In a statement released on March 7, the Canadian fintech entity Mogo disclosed its strategy to diversify its portfolio by investing in bitcoin and bitcoin exchange-traded funds (ETFs), earmarking an initial outlay of as much as $5 million. Canadian Fintech Mogo Dives Deeper Into Bitcoin The publicly traded Canadian enterprise Mogo (Nasdaq: MOGO) (TSX: MOGO) […]

In a statement released on March 7, the Canadian fintech entity Mogo disclosed its strategy to diversify its portfolio by investing in bitcoin and bitcoin exchange-traded funds (ETFs), earmarking an initial outlay of as much as $5 million. Canadian Fintech Mogo Dives Deeper Into Bitcoin The publicly traded Canadian enterprise Mogo (Nasdaq: MOGO) (TSX: MOGO) […]

Source link

LongTerm

The artificial intelligence (AI) market is full of hype and speculation, with early AI leaders like Nvidia or Microsoft trading at nosebleed valuations. Whether the AI market darlings deserve their rich valuations or not, three Fool.com contributors believe it’s time to look beyond the usual suspects.

They put their heads together to uncover existing tech giants like International Business Machines (IBM 1.71%), Cloudflare (NET 1.40%), and Salesforce (CRM 2.61%) — three great companies with deep AI expertise. This trio offers compelling value and potentially significant long-term returns from their AI initiatives.

Investing is a marathon. IBM, Salesforce, and Cloudflare have been running the AI race for years, and they won’t stop anytime soon.

IBM is the big, blue AI workhorse

Anders Bylund (IBM): Generative AI tools and flashy consumer tech often dominate the headlines. Meanwhile, good old tech titan IBM is quietly positioning itself as the backbone of enterprise-grade AI solutions.

The company’s hybrid cloud focus, emphasis on explainability and trackable data sources, and deep industry relationships might not seem as sexy as the latest ChatGPT upgrade, but these are the very elements that should make IBM an enduring force in the AI space.

IBM’s focus on long-term partnerships and sustainable solutions aligns with the needs of businesses wanting to use AI in an impactful yet responsible way. As concern grows around AI systems’ potential for harmful biases, misleading output, and black-box decision-making, IBM’s approach inspires a deeper trust.

The long-term contracts Big Blue signs with enterprise-class customers will depend on that professional-grade trust. “Hallucinations” and data mishaps are common themes in today’s large language models (LLMs), but IBM isn’t interested in playing that game. The likes of OpenAI, Microsoft, and Alphabet don’t seem ready to compete from the transparency and quality angle so far.

Critics might argue that IBM’s “slow and steady” approach is a disadvantage. But in the realm of enterprise solutions, patience and thoroughness should be seen as strengths. The slow and heavy vetting IBM’s prospective clients apply to the Watson AI systems today will result in lucrative, hard-to-replace, multiyear contracts.

“The early work for clients around data architecture, security, and governance is critical and hard, and we think consulting expertise is going to be crucial here,” CEO Arvind Krishna said in the recent fourth-quarter earnings call.

Moreover, IBM’s current valuation presents a potential value opportunity compared to some of the AI market’s highfliers. The stock trades at a modest 2.7 times sales and 13 times free cash flow, making even Alphabet look expensive in comparison with the same ratios clocking in at 5.6 and 25, respectively.

If the company can continue to prove that its AI solutions add tangible, measurable value to businesses, investors who focus on long-term potential may find IBM to be the unsung workhorse of the AI revolution. If nothing else, you’re looking at a generous dividend payer with torrential cash flows and a centennial business history.

IBM’s big AI bet is starting to pay off right now, but even if the business-grade AI strategy fizzles, it’s still a great income-generating stock to own in the long run. That’s a big “if,” though. AI and hybrid cloud computing have emerged as leading growth drivers for the ultra-experienced tech giant. I expect good things and big wins from Big Blue’s AI business in the coming years.

Could this edge computing play be an under-the-radar AI star?

Billy Duberstein (Cloudflare): The past 18 months in artificial intelligence have been all about training, which is the act of building extremely large language models out of billions of data parameters. But now the AI industry is moving to an “if you build it, they will come” phase. In layman’s terms, companies are now actually putting these models to work.

