COO responsibilities will be shared, GameStop said.

Source link

latest

Cardano Latest Technological Updates Unveiled, Analyst Maintains Bullish Outlook on ADA

Cardano (ADA), the proof-of-stake blockchain platform, has made notable progress in technological advancements, according to Input Output Hong Kong (IOHK), the engineering firm behind the Cardano blockchain.

IOHK’s recent announcement highlights crucial improvements across various aspects of the platform, signaling further growth and development for Cardano.

Cardano Smart Contract Optimization

One significant area of improvement lies within the ledger team, which has reportedly enhanced test frameworks and data quality in the Newconstraints phase3. They achieved this by introducing constraints and new types such as Size, SizeSpec, and Sized.

The engineering company has also noted advancements in wallets and services. The Lace team is preparing to release Lace v.1.9, which promises new features and improvements for Cardano users.

In the realm of smart contracts, the Plutus team has included a guide in the documentation, elucidating how to use AsData functionality to optimize scripts. They have also implemented a UPLC optimization pass to minimize the number of forces and delays in the script.

Mithril Team Releases Major Update

Addressing scalability, the Hydra team has restored test compatibility with all networks and reviewed and merged streaming plugins. They have rectified tutorial instructions for downloading the latest Cardano-node and resolved the observed contesters bug.

The Mithril team has released Mithril distribution 2412.0, encompassing critical updates and enhancements. These include support for the Prometheus metrics endpoint in signer, deprecation of the snapshot command in the client CLI, full Pallas-based implementation of the chain observer, and compatibility with Cardano node v.8.9.0.

Moreover, the team has implemented community-requested features to verify the output folder structure created by the client. They continue to investigate and address any sources of “flakiness” in the CI end-to-end test.

Notable Surge In Token Trading Volume

According to DeFiLlama data, Cardano’s total value locked (TVL) currently stands at $422 million, signifying a slight dip of $80 million following the achievement of the $500 million milestone. Cardano boasts a significant figure of $23.3 million in terms of stablecoin market capitalization.

Analyzing Token Terminal data reveals several key market indicators for Cardano. The fully diluted market cap, representing the maximum potential market value of all tokens in circulation, is estimated at $29.20 billion, reflecting a notable 4.9% increase over the past 30 days.

Similarly, the circulating market cap, which considers only the tokens in active circulation, stands at $22.88 billion, with a 5.2% growth rate over the same period.

Long-Term Outlook Remains Bullish For ADA

Regarding price action, crypto analyst “Trend Rider” recently shared insights on ADA’s latest price action in a post on the social media platform X (formerly Twitter).

According to the analyst, ADA’s price experienced a decline after reaching a yearly high of $0.811 on March 14. It is currently trading within the range of a parabolic red line and a rider band.

The parabolic red line represents a significant resistance level, while the rider band indicates a potential support region for ADA’s price. This range-bound movement suggests a period of consolidation for ADA, as the cryptocurrency takes a breather before its next significant move.

Furthermore, the analyst notes that the bullish strength of the trend has weakened over the past two weeks. This could indicate a temporary slowdown in ADA’s upward momentum, potentially leading to consolidation or sideways trading.

However, despite this weakening bullish strength, the analyst stated that the overall trend direction remains bullish, suggesting that ADA’s long-term prospects remain positive.

ADA is trading at $0.652, exhibiting a sideways price action in the last 24 hours. However, over the past seven days, the token has successfully recovered from previous losses and registered a gain of 5.4%.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Gary Gensler compares Bitcoin’s latest all-time high to a ‘roller coaster ride’

SEC chair Gary Gensler cautioned investors to carefully consider the merits of each project after the market experienced extreme volatility following Bitcoin’s ascent to a new all-time high.

Gensler made the statements during an interview with Bloomberg on March 6 and likened the crypto market’s volatility to a roller coaster ride.

According to the SEC chair:

“[Cryptocurrency] is a highly speculative asset class. One could just look at the volatility of Bitcoin in the last few days. And I grew up loving roller coasters … but you really should be conscious, as the investing public, that this is a bit of a roller coaster ride on volatile assets.”

Continuing the metaphor, Gensler urged investors to consider the strength of each asset’s foundation as it reaches “the top of [the] hill.” He added that essential considerations include cash flows, use cases, and each asset’s potential status as a security.

Gensler’s comments come after Bitcoin briefly touched a new all-time high price of $69,324 on March 5 before falling 11% to $60,861 within hours, causing a bloody market rout.

