On Friday, the Avalanche-based options protocol, Arrow Markets, unveiled its successful $4 million Series A fundraising initiative. The global project aiming to “revolutionize crypto options trading” garners support from prominent backers including Framework Ventures, Delphi Ventures, and the Avalanche Blizzard ecosystem fund. Crypto Options Platform Arrow Markets Bags $4M in Funding Arrow Markets, an options […]

On Friday, the Avalanche-based options protocol, Arrow Markets, unveiled its successful $4 million Series A fundraising initiative. The global project aiming to “revolutionize crypto options trading” garners support from prominent backers including Framework Ventures, Delphi Ventures, and the Avalanche Blizzard ecosystem fund. Crypto Options Platform Arrow Markets Bags $4M in Funding Arrow Markets, an options […]

Source link

options

$9.5 Billion In Bitcoin Options Poised To Expire This Friday: Market Turbulence Ahead?

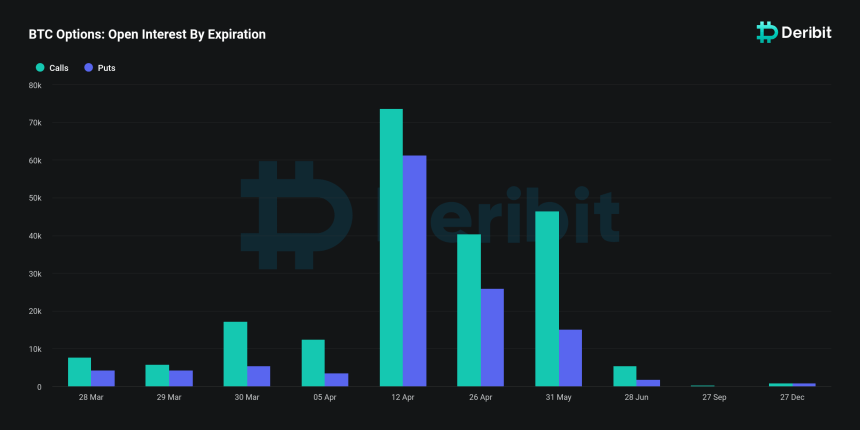

This Friday, the spotlight is turned to Deribit, the leading crypto derivatives exchange, as it gears up for a notable event in its trading history. Particularly, the exchange is poised to witness the expiration of over $9.5 billion in Bitcoin options open interest.

For context, Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled or closed. It represents the number of contracts market participants hold at the end of each trading day.

This surge in open interest recorded by Deribit reflects increased market participation and signals heightened liquidity, marking a notable milestone in the crypto derivatives landscape.

Record-Breaking Open Interest

Notably, this event is significant in two ways: It underscores the growing interest in Bitcoin as an asset class and highlights the increasing “sophistication” of the cryptocurrency market. This is because Open interest can also serve as a critical indicator of market health and trader sentiment.

As such, the record levels of open interest set to expire on Deribit suggest a “vibrant” trading environment, with more investors engaging in complex financial instruments like options.

According to Deribit data, the exchange is set to host one of its largest option expiries ever, with $9.5 billion worth of Bitcoin options poised for expiry at the end of the month. This figure represents a substantial portion, approximately 40%, of the exchange’s total options open interest, which stands at $26.3 billion.

The magnitude of this expiry event eclipses previous months, with January and February end-of-month expiries totaling $3.74 billion and $3.72 billion, respectively. This trend indicates a large increase in market activity and investor engagement on the platform.

Implications Of The Bitcoin Expiry

The upcoming expiry has notable implications for the market, especially considering the current pricing dynamics of Bitcoin.

With Bitcoin’s spot price hovering below $70,000, an estimated $3.9 billion of the open interest is expected to expire “in the money,” according to Deribit analysts, presenting profitable opportunities for holders of these options contracts.

