The Government of Paraguay will strengthen the measures directed to combat the illegal cryptocurrency mining operations in the country. In a recent meeting, ANDE, the National Power Administration, the Supreme Court, and the Department of Justice, agreed to deal with these crimes swiftly given the damages they cause to the Paraguayan power grid. Paraguay Prepares […]

The Government of Paraguay will strengthen the measures directed to combat the illegal cryptocurrency mining operations in the country. In a recent meeting, ANDE, the National Power Administration, the Supreme Court, and the Department of Justice, agreed to deal with these crimes swiftly given the damages they cause to the Paraguayan power grid. Paraguay Prepares […]

Source link

fight

Fed’s inflation fight will affect housing supply for decades, says Redfin CEO

The housing market is showing signs of a recovery as the spring home-buying season gets underway.

Mortgage rates fell for the second week in a row, declining to the lowest level in more than a month. The average rate on the benchmark 30-year fixed mortgage fell to 6.74% from 6.88% the week prior, per Freddie Mac.

And as mortgage rates decline, supply is starting to rebound. New listings hit a 17-month high in February, while the total number of homes for sale rose to the highest level in a year, according to Redfin (RDFN).

Read more: Mortgage rates hover around 7% — is this a good time to buy a house?

It’s an improvement from last year’s depressed levels, but supply-demand remains far from balanced. The culprit: Side effects of the Fed’s aggressive rate-hiking campaign.

Top economist Gary Shilling told Yahoo Finance that the Fed’s change in interest rate policy created a “perfect storm” for the industry, with higher rates prompting would-be sellers to stay put, as many have locked in ultra-low rates during the pandemic or in the years prior.

The giant gap between current and past mortgage rates is creating “artificial tightness” in the housing market. “It won’t continue indefinitely, but it certainly is disruptive right now,” Shilling said.

Redfin CEO Glenn Kelman expects the Fed’s recent moves to affect the housing sector for decades, warning it will take years to work through the aftershocks of the central bank’s aggressive rate-hiking campaign.

“There’s going to be low supply for a long time to come,” Kelman told Yahoo Finance. “What the Fed did … will have a 30-year tail on it.”

Lackluster supply has kept home prices elevated. The median price of previously owned homes rose 5.1% in January from a year ago, with all four US regions showing price growth, according to the National Association of Realtors.

Any hope of relief for the housing sector may be postponed. A series of hotter-than-expected inflation prints has bolstered the case for policymakers to delay rate cuts, according to Oppenheimer’s John Stoltzfus. He told Yahoo Finance Live that he thinks the Fed won’t cut rates until at least its June meeting.

A delayed rate cut suggests, at least in the near term, that mortgage rates are unlikely to fall much further, potentially postponing a more substantial rebound in the housing market.

“We need more supply. The real gate on home sales has been the number of homes for sale,” Kelman explained. “If interest rates don’t come down significantly, we’ll see a modest uptick in inventory, but to see a big gain, you’re going to have to see a real drop in mortgage interest rates.”

Moody’s Analytics expects a total housing deficit of 1.5 million to 2 million units this year, with a shortfall of up to 1.2 million for single-family homes.

Seana Smith is an anchor at Yahoo Finance. Follow Smith on Twitter @SeanaNSmith. Tips on deals, mergers, activist situations, or anything else? Email seanasmith@yahooinc.com.

Click here for real estate and housing market news, reports, and analysis to inform your investing decisions.

Social media giant Meta, formerly known as Facebook, will include an invisible watermark in all images it creates using artificial intelligence (AI) as it steps up measures to prevent misuse of the technology.

In a Dec. 6 report detailing updates for Meta AI — Meta’s virtual assistant — the company revealed it will soon add invisible watermarking to all AI-generated images created with the “imagine with Meta AI experience.” Like numerous other AI chatbots, Meta AI generates images and content based on user prompts. However, Meta aims to prevent bad actors from viewing the service as another tool for duping the public.

Like numerous other AI image generators, Meta AI generates images and content based on user prompts. The latest watermark feature would make it more difficult for a creator to remove the watermark.

“In the coming weeks, we’ll add invisible watermarking to the image with Meta AI experience for increased transparency and traceability.”

Meta says it will use a deep-learning model to apply watermarks to images generated with its AI tool, which would be invisible to the human eye. However, the invisible watermarks can be detected with a corresponding model.

