In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

Source link

Investments

We’re 56 With $1.2 Million in Investments and Savings. Can We Afford to Withdraw $60k-$80k Per Year in Retirement?

My wife and I are both 56. We have around $1.2 million saved – approximately $450,000 in company 401(k)s, $650,000 in a managed account, and approximately $70,000 in personal stocks. We also have approximately $22,000 in savings. Our home is worth $700,000 or more and we owe $197,000 with a 3.875% interest rate. Our advisor says we will be in good shape by 60. We will withdraw 5-8% from our investments and then take Social Security at 62. Do you think will we be able to withdraw between $60,000 and 80,000 annually and still be OK as long as our advisor makes us at least 5% to 8% per year?

– Jim

While it appears that you and your wife have done a good job of saving over the years, the strategy your advisor is proposing sounds risky to me. It certainly could work out for you, but there are two main reasons why I would consider a more conservative approach, which I’ll get into below. (And if you need additional help planning for retirement, consider speaking with a financial advisor today.)

Reason #1: Annual Returns Will Vary

While 5% to 8% is a reasonable expectation for the average long-term return of a low-cost, diversified investment portfolio, you cannot expect your advisor to produce those returns every year. Market returns can fluctuate widely from year to year. For example, the S&P 500 produced a positive return of 28.47% in 2021, only to lose 18.01% in 2022.

No matter how good your financial advisor is, your portfolio is going to be subject to these kinds of ups and downs. You can of course manage that risk through your asset allocation, but you will still have good years and bad years.

If your financial advisor is telling you that he or she can consistently produce returns between 5% and 8% or better, you need to be incredibly wary. Research shows that even professionals struggle to beat the market consistently, so the best you can hope for might be a portfolio that tracks market returns, in accordance with your asset allocation, with as little cost as possible.

The bottom line is that you cannot count on consistent 5% to 8% returns. Your withdrawal strategy needs to account for the fact that your returns will vary, as well as the possibility that the market will suffer a downturn in the early years of your retirement. The latter is known as sequence of returns risk and it can severely impact the long-term viability of your savings. (Talk to a financial advisor to build a retirement plan suitable for your circumstances.)

Reason #2: You’ve Proposed an Aggressive Withdrawal Rate

You may have heard of the 4% rule, which states that you can safely withdraw 4% from a balanced portfolio each year, adjusting upward for inflation, with little risk of running out of money over a 30-year timeline. A recent study by Morningstar does a good job of diving a little deeper, testing safe withdrawal rates that range up to 10% for various asset allocations and time horizons.

Your total investment portfolio balance is $1.17 million. Applying the 4% withdrawal rule to that balance, you could safely withdraw about $46,800 per year.

However, your plan is to withdraw between $60,000 and $80,000 per year, which equates to a withdrawal rate of 5.1% to 6.8%. According to the Morningstar study, those withdrawal rates could give you a 90% chance of making it 15 to 20 years, assuming just 40% of your assets were invested in equities. However, your success rate would go down as you extend your timeline out to 30 or 40 years.

In other words, you may be able to get away with withdrawing that much each year, especially if you are lucky and the stock market is up in the early years of your retirement. But it’s an aggressive strategy with lower odds of success than I would typically recommend. (A financial advisor can help you plan your withdrawals and build a retirement income plan.)

What Are Your Alternatives?

If I were your advisor, I would suggest a few alternatives to the plan you’ve presented.

One option is to reduce your expenses so that you can live on smaller withdrawals. If you can get your annual withdrawal closer to that $46,800 amount, you’ll increase the odds of your portfolio lasting you through your retirement.

Another option is to work longer. That will give you more time to save, more time to accumulate Social Security benefits and fewer years of retirement to support.

You can also consider how you claim your Social Security benefits. There are strategies you can use to maximize those benefits, which could reduce the amount you need to withdraw from your investment portfolio. (And if you need help optimizing your financial plan for retirement, consider speaking with a financial advisor.)

Bottom Line

Your advisor has much more insight into your situation than I do, so it’s certainly possible that I am missing something and that your plan is solid. But based on the information you’ve provided, you may want to proceed cautiously. If you are overaggressive with withdrawals, particularly in the early years of retirement, it could cause problems down the road.

Retirement Planning Tips

-

Your income needs typically fall in retirement, but by how much? T. Rowe Price recommends that you start by aiming to replace 75% of your pre-retirement income. You can then adjust that percentage up or down based on your savings rate during your working years and your expenses in retirement.

-

A financial advisor can help you save and plan for retirement. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/zamrznutitonovi, ©iStock.com/yongyuan

The post Ask an Advisor: We’re 56 With $1.2 Million in Investments and Savings. Can We Afford to Withdraw $60k-$80k Per Year in Retirement? appeared first on SmartReads by SmartAsset.

