“He and his daughter have not seen each other or spoken to each other in at least three years.”

Source link

power

Paraguayan Senate Supports Selling Power to Crypto Mining Companies, Criticizes Subpar Energy Agreements With Brazil

The Paraguayan Senate has approved a resolution supporting selling the country’s energy surplus to crypto mining companies, given the price and guarantees that these institutions offer. The declaration criticizes the subpar agreements that sell energy to Brazil for 25% of the fees collected for mining activities, calling to direct this energy to 20 new contracts […]

The Paraguayan Senate has approved a resolution supporting selling the country’s energy surplus to crypto mining companies, given the price and guarantees that these institutions offer. The declaration criticizes the subpar agreements that sell energy to Brazil for 25% of the fees collected for mining activities, calling to direct this energy to 20 new contracts […]

Source link

(Bloomberg) — As utilities race to keep ahead of rising electricity demand, developers have proposed a surge of new power plants across the US — and very few of them would run on fossil fuels.

Most Read from Bloomberg

The generating capacity of proposed plants seeking to connect to the power grid jumped nearly 90% in the last three years, according to a new study from Lawrence Berkeley National Laboratory. In 2023, the combined capacity of all those plants totaled almost 2,600 gigawatts. A single gigawatt of electricity can power 750,000 homes.

Read More: AI Demand for Data Centers Vastly Underestimated, CoreWeave Says

Solar power and large-scale batteries account for more than 80% of the proposed capacity, according to the study. In contrast, power plants that would burn natural gas or coal represent just 3%.

Still, the study cautions that historically, less than 20% of projects that apply for a grid connection actually get built.

After remaining flat for years, US electricity demand is expected to climb rapidly as electric vehicles and data centers proliferate. A BofA Global Research report Wednesday forecast demand would grow 15% by 2030, or roughly 70 gigawatts.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Greenpeace’s Anti-Bitcoin “Mining for Power” Report Receives Fierce Backlash on X

“Mining for Power,” an anti-Bitcoin report by Greenpeace USA that explains the links between the bitcoin mining industry and fossil fuel companies, has faced a backlash in social media due to its inaccurate portraits of the mining activity. Using community notes, social network users detailed the report contained “many factual errors,” including outdated information. Greenpeace […]

“Mining for Power,” an anti-Bitcoin report by Greenpeace USA that explains the links between the bitcoin mining industry and fossil fuel companies, has faced a backlash in social media due to its inaccurate portraits of the mining activity. Using community notes, social network users detailed the report contained “many factual errors,” including outdated information. Greenpeace […]