Unlike traditional watermarks, Meta claims its AI watermarks — dubbed Imagine with Meta AI — are “resilient to common image manipulations like cropping, color change (brightness, contrast, etc.), screenshots and more.” While the watermarking services will be initially rolled out for images created via Meta AI, the company plans to bring the feature to other Meta services that utilize AI-generated images.

In its latest update, Meta AI also introduced the “reimagine” feature for Facebook Messenger and Instagram. The update allows users to send and receive AI-generated images to each other. As a result, both messaging services will also receive the invisible watermark feature.

Related: Tom Hanks, MrBeast and other celebrities warn over AI deep fake scams

AI services such as Dall-E and Midjourney already allow adding traditional watermarks to the content it churns out. However, such watermarks can be removed by simply cropping out the edge of the image. Moreover, specific AI tools can remove watermarks from images automatically, which Meta AI claims will be impossible to do with its output.

Ever since the mainstreaming of generative AI tools, numerous entrepreneurs and celebrities have called out AI-powered scam campaigns. Scammers use readily available tools to create fake videos, audio and images of popular figures and spread them across the internet.

In May, an AI-generated image showing an explosion near the Pentagon — the headquarters of the United States Department of Defense — caused the stock market to dip briefly.

Prime example of the dangers in the pay-to-verify system: This account, which tweeted a (very likely AI-generated) photo of a (fake) story about an explosion at the Pentagon, looks at first glance like a legit Bloomberg news feed. pic.twitter.com/SThErCln0p

— Andy Campbell (@AndyBCampbell) May 22, 2023

The fake image, as shown above, was later picked up and circulated by other news media outlets, resulting in a snowball effect. However, local authorities, including the Pentagon Force Protection Agency, in charge of the building’s security, said they were aware of the circulating report and confirmed that “no explosion or incident” occurred.

@PFPAOfficial and the ACFD are aware of a social media report circulating online about an explosion near the Pentagon. There is NO explosion or incident taking place at or near the Pentagon reservation, and there is no immediate danger or hazards to the public. pic.twitter.com/uznY0s7deL

— Arlington Fire & EMS (@ArlingtonVaFD) May 22, 2023

In the same month, human rights advocacy group Amnesty International fell for an AI-generated image depicting police brutality and used it to run campaigns against the authorities.

“We have removed the images from social media posts, as we don’t want the criticism for the use of AI-generated images to distract from the core message in support of the victims and their calls for justice in Colombia,” stated Erika Guevara Rosas, director for Americas at Amnesty.

Magazine: Lawmakers’ fear and doubt drives proposed crypto regulations in US

Here’s Walt Disney’s Biggest Problem to Solve in 2024 (and It’s Not the Nelson Peltz Proxy Fight)

There’s no denying that the verbal sparring between activist investor Nelson Peltz and Walt Disney (DIS -1.33%) CEO Bob Iger has been fun to watch. The proxy fight will probably lead to structural changes — even more than it already has — even if we can’t yet predict what those changes might be.

Whichever of these two men ends up winning this well-publicized argument, however, the 2024 priority should be the same. That’s Disney’s TV business, consisting of ABC, The Disney Channel, National Geographic, ESPN, A&E, and a handful of other channels. This division remains the company’s single biggest source of revenue and operating income. If Walt Disney is going to thrive, it needs to do so on this front more than any other.

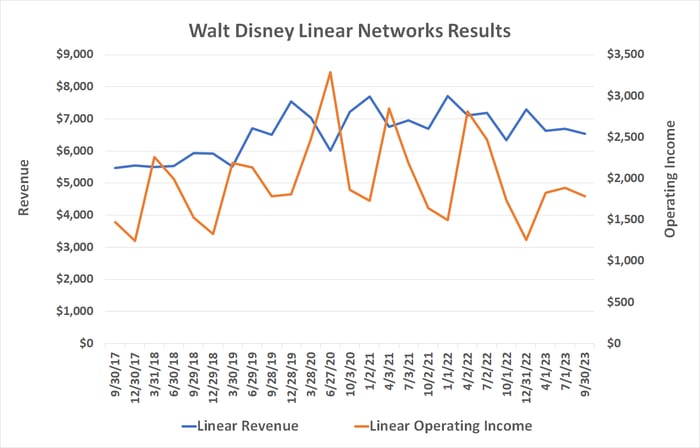

And there’s the rub. Disney’s television revenue has been stagnant since 2019, while its operating profits have been deteriorating since 2021. Something’s got to change, and soon.