However, the flagship asset and the overall market recovered most of the losses on March 6, with the flagship crypto trading at $65,834 as of press time.

ETH ETFs

When pressed to comment on the possible approval of spot Ethereum ETFs, Gensler said that the SEC has the filings before it and is reviewing them. He did not comment on specific applications.

The SEC has to decide whether to approve or reject VanEck’s spot Ethereum ETF application by the May 23 deadline, and many expect the regulator will simultaneously issue a decision regarding the other applications.

One Polymarket prediction market places May approval odds at 43%, while various experts, including executives at asset management firms, have placed approval odds close to 50%.

Gensler also declined to comment on whether the Ethereum token (ETH) is considered a security and if this would impact the approval of each pending ETF application. However, he said there are up to 20,000 crypto tokens, and many of them could be deemed securities because investors rely on the efforts of a group of entrepreneurs behind each project.

Gensler is known for his rigid stance toward crypto and his view that most tokens are securities that should be regulated by the SEC. Bitcoin remains the only asset he has confirmed as a commodity by the regulator and its chair.

Warren Buffett’s Latest $2.1 Billion Buy Brings His Total Investment in This Stock to More Than $74 Billion in Under 6 Years

For nearly six decades, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been putting on a clinic for Wall Street. Whereas the benchmark S&P 500 has delivered a total return, including dividends, of a little north of 33,000% since the “Oracle of Omaha” took over as CEO in the mid-1960s, Berkshire’s Class A shares (BRK.A) have galloped higher by an aggregate of more than 5,000,000% as of the closing bell on Feb. 28, 2024! An outperformance of this magnitude is going to get you noticed by professional and retail investors.

Warren Buffett’s phenomenal track record is a big reason why there’s a buzz surrounding Berkshire Hathaway every time the company files Form 13F with the Securities and Exchange Commission (SEC). A 13F gives investors an over-the-shoulder look at what Wall Street’s greatest money managers have been buying and selling, and is a required quarterly filing for institutions and investors with at least $100 million in assets under management.

Warren Buffett has been adding to a core position and building up his stake in a value stock

Throughout 2023, the Oracle of Omaha and his investment aides, Todd Combs and Ted Weschler, were very selective about their purchases. One core holding that’s continued to see somewhat regular additions is energy stock Occidental Petroleum (NYSE: OXY).

Accounting for Berkshire’s latest share purchases during the first week of February, Buffett’s company has gobbled up more than 248 million shares of Occidental Petroleum since the start of 2022. That’s a roughly $15 billion position, with $34 billion, in total, devoted to energy stocks, including Berkshire’s position in Chevron.

Having 9% of Berkshire’s invested assets tied up in two integrated oil and gas stocks is a pretty clear message that the company’s brightest minds anticipate crude oil prices will remain elevated for an extended period. With the global supply of oil remaining tight following years of capital underinvestment tied to the COVID-19 pandemic, there’s a real possibility the spot price of crude oil heads even higher.

What makes Occidental Petroleum an intriguing investment in the energy arena is its revenue breakdown. Despite being an integrated operator that generates some of its revenue from downstream chemical plants, Occidental derives the lion’s share of its sales from drilling. If the spot price of crude oil climbs, it’ll benefit more than virtually any other integrated oil and gas company.

Beyond Occidental, we’ve also seen Warren Buffett and his team piling back into satellite-radio operator Sirius XM Holdings (NASDAQ: SIRI). Though radio operators are often highly dependent on advertising revenue to keep the lights on, Sirius XM has an assortment of competitive advantages working in its favor that should help it navigate any economic climate better than terrestrial and online radio companies.

To start with the obvious, Sirius XM is the only licensed satellite-radio operator. While this doesn’t mean it’s free of competition for listeners, it does give the company reasonably strong subscription-pricing power.

What’s arguably even more important with Sirius XM is how the company generates revenue. Whereas terrestrial and online radio providers are reliant on advertising revenue, only 20% of Sirius XM’s sales came from advertising in 2023. Meanwhile, a whopping 77% of Sirius XM’s revenue can be traced to subscriptions. Subscribers are less likely to cancel their service during an economic downturn than businesses are to meaningfully pare back their advertising budgets.

Sirius XM is also historically cheap. Shares are currently trading for a multiple of 13 times forward-year earnings, which is a 32% discount to its average forward-year earnings multiple over the trailing five-year period.