MicroStrategy’s leverage scenarios show potential for astronomical returns on Bitcoin investments

Quick Take

In its Q4 earnings report, MicroStrategy disclosed its substantial Bitcoin investment in Q4 2023 of $1.25 billion, which is now worth a staggering $8 billion. The firm holds 190,000 BTC in its corporate treasury.

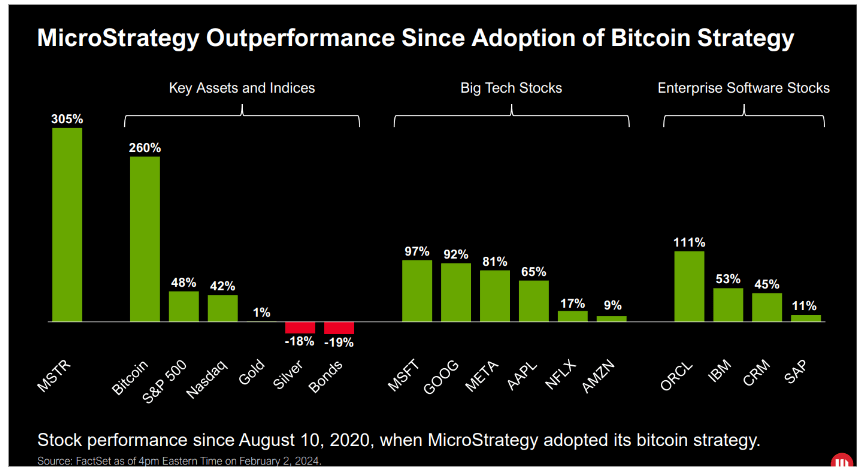

MicroStrategy’s Q4 2023 Earnings Presentation shows that this strategic decision has paid dividends, as its stock has surged by 305% since it started investing in Bitcoin in August 2020. For comparison, Bitcoin itself saw an increase of 260% during the same period, while more traditional assets lagged behind, with the S&P 500 and gold only increasing by 48% and 1%, respectively, according to MicroStrategy data.

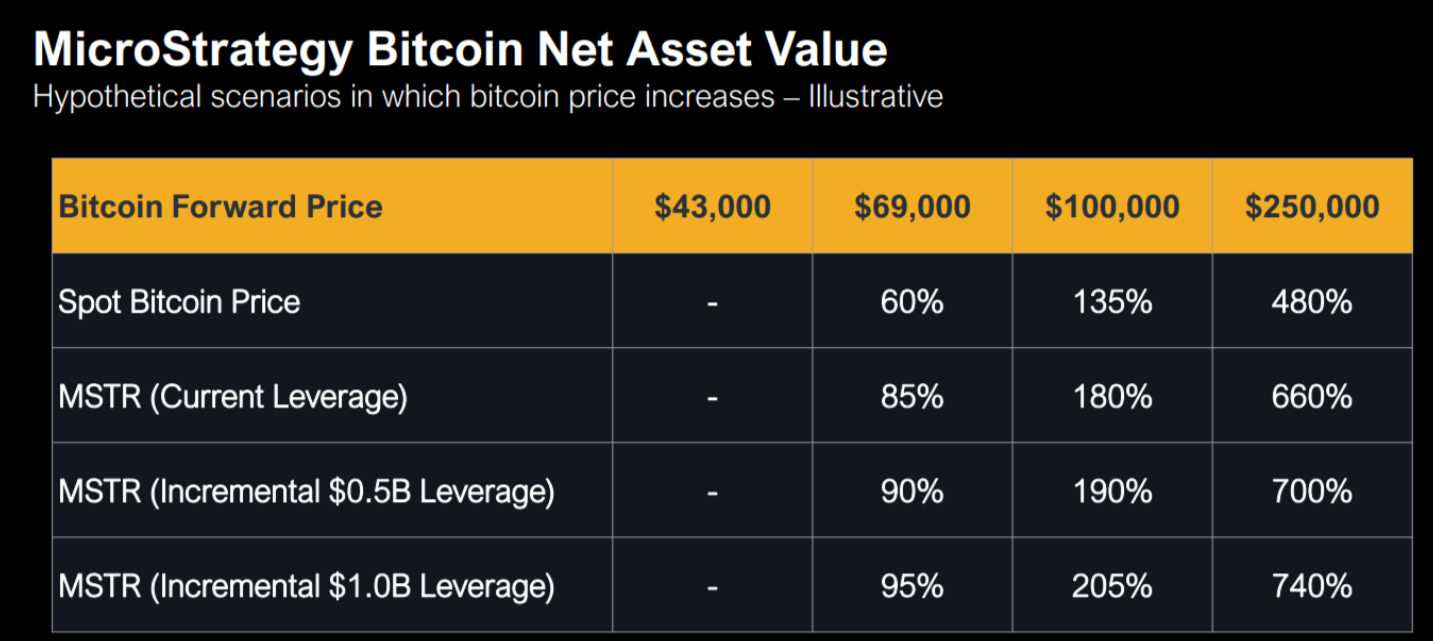

Furthermore, MicroStrategy presented hypothetical scenarios in the earnings presentation based on their net asset value, calculated as their Bitcoin holdings market value minus total outstanding debt.