Not even ESPN is helping Disney’s TV business

Yes, Walt Disney’s theme park and resort business is massive. And technically speaking, depending on the year in question, the company’s combined domestic and international parks and experiences arm can be Disney’s top breadwinner, as measured by revenue and/or operating income.

In a normal environment, unlike the one we’ve been in for nearly a couple of years now, Disney’s cable television business is its champion. It accounted for more than half of last fiscal year’s operating income of $12.9 billion. That’s still roughly in line with the theme parks and experiences’ contribution to the bottom line.

But there’s a legitimate concern to consider here. Its domestic parks and experiences business, which is much bigger than its international theme parks business, is finally running into a revenue and profit headwind. At the same time, Disney’s cable TV revenue and operating income are also hitting a wall. They’ve been hitting a wall, in fact, since 2020.

Date source: Walt Disney. Chart by author. Figures are in millions of dollars.

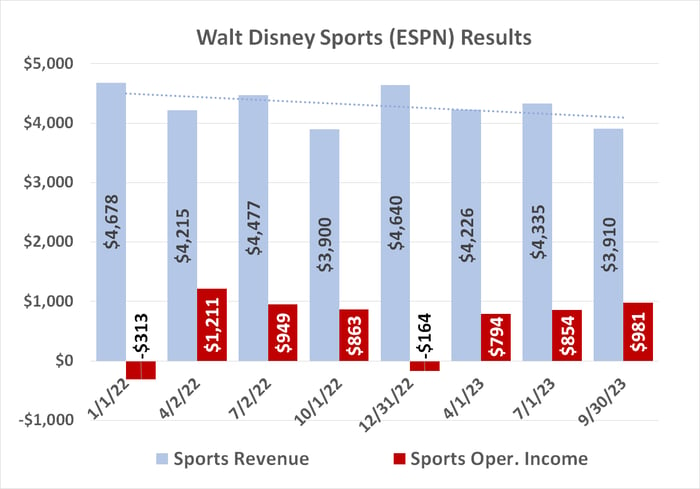

These numbers include results from Disney’s lauded sports channel, ESPN, which hasn’t had the best of years despite the post-pandemic recovery of the sports industry. ESPN’s operating income only grew slightly last quarter. Before that, it was falling. Ditto for revenue.

Data source: Walt Disney. Chart by author. All figures are in millions.

While this sports-centric brand remains the premier name in cable TV’s sports programming, its tepid growth is still a companywide problem, as it alone makes up about half of Disney’s TV business. If it’s not thriving, Walt Disney’s entire TV arm isn’t thriving either.

Industrywide headwinds are blowing

Much of this weakness is attributable to plain old cord-cutting. Data from Leichtman Research Group indicates the nation’s major cable television companies shed another 465,000 net paying customers last quarter alone. That brings the three-quarter/year-to-date tally of domestic cable cancellations up to more than 4 million, extending a downtrend that first got going in 2015. The nationwide count has fallen from a little over 100 million cable-customer households then to just a little over 70 million now.

That said, it would be naive to ignore the toll that alternative advertising venues are also increasingly taking on cable’s pricing power as an advertising medium. Market research outfit Omdia believes free-to-watch, ad-supported streaming platforms will collect $6.3 billion worth of worldwide ad revenue this year alone, with 80% of that figure being driven just within the United States. Ad-supported and subsidized streaming platforms, meanwhile, should handle $39 billion worth of advertising business, according to estimates from Digital TV Research. Roughly one-third of that business will also be done in the same U.S. market that Walt Disney’s cable arm serves.

Those figures are getting too big for any cable TV player to ignore. That’s particularly true given that television ad rates fell again for the current fall season of television shows.

But the writers’ strike? It may not have been as much of a problem as first suggested. TV ad spending has actually been in a shallow decline in the United Stets for several years now. Indeed, WARC Data reports 2019’s pre-pandemic television ad-spending of $61 billion was the least spent on TV advertising in the United States since 2011. These figures were also expected to continue sliding at least for the next several years even before the strike materialized.

Connect the dots. This business hasn’t been wildly marketable in a long, long time.

Disney stock is tough to own until cable TV is fixed

Bob Iger is seemingly well aware of the company’s cable television woes. In July, he commented that the company’s cable TV arm “may not be core” to its overall business, adding that he and other executives would soon be taking an “expansive” look at Walt Disney’s television arm. He’s since reined in sweeping assumptions that the comment meant a sale of a least some of its TV assets was on the table. Just last month, he plainly stated these assets are “not for sale.”

