There was a time when the S&P 500 reaching record highs without any help from Apple Inc. was almost unthinkable. But those days are over, at least for now.

Source link

influence

Charles Hoskinson Signals Alert of Legacy Finance’s Creeping Influence in Crypto

In a video address, Charles Hoskinson casts a spotlight on the advance of traditional financial mechanisms into the realm of cryptocurrency, warning that the essence of digital currencies is at stake. Charles Hoskinson Warns of Crypto’s Creeping Centralization In a recent video titled “Legacy is Eating Crypto,” Charles Hoskinson, the co-founder of Ethereum and Cardano, […]

In a video address, Charles Hoskinson casts a spotlight on the advance of traditional financial mechanisms into the realm of cryptocurrency, warning that the essence of digital currencies is at stake. Charles Hoskinson Warns of Crypto’s Creeping Centralization In a recent video titled “Legacy is Eating Crypto,” Charles Hoskinson, the co-founder of Ethereum and Cardano, […]

Source link

The COVID-19 pandemic, rampant inflation and regional conflicts directly influenced Bitcoin’s (BTC) drop in value over the past two years. However, 2024 promises to be a resurgent period, according to Blockstream CEO Adam Back.

The cryptographer, who pioneered the proof-of-work algorithm applied in Bitcoin’s protocol, tells Cointelegraph that the preeminent cryptocurrency is trailing below the historical price trend line of previous mining reward halving events.

“Biblical” events hurt Bitcoin

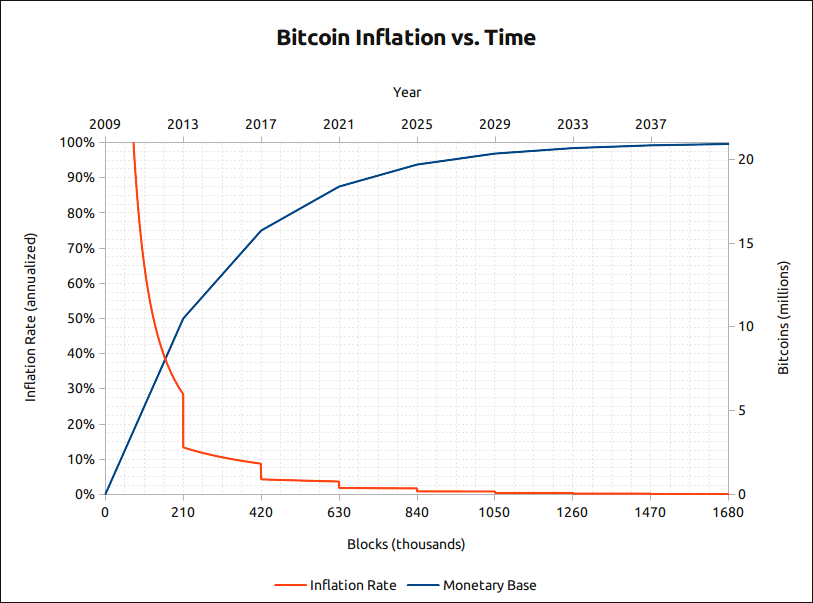

Back weighed in on the potential price action of Bitcoin as the next halving approaches, which will see Bitcoin miners’ block reward reduced from 6.25 BTC to 3.125 BTC. Block reward halvings are programmatically hardwired into Bitcoin’s code, taking place after every 210,000 blocks.

Back says that the overlaid averages of the previous market cycles and halvings indicate that Bitcoin’s relative value is trailing behind widely accepted projections. Multiple events have played a role in driving the price of BTC down, which has also been seen across traditional financial markets:

“The last few years were like biblical pestilence and plague. There was COVID-19, quantitative easing and wars affecting power prices. Inflation running up people, companies are going bankrupt.”

The impact has keenly affected markets and portfolio management, according to Back. Investment managers have had to manage risk and losses over the past few years, which has necessitated the sale of more liquid assets.

“They have to come up with cash, and sometimes they’ll sell the good stuff because it’s liquid and Bitcoin is super liquid. It used to happen with gold, and I think that’s a factor for Bitcoin in the last couple of years,” Back explains.

Bitcoin would have hit $100,000 already

As 2023 comes to a close, many of these macro events that Back cited have wound down, while more industry-specific failures have also been resolved. This has been reflected in Bitcoin’s recent price surge from Nov. 2023 onwards.

