After the former 45th President of the United States, Donald Trump, saw his cryptocurrency holdings exceed $5 million, just ten days later, the value of Trump’s digital asset collection has escalated to $7.5 million. This increase is largely due to $4.66 million emanating from the cryptocurrency he holds called TRUMP, which has experienced a significant […]

After the former 45th President of the United States, Donald Trump, saw his cryptocurrency holdings exceed $5 million, just ten days later, the value of Trump’s digital asset collection has escalated to $7.5 million. This increase is largely due to $4.66 million emanating from the cryptocurrency he holds called TRUMP, which has experienced a significant […]

Source link

fueled

Filecoin surges to new highs fueled by pivotal Solana deal and AI sector growth

Filecoin has surged to a new yearly high amid significant development within its ecosystem.

The decentralized storage protocol’s FIL token price soared to a yearly peak of $8.43 but has slightly corrected to $7.92 as of press time, according to CryptoSlate data.

Notably, FIL is the only digital asset among the top 25 cryptocurrencies by market capitalization that saw a green candle in the last 24 hours, up more than 7% during the reporting period.

Over the past 30 days, FIL has grown by more than 63.61% and by 15% on the year-to-date metric. Despite this growth, Filecoin remains down about 96.54% from its all-time high of $236.965 in April 2021.

Why is Filecoin’s value rising?

FIL’s price performance can be attributed to several reasons, including recent developments within its ecosystem and the current artificial intelligence (AI) narrative pervading the broader market.

During the past week, Filecoin announced a significant partnership with the leading blockchain network, Solana.

According to the announcement, the collaboration would allow infrastructure providers, explorers, indexers, and anyone needing historical access to have seamless access to Solana’s block history.

“By leveraging Filecoin’s decentralized storage capabilities, Solana can achieve data redundancy, scalability, and enhanced security while staying true to its decentralized ethos,” it added.

Besides that, market observers have highlighted the current AI narrative as another reason for FIL’s bullish price performance.

Recent reports revealed that AI-linked tokens have rapidly gained after OpenAI announced its AI-powered video generation service, Sora. In addition, Nvidia’s recent earning report showed a massive demand for generative AI.

Considering this, Arthur Hayes, the co-founder of the BitMEX exchange, said, “All things AI-related [will] levitate.” According to him, this would push FIL’s price to $100.

Furthermore, a recent report from the protocol highlighted increased accessibility and demand for its products in the previous year. Notably, the protocol onboarded over 1,800 new large dataset clients and more than 180 clients to Singularity alone.

Bitcoin ETFs fueled hopes for other crypto ETFs — but don’t get too excited

Welcome back to Distributed Ledger. This is Frances Yue, crypto and markets reporter at MarketWatch.

The first approved bitcoin

BTCUSD,

ETFs have now been trading for two weeks, with BlackRock and Fidelity leading the race after the U.S. Securities and Exchange Commission greenlighted such products on Jan. 10.

Some crypto investors now are hoping to see ETFs based on smaller cryptocurrencies, such as ether

ETHUSD,

also receive the SEC’s approval down the road.

However, it may be too early to get excited, according to Stephanie Breslow, partner and co-head of the investment-management group at law firm Schulte Roth & Zabel.

Find me on X at @FrancesYue_ to share any thoughts on crypto or the newsletter.

The securities debate

“Bitcoin itself is not a security. Nobody even was able to identify an issuer,” Breslow told Distributed Ledger.

“But for other crypto, there is still a dispute in many cases between the SEC and other market participants about which cryptocurrencies are securities, and whether the crypto that were once securities are still securities,” she said.

SEC Chair Gary Gensler once said that bitcoin was the only crypto he was prepared to publicly label a commodity, rather than a security.

In June, the SEC separately sued crypto exchanges Coinbase and Binance. While the lawsuits contain different allegations, both contend that the companies ran unregistered securities exchanges. Both lawsuits are still ongoing.

In July, U.S. District Judge Analisa Torres ruled that Ripple Labs’ crypto token XRP

XRPUSD,

is not a security when sold on digital-asset exchanges to the general public, but that Ripple’s sales to sophisticated institutional investors did qualify as an unregistered sale of investment contracts, in violation of federal law.

In October, the same judge refused to let the SEC appeal the decision.

