The Houthi attacks on cargo ships in the Red Sea, which started last year, sparked concern about the impact on retailers confronted with increased shipping rates and longer journey times as freight is rerouted from the troubled region.

Source link

red

These seven tanker stocks set for upside amid Red Sea disruption, says Evercore

A number of tanker stocks are well positioned to benefit from the fallout from the disruption to Red Sea shipping caused by the Houthi attacks on cargo ships, according to Evercore ISI.

“It appears only a black swan event could overwhelm what is an incrementally strong supply/demand backdrop for the industry… and the current black swan in the form of Red Sea diversion is more likely to add upside,” wrote Evercore analyst Jonathan Chappell, in a note released Wednesday. “Capacity adds remain muted well into 2026, and despite macro fears, oil demand projections continue to increase. Utilization is pegged to move higher in the next two years, driving further rate and stock upside.”

As a result of the attacks, some major shipping companies have re-routed their ships to travel around the Cape of Good Hope in South Africa, which results in a longer voyage. But Evercore sees the unfolding scenario as benefitting tanker stocks.

Related: UPS ‘a good value proposition’ for shippers amid Red Sea attacks, says T.D. Cowen

“It has been this evolving situation, rerouted ships, skyrocketing insurance, and uncertainty regarding the duration to the disruption that has helped tanker stocks catch a bid that finally narrowed the large valuation gaps at which most equities were trading throughout 2023,” wrote Chappell. The analyst also noted the recent strength in the tanker stocks, which are up 1 to 33% and 14% on average over the last three months. The S&P 500 index

SPX

is up 16.8% over that period.

Set against this backdrop, Evercore raised its price target for Ardmore Shipping Corp.

ASC,

and Scorpio Tankers Inc.

STNG,

which skipper petroleum-product tankers, to $20 from $18 and to $89 from $80, respectively. The analyst firm also raised its target for crude-oil tanker company DHT Holdings Inc.

DHT,

to $14 from $13 and increased its price target for tanker group Frontline PLC

FRO,

to $29 from $24. Shipping company Nordic American Tankers Ltd.’s

NAT,

price target was increased to $5 from $4.50 by Evercore and tanker operator Teekay Tankers Ltd.’ s

TNK,

price target was raised to $77 from $65. Evercore raised its price target for Danish tanker owner Torm PLC

TRMD,

to $42 from $38. Evercore has an outperform rating for Ardmore, DHT, Frontline, Scorpio Tankers, Teekay Tankers, and Torm, and an in line rating for Nordic American Tankers.

“Headline-risk notwithstanding, we believe a seasonal pullback in rates and some minor risk to 4Q EPS and 1Q ‘guides’ could result in near-term profit taking,” the analyst added. “As such, we’d pause on adding to positions through February before becoming more aggressively long in the spring.”

Related: Fallout from Red Sea attacks could boost this sector’s margins, says T.D. Cowen

The 2-year fundamental outlook for tanker stocks remains robust, according to Evercore. “As we also roll our price targets to yearend 2024 NAVs [Net Asset Values], there still appears to be material upside across the group.”

“The fundamentals for the tanker sector remain robust through 2025, at least, and any headline risk that could potentially derail that outlook is effectively impossible to predict,” Chappell added. “So long and strong is the way to think about the group over the next 12 months.”

The attacks by Houthi rebels, who control much of Yemen, have prompted a U.S. led-coalition to launch air strikes against the group. On Wednesday U.S. forces conducted strikes against two Houthi anti-ship missiles that were aimed into the Southern Red Sea and were prepared to launch, according to the U.S. military’s Central Command.

Related: Shipping stocks rise as latest Houthi attack thrusts dry bulk fleet into the spotlight

The Red Sea is a critical shipping lane for cargo traveling through the Suez Canal. Approximately 12% of global trade and 30% of global container traffic traverses the Suez Canal, transporting $1 trillion of goods per annum, the government of New Zealand reported in 2021.

These toy makers are well-positioned to handle Red Sea and Panama Canal disruptions

The Houthi attacks on cargo ships in the Red Sea and the drought conditions impacting the Panama Canal have sparked concern about the impact on global supply chains.

Last week, for example, British clothes seller Next PLC warned that the Houthi attacks could disrupt the company’s supply chains and delay U.K. deliveries by up to two and a half weeks, and there are worries about potential disruption for American retailers.