“The wave of the contagion, the companies that went bankrupt because they were exposed to Three Arrows Capital, Celsius, BlockFi and FTX — that’s mostly done. We don’t think there are many more big surprises in store,” Back said.

Related: Blockstream targets continued Bitcoin miner surplus with Series 2 BASIC Note

The Blockstream CEO previously predicted that Bitcoin would hit $100,000 in the next market cycle and referred back to this point. He believes BTC would have hit this mark already if not for the macro factors highlighted before.

Back also referred to the Bitcoin “stock-to-flow” model created by pseudonymous former institutional investor PlanB as a reference point for the potential upside for Bitcoin in 2024.

If you want to know more about bitcoin Stock-to-Flow:

* This is the original 2019 article:https://t.co/n5P5uMCKHT

* Or watch this YouTube video: pic.twitter.com/Qp8SjqtXIB— PlanB (@100trillionUSD) December 5, 2023

Back explains that PlanB’s model and heuristics suggest that savvy Bitcoin investors historically bought BTC six months before a halving event and sold into significant surges in price that have occurred in the 18 months following the drop in mining rewards:

“People thought it was a bit of a crazy assertion that we might get to $100,000 pre-halving because I said it when the price was around $20,000.”

He adds that Bitcoin’s price hitting $44,000 multiple times in Dec. 2023 suggests that his prior prediction might not be so far-fetched.

The Bitcoin ETF effect

Prominent investors and market analysts have also highlighted the effect of the potential approval of several spot Bitcoin exchange-traded fund (ETF) applications by the United States Securities and Exchange Commission (SEC).

People asking me if we changed odds. No, we still holding line at 90% odds of approval by Jan 10 (aka this cycle), the same odds we’ve had for months (before it was cool/safe). What we watching for now: more amended/final filings to roll in and clarity on in-kind vs cash creates https://t.co/uiWgfxOfzz

— Eric Balchunas (@EricBalchunas) November 29, 2023

Senior ETF analysts Eric Balchunas and James Seyffart have touted these applications to get the green light in early 2024. Galaxy Digital’s co-founder Michael Novogratz has also predicted mass inflows of institutional investment into the BTC-backed products, a point echoed by Back:

“I think Bitcoin could get to $100,000 even before the ETF and before the halving. But I certainly think the ETF shouldn’t be undervalued in its influence.”

A key reason cited by the Bitcoin advocate is that whole segments of traditional markets, including major fund managers like BlackRock and Fidelity, are simply not allowed to invest directly into assets like Bitcoin.

Related: Bitcoin ETFs will drive institutional adoption in 2024 — Galaxy Digital’s Mike Novogratz

“If they’re managing a mutual fund, they have rules, either externally imposed or as part of their fund, that they can only buy things like public stocks and ETFs. They can’t buy into startups, they can’t buy precious metals physically. They can’t do any of that stuff,” Back said.

This remains a pertinent reason why a spot Bitcoin ETF could drive significant capital inflows into the space. Back adds that the investment vehicle opens access to Bitcoin exposure for many types of funds, particularly in the U.S., that are more inclined to do so through Fidelity or BlackRock than with a cryptocurrency exchange.

Magazine: ‘Elegant and ass-backward’: Jameson Lopp’s first impression of Bitcoin

Soybeans have become a cornerstone of American agriculture, contributing $124 billion to the U.S. economy in 2022, according to a study conducted by the National Oilseed Processors Association and the United Soybean Board.

“Soybeans’ contribution to the U.S. economy is only increasing day by day,” Himanshu Gupta, CEO and co-founder of ClimateAI, told CNBC.

The legume is hailed as a versatile crop used in food, fuel and animal feed worldwide.

“Soybeans are kind of that wonder crop that has amazing capabilities” Arlan Suderman, chief commodities economist at StoneX, told CNBC.

The U.S. wasn’t always a soybean-producing powerhouse.

“I’m old enough to remember when soybeans were an alternative crop that a few people were playing with back in the 1960s,” Suderman said.

Soybeans were once considered a niche crop before U.S. farmers realized their potential for animal feed, protein use and export value. Farms would see their soybean yields increase.

“The average soybean production in our county 40 years ago, in 1980, was 31 bushels. Today, that same acre produces 51 bushels on average,” Soybean farmer Meagan Kaiser and chair of the United Soybean Board, told CNBC. “Most of the time it’s much higher than that.”