Source link

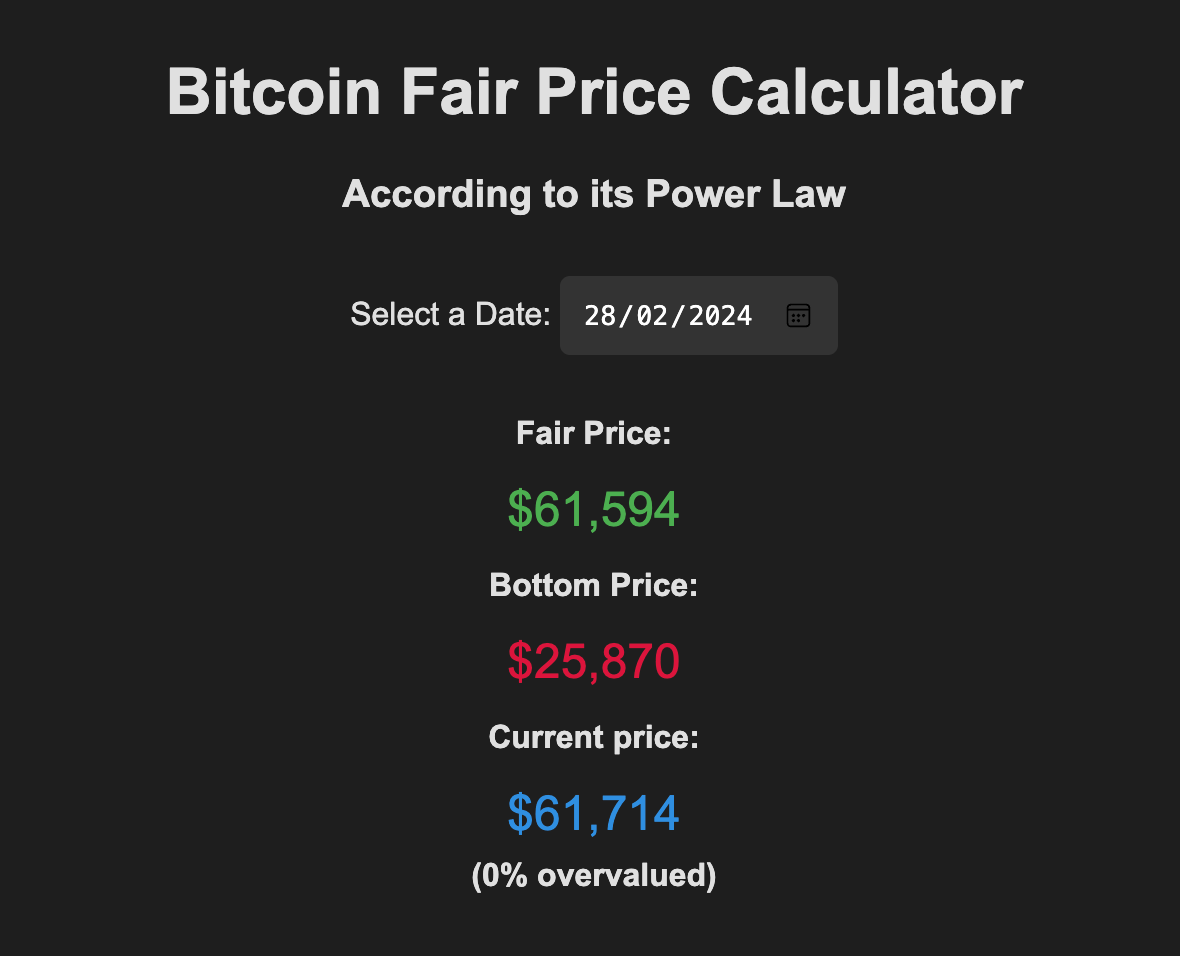

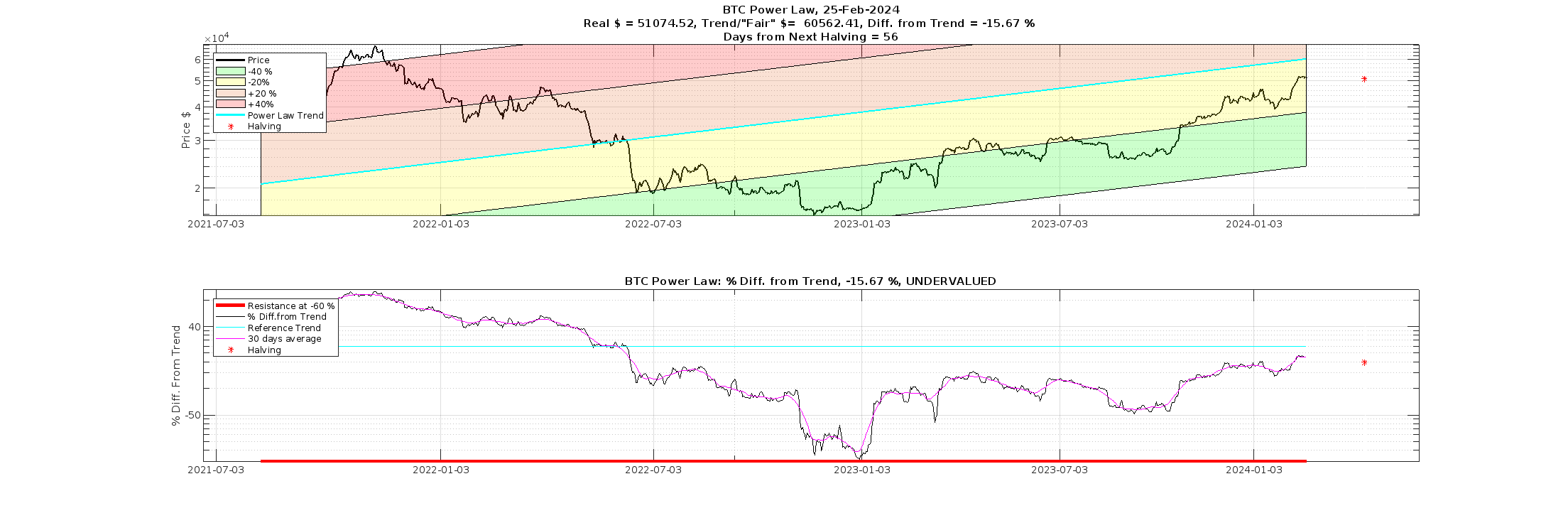

At $61,594 Bitcoin is at fair market price according to the power law model

On a monumental day for Bitcoin, where it opened at $56,900, the flagship digital asset has officially exited the bear market according to the Bitcoin Power Law model. After surpassing $61,000, it has now reached the ‘fair price’ of $61,594, aligning with the projected power law price.

First posited by Giovanni Santostasi, the Bitcoin Power Law is a model that attempts to predict Bitcoin’s long-term price trajectory based on its historical tendency to follow a roughly straight line when plotted on a logarithmic scale. This pattern suggests an underlying pattern to Bitcoin’s growth.

The model distinguishes between “fair price” (the trend line representing an average valuation) and “bottom price” (historically about 58% below the fair price, indicating a potential floor). These values are calculated using a formula based on the number of days since Bitcoin’s creation (Genesis Block) and a specific exponent:

Fair Price = 1.0117e-17*(days since Genesis Block)^5.82.

The chart below shows a section of the power law model and its relative fair price as shared by Santostasi on Feb. 25. Bitcoin has since passed the current ‘fair price,’ indicating it is heading toward the bull market ‘bubble’ identified as a key component of each Bitcoin halving cycle within the power model.

Within the power law model, the price deviates from the ‘fair value’ above and below during bull and bear markets but ultimately returns to the fair value over time. Historically, the model has been highly accurate. However, it’s important to note that this is a model, and while it has held up surprisingly well at times, market forces can change, and the model cannot account for all factors potentially influencing Bitcoin’s price.

