected last month, with inflation rising 3.1% year-over-year in January.

Zentner predicted that inflation would probably reaccelerate over the first quarter, pointing to the 3.9% growth in core inflation last month. That reacceleration could show up in the next consumer-price-index report, which markets are expecting later this week.

“We do expect inflation reacceleration to be temporary, but that is an open question,” Zentner said, adding that markets might have to consider Fed rate cuts pushed beyond mid-year.

Investors had been pricing in ambitious rate cuts to come in 2024, but many forecasters have dialed back their expectations amid hot inflation data. Markets are now pricing in a 39% chance that the Fed could lower rates by 100 basis points or more by the end of the year, according to the CME FedWatch tool.

Read the original article on Business Insider

Fed is ‘not out of woods’ on inflation, new regional bank president says

The battle against rising prices is not over, one of the newest top Federal Reserve officials said Monday.

“When it comes to too-high inflation, I believe we are not out of the woods yet,” Kansas City Fed President Jeff Schmid said in his first public speech since joining the central bank six months ago.

Progress on inflation has been encouraging but has “largely” been driven by reductions in energy and goods prices, he said.

That might not last.

Residents of the Kansas City Fed district know that energy prices “are anything but stable,” Schmid said. And turmoil in the Middle East could put pressure on supply chains and affect the prices of goods.

That means further progress on inflation might have to come from lower prices for services, Schmid said. But the January CPI data showed that prices of services “continue to rise briskly amid still-tight labor markets and elevated wage growth,” he noted.

Schmid started his career as a Fed bank examiner in 1981 and went on to serve as CEO of several banks. He will be a voting member of the Fed’s interest-rate committee in 2025.

His caution about inflation fit with recent remarks from other top Fed officials.

“Recent Fedspeak has sent a clear signal that, although the policy rate has likely peaked and rate cuts are expected to commence this year, officials are not in a rush to lower rates,” said Matthew Luzzetti, chief U.S. economist at Deutsche Bank.

Luzzetti floated the idea that the Fed would cut in a “two-stage process,” with a few quarter-point cuts followed by a potentially lengthy pause.

Many economists think the Fed will delay their first cut until June. At the start of the year, the betting in financial markets had been that the first cut would come in March.

Stocks

DJIA

SPX

closed lower Monday and the yield of the 10-year Treasury note

BX:TMUBMUSD10Y

inched down to 4.281%.

Do stock-market investors care more about Nvidia than the Fed? A big test awaits.

It might seem at times that investors care more about Jensen Huang than Federal Reserve Chair Jerome Powell.

Huang is the longtime CEO of chip maker Nvidia Corp.

NVDA,

which stole the show last week by blowing away already lofty earnings expectations and leading stocks to new rounds of all-time highs, even as nagging worries over resurgent inflation continued to percolate in the background. Huang declared that the artificial intelligence industry, of which Nvidia is a prime supplier of crucial chips, has reached a “tipping point” that will see the technology go “mainstream.”

Deep Dive: After Nvidia’s latest blowout, here are 20 AI stocks expected to rise as much as 44%

That may lead investors to wonder whether they’re wasting their energy fretting over the economic cycle and the timing of Federal Reserve interest rate cuts. Should they instead embrace a rally led by technology stocks that is started to broaden out to other sectors, enhanced by the potential for advances in artificial intelligence to bring about a generational productivity boost that will lift corporate profits and cap inflation pressures?

That’s a pretty picture, but one that is unlikely to come together so seamlessly.

“I think investors will obsess over inflation metrics again,” Michael Arone, chief investment strategist at State Street Global Advisers, told MarketWatch in a phone interview.

It so happens that the Federal Reserve’s favored inflation metric, the core reading of the personal-consumption expenditures index is due Thursday morning. The January data comes after markets were previously rattled by hotter-than-expected consumer-price index and producer-price index readings.

Investors know — and the Fed has emphasized — that one month’s data doesn’t make a trend, Arone said, but it will be important for inflation to resume a trend back down toward the central bank’s 2% target. If that begins to look in serious jeopardy, market volatility will eventually be in store.