These scenarios considered varying Bitcoin spot prices and the effect of adding leverage. For instance, if Bitcoin’s price rose from $43,000 to $69,000, this would result in a 60% increase, scaling up to a 135% increase if Bitcoin hit $100k and a whopping 480% surge if Bitcoin reached $250k, MicroStrategy data shows.

As MicroStrategy reported, adding the company’s existing leverage would further enhance returns, potentially by 85% at a Bitcoin price of $69,000 and up to 660% if Bitcoin soared to $250k. An additional scenario illustrated how a further $0.5B of leverage could substantially augment these returns.

The post MicroStrategy’s leverage scenarios show potential for astronomical returns on Bitcoin investments appeared first on CryptoSlate.

Apple and Tesla may no longer be ‘safe investments’ as China’s troubles grow

Another tough day for Wall Street is in the making, after China growth numbers disappointed, hitting oil and a bunch of U.S.-listed Chinese stocks.

That brings us to our call of the day, where market observers say China-related trouble continues to build for Tesla

TSLA

and Apple

AAPL

and their investors.

In a note to clients, Mike O’Rourke, chief technical strategist at JonesTrading, observes how Magnificent Seven stocks have been under pressure to shore up the S&P 500

in a bumpy 2024.

“Key leaders Apple and Tesla continue to be bombarded by daily negative headlines regarding their fundamental businesses. While it barely draws much attention, it does not help that they are also the two most China exposed companies,” says the strategist.

Apple and Tesla have lost 4% and 11% respectively this year, the worst performers of the seven.

So is China the common denominator for the pair’s woes?

Apple recently cut handset prices in the China where it battles competitors like Huawei. Tesla also reduced EV prices in the country where Berkshire Hathaway-owned BYD

CN:002594

rules. Wednesday brought news of Tesla price cuts in Germany, where it faces production disruptions due to Red Sea ship attacks.

China represented a 19% chunk of Apple’s revenue in 2023, and roughly 22% for Tesla in the first nine months of last year.

Jenny Hardy, portfolio manager on the GP Bullhound Global Technology Fund, tells MarketWatch that for Apple and Tesla, “it’s much more about the competitive environment that could hurt them rather than their underlying markets.” She notes that in a gloomy China market, EVs and smartphones were strong into end 2023.

Hardy notes a number of new launches in China have been competing with Tesla at the higher end, such as Huawei’s luxury Aito M9 model, rumored to have hit weekly sales of more than 20,000. “At the very least for Tesla it means the aggressive price war it is facing in China continues,” she says.

And Huawai has also been taking “significant share” where Apple is concerned. That company had a 16% smartphone share in China that fell to around 2% by 2022 after the U.S. blacklist, she notes.

“For us in the portfolio, we continue to be exposed to China EV through the semiconductor component companies who supply into the Chinese market (Infineon

XE:IFX

and NXP

NXPI

) – who are less vulnerable to pricing pressure than the OEMs. We remain cautious around broader consumer electronics exposure, where the Chinese demand recovery remains uncertain,” she says.

More food for thought comes from Peter Navarro, former White House trade adviser under President Donald Trump, whose recent op/ed — “The eve of Apple and Tesla’s destruction in China” — has been making the rounds. Navarro, it should be noted, is due to be sentenced later this month after being found guilty of contempt of Congress for not cooperating with a probe into the U.S. Capitol attack two year ago.

“Like GE before it, Apple and Tesla now have this grim mercantilist reality. Because Mr. Cook and Mr. Musk each directed the offshoring of the vast bulk of Apple’s and Tesla’s production to China , the companies are at the mercy of a merciless dictator in Xi Jinping,” he writes.

“Arrogance and hubris are common threads that run from Mr. Immelt [Jeffrey, former CEO] in the 2000s through Mr. Cook and Mr. Musk today,” said Navarro, adding that the companies’ products face a “xenophobic ban” in the country.

The food-for-thought kicker from Navarro? “Whether you are a big hedge-fund manager or a small retail investor, you have to wonder whether Apple or Tesla are still safe investments — at least on the long side, if you get my drift.”

Read: Is AI hype starting to fade? Companies are poised to turn the talk into action in 2024, says Deutsche Bank.