The post At $61,594 Bitcoin is at fair market price according to the power law model appeared first on CryptoSlate.

The new frontier in Bitcoin mining: Stranded energy utilization and open hash power markets

In the latest episode of SlateCast, CryptoSlate’s Liam “Akiba” Wright and CEO Nate Whitehill welcomed Ryan Condron, CEO of Titan Mining and the creator of Lumerin Protocol, to discuss the current state of Bitcoin mining and the potential for hash power to become a valuable asset in the future.

How Titan Lightning streamlines the experience of mining

Titan Lightning, a new integration with the Lumerin hash power marketplace, aims to streamline the mining experience for users. As Condron explained, traditional mining setups often involved significant friction for newcomers:

“Previously, [new miners] had to set up an account with a mining pool, plug in the credentials — it was hard to onboard through that.”

Titan Lightning solves this by allowing users to simply provide a Lightning address when purchasing hash power through the Lumerin marketplace. The hash power then streams directly to the Titan Lightning pool, which pays users out in real-time on a “pay per share” basis.

Condron highlighted the powerful feeling of “purchasing hash power, which is essentially Bitcoin over time, and then you start receiving the stream of sats directly into your wallet.” This seamless integration removes barriers to entry, providing an instant and intuitive mining experience where users can see their rewards hit their Lightning wallet almost immediately after purchase.

Condron further explained:

“You can take a mining facility and put the hash power up for sale to the highest bidder. It’s an open market around hash power on a global decentralized anonymous scale.”

