Bitcoin’s ascent beyond the $51,000 mark has propelled the Crypto Fear and Greed Index (CFGI) into the “greed” territory, registering a notable 74 out of 100. Just a day earlier, the CFGI soared to an impressive peak of 79, denoting “extreme greed” and marking its highest point since 2021. Crypto Fear and Greed Index Score […]

Bitcoin’s ascent beyond the $51,000 mark has propelled the Crypto Fear and Greed Index (CFGI) into the “greed” territory, registering a notable 74 out of 100. Just a day earlier, the CFGI soared to an impressive peak of 79, denoting “extreme greed” and marking its highest point since 2021. Crypto Fear and Greed Index Score […]

Source link

highs

Quick Take

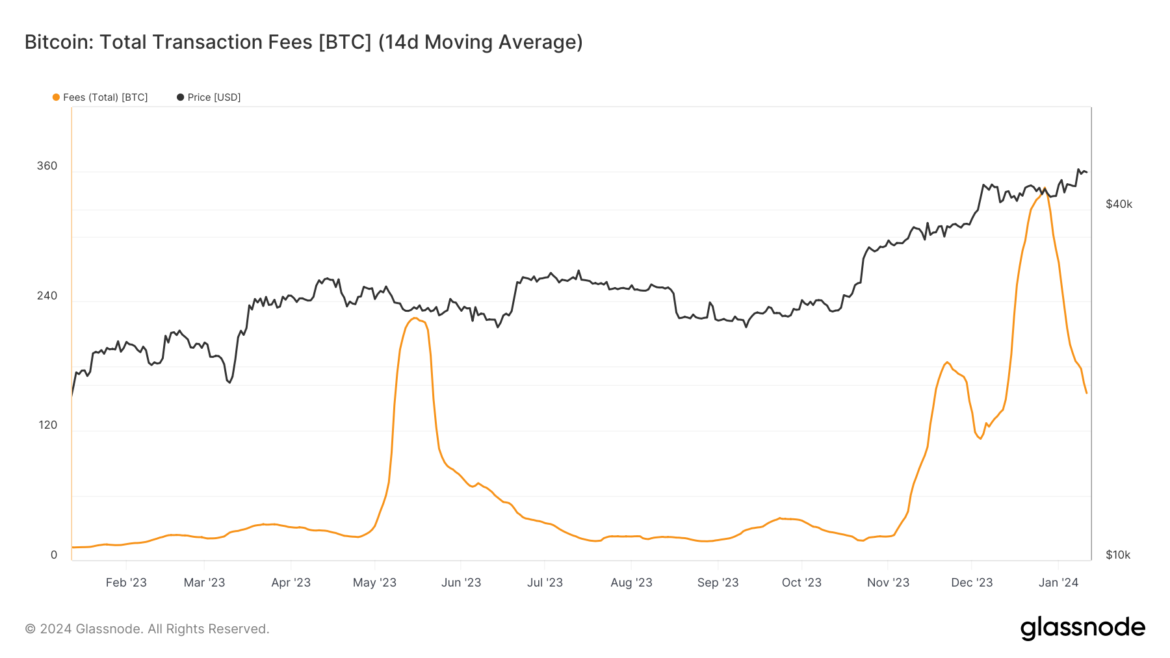

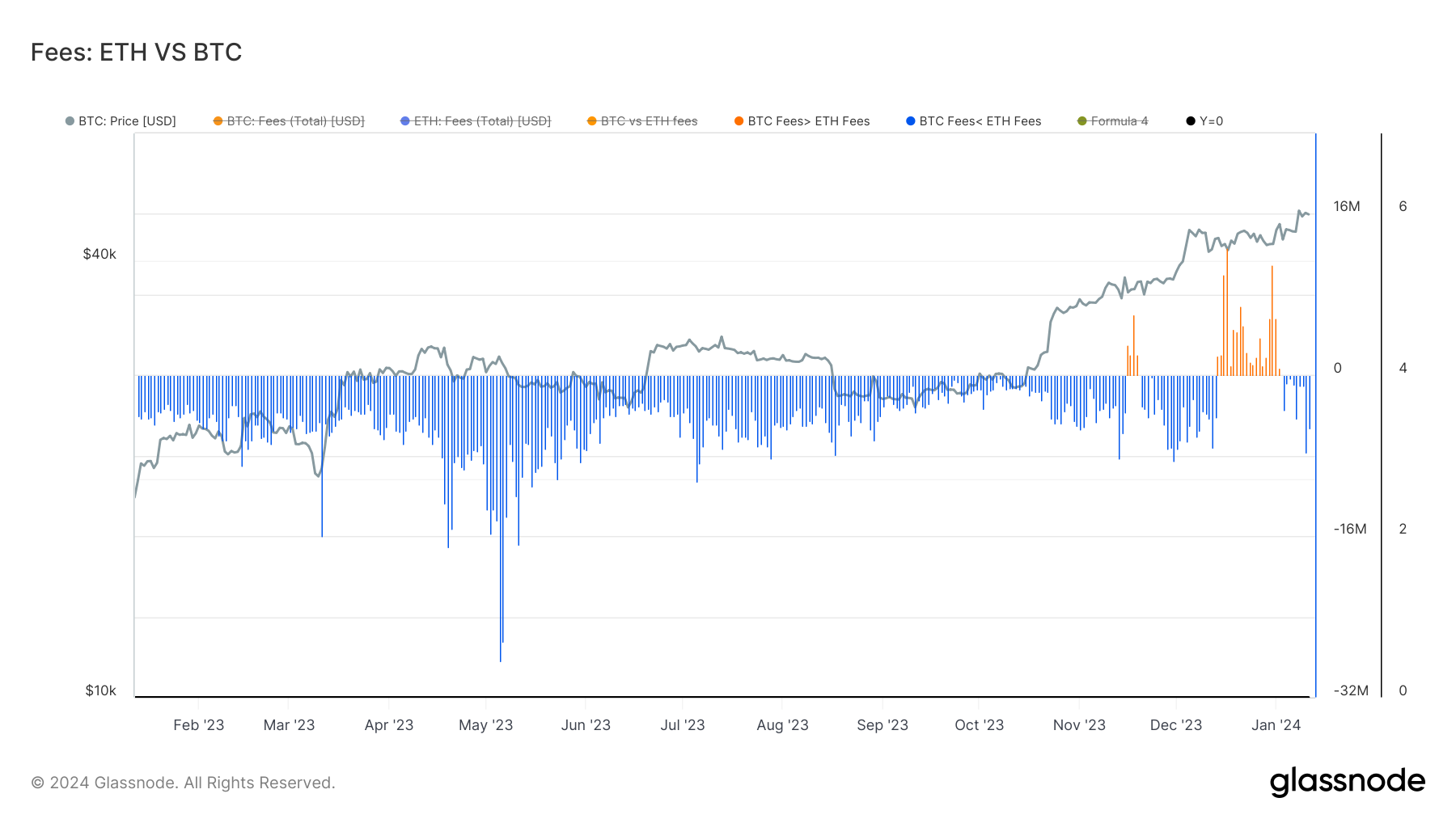

A marked shift in Bitcoin’s fee structure has become noticeable as the digital asset continues to fluctuate. Bitcoin’s fees have seen a significant decrease of 50% from the peak of its recent mini-bull run.

In numerical terms, by the end of Dec. 2023, the total amount paid to miners in fees stood at approximately $15 million, which has dwindled to around $7 million. This scenario suggests that we are in slightly uncharted territory, just above the zenith of the “inscription frenzy” observed in May 2023.

The proportion of miner revenue derived from fees, calculated as fees divided by the sum of fees and minted coins, currently sits at about 14%, a drop from its peak of 25%. While Bitcoin exhibits these changes, Ethereum’s fees have maintained a steadier course, consistently outpacing Bitcoin’s since Jan. 3.

These contrasting trends in fee structures highlight the unique dynamics between Bitcoin and Ethereum, further underlining the necessity for investors and miners to monitor and consider such factors closely in their strategic decision-making.

The post Bitcoin’s miner fee revenue plummets by 50% from recent highs appeared first on CryptoSlate.

Ethereum Price Retreats From Highs But Technicals Suggest Upside Continuation

Ethereum price is correcting gains from the $2,440 zone. ETH is correcting gains, but the bulls might remain active near the $2,300 and $2,240 support levels.

- Ethereum is correcting gains and trading below the $2,400 level.

- The price is trading above $2,320 and the 100-hourly Simple Moving Average.

- There is a bullish flag forming with resistance near $2,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if there is a close above the $2,400 level.