The markets

U.S. stock futures

ES00

NQ00

extended losses after the retail sales data. The action was in bonds: the yield on the 2-year Treasury

shot 14 basis points higher.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,765.98 | 0.05% | 0.54% | -0.08% | 19.18% |

| Nasdaq Composite | 14,944.35 | 0.68% | 0.26% | -0.45% | 34.89% |

| 10 year Treasury | 4.076 | 4.21 | 22.78 | 19.52 | 70.27 |

| Gold | 2,024.10 | -0.49% | -0.84% | -2.30% | 5.26% |

| Oil | 71.74 | 1.16% | -1.58% | 0.57% | -10.39% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

Retail sales came in surprisingly strong — up 0.6% at the headline level, or up by 0.4% excluding autos. Separately, import prices were steady in December.

Industrial production hits at 9:15 a.m. and a home builders confidence index at 10 a.m. Data showed weekly mortgage demand surging as rates fell across the board.

Fed Vice Chair for Supervision Michael Barr and Fed Gov. Michelle Bowman will both speak at 9 a.m. The Fed’s Beige Book of economic conditions is due at 2 p.m.

Spirit Airlines shares

SAVE

remain under pressure after a federal judge blocked JetBlue’s proposed $3.8 billion acquisition of the airline.

China’s economy grew 5.2% in 2023, but data showed an uneven recovery and some analysts were looking for growth of 5.3%.

Read: Government shutdown: Congress has four days to act. Here’s what’s at risk.

Best of the web

Japan’s market roars back to life—with old-timers leading the way

The downside of a longer life: More time spent sick

Former Australian prime minister dismisses peak China narrative

The chart

The rocky start to 2024 is a sign the “easy money” has been made and to expect a challenging year, says Tom Lee, head of Fundstrat.

“But the reason we see the ‘easy money’ made is we are now overbought. So, even with new highs likely at the end of January, this is not a full ‘risk-on’ market,” says Lee, who adds the bulk of gains will be seen in the second half.

Bloomberg/Fundstrat. (BTD — buy the dip)

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

Random reads

U.K. space minister mocked after confusing the Sun and Mars,

A 524.7 pound bluefin tuna sold for $789,000 in Tokyo.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Operating within tightly regulated stock exchanges, ETFs ensure accessibility through existing retail investors’ brokerage accounts, subject to stringent supervision.

In a historic decision, the US Securities and Exchange Commission (SEC) granted approval to exchange-traded funds (ETFs) that mirror the price of Bitcoin. This marks a significant breakthrough for the cryptocurrency industry, which has sought to introduce such products for over a decade.

Numerous asset managers have submitted Bitcoin ETF applications since 2013, only to face rejection from the SEC due to concerns about susceptibility to market manipulation. In August, a court ruling challenged the SEC’s decision to reject Grayscale Investments’ Bitcoin ETF application, prompting the regulatory agency to reconsider its stance.

On Wednesday, the SEC gave the green light to applications from well-known entities such as ARK Investments, BlackRock, and Fidelity, signaling a shift in the regulatory landscape.

The exact financial impact of Bitcoin ETFs remains uncertain. The ProShares Bitcoin Strategy ETF (BITO.P), the first Bitcoin futures ETF approved by the SEC in 2021, witnessed approximately $1 billion worth of shares traded on its inaugural day. Some experts speculate that a spot Bitcoin ETF could attract triple that amount on its debut, potentially reaching a staggering $55 billion within five years.

While Bitcoin has experienced a 70% surge since the Grayscale ruling, analysts remain cautious about predicting its future trajectory. Factors such as interest rates are expected to play a pivotal role in shaping the cryptocurrency’s market dynamics.

While Canada and Europe already boast spot Bitcoin ETFs, the United States, as the world’s largest capital market, offers a distinctive environment. Home to some of the most prominent asset managers and institutional investors globally, the approval of Bitcoin ETFs in the US opens new avenues for market participation and capital infusion.

How Do Spot Bitcoin ETFs Work?

The anticipated launch of Bitcoin exchange-traded funds (ETFs) is set to bring a new dimension to the cryptocurrency market, unveiling a carefully orchestrated operational model. These ETFs will make their debut on prominent exchanges, including Nasdaq, NYSE, and the CBOE.

A critical aspect of their asset composition involves the inclusion of physical Bitcoin, strategically procured from cryptocurrency exchanges and held under the custodianship of reputable entities like Coinbase Global. In terms of benchmark tracking, these innovative products will meticulously follow specified Bitcoin benchmarks, with some opting for indices provided by CF Benchmarks, a subsidiary of Kraken.

To address regulatory concerns regarding market manipulation, Nasdaq and CBOE have collaborated with Coinbase to establish a robust market surveillance mechanism. The fee structure for these ETFs is between 0.20% and 0.8%, presenting a competitive edge below the broader ETF market average.

Notably, a spot Bitcoin ETF offers investors a simplified route to exposure without the complexities of direct ownership, eliminating the need for crypto wallets and circumventing potential cybersecurity risks associated with exchanges. This ETF structure provides a sense of regulatory oversight and confidence for investors, especially in the wake of industry challenges and scandals.