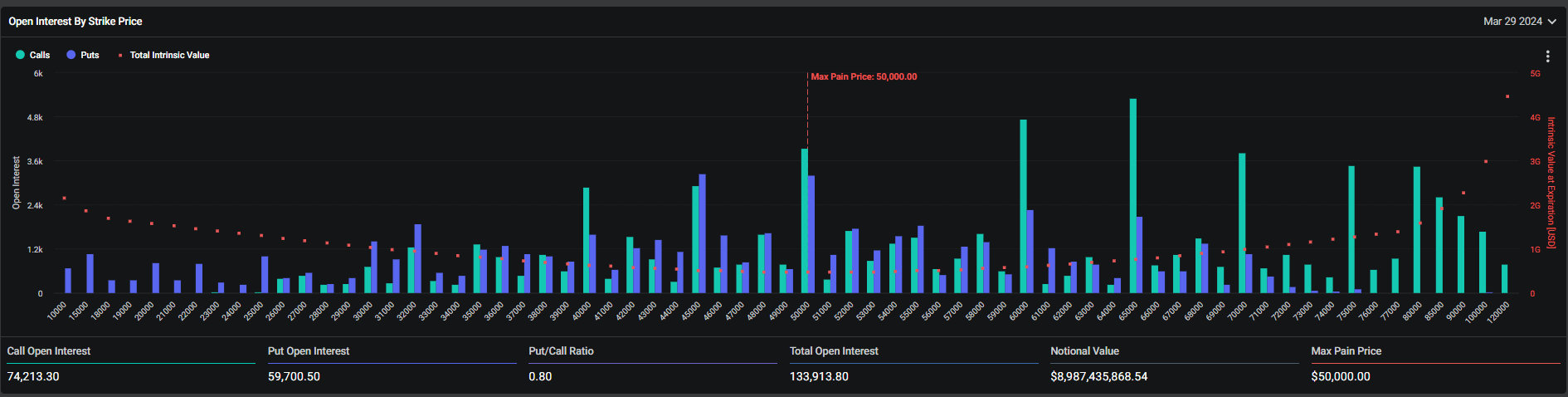

The “max pain” price, which represents the strike price at which the highest number of options would expire worthless, thereby causing the maximum financial loss to option holders, is identified at $50,000.

According to the analysts, this scenario suggests that a significant number of traders are positioned to benefit from the current market conditions, potentially leading to “increased buying activity” as these options are exercised.

Additionally, Deribit analysts speculate that the high level of “in-the-money expiries” could exert upward pressure on Bitcoin’s price or amplify market volatility. They added that as traders “hedge their positions” or “speculate on future price movements,” the market may witness a flurry of activity, impacting Bitcoin’s price trajectory in the short term.

This comes at a time when Bitcoin has experienced a slight retracement from its recent all-time high above $73,000, with the price adjusting to approximately $68,946, at the time of writing

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Quick Take

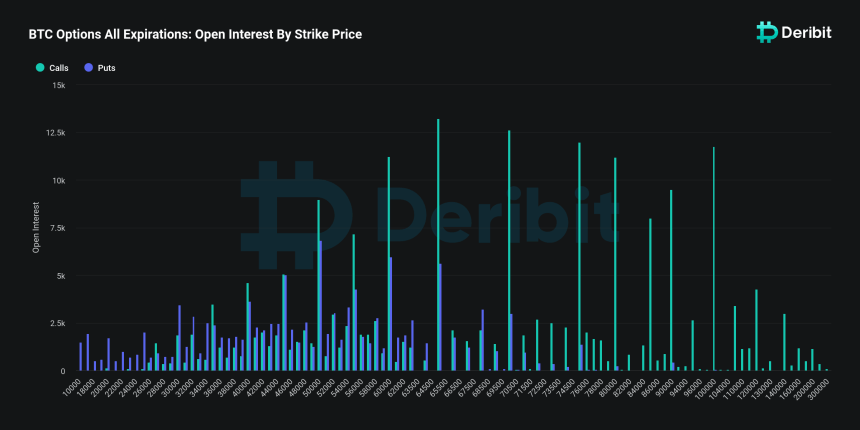

Deribit data indicates that nearly $9 billion worth of Bitcoin (BTC) options are due to expire on March 29, the last Friday of the month, with the total open interest amounting to 133,914 BTC. The put/call ratio is reported at 0.80, signifying more calls in circulation compared to puts, and reflects bullish market sentiment — for every 100 calls, there are 80 puts. Call open interest stands at 74,213 BTC, outstripping put open interest, which totals 59,701 BTC.

Deribit’s figures highlight the relevance of the put/call ratio with Bitcoin’s price at roughly $67,000, significantly surpassing the ‘max pain’ point of $50,000, indicating that a considerable number of call options are presently in the money.

The disparity between the elevated current price of BTC and its strike prices may suggest a prior underestimation of its volatility. There is also a marked concentration of open interest in calls at the upper strike prices, starting at $75,000, which could have implications for future volatility perceptions and options pricing.

The post $9 billion in Bitcoin options set to expire on March 29 appeared first on CryptoSlate.

Bitcoin.com Announces Integration of VERSE Token With BitPay for Expanded Payment Options

Bitcoin.com, a leading figure in the world of cryptocurrency and blockchain technology, is thrilled to announce a significant enhancement to the utility of its ecosystem token, VERSE. In a groundbreaking collaboration, VERSE has now been integrated with BitPay, the world’s largest provider of Bitcoin and cryptocurrency payment services. This integration heralds a new era of […]

Bitcoin.com, a leading figure in the world of cryptocurrency and blockchain technology, is thrilled to announce a significant enhancement to the utility of its ecosystem token, VERSE. In a groundbreaking collaboration, VERSE has now been integrated with BitPay, the world’s largest provider of Bitcoin and cryptocurrency payment services. This integration heralds a new era of […]

Source link

Grayscale lobbying for regulatory approval of options for spot Bitcoin ETFs

Grayscale is lobbying for the US SEC to approve options on its spot Bitcoin exchange-traded fund (ETF), Reuters reported on Feb. 29.