Still, all of it acknowledges he knows something must change for this important profit center.

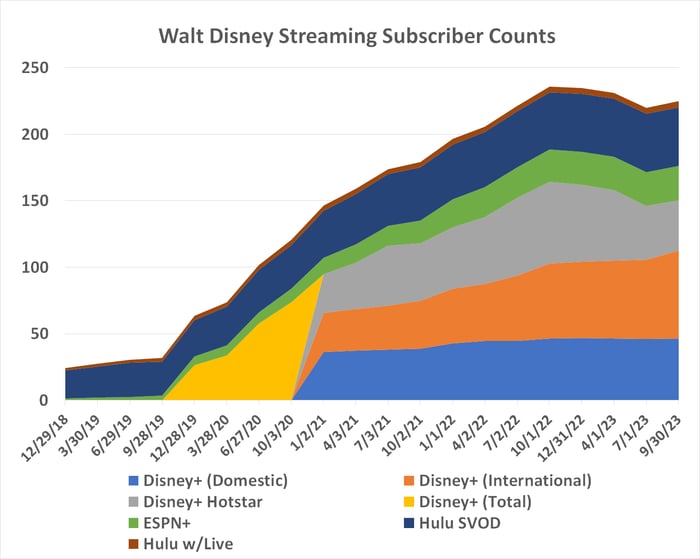

In the meantime, Iger and his team continue working on Walt Disney’s next best growth bet. That’s streaming. Although the combination of Disney+, Hulu, and ESPN+ aren’t yet profitable, they are generating almost as much revenue as the company’s cable TV arm. That’s something to build on, including an eventual pairing of Hulu and Disney+. Presumably, ESPN+ will be folded in the standalone streaming version of ESPN once it launches.

There is no easy ESPN transition in the cards, though. The sports-centric network is one of the top reasons consumers continue paying steep prices for cable television. Once it becomes available outside cable bundles, many consumers will probably sacrifice their access to The Disney Channel, A&E, and Disney’s other less-watched channels; these people can gain access to ABC’s programming through other means as well, like an aerial antenna.

That shift will put tremendous pressure on the other half of Disney’s cable TV operation. There’s also no assurance that all cord-cutters are truly interested in paying a premium for access to a streaming version of ESPN.

Meanwhile, although Walt Disney intends to dial back its total spending on content, less new programming could bring its already-slowing streaming subscriber growth to a screeching halt before this arm ever works its way out of the red.

Data source: Walt Disney. Chart by author. Figures are in millions. Note that last quarter’s growth surge stemmed from heavy promotions of the international version of Disney+

It’s a tricky set of problems, to be sure. It’s not clear how the company will be able to solve one without making another one worse. What is clear is that fixing its cable TV business needs to be prioritized. It’s carrying half of the company’s current profit weight, funding many of Disney’s other, smaller growth initiatives.

More to the point, Disney stock could continue struggling until this fix is in place.

Judge rules against tribes in fight over Nevada lithium mine they say is near sacred massacre site

RENO, Nev. (AP) — A federal judge in Nevada has dealt another legal setback to Native American tribes trying to halt construction of one of the biggest lithium mines in the world.

U.S. District Judge Miranda Du granted the government’s motion to dismiss their claims the mine is being built illegally near the sacred site of an 1865 massacre along the Nevada-Oregon line.

But she said in last week’s order the three tribes suing the Bureau of Land Management deserve another chance to amend their complaint to try to prove the agency failed to adequately consult with them as required by the National Historic Preservation Act.

“Given that the court has now twice agreed with federal defendants (and) plaintiffs did not vary their argument … the court is skeptical that plaintiffs could successfully amend it. But skeptical does not mean futile,” Du wrote Nov. 9.

She also noted part of their case is still pending on appeal at the 9th U.S Circuit Court of Appeals, which indicated last month it likely will hear oral arguments in February as construction continues at Lithium Nevada’s mine at Thacker Pass about 230 miles (370 kilometers) northeast of Reno.

Du said in an earlier ruling the tribes had failed to prove the project site is where more than two dozen of their ancestors were killed by the U.S. Cavalry Sept. 12, 1865.

Her new ruling is the latest in a series that have turned back legal challenges to the mine on a variety of fronts, including environmentalists’ claims it would violate the 1872 Mining Law and destroy key habitat for sage grouse, cutthroat trout and pronghorn antelope.

All have argued the bureau violated numerous laws in a rush to approve the mine to help meet sky-rocketing demand for lithium used in the manufacture of batteries for electric vehicles.