Operating within tightly regulated stock exchanges, ETFs ensure accessibility through existing retail investors’ brokerage accounts, subject to stringent supervision. Beyond retail, the institutional accessibility offered by ETFs further positions them as a key player in facilitating Bitcoin investments for a broader investor base.

Also, the imminent launch of Bitcoin ETFs is likely to mark a significant milestone, bridging traditional financial markets with the dynamic cryptocurrency landscape, and offering a regulated and accessible avenue for investors to engage with Bitcoin.

next

Funds & ETFs, Market News, News

You have successfully joined our subscriber list.

VanEck’s Head Of Research Says BlackRock Has $2 Billion In Investments Lined Up

VanEck’s Head of Research, Matthew Sigel, recently hinted that the Spot Bitcoin ETF of the world’s asset manager, BlackRock, could see a record-breaking amount of inflows upon launch. This comes as an approval order by the Securities and Exchange Commission (SEC) looks imminent.

BlackRock’s Bitcoin ETF Could See Inflows Of Over $2 Billion

Sigel mentioned on an X (formerly Twitter) space hosted by the media platform, The Block, that he heard from a reliable source that BlackRock has “more than $2 billion lined up in week one.”

This investment capital is said to be coming from existing Bitcoin holders who are looking to increase their exposure to the flagship cryptocurrency.

He quickly added that he couldn’t be 100% certain of this information. However, it is a possibility, considering that issuers would be looking to get investors that can inject huge sums into their respective ETFs.

Sigel went on to highlight how significant it could be if BlacRock’s ETF indeed saw $2 billion of inflows in the first week of trading, saying that it would “blow away” their initial projections. They estimate that the Spot Bitcoin ETFs could see $2.5 billion of inflows in the first quarter of trading. Meanwhile, they believe the market could grow to $40 billion in the next two years.

BTC price struggles to reclaim $44,000 | Source: BTCUSD on Tradingview.com

Not Out Of Place For BlackRock

Commenting on the possibility of BlackRock seeing this significant amount of inflows, Bloomberg analyst Eric Balchunas noted that such an occurrence isn’t unusual for the world’s largest asset manager. According to him, BlackRock is known for lining up and injecting big cash into new ETFs on the first day of trading. That way, it registers as volume for them.

Balchunas further noted that BlackRock’s Bitcoin ETF, seeing $2 billion of inflows, would shatter all records relating to first-day and week volume for an ETF. Interestingly, BlackRock already holds the record for the most successful ETF launch going by the amount of inflows recorded on day one.

The world’s asset manager further dominates the top 10 list of most successful ETF launches. Balchunas, however, clarified that those inflows were mainly lined up cash and not organic, as they were readily available before the ETF launched. He also mentioned that he got a second source to confirm Sigel’s claims that BlackRock has a big day one lined up.

Meanwhile, the Bloomberg analyst provided an update on when the approval order from the SEC was likely to come. Citing multiple sources, he stated that the SEC is lining up all issuers for a potential launch on January 11.

Featured image from Decrypt, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

In the ever-evolving landscape of cryptocurrency, Solana has emerged as a prominent player, and within its ecosystem, meme coins are creating a buzz in the crypto community. Meme coin trading, with its inherent thrill of pump-and-dump scenarios, has gained momentum on Solana, driven by a surge in liquidity and recent airdrops that have propelled SOL prices.

People who got the Pyth airdrop, the Jito airdrop, and the BONK airdrop need a place to dump and trade their free money, and Solana meme coins have given them the perfect avenue to do so.

This comprehensive guide aims to walk you through the intricate process of acquiring SOL and navigating the exciting world of Solana meme coin trades, emphasizing key considerations for successful and profitable transactions.

Understanding The Landscape Of Meme Coins

Before delving into the specifics, let’s briefly understand the unique landscape of meme coin trading on Solana. Unlike traditional cryptocurrencies with established utilities and roadmaps, meme coins often lack such fundamentals. Don’t expect a life-changing technology that is supposed to change the crypto game.

These meme coins thrive on community-driven speculation, making them a double-edged sword for traders – an opportunity for exhilarating gains or potential losses. It’s a game of rug, loss, or victory. The moment you start trading, you either make a profit or you lose.

Acquiring SOL for Meme Coin Trades

For those new to Solana meme coin trading, the journey begins with acquiring SOL, Solana’s native cryptocurrency. Popular exchanges like Binance, Kucoin, and Bybit offer a gateway to obtain SOL.

Once secured, the next step is transferring it to a compatible Solana decentralized exchange (DEX) wallet, such as Phantom Wallet. You can add the wallet to your computer’s browser as an extension or download the app directly to your device.

