Goldman Sachs is seeing more institutions diving into crypto, the global investment bank’s head of digital assets has revealed, noting that until now the bitcoin price action has been driven primarily by retail investors. “But it’s the institutions that we’ve started to see come in,” he stressed, adding that the appetite has “transformed.” Bitcoin ETFs […]

Goldman Sachs is seeing more institutions diving into crypto, the global investment bank’s head of digital assets has revealed, noting that until now the bitcoin price action has been driven primarily by retail investors. “But it’s the institutions that we’ve started to see come in,” he stressed, adding that the appetite has “transformed.” Bitcoin ETFs […]

Source link

institutions

Coinbase (COIN) Stock Could Indicate Index Play for TradFi Institutions Looking for Crypto Exposure

The analyst said TradFi institutions trying to get into crypto, but are unsure how to begin, may use Coinbase stock to enter.

According to the co-founder of research firm Reflexivity Research Will Clemente, shares of major cryptocurrency exchange Coinbase Global Inc (NASDAQ: COIN) could serve as an indicator for the crypto sector. Clemente says Coinbase shares could be an “index play” for traditional finance (TradFi) firms looking for a way into the industry.

Clemente offered his opinion while speaking on an X (formerly Twitter) Space hosted by Bitcoin bull and tech investor Anthony Pompliano. The Reflexivity Research exec said:

“I think TradFi will probably view COIN as kind of an index play on crypto because they have so many different kinds of verticals now…Someone might come in the space and say, ” I bought some Bitcoin. I don’t really know which of these other assets to pick. Coinbase feels like a pretty safe kind of index style play.”

A Bitwise exec also shares this optimism and generally bullish sentiment. Speaking on the same Space, crypto asset manager Bitwise’s Chief Investment Officer Matt Hougan said he believes that Coinbase “is executing better than any financial services company in America”.

Hougan also seemed to review an earlier Bitwise forecast that Coinbase will double its revenue in 2024. On the Space, he said:

“I almost wonder if their revenues doubling will be too low. So we have a lot of conviction in that.”

MarketWatch data shows that Coinbase stock has recorded more than 374% in year-to-date (YTD) gains, beating out Bitcoin’s (BTC) 163% and Ether’s (ETH) 94%. The stock has also gained nearly 126% in 3 months, 54% in 1 month, and a healthy 9.37% in the last 5 days.

Coinbase Stock Supported by Multiple Updates

Several Coinbase updates that may be contributing to the stock’s rise in recent times. For instance, Coinbase is continuing its expansion in Europe and recently received a virtual asset provider (VASP) license from regulators in France. The license allows Coinbase to provide trading, custody, and related services to users in France who may transact using legal tender or other cryptocurrencies.

Another update is Project Diamond, a platform designed for institutions to tokenize and trade real-world assets. Backed by Coinbase, Project Diamond is powered by the exchange’s Base layer-2 scaling solution to deliver a robust and compliant platform to improve mass crypto and blockchain adoption.

Despite these and many more, Coinbase is still at loggerheads with the United States Securities and Exchange Commission (SEC). Last week, the SEC rejected Coinbase’s request for crypto rules, seemingly elongating the battle between both entities. In July last year, Coinbase asked the SEC for new rules on crypto assets that qualify as securities. Unfortunately, SEC Chair Gary Gensler recently announced a refusal for multiple reasons.

Firstly, Gensler pointed out that the current securities laws are robust enough to cover the crypto securities markets. He also added that the timing for rulemaking is wrong and that the SEC is still seeking comments on crypto rules. Lastly, Gensler suggested that rulemaking should be at the SEC’s discretion.

Interestingly, SEC Commissioners Hester M. Peirce and Mark T. Uyeda published a statement disagreeing with the agency’s decision. While the statement respects the SEC’s discretion on rulemaking, it notes that Coinbase’s petition raises specific issues around new technologies. The Commissioners state that these issues should be thoroughly addressed via concept releases, requests for comments, and public roundtables.

next

Market News, News, Stocks

You have successfully joined our subscriber list.

Google grants limited access to its Gemini AI product to select institutions

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Cryptocurrency exchange Coinbase has rolled out a crypto lending service for institutional investors in the United States, reportedly aiming to capitalize on massive failures in the crypto lending market.

Coinbase has launched an institutional-grade crypto lending platform to U.S. investors, offered as part of its existing offering Coinbase Prime, a spokesperson for Coinbase confirmed to Cointelegraph on Sept. 6.