Why decentralizing hash power democratizes the Bitcoin network

Decentralizing hash power is crucial for maintaining the democratic nature of the Bitcoin network. As institutional investors and large mining pools increasingly dominate Bitcoin’s hash rate, there is a risk of centralization that could undermine the foundational principles of the network.

By enabling a global, decentralized marketplace for hash power like Lumerin, individual miners and smaller players can access and contribute computing resources without going through a centralized mining pool. This promotes a more evenly distributed hash rate and decision-making power over which transactions are included in blocks. Condron emphasized:

“Hash power needs to be accessible to everyone on earth if the Bitcoin network is going to stay democratized.”

A truly decentralized network, where no single entity controls a majority of the hash power, aligns with Bitcoin’s vision of monetary sovereignty for all participants. Initiatives focused on democratizing access to hash power are vital for upholding this ideal.

While acknowledging the potential for governments to regulate mining pools and on-ramps, Condron highlighted the need for a balanced approach:

“Governments really don’t like it when you mess with their money supply,” he said. “They’re going to look to regulate the ownership and control the transaction processing and interiors of the system.”

The future of Bitcoin mining: Embracing stranded energy

The future of Bitcoin mining lies in harnessing stranded energy resources worldwide. Many developing nations have abundant renewable energy potential that is underutilized due to infrastructure challenges or lack of local energy demand. Bitcoin mining presents an opportunity to monetize this stranded energy.

As Condron explained:

“With the advent of Bitcoin mining, you have miners coming in and actually government sponsoring mining build-out now because they realize that they can use up the electricity from these large production facilities to mine Bitcoin.”

Miners can establish operations near remote renewable energy sites, utilizing excess power that would otherwise be wasted. This facilitates Bitcoin’s sustainable growth and can drive economic development by bringing investment, jobs, and supplemental power to local communities with abundant but stranded energy resources.

The discussion with Ryan Condron offered insightful perspectives on the evolving landscape of Bitcoin mining and hash power. As the network grows, the democratization of hash power and the utilization of stranded energy resources will play pivotal roles in shaping the future of Bitcoin mining.

Watch the full podcast here.