The Oracle of Omaha has purchased in excess of $74 billion worth of this stock

Although Berkshire’s 13Fs have told an interesting story for more than a year — Buffett and his team have been net sellers of equities for the past five quarters — it’s what’s not in Berkshire’s 13Fs that’s an even bigger deal.

Warren Buffett’s favorite stock to buy isn’t Apple, Occidental Petroleum, or any of the nearly four dozen securities currently listed in Berkshire’s quarterly filed 13F. The only way to find this mystery stock that the Oracle of Omaha can’t stop buying is to dig into his company’s operating results. That’s where you’ll find the quarterly share-repurchase activity, because Warren Buffett’s favorite stock to buy is none other than shares of his own company! Don’t you love a good plot twist?

Prior to July 2018, the rules governing Berkshire’s share-buyback program didn’t allow its then-dynamic duo of Warren Buffett and Charlie Munger to get off the proverbial bench. Repurchases could only be undertaken if Berkshire’s share price fell to or below 120% of book value (i.e., no more than 20% above its listed book value, as of the end of the latest quarter). Because Berkshire’s share price never fell to or below this preset threshold, no buybacks were undertaken for years.

On July 17, 2018, everything changed for Buffett, Berkshire, and the company’s shareholders. The company’s board amended the buyback rules to allow their star players to “get in the game.” As long as Berkshire holds at least $30 billion in cash, cash equivalents, and U.S. Treasuries on its balance sheet, and Buffett and Munger agreed that their company’s stock was intrinsically cheap, buybacks could commence without a ceiling.

During the December-ended quarter, Berkshire retired 3,623 shares of Class A stock and 660,585 shares of Class B stock (BRK.B) at a total cost of $2,147,823,075! This marked the 22nd consecutive quarter that Buffett’s company has repurchased its own stock, and it brought the grand total of buybacks since July 2018 to more than $74 billion. To put this into context, Buffett and the late Charlie Munger spent roughly twice as much buying Berkshire stock compared to how much they spent purchasing shares of Apple.

Since Berkshire Hathaway doesn’t pay a dividend, share repurchases are the direct way Warren Buffett and his investment team can reward investors who align with their long-term vision. Steadily buying back stock should increase the ownership stakes of the company’s shareholders.

Furthermore, businesses like Berkshire Hathaway that tend to grow their operating income over time should enjoy a hearty boost to their earnings per share as their outstanding share count declines. This is only going to make the stock more attractive to fundamentally focused investors.

Buying back tens of billions in his own company’s stock is also a pretty clear indication that Buffett is betting on himself and the business he, Munger, Combs, and Weschler have built to succeed over the long run.

With a record $167.6 billion in cash on hand and few, if any, values piquing the interest of the Oracle of Omaha and his team, look for repurchases of Warren Buffett’s favorite stock to continue throughout the first quarter (and likely well beyond).

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Sean Williams has positions in Sirius XM. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and Chevron. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett’s Latest $2.1 Billion Buy Brings His Total Investment in This Stock to More Than $74 Billion in Under 6 Years was originally published by The Motley Fool

Bitcoin’s Latest Difficulty Retarget Jumps 8.24%: Miners Navigate the Toughest Mining Landscape Yet

Bitcoin’s mining difficulty has hit an unprecedented peak, marking the most significant jump of 2024. On Thursday, at the milestone of block 830,592, the network experienced its fourth adjustment this year with a sharp 8.24% uptick. Bitcoin Mining Difficulty Skyrockets, Setting New Records in 2024 Mining bitcoin (BTC) has become considerably more challenging, following an […]

Bitcoin’s mining difficulty has hit an unprecedented peak, marking the most significant jump of 2024. On Thursday, at the milestone of block 830,592, the network experienced its fourth adjustment this year with a sharp 8.24% uptick. Bitcoin Mining Difficulty Skyrockets, Setting New Records in 2024 Mining bitcoin (BTC) has become considerably more challenging, following an […]

Source link

The Avalanche token has been in a positive form recently, with the AVAX price turning in a good performance over the past week. This latest price boost makes a run to the $40 level more or less inevitable for the altcoin.

However, investors are curious to see how long this rally will last, especially with the unlocking of a substantial amount of AVAX tokens on the horizon.

AVAX Price Overview

As of this writing, the AVAX price is slightly above $39, reflecting a nearly 8% jump in the last 24 hours. This recent increase only underscores how well the cryptocurrency has been performing in recent weeks.