Grayscale CEO Michael Sonnenshein said:

“It is vital to the interests of GBTC and all spot Bitcoin [exchange-traded product] investors to access exchange-listed options on GBTC and other spot Bitcoin ETPs.”

The SEC approved Grayscale’s spot Bitcoin ETF (GBTC) in January. Unlike most of the other newly approved spot Bitcoin ETFs, GBTC was converted to an ETF from an existing fund.

Options could enhance regulation

According to Sonnsenshein, the SEC’s rejection of options on GBTC would unfairly discriminate against shareholders because the regulator has approved options on Bitcoin futures ETFs.

He added that options could also support spot Bitcoin ETF investment more broadly as they could provide price discovery, assist market condition navigation, and support hedging and income generation.

Furthermore, options would bring BTC within the regulatory perimeter, allowing more market participants, including contract merchants and broker-dealers, to trade the funds.

Grayscale’s letter was reportedly prompted by the SEC’s decision to open comments on options for its ETF on Feb. 23. The regulator’s notice also opened comments on Bitwise’s equivalent ETF and other NYSE-listed trusts that hold Bitcoin.

Previously, in January, the SEC opened comments on options for BlackRock’s Nasdaq-listed spot Bitcoin ETF and various Cboe-listed spot Bitcoin ETFs.

Grayscale is a key ETF player

Grayscale’s communications with the SEC are critical because its past efforts have contributed to approvals. After the SEC dismissed Grayscale’s spot Bitcoin ETF application, the firm initiated a legal case against the regulator and won a victory that compelled the SEC to re-address the matter.

SEC chair Gary Gensler cited that outcome in his agency’s approval of spot Bitcoin ETFs, noting that the legal result made approval the “most sustainable path forward.”

The company and other asset managers have also applied for spot Ethereum ETFs. Grayscale’s application recently gained support from Coinbase on Feb. 21.

While Grayscale’s latest letter does not compel the SEC to act in any way, the company’s past significance means that its comment could influence future outcomes.

Open interest, the total number of outstanding derivative contracts that have not been settled, is an important metric for gauging market health and sentiment. An increase in open interest means new money entering the market, showing heightened trading activity and interest in Bitcoin. Conversely, a decline suggests closing positions, potentially indicating a change in market sentiment or a consolidation phase. Monitoring these trends is important for understanding the liquidity, volatility, and future price expectations in the market.

In a bullish market, an increase in open interest often correlates with rising prices, suggesting that new money is betting on further price appreciation. This scenario typically reflects a strong market sentiment and investor confidence in Bitcoin’s upward trajectory. On the other hand, in a bearish context, growing open interest might indicate that investors are hedging against expected price declines, revealing a more cautious or negative market outlook.

Furthermore, the balance between call and put options within the open interest provides deeper insights into market sentiment. A predominance of calls suggests a bullish market sentiment, with many investors expecting price rises, whereas a majority of puts can indicate bearish expectations.