Read: Wall Street is bracing for more strong U.S. economic and inflation data next week

Investors came into 2024 pricing in six to seven quarter percentage point rate cuts over the course of the year, beginning in March. As the data came in and the Fed pushed back on those expectations, markets now see a somewhat better-than-50% chance cuts will begin in June and that the Fed will deliver only three or four by year-end, according to the CME FedWatch tool.

Should inflation prove sticky or start to climb, investors could eventually be forced to countenance no rate cuts in 2024 or even the outside prospect that the Fed will need to hike yet again. That would be a major shock, Arone said, likely sending stocks into a correction and significantly pushing up Treasury yields.

Barring that, Arone, is upbeat, and sees prospects for the rally to continue broadening out after the past week also saw strength in sectors outside tech and consumer services. A continued rally would give investors the opportunity to build exposure to small-caps and value stocks.

Stocks extended their climb last week, with the S&P 500

SPX

and the Dow Jones Industrial Average

DJIA

reaching new highs. The tech-heavy Nasdaq Composite

COMP

briefly flirted with its first record close in more than two years on Thursday and again Friday before pulling back, but still ended the week up 1.4%.

Of course, the megacap-led tech rally isn’t a new phenomenon. Nvidia and its cohort of heavyweight AI beneficiaries led a 2023 stock-market rally that grew increasingly — and worryingly — concentrated.

The “most important event in world stock markets last year was nothing macro but the Microsoft

MSFT,

investment in ChatGPT-maker OpenAI,” argued Christopher Wood, global head of equity strategy at Jefferies, in a note last week.

“This was the catalyst for the AI thematic to start driving market psychology and, crucially, gave the most important sector in the world’s largest stock market a new story which is secular not cyclical,” he wrote.

The rally has also prompted comparisons to the dot-com bubble of the late 1990s.

Barron’s: Echo of 1995 or 1999?

A look at how big one-day gains have contributed to the stock market’s year-to-date rally illustrates the role that tech sector strength plays.

The S&P 500 was up 6.7% for the year to date through Thursday, with just five trading days accounting for that gain, noted Nick Colas, co-founder of DataTrek Research, in a note.

That includes Thursday’s 2.1% rise, driven by Nvidia’s earnings, and four days with gains of 1% to 1.4%, including a Jan. 8 rise following an announcement of new chips by Nvidia; a Jan. 19 gain led by chip stocks following earnings guidance from Taiwan Semiconductor

TSM,

; a Feb. 1 bounce following a selloff inspired by remarks from Powell; and a Feb. 2 rally driven by Meta Platform Inc.’s

META,

20% surge.

The lesson is that the market is shrugging off the prospect of interest rates remaining higher for longer to focus on Big Tech’s earnings leverage, Colas wrote. “This is classic ‘midcycle’ market behavior. Investors can live with higher interest rates if (but only if) there is a promising development in an important sector.”

Meanwhile, the degree of that promise remains up for debate.

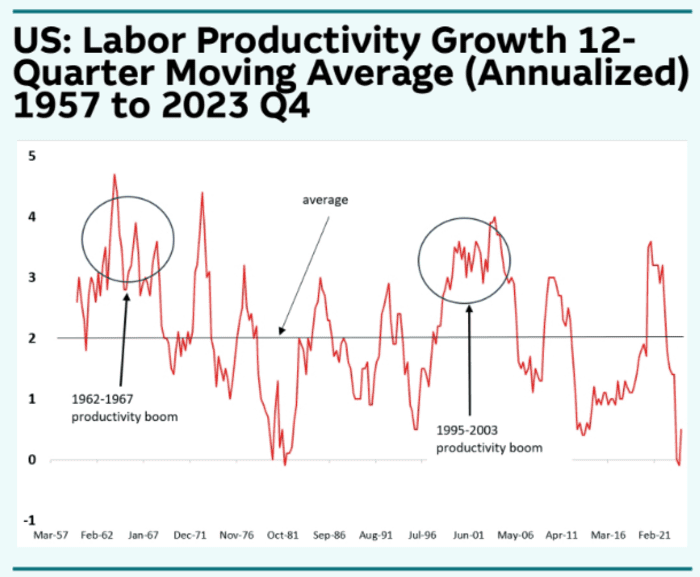

“Of course, many ‘new paradigms’ about U.S. productivity growth have been proffered by market pundits in the past 125 years. Not all of them have panned out, and there were really only two episodes (the mid-1960s and the mid-1990s) in which productivity growth in the U.S. stayed high sustainably,” said Thierry Wizman, global FX and rates strategist at Macquarie, in a note (see chart below).