“Coinbase is launching a digital asset lending program for its institutional Prime clients,” the representative said, adding:

“With this service, institutions can choose to lend digital assets to Coinbase under standardized terms in a product that qualifies for a Regulation D exemption.”

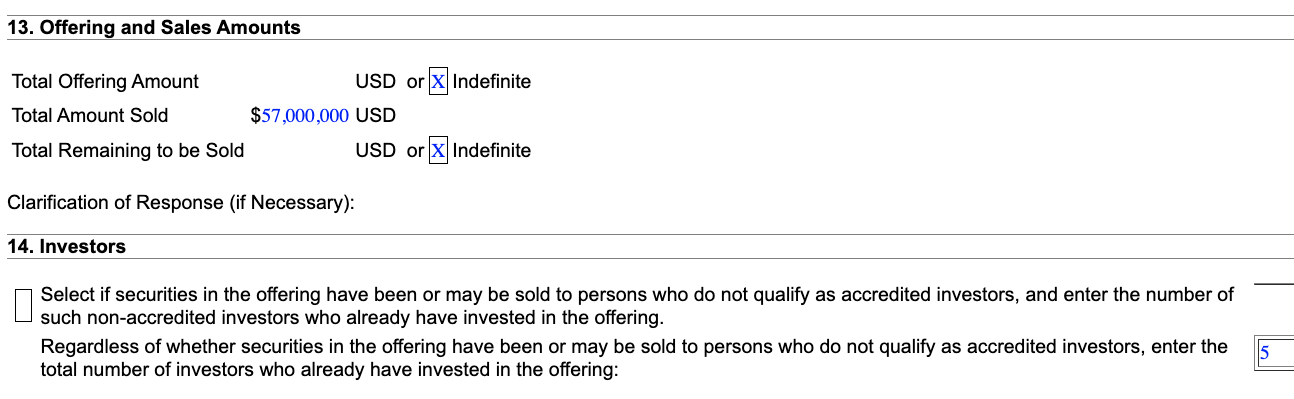

According to a filing with the U.S. Securities and Exchange Commission, Coinbase customers have already invested $57 million in the lending program since the first sale occurred on Aug. 28. The offering had attracted five investors as of Sept. 1.

The new product comes in line with Coinbase’s commitment to “update the financial system that was built over 100 years ago, leveraging crypto to provide people with more economic freedom and opportunity,” a spokesperson for Coinbase the noted.

The new crypto lending product by Coinbase follows the halt of new loan issuance on Coinbase Borrow in May 2023. The program is designed to allow users to receive up to $1 million through Bitcoin (BTC) collateral. The new institutional program is operated through Coinbase Credit, the same entity that manages Coinbase Borrow.

Related: SEC vs. Coinbase: New lawyer Patrick Kennedy joins fight

The news comes months after the U.S. SEC charged Coinbase with alleged offering and sale of unregistered securities in connection with its crypto starking services, which allow users to earn yields on giving their crypto to the platform. The exchange opposed the SEC’s allegations, arguing that it strongly disagreed with any allegations that its staking services were securities.

Coinbase eventually had to pause its staking program in four states — California, New Jersey, South Carolina and Wisconsin — while the proceedings were going forward.

The crypto lending industry was hit with a massive crisis last year, with major companies like BlockFi, Celsius and Genesis Global going bankrupt amid a lack of liquidity caused by the bear market of 2022. Some crypto enthusiasts said that the crypto lending sector must learn lessons from the collapses and solve issues related to short-term assets and short-term liabilities.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Magazine: How to protect your crypto in a volatile market — Bitcoin OGs and experts weigh in

Rep. Maxine Waters criticizes PayPal’s stablecoin, demands regulation on par with financial institutions

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

The outlook for DeFi lending remains strong – The industry is mature and ripe for institutions

The following is a guest post from Robert Alcorn, co-founder and CEO of Clearpool.

As we enter the mid-point of 2023, the DeFi lending market continues to grow, observing a 20.5% increase in Total Value Locked (TVL). This reflects a shared consensus among traditional and crypto-native institutions that DeFi has the potential to solve the problems that led to systemic failures across the CeFi market in 2022.

Regulation, though presenting hurdles, is further propelling the evolution of DeFi. The emergence of sophisticated protocols is moving the nascent crypto credit market to a mature DeFi ecosystem. Growing regulatory scrutiny emphasizes the need for KYC and AML-compliant protocols to enable institutional DeFi adoption.

Resilient DeFi protocols, having withstood the tests of 2022, have emerged as critical pieces of market infrastructure. For the DeFi industry to continue growing, we must focus on attracting more institutional players and creating more sophisticated products.