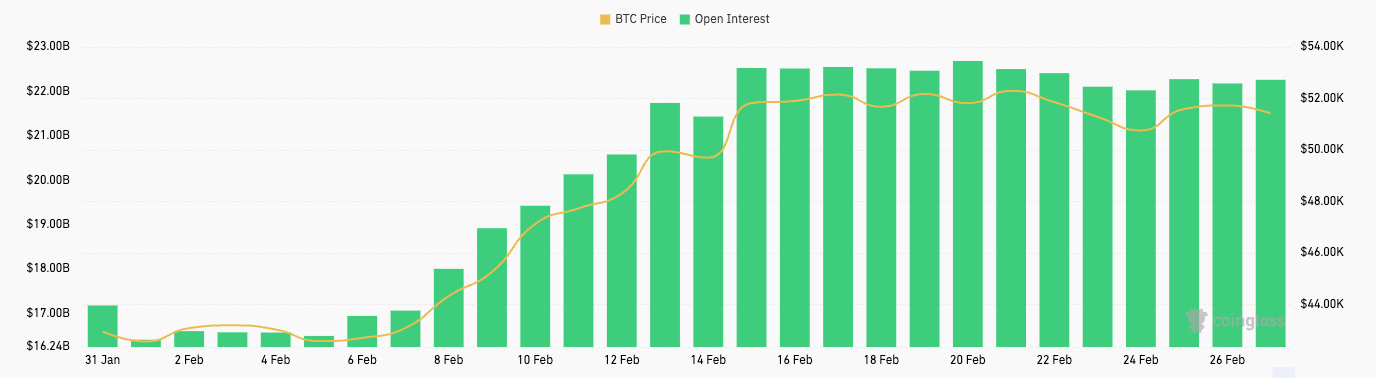

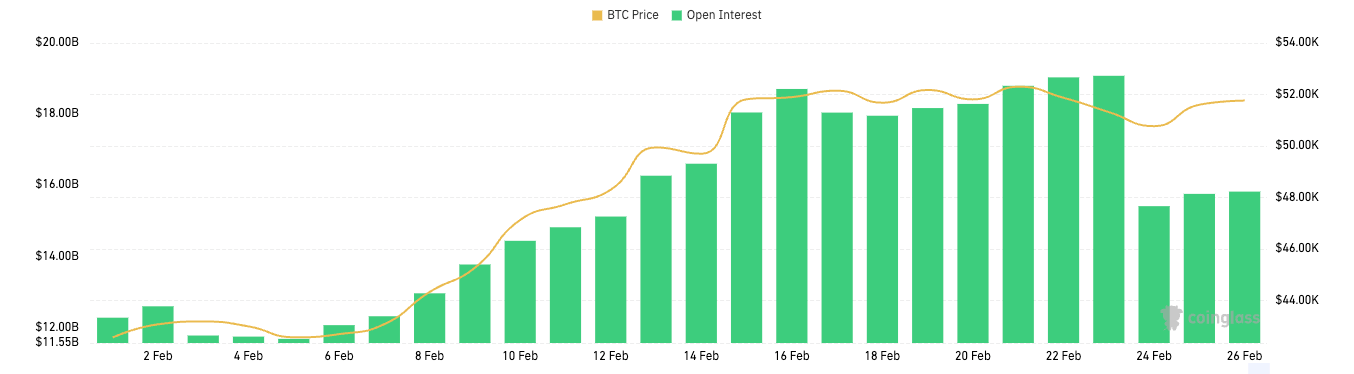

February saw a significant increase in open interest for Bitcoin futures and options.

From Feb. 1 to Feb. 20, Bitcoin futures open interest grew from $16.41 billion to $22.69 billion. This substantial rise suggests that traders were increasingly entering into futures contracts, anticipating higher volatility or making directional bets on Bitcoin’s price. Interestingly, this period aligns with a notable increase in Bitcoin’s price, from $42,560 to $52,303, suggesting a bullish sentiment among futures traders. The slight decrease in open interest by Feb.26 to $22.21 billion, alongside a marginal dip in Bitcoin’s price to $51,716, could indicate some traders taking profits or closing positions in anticipation of a consolidation phase or to reduce exposure ahead of potential volatility.

Similarly, Bitcoin options open interest saw a dramatic increase from $12.27 billion at the beginning of February to a peak of $19.08 billion by Feb.23 before dialing back to $15.82 billion towards the month’s end. Options provide the holder the right, but not the obligation, to buy (call option) or sell (put option) Bitcoin at a specified price, offering more complex strategies for traders to express bullish or bearish views or to hedge existing positions. The initial spike in options open interest reflects a robust engagement from investors, leveraging options for directional bets on Bitcoin’s price and protective measures against potential downturns.

The ratio between calls and puts for Bitcoin options provides a deeper insight into market sentiment and potential expectations for Bitcoin’s price direction. The distribution between calls and puts is a direct indicator of the market’s bullish or bearish inclinations, with calls representing bets on rising prices and puts on falling prices.

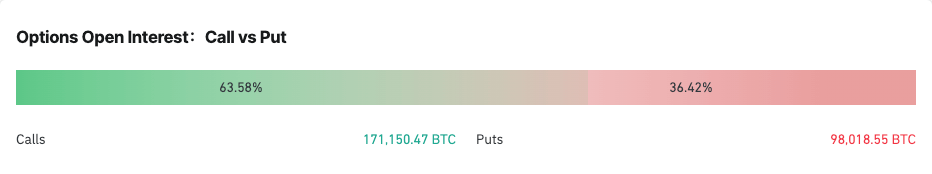

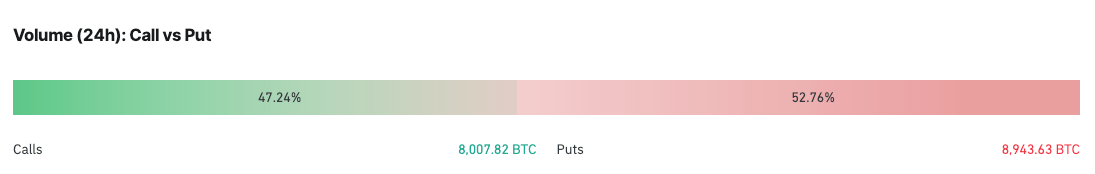

As of Feb. 26, the open interest in Bitcoin options was skewed towards calls, comprising 63.76% of the total, compared to 36.24% for puts. This distribution reinforces the bullish sentiment observed through the increase in options open interest earlier in the month. A predominance of calls in the open interest suggests that a significant portion of market participants were expecting Bitcoin’s price to continue rising or were utilizing calls to hedge against other positions.