Macquarie

“But what matters is not so much whether this new AI-driven paradigm

pans out; it matters whether people believe it will pan out, if it is to

change macro dynamics,” he said.

Such a change could carry a sting.

The danger is that a new growth paradigm leads the Fed to conclude that the so-called neutral rate — the level at which the official interest rate neither enhances nor sustains growth — is higher than it currently thinks, opening the door to further hikes.

Meanwhile, investors are focused on whether AI will continue to drive strong results for leading technology providers and if it will allow companies that eventually use those products to become increasingly productive and more profitable, said Jose Torres, senior economist at Interactive Brokers, in a note.

With many companies outside the tech sector offering cautious guidance, it doesn’t look like the practical aspects of AI are yet supporting aggregate profits, he said.

“Only time will tell if Nvidia CEO Jensen’s optimism is warranted,” Torres wrote, “and while bulls have been energized by his comments and Nvidia’s quarterly results, bears are praying that AI may be more fluff than substance.”

Markets are now betting the Fed is going to make a mistake with rate cuts, BofA says

-

Markets are now betting the Fed is going to make a mistake with rate cuts, BofA says

-

While prospects of a March rate cut have dimmed, investors still expect aggressive rate cuts this year.

-

“Markets are still pricing about six cuts over the course of this year. This suggests to us that they are pricing in a policy error.”

Jerome Powell probably wanted to reduce some investor bullishness with his comments about a March rate cut at the Fed’s January meeting. Instead, markets are now betting the Fed is going to make a mistake, according to Bank of America.

“Markets are pricing a policy mistake,” analysts wrote in a note Friday.

The Fed signaled this week that a March rate cut is unlikely, with Powell insisting there needs to be a continuation of “good data” to bring an end to the pause in interest rate hikes. But that didn’t dim investor optimism about cuts for the rest of the year.

“Powell’s strong statement about March lowered pricing of a March cut, but markets are still pricing about six cuts over the course of this year,” Bank of America analysts wrote. “This suggests to us that they are pricing in a policy error.”

Previously, central bank officials have said they foresee about three rate cuts in 2024. And yet, markets have continued expecting more, with some predicting as many as six cuts. Investors were also more optimistic about the timing of the cuts, hoping that the first cut would arrive early. The CME FedWatch Tool showed traders were wagering a 70% chance the Fed would pivot in March early last month.

The data now says traders place the odds that the Fed will hold rates steady in March at over 80%. But they still expect aggressive cutting in 2024 for a total of around 100 basis points.

“Going into the January meeting, we thought it was more important for the Fed to push back against market pricing of the speed of rate cuts rather than the timing of the first cut,” the analysts wrote. “Yet the Fed achieved the exact opposite.”

Wall Street bulls like Tom Lee were also more certain about rate cuts after Powell’s hawkish remarks this week. Others think the real mistake is a Fed that cuts too early.

“If the Fed wants to cut rates at a quarterly pace, it has a lot of work to do in terms of moving market pricing, and it runs the risk of inducing meaningful financial tightening,” the analysts wrote.

Read the original article on Business Insider

Federal Reserve Chair Jerome Powell holds a press conference following the release of the Fed’s interest rate policy decision at the Federal Reserve in Washington, U.S., January 31, 2024.

Evelyn Hockstein | Reuters

Fed Chairman Jerome Powell said Wednesday that the central bank would likely not be comfortable enough with the path of inflation by its next meeting in March to cut interest rates.

“Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that. But that’s to be seen,” Powell said.

The statement came in a news conference after the Fed’s January meeting, where the central bank left its benchmark interest rate unchanged. Powell did say earlier in the news conference that rate cuts would likely begin at some point this year.

Stocks fell to their session lows as the Fed chief dashed hopes of traders who want the central bank to slash rates sooner, before there’s a recession. The Dow Jones Industrial Average lost 300 points at one point.

