There are still a number of companies in the private market that are potential IPOs — but underwriters will likely take a cautious approach this year.

Source link

Game

Operating within tightly regulated stock exchanges, ETFs ensure accessibility through existing retail investors’ brokerage accounts, subject to stringent supervision.

In a historic decision, the US Securities and Exchange Commission (SEC) granted approval to exchange-traded funds (ETFs) that mirror the price of Bitcoin. This marks a significant breakthrough for the cryptocurrency industry, which has sought to introduce such products for over a decade.

Numerous asset managers have submitted Bitcoin ETF applications since 2013, only to face rejection from the SEC due to concerns about susceptibility to market manipulation. In August, a court ruling challenged the SEC’s decision to reject Grayscale Investments’ Bitcoin ETF application, prompting the regulatory agency to reconsider its stance.

On Wednesday, the SEC gave the green light to applications from well-known entities such as ARK Investments, BlackRock, and Fidelity, signaling a shift in the regulatory landscape.

The exact financial impact of Bitcoin ETFs remains uncertain. The ProShares Bitcoin Strategy ETF (BITO.P), the first Bitcoin futures ETF approved by the SEC in 2021, witnessed approximately $1 billion worth of shares traded on its inaugural day. Some experts speculate that a spot Bitcoin ETF could attract triple that amount on its debut, potentially reaching a staggering $55 billion within five years.

While Bitcoin has experienced a 70% surge since the Grayscale ruling, analysts remain cautious about predicting its future trajectory. Factors such as interest rates are expected to play a pivotal role in shaping the cryptocurrency’s market dynamics.

While Canada and Europe already boast spot Bitcoin ETFs, the United States, as the world’s largest capital market, offers a distinctive environment. Home to some of the most prominent asset managers and institutional investors globally, the approval of Bitcoin ETFs in the US opens new avenues for market participation and capital infusion.

How Do Spot Bitcoin ETFs Work?

The anticipated launch of Bitcoin exchange-traded funds (ETFs) is set to bring a new dimension to the cryptocurrency market, unveiling a carefully orchestrated operational model. These ETFs will make their debut on prominent exchanges, including Nasdaq, NYSE, and the CBOE.

A critical aspect of their asset composition involves the inclusion of physical Bitcoin, strategically procured from cryptocurrency exchanges and held under the custodianship of reputable entities like Coinbase Global. In terms of benchmark tracking, these innovative products will meticulously follow specified Bitcoin benchmarks, with some opting for indices provided by CF Benchmarks, a subsidiary of Kraken.

To address regulatory concerns regarding market manipulation, Nasdaq and CBOE have collaborated with Coinbase to establish a robust market surveillance mechanism. The fee structure for these ETFs is between 0.20% and 0.8%, presenting a competitive edge below the broader ETF market average.

Notably, a spot Bitcoin ETF offers investors a simplified route to exposure without the complexities of direct ownership, eliminating the need for crypto wallets and circumventing potential cybersecurity risks associated with exchanges. This ETF structure provides a sense of regulatory oversight and confidence for investors, especially in the wake of industry challenges and scandals.

Operating within tightly regulated stock exchanges, ETFs ensure accessibility through existing retail investors’ brokerage accounts, subject to stringent supervision. Beyond retail, the institutional accessibility offered by ETFs further positions them as a key player in facilitating Bitcoin investments for a broader investor base.

Also, the imminent launch of Bitcoin ETFs is likely to mark a significant milestone, bridging traditional financial markets with the dynamic cryptocurrency landscape, and offering a regulated and accessible avenue for investors to engage with Bitcoin.

next

Funds & ETFs, Market News, News

You have successfully joined our subscriber list.

China’s Xpeng claims its latest EV model could be an industry ‘game changer’

Chinese electric vehicle company Xpeng told CNBC on Friday that its newly launched X9 model could be a “game changer” for the industry.

Xpeng launched the X9 large 7-seater EV on Jan. 1, a car built on its SEPA2.0 architecture for the Chinese market. The X9 series are priced between 359,800 yuan to 419,800 yuan (about $50,360 to $58,760) with immediate deliveries.

“For X9, we actually anticipate this to be a game changer for the battery electric vehicles segment for MPVs (multi-purpose vehicles),” Brian Gu, vice chairman and co-president of Xpeng, told CNBC’s Emily Tan in an exclusive interview.

“We believe this could be the top seller in its category … because I think it has some very innovative technology and design as well as superior handling, industry leading smart driving technology – packed into a very beautifully designed product,” said Gu.

Xpeng’s new launch comes as several domestic EV players such as Nio, Huawei and Zeekr recently revealed new electric vehicles. Even Chinese consumer electronics company Xiaomi is launching its first EV to compete in the market.

We anticipate in 2024, we will be growing much faster than the industry growth which means that we can expand our market share.