When a trained model is prompted and then goes to work on finding answers or completing a task, that’s called inferencing. And inferencing applications are about to take off.

To see how that shift is unfolding, look no further than Nvidia’s recent earnings report. CEO Jensen Huang said he estimates about 40% of Nvidia’s data center revenue over the past year was actually for inference, not training. That’s somewhat surprising, as Nvidia is thought to be the only game in town for training, whereas it’s possible inferencing could be done with some lower-power processors from competitors.

One company that could be an under-the-radar inference play is Cloudflare, which began as a software company that helped speed up websites, software applications, and content delivery.

But Cloudflare’s management was forward-thinking, taking the time and cost to build an integrated software stack from the beginning, whereby all of its new products and services can be run on the same type of commodity hardware. That has paid off in the form of an ever-increasing portfolio of products, including cybersecurity, network management, and developer platforms that run on its lightweight servers in internet service provider data centers close to customers at the edge.

Today, Cloudflare’s servers are in 310 cities in over 120 countries connecting 13,000 networks, with its network now within 50 milliseconds of 95% of the world’s population. And that makes Cloudflare a potentially ideal place for businesses to run their inference workloads. That’s because inference workloads are likely too computing-intense to run on end devices such as PCs or phones, but are likely “lightweight” enough so that they don’t have to be run all the way back in a large, cloud-based data center.

Management began to capitalize on this potential last September when Cloudflare released Workers AI, an inferencing-as-a-service platform for developers in Cloudflare’s servers, which could potentially put Cloudflare up against the big cloud computing players for inference workloads.

And the new offering is showing early signs of success, with Workers AI requests growing 9x between September and December, according to Cloudflare’s recent fourth-quarter conference call with analysts. And even though the new inference offering just came out and contributes little to revenues today, Cloudflare still saw a very healthy 32% revenue growth in the last quarter, driven by its core products. Of note, Cloudflare is really penetrating larger enterprise customers now, with the company recording its largest customer win, as well as its largest customer renewal ever last quarter.

With much-loved offerings across its core content delivery, network, and cybersecurity markets that are still growing strong, Cloudflare’s new inference products could bolster its already-strong growth rate for years to come.

A transition from growth to value

Nicholas Rossolillo (Salesforce): After a couple of years of unwinding out-of-control spending that cropped up during the pandemic, customer data and relationship management platform Salesforce (CRM 2.61%) is totally back. The software giant reported revenue growth of 11% this past year, despite a big slowdown in corporate spending as companies looked to tighten up as the economy slowed. Salesforce is predicting some of this soft spending among its users will continue, but is still nevertheless predicting revenue growth of about 9% for 2024 (fiscal year 2025 for Salesforce).

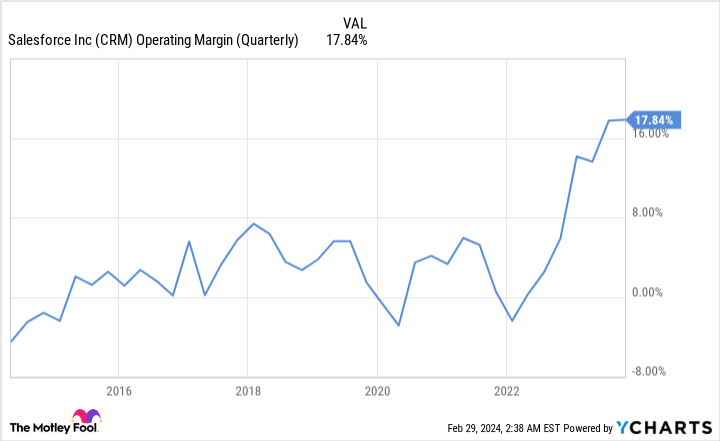

As the business has matured, Salesforce made a quick pivot from all-out growth (it had been putting up 20%-plus sales growth for the duration of its existence as a publicly traded stock over the last two decades) to a more value-generating business. CEO Marc Benioff and the top team ratcheted up generally accepted accounting principles (GAAP) operating profit margins this last year to 14.4%, and expects that figure to jump to 20.4% for full-year fiscal 2025.