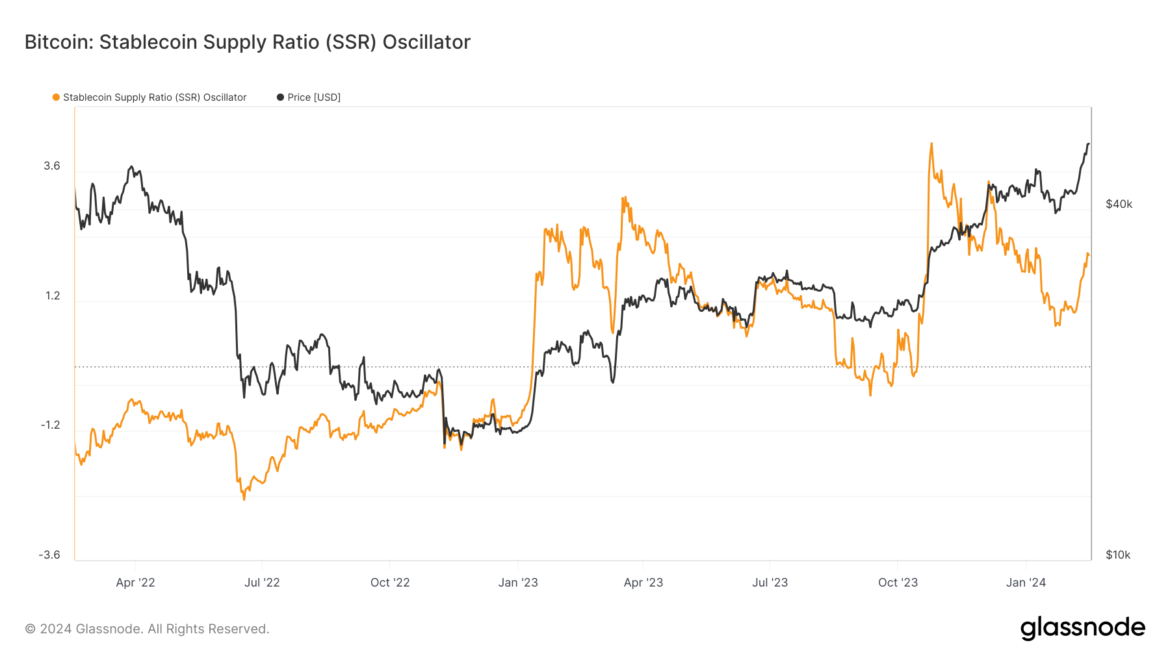

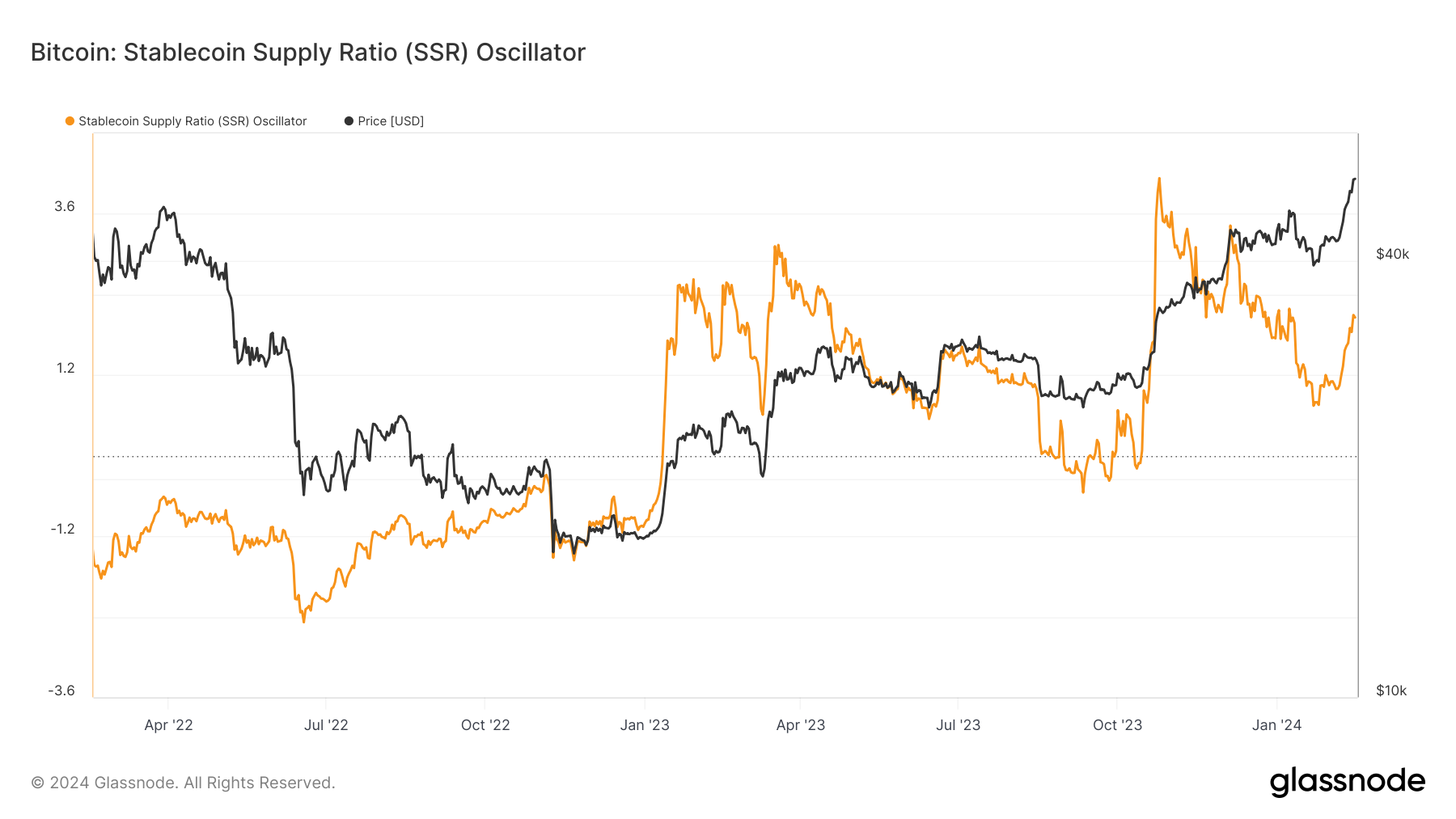

Surge in stablecoin supply ratio signals increased Bitcoin buying power

Quick Take

The Stablecoin Supply Ratio (SSR), a key metric that quantifies the supply forces between Bitcoin and various stablecoins, has been signaling increased “buying power” for Bitcoin in the past ten days.

Glassnode defines the SSR as the ratio of Bitcoin’s market cap to that of stablecoins denoted in Bitcoin, which serves as a proxy for the demand-supply mechanics of BTC versus USD. When the SSR dips, it implies a heightened buying power for the current stablecoin supply to purchase Bitcoin.

Three weeks ago, CryptoSlate observed a subtle upsurge in the SSR, from 0.74 to 1.04, corresponding to an increase in Bitcoin’s value to $42,000. Back then, the SSR was at 1.04, and it is now at 2.04. The upward movement started on Feb. 8 and coincided with the rise in Bitcoin price to $52,000.

This suggests that the demand for Bitcoin is driven by ETF interest and stablecoin liquidity entering the Bitcoin market.

The post Surge in stablecoin supply ratio signals increased Bitcoin buying power appeared first on CryptoSlate.

Jamie Dimon believes U.S. debt is the ‘most predictable crisis’ in history—and experts say it could cost Americans their homes, spending power and national security

In the late 19th century Alexander Hamilton wrote “national debt, if it is not excessive, will be to us a national blessing.” A nice idea in theory, but America’s governments since then haven’t quite stuck to the plan.

Instead, the U.S. economy is resting atop a public debt exceeding $34 trillion, with its debt-to-GDP ratio sitting at around 120%. Perhaps not the blessing the Founding Fathers had once envisioned.

Now, alarm bells are beginning to ring with increasing frequency and volume.

Jamie Dimon says Washington is facing a global market “rebellion” because of the tab it is racking up, while Bank of America CEO Brian Moynihan believes it’s time to stop admiring the problem and instead do something about it.