Brian Gu

Vice Chairman and Co-President, Xpeng

Xpeng has laid out ambitious plans to roll out driver-assist technology in China by end of last year and in Europe by the end of 2024.

The Chinese EV maker also entered into a cooperation framework agreement with Guangdong Huitian on Jan. 2 to manufacture, develop and sell flying vehicles, where Xpeng will provide research and development, technology consulting services and sales agent services to Guangdong Huitian.

“We anticipate in 2024, we will be growing much faster than the industry growth which means that we can expand our market share,” said Gu, adding that the firm will be looking to increase profit margins with greater scale and better product mix.

“The X9 will be a very high margin product for us,” said Gu.

Stiff competition

Competition is intensifying in the Chinese EV market, with BYD, Li Auto and Geely among the small number of players that have hit their annual sales targets.

Xpeng and Nio were among those that missed their targets.

Xpeng delivered a total of 141,601 units in 2023, a 17% increase from a year ago. This fell short of the firm’s target of delivering 200,000 vehicles for the year as reported by local media.

“The focus of investors [for 2024] is whether the company can maintain decent delivery momentum with new launches and improve profitability in a challenging pricing environment, in our view,” said Morningstar analyst Vincent Sun in a Nov. 16 note on Xpeng.

2024 will be a very competitive year with obviously a number of new models as well as new brands launching in the segment.

Brian Gu

Vice Chairman and Co-President, Xpeng

Nio delivered 160,038 vehicles in 2023, representing an increase of 30.7% compared to a year ago — but it still was well below its target of about 245,000 cars based on management’s target to “double the volume” of 2022 during their fourth quarter earnings call.

Li Auto delivered 376,030 vehicles in 2023 – meeting its annual delivery milestone of 300,000 vehicles.

In terms of sales, BYD met its 3 million target in 2023 and surpassed Tesla as the world’s top-selling EV brand in the fourth quarter, selling more battery-powered vehicles than its U.S. rival.

BYD produced 3.05 million vehicles in 2023 while Tesla said it made 1.84 million vehicles that same year.

‘Strong momentum’

Gu is optimistic on China’s EV market in 2024 despite challenges, saying that “2024 will be a very competitive year” with new model and brand launches.

“I think that the EV sector in China ended on a very high note in the fourth quarter, if you look at the penetration rates approaching 40% towards the end of this 2023, which is the high point that we have seen in the industry,” said Gu. “So all that points to a strong momentum.”

According to TrendForce, China’s new energy vehicle penetration rate exceeded 40% for the first time in November and “optimistic growth” is anticipated by 2024.

“I think we will continue to see a number of the catalysts that’s propelling the growth of the new energy vehicle market, obviously the technology, the product launches, as well as the continued conversion from internal combustion engines to new energy vehicles,” said Gu.

The new energy category includes electric and plug-in hybrid power sources.

“But in order to be competitive, I think we still need to focus on differentiating innovative technology as well as maintaining a very strong cost-competent competitive advantage with scale as well as technological innovations,” he added.

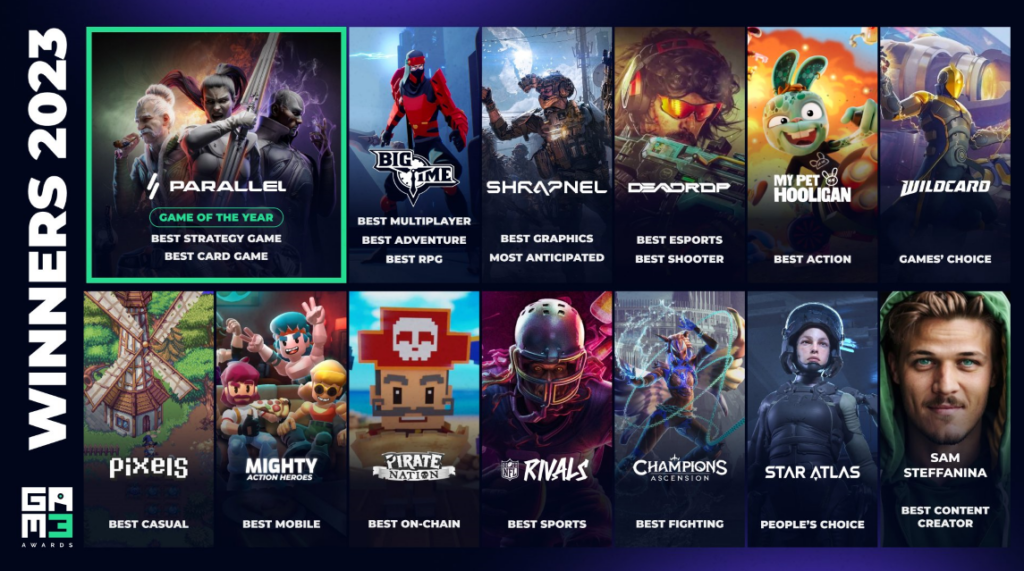

Parallel dominates Gam3 Awards with triple win including Game of the Year

The second annual Gam3 Awards has concluded, with Parallel earning top honors in several categories, including Best Strategy Game, Best Card Game, and the prestigious Game of the Year award. The event, celebrating the hard work of development teams in web3 gaming, showcased the diverse potential of blockchain technology in gaming.