Institutions assess the DeFi landscape

In assessing DeFi, crypto-native institutions are, of course, more familiar with the concepts. However, both traditional and crypto-native institutions share optimism for DeFi’s potential in building a more transparent and efficient financial market infrastructure.

Even with last year’s CeFi collapses, DeFi is seeing a gradual return to growth, albeit slower than in 2022.

Nevertheless, DeFi, and the broader digital asset market in general, continue to draw institutional attention. Notable examples include:

- BlackRock’s June 2023 paperwork filing for a spot bitcoin (BTC) ETF.

- Franklin Templeton’s launch of a crypto product that tokenizes U.S. government securities, cash, and repurchase agreements on Polygon in April 2023.

- JPMorgan Chase’s continued commitment to tokenizing traditional financial assets through its Onyx digital assets platform, processing nearly $700 billion in short-term loan transactions.

- Jane Street’s first-of-its-kind loan agreement with BlockTower Capital for $25M in May 2022.

Regulatory clarity and innovation dual approach gain institutional traction

The main obstacle for traditional institutions remains; regulatory clarity and compliance. A recent report from JPMorgan (JPM) underscored this, suggesting the need for

“a comprehensive framework on how to regulate the crypto industries and the relative responsibilities of SEC vs the Commodity Futures Trading Commission (CFTC).”

Notably, significant progress has been made across Asia and the Middle East. Hong Kong’s Securities and Futures Commission (SFC) is actively adapting its policy for better cryptocurrency retail access. With establishing VARA, the inaugural standalone regulator for virtual assets, Dubai has positioned itself as a pioneer in crypto regulation.

In addition, central banks in both Hong Kong and the UAE have unveiled plans for joint efforts in crypto asset regulation, signaling their commitment to fostering a crypto-friendly environment. These advancements suggest that Asia and the Middle East will emerge as the leading crypto lending hubs as investor confidence builds.

Alongside regulatory advancements, DeFi protocols must develop innovative, sophisticated products to attract a more diverse user base. This includes fostering a secure and compliant environment for wholesale borrowing and lending of digital assets by institutions, thereby ensuring liquidity and efficient pricing to market participants.

Undoubtedly, the setbacks in 2022, primarily due to mismanagement issues within the more opaque CeFi segment, temporarily slowed institutional adoption of DeFi. However, the recent moves by large financial institutions towards DeFi is a promising sign that the industry is gaining momentum.

DeFi outperformed CeFi

Since the 2021 DeFi boom, decentralized exchanges (DEXs) trading volume has grown consistently, showing a clear shift from centralized exchanges with their opaque practices and questionable risk management.

DeFi platforms offer a unique advantage – they eliminate central points of failure. With DeFi, lenders have the autonomy to select their borrowers. Fund transfers occur directly between lender and borrower through a smart contract coded in a way that can’t be changed – there’s no central intermediary.

Rather than causing chaos, market volatility activates certain in-built mechanisms within these smart contracts. They incentivize certain behaviors from borrowers and lenders to help maintain a balanced marketplace.

Ushering in a new era of decentralized finance

DeFi’s resilience stems from its architectural design and its community of builders and stakeholders who rise to the challenges thrown at them. Their commitment to innovation and sustainable growth enables DeFi platforms to weather the storms of market volatility.

Unique mechanisms like direct transactions via unchangeable smart contracts and autonomous market responses to market upheavals reinforce this resilience. These advantages set DeFi apart from CeFi and ensure its better performance in stress tests.

The digital assets industry will become an integral part of the global economy. The traditional financial services industry will always have its place, but it will be augmented by the decentralized financial ecosystem we are building today.

DeFi is not just surviving – it’s set to thrive.

Robert Alcorn is an experienced entrepreneur with over 20 years of professional experience across global financial markets. Rob was an early adopter of Bitcoin, first venturing into crypto in 2015.

Before establishing Clearpool, Rob was the APAC Head of Repo Trading at First Abu Dhabi Bank, where he built the sales and trading desk from the ground up, into a multi-billion-dollar franchise. Alongside this role, Rob initiated and led a project to build an Automated Wealth Management Platform using blockchain technology.

During his career, Rob has held positions in Asset and Liability Management, Fixed Income / Money Market Sales, and working as a Senior Broker in Fixed Income Markets. In 2021, Rob co-founded Clearpool to solve one of the most significant problems facing DeFi borrowers – over-collateralization. Rob is a CFA Charterholder and holder of the Massachusetts Institute of Technology’s Fintech Certificate in Future Commerce.