However, the 24-hour volume tells a slightly different story, with calls accounting for 47.24% and puts for 52.76%. Compared to the overall open interest, this shift towards puts in the daily trading volume might indicate a short-term increase in caution among traders. It suggests that within the last 24 hours, there was a noticeable pick-up in defensive strategies or bearish bets.

The immediate implication for Bitcoin’s price is a potential increase in volatility. The bullish sentiment, as evidenced by the growing open interest and high proportion of calls, supports a continued positive outlook among many market participants. However, the recent uptick in puts volume may signal upcoming price fluctuations as traders adjust their positions in anticipation of or in response to new information or market trends.

Considering these, the market appears to be at a crossroads, with a strong bullish sentiment tempered by short-term caution. This scenario often precedes periods of heightened volatility as conflicting expectations play out through trading activities.

Ethereum (ETH) is showing a noteworthy pattern in the options market. According to data from Deribit, a leading platform for crypto futures and options trading, there’s a significant concentration of call options for ETH around the $4,000 strike price for both the June and September expiries.

Options Traders Anticipate $4,000 Ethereum

This accumulation of ETH call options centered on the $4,000 mark indicates a concentrated expectation among traders that the price of Ethereum could rise to, or above, $4,000 by these dates.

For context, options are financial derivatives that give the buyer the right, but not the obligation, to buy (in the case of call options) or sell (put options) the underlying asset at a predetermined price on or before a specified date.

Notably, according to a chart from the crypto futures and options trading platform, the $4,000 ETH strike price emerged as the dominant position in the ETH options trading landscape, surpassing other strike prices for the June and September expiry dates.

It is worth noting that such a pattern indicates market sentiment and can influence trading strategies. In this instance, the pattern implies that most options traders are likely bullish on Ethereum, anticipating a notable increase in its value.

Furthermore, this trend might lead fundamental traders to reconsider their positions on Ethereum, potentially shifting their outlook to expect an upward trajectory in the asset’s performance.

Factors Influencing $4,000 ETH Options Strike Price

This clustering of Ethereum call options at the $4,000 strike price appears to be influenced by several factors, including the potential approval of a spot Ethereum exchange-traded fund (ETF) by the US. Securities and Exchange Commission (SEC).

With the final decision deadline for these spot ETF applications set for May 23, traders seem to be positioning their Ethereum options contracts in anticipation of a favorable outcome, as observed by Bitfinex’s Head of Derivatives, Jag Kooner.

However, Deribit’s Chief Commercial Officer, Luuk Strijers, cautions against drawing definitive “conclusions” about the link between the derivatives market and the Ethereum spot ETF approval expectations.

Strijers notes that while the “June skew” is higher, indicating more “expensive calls,” it’s challenging to pinpoint this precisely to the spot ETF news or expected correlation with the upcoming Bitcoin halving.

Meanwhile, Altcoin Daily crypto analysts recently outlined three key factors that could propel Ethereum’s price to $4,000. Among these factors, the anticipation and potential approval of Ethereum Spot Exchange-Traded Funds (ETFs) were highlighted as a major catalyst.

While Ethereum futures have already gained global acceptance, analysts emphasize that the green light for these spot ETFs could significantly trigger Ethereum’s long-term price appreciation.

Regardless of this contrasting ETH view, ETH currently trades at $2,495, showing a 7.7% increase in the past week and a 1.9% rise in the past 24 hours.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