The Gam3 Awards, hosted by GAM3S.GG, formerly Polkastarter Gaming, had a total of 40 finalists from 214 nominated games. The other Game of the Year finalist nominees were My Pet Hooligan, Wildcard, Big Time, Deadrop, and last year’s winner, Big Time.

Parallel, which is yet to be officially released, is a science fiction trading card game (TCG) that blends traditional gaming mechanics with the advanced capabilities of blockchain technology. Developed by Parallel Studios on Ethereum using the Echelon Prime ecosystem, it completed a closed alpha phase earlier this year, where participants had the opportunity to explore all game modes, experiment with different cards, and contribute feedback to refine the game. Players are currently engaging with a closed beta, which includes a $25k tournament, and the full, on-chain version is expected to ship in 2024.

The game is rooted in a dystopian future narrative. It unfolds in a world where Earth, devastated by a cataclysmic event using anti-matter, forces humanity to colonize space, creating distinct civilizations, each with unique capabilities and backgrounds.

The game’s universe is marked by five parallels – the Earthen, Marcolian, Augencore, Kathari, and Shroud, each representing different factions that have evolved over thousands of years. These groups converge in a quest to harness Earth’s newfound energy, resulting in conflicts and alliances, providing an immersive storytelling canvas for players.

Parallel’s gameplay allows players to collect and use NFT-based cards, creating decks to engage in strategic battles against others. These decks can represent a single faction or a combination of universals applicable across factions. The game operates on a play-and-earn model, where players genuinely own their digital cards and earn PRIME tokens, the utility currency within the Echelon ecosystem.

PRIME tokens serve multiple functions, including value transfer, rewards, and governance participation. The token, which lives on the Ethereum network, is up 58% over the past 30 days, reaching an all-time high following the awards ceremony. It has since retraced 13% along with the broader market, according to CryptoSlate data.

Players can experience various game modes in Parallel, such as The Ladder, where they compete in one-on-one battles, and Sectors, where they start with a 30-card deck and modify it as they progress. The rookie queue provides a training ground for newcomers, offering immutable rookie decks that evolve with player experience.

You can learn more about Parallels on Gam3s.gg, including guides and reviews from players participating in the test releases.

Information on the winners from other categories at The Gam3 Awards is available on the awards website.

Esports leader Team Liquid joins Illuvium for strategic blockchain game beta test

Illuvium, an Ethereum (ETH)-based decentralized gaming platform, has joined forces with Team Liquid, a globally recognized esports organization, to beta-test the early access version of its game, Illuvium: Arena, according to a Dec. 1 statement shared with CryptoSlate.

The collaboration aims to introduce blockchain gaming to a broader audience by showcasing gameplay through Team Liquid’s prominent gamers like Midbeast, SnoodyBoo, and Broxah.

Over the past years, several blockchain-based games have failed to achieve mainstream success due to their perceived inferior quality. CoinGecko research showed that three out of every four web3 games launched during the past five years have failed, with more than 2000 games failing during the reporting period.

However, Team Liquid’s Co-CEO Victor Goossens expressed confidence in Illuvium: Arena‘s detailed design and competitive nature. He said the game could help shift gamers’ perception of blockchain-based games while highlighting its focus on skill and strategy.

Illuvium’s gaming ecosystem comprises three main stages: starting with Illuvium: Zero for acquiring fuel, followed by exploration in Illuvium: Overworld, and culminating in player-versus-player (PvP) matches within Illuvium: Arena using acquired assets.

The game’s high-quality graphics and strategic depth position it as a contender against popular titles like Pokémon and Teamfight Tactics. Additionally, players can earn in-game assets convertible to real-world currency, enhancing its appeal.

Beyond game testing, users can obtain exclusive Team Liquid digital collectibles, Illuvitars, from Dec. 12, which unlock rare in-game cosmetics.

Kieran Warwick, Illuvium’s CEO, emphasized the significance of delivering exceptional gaming experiences to dispel skepticism surrounding blockchain games. He sees the collaboration with Team Liquid as a milestone, demonstrating that blockchain games, including those with NFTs, offer immersive experiences comparable to traditional games.

While the primary focus of the current partnership is game testing, Illuvium hinted at potential future tournaments within Illuvium: Arena as part of their collaboration with Team Liquid.