Lithium Nevada officials said the $2.3 billion project remains on schedule to begin production in late 2026. They say it’s essential to carrying out President Joe Biden’s clean energy agenda aimed at combating climate change by reducing dependence on fossil fuels.

“We’ve dedicated more than a decade to community engagement and hard work in order to get this project right, and the courts have again validated the efforts by Lithium Americas and the administrative agencies,” company spokesman Tim Crowley said in an email to The Associated Press.

Du agreed with the government’s argument that the consultation is ongoing and therefore not ripe for legal challenge.

The tribes argued it had to be completed before construction began.

“If agencies are left to define when consultation is ongoing and when consultation is finished … then agencies will hold consultation open forever — even as construction destroys the very objects of consultation — so that agencies can never be sued,” the tribal lawyers wrote in recent briefs filed with the 9th Circuit.

Will Falk, representing the Reno-Sparks Indian Colony and Summit Lake Paiute Tribe, said they’re still considering whether to amend the complaint by the Dec. 9 deadline Du set, or focus on the appeal.

“Despite this project being billed as `green,’ it perpetrates the same harm to Native peoples that mines always have,” Falk told AP. “While climate change is a very real, existential threat, if government agencies are allowed to rush through permitting processes to fast-track destructing mining projects like the one at Thacker Pass, more of the natural world and more Native American culture will be destroyed.”

The Paiutes call Thacker Pass “Pee hee mu’huh,” which means “rotten moon.” They describe in oral histories how Paiute hunters returned home in 1865 to find the “elders, women, and children” slain and “unburied and rotting.”

The Oregon-based Burns Paiute Tribe joined the Nevada tribes in the appeal. They say BLM’s consultation efforts with the tribes “were rife with withheld information, misrepresentations, and downright lies.”

Bitcoin traders have engaged in a tough battle as BTC price shoots to $37,000. The Bitcoin futures open interest has shot to a seven-month high.

Earlier this week, the world’s largest cryptocurrency Bitcoin (BTC) made a strong move to $37,000 levels and is currently hovering around those levels. After significant overnight gains, Bitcoin price is making a determined push towards the $40,000 threshold. Surging by 6.6% in November and achieving nearly a 30% gain in October, the cryptocurrency’s robust performance is surprising some market observers.

Bitcoin Price Movements

However, concerns arise around trading volume, as Material Indicators, an on-chain monitoring resource, highlights a lack of strong volume support at current levels. The support rests around the $33,000 mark, with resistance now positioned in the $42,000 range, a shift from the previous $40,000 resistance level. An accompanying chart illustrates BTC/USDT order book liquidity on the major global exchange, Binance. In their post, Material Indicators noted:

“There is no denying the fact that price has been challenging a number of different local top signals, but there is also no denying that something doesn’t seem right about this move. The most obvious red flag for me is that we are seeing price appreciate on declining volume. That typically doesn’t end well, but we are going to have to watch to see if this time is different.”

Bitcoin Open Interest at Seven-Month High

In other developments, financial commentator Tedtalksmacro highlighted a notable increase in open interest (OI), a factor that has been a driving force behind rapid upward movements in recent weeks and months.

According to data from monitoring resource CoinGlass, the total open interest in Bitcoin futures has surpassed $17 billion, marking the highest value since mid-April. Tedtalksmacro observed that during bearish periods, the market tends to resist these OI impulses, leading to a predatory and ranging environment.

He suggests that a full bullish trend would emerge when the market starts trending higher despite rising OI, indicating a noteworthy aspect to monitor.

Photo: CoinGlass

But popular crypto analyst Ali Martinez noted that the BTC price flashes a sell signal as per the technical chart. The TD Sequential is signaling a sell on the weekly chart as #BTC nears a crucial resistance zone ranging from $38,500 to $42,000.

Anticipating the impact of this resistance barrier, I foresee a potential correction towards $33,000, presenting a buying opportunity for the dip before the upward trend resumes. The scenario would be invalidated if there is a weekly candlestick close above $42,500.

Photo: Ali / X

On the other hand, amid the recent price rally, Bitcoin miners have also started offloading their BTC holdings. Following the late October surge that propelled Bitcoin beyond $34,000, miners of $BTC have been actively selling. More than 5,000 BTC, equivalent to approximately $175 million, have been divested since that period.

next

Altcoin News, Bitcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Thousands of Coinbase users sign up as potential amicus curiae in legal fight with SEC

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Europe is looking to fight the flood of Chinese electric vehicles. But Europeans love them

LONDON (AP) — When Laima Springe-Janssen was looking to replace her French-made gasoline-powered SUV with an electric car, she considered models from Volvo and Nissan.