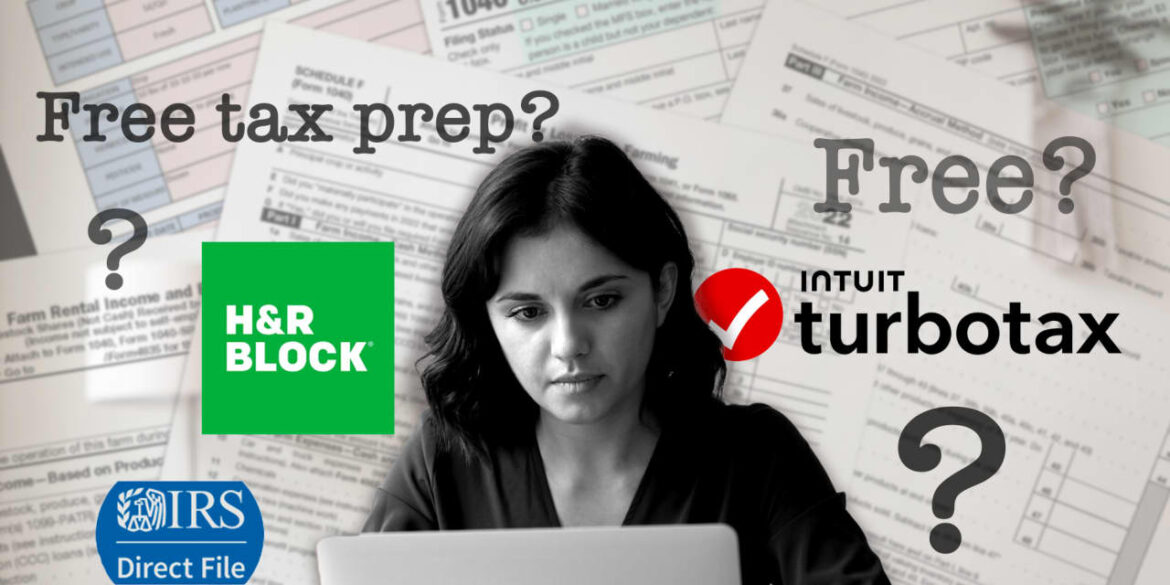

When major tax-preparation brands TurboTax, made by Intuit, and H&R Block say they’ll do income tax returns at no cost, that only applies to certain people.

Live a straightforward financial life with few complications or income sources? The two major players in mass-market tax prep say they will do your return for free. But if your tax return has just a few financial wrinkles, TurboTax and H&R Block will charge you money, according to the fine print.

For example, Intuit’s

INTU,

TurboTax and H&R Block

HRB,

say users have to pay for tax returns that will report sales of stock and cryptocurrency. The same is true if the taxpayer has income to report from gig work.

There can also be extra costs for certain tax-prep services. Want some AI-infused help from H&R Block? The price starts at $35 for a federal return and $37 per state return.

TurboTax says its own AI-powered tax help is available on all of its free products this tax filing season. And its “TurboTax Live Assisted Basic,” which lets taxpayers ask questions of tax pros in real time, is free through March 31, according to a spokeswoman. But only customers who have “limited credits” — meaning they have a simple tax return and they’re claiming the earned income tax credit or child tax credit, but no other tax credits — can take advantage of that offer.

Prices on tax software are a prickly topic this tax season. Last week, the Federal Trade Commission ruled that TurboTax used deceptive advertising for years when it promoted its free services without clearly explaining that many taxpayers weren’t eligible for its free option.

Intuit said it will appeal the FTC’s “deeply flawed decision” and insisted to regulators that its disclosures were sufficient. TurboTax now says around 37% of tax filers qualify for its free edition, and some of its current TV ads highlight this.

Meanwhile, Intuit sued H&R Block, alleging that H&R Block’s advertising misleads potential customers about TurboTax’s prices and how the rivals compare. H&R Block countered in court papers that Intuit is “aggressively seeking to avoid legitimate comparative price advertising.” Both companies declined to comment on the lawsuit.

Overall, it’s “incredibly challenging” for people to understand whether free tax-preparation offers really apply to them, said Nina Olson, the former IRS national taxpayer advocate.

The “up-sell problem” — where customers start a tax return thinking it’s going to be free, but then the tax-prep company ends up charging them — has been an issue for at least two decades, and it’s not limited to any one company, said Olson, who retired from the IRS to start the nonprofit Center for Taxpayer Rights.

Olson is fine with tax-prep companies only providing free tax prep for “plain vanilla” returns. Taxes are complicated, she noted. But “transparency is a wonderful thing, and that’s what we’ve got to get better at, so consumers are aware what they are signing up for,” Olson said.

Both TurboTax and H&R Block say they are upfront with consumers. Here’s a MarketWatch breakdown on who qualifies for the free editions of TurboTax and H&R Block, and tips on other ways to file your taxes for free, including IRS Direct File, IRS Free File and other free programs.

Who is eligible for TurboTax’s free edition?

The free version of TurboTax is available to people who use a Form 1040 (the most basic type of income-tax form) to file their taxes, and who only file “limited credits,” meaning the earned income tax credit and the child tax credit, but no others.

TurboTax says its free edition can handle wages paid by an employer and reported on a W2. It can also support income from interest and dividends reported on a 1099-INT or a 1099-DIV that is below $1,500. (Sums above that amount require a Schedule B and the free edition will not cover that.)

It can also handle the taxes connected to money coming from a retirement account, like a 401(K), or a pension, a spokeswoman said.

TurboTax’s free edition applies the standard deduction, which most taxpayers use instead of itemizing their deductions. It also applies the student-loan interest deduction.