Jacob Kupferman | Getty Images

The Miami Dolphins and the New York Jets face off in the National Football League’s first ever Black Friday game this week — but it’s not going to be the usual broadcast or cable offering. The game will stream exclusively on Amazon’s Prime Video.

The NFL’s decision to start a new Thanksgiving tradition with a streaming platform instead of a broadcast or cable channel is yet another indicator of trouble for linear, or traditional, TV, which has suffered from slumping ad revenue and customers cutting the cable cord.

The Black Friday matchup is an expansion of Amazon’s “Thursday Night Football” deal with the NFL, which has helped drive a 6% jump in NFL viewership since last year. And with the game streaming the day after Thanksgiving, Amazon could capture some of the holiday viewership, which broke records last year.

“I don’t make predictions on ratings,” Brian Rolapp, the NFL’s chief media and business officer, told CNBC’s Julia Boorstin this week. “But I think they’ll be good.” The Black Friday game kicks off at 3 p.m. ET.

Thanksgiving Day is already a football tradition, with the Detroit Lions and Dallas Cowboys headlining matchups through the years. Fox, CBS and NBC all will broadcast games on the holiday.

The NFL and Amazon hope the Black Friday game will become an annual tradition, executives said Tuesday at a media conference. In a push to drive Amazon e-commerce sales, the streaming broadcast will feature QR codes at the bottom of the screen that will link to some of Amazon’s Black Friday deals. Country music icon Garth Brooks will take the stage in an exclusive postgame concert.

Amazon’s 11-year “Thursday Night Football” deal and YouTube TV’s “NFL Sunday Ticket” package are just a few examples of live sports programming making the jump from cable to streaming. In October, Warner Bros. Discovery rolled out its Bleacher Report Sports Add-On Tier for the company’s flagship streaming platform Max, offering subscribers hundreds of live sports events.

ESPN’s pivot

ESPN has long ruled sports programming on traditional TV. But that could all change when the cable stalwart brings all its programming to streaming, in a planned direct-to-consumer release.

Yet even as the streaming trend picks up, sports programming is helping keep cable and traditional TV alive, for the moment.

Earlier this year, data firm Nielsen reported that traditional TV made up less than half of overall TV usage in July. But linear popped back in August and September. The jump was largely driven by the return of college and professional football, Nielsen said in a report released last month. ESPN also snagged the top 11 telecasts for the month of September, 10 of which were football-related.

ESPN has so far weathered the storm of the TV decline, capturing a “modest increase” in ad revenue in parent company Disney’s most recent quarterly report, even as overall TV revenue for the company fell.

Sports programming is holding the linear television industry together, according to Macquarie analyst Tim Nollen. And ESPN is a huge part of that.

But ESPN’s dominance in sports programming could pose a potentially fatal threat to linear TV. When ESPN unleashes its direct-to-consumer service, which would offer much more than its current ESPN+ app, it could be the push sports fans are waiting for to abandon the bundle altogether.

“When ESPN puts their DTC product online, depending on the pricing, it may create a critical mass of live sports outside of the bundle to accelerate cord cutting,” said UBS media and telecom analyst John Hodulik. “That’s what I think people are waiting for.”

Disney CEO Bob Iger told CNBC’s Boorstin on Nov. 8 that Disney will launch a direct-to-consumer ESPN flagship no later than 2025, putting the sports programming world on notice.

But not everyone is convinced that ESPN’s foray into streaming will do too much damage too quickly.

“When you look at the economics that ESPN gets from the pay TV bundle, they cannot just step away and pirouette to DTC and everything stays the same,” said sports media consultant and former Fox Sports executive Patrick Crakes. “There’s no DTC streaming product that scales like pay TV, even today, with pay TV in decline.”

The future looks more like a reimagined pay TV bundle, Crakes said, with streaming products included in the traditional economics of bundle. It’s reminiscent of the recent Disney-Charter agreement, in which Disney+ and ESPN+ are now included in some Spectrum cable packages.

But challenges could lie ahead for media companies that have not yet made the jump to bring their programming to the streaming world.

How vulnerable is Fox?

A FOX Sports TV camera operator during the week 5 NFL game between the Atlanta Falcons and the Carolina Panthers at Mercedes-Benz Stadium on October 11, 2020 in Atlanta, Georgia.

David J. Griffin | Icon Sportswire | Getty Images

The biggest loser of the slowing ad market will be Fox, Macquarie’s Nollen said. (Macquarie Group and its affiliates own a net long of 0.5% or more of the equity securities of Fox Corp.)

Other media companies, including NBCUniversal through its Peacock service, have pivoted in large part to streaming ventures, where ad revenue through those platforms can partially offset the slump in linear. The problem with Fox? It doesn’t have a streaming platform beyond its free, ad-supported service Tubi.