Data by YCharts.

Along the way, Salesforce started repurchasing its own stock as part of a new strategy to begin returning cash to shareholders. And starting this year, Salesforce will also begin paying a quarterly dividend — which, as of this writing, is worth 0.5% in annualized yield. That’s not too exciting, but it nevertheless signals this data management software company’s successful evolution into a more mature business.

Of course, customer data is more important than ever in a new era of AI-fueled computing technology. Salesforce’s own development of AI throughout its platform isn’t translating into any pick-up in growth just yet. However, that tees up the possibility of management underpromising and overdelivering this year on financial guidance. Plus, Benioff and company said its own internal use of its AI tools should fuel the profit margin expansion story for years to come.

Salesforce stock now trades for about 45 times expected GAAP earnings per share (EPS), or about 30 times EPS on an adjusted basis (which corresponds a bit more closely to free cash flow). Shares have been on a hot run in the last year, but there are still years’ worth of profitable returns left in the tank for this cloud software leader. I’m happy to keep holding.

Long-term Bitcoin holders selling off could signal more price increases

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Forget Rent Hikes, This Is Where Long-Term Growth Will Come From for Prologis

Prologis (PLD 0.76%) is one of the world’s largest real estate investment trusts (REITs), with a market cap of about $120 billion. That size is important to keep in mind as you look at its long-term business opportunity. Of late, however, investors have been more focused on the short term. Here’s why you may want to dig deeper.

Prologis’ shares have cooled off

Supply chain problems related to the coronavirus pandemic caused investors to rush into the warehouse market. As the leader of this REIT sector, Prologis was a big beneficiary. The story is pretty simple. With more people stuck at home, online shopping grew quickly. Companies needed more warehouse space to accommodate those sales. On top of that, supply chain snarls caused by the pandemic resulted in companies holding higher levels of inventory than normal. Again, a need for more warehouse space was the end result.

Image source: Getty Images.

Increased demand resulted in rising rental rates. The numbers are kind of shocking. For example, in the third quarter of 2023 Prologis was able to increase rents by a whopping 74% on expiring leases, which was actually down sequentially from the second quarter. As you might expect, big rent hikes are good for business. All of the REIT’s leases don’t expire at the same time, so the benefit has been ongoing and is likely to continue for a while longer.

Early on, Wall Street was very excited about this story and pushed Prologis’s share sharply higher. And then reality seems to have set in that this situation wouldn’t last forever. The stock has since fallen back down to earth, though it remains well above where it started out in 2020.

Here’s the thing: Rent hikes are only one avenue for growth that Prologis has to offer investors.

Prologis has other levers to pull

This brings the story back to Prologis’s size, which its enormous market cap highlights. The most obvious growth path was put on display in 2022, when Prologis agreed to pay $26 billion to buy rival Duke Realty. That’s a big chunk of change, but given Prologis’s size it was a manageable transaction. It’s highly likely that no other REIT could have pulled off that deal. Being an industry consolidator is a key growth path, as indicated by Prologis’s follow-up purchase of a large property portfolio from alternative investment manager Blackstone.

But there’s something of a hidden gem waiting to be taken advantage of within Prologis’ globally diversified portfolio. Here are the numbers. In North America the REIT owns 803 million square feet of space across 3,877 buildings and 7,885 acres of undeveloped land. In South America the numbers are 83 million square feet across 341 buildings and 1,960 acres of undeveloped land. In Europe the REIT owns 242 million square feet across 1,112 buildings and has 2,157 acres of undeveloped land. And in Asia, Prologis operates 114 million square feet of warehouse space across 283 buildings and owns 89 acres of undeveloped land.

The takeaway is that it owns a massive portfolio of working properties in key transportation hubs. And, right in the same areas, it has land that it can develop if demand for property merits the investment. Prologis estimates that this land could be a $40 billion investment opportunity, which is even bigger than the Duke deal. Clearly, that won’t all happen at one time. But that’s actually good news, since it suggests that there are years of growth ahead for Prologis even after the benefit from rent increases dwindles.