The SOL price has been trading pretty high since trading activities have been increasing, thanks to the meme coin trading. The last bull run saw the SOL price increase driven by an increase in NFT trading; this time around, it’s meme coins.

Identifying Profitable Meme Coins

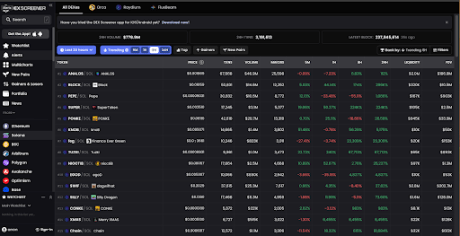

With SOL in your Phantom wallet, the focus shifts to identifying promising meme coins. Platforms like Solana Dexscreener become invaluable, allowing you to track meme coins specifically on the Solana chain.

Look for meme coins with lower market caps – an indicator that can significantly amplify profits during pump phases. Their names sometimes help, as meme coins with controversial names also help boost the chances of increasing the price or attracting people into trading them.

Navigating Social Signals To Buy Good Coins On Solana

Beyond market cap considerations, a crucial aspect of meme coin trading is community engagement. A vibrant community can drive trading activity, contributing to a coin’s success. Check X (formerly Twitter) and other social platforms for discussions around the meme coin of interest.

An active community that posts updates and engages with its audience adds credibility to the project. People get more excited and motivated when they keep seeing people talk about them, this is where the FOMO (Fear Of Missing Opportunity) comes into play.

Guarding Against Rug Pulls On Solana Network

While pump and dump dynamics are inherent in meme coin trading, the specter of rug pulls adds an extra layer of risk. A rug pull occurs when the creators of a meme coin remove liquidity, rendering the coin untradable and leaving investors with a worthless asset.

Rug pulls often go undetected until they happen, making due diligence crucial when selecting meme coins for trading. You can never be too careful about them, this is why it’s advisable to trade with what you can afford to lose.

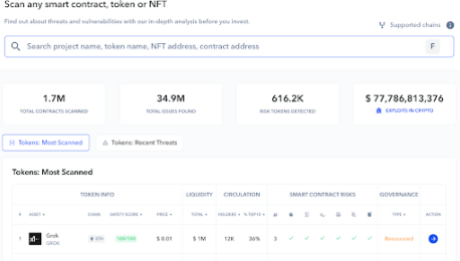

Additionally, there are scanners that provide some layer of security for investors by carrying out a rudimentary rug pull check. They check for common features of rug pull and honey pot contracts such as the inability to sell after buying, high taxes on transactions, etc. Examples of these tools include the Smart Contract Scanner by De.Fi.

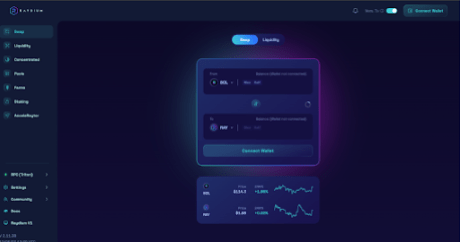

Choosing the Right Solana DEX

The Solana ecosystem boasts various decentralized exchanges, each with its unique features. Jupiter Exchange, Raydium, Birdeye, and Orca are among the prominent options. Platforms like Birdeye also provide charting capabilities, simplifying the decision-making process for traders.

Some of the charts make trading meme coins easier as they have the contract addresses of the meme coins, but to be sure, it is advisable to check their Twitter because they can be fake copies of these meme coins that might want to take advantage of the meme coin hype and rug.

Executing Your First Solana Meme Coin Trade

With SOL secured in your phantom wallet and a meme coin identified, it’s time to execute your first trade. Obtaining the contract address from the meme coin’s Twitter page is an essential step in the trading process.

Connect your Phantom wallet to the chosen Solana DEX, input the contract address where you are supposed to swap for SOL, and initiate the swap, converting SOL to the selected meme coin.

Alternatively, utilize Dexscreener to locate the “Trade On X” icon, where “X” represents the DEX for the Solana meme coin. A click directs you to a tab where the contract address is pre-filled, streamlining the trading process.

This makes it easier to trade, and saves you time, should, in case, you want to trade at launch to catch the best prices.

Risk Management And Future Trades

Prudent risk management is essential in meme coin trading. Avoiding the “MAX” button ensures you retain SOL for transaction fees during future trades. Consider allocating a portion of your SOL rather than risking the entire amount, providing flexibility for subsequent transactions. Remember to always trade with what you can afford to lose, so you don’t lose all your money.

Monitoring And Expanding Your Solana Portfolio

Congratulations, you’ve completed your first Solana meme coin trade! Now, whether you choose to monitor the chart for price progress or explore additional meme coin opportunities on Dexscreener, stay informed.