“Fox made the decision to double down on the bundle a few years ago and then they’ve done surprisingly well for it,” said Nollen. “But if cord-cutting accelerates and everyone picks up streaming sports elsewhere, I just don’t understand what Fox’s plan is.”

When asked for comment, Fox referenced a quote made by Fox Corp. CFO Steve Tomsic at the Bank of America media conference in September.

“I can see a world where the ESPNs of this world do go DTC, but I’m not sure how impactful that will be for us or the entire industry,” he said. “If there is the emergence of some sort of sports bundle that is across different network providers, then the first port of call is going to be Fox in terms of people wanting to aggregate our content with their service just given how strong our sports offering is.”

Disclosure: Comcast is the parent company of NBCUniversal and CNBC.

Urban Outfitters Inc., or URBN, has been quietly building a new segment near its headquarters in Philadelphia.

Launched in 2019, Nuuly is a clothing rental subscription service that features the company’s brands Urban Outfitters, Free People and Anthropologie, as well as more than 400 other brands and designers.

URBN leaders say Nuuly further expands the company’s flagship brands, rather than diluting its wholesale profitability among customers.

“They’re getting exposure to our family of brands, and they are actually more inclined to go buy from our sister brands,” said Nuuly President and URBN Chief Technology Officer Dave Hayne.

Nuuly is set to reach profitability in its third or fourth fiscal quarter of 2023. The service has seen substantial growth in its short existence. Its revenue almost doubled year over year in URBN’s second quarter, driven by an 85% increase in active subscribers.

“In 2019, they launched with $0 in revenue. This is going to be one of the fastest kind of concepts to get to break even profitability that we’ve ever seen,” said Adrienne Yih, a consumer discretionary analyst at Barclays.

The number of users is only growing. Nuuly boasted about 198,000 subscribers as of Nov. 3, just 2,000 shy of the goal its leaders set out to achieve by the end of the fiscal year.

“Most of the timeframes that we’ve set up until now, we’ve been running ahead of,” Hayne said.

Analysts project Nuuly will add $1 billion in value to URBN over the next three to five years.

Nuuly leaders hope the momentum continues. As the platform grows, the company is opening a new $60 million facility in the Kansas City, Missouri, region in January 2024, which it says will help support upward of 600,000 subscribers.

“The goal is to triple the overall business. And Kansas City is really what allows us to do that,” Hayne said.

Though Nuuly isn’t the first rental service on the market, analysts said there’s a lot of opportunity in the nascent space.

Consumers are increasingly curious about rental. The current millennial and Gen Z generations are interested in both sustainability and newness. Of this group, 15% say they’re willing to try clothing rental and 48% are willing to buy apparel secondhand, according to a McKinsey & Company report.

The report predicts the rental industry could represent 3% of the total retail market by 2030, while re-commerce, or secondhand sales, will likely represent 12%.

Analysts said Nuuly is well-positioned because of the backing of its parent company, which has invested more than $100 million in its development and essentially sped up development by “at least three years,” Yih said.

As Nuuly rises in the industry, another company is falling. Rent the Runway’s share price has dropped about 97% since it went public in late October 2021. In its second quarter this year, the company reported $75.5 million in revenue, down 1% from the same quarter the year prior.

An industry source said this was a reflection of Rent the Runway’s performance, rather than the rental market as a whole. Other companies such as Express, Vince Camuto and Banana Republic all launched rental platforms in 2018 and 2019, though unlike Nuuly, they only offer their own labels.

While data on the emerging segment varies greatly, experts agree the potential is huge. McKinsey & Company predicts it could reach $2.1 billion by 2025.

Watch the video to learn more.

Fantasy football game on Telegram: Fanton joins Cointelegraph Accelerator

What’s a better way than combining the world’s most popular sports with Web2’s most socialized aspects to introduce new users to Web3 through gaming? Association football, or soccer, boasts the largest fan base among sports enthusiasts, with over 3.5 billion estimated people rooting for their favorite teams. Built mainly for football fans, the fantasy sports industry, a vast network of virtual sports leagues where users can create their own teams, has also grown to become a $25 billion global market.

Mixing fantasy football with blockchain features like nonfungible token (NFT) cards could create an ideal entry point to Web3 for the masses. However, current platforms present complex mechanics for newcomers, and most of them lack in-platform user interaction —a big loss considering the social aspect of fantasy football.

Soccer superstars as collectible cards

Fanton has built a fantasy football game that is integrated into Telegram to benefit from the instant messenger service’s 800 million-strong user base. It features collectible cards of top football players that earn points according to their real-life performances. These cards are issued on the blockchain as NFTs and can be easily traded among players.

The game benefits from Telegram’s recent integration with The Open Network (TON) blockchain, which enables the use of a noncustodial wallet directly from the Telegram app. Users can create a virtual football team with their cards of players, and earn points for their players’ actions in the real world.