The Red Sea is a critical shipping lane for cargo traveling through the Suez Canal, which is said to account for about 12% of global trade. Approximately 30% of global container traffic traverses the Suez Canal, transporting $1 trillion of goods a year, the government of New Zealand reported in 2021.

Some major shipping companies have re-routed their ships to travel around the Cape of Good Hope in South Africa, but that results in a longer voyage. T.D. Cowen estimates that the detour adds eight to 12 days on journeys from the Middle East or Southeast Asia to the Port of Rotterdam in the Netherlands.

Related: Barrage of Houthi drones, missiles shot down over Red Sea, U.S. says

The disruption in the Red Sea has resulted in a spike in freight rates, according to a Citi note released Wednesday. Cancelled sailings have also increased to 11.5%, from 8.5% last week, Citi said. “We think the bottleneck at Red Sea and Panama Canal contributed to elevated cancellations,” wrote Citi analyst Sathish B Sivakumar, in the note.

But D.A. Davidson analyst Linda Bolton Weiser says two toy-industry giants are well-positioned to avoid the spike in ocean freight rates. “The majority of the freight-rate exposure of Buy-rated Mattel (MAT) and Neutral-rated Hasbro (HAS) is related to shipping from Asia to the U.S. West Coast, not from Asia to Europe,” she wrote, in a recent note. Mattel Inc.

MAT,

and Hasbro Inc.

HAS,

also have contracts for freight rates, and generally do not buy containers on the spot market, although they could be susceptible to surcharges, Bolton Weiser added.

The spot market refers to the one-time fees paid to ship containers — these so-called spot rates can be volatile. The Wall Street Journal reported that the spot-market price to move containers between China and Rotterdam reached $3,577 in the week ending Jan. 4, a 115% hike from the prior week.

Related: Retailers could suffer ‘perfect storm’ of Red Sea and Panama Canal disruption, says logistics expert

D.A. Davidson’s Bolton Weiser also noted that shipping of toys out of Asia is at a seasonal low point during the first quarter, with peak shipping of toys from Asia occurring between August and September.

Other elements of Mattel’s and Hasbro’s cost structures are likely to be tailwinds in 2024, according to the analyst, who pointed to favorable trends in plastic resin costs and electronic chip-component costs, which are in a deflationary trend, as well as lower China manufacturing costs.

Elsewhere in the consumer-goods sector, Bolton Weiser told MarketWatch that she recently met with Helen of Troy Ltd.

HELE,

which ships a lot of durable consumer goods from Asia to Europe. “They said they are watching the situation, but that they operate under contracts for ocean freight, so a spike up in spot rates in the near term does not impact them right away,” she said. “I would think it is the same for the toy companies.”

Related: Fallout from Red Sea attacks could boost this sector’s margins, says T.D. Cowen

Mattel’s stock is down 1% on Thursday, while Hasbro shares are down 3.1%, outpacing the S&P 500 index’s

SPX

decline of 0.2%. Helen of Troy’s shares are up 0.2%.

Oil prices rise as Iran sends warship to Red Sea after U.S. destroys Houthi vessels

Oil futures rose Tuesday to kick off the new year after an Iranian warship entered the Red Sea, heightening tensions and fears of crude supply disruptions sparked by attacks on shipping by Iran-backed Houthi rebels in Yemen.

Price action

-

West Texas Intermediate crude for February delivery

CL00,

+2.37% CL.1,

+2.37% CLG24,

+2.37%

rose $1.71, or 2.4%, to $73.36 a barrel on the New York Mercantile Exchange. -

March Brent crude

BRN00,

+2.19% BRNH24,

+2.19% ,

the global benchmark, was up $1.86, or 2.4%, at $78.90 a barrel on ICE Futures Europe. -

Back on Nymex, February gasoline

RBG24,

+2.52%

rose 2.4% to $2.156 a gallon, while February heating oil

HOG24,

+2.06%

was up 2% at $2.58 a gallon. -

February natural gas

NGG24,

+4.38%

rose 4% to $2.615 per million British thermal units.

Market drivers

News reports said Iran’s semiofficial Tasnim news agency on Monday reported that Iran’s Alborz warship had entered the Red Sea without providing details of the ship’s mission.

The U.S. military said Sunday that its forces opened fire on Houthi rebels after they attacked a cargo ship in the Red Sea, killing several of them and destroying three boats in an escalation of the maritime conflict linked to the war in Gaza.

Oil prices rose after the start of the Israel-Hamas war in October, but the risk premium attached to fears of a wider conflict in the region soon evaporated. Crude has seen periodic jumps in price around fears of potential escalation, but fell sharply over the course of the fourth quarter, with both Brent and WTI ending 2023 with a year loss, their first since 2020.