Ethereum Price Remains Supported

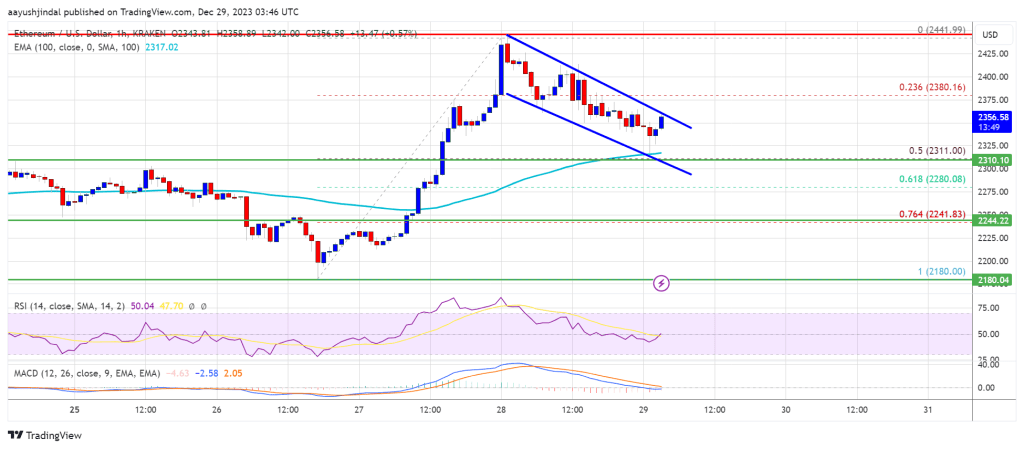

Ethereum price climbed higher above the $2,320 resistance zone. ETH even broke the $2,400 level before the bears appeared. A high was formed near $2,441 before the price started a downside correction, like Bitcoin.

There was a move below the $2,400 and $2,380 levels. The price declined and tested the 50% Fib retracement level of the upward wave from the $2,180 swing low to the $2,441 high. The bulls seem to be active near the $2,320 support zone.

Ethereum is now trading above $2,320 and the 100-hourly Simple Moving Average. On the upside, the price is facing resistance near the $2,360 level. There is also a bullish flag forming with resistance near $2,360 on the hourly chart of ETH/USD.

Source: ETHUSD on TradingView.com

The first major resistance is now near $2,400. A close above the $2,400 resistance could send the price toward $2,440. The next key resistance is near $2,500. A clear move above the $2,500 zone could start another increase. The next resistance sits at $2,620, above which Ethereum might rally and test the $2,750 zone.

More Losses in ETH?

If Ethereum fails to clear the $2,400 resistance, it could continue to move down. Initial support on the downside is near the $2,320 level and the 100 hourly SMA.

The first key support could be the $2,240 zone or the 76.4% Fib retracement level of the upward wave from the $2,180 swing low to the $2,441 high. A downside break and a close below $2,240 might start another major decline. In the stated case, Ether could test the $2,165 support. Any more losses might send the price toward the $2,120 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now near the 50 level.

Major Support Level – $2,320

Major Resistance Level – $2,400

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Oil prices pull back from December highs, end lower as traders monitor Red Sea developments

Oil futures on Wednesday pulled back from December highs, ending lower as investors continued to monitor developments in the Red Sea amid worries over potential disruptions to crude shipments.

Price action

-

West Texas Intermediate crude for February delivery

CL00,

-0.34% CLG24,

-0.34% CL.1,

-0.34%

fell $1.46, or 1.9%, to close at $74.11 a barrel on the New York Mercantile Exchange. -

February Brent crude

BRNG24,

-0.39% ,

the global benchmark, declined $1.42, or 1.8%, to settle at $79.65 a barrel on ICE Futures Europe. -

On Nymex, January gasoline

RBF24,

-0.52%

fell 0.2% to end at $2.155 a gallon, while January heating oil

HOF24,

-0.03%

declined 1.7% to $2.624 a gallon. -

January natural gas

NGF24,

+2.35%

rose 2.7% to finish at $2.619 per million British thermal units.

Market drivers

Oil rose to December highs on Tuesday after Yemen’s Iran-backed Houthi rebel militia claimed responsibility for both a missile attack against the containership MSC United VIII and an attempt to attack Israel with drones.

The attacks rattled investors and came after the U.S. last week announced the formation of a naval coalition to address attacks in the region. Crude prices initially saw pressure on Tuesday after shipping company Maersk

MAERSK.A,

MAERSK.B,

over the weekend said it would resume shipments via the Red Sea.

The concerns saw WTI face clear resistance in the $74-$75 per barrel range on Tuesday, though the “bullish market reaction” looks relatively weak given the potential for disruption, said Ipek Ozkardeskaya, senior analyst at Swissquote Bank, in a note.

Meanwhile, demand concerns also loom over the market, particularly in China where strong demand over the first nine months of the year has started to moderate, said Rebecca Babin, senior energy trader at CIBC Private Wealth U.S., in a note.