The teams are made of five players: a goalkeeper, a defender, a midfielder, a forward and a substitute player. These players earn points based on their performances in their real-life football matches. Points are awarded for various actions, such as goals, assists and saves of goal chances by the goalkeeper. The combined score of the points equals the team score.

Tournaments are organized based on match days of real football leagues, including the English Premier League, Spanish LaLiga, German Bundesliga, Italian Serie A and the French Ligue 1. Players can partake in a special championship consisting of the most important matches from the five European leagues, the Brazilian Championship and the UEFA Champions League, the world’s most prestigious championship.

Users can join these tournaments by paying a participation fee, of which 85% is added to the prize pool while 15% goes to Fanton. Teams that score more points than others are rewarded with TON coins and collectible cards.

Fanton features soccer superstars as NFT cards. Source: Fanton

Cards are divided into rarity classes based on their scarcity, giving them value and uniqueness. Non-NFT cards are classified as common, while NFT cards can have rare, epic and legendary rarities. The game is free to play and provides common cards without charge for everyone who wants to participate. The rarer NFT cards should be purchased to take part in special NFT tournaments with higher prizes.

Fanton became a part of the Cointelegraph Accelerator program with its straightforward product that is already showing good traction in user onboarding and revenue. The Cointelegraph Accelerator team was inspired by the innovative game-in-a-messenger format, easy user onboarding and the perspective of crypto adoption via messengers. The platform has over 350,000 users and surpassed $40,000 in monthly revenue. With a seasoned team of 15 based in Spain and Indonesia, the game managed to raise $300,000 in a pre-seed round in February.

Today, October 27, 2023, Fanton launched its product on Product Hunt, a platform where users can discover and upvote new products. Fanton encourages its supporters to visit Product Hunt on Friday and upvote the product.

Horse Racing Game NEOBRED Integrates with Avalanche for Superior Web3 Gaming Experience

Layer-1 blockchain Avalanche is known for its speed, low cost, scalability, and security.

Blockchain horse racing game NEOBRED has announced that it is integrating with blockchain Avalanche to provide players with a superior gaming experience by leveraging the network’s speed and cost-effectiveness.

A spokesperson from NEOBRED said of the integration:

“We are excited to integrate with Avalanche and offer our players a new level of gaming performance and efficiency […] Avalanche’s speed, scalability, and low costs have the potential to make NEOBRED one of the most enjoyable blockchain horse racing games on the market.”

NEOBRED allows players to own, train and breed horses which they can use to take part in races and earn rewards. Finishing in the top ranks in races is a key way to win prizes in the game and so players have to choose steeds with genetic combinations ideal for a race-horse. As part of an intensive 40-turn training period, players have the chance to make strategic decisions to turn their newly minted steed into a “uniquely skilled and diverse racing-ready horse.” The training focuses on specific attributes such as speed, power, stamina, and elemental abilities.

Upon retirement, NEOBRED horses are converted into GENEs. A GENE inherits the horse’s attributes and can be paired with DNA to breed a new generation of steeds. Players have the option of taking part in the full-gaming experience from breeding to retirement or they can choose to specialize in gaming aspects like breeding, training, or racing.

Layer-1 blockchain Avalanche is known for its speed, low cost, scalability, and security. It is one of the fastest smart contract networks by time-to-finality and asserts that it uses “the same energy as only 46 US households each year.” According to NEOBRED, these features make it the ideal platform for the game because they provide players with smooth web3 gaming that does not incur trade-offs.

“We are excited to welcome NEOBRED to the Avalanche ecosystem,” said Ed Chang, Head of Gaming at Ava Labs. “NEOBRED looks like it will take a proven on-chain game model with racing to the next level by improving gameplay.”

The game is set to launch before the end of the year.

next

Blockchain News, Cryptocurrency News, News

Mercy Mutanya is a Tech enthusiast, Digital Marketer, Writer and IT Business Management Student.

She enjoys reading, writing, doing crosswords and binge-watching her favourite TV series.

You have successfully joined our subscriber list.

Web3 game project allegedly hired actors to pose as executives in $1.6M exit scam

On Oct. 10, the development team for gaming project FinSoul carried out an alleged exit scam, siphoning away $1.6 million from investors through market manipulation, according to a recent report from blockchain security platform CertiK shared with Cointelegraph.