Elsewhere The Black Swan author Nassim Taleb says the economy is in a “death spiral”, while Fed chairman Jerome Powell says it’s past time to have an “adult conversation” about fiscal responsibility.

And despite the issue being the “most predictable crisis we’ve ever had” according to former Speaker of the House Paul Ryan—a summary Dimon agrees with—it’s an item that isn’t yet top of the political agenda.

It’s also worth noting this isn’t the job of one party or the other to fix—this debt has been accumulated courtesy of spending by both Republicans and Democrats.

The list of presidents who added the most debt by percentage begins with FDR (Dem.), followed by Woodrow Wilson (Dem.) and Ronald Reagan (Rep.).

Whoever’s shoulders it falls on to address, it’s clear the public now wants action.

Last year Pew Research found that ‘reducing government debt’ was a key concern for 57% of the 5,152 people surveyed—up from 45% just a year prior.

But do individuals—who currently have a sum of more than $100,000 dangling over their heads when debt is divided by capita—need to be so concerned about the issue?

How will it impact their purse strings, their living costs, and their savings plans?

How big is the threat?

It depends on who you ask.

If it’s the Peter G. Peterson Foundation you’re talking to, the issue is pretty sizable.

The New York-based nonpartisan organization dedicates itself to increasing public awareness around fiscal challenges, with the increasing government debt being one of its top concerns.

The group believes debt could lead to reduced public spending, private investors losing faith in America’s economy, a shrinking window of prosperity for U.S. families thanks to worsening housing and jobs markets, and a threat to national security.

Laura Veldkamp, a professor of finance at Columbia University, has a less catastrophic view.