Uncertainty over the demand outlook, a rise in U.S. production to record levels above 13 million barrels a day and doubts about the unity of the Organization of the Petroleum Exporting Countries have served to undercut support for crude.

With demand “expected to remain subdued due to a global economic slowdown and U.S. crude production at record levels, the recovery may be destined to remain limited and short lived,” said Charalampos Pissouros, senior investment analyst at XM, in a note.

Oil prices pull back from December highs, end lower as traders monitor Red Sea developments

Oil futures on Wednesday pulled back from December highs, ending lower as investors continued to monitor developments in the Red Sea amid worries over potential disruptions to crude shipments.

Price action

-

West Texas Intermediate crude for February delivery

CL00,

-0.34% CLG24,

-0.34% CL.1,

-0.34%

fell $1.46, or 1.9%, to close at $74.11 a barrel on the New York Mercantile Exchange. -

February Brent crude

BRNG24,

-0.39% ,

the global benchmark, declined $1.42, or 1.8%, to settle at $79.65 a barrel on ICE Futures Europe. -

On Nymex, January gasoline

RBF24,

-0.52%

fell 0.2% to end at $2.155 a gallon, while January heating oil

HOF24,

-0.03%

declined 1.7% to $2.624 a gallon. -

January natural gas

NGF24,

+2.35%

rose 2.7% to finish at $2.619 per million British thermal units.

Market drivers

Oil rose to December highs on Tuesday after Yemen’s Iran-backed Houthi rebel militia claimed responsibility for both a missile attack against the containership MSC United VIII and an attempt to attack Israel with drones.

The attacks rattled investors and came after the U.S. last week announced the formation of a naval coalition to address attacks in the region. Crude prices initially saw pressure on Tuesday after shipping company Maersk

MAERSK.A,

MAERSK.B,

over the weekend said it would resume shipments via the Red Sea.

The concerns saw WTI face clear resistance in the $74-$75 per barrel range on Tuesday, though the “bullish market reaction” looks relatively weak given the potential for disruption, said Ipek Ozkardeskaya, senior analyst at Swissquote Bank, in a note.

Meanwhile, demand concerns also loom over the market, particularly in China where strong demand over the first nine months of the year has started to moderate, said Rebecca Babin, senior energy trader at CIBC Private Wealth U.S., in a note.

“The market expects that approximately 800,000 of the 1.2-1.6 million barrels-per-day growth next year will come from China, with jet fuel leading the charge,” she wrote. “The lack of confidence in China’s economy in 2024 remains the market’s biggest concern followed by fear that U.S. production will continue to beat estimates as it did in 2023.”

The cautious sentiment, however, creates a low bar for positive surprises in 2024, Babin said, in contrast to a 2023 where expectations of massive inventory draws were too hard to live up to.

On the charts, a bearish “death cross” pattern appeared Tuesday, with the 50-day moving average for WTI crossing below the 200-DMA.

The 50-DMA is a widely followed short-term trend tracker, while many view the 200-DMA as a dividing line between longer-term uptrends and downtrends. So a death cross is seen by many Wall Street chart-watchers as marking the spot where a shorter-term pullback transforms into to a longer-term downtrend.

See: Crude oil sees first real ‘death cross’ since the pandemic plunge of early 2020

Oil futures tally a third straight gain on Red Sea shipping disruptions

Oil futures tallied a third straight climb on Wednesday, buoyed by tensions in the Red Sea that have led to disruptions to global trade.

Meanwhile, data from the U.S. government revealed weekly increases for domestic crude and petroleum-product supplies.

Price action

-

West Texas Intermediate crude for February delivery

CL.1,

-0.20% CL00,

-0.20% CLG24,

-0.20%

edged up by 28 cents, or 0.4%, to settle at $74.22 a barrel on the New York Mercantile Exchange. -

February Brent crude

BRN00,

-0.65% BRNG24,

-0.65% ,

the global benchmark, added 47 cents, or 0.6%, at $79.70 a barrel on ICE Futures Europe after trading as high as $80.60. Brent and WTI oil each saw their highest finish since Nov. 30. -

January gasoline

RBF24,

-0.77%

settled flat at $2.20 a gallon, while January heating oil

HOF24,

-0.75%

shed 0.3% to $2.71 a gallon. -

Natural gas for January delivery

NGF24,

-3.01%

settled at $2.45 per million British thermal units, down 1.8%.