It’s important to watch the developments and rulings of such lawsuits, according to Breslow. “Those court cases are not in themselves directly about whether you could have an ETF, but I do think that finding the boundaries between what is and what isn’t a security will be relevant to which crypto end up being capable of being wrapped into ETFs,” Breslow said.

“If the SEC is thinking that a given crypto is a security and that various exchanges should not be trading it [and] it shouldn’t be open to U.S. markets, then likely they would not be allowing an ETF around that crypto,” she added.

Still, even if a crypto is not considered a security, there remains the question of whether the market for it is large and rational enough, according to Breslow.

“In the case of bitcoin, it is very widely traded. Something that is more thinly traded wouldn’t really support an ETF,” she said.

Trump’s stance on crypto

As former U.S. president Donald Trump cruises toward the Republican Party nomination for the 2024 presidential election, some crypto supporters are putting their faith in a potential second Trump administration.

However, a careful look at Trump’s term in office could cast doubt on those hopes, writes MarketWatch’s Chris Matthews.

“Bitcoin, it just seems like a scam,” Trump told Fox Business in 2021. “I don’t like it because it’s another currency competing against the dollar.”

In 2019, amid controversy over Facebook’s Libra cryptocurrency project, Trump lamented that the value of cryptocurrencies is “based on thin air.”

Read more about it here.

Crypto in a snap

Bitcoin fell 6.2% in the past seven days and ether lost about 12.2% during the same period, according to CoinDesk data.

Must-reads

- Terraform Labs files for bankruptcy following crash of its stablecoins in 2022 (MarketWatch)

- ‘It was just a facade’: CEO charged with stealing $150 million in crypto scam (MarketWatch)

Goldman Sachs: Global Economy Is on Cusp of New ‘Super Cycle’ Fueled by AI and Decarbonization

Peter Oppenheimer, head of macro research in Europe at Goldman Sachs expects major global economic expansion akin to the late 19th century.

The global economy is fast approaching a new ‘super cycle’ similar to the one experienced during the late 1980s fueled by the rise of Artificial Intelligence (AI) and decarbonization. While speaking on Monday at Squawk Box Europe, Peter Oppenheimer, a researcher at Goldman Sachs, noted that the global economy is moving into a super cycle that is commonly defined by a high employment rate, rising gross domestic product (GDP), and robust demand for goods thus triggering increased prices. He further noted that global super cycles have been preceded by peaks of interest rates and inflation, followed by a decade of falling inflation and interest rates.

Already, the leading global economy, the United States, has recorded a series of interest rate hikes in the past three years but the Federal Reserve has signaled several rate cuts by the end of this year. Moreover, US inflation has dramatically slowed down in the past year without major reports of unemployment. Meanwhile, Oppenheimer highlighted that the world may not record extreme interest rate cuts in the next decade but a change in economic policies to enable privatization and globalization.

In the next coming years, Oppenheimer expects to see a notable rise in AI applications, thus widening human productivity. Furthermore, the ongoing modernization of industrialization has largely been driven by technological developments.

“The second thing that we haven’t yet seen, and I think we’re relatively positive that we will see, is an improvement in productivity on the back of the applications of AI which could be positive for growth and of course for margins,” Oppenheimer noted.

Global Market Outlook

With the help of Artificial Intelligence and blockchain technology, the global economy is fast opening up from traditional geographical areas. For instance, more institutional investors are using blockchain technology to enable real-world assets (RWA) tokenization in areas like carbon credits, real estate, and government bonds, among many others. Consequently, more governments around the world have been enacting regulatory policies that attract web3 investors and developers.

Moreover, there is a significant demand for digital assets from both retail traders and institutional investors. Already, the global cryptocurrency market has eclipsed over $1.7 trillion led by Bitcoin, which has rallied above $47k for the first time since the Terra Luna UST crypto capitulation. Nonetheless, the entire crypto market cap is dismal compared to the global debt that recently eclipsed above $304 trillion.

Meanwhile, more countries are coming together through the BRICS alliance to dethrone the United States dollar as the global reserve currency. Led by Russia, China, and India, the global economic shift is expected to be expedited in the coming years amid the Middle East crisis and the ongoing Ukraine war.

next

Artificial Intelligence, News, Technology News

You have successfully joined our subscriber list.