There are still reasons to like Prologis

It is likely that Wall Street got ahead of itself with Prologis coming out of the pandemic disruptions. But investors looking at the REIT today need to think long-term. Yes, the benefit of rolling over expiring leases to higher rates will eventually peter out. But the company’s ability to act as an industry consolidator and its massive portfolio of vacant land suggest that there are other powerful growth drivers here. With the 2.7% dividend yield still near its highest levels in five years, growth and income investors should probably give Prologis a second look.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Blackstone and Prologis. The Motley Fool has a disclosure policy.

Long-term Treasury yields end the week higher despite mild PCE inflation data

U.S. government-debt yields finished mostly higher on Friday after December inflation data reinforced the possibility of a soft landing for the economy.

What happened

-

The yield on the 2-year Treasury

BX:TMUBMUSD02Y

rose 5.3 basis points to 4.365%, from 4.312% on Thursday. For the week, it fell 4.1 basis points. Yields move in the opposite direction to prices. -

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

advanced 2.8 basis points to 4.159%, from 4.131% on Thursday. It rose 1.4 basis points this week. -

The yield on the 30-year Treasury

BX:TMUBMUSD30Y

rose less than 1 basis point to 4.388%, from 4.380% on Thursday. For the week, it rose 3.5 basis points. - Ten- and 30-year rates both ended higher for a second straight week, according to Dow Jones Market Data, while also finishing at their second-highest levels of the year so far.

What drove markets

The PCE price index, the Federal Reserve’s preferred inflation measure, rose a mild 0.2% in December. The core rate, which excludes food and energy, advanced by the same magnitude — in line with the expectations of economists polled by the Wall Street Journal.

Meanwhile, the annual rate of core inflation eased to 2.9% from 3.2%, marking the lowest level in almost three years and suggesting that the disinflation trend is continuing.

Interest-rate expectations were little changed after the inflation report. Fed-funds futures traders saw a 97.4% chance of no action by the Federal Reserve at its meeting next week, which would leave the main policy-rate target between 5.25%-5.5%, according to the CME FedWatch Tool. The chance of no action again by March was seen at 52.6%. Traders mostly expect five or six quarter-point rate cuts by December.

Other data released on Friday showed that pending home sales in December posted their biggest jump since June 2020. With Friday’s data now out of the way, traders have turned their attention to Monday’s release of financing estimates by the Treasury.

See: Wall Street is counting on Treasury’s borrowing needs to trend lower between now and June

What strategists are saying

“For a market that was looking for a ‘high’ +0.1%, the realized figures were very much in line,” said BMO Capital Markets strategist Ben Jeffery, referring to Friday’s PCE report for December.

“We don’t expect December’s data will materially shift March cut odds ahead of the weekend, and instead we’ll look for next week’s supply announcements, FOMC [Federal Open Market Committee] decision, and payrolls print to quickly take the market’s focus as the PCE print is digested,” he wrote in an email.

Have $500? 2 Absurdly Cheap Stocks Long-Term Investors Should Buy Right Now

Investors have mixed ideas about how much valuation should affect their stock-buying decisions. If everything about a company sounds amazing, should a rich valuation matter?

I would break valuation down into three categories. There are some astronomical valuations that simply scream, “Don’t buy right now.” With expectations that high, the market is bound to be disappointed at some point, sending the stock plunging. Then, there are those in the middle where the valuation is high but not outrageous, and that can generate strong opinions.

The third group are the bargains, where the stocks are cheap despite their long-term growth prospects. Sometimes it’s recent performance that’s weighing on the stock price, and other times, the market just looks like it’s missing the full story. Williams-Sonoma (WSM -1.36%) is an incredible company that’s feeling the impact of inflation, and Skechers U.S.A. (SKX -1.30%) just isn’t getting investors excited. If you have $500 to invest in the new year, these both look like bargains right now.