“The market expects that approximately 800,000 of the 1.2-1.6 million barrels-per-day growth next year will come from China, with jet fuel leading the charge,” she wrote. “The lack of confidence in China’s economy in 2024 remains the market’s biggest concern followed by fear that U.S. production will continue to beat estimates as it did in 2023.”

The cautious sentiment, however, creates a low bar for positive surprises in 2024, Babin said, in contrast to a 2023 where expectations of massive inventory draws were too hard to live up to.

On the charts, a bearish “death cross” pattern appeared Tuesday, with the 50-day moving average for WTI crossing below the 200-DMA.

The 50-DMA is a widely followed short-term trend tracker, while many view the 200-DMA as a dividing line between longer-term uptrends and downtrends. So a death cross is seen by many Wall Street chart-watchers as marking the spot where a shorter-term pullback transforms into to a longer-term downtrend.

See: Crude oil sees first real ‘death cross’ since the pandemic plunge of early 2020

History Says This Is the Best Way to Invest With Stocks at All-Time Highs

2023 has been a momentous year for the stock market. The Dow Jones Industrial Average (^DJI -0.05%) reached new all-time highs in mid-December. The S&P 500 is within spitting distance of its own record level, and the Nasdaq Composite isn’t far off.

If you’ve remained invested in the stock market throughout the past few years, then 2023 has provided more proof of what history has said countless times before: After bear markets and other significant market downturns, stocks have always recovered and rewarded long-term investors. But for many who lost confidence in stocks during 2022’s bear market, 2023 has been frustrating, because it has shown how selling stocks at their lows can ultimately prove counterproductive.

Regardless of whether you have a stock-heavy portfolio or are just now thinking about investing in stocks, a look back at the past can reveal a lot about what the best strategy is when stocks are at all-time highs. It’s not complicated, and many long-term investors will find that they don’t have to change a thing about what they’re doing in order to remain successful well into the future.

Image source: Getty Images.

What bull market history has to say

When you look back at past bull markets, you can see that on many occasions, stocks continue to gain ground even after they’ve made big moves to return to all-time highs. After the financial crisis in 2008 and 2009, it took the S&P 500 until March 2013 to surpass its old high from 2007 and hit new record levels. Some investors suggested that after such an impressive recovery, it would be smart to take some money off the table.

Yet what happened after that was a nearly seven-year run of success, with the S&P continuing to rise and set records consistently on dozens of occasions between that first new all-time high and early 2020. By the end, the index had more than doubled from its record close in March 2013.

The same thing happened after the lightning bear market at the beginning of the COVID-19 pandemic. After plunging in February and March 2020, markets recovered quickly, and the S&P returned to record levels that August. Again, some felt it prudent to reduce stock exposure at that point, yet the S&P climbed another 40% between August 2020 and January 2022 before the most recent bear market began.

Admittedly, there have been occasions when stocks recovered to record levels just to fall again. After the tech bubble burst in 2000 through 2002, it took the market seven years to reach new records. Yet the S&P only rose another few percent before the financial crisis took hold.

The right strategy for right now

With history as background, there are several things to consider with markets at all-time highs. The right way to approach things right now depends a lot on your particular situation.

If you still have a long time horizon before you’ll need the money that you’re investing, then there’s little reason to pay attention to the ups and downs of the market. Keep saving and consistently invest more into stocks, and you’ll benefit from what have historically been superior returns.

If it took all your discipline to avoid selling stocks at 2022’s bear market lows, then pat yourself on the back for having outlasted the downturn. However, look critically at your asset allocation. Did you overestimate your ability to weather a severe bear market? If so, consider a more conservative investing approach. That doesn’t mean selling all your stocks right away, but it could mean shifting a percentage out of the market into other asset classes like bonds and cash.

Similarly, if you’re retired and have been spending down your cash cushion in order to avoid having to sell stocks at lows, then now’s a good time to consider replenishing your cash reserves. Again, you don’t necessarily want to sell a huge amount right now, but taking steps to give yourself the balance you want is essential for the success of your long-term strategy.

On the other hand, if you’ve been out of the market, you might think now’s the worst time to invest. Yet the smart move is still to make some stock purchases, perhaps through a dollar-cost averaging strategy that ensures all of your money won’t go in at the absolute top if a market downturn is on the way.

A final thing to consider

Lastly, bear in mind that just because the Dow Jones and other indexes are at or near all-time highs, many individual stocks remain far below their record levels. Indeed, it’s the very fact that many stocks are still playing catch-up at the end of a bear market that often keeps driving market indexes higher.