The Volvo extras she wanted would have busted her budget, while the Nissan lacked the “wow factor.” The Copenhagen, Denmark, resident ended up buying a compact SUV from China’s BYD.

“I really, really love the car,” Springe-Janssen said. For the equivalent of about $50,000, the Atto 3 SUV came with “all these goodies” like a 360-degree dash cam, two years of free charging and an extra set of winter tires.

Her husband likes it so much he’s considering buying another BYD to replace their other car, from Volkswagen’s Skoda brand.

“I’m sorry, Europe. Go home,” she said. “China has a better offer.”

Her enthusiasm underscores how Chinese automakers are winning over drivers as they make major inroads into Europe’s electric vehicle market, challenging long-established homegrown brands in an industry that’s key to the continent’s green energy transition.

The competitive threat has spurred the European Union to launch an investigation into Beijing’s support for its EV industry. That adds to tech-related tensions between the West and China, which is one of Europe’s biggest trading partners and the world’s biggest auto market.

China’s EV onslaught, along with massive U.S. clean energy funding that has drawn investment away from Europe, shows how the 27-nation bloc is caught in the middle of the global race for green technology.

Chinese EV makers are drawn to Europe because auto import tariffs are just 10% versus 27.5% in the U.S., independent auto analyst Matthias Schmidt said. Europe also has the world’s second-biggest EV battery market after China.

Nevermind the geopolitics. Climate-conscious car buyers in Europe who are grappling with an increased cost of living rave about how Chinese EVs are affordable yet packed with features and stylish design. Concerns about the threat to local carmakers and jobs just aren’t a factor for them.

British retiree John Kirkwood replaced his Volkswagen Passat three years ago with an MG5 station wagon because the 30,000-pound ($36,000) price tag “wiped the floor” with its nearest rival — a Kia that cost thousands more.

“It’s nice. It’s quiet, it’s refined” and very quick, Kirkwood said, adding that he had few qualms about British brand MG’s Chinese ownership.

MG — owned by SAIC Motor, China’s biggest automaker — is the largest Chinese EV player in Europe. BYD, backed by billionaire investor Warren Buffett, is growing fast. There’s also Geely, which owns Sweden’s Volvo and a stable of EV brands including Polestar, Lynk & Co. and British sportscar maker Lotus.

Behind them are a slew of startups, like NIO and Xpeng.

Their combined sales are a sliver of the 9.2 million vehicles sold in Europe every year, but they have been gobbling up a piece of the smaller EV market at an astonishing pace.

Chinese automakers account for only about 3% of Western Europe’s overall car market but 8.4% of the EV market, up from 6.2% last year and almost nothing in 2019, according to Schmidt’s data.

The surge is stoking fears about Europe’s automotive industry, an economic powerhouse centered in France and Germany that employs millions of workers, staying competitive as it transitions from fossil fuels to electricity.

European Commission President Ursula von der Leyen says “global markets are now flooded with cheaper Chinese electric cars,” with prices “kept artificially low by huge state subsidies.”

The commission, the EU’s executive arm, formally opened its investigation this month, saying it would take up to 13 months and could result in import duties.

Beijing voiced “strong dissatisfaction” and vowed to “firmly safeguard“ Chinese companies’ rights. The Chinese Commerce Ministry said the EU probe is based on “subjective assumptions,” lacks enough evidence and goes against World Trade Organization rules.

Complicating matters, global automakers build vehicles in China and have exported 164,300 this year to Europe, including BMW’s iX3 SUV made in northeastern Shenyang and Tesla’s Model 3 and Y produced in Shanghai, according to Schmidt’s data. That means one in every five EVs sold in Europe is a Chinese import.

A commission spokesman said the investigation is looking at China’s EV exports “regardless of the brand.”

Stellantis, which owns French auto brands Peugeot and Citroen as well as Italy’s Alfa Romeo and Fiat, is vowing to fight back against China’s EVs. In a recent earnings call, CEO Carlos Tavares said the world’s No. 3 automaker is responding to a “Chinese invasion in a European market” with a new Citroen e-C3 cheap compact.

Stellantis faces added pressure from a union strike in the U.S. over EV battery plant jobs.