According to data from CoinGecko, the value of the Avalanche token has increased by approximately 10% in the past week. After sinking to a low of $28 in late January, AVAX’s price has recovered quite well in the new month, surging by more than 17% since February started.

With the latest price growth, Avalanche looks set to reclaim $40, a level it occurred between December 2023 and early January 2024. The token, however, lost this level due to the downturn that hit the entire crypto market following the Bitcoin spot ETF approval.

With $40 already in sight, the question is whether AVAX can sustain a rally above this mark in the long term. While price indicators like the Relative Strength Index (RSI) are not showing any signs of trend reversal, upcoming events suggest that the Avalanche token might need to overcome some degree of bearish pressure in the coming days.

Avalanche To Unlock About $370 Million Worth Of Tokens

According to on-chain data, Avalanche will unlock 9.54 million tokens (worth about $372 million) on February 22. This figure represents about 2.6% of AVAX’s total supply and will be disbursed in four tranches.

Breaking it down, 2.25 million AVAX is expected to go to strategic partners, 1.67 million coins to the foundation, 4.5 million tokens to the Avalanche team, and 1.13 million AVAX are set to be released in a little over a week.

It is common for crypto projects to execute token unlocks, which may have a corresponding impact on the value of the unlocked token (AVAX, in this case). This effect is because this substantial amount of token, once unlocked, may become available for trading on the open market.

If these newly unlocked tokens are dumped on the open market, this can place some bearish pressure on the burgeoning price of AVAX. This selling pressure could halt the recent growth of the Avalanche token.

AVAX price approaches the $40 mark on the daily timeframe | Source: AVAXUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

COTI’s privacy-focused Ethereum L2 development reached a critical milestone by successfully integrating its Multi-Party Computation (MPC) protocol. Its token price surged approximately 55% following this technical achievement.

MPC is a powerful cryptographic tool that allows several parties to work together on a computation using their private data without revealing that data to each other. COTI confirms that the successful implementation of the MPC protocol represents the first in a series of technical goals they will meet before COTI V2 is fully deployed.

COTI V2 architecture and MPC integration.

COTI V2 architecture hinges on MPC technology, ensuring the privacy of its Layer 2 computations on Ethereum over private inputs executed without compromising data confidentiality. Participants supply encrypted data to an MPC’ black box’, which executes specific computational processes. MPC results are delivered in a way that safeguards data integrity throughout, even amidst potential external scrutiny. Each MPC entity, dubbed an “MPC endpoint,” will later integrate into the project’s custom Extended-EVM execution module.

MPC endpoints facilitate collaborative computation without sacrificing data privacy. This advancement significantly improves EVM functionality, unlocking support for more diverse dApps within a framework offering transparency alongside essential privacy capabilities. This integrated MPC architecture provides greater privacy and security for complex computations on-chain, potentially fueling wider adoption of Ethereum technology as use cases expand.

To facilitate MPC use, users first establish cryptographic key material. Next, data is submitted in encrypted form for safe storage. Users then submit workloads in secure MPC bytecode, with operations like addition and multiplication taking place on confidential data without exposing those original values. Workloads can generate public outputs or outputs specifically encrypted to remain accessible only to chosen users.

Testing and future plan.

Per COTI, a simulated state was tested within MPC modules as they collaboratively generated a ‘garbled circuit.’ This cryptographic concept represents a specific computational function and has inherent security, being inherently single-use. This provides forward and backward secrecy through design.

This first development milestone includes completing the protocol, including design and algorithms. Importantly, COTI developers demonstrated the capability to securely input and output data using distributed keys, enabling advanced encryption and decryption functions without compromise.

The achievement of this privacy-focused landmark emphasizes the progress towards COTI’s ambitious Layer 2 solution. A COTI blog post states,

“The creation and implementation of a secure MPC protocol is the first of many development milestones we’ll reach throughout the year. Stay tuned for further COTI V2 updates as development continues.”

Super Micro’s blowout numbers are latest bit of good news for chip industry

Super Micro Computer Inc. on Thursday delivered the latest upbeat signal for the chip industry.

The company, which is a partner of Nvidia Corp.

NVDA,

and offers servers that run artificial-intelligence chips, expects to report fiscal second-quarter results vastly above the consensus view. Super Micro

SMCI,

issued preliminary quarterly figures Thursday afternoon that call for $3.6 billion to $3.65 billion in net sales, ahead of the $2.8 billion FactSet consensus, which was also the midpoint of the company’s prior outlook.