But the free version will not support income from unemployment benefits, capital gains taxes, business income or self-employment taxes. It’s also not built for the taxes on money paid to an independent contractor, which generally comes on a 1099-NEC.

The free edition has no income maximum and it covers both federal and state returns, according to an Intuit spokeswoman. Credit Karma, which is also owned by Intuit, has a free offer for people who did not use TurboTax last year and it can handle more tax complexity, the spokeswoman noted.

More than 10 million people file their taxes for free with TurboTax each year, Intuit said in court papers and elsewhere.

Who is eligible for H&R Block’s free edition?

Similar to TurboTax, H&R Block’s free version is mostly limited to taxpayers with relatively simple returns filed on a 1040 — but it does have some more capabilities than TurboTax’s free product.

A federal and state return filed with H&R Block Online can be done for free, according to the company. The free return supports income from W2 wages, Social Security income, unemployment benefits and interest and dividends under $1,500. Normal retirement distributions pulled from accounts like a 401(k) may fit the free version, depending on a taxpayer’s circumstances.

It handles the child tax credit and the earned income tax credit. It also applies the standard deduction, student-loan interest deduction and education credits. It can also handle the American Opportunity Credit and Lifetime Learning Credit, which are linked to an eligible person’s educational pursuits.

There’s also no income limit on the H&R Block free offering, so long as the taxpayer sticks with the applicable credits and deductions.

How can I file my taxes for free with IRS Direct File?

The IRS Direct File platform, the government-run version of free tax-prep software, is intentionally starting small, IRS officials said. It will be available to residents in 12 states starting around mid-March. Similar to the TurboTax and H&R Block free versions, only certain taxpayers are eligible to use Direct File.

It can handle income reported on W-2 job wages, unemployment benefits and Social Security payments. It can also handle interest income up to $1,500. It applies the child tax credit, the earned income tax credit and deductions for student-loan interest and $300 out-of-pocket expenses for teachers.

But Direct File cannot process the tax credit for households with health insurance through the Affordable Care Act’s exchange. It also can’t handle provisions like the “saver’s credit” for retirement contributions, independent contractor money or capital gains.

The 12 states where Direct File will be available are: Arizona, California, Florida, Nevada, New Hampshire, New York, Massachusetts, South Dakota, Tennessee, Texas, Washington state and Wyoming.

Another option for free tax prep: IRS Free File

While taxpayers will have to wait for the IRS Direct File platform, there’s another free option that’s ready to use now: the IRS Free File program.

To qualify for IRS Free File this year, households can make up to $79,000, which is roughly 70% of households.

The Free File program is an IRS partnership with some tax software companies — but not TurboTax and H&R Block. The program has run for two decades yet few taxpayers take advantage of it. “It’s a good product. We just need more people to know about it,” said Tim Hugo, executive director of the Free File Alliance.

This year, the program has eight tax software providers and some offer free state returns in addition to free federal returns. One caveat: Some of the providers cap the income limits for their Free File offerings at levels under $79,000.

The eight providers are: 1040Now; 1040.com; ezTaxReturn.com; FileYourTaxes.com; On-Line Taxes; TaxAct; FreeTaxUSA; and TaxSlayer.

“Free File can provide a multitude of services,” Hugo said. “You can have very complicated returns,” he added. Free File providers offer the same customer service for their free customers and their paying customers, Hugo said.

The IRS has a list of the tax scenarios that Free File providers can handle. It includes capital gains and losses, self-employment taxes, and child and dependent care expenses — all of which aren’t included in the free versions of TurboTax and H&R Block, or IRS Direct File.

Through May 2023, the IRS took in 2.7 million Free File returns, a 10% decrease year over year, according to a Treasury Department watchdog.

Other ways to get free tax-prep help

There are other IRS-backed free tax-preparation programs. They include the Volunteer Income Tax Assistance program and the Tax Counseling for the Elderly program.

Income thresholds are generally around $64,000 for VITA. The TCE program is geared at taxpayers age 60 and above. Here’s a link where to find nearby organizations participating in the VITA and TCE programs.

The people doing these tax returns are IRS-certified volunteers. The hours and services might be limited, the IRS says. But these volunteers can do basic tax returns, along with IRA distributions, pension income, simple forms of capital gains, self-employment income and some itemized deductions.

SEC opens comments on options trading for BlackRock, Cboe spot Bitcoin ETFs

The U.S. Securities and Exchange Commission (SEC) on Jan. 19 opened comments on proposals related to options trading on Bitcoin ETFs.

One SEC notice concerns a proposed rule change allowing Nasdaq to list and trade options on BlackRock’s iShares Bitcoin Trust.

A second SEC notice concerns a proposed rule change that would allow Cboe Exchange Inc. to list and trade options on various Bitcoin exchange-traded products (ETPs). Though the text of the notice does not indicate which funds the proposal applies to, Cboe BZX is responsible for listing and trading the majority of spot Bitcoin ETFs approved this January, including those from Ark Invest, VanEck, WisdomTree, Invesco, Fidelity, GlobalX, and Franklin Templeton.