1. Williams-Sonoma: Premium housewares, cheap valuation

Williams-Sonoma sells posh housewares through its eponymous stores, and it also owns several other home goods and furniture brands that cater to an upscale clientele. The business tends to be resilient since much of its target market isn’t penny-pinching, even in tough times. However, there are several factors working against it right now. One is a dismal overall housing market, and the other is lasting financial pressure that’s affecting some of its customers.

In the fiscal 2023 third quarter (ended Oct. 30, 2023), comparable brand revenue, which it uses as its base top-line metric, decreased 14.6% year over year. However, it remained strongly profitable. Gross margin increased 2.9 percentage points to 44.4%. Earnings per share (EPS) was $3.66, and operating margin was 17.0%. Those were both down from last year but above management’s expectations. They’re also well ahead of pre-pandemic levels.

Data by YCharts.

Management is expecting continued pressure in the near term. However, there are several factors that should work in the company’s favor in the long term. A whopping 66% of Williams-Sonoma’s sales come from e-commerce in an underpenetrated industry — only 30% of total houseware and home furnishing sales come from e-commerce, in contrast to 46% for apparel and 80% for consumer electronics. Williams-Sonoma only controls about 1% of its total addressable market, but that should rise organically as more customers shop online. The company is also expanding its markets with business-to-business initiatives and new regions abroad.

The cherry on top is that Williams-Sonoma pays a dividend yielding 1.7% as of this writing. Its stock trades at a price-to-earnings ratio of 14, and it’s a no-brainer value stock to add to your portfolio.

2. Skechers: Budget activewear and a bargain stock

Skechers has carved out an activewear and footwear niche as the budget alternative to premium brands like Nike. However, it collaborates with celebrities as well and has cultivated more of a quirky image than a cheap one, leading to brand differentiation and a loyal fan base.

And in this inflationary environment when shoppers can’t necessarily afford to pay extra for fancy labels, the company is still growing. Sales increased 7.8% year over year in the third quarter, way ahead of Nike in its comparable period. Even better, Skechers is distinguishing its brand with direct-to-consumer sales up 23%. That’s great for creating consumer loyalty, and it’s also important in expanding margins, since profitability is stronger for direct-to-consumer sales. Gross margin indeed improved from 47.1% in the year-ago period to 52.9%, and operating margin expanded from 6.9% to 10.5%.

Operating margin is in line with usual levels, but gross margin has soared. Management attributed that to “favorable pricing, a higher mix of direct-to-consumer sales, and lower unit costs.”

Data by YCharts.

EPS was up 69% year over year as a result. Though Skechers doesn’t pay a dividend, it does have a share-buyback program with $100 million of stock repurchased in the past year.

Skechers trades at a price-to-earnings ratio of 18, and it has been a market-beating stock for years. I expect that to continue, and now is a great time to buy.

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike, Skechers U.s.a., and Williams-Sonoma. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