Executives at Shanghai-based Aiways, a startup headed by Volvo’s former China sales chief, rejected accusations that Beijing provides a helping hand.

“We’re not selling inside China, we’re not being subsidized in China,” said Alexander Klose, vice president of overseas operations. “Yes, we obviously have some subsidies for putting a plant somewhere, which is, I think, what everybody has in Europe.”

Aiways is focusing on Europe and Israel instead of China, where the auto market is so crowded that “we don’t think it makes sense to compete right now,” Klose said.

The EU should be working on getting to a green future “rather than keeping competition out,” he said.

One reason Chinese companies can offer high-quality cars at affordable prices stems from the rules to enter the Chinese market. Global automakers had to team up with local companies, providing them crucial automaking knowhow.

“They were kind of like the sous chefs to the Western companies,” said Schmidt, the auto analyst. “The situation now is those sous chefs are opening up their own restaurants and, in some cases, better than their masters’ restaurants.”

Also helping level the playing field is battery-powered motors being less complex to build than internal combustion engines and requiring fewer workers. That’s a problem for European brands with big workforces that will need years to revamp operations, Schmidt said.

Chinese EV makers, meanwhile, are trying to stand out in a crowded field.

SUV maker Great Wall Motors’ EV sub-brand Ora is targeting women, with cars it says are designed for their body sizes and daily needs.

The Ora Funky Cat, with throwback round headlights, an exclamation mark on its hood badge, and a 32,000-pound ($38,600) price tag, appealed to British scriptwriter Justin Nicholls, who bought one for his wife.

“The looks are awesome, and the tech great. It’s so easy to drive, yet feels like a lot larger car and feels premium,” he said.

It also appealed to Nicholls because it’s different from the Volkswagens, Peugeots and BMWs common on British roads: “I think it is a lot more quirky than European cars.”

How a fight over two jobs pushed the dockworker union into bankruptcy

Only weeks ago, the dockworkers union was riding high as its members voted to approve a new six-year contract, ensuring peace at the ports of Los Angeles, Long Beach and 27 other West Coast harbors.

Now, the union has landed in bankruptcy protection as it figures out how to pay a hefty court judgment involving accusations of slowdowns and other labor actions during a 2011 dispute — the same kind of tactics employed during the recent contentious contract negotiation. Labor experts are concerned that a serious precedent is being set.

“We intend to use the Chapter 11 process to implement a plan that will bring this matter to resolution and ensure that our Union continues to do its important work for our members and the community,” said Willie Adams, president of the 40,000-member International Longshore and Warehouse Union, in a news release this week.

The union said it will continue to operate as usual but can no longer afford to defend itself in the lawsuit brought by a former shipping terminal operator at the Port of Portland, Ore.

The company, ICTSI Oregon Inc., which is based in the Philippines, could not be reached for comment. In a statement emailed to Reuters, the terminal operator said that the bankruptcy filing was the union’s “latest maneuver to avoid accountability.”

Read more: West Coast dockworkers ratify a new six-year contract

Ken Jacobs, a labor specialist and chair of the UC Berkeley Center for Labor Research and Education, said “people are very concerned about the precedent this is setting with an employer suing a union over labor activity. The severity of the penalty that was levied was also disconcerting.”

Nelson Lichtenstein, director of the UC Santa Barbara Center for the Study of Work, Labor and Democracy, said: “I think it means that when employers see a legal opening against a union they are going to run with it to bankrupt or weaken existing unions.”

The case involves a bitter labor dispute over just two jobs that pitted the ILWU against terminal operator ICTSI Oregon at a seaport of only minor significance in terms of the number of cargo containers moved.

The obscure feud began when ILWU leaders pushed ICTSI Oregon to give it two jobs previously represented by the electricians’ local after ICTSI signed a lease with the Portland port in 2011 to begin running the container yard. ICTSI, which accused the union of work slowdowns, said it could not reassign the jobs because the port controlled them. During the dispute, international shipping lines stopped sending cargo containers to Portland.

ICTSI paid the port $20 million to get out of its lease and sued the union, listing that amount and other losses as damages.

Read more: UAW aims for drivers’ attention by striking parts warehouses, including two in the Inland Empire

A federal jury found the union liable for unlawful labor practices and awarded the company $94 million, an amount subsequently reduced by a U.S. District Court judge to $19 million. But ICTSI rejected that amount, and a retrial was set for next year, leading to the bankruptcy filing, ILWU told its members.