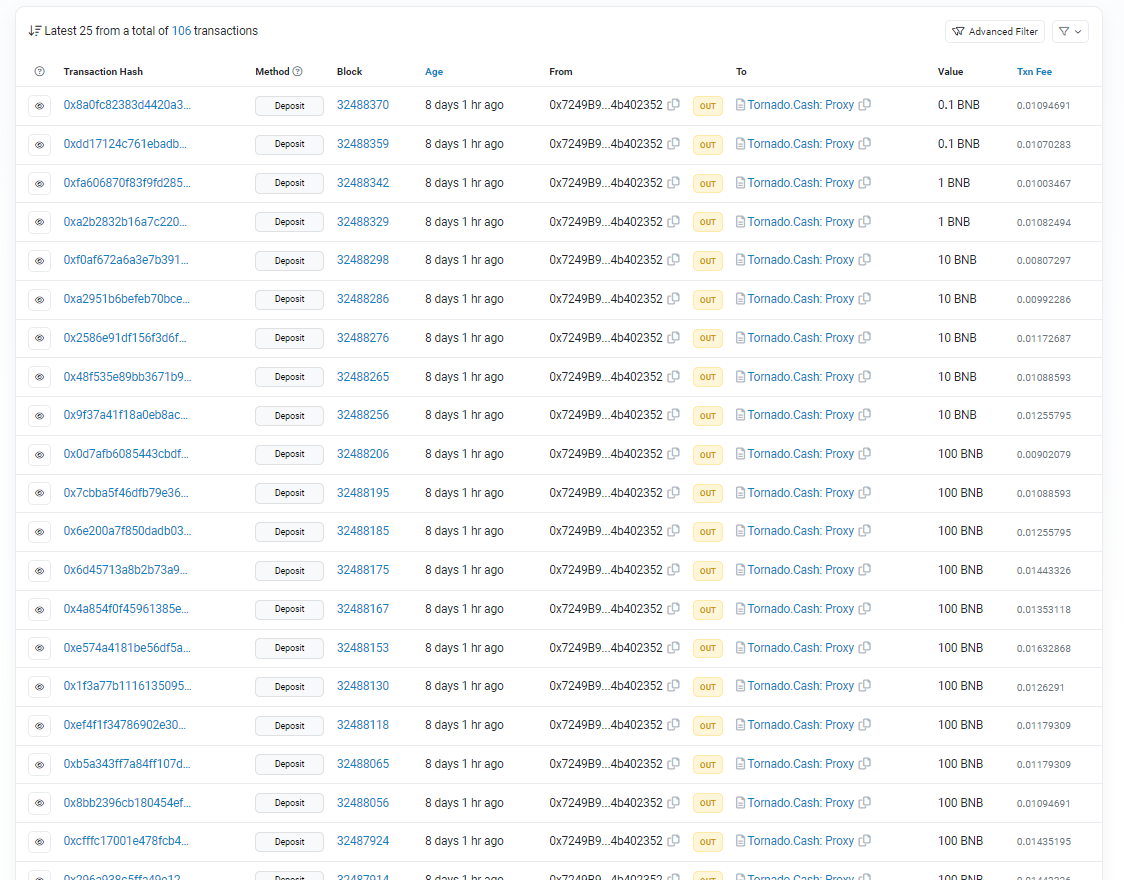

The FinSoul team allegedly hired paid actors to pretend to be its executives, then raised funds for the sole purpose of developing a gaming platform. However, instead of actually creating the platform, the FinSoul team allegedly transferred $1.6 million in bridged Tether (USDT) from investors to itself. Blockchain data indicates developers then laundered the funds through cryptocurrency mixer Tornado Cash. Surprisingly, this was not the first allegation of misconduct against FinSoul’s developers.

On May 23, decentralized finance (DeFi) project Fintoch published a press release claiming it had adopted “advanced technology to develop the FinSoul U.S.-based metaverse platform” and had gone “live.” The announcement stated that the company was using “advanced technologies such as Unreal Engine 5 and Cocos 2D” to develop “sandbox worlds, multiplayer sports, leisure experiences, player socializing, MMORPG” and other types of gaming content.

The same day, on-chain sleuth ZachXBT reported that the original Fintoch DeFi project had performed an exit scam. The team had seemingly stolen $31.6 million and bridged it to Tron blockchain in an attempt to launder the funds, ZachXBT claimed.