All-time highs are exciting, but they shouldn’t have a huge impact on your investing. By keeping an even keel and not letting headlines affect you too much, you’ll be in a better position to reap the true rewards that await those with a long-term investing mindset.

Polygon has seen some sharp uptrend during the past day and has now broken above $0.85. Here’s why this break could pave the way for a further rally.

Polygon Has Risen By More Than 6% During The Past 24 Hours

After topping above the $0.94 mark earlier in the month, MATIC had gone on to register some significant drawdowns. In the last few days, though, the asset appears to have hit a bottom around the $0.75 level, as it hasn’t gone below the mark yet.

Something that could add further evidence for this is the fact that bullish momentum has returned for Polygon in the past day, as its price has shot up over 6%.

The below chart shows how the cryptocurrency has performed during the past month:

Looks like MATIC has sharply risen in the past day | Source: MATICUSD on TradingView

With this sharp surge, the cryptocurrency has recovered back above the $0.85 mark. This break could turn out to be significant for Polygon if on-chain data is anything to refer to.

MATIC Has Broken Past A Major Resistance Zone With The Latest Surge

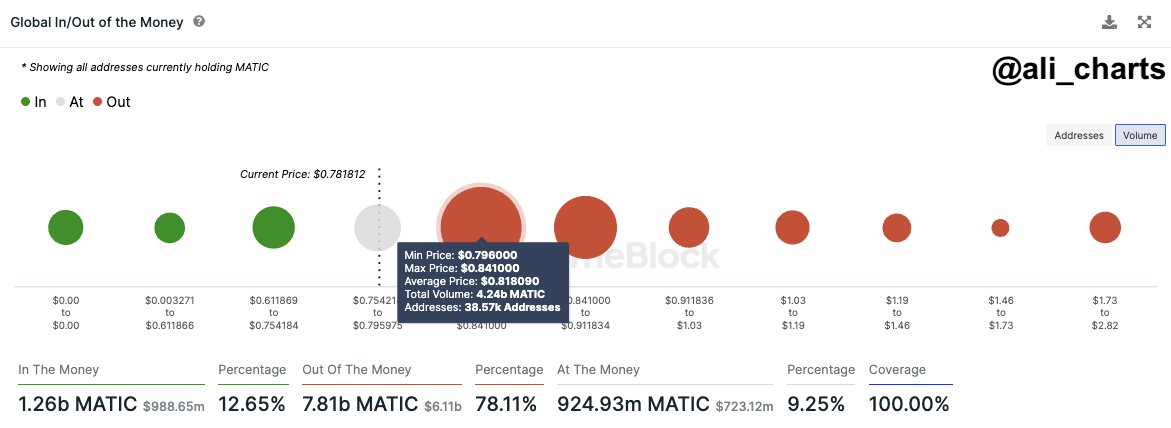

In a post on X, analyst Ali discussed about how Polygon was about to face a major test of on-chain resistance. When the analyst had made the post, the coin was still trading around the $0.78 mark.

Here is a chart that shows how the on-chain support and resistance levels looked like at the time of the post:

The different MATIC price ranges based on the density of cost basis | Source: @ali_charts on X

In on-chain analysis, the potential of any price range to act as support or resistance depends on the number of coins that the investors purchased inside the particular range.

This is because of the fact that holders are more likely to react whenever the price retests their cost basis or acquisition price, as such a retest can flip their profit-loss condition. The more addresses that have their cost basis inside a particular range, the stronger the market reaction when the price retests said range.

From the chart, it’s visible that Polygon’s price had been trading just under the $0.79 to $0.84 range at the time Ali had made the post. This range carried the cost basis of around 38,570 addresses, which bought 4.24 billion MATIC at it.

Generally, whenever the investors are in a loss (as these holders would have been when MATIC was trading under the range), there is a chance that they sell when the price retests their cost basis since they might get desperate to exit the market and break-even would sound like a good opportunity to do so.

As a result of this, price ranges above the spot price that are dense with investors can provide resistance to the cryptocurrency. This had made the aforementioned thick $0.79 to $0.84 range important for Polygon. “For MATIC to embark on a journey to new heights, it’s crucial to break through this level with conviction,” the analyst noted in the post.

Following the latest surge, MATIC has clearly surged past this major obstacle. And as is visible in the graph, there aren’t any ranges this difficult to break anymore, either. It now remains to be seen how the Polygon price develops from here, given the lower on-chain resistance at the levels above.