“While we have attempted numerous times to resolve the decade-long litigation with ICTSI Oregon, Inc., at this point, the Union can no longer afford to defend against ICTSI’s scorched-earth litigation tactic,” Adams said.

This story originally appeared in Los Angeles Times.

WASHINGTON — The White House’s oversight and investigations war room finally got the battle on Tuesday that they’d been arming themselves for.

House Speaker Kevin McCarthy’s announcement that he has directed GOP-led House committees to open an impeachment inquiry into President Joe Biden was the long-anticipated retribution that White House aides had been waiting for, after House Democrats twice impeached Donald Trump during his term in office.

Ever since Republicans retook the House majority last year, the White House has been building a team of legal experts and spokespeople to counter the congressional inquiry launched into the president and his son, Hunter Biden.

And in recent months, as the calls for impeachment grew louder on the far right of the GOP, the new White House war room has responded by publicly refuting Republican accusations and amplifying the voices of impeachment skeptics within the GOP caucus.

“House Republicans have been investigating the president for nine months, and they’ve turned up no evidence of wrongdoing,” Ian Sams, the White House spokesperson for oversight and investigations, said on Tuesday, noting that McCarthy’s “own GOP members have said so.”

To date, House Republicans have yet to produce any evidence that Biden personally profited off of his son’s business dealings, or that the president committed any other high crimes or misdemeanors. But proponents of impeachment insist that a formal inquiry will give investigators precisely the legal power they need to subpoena records from Biden that might prove wrongdoing.

Still, McCarthy’s decision to skip holding a formal vote on opening an inquiry — and just declaring one — appeared at first glance Tuesday to indicate that committees would not be granted any greater investigatory power under House rules than they currently have.

Absent a smoking gun, Republicans have latched on to testimony from Devon Archer, a former business partner of Hunter Biden’s, who told the House Oversight and Accountability Committee that over a 10-year period, Hunter put his father on speakerphone while talking to business associates “about 20 times,” and that Joe Biden attended two meals with Hunter and his business associates.

Archer also told the committee the elder Biden did not discuss business matters on any of the calls and meetings. Nonetheless, the younger Biden sought to portray an “illusion” of access to the then-vice president as part of his business “brand,” he said.

The lack of hard evidence hasn’t deterred the court of public opinion, however. A CNN poll released last week found a majority of Americans, 61%, believe the president was involved in his son’s business dealings while he was vice president, with 42% believing the involvement was illegal.

McCarthy has been under intense pressure from some far-right GOP members to press for impeachment even as others warn it’s too early. With a slim 222-212 majority in the House, the whims of every member of McCarthy’s caucus count.

Rep. Marjorie Taylor Greene, R-Ga., said she would not vote on any necessary budget bills unless the House opened an impeachment inquiry. Congress has about 12 working days to pass all 12 appropriations bills and get Biden’s signature before the government shuts down on Sept. 30. Rep. Matt Gaetz, R-Fla., threatened to oust McCarthy from his speakership if impeachment proceedings did not begin.

The White House said caving to their demands would show that the exercise is a “costly, illegitimate, politically-motivated exercise not rooted in reality.”

“If Speaker McCarthy opens an impeachment inquiry simply to throw red meat to his most extreme far-right members like Marjorie Taylor Greene and Matt Gaetz, it will prove that this is nothing more than an evidence-free political stunt to baselessly attack the president, not a legitimate inquiry to pursue the truth,” Sams said in a statement last week.

Politically unpopular impeachment hearings have hurt the party before. Republicans lost seats in the 1998 midterm elections following the impeachment proceedings into then-president Bill Clinton.

Sams on Tuesday criticized McCarthy’s decision to launch the inquiry on his own after previously promising to bring it to a floor vote. McCarthy in 2019 said then-Speaker Nancy Pelosi’s move to open an impeachment inquiry against Trump without a floor vote made it “completely devoid of any merit or legitimacy.”

McCarthy did not give reasoning for forgoing a vote on impeachment but it suggests he may not have had the support within his caucus to garner the 218 votes needed to do so. Several Republican members of the House have thrown cold water on the idea of impeachment in recent weeks.

Rep. Ken Buck, R-Co., a member of the Freedom Caucus, called the situation “absurd” in an interview with MSNBC.

“The time for impeachment is the time when there’s evidence linking President Biden — if there’s evidence linking President Biden — to a high crime or misdemeanor. That doesn’t exist right now,” Buck said. “And it is really something that we can say, well, in February, we’re going to do this. It’s based on the facts. You go where the facts take you.”