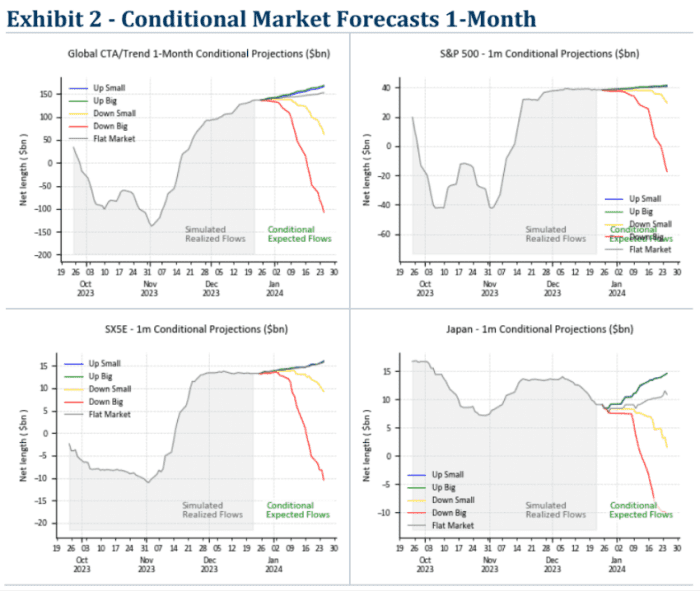

Traders that fueled stock-market rally are now nearly tapped out, Goldman says

After helping to push U.S. stocks’ higher in November and December, trend-following trading firms known as CTAs are nearly tapped out, according to a report published by a Goldman Sachs Group trading desk.

That could limit further upside for the market, although the analysts cautioned that CTAs’ positioning may not be indicative of what other market participants are doing.

According to a report reviewed by MarketWatch on Wednesday, Goldman’s models suggest that CTAs — or commodity trading advisers — are already nearly max long when it comes to their exposure to the S&P 500, which they typically trade by buying or shorting futures contracts tied to the index.

Numbers from the Goldman trading desk that typically services CTAs show that this class of traders is carrying about $40 billion in long exposure to the S&P 500, and nearly $150 billion in exposure to global equities.

This would suggest that even if global stocks continue to power higher, CTAs’ ability to keep chasing the tape may have reached its limit.

GOLDMAN SACHS

CTAs certainly have a lot of influence across equity, fixed-income and commodity markets.

That said, Goldman’s numbers represent only a partial view of what’s happening in the space, and there are plenty of other types of traders aside from CTAs who can help push markets higher or lower.

See: November’s stock-market rally gets a boost from trend-following funds and company share buybacks

The S&P 500

SPX

gained 0.1% on Wednesday, closing at around 4,781, just a few points shy of its record closing high from Jan. 3, 2022, according to FactSet data. The large-cap index has gained nearly 25% since the beginning of 2023. The Dow Jones Industrial Average

DJIA

rose by around 111 points, or 0.3%, to notch its sixth record close of the year.

Check out: The latest threat to U.S. stocks: computerized trend-following funds are cutting their exposure to the market