The Fed’s policy statement released earlier Wednesday included several tweaks that suggested the central bank was taking further rate hikes off the table but not yet ready to cut. Powell’s comments appeared to clarify for traders that the stance would continue for at least one more meeting.

“The Fed was badly burned in late 2021 and 2022 when they thought high inflation would be transitory, then got caught by surprise when it was higher and more persistent than expected. They want to avoid making the same mistake twice,” Comerica Bank’s chief economist, Bill Adams, said in a note Wednesday afternoon.

“The Fed will wait to pull the trigger on rate cuts until they see the whites of 2% inflation’s eyes,” Adams added.

Powell also declined to commit to a series of rate cuts once the Fed makes its first move, saying that it “would depend on the data.”

The central bank’s next two policy decision dates are scheduled for March 20 and May 1. In recent months, traders and Wall Street strategists have focused on those two meetings as likely candidates for the first rate cut, as inflation continues to fall and job growth slows.

The Fed’s preferred inflation gauge, the personal consumption expenditures price index, is updated near the end of each month. There will likely be only one more PCE reading before the Fed’s March meeting, but three more before May.

There will also be three more federal jobs reports released before the May meeting, with the January report due out on Friday.

Don’t miss these stories from CNBC PRO:

U.S. Federal Reserve Chair Jerome Powell attends a press conference in Washington, D.C., on Dec. 13, 2023.

Liu Jie | Xinhua News Agency | Getty Images

Immediately after the Federal Reserve wraps up its meeting this week, all eyes are likely to gravitate to one small piece of wording that could unlock the future of monetary policy.

In its post-meeting statement, the central bank is expected give an important hint about interest rate moves to come by removing a clause from previous statements that reads: “In determining the extent of any additional policy firming that may be appropriate to return inflation to 2 percent over time,” followed by an outlining of conditions it assesses.

For the past year-plus, the wording has underlined the Fed’s willingness to keep raising interest rates until it reaches its inflation goal. Remove that clause and it opens the door to potential rate cuts ahead; keep it and policymakers will be sending a signal that they’re not sure what’s to come.

The difference will mean a lot to financial markets.

Amending the wording could amount to a “meaningful overhaul” of the Federal Open Market Committee’s post-meeting statement, and its direction, according to Deutsche Bank economists.

“We heard at the December meeting that no official expected to raise rates further as a baseline outcome. And we’ve heard that Fed officials are beginning the discussions around rate cuts,” Matthew Luzzetti, Deutsche Bank’s chief U.S. economist, said in an interview. “So getting rid of that explicit tightening bias is kind of a precondition to more actively thinking about when they might cut rates, and to leaving the door open for a March rate cut.”

While the market has accepted for months that the Fed is likely done raising rates, the most burning question is when it will start cutting. The Fed last hiked in July 2023. Since then, inflation numbers have drifted lower and are, by one measure, less than a percentage point away from the central bank’s 2% 12-month target.

Just a few weeks ago, futures markets were convinced the Fed would start in March, assigning a nearly 90% probability to such a move, according to the CME Group’s FedWatch gauge. Now, there’s considerably more uncertainty as multiple statements from Fed officials point to a more cautious approach about declaring victory over inflation.

Reading the tea leaves

Chairman Jerome Powell will have a thin line to walk during his post-meeting news conference.

“They’re going to get a lot of data between the January and March meetings, particularly as it relates to inflation,” Luzzetti said. “How those data come in will be critical to determining the outcomes of future meetings. He’ll leave it open, but will not try to open it any more than what the market already has.”

For this meeting, it will be harder to decipher where the full FOMC is heading as it will not include the quarterly “dot plot” of individual members’ projections.

However, most of the public statements that officials have delivered in recent days point away from a hurry to cut. At the same time, policymakers have expressed concern about over-tightening.

The fed funds rate, currently targeted in a range between 5.25% and 5.5%, is restrictive by historical standards and looks even more so as inflation drops and the “real” rate rises. The inflation rate judged by core personal consumption expenditures prices, a U.S. Department of Commerce measure that the Fed favors, indicates the real funds rate to be around 2.4%. Fed officials figure the long-run real rate to be closer to 0.5%.