Featured image from Shutterstock.com, charts from TradingView.com, Santiment.net

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Why Fed Policy Will Push Bitcoin and Gold to New Highs after Spot BTC ETF Approval

Novogratz is not the only expert who expects Bitcoin price to skyrocket soon. One of the main reasons is that long-term holders are not selling off their positions

According to Michael Novogratz, founder of digital asset management company Galaxy Digital, things may soon change for other stores of value like gold and Bitcoin (BTC) as the United States Federal Reserve changes course. In a Bloomberg interview, Novogratz shared optimism for these assets based on expectations that the Fed will become less aggressive with its policies.

Since it looks like the Fed is shifting from tough tightening policies, Novogratz believes the US central bank will spark an increased willingness among investors to take on more risks across various markets. Also, the US dollar has already shown declines as traders anticipate future Fed rate cuts in prices.

Economically, Novogratz sees meaningful slowing in the US early next year, clearing the way for Fed rate cuts by mid-2024. Recent dollar weakness could show a long-term change as well. Despite the shifting situation, Novogratz stays strongly positive on Bitcoin (BTC), especially if Wall Street giants like BlackRock or Fidelity join the physically backed ETF train.

For Bitcoin, Novogratz notes some possible supports, including physically-backed ETF approvals, less selling activity from long-term holders, and reduced creation of new coins which will be introduced by the upcoming halving event next year. Under this situation, he believes Bitcoin could go beyond its old all-time highs next year.

Novogratz is not the only expert who expects Bitcoin prices to skyrocket soon. One of the popular reasons is that the long-term holder is not selling off their positions for the belief that the crypto will soon experience a bull run and the expectation of more bullish price potential, especially because the coin has not reached its full potential. His belief that the approval of the physically back ETFs will also drive the price up is agreed upon by many analysts, especially because the acceptance is expected to drive hundreds of billions of dollars into the BTC market, seeing that major financial giants like Black Rock and Fidelity are also involved.

How Other Currencies Could Fare, According to Michael Novogratz

Novogratz’s negative forecast for the US dollar is also based on weaker US growth and interest rate direction. However, he sees Euro, Australian dollar, and Brazilian real doing well if the dollar remains weak. The expert also sees upside potential for gold if prices stay above $2,000 for some weeks. Additionally, silver could surge even higher as shortages stoke demand. However, Novogratz maintains a gloomy outlook for China’s yuan, given disappointing economic data.

Commenting on the crypto sector overall, Novogratz said most fraudulent projects were removed during the 2022 decline as markets and regulators effectively eliminated bad actors. They are also ensuring existing projects are fully compliant with regulations and any wrongdoing is punished, as evident in the recent Binance and its CEO’s cases. The way regulators and relevant government agencies have handled cases of fraud within the industry has also been highly commendable.

next

Bitcoin News, Blockchain News, Cryptocurrency News, Market News, News

You have successfully joined our subscriber list.

Dow Jones ends slightly lower as stocks struggle for direction after hitting nearly 4-month highs

U.S. stocks closed with small losses on Monday, with the Dow Jones Industrial Average and S&P 500 pulling back from their strongest levels since early August, as investors awaited a busy week of economic data.

What happened

For all of last week, the Dow Jones rose 1.3% to reach its highest close since Aug. 7, while the S&P 500 advanced 1% to its highest since Aug. 1 and the Nasdaq Composite gained 0.9%. Activity was thin, with U.S. markets closed last Thursday for the Thanksgiving Day holiday followed by an abbreviated…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

3 Rock-Solid Dividend Stocks That Just Raised Their Payouts To Record Highs

Oftentimes a stock has a high yield simply because it has recently underperformed the stock market. But many of the best dividend stocks combine dividend raises with capital gains, giving investors a source of passive income and access to the risks and potential rewards of the stock market.

Microsoft (MSFT -0.11%), Emerson Electric (EMR -0.37%), and Hubbell (HUBB 0.27%) are three dividend stocks that don’t sport the highest yields. But Microsoft and Hubbell have trounced the S&P 500‘s performance over the last five years, while Emerson blends an ultra-reliable yield with slow and steady growth.

Here’s why all three stocks are worth buying now.

Image source: Getty Images.

Microsoft remains very committed to its dividend

Daniel Foelber (Microsoft): Today folks think of Microsoft as a tech giant with massive growth potential, not a dividend stock. After all, Microsoft yields just 0.8%. But Microsoft’s low yield is the result of its outperforming stock price, not a lack of commitment to dividend raises.

In fact, Microsoft has raised its dividend for 20 consecutive years. In Q1 of fiscal 2024, its most recent quarter, it paid a $0.75 per share dividend. The distribution marked an all-time high quarterly dividend and an over-10% increase from its prior dividend.