Analyze trading activity, distinguishing between buying and selling actions – greens for buying, reds for selling. This analysis aids in making informed decisions, allowing you to stay ahead in the dynamic world of meme coin trading.

Conclusion

In conclusion, navigating the realm of Solana meme coin trading requires a blend of market awareness, community engagement, and strategic decision-making. By understanding the fundamentals, conducting thorough research, and implementing sound risk management practices, you can unlock the potential for profitable meme coin trades on the Solana blockchain.

As the crypto landscape continues to evolve, staying informed and adaptable will be key to success in this dynamic market. Happy trading!

SOL price falls to $107 Source: SOLUSD On Tradingview.com

Featured image from Facts.net, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Grayscale Investments’ Top Executives Barry Silbert and Mark Murphy Resign from Board of Directors

In addition to top executives stepping aside from the board of directors, Grayscale Investments also filed an updated spot Bitcoin ETF application with the SEC on Tuesday.

Top cryptocurrency investor Grayscale Investments LLC has been preparing to offer spot Bitcoin exchange-traded funds (ETF) in a bid to widen its market share. On Tuesday, the company made several moves to ensure an imminent approval of spot BTC ETF, which is anticipated to happen in the next few weeks. Grayscale Investments announced on Tuesday that its chairman and founder of Digital Currency Group Barry Silbert and DCG president Mark Murphy had resigned from the board of directors effective January 1, 2024.

Notably, the company highlighted that Mark Shifke has replaced Silbert, whereby Mathew Kummell and Edward McGee are the new appointees of the board of directors, who join Michael Sonnenshein.

The three new appointees of the board of members bring immense experience to fund management. For instance, the 64-year-old Shifke has been working as the Chief Financial Officer of Digital Currency Group Inc (DCG). Since March 2021, Shifke has served on the board of directors of Dock Ltd., a pay and digital banking platform. In the past, Shifke has also served as CFO of Green Dot (NYSE: GDOT) and led teams at JPMorgan Chase & Co (NYSE: JPM) and Goldman Sachs Group Inc (NYSE: GS).

Kummel, on the other hand, has been working as the senior vice president of operations at Digital Currency Group. The 47-year-old has served on the board of directors at Coindesk, among other notable roles. As for McGee, he has been working on the company’s audit committee in addition to the CFO role since January 2022. Notably, McGee has also served at Goldman Sachs as VP of accounting policy.

Grayscale Investments Prepares for SEC’s Approval of Spot Bitcoin ETFs

Grayscale Investments has been at the forefront of pushing the United States Securities and Exchange Commission (SEC) to approve the spot Bitcoin ETFs. Earlier this year, the US SEC was compelled by the court to relook into the spot Bitcoin ETFs applications from a similar angle as Bitcoin futures ETPs that were previously approved. Since then, the US SEC has significantly changed its approach to crypto firms, with ETF experts forecasting imminent approval in early January.

Grayscale Investments holds more than $25 billion in its GBTC trust and wants the SEC’s approval to convert it to a spot Bitcoin ETF. On Tuesday, Grayscale Investments filed another amended S-3 to comply with the SEC’s demand for cash-only redemption, which has been a similar case with other fund managers seeking to offer spot Bitcoin ETFs.

Even @Grayscale is accepting the SEC’s Cash-only creation/redemption edict. Looks like they’re bending the knee. pic.twitter.com/BtbyE5XQv0

— James Seyffart (@JSeyff) December 26, 2023

Market Outlook

Despite the heightened speculation of spot BTC ETF approval in the United States, Bitcoin price has struggled to rally beyond $44.5k. With a few days to the end of the year, the altcoin market has been preparing for further breakout as Bitcoin whale accounts accelerate profit taking and diversification to the alternative crypto coins.

next

Cryptocurrency News, News

You have successfully joined our subscriber list.

‘We went through all of my 401(k) investments’: I lost my job, then my home. Do I have any claim to my wife’s $200,000 inheritance?

Dear Quentin,

My wife and I have been married for over 30 years. Throughout the years, we relied mainly on my income. My wife worked occasionally, but mainly raised the children. We started to struggle financially when I was laid off. We went through all of my 401(k) investments.

I lost my home through a short sale because of the difficulty of keeping up with the expenses. I asked my wife to help by getting a job, but that did not happen. Now we are finally at a comfortable place, renting a home, and my wife is finally working.

My question: Do I have the legal right to an equal share of her $200,000 inheritance when she gets it, given I used all of my retirement funds to get us through those hard years?

Divorcing in Ohio

Related: My husband added my mother-in-law to the deed of our house 20 years ago. Now we’re getting divorced, and she wants one-third. Can I fight this?

“It’s a tough break that after 30 years of marriage and several years of homeownership, you are bidding adieu to the former and had to let go of the latter.”