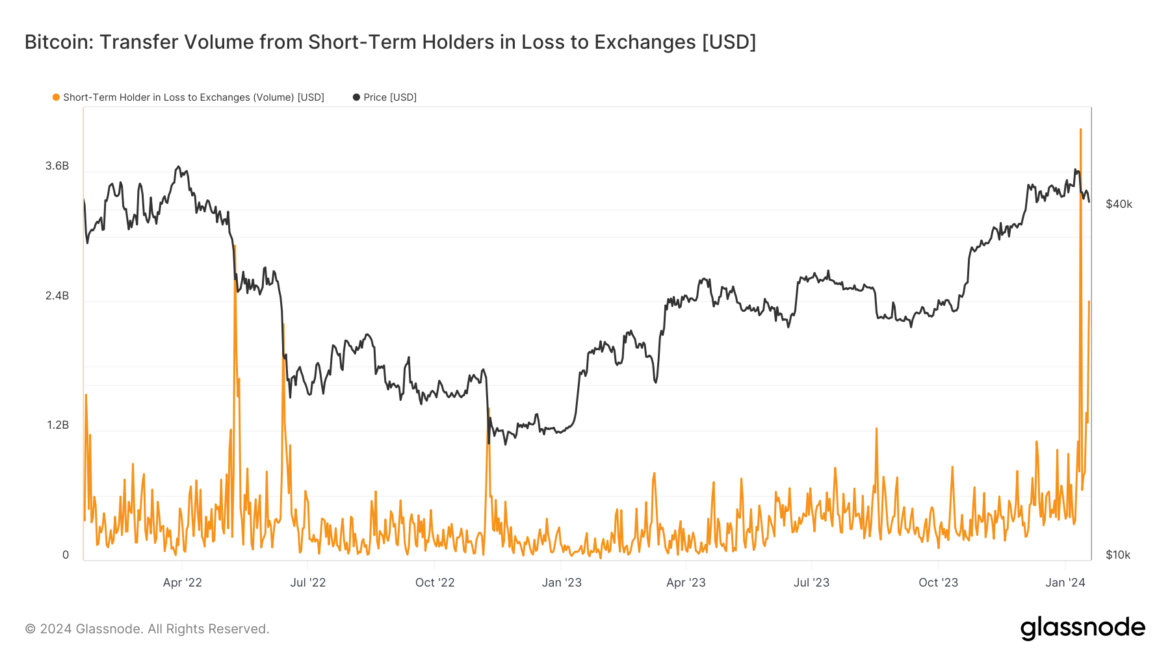

Long-term Bitcoin holders start to cash in as short-term investors face losses

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

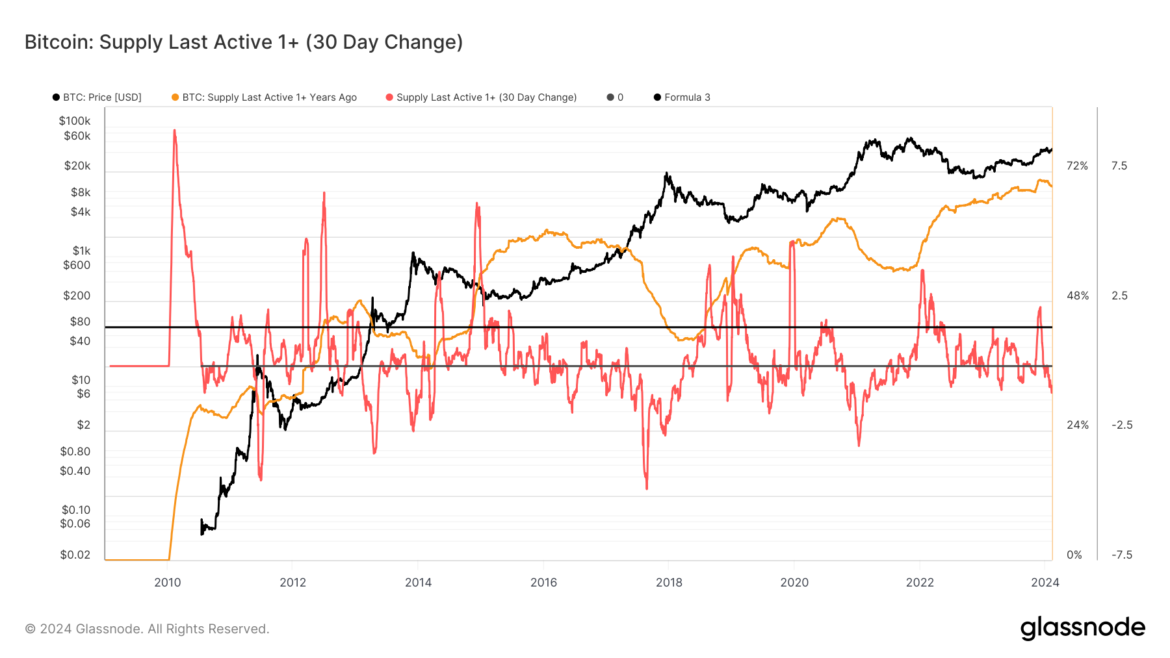

On-chain data shows the Bitcoin long-term holders (the so-called HODLers) are now carrying an unrealized profit of 55% on average.

Bitcoin Long-Term Holder NUPL Has Hit A Value Of 0.55

According to the latest weekly report from Glassnode, the profit that the BTC long-term holders are holding has gone up recently. The indicator of interest here is the “Net Unrealized Profit/Loss” (NUPL), which keeps track of the difference between the unrealized profit and loss that Bitcoin investors are carrying currently.