Options trading would introduce new investment strategies for each fund. Specifically, this approach would allow investors to engage in leveraged trading, potentially earning greater returns at a higher risk.

SEC could decide on approval in coming months

Bloomberg ETF analyst James Seyffart commented on the development, noting:

“The SEC has already acknowledged the 19b-4’s requesting the ability to trade options on spot Bitcoin ETFs. This is faster than SEC typically moves. Options could be approved before end of February if SEC wants to move fast?”

Seyffart’s other statements indicate the SEC could make its a decision around Feb. 15 at the earliest, or around Sept. 21 at the latest.

Seyffart also noted that each proposal was posted on Jan. 16, meaning that the SEC published its latest notices after three days. He said the latest developments are “significantly faster” than other 19b-4 rule change proposals, which reached similar stages after more than 14 days.

The text of each document, however, indicates slightly earlier filing dates for each proposal. Nasdaq (on behalf of BlackRock) filed its proposal on Jan. 9 and submitted an amendment on Jan. 11. Cboe filed its proposal on Jan. 5.

The post SEC opens comments on options trading for BlackRock, Cboe spot Bitcoin ETFs appeared first on CryptoSlate.

According to Crypto trader Mags, Bitcoin, the flagship cryptocurrency, has recently demonstrated a notable +55% surge, breaking out from a smaller broadening wedge pattern.

Mags shared insights on this significant price movement, observing Bitcoin’s breakout and suggesting a mid-term target at the “upper trendline resistance of a larger broadening wedge.”

This surge notably results from several catalysts in play, such as the surging interest of institutional investors and the US approval of spot Bitcoin Exchange-Traded Funds (ETFs).

Upcoming Options Expiry Impact’s Bitcoin Price

However, Bitcoin has seen a slight downturn following its recent surge over the past 24 hours. Despite being significantly up over the past month, the asset has declined by nearly 10% in the past day, with its current trading volume slightly decreasing to $44 billion from over $50 billion yesterday.

This sudden dip can largely be attributed to the imminent expiration of options. According to the options trading platform Greeks.live, a substantial 36,000 BTC options are set to expire soon, featuring a Put Call Ratio of 0.9.

Notably, the ‘Put Call Ratio’ serves as a sentiment indicator, assessing the market mood by comparing the volume of put options to call options. It is calculated by dividing the number of traded put options by the number of traded call options.

Put options grant the holder the right (but not the obligation) to sell a specified amount of an underlying asset at a predetermined price within a specific timeframe. Conversely, call options allow the holder the right (but not the obligation) to buy a specified amount of an underlying asset at a set price within a specific timeframe.

The Put Call Ratio is interpreted in two ways: a high ratio (greater than 1) and a low ratio (less than 1). A low ratio suggests more call options are being bought than put options, indicating bullish market sentiment as more traders expect the market to rise.

Conversely, a high ratio indicates that more put options are being bought than call options, suggesting bearish market sentiment as more traders anticipate a market decline.

Jan12 Options Data

36,000 BTC options are about to expire with a Put Call Ratio of 0.9, a Maxpain point of $45,000 and a notional value of $1.68 billion.

262,000 ETH options are due to expire with a Put Call Ratio of 0.64, a Maxpain point of $2,400 and a notional value of $680… pic.twitter.com/LSKNGKVjrH— Greeks.live (@GreeksLive) January 12, 2024

With Bitcoin’s Put Call Ratio currently at 0.9, as reported by Greeks.live, it implies that traders are leaning towards a bearish move for Bitcoin. This anticipated decline may contribute to Bitcoin’s current dip, despite the recent commencement of spot Bitcoin ETF trading in the US.

Bitcoin’s Bullish Potential

Despite the current dip, market analysts suggest this downturn might be short-lived. As highlighted by crypto trader Mags, the breakout from a smaller broadening wedge pattern signifies a bullish sentiment in the short term.

The +55% surge marks a recovery from previous lows and prepares the stage for a potential ascent toward the upper trendline of a larger broadening wedge. Such a pattern hints that Bitcoin could be primed for further substantial price movements shortly.

Additionally, the ‘Max Pain’ point, as identified by Greeks.live, is currently pegged at $45,000 for Bitcoin, holding a total notional value of $1.68 billion. This point, where option holders face the most financial loss, is a critical indicator of the market’s potential direction.

According to Greeks.live’s analysis, the nearing expiry of 36,000 BTC options implies that the market is poised for significant movements. In anticipation of these dynamics, Greeks.live reported a shift in trading strategies has been observed, with a growing emphasis on ‘LONG GAMMA’ approaches.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.