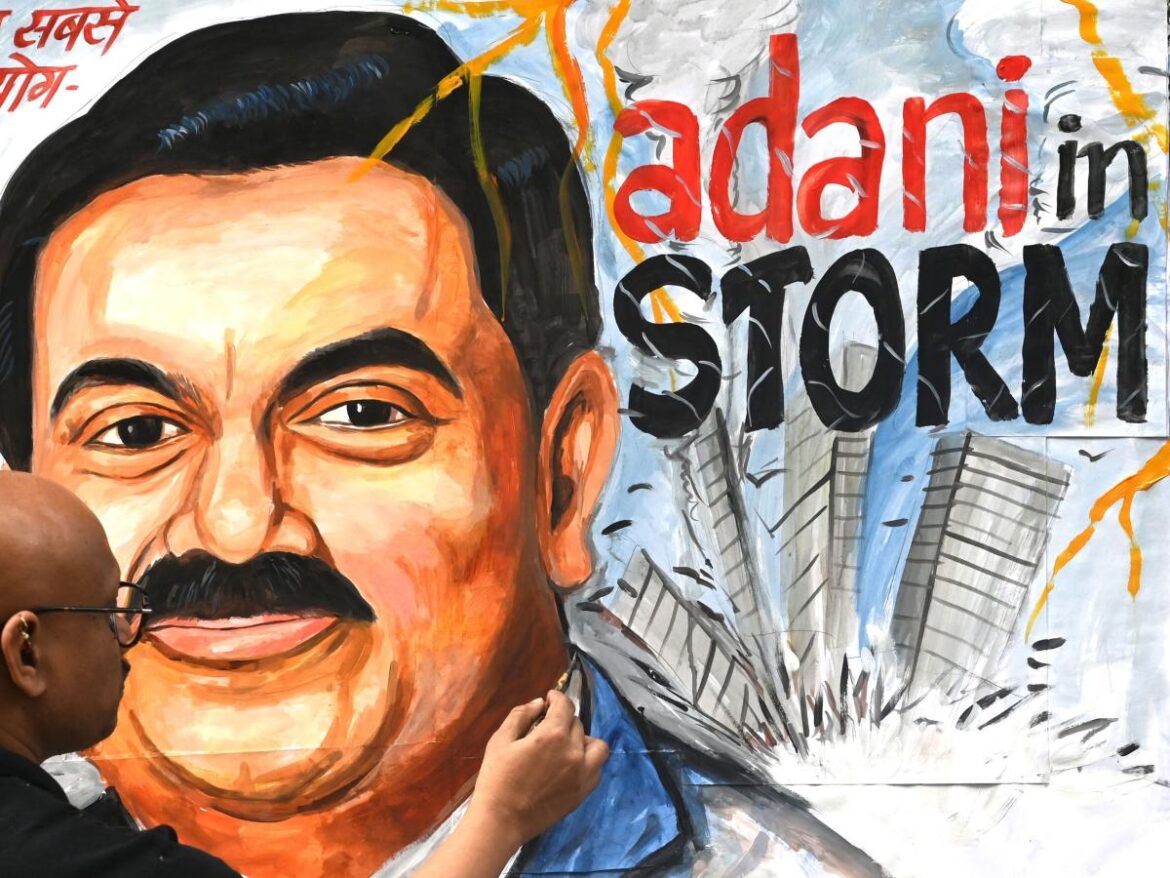

Short-seller Hindenburg has fueled a massive wealth wipeout for 3 of the world’s richest men this year

-

Short-seller Hindenburg Research has targeted three of the world’s wealthiest men this year.

-

It’s made high-profile bets against Adani Group, Block, and Icahn Enterprises.

-

Gautam Adani, Jack Dorsey, and Carl Icahn have seen their wealth plummet in 2023.

Short-seller Hindenburg Research’s big bets against Adani Group, Block, and Icahn Enterprises have fueled a massive wealth wipeout for three of the world’s richest men this year.

Indian magnate Gautam Adani, Twitter and Block founder Jack Dorsey, and activist investor Carl Icahn have all seen their personal fortunes plummet, according to data from the Bloomberg Billionaires Index.

Adani has suffered the largest losses of the three, with his wealth plunging $57 billion since Hindenburg published a report in January that accused him of “pulling the largest con in corporate history“, sparking major losses for his publicly-traded companies.

Dorsey lost a more modest $530 million after Hindenburg critiqued his payment firm Block – but Icahn has got nearly $16 billion poorer after the short-seller said in May that he used “Ponzi-like structures” to deceive investors.

On Friday alone, Icahn Enterprises’ stock plunged 23% after it slashed shareholders’ payouts from $2 to $1, which Icahn himself attributed to Hindenburg’s “misleading and self-serving” report.

Icahn’s wealth fell from $10.5 billion to $8 billion that day alone, per Bloomberg’s index.

Hindenburg, which achieved prominence in the past with big bets against EV corporation Nikola and the Chamath Palihapitiya-backed firm Clover Health, has hit headlines this year with its high-profile reports targeting the three billionaires’ companies.

Its attacks have erased $173 billion from the value of their publicly-traded companies, with the brunt of those losses borne by listed firms under the Adani Group umbrella, per Bloomberg.

Perhaps surprisingly, Hindenburg and its founder Nate Anderson probably only made tiny gains this year, according to the outlet, which cited data from S3 Partners showing the short-seller would have earned just $56 million from its bet against Icahn if it perfectly timed its exits.

Read the original article on Business Insider