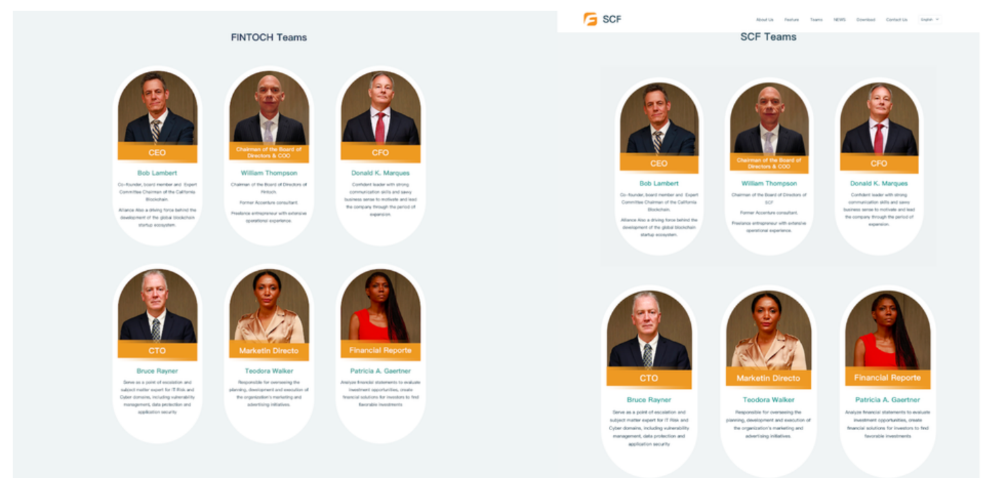

In response, CertiK claims that the team “rebranded” in August, changing its name and social channels. “Fintoch” became “Standard Cross Finance (SCF).” CertiK produced an image showing the key executives of both Fintoch and Standard Cross Finance, who appear to be identical.

CertiK claims to have verified the real names of the persons listed as the CEO, chief operating officer and chief financial officer of the project. According to it, these “executives” are actually actors who work in the entertainment industry. In addition, CertiK claims that the project’s chief technology officer was listed on a promotional poster for an entertainment company, providing evidence that he is also a paid actor. It could not determine the identities of the other two people claimed to be “executives.”

The rebranded “Standard Cross Finance” team continued to promote FinSoul on YouTube and Telegram, the report states. Its marketing efforts included a video depicting an alleged “R&D Headquarters,” later revealed to be an office building on East Hamilton Avenue in Campbell, California. It also produced a video of an alleged promotional event in Vietnam.

The team page on the Fintoch website names “Bobby Lambert” as the CEO when in reality he does not exist and is a paid actor.

Previously both the Singapore Government and Morgan Stanley issued warnings about this investment scheme. pic.twitter.com/SLxvOCPj1s

— ZachXBT (@zachxbt) May 23, 2023

According to blockchain data, the project deployed its token contract to the BNB Smart Chain network on Oct. 10. At the time of deployment, 100 million FinSoul (FSL) tokens were minted and transferred into the deployer account. The deployer then sent 3 million FSL to other accounts through multiple transactions, leaving 97 million remaining in its possession. One of the transfers was for 210,000 FSL to an address that subsequently used the tokens to create a liquidity pool for FSL on PancakeSwap. From that point on, this pool was used by traders to buy and sell FSL.

Related: Cardano stablecoin project gambled away investors’ money before rug: Report

Data from DEX Screener shows that the price of FSL was initially set at $0.3911 per token on Oct. 10 at 6:30 am UTC. Over the next few hours, it rose to $17.5774, then retreated from this peak and came to stabilize at around $5 for the next few hours. Then, between 4:30 pm and 5:00 pm UTC, the price suddenly collapsed, falling from approximately $5 to near zero.

The two events appear to have occurred between 4:25 pm and 4:35 pm UTC on Oct. 10, which may explain the sudden price decline. At 4:25 pm, the FSL deployer account transferred the remaining 97 million FSL to another address. At 4:35 pm, this account sold all 97 million tokens into the liquidity pool, moving $1.6 million worth of Binance-pegged USDT from the liquidity pool into this account. This sale represented 32.33x the amount of FSL coins that had previously been circulating. This account subsequently transferred the drained funds to Tornado Cash through a series of transactions.

According to CertiK, the Standard Cross Finance team has managed to convince investors to once again invest in its project, despite twice draining funds from investors. It has now relaunched FSL with a new token contract. At the time of writing, DEX Screener shows that the new version of FSL is valued at $1.29 per coin.

Cointelegraph contacted the Standard Cross Finance team but did not receive a response by the time of publication.

The story of FinSoul serves as a cautionary reminder that crypto investors should investigate new projects before committing funds to them. If CertiK’s report is to be believed, it implies that a scam team was able to trick investors, not just once, but twice, and is currently attempting a third fraud. Investors should remember to exercise due diligence before investing in projects that do not have a functioning blockchain project.

Related: Pond0x DEX claims $100M in trading volume as critics allege it’s a scam

“Rug pulls,” or exit scams, have posed a continuing problem in the world of decentralized finance. Arbitrum-based protocol Xirtam allegedly stole over $3 million from investors using a token sale over the summer. In this instance, Binance managed to freeze the funds and return them to users via a smart contract beginning on Sept. 6.

However, most rug-pull victims are not so lucky. In June, DeFi project Chibi Finance removed over $1 million of its users’ funds through a “panic” function, and these funds have yet to be recovered. In 2021, the PopcornSwap exit scam resulted in over $11 million in losses to investors and led to criticism of the BNB Chain development team that still continues to this day.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.