Opinion (from November 2023): This Nvidia partner has seen its stock surge. But investors may be overlooking a risk.

Super Micro also now expects to post $5.40 to $5.55 in adjusted earnings per share for the December quarter, while analysts had been looking for $4.51 and the company’s earlier forecast called for $4.40 to $4.88.

The company’s release on the matter was brief, calling out “a strong market and end customer demand for our rack-scale, AI and Total IT Solutions” and noting that the company’s earnings call will take place after the close of trading on Jan. 29.

Super Micro shares were up more than 6% in aftermarket action Thursday.

The preliminary results come as the latest bit of good news for the chip sector. Earlier Thursday, Taiwan Semiconductor Manufacturing Co.

TSM,

issued a better-than-expected forecast for the current quarter while giving upbeat commentary on the future of artificial-intelligence chips. TSMC shares surged nearly 10% on the day, and the report helped to lift other chip stocks, including Advanced Micro Devices Inc.

AMD,

which finished the session in record territory.

Shares of Super Micro have almost quadrupled over the past 12 months, with the name seen as a play on the artificial-intelligence frenzy. In the fiscal first quarter, Super Micro generated more than half of its revenue from AI-related servers. The company acknowledged supply constraints on its last earnings call.

Iowa GOP caucuses: Haley now 2nd in latest polls, and here’s key level for Trump

Republican voters in Iowa are getting their customary moment in the spotlight right now, as they’re due to convene their first-in-the-nation caucuses at 8 p.m. Eastern Monday, kicking off the 2024 GOP presidential race.

But it’s not looking like much of a contest, as former President Donald Trump has big leads in most polls over rivals such as Nikki Haley, his former ambassador to the United Nations, and Florida Gov. Ron DeSantis.

So a main focus is whether DeSantis or Haley could get second — and how close they’ll get to the former president.

Another key is what level of support should Trump’s 2024 campaign want to see among Iowa GOP voters? There’s an expectations game in presidential primaries, just as there is with quarterly earnings or economic data.

“The 50% barrier is really critical for him,” said Jim Ellis, president of election analysis firm Ellis Insight and a former GOP congressional aide. “Most of the polling indicates that he can reach or exceed that, and I think he needs to. If he does, that gives him good momentum going the rest of the way.”

Getting support in the low 40s “could be a warning sign” for Trump, but it’s not likely, Ellis added.

The 45th president has 53% support in Iowa polls, according to a RealClearPolitics moving average of surveys as of Friday. DeSantis, whose campaign has bet big on Iowa, has been second in RCP’s average of Iowa polls up until last week. Haley is now No. 2 with 18% support, ahead of DeSantis at 16%.

In New Hampshire, which is scheduled to hold its GOP primary on Jan. 23, Trump gets 44% support vs. 29% for Haley, 11% for former New Jersey Gov. Chris Christie — who recently dropped out of the White House race —- and 7% for DeSantis.

Related: Christie drops out of 2024 GOP presidential race, a move that could help Haley vs. Trump in New Hampshire

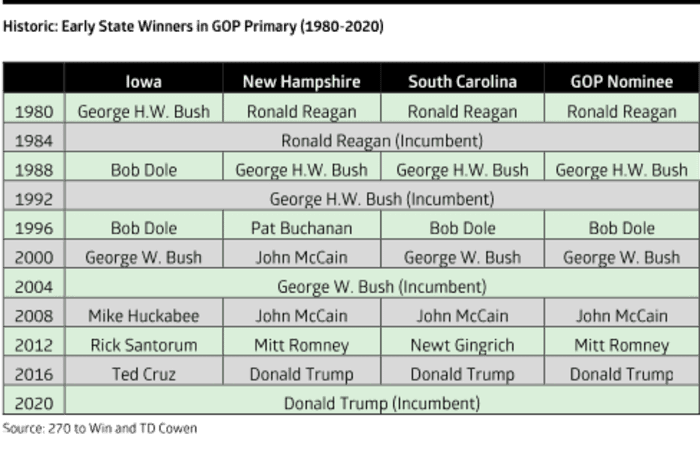

Trump is attempting to become the first non-incumbent Republican presidential candidate to win in both Iowa and New Hampshire, noted Chris Krueger, an analyst at TD Cowen Washington Research Group. Krueger has offered the chart below that illustrates how the Hawkeye State often hasn’t been kind to the candidate who goes on to become the GOP nominee.