“The main thing that they will probably want to do is gain a lot of optionality,” said Bill English, the former head of monetary affairs at the Fed and now a finance professor at the Yale School of Management. “That would mean saying something rather vague at this point [such as] we’re determining the stance of policy that may be appropriate or something like that.”

Preparing for the future

Post-meeting statements going back to at least late 2022 have used the “in determining the extent of any additional policy firming” phrasing or similar verbiage to indicate the FOMC’s resolve in tightening monetary policy to bring down inflation.

With six- and three-month measures showing inflation actually running at or below the 2% target, such hawkishness could seem unnecessary now.

“In effect, that’s saying that they’re more likely to be raising than cutting,” English said of the clause. “I guess they don’t think that’s really true. So I would think they’d want to be ready to cut rates in March if it seems appropriate when they get there.”

Officials will be weighing the balance of inflation that is declining against economic growth that has held stronger than anticipated. Gross domestic product grew at an annualized pace of 3.3% in the fourth quarter, lower than the previous period but well ahead of where Fed officials figured it would be at this stage.

Traders in the fed funds futures market are pricing in about a 60% chance of a cut happening in March, the first of five or six moves by the end of 2024, assuming quarter-percentage-point increments, according to the CME Group’s FedWatch gauge. FOMC members in their latest projections in December pointed to just three reductions this year.

The Fed hasn’t cut as aggressively as traders expected absent a recession since the 1980s and that “led to excess investor confidence culminating in the 1987 stock market crash,” Nicholas Colas, co-founder of DataTrek Research, said in his daily market note Monday evening.

Yet, Goldman Sachs economists said they figure the Fed will “remove the now outdated hiking bias” from the post-meeting statement and set the stage for a cut in March and five total on the year. In a client note, the firm said it also figures the committee could borrow a line from the December meeting minutes indicating it would “be appropriate for policy to remain at a restrictive stance until inflation is clearly moving down sustainably toward the Committee’s objective.”

However, a restrictive stance isn’t the same as holding rates where they are now, and that kind of linguistic move would give the committee wiggle room to cut.

Markets also will be looking for information on when the Fed begins to reverse its balance sheet runoff, a process that has seen the central bank reduce its bond holdings by about $1.2 trillion since mid-2022.

Don’t miss these stories from CNBC PRO:

Two important events this week could determine the future of Fed rate policy

Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., January 19, 2024.

Brendan Mcdermid | Reuters

Markets have become less convinced that the Federal Reserve is ready to press the button on interest rate cuts, an issue that cuts at the heart of where the economy and stocks are headed.

Two big economic reports coming up this week could go a long way toward determining at least which way the central bank policymakers could lean — and how markets might react to a turn in monetary policy.

Investors will get their first look at the broad picture of fourth-quarter economic growth for 2023 when the Commerce Department releases its initial gross domestic product estimate on Thursday. Economists surveyed by Dow Jones are expecting the total of all goods and services produced in the U.S. economy to have grown at a 1.7% pace for the final three months of 2023, which would be the slowest since the 0.6% decline in Q2 of 2022.

A day later, the Commerce Department will release the December reading on the personal consumption expenditures price index, a favorite Fed inflation gauge. The consensus expectation for core PCE prices, which exclude the volatile food and energy components, is 0.2% growth for the month and 3% for the full year.

Both data points should garner a lot of attention, particularly the inflation numbers, which have been trending toward the Fed’s 2% goal but aren’t there yet.

“That’s the thing that everybody should be watching to determine what the Fed’s rate path will end up being,” Chicago Fed President Austan Goolsbee said during an interview Friday on CNBC. “It’s not about secret meetings or decisions. It’s fundamentally about the data and what will enable us to become less restrictive if we have clear evidence that we’re on the path to get” inflation back to target.

Lowered rate cut outlook

The releases come amid a market snapback about where the Fed is heading.

As of Friday afternoon, trading in the fed funds futures market equated to virtually no chance the rate-setting Federal Open Market Committee will cut at its Jan. 30-31 meeting, according to CME Group data as indicated through its FedWatch Tool. That’s nothing new, but the odds for a reduction at the March meeting fell to 47.2%, a steep slide from 81% just a week ago.