She encourages the public to use real-world comparisons to understand the context around the headline-grabbing figures.

Professor Veldkamp explained to Fortune: “If the US were a household, we might measure its debt by the debt-to-income ratio. The debt is about 1.3 times the national income (GDP).

“The payment each year for federal debt interest is around 4% of the debt. This means the U.S. government needs to pay about 5.2% of GDP in interest expenses.

“Federal tax income is around 18% of GDP. So, the debt payments are less than one-third of the income. If this were a household or firm, we wouldn’t call that highly indebted.”

The far more difficult issue is whether or not this debt is being accumulated responsibly, and will result in a positive return in the future.

This is where JPMorgan boss Dimon gets concerned: in a slowing economy, can the government expect to see an uptick in output to offset the investment?

“Instead of focusing on the level of debt, we should be asking: What is the return on the investment?” Professor Veldkamp added. “If the government is issuing debt to invest in high-return projects, then debt is good. If it is not, then the debt will be tough to pay off because of low future productivity.”

And in The Deficit Myth, Stephanie Kelton, professor of economics at Stony Brook University, points out that public debt in the past has made economies more equitable and prosperous, but that scary words like “deficit” quell societies into not pushing fiscal support far enough for it to truly pay off on a large scale.

While Professor Kelton’s belief is a far cry from the doomsday opinions of some, she doesn’t advocate for limitless spending without cause or future societal payoff either, as investing in areas of the economy that are already working well merely results in inflation.

Could the housing market be impacted?

Housing, construction, cars and any other interest-rate sensitive sectors will be “disproportionately” impacted by an attempt to rebalance public debt, William G. Gale of the Brookings Institute told Fortune.

“Higher government debt will tend to raise interest rates,” the author of Fiscal Therapy: Curing America’s Addiction to Debt and Investing in the Future said.

“If government creates debt, it has to be financed somehow—taxes or money creation. If debt gets out of hand, money creation historically has been the (false) solution as it is easier to issue money than raise taxes but often more disastrous in the long term.”

Any rise in interest rates will shock younger generations coming up the housing ladder over the next few decades.

While many economists point out the controversial Fed rate hikes of the 2020s are merely normalizing the rates of many eras before, homeowners and prospective buyers have grown accustomed to a Federal base rate of effectively less than 1%.

Beyond having negative psychological impacts, rising rates is also bad news for the already unattainable market.

According to the latest National Realtors’ Association index, the median family income is $99,432 while the median amount needed to qualify to buy a home is $105,504.

Will public debt impact America’s national security?

This is a long-held fear from experts in the field.

More than a decade ago when national debt sat at a measly $19 trillion, America’s former joint chiefs of staff chairman Admiral Michael Mullen said debt was the top threat to national security.

Fourteen years on, former Speaker Ryan told the Bipartisan Policy Centre in January that before long the government will be spending more on servicing its debt than it is on investing in the Pentagon.

Dimon added: “This is about the security of the world. We need a stronger military, we need a stronger America. We need it now. So I put this as a risky thing for all of us.”

Couldn’t the government just keep spending?

If the government’s racked up this level of debt and the economy is still surviving—after all, inflation is down, jobs are steady, consumers are in ‘decent shape’—some might question why politicians can’t keep spending seemingly without confidence.

There are a couple of issues with that.

The first is well known: the government has a self-imposed debt ceiling which it cannot spend above, and it needs congressional approval to raise or extend it.

This is a fairly regular occurrence—it’s happened 78 separate times since 1960—however, negotiations reached the eleventh-hour last summer when Republicans pushed hard for promises from President Biden’s government to reign in spending.

When the issue comes around again just after the 2024 election, a deal may be more difficult.

The other issue is that, at some point, investors may no longer want to buy government debt if they fear the government won’t be able to pay it back.

That’s a primary concern for Joao Gomes, senior vice dean of research and Professor of finance at the University of Pennsylvania’s Wharton School.

“The most important thing about debt to me that people to keep in mind is you need somebody to buy it,” Gomes told Fortune. “We used to be able to count on China, Japanese investors, the Fed to [buy the debt.] All those players are slowly going away and are actually now selling.”