By “unrealized,” what’s meant here is that the profit or loss is yet to be harvested, as the investor carrying it hasn’t transferred their BTC on the blockchain yet. Once the holder would eventually move the coins, the profit/loss they were holding would then become “realized.”

In the context of the current discussion, the NUPL of only a specific segment of the market is of relevance: the long-term holders (LTHs). The LTHs are the Bitcoin holders who have been keeping their coins dormant on the network since at least 155 days ago.

These are the diamond hands of the market who are known to hold through periods of uptrends and downtrends alike, only selling when major market events take place.

“This includes periods when the market sets new ATHs, around cycle tops and bottoms, and during large shifts in market structure (e.g. Mt Gox, Halvings, and now the launch of spot ETFs),” explains the analytics firm.

Now, here is a chart that shows the trend in the Bitcoin LTH NUPL over the history of the asset:

The value of the metric seems to have been going up in recent weeks | Source: Glassnode's The Week Onchain - Week 3, 2024

As displayed in the above graph, the Bitcoin LTH NUPL has registered a rise in the last couple of months as the cryptocurrency’s spot price has gone through a notable surge.

“This metric reached 0.55 this week, which is meaningfully positive, and puts the average long-term investor at a 55% unrealized profit,” notes the report. Interestingly, BTC has registered some resistance around this level during the past.

As Glassnode has highlighted in the chart, the bulls encountered trouble here during August 2012, June 2016, July 2019, and August 2020. In all of these cases, the resulting top was only a local one, except for July 2019, where the recovery rally of the cycle hit a top that BTC wouldn’t surpass for a significant period of time.

Generally, investors in profit are more likely to sell their coins. The higher the gains that they hold, the stronger can be the allure of profit-taking. Thus, it’s not surprising to see that the LTHs holding significant profits has lead to selling pressure in the market during previous cycles.

The LTHs have indeed participated in some selling recently as well, as the data for their supply suggests.

Looks like the value of the metric has seen some decline recently | Source: Glassnode's The Week Onchain - Week 3, 2024

The Bitcoin LTH supply has now come down 75,000 BTC since the all-time high registered in November, while the opposite cohort, the short-term holders (STHs), have naturally gained some share.

“Whilst 75k BTC is a meaningful sum, it should also be viewed within the context of total LTH supply accounting for a whopping 76.3% of the circulating coin supply,” says the report.

BTC Price

Bitcoin has continued its recent sideways trend during the past day as its price currently floats around the $42,600 level.

The price of the coin hasn't shown much volatility recently | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