Five years ago Microsoft was trading around $100 a share. If the stock had gone nowhere, the company’s forward yield would have been 3% today, not 0.8%. Microsoft provides a good lesson that a low yield isn’t indicative of a bad dividend stock, and is sometimes just due to a strong performance. Investors would surely trade a near four-fold increase in their Microsoft investment in five years for a lower yield.

Microsoft is up a staggering 57.5% year to date. The gain has far outpaced the company’s earnings growth. As a result, Microsoft’s price to earnings (P/E) ratio has ballooned to 36.6 — well above its five-year median P/E ratio of 31.4. This is a sign that the market is pricing in higher future growth and is willing to pay a higher price for the stock today, even if its current earnings have yet to reflect that growth.

Microsoft isn’t cheap. But the company is nothing short of a cash cow. It has more cash on its balance sheet than debt, and has a business model capable of supporting dividend raises no matter the market cycle. What makes Microsoft a unique investment is that the stock has tons of upside potential from its legacy businesses, its growing cloud business, and artificial intelligence (among other things). But even if the stock stalls, investors can count on sizable dividend raises.

There aren’t too many companies out there with the financial muscle and market positioning of Microsoft that have plenty of cash flow to fund buybacks, dividend raises, and expensive research and development budgets, and still have plenty of money left over. Add it all up, and Microsoft is an excellent choice for risk-tolerant investors looking for a company’s commitment to its dividend rather than a high yield today.

Emerson Electric can charge your passive income stream

Scott Levine (Emerson Electric): Raising its payout for 66 consecutive years, Emerson Electric is a Dividend King that’s as steady as they come. It’s no small feat for a company to achieve a record such as this, and it doesn’t seem like Emerson Electric, a leading provider of electrical solutions, will fail to extend its streak in 2024. For those looking to fortify their portfolios with a tried-and-true income stock, Emerson Electric — along with its 2.4% forward-yielding dividend — is a worthy consideration.

While companies will placate shareholders with hefty payouts, jeopardizing their financial wellbeing in the process, Emerson Electric takes a more judicious approach. Over the past 10 years, Emerson Electric has averaged a conservative payout ratio of 57.8%. The company’s strong free cash flow provides further evidence that the dividend is not imperiling its financial health. From 2020 through 2022, Emerson Electric generated annual average free cash flow of $2.6 billion, and it returned $1.2 billion on average to shareholders in the form of dividends.

A strong backlog further buttresses the bull case for Emerson Electric. The company recently reported that its backlog stands at $6.6 billion at the end of fiscal 2023, having climbed 12% year-over-year — and that’s not including any backlog associated with AspenTech, which Emerson Electric acquired in 2022. AspenTech occupies a valuable place in Emerson Electric’s portfolio. In 2023, for example, Emerson Electric reported earnings per share of $3.72, of which AspenTech contributed $0.27, and AspenTech contributed $305 million in free cash flow.

A rising dividend signals management’s confidence in its growth outlook

Lee Samaha (Hubbell): Electrification and utility solutions company Hubbell recently raised its dividend to a record $1.22 a quarter. While the current yield of 1.62% isn’t anything to write home about, the 9% increase in the dividend payout is an indication of the underlying strength of the business.

In a nutshell, Hubbell is a play on the electrification of the economy. It’s a compelling trend driven by the ongoing need to replace and upgrade existing transmission and distribution networks. At the same time, the growth of renewable energy, electric vehicles, the Internet of Things, and other technologies that require electricity to function is adding new sources of demand.

These solutions are known as being in “front of the meter” and are sold through its utility solutions segment, responsible for 58% of sales in 2022. They also include smart meters and control devices that manage how energy and data are transferred between utilities and operators — likely to be a growing market given advancements in smart technology.

The other segment, electrical solutions (accounting for 42% of sales in 2022), has “behind the meter” solutions that help operators and industrial customers operate their energy infrastructure efficiently.

The positive momentum in its business can be seen in the increase in management’s expectations for organic sales growth of 7% in 2023 from an initial estimate of 4%-6%. Management said its transmission end market has robust in the third quarter, and is seeing strength in renewables and data centers that more than offsets softness in telecom and consumer markets. Wall Street analysts are expecting another year of high-single-digit revenue growth in 2024, and given the strength in the electrification-of-everything megatrend, Hubbell could be set for growth for many years to come.

1 Top Dividend Chip Stock Down 20% From All-Time Highs — Time to Buy?

Microchip Technology‘s (MCHP -1.21%) 2024 fiscal year (the 12-month period that will end in March 2024) is suddenly turning ugly, but the stock is holding up pretty well considering. Share prices are down 20% from all-time highs reached a couple of months ago, but actually rallied slightly after management offered a not-so-great outlook for the closing months of calendar year 2023.