If Haley were to get second to Trump in Iowa, topping DeSantis, that would give her momentum going into New Hampshire, where she might be able to score a surprise win, Krueger said in a recent report. The Granite State is “a prime location for a potential Trump ambush” given Haley has been endorsed by popular GOP Gov. Chris Sununu and the primary’s open structure allows Democrats and independents to vote in it.

Haley then might keep her momentum going into her home state of South Carolina’s Feb. 23 primary, as well as into the Super Tuesday races on March 5, but overall this is a “fraught” path, the TD Cowen analyst said. It’s “possible — just not probable,” he wrote.

Betting markets tracked by RealClearPolitics put Trump’s chances for winning the 2024 GOP presidential nomination at 74%, while Haley is at 15% and DeSantis, 5%.

In South Carolina, the former president has 52% support, according to RCP’s moving average, followed by 22% for Haley, a former governor of the state, and 11% for DeSantis.

Related: How betting markets got the 2022 midterm elections wrong

When Trump might clinch the nomination

When might the front-runner put the nomination fight to bed and move on to the general-election battle against President Joe Biden?

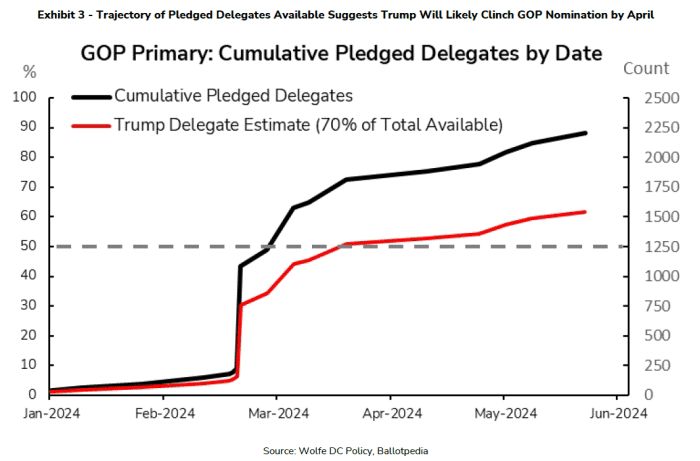

Wolfe Research has offered an assessment of that question that’s illustrated in the chart below. The chart shows the “cumulative percentage of delegates awarded as the nomination calendar proceeds, along with a rough ballpark of where Trump’s delegate count might be tracking if he wins around 70% of the delegates, representing a mix of winner-take-all victories and narrow majorities or strong pluralities in states where Haley makes a good showing,” said Wolfe’s head of policy and politics, Tobin Marcus.

“On this trajectory, even if Haley and/or DeSantis attempt to go the distance rather than dropping out, Trump would formally clinch the nomination by early April, and the writing will be on the wall by early March,” Marcus added. “Note this puts him on track to win the nomination before a verdict is delivered in any of his criminal prosecutions.”

Non-Trump Republican presidential hopefuls might keep their campaigns going because of the former president’s legal troubles.

“There’s an incentive to stay in the race because of the possibility that Trump may be convicted of a criminal offense,” said Stephen Farnsworth, a professor of political science at the University of Mary Washington in Virginia.

“It isn’t just about what the voters in Iowa and New Hampshire think. It’s also what the jurors in various courtrooms around the country think.”

The former president’s GOP rivals are “hoping for a Hail Mary — some dramatic change in circumstances — that allows you to win over support that is now pretty much locked in for Trump,” Farnsworth told MarketWatch.

Trump faces charges in Washington, D.C., and Georgia’s Fulton County in election-interference cases and also was indicted last year in a hush-money case and a classified-documents case. He has denied wrongdoing and argued the charges are politically motivated, and many Republican primary voters share his views and have rallied around him.

Don’t miss: DeSantis says his Disney fight was to ‘protect our kids,’ while Haley says government shouldn’t bully businesses

And see: Here’s how the Iowa caucuses work

Economic plans from DeSantis, Haley and Trump

In his economic plan, DeSantis has leaned heavily into energy

XLE

policy for addressing inflation, and he’s promised to rein in spending and criticized the Trump administration’s outlays.

Haley’s economic proposals include raising Social Security’s retirement age but only for younger people just entering the system, along with eliminating the federal tax on gasoline

RB00,

Trump’s ideas for a second term include a 10% tariff on all imports, making another attempt to end Obamacare

XLV

and addressing student debt by launching a free online college called the American Academy.