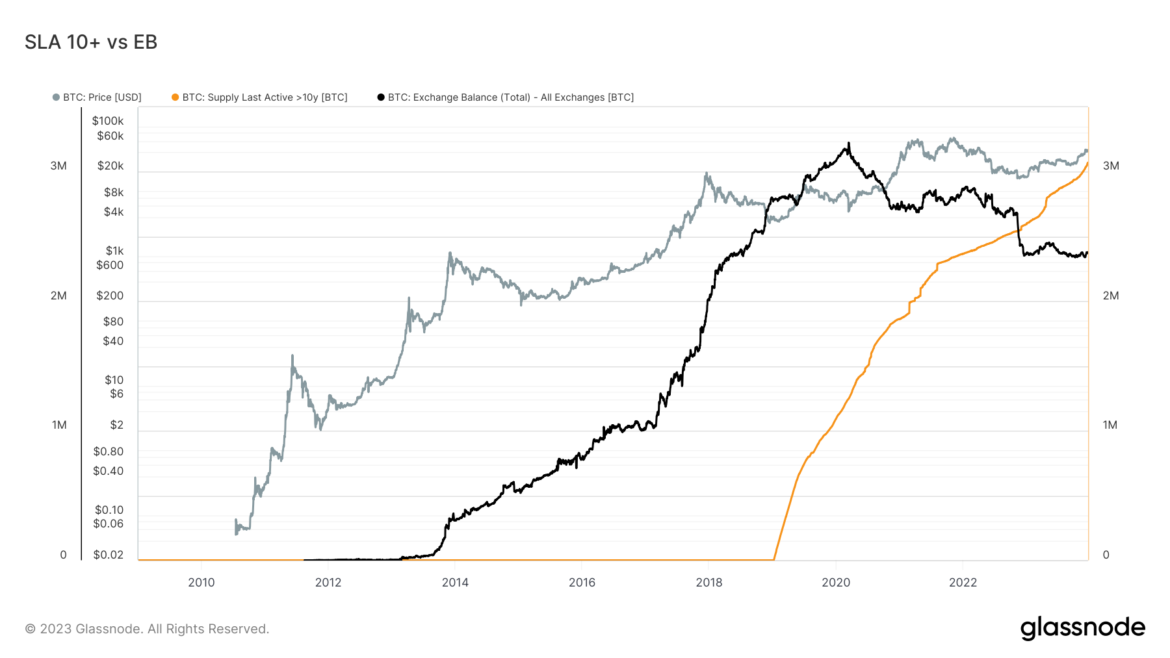

Over 3 million Bitcoins dormant for a decade signal long-term investor confidence

Quick Take

As of November’s end, the number of Bitcoins that have remained inactive for a decade or more has exceeded the 3 million mark. To put this into perspective, given that the circulating supply totals 19.5 million coins, this long-term holding represents about 15% of that supply.

This suggests an increasing propensity for long-term investment and a growing confidence in Bitcoin’s prospects, a significant shift from the quick-profit trading mindset commonly associated with digital assets.

Furthermore, a noteworthy divergence is intensifying between the balance of Bitcoin on exchanges, approximately 2 million, and the aforementioned inactive supply. With a difference now standing at 1 million coins, this expanding gap could potentially signal reduced liquidity in the market but also points towards a mounting faith in Bitcoin’s long-term stability and value.

The post Over 3 million Bitcoins dormant for a decade signal long-term investor confidence appeared first on CryptoSlate.

Bill Morgan, a cryptocurrency enthusiast and lawyer, has underscored an insightful factor towards investing in the XRP token.

Bill Morgan On XRP Price Action

The lawyer recently used X (formerly Twitter) to share his optimism about XRP’s price action. According to the analyst, traders and investors interested in the crypto asset’s price movement should concentrate on the long term.

Bill Morgan’s post addressed yesterday’s volatility and how the cryptocurrency community perceived it. The X post was published in response to “Matt,” the Moon Lambo YouTube Channel host.

The host refuted the cryptocurrency community members’ assertions that yesterday’s XRP decrease was more violent than other coins. Morgan provided an alternative viewpoint while admitting that Matt’s position was correct.

The analyst asserted that XRP’s price behavior has not been “excellent” over the past month despite a market-wide increase, falling by over 2%.

Because of this, he believes the decline of digital assets was more difficult than expected. He further pointed out that the token has experienced a rebound today but has not been very robust.

Furthermore, he asserted that he “does not place much significance on a month’s price action” in these markets. He believes conviction must go “beyond a day, week, or month of price movement.”

So far, Morgan has noted that yesterday’s decline did not affect him emotionally. He was only surprised by yesterday’s fall’s depth and today’s recovery’s weakness. Nonetheless, he has clarified that this would not influence his choice to hold or sell the digital asset.

The Crypto Asset Price To Reach $22

Several cryptocurrency enthusiasts have recently expressed a bullish sentiment toward XRP’s price action. On Sunday, Patrick Riley, the founder of Reaper Financial, stated that the token will reach $22 in the next bull run.

Riley added that the crypto asset will maintain a $10 price level after the bull run. Since analysts predict the next bull run will be in 2024, XRP might reach $22 next year.

The cryptocurrency founder made other audacious claims besides his $22 price mark estimate. He believes that XRP will eventually “overtake” Bitcoin, though he did not provide a specific timeframe for this event.

As of this writing, XRP was trading at $0.6081, an increase of over 3% in the past 24 hours. The token is gradually regaining momentum and is currently ranked 5th by market capitalization.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.