The reason? Microchip has gotten itself in excellent shape after a spate of rapid and profitable growth in the last couple of years, and it’s a top dividend stock that has managed many downturns before. Is it a buy now?

A top all-weather chip stock

Microchip is a top provider of microcontrollers (a type of processor that controls a specific function in a piece of equipment), analog chips (sensors), and “total solutions” spanning computing systems and integrated software. Its customers slant heavily toward industrial (41% of revenue), data center (19% of revenue), and automotive (17% of revenue) businesses.

Perhaps you’ve heard, besides booming AI chips from the likes of Nvidia, and the PC and smartphone market finally bottoming and heading toward a long-awaited rebound, industrial-focused chips like what Microchip specializes in are headed for a downturn after holding up particularly well during the bear market.

Indeed, revenue growth has been impressive, soaring nearly 70% higher since the start of 2021 as industrial automation and automotive technology has been in high demand. And like in the last couple of quarters, even as some of its peers reported weakening sales, Microchip once again reported revenue growth in Q2 fiscal 2024 (the three months ended September 2023) of 8.7% year over year to $2.27 billion.

The problem, though, is guidance as the current industrial chip downturn has finally come for Microchip too. Management guided for a 14% year-over-year sales decline for the quarter that will end this December. Customers are in cash-conservation mode as interest rates have spiked this year, and many are asking Microchip to cancel or delay orders.

However, Microchip’s end markets have always been cyclical, and this time looks no different. This was my favorite quote from CEO Ganesh Moorthy on the earnings call:

Our experience from prior cycles is that at this stage of the cycle, customers tend to overcorrect their inventory and backlog due to their business uncertainty, combined with the availability of product with very short lead times. This is, in effect, the flip side of what we saw during 2021 and 2022, when demand was historically strong and seemingly insatiable.

In other words, customers are in a panic right now, just as they were in a panic to buy every chip they could two years ago. The cycle will repeat, and Microchip expects its long-term growth trajectory (average annual revenue growth of 10% to 15% through fiscal year 2026) to persist.

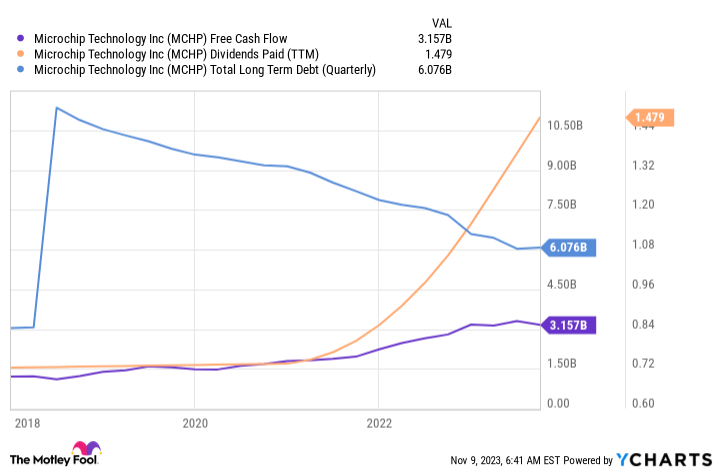

Microchip is great for growth and income

Microchip has a long track record of remaining highly profitable even during downturns. In fact, though it expects sales to temporarily retreat next quarter, its outlook for adjusted operating profit margins remains north of 41%.

With the exception of those few cyclical bumps, free cash flow generation has been steadily on the rise over the years. This has allowed the company to aggressively pay down debt from a big acquisition in 2018, repurchase plenty of stock ($340 million worth last quarter alone), and increase the dividend payout.

Data by YCharts.

Wall Street analysts are figuring a mid-single-digit earnings per share (EPS) decline is in the works for the current fiscal year. I agree. But it’s too soon to tell what next year (calendar year 2024 and into 2025) will look like. I’m figuring for a resumption of growth before too long, given AI (read “automation,” a way for businesses to save money) and the digitization of autos is continuing to expand at a rapid pace.

With this as an assumption, I plan on continuing to accumulate shares of Microchip during this downturn through the dollar-cost averaging plan I have in place. Shares trade for just under 17 times trailing-12-month EPS and 13 times trailing-12-month free cash flow. It looks like a very reasonable valuation for a top semiconductor company that I expect will enjoy secular growth propelling it forward for many years to come.

Nicholas Rossolillo and his clients have positions in Microchip Technology and Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.