MarketWatch illustration

Dear Divorcing,

You have experienced a lot of financial loss, and you are about to go through what I hope is the last of it. It’s a tough break that after 30 years of marriage and several years of homeownership, you are bidding adieu to the former and had to let go of the latter. Given how difficult it is to get on the property ladder, you would have been better off living in a studio rental with your wife and renting out your house rather than letting it go. But we all do the best we can with the resources we have at the time, and you have finally reached a place of stability.

The short and long answer to your question: Ohio is an equitable-distribution state, meaning that marital assets are divided fairly, if not equally. Inheritance is regarded as separate property in Ohio, unless it is in some way used to benefit the marital assets — that is, commingled. For instance, if it were used to renovate your home or it was deposited in a joint bank account, it would cease to be separate property in a process called transmutation. This can easily happen: One letter writer used $142,000 from a $246,000 inheritance to pay off her mortgage.

For anyone else out there with an inheritance and a divorce pending: “Do not use inheritance money for regular spending, then replenish the account balance,” according to Manning & Clair Attorneys At Law, a law firm in Willoughby, Ohio. “This can be problematic for a separate-property claim. That is because inheritance money must be ‘traceable’ [or identifiable] to prove to a court that it is separate property. … You must be able to prove the inheritance, or asset purchased with the inheritance, maintained its separate nature from the rest of the marital assets.”

The final and, perhaps, bitter irony of your own situation is that you would, in all likelihood, have had to give up 50% of your property if you still owned it at the time of your divorce, assuming it was purchased during your marriage. Unless you had a prenuptial agreement before you got married, you may have to factor in alimony payments given that you have typically been the breadwinner in the relationship, in addition to other legal costs. The sooner you get divorced, the sooner you can start rebuilding your wealth, and saving once more for retirement.

Obviously, withdrawing money from your 401(k) comes with penalties and should always be seen as a last resort. But you’re not the only one who has had their hand forced in such a way: 37% of workers have taken a loan, early withdrawal or hardship withdrawal from their 401(k) or similar retirement plan, according to a report released earlier this year by the nonprofit Transamerica Center for Retirement Studies in collaboration with Transamerica Institute. Among those workers, 21% took an early and/or hardship withdrawal.

Good luck with the next chapter.

More from Quentin Fottrell:

My father has dementia and ‘forgave’ my brother’s $200,000 house loan. The nursing-home notary said he was of sound mind. What can we do?

My husband bought our house with an inheritance. I signed a quitclaim. He said I could live there after he dies, but changed his mind. What now?

Low-paying jobs are the economy’s way of saying you should get a better job’: I’ve decided to stop tipping, except at restaurants. Am I wrong?

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com, and follow Quentin Fottrell on X, the platform formerly known as Twitter. The Moneyist regrets he cannot reply to questions individually.

Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Readers write to me with all sorts of dilemmas. Post your questions, or weigh in on the latest Moneyist columns.

By emailing your questions to the Moneyist or posting your dilemmas on the Moneyist Facebook group, you agree to have them published anonymously on MarketWatch.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

European Central Bank president says her son lost 60% of his investments trading crypto

European Central Bank President Christine Lagarde revealed that her son lost money investing in cryptocurrency, according to Reuters on Nov. 24.

Lagarde said that her son lost “almost all” of his investments by trading cryptocurrency against her warnings. During an event, she said:

“He ignored me royally, which is his privilege … And he lost almost all the money that he had invested. It wasn’t a lot but he lost it all, he lost about 60% of it … So when I then had another talk with him about it, he reluctantly accepted that I was right.”

Lagarde added that she has a “very low opinion of cryptos.” She said that although people are free to invest and speculate in the area, they should not be allowed to take part in business and trade that involves criminal activity.

Lagarde addressed an students at an event in Frankfurt, Germany. The event was titled Euro20plus and was organized by Germany’s central bank, Deutsche Bundesbank.

Lagarde is involved in ECB policy

Lagarde is otherwise involved with many of the ECB’s other activities concerning the regulation of cryptocurrencies, stablecoins, and digital assets.

In November 2022, Lagarde advocated for an update to Markets in Crypto-Assets (MiCA) Regulation called MiCA 2, which she said would be “broader [in] what it aims to regulate” than its precursor. MiCA applies to custodial wallets and exchanges and certain crypto assets and stablecoins. By contrast, MiCA 2 would address regulation of decentralized DeFi platforms and crypto assets without issuers, for example.

Though she had previously advocated for the MiCA 2 framework, Lagarde also discussed cited the then-recent collapse of FTX during that speech.

In October 2023, Lagarde issued a statement describing advances around the digital euro, a central bank digital currency (CBDC) that could provide a regulated alternative to cryptocurrency. She more broadly advocated for CBDCs in May 2023.

The post European Central Bank president says her son lost 60% of his investments trading crypto appeared first on CryptoSlate.