America’s ability to pay its debts is a concern for the nations around the world that own a $7.6 trillion chunk of the funds.

The nations most exposed are Japan, which owned $1.1 trillion as of November 2023, China ($782 billion), the U.K. ($716 billion), Luxembourg ($371 billion), and Canada ($321 billion).

“If at some moment these folks that have so far been happy to buy government debt from major economies decide that ‘You know what, I’m not too sure if this is a good investment anymore, I’m going to ask for a higher interest rate to be persuaded to hold this’ then we could have a real accident on our hands,” Gomes said.

He added: “The moment the government in any country realizes that it cannot sell $1.7 trillion in [annual] debt anymore, you will have to impose major cuts on some programs. That opens a Pandora’s box of social unrest that I don’t think anybody wants to think about.”

This story was originally featured on Fortune.com

Fool.com contributor Parkev Tatevosian conducts a financial statement analysis of Plug Power (PLUG 5.97%) stock.

*Stock prices used were the afternoon prices of Jan. 19, 2024. The video was published on Jan. 21, 2024.

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

Shares of Plug Power (NASDAQ: PLUG) plunged 63.6% in 2023, according to data provided by S&P Global Market Intelligence. And year to date in 2024, the stock has dropped by another 20%, leaving the hydrogen stock down by a staggering 78% over the past 12 months.

Although Plug Power sealed several deals in 2023, its operational performance consistently failed to meet investors’ expectations. With the company struggling to stay afloat, Plug Power stock is heading even lower.

When Plug Power spooked investors

When Plug Power announced its full numbers for 2022 in early March last year, management was confident that it would generate $1.4 billion in revenue in 2023 with a gross margin of 10%. For 2024, the company forecast that it would deliver a gross margin of 25% on sales of $2.1 billion.

Here’s where things stand right now: In the first three quarters of 2023, Plug Power generated just about $669 million in revenue. Even more alarming, Plug Power reported a gross loss of $285.5 million for the period — 2.5 times as much as it lost in the prior-year period. So forget a 10% gross margin — Plug Power’s gross margin is deep in the red for 2023 so far, and there’s little chance the company’s top line will cross the $1 billion mark, let alone reach the $1.4 billion it guided for.

Looking at those numbers, one can’t blame the market for punishing Plug Power stock throughout 2023. The company’s last earnings release, in fact, was one more nail in the coffin for the stock price. Not only did it report an insignificant 5% growth in revenue and a negative gross margin of 69% for Q3, but it confirmed it needed more cash to run its business and fund growth. The company is, therefore, pursuing several options to raise funds, including taking on debt and selling more shares.

Those moves, however, may not be enough to keep Plug Power afloat. The company itself warned investors so, hinting that it might not survive at all.

Yes, you read that right.

In its quarterly regulatory filing with the Securities and Exchange Commission, Plug Power stated that “its existing cash and available for sale and equity securities will not be sufficient to fund its operations through the next twelve months,” and that raises “substantial doubt about the company’s ability to continue as a going concern.”

Can Plug Power stock revive in 2024?

Plug Power is the front-runner in hydrogen fuel cells, building giga factories, and aiming for leadership in the green hydrogen space by 2025 in terms of capacity. It also sealed multiple sales deals last year, especially for electrolyzers. However, none of that matters if the company is deep in losses and doesn’t have enough money to run its operations for even a year or so.

That’s unfortunately the situation at Plug Power now, which makes it even harder for investors to believe a management team that has been dishing out lofty long-term financial goals despite all the problems. At its annual event in October, for example, management reiterated its forecast that Plug Power is on track to generate about $6 billion in revenue with a gross margin of 32% by 2027, and can grow those numbers to $20 billion and 35%, respectively, by 2030.

Plug could still pull through, but at what cost? If the company keeps issuing debt and selling shares to run its business and build factories, investors shouldn’t expect the stock to earn them much.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Plug Power Stock Plunged 64% in 2023 was originally published by The Motley Fool