The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

Source link

hour

Grayscale wins court battle against SEC; Bitcoin jumps 6% within first hour after ruling

In a landmark ruling on August 29, 2023, the United States Court of Appeals for the District of Columbia Circuit vacated an order from the Securities and Exchange Commission (SEC), granting Grayscale Investments LLC a long-awaited victory in its lawsuit over the conversion of its Bitcoin Trust into a spot Bitcoin exchange-traded fund (ETF).

The SEC rejected Grayscale’s initial application to convert the Grayscale Bitcoin Trust to a spot Bitcoin ETF on June 29, 2022. Grayscale argued that the SEC acted “arbitrarily and capriciously” in rejecting spot Bitcoin ETF applications, especially considering it had approved Bitcoin futures ETFs. Grayscale claimed that the SEC violated the Securities Exchange Act with its “unfair discrimination” against spot Bitcoin ETF issuers.

Bitcoin (BTC) experienced a 6% percent bump on the news before retracting slightly to around 5%.

Broader implications

The ruling is not only a significant victory for Grayscale but also holds profound implications for the backdrop of future spot Bitcoin ETF applications. As previously reported by CryptoSlate, the court’s decision on the lawsuit could dictate the fate of the string of spot Bitcoin ETF applications filed earlier this year.

Grayscale’s argument centered around the SEC’s disparate treatment of spot and futures Bitcoin ETFs, despite both posing similar risks and being priced based on the same underlying spot markets. In contrast, the SEC contended that spot Bitcoin ETFs are more susceptible to manipulation and fraud because the underlying spot market remains unregulated. The SEC further argued that the regulated Chicago Mercantile Exchange, where Bitcoin futures ETFs trade, has sufficient safeguards against fraud and manipulation.

Responding to the court ruling, Grayscale CEO, Michael Sonnenshein, expressed gratitude to the firm’s investors for their support and encouragement via a tweet. He also indicated that Grayscale’s legal team is actively reviewing the Court’s opinion.

The court’s decision, regardless of the outcome, was crucial for all those looking to issue spot Bitcoin ETFs in the U.S. Had Grayscale lost, the firm could have called for an “en banc” hearing, where all judges of the D.C. Circuit would weigh in on the case. Alternatively, they could have appealed the decision in the Supreme Court. Now, with this ruling in Grayscale’s favor, the firm sees a significant win, and the future for spot Bitcoin ETF issuers in the U.S. may have just brightened.

The U.S. Securities and Exchange’s (SEC) lawsuit against Binance wiped off over $200 million within one hour from crypto traders who held positions on the market.

Following the news, CryptoSlate’s data showed that the total market cap of digital assets declined 2.87% to $1.12 trillion.