Along with that, traders have taken one expected cut off the table, reducing the outlook for easing to five quarter percentage point decreases from six previously.

The change in sentiment followed data showing stronger-than-expected 0.6% growth in consumer spending for December and initial jobless claims falling to their lowest weekly level since September 2022. On top of that, several of Goolsbee’s colleagues, including Governor Christopher Waller, New York Fed President John Williams and Atlanta Fed President Raphael Bostic, issued commentary indicating that at the very least they are in no hurry to cut even if the hikes are probably done. Goolsbee is not a voter on the FOMC this year.

“I don’t like tying my hands, and we still have weeks of data,” Goolsbee said. “Let’s take the long view. If we continue to make surprising progress faster than was forecast on inflation, then we have to take that into account in determining the level of restrictiveness.”

Goolsbee noted that one particular area of focus for him will be housing inflation.

The December consumer price index report indicated that shelter inflation, which accounts for about one-third of the weighting in the CPI, rose 6.2% from a year ago, well ahead of a pace consistent with 2% inflation.

However, other measures tell a different story.

A new Labor Department reading known as the New Tenant Rent Index, indicates a lower path ahead for housing inflation. The index, which measures prices for new leases that tenants sign, showed a 4.6% decline in the fourth quarter of 2023 from a year ago and more than double that quarterly.

Watching the data, and other factors

“In the very near term, we think the inflation data will cooperate with the Fed’s dovish plans,” Citigroup economist Andrew Hollenhorst said in a client note.

However, Citi foresees inflation as stubborn and likely to delay the first cut until at least June.

While it’s unclear how much difference the timing makes, or how important it is if the Fed only cuts four or five times compared with the more ambitious market expectations, market outcomes have seem linked to the expectations for monetary policy.

There are plenty of factors that change the outlook in both directions — a continued rally in the stock market might worry the Fed about more inflation in the pipeline, as could an acceleration in geopolitical tensions and stronger-than-expected economic growth.

“By keeping the potential alive for inflation to turn up, these economic and geopolitical developments could put upward pressure on both short-term rates and long-term yields,” Komal Sri-Kumar, president of Sri-Kumar Global Strategies, said Saturday in his weekly market note.

“Could the Federal Reserve be forced to raise the Federal Funds rate as its next move rather than cut it?” he added. “An intriguing thought. Don’t be surprised if there is more discussion along these lines in coming months.”

Don’t miss these stories from CNBC PRO:

Consumers are casting a wary eye at their debt, New York Fed survey shows

U.S. consumers may be growing a bit more uneasy about their debts.

That’s according to a report released Tuesday by the Federal Reserve Bank of New York, which looked at Americans’ recent spending habits and how much they plan to spend in the near future.

The survey asks individuals how they would allocate an unexpected 10% increase in their income.

An average 38% of households said they would use that surprise pay bump to pay down debt, rather than spending or saving the funds.

That’s a jump of nearly a 5 percentage points from last year and the highest share of respondents who said they would set the money aside for debt payments since 2016.

Only 16% said they would spend or donate that money — the lowest percentage since the Fed started tracking the data nine years ago.

U.S. consumers have been racking up big debt balances over the past year, with consumer credit-card debt levels hitting record highs in recent months. Widespread use of buy-now-pay-later services during the holidays added to worries that so-called phantom debt may be weighing on Americans’ wallets without being documented on their credit reports.

Total consumer credit, a measure of how much money people have borrowed, topped $5 trillion for the first time in November, a trend that Sheila Bair, former chair of the Federal Deposit Insurance Corp., called “not good.”

What else the data showed

The New York Fed report showed that household spending continued to moderate at the end of 2023.

“The survey shows a continuation of the recent declining trend in monthly household spending growth,” the report said, “even though spending growth remains well above pre-pandemic levels.”

Expectations of growth in household spending for the year ahead reached the lowest level since December 2020, the report showed.

Survey respondents said they were less likely to make a large purchase such as a home appliance, furniture or home repairs over the next four months. However, consumers indicated they were more likely to purchase a home in the next four months than they were in August.