The global soybean market exploded in recent years with U.S. production at the forefront.

For example, in the early 2000s, the U.S. made about $9 billion from all oilseed crop exports combined. By 2021, the cash coming in from soybean exports alone skyrocketed to $26.4 billion, according to the U.S. Department of Agriculture.

However, the U.S. has since lost its dominance, in part, thanks to its reliance on a single export market: China.

China is the largest importer of soybeans in the world, making up about 60% of the total soybean trade. According to data from the USDA, about half of the value of U.S. soybean exports head to China.

This trade relationship turned sour in 2018 as the U.S. entered a tit-for-tat tariff dispute with China, and soybeans were key to that fight.

China would turn to Brazil for soybeans, and now the South American country has become the world’s No. 1 producer and exporter of soybeans.

“Over 30 or 40 years, [Brazil] dramatically increased soybean acreage and production,” Joe Janzen, assistant professor at the University of Illinois and its FarmDoc project, told CNBC.

“Brazil is a relatively low-cost place to produce corn and soybeans,” Janzen said. “The export market is very competitive and we need to be cost competitive with Brazil and Argentina if we want to capture market share.”

The heated international competition has pushed the American market to explore alternative uses for soybeans, including biofuels, renewable diesel and bioplastics.

“In the next 10 years, we’re going to have a whole new generation of farmers … and they’re going to solve [problems] in a more efficient way,'” Kaiser said. “Ways that I probably can’t even imagine.”

Watch the video above to learn more about how the U.S. became a soybean stronghold before falling behind Brazil, the influence of China’s demand and why soybeans are critical for food security and a clean energy future.

DoJ says SBF has tried to ‘corruptly influence witnesses’ multiple times; urges bail revocation

The U.S. Department of Justice (DoJ) urged federal judge Lewis Kaplan to revoke FTX founder Sam Bankman-Fried’s bail in a filing on July 28. The DoJ argued that SBF has “flouted even the increasingly strict conditions” placed on him multiple times.

The DoJ’s request comes after SBF surrendered 8 pages of former CEO of Alameda Research Caroline Ellison‘s diary entries in court on July 27.

The DoJ stated that SBF leaked Ellison’s diary to the New York Times to “intentionally harass” her. The DoJ claimed that SBF’s goal in leaking the documents was to “hinder, prevent, or dissuade” Elisson from testifying against him. Ellison signed a plea deal in December and is set to testify in SBF’s trial scheduled in October.

With multiple infractions of bail conditions and his recent conduct, which “reinforces his intent to influence witnesses,” it is necessary to jail SBF, the DoJ said, adding:

“…no set of pretrial release conditions can adequately assure the safety of the community and that the defendant is unlikely to fully abide by any conditions of release.”

Witness tampering and evading bail conditions

SBF was first accused of witness tampering in January for contacting the General Counsel for FTX US Ryne Miller over the messaging app Signal. In the same month, SBF was accused of violating his bail conditions by using a virtual private network (VPN).

At the time, SBF claimed he used the VPN to “watch football.” However, prosecutors discovered that the football matches he purportedly watched using a VPN were freely available on television, per the DoJ filing. Following these infractions, SBF’s bail conditions were modified to increase restrictions twice in January, twice in February, and a fifth time in March.

SBF leaking Ellison’s diary to the media was not just a second attempt at witness tampering but also an attempt to influence prospective jurors, the DoJ claimed, noting:

“…the defendant’s communications with the media were intended to affect the public’s—including prospective jurors’—impression of the defendant’s guilt.”

The DoJ added that SBF intended to “portray a key cooperator testifying against him in a poor and inculpatory light” by leaking the diary, which was not part of the prosecution’s discovery material. It was also an “effort to influence or prevent the testimony of other potential trial witnesses by creating the specter that their most intimate business is at risk of being reported in the press,” the filing noted.

Although SBF has no criminal history, the DoJ argued that he faces a potential sentence of over 100 years, demonstrating the issue’s seriousness and the need for a fair trial.

The DoJ concluded:

“What the defendant may not do, and what he has now done repeatedly, is seek to corruptly influence witnesses and interfere with a fair trial through attempted public harassment and shaming.”

The post DoJ says SBF has tried to ‘corruptly influence witnesses’ multiple times; urges bail revocation appeared first on CryptoSlate.