Nearly $300M in the last 24 hours

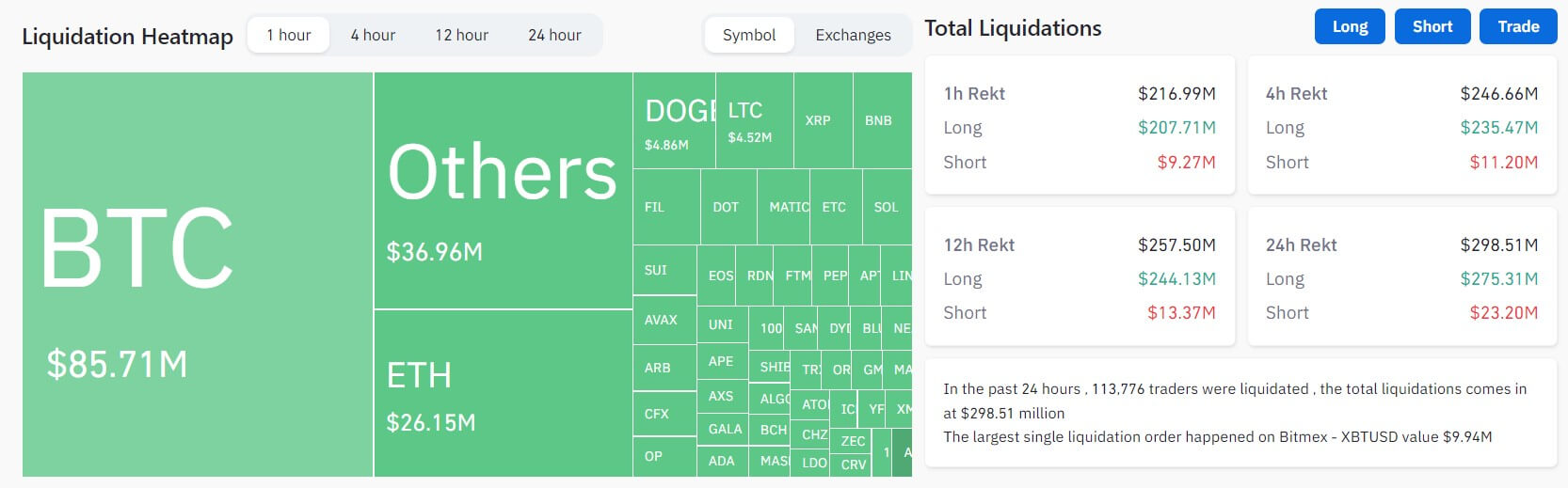

The crypto market saw $298.51 million liquidated in the past 24 hours, with more than 110,000 traders affected.

Data from Coinglass showed that long traders lost $275.31 million, with Bitcoin and Ethereum accounting for $130.46 million of these losses.

Meanwhile, short traders experienced $23.2 million in liquidations. The top two digital assets were responsible for around 49.5% of these losses.

Other assets such as BNB, Chainlink, XRP, Litecoin, and Solana experienced less than $2 million in liquidations, respectively.

Across exchanges, most of the liquidations occurred on OKX, Binance, and ByBit. These three exchanges accounted for 75% of the overall liquidations, with 92% being long positions. Other exchanges like Huobi, Deribit, and Bitmex also recorded a sizeable amount of the total liquidations.

The most significant liquidation occurred on Bitmex – XBTUSD, valued at $9.94 million.

Red market

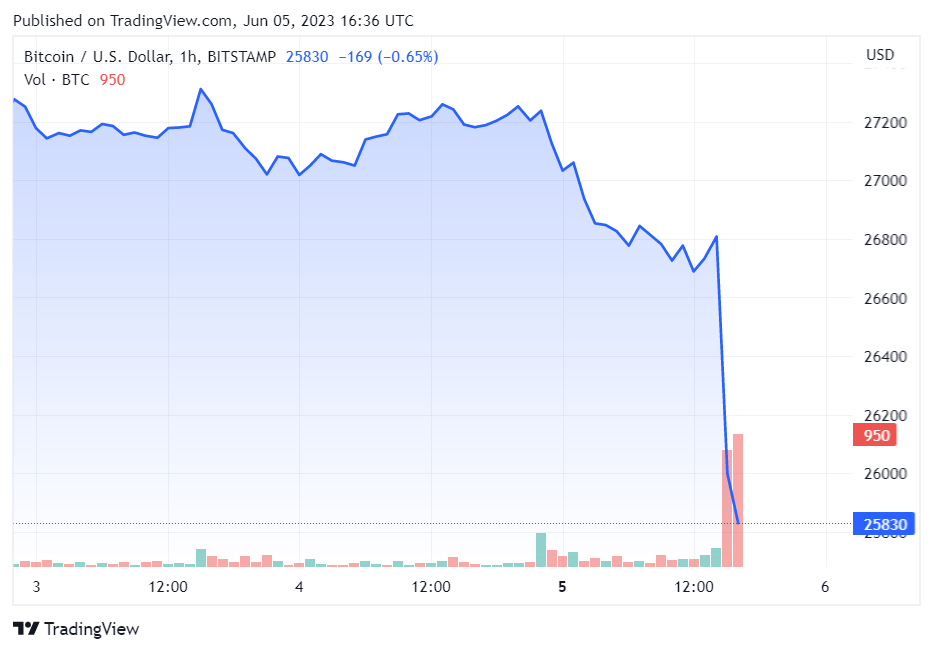

Bitcoin dipped from over $27,000 to below $26,000 within one hour and was trading at $25,859 as of 16:36 UTC — its lowest value since March 17, according to CryptoSlate’s data.

The price of Bitcoin is down overall by almost 5% over the past 24 hours.

Binance-related BNB saw the highest loss, plunging by nearly 10% to $281, while Ethereum (ETH) fell 3%. Other top digital assets like XRP, Cardano (ADA), Dogecoin (DOGE), and others also reported significant losses during the reporting period.

The post Liquidations surpass $200M in 1 hour after SEC’s Binance lawsuit appeared first on CryptoSlate.