Now read: Here’s how the 2024 presidential candidates say they’ll tackle elevated home prices

And see: As Biden touts his Inflation Reduction Act, analysts size up how Trump might repeal it

China’s Xpeng claims its latest EV model could be an industry ‘game changer’

Chinese electric vehicle company Xpeng told CNBC on Friday that its newly launched X9 model could be a “game changer” for the industry.

Xpeng launched the X9 large 7-seater EV on Jan. 1, a car built on its SEPA2.0 architecture for the Chinese market. The X9 series are priced between 359,800 yuan to 419,800 yuan (about $50,360 to $58,760) with immediate deliveries.

“For X9, we actually anticipate this to be a game changer for the battery electric vehicles segment for MPVs (multi-purpose vehicles),” Brian Gu, vice chairman and co-president of Xpeng, told CNBC’s Emily Tan in an exclusive interview.

“We believe this could be the top seller in its category … because I think it has some very innovative technology and design as well as superior handling, industry leading smart driving technology – packed into a very beautifully designed product,” said Gu.

Xpeng’s new launch comes as several domestic EV players such as Nio, Huawei and Zeekr recently revealed new electric vehicles. Even Chinese consumer electronics company Xiaomi is launching its first EV to compete in the market.

We anticipate in 2024, we will be growing much faster than the industry growth which means that we can expand our market share.

Brian Gu

Vice Chairman and Co-President, Xpeng

Xpeng has laid out ambitious plans to roll out driver-assist technology in China by end of last year and in Europe by the end of 2024.

The Chinese EV maker also entered into a cooperation framework agreement with Guangdong Huitian on Jan. 2 to manufacture, develop and sell flying vehicles, where Xpeng will provide research and development, technology consulting services and sales agent services to Guangdong Huitian.

“We anticipate in 2024, we will be growing much faster than the industry growth which means that we can expand our market share,” said Gu, adding that the firm will be looking to increase profit margins with greater scale and better product mix.

“The X9 will be a very high margin product for us,” said Gu.

Stiff competition

Competition is intensifying in the Chinese EV market, with BYD, Li Auto and Geely among the small number of players that have hit their annual sales targets.

Xpeng and Nio were among those that missed their targets.

Xpeng delivered a total of 141,601 units in 2023, a 17% increase from a year ago. This fell short of the firm’s target of delivering 200,000 vehicles for the year as reported by local media.

“The focus of investors [for 2024] is whether the company can maintain decent delivery momentum with new launches and improve profitability in a challenging pricing environment, in our view,” said Morningstar analyst Vincent Sun in a Nov. 16 note on Xpeng.

2024 will be a very competitive year with obviously a number of new models as well as new brands launching in the segment.

Brian Gu

Vice Chairman and Co-President, Xpeng

Nio delivered 160,038 vehicles in 2023, representing an increase of 30.7% compared to a year ago — but it still was well below its target of about 245,000 cars based on management’s target to “double the volume” of 2022 during their fourth quarter earnings call.

Li Auto delivered 376,030 vehicles in 2023 – meeting its annual delivery milestone of 300,000 vehicles.

In terms of sales, BYD met its 3 million target in 2023 and surpassed Tesla as the world’s top-selling EV brand in the fourth quarter, selling more battery-powered vehicles than its U.S. rival.

BYD produced 3.05 million vehicles in 2023 while Tesla said it made 1.84 million vehicles that same year.

‘Strong momentum’

Gu is optimistic on China’s EV market in 2024 despite challenges, saying that “2024 will be a very competitive year” with new model and brand launches.

“I think that the EV sector in China ended on a very high note in the fourth quarter, if you look at the penetration rates approaching 40% towards the end of this 2023, which is the high point that we have seen in the industry,” said Gu. “So all that points to a strong momentum.”

According to TrendForce, China’s new energy vehicle penetration rate exceeded 40% for the first time in November and “optimistic growth” is anticipated by 2024.

“I think we will continue to see a number of the catalysts that’s propelling the growth of the new energy vehicle market, obviously the technology, the product launches, as well as the continued conversion from internal combustion engines to new energy vehicles,” said Gu.

The new energy category includes electric and plug-in hybrid power sources.

“But in order to be competitive, I think we still need to focus on differentiating innovative technology as well as maintaining a very strong cost-competent competitive advantage with scale as well as technological innovations,” he added.