Red Sea shipping woes

Several shippers have suspended shipments through the Red Sea after a series of drone and missile attacks by Iran-backed Houthi rebels since the start of the Israel-Hamas war.

Read: Attacks in the Red Sea add to global shipping woes

The actions by the Houthi rebels to “disrupt international shipping lanes are not only an act of war but also an assault on the global economy,” said Phil Flynn, senior market analyst at The Price Futures Group. While the U.S. is setting up an international coalition to try to stop the piracy, “the question becomes whether they will go after Iran.”

On Tuesday, the U.S. announced the launch of an international naval effort to thwart the attacks.

See: Inflation worries return after Red Sea shipping attacks

“For the oil trade, it is a wake-up call,” said Flynn, in a note. “Last month, the market declared that war premium was unnecessary, but we are seeing that war premium forced back into the price.”

Still, in a note, Marios Hadjikyriacos, senior investment analyst at XM, said that it’s “questionable” whether such concerns over the disruptions to global trade will manage to keep oil prices supported for long, “against the backdrop of slowing demand next year coupled with record-high U.S. crude production.”

The Year Ahead: Why oil may not see a return to $100 a barrel in 2024

Supply data

U.S. crude, gasoline and distillate supplies all climbed last week, according to data from the Energy Information Administration released Wednesday. Domestic petroleum production, meanwhile, marked a climb to another record high, based on EIA data going back to 1984.

Domestic commercial crude inventories rose by 2.9 million barrels for the week ended Dec. 15.

On average, analysts polled by The Wall Street Journal expected the report to show a climb of 2.5 million barrels. The American Petroleum Institute late Tuesday reported that U.S. crude inventories rose 939,000 barrels last week, according to a source citing the data.

The EIA report also revealed supply increases of 2.7 million barrels for gasoline and 1.5 million barrels for distillates. Analysts had forecast supply increases of 700,000 barrels each for gasoline and distillates.

Crude stocks at the Cushing, Okla., Nymex delivery hub rose by 1.7 million barrels last week, the EIA said, while domestic petroleum production moved up by 200,000 barrels a day last week to a record of 13.3 million barrels a day.

Oil prices notch back-to-back gains after suspension of Red Sea shipments

Oil futures notched a second gain in a row Tuesday to settle at a more than two-week high as recent attacks on ships in the Red Sea stoked worries over potential supply disruptions.

Price action

-

West Texas Intermediate crude for January delivery

CL.1,

+1.53% CLF24,

+1.53%

gained 97 cents, or 1.3%, to settle at $73.44 a barrel on the New York Mercantile Exchange on the contract’s expiration day, marking the highest finish since Dec. 1, according to Dow Jones Market Data. February WTI crude

CLG24,

+1.85% ,

which became the front month at the end of the session, added $1.12, or 1.5%, to $73.94. -

February Brent crude

BRN00,

+0.06% BRNG24,

+0.06% ,

the global benchmark, rose $1.28, or 1.6%, to $79.23 a barrel on ICE Futures Europe, the highest finish since Nov. 30. -

January gasoline

RBF24,

+1.80%

tacked on 1.9% to $2.20 a gallon, while January heating oil

HOF24,

+2.03%

climbed nearly 1.7% to $2.72 a gallon. -

Natural gas for January delivery

NGF24,

+2.40%

settled at $2.49 per million British thermal units, down 0.4%.

Market drivers

Brent crude settled Tuesday at its lowest level since late November, while WTI crude ended at a more than two-week high, with the latest support for prices tied to Monday’s news that oil major BP PLC

BP,

BP,

said it was temporarily suspending shipments through the Red Sea.

Read more: Attacks in the Red Sea add to global shipping woes

Several shipping companies had previously announced they would pause shipments due to a series of drone and missile attacks by Houthi rebels, who largely control Yemen, since the start of the Israel-Hamas war.

The “longer-term impact on oil prices of Houthis’ attacks on oil tankers through the Red Sea is a complicated one, but the attacks do have immediate repercussions: delay in delivery of crude and higher shipping costs,” said Fawad Razaqzada, market analyst at City Index and FOREX.com, in emailed commentary.

Given that, “the oil price gains are justified,” he said in market commentary. Still, it’s “very difficult to say how long the gains will last for, or how much higher will prices go from here on, just on the back of this factor alone.”

Read The Year Ahead: Why oil may not see a return to $100 a barrel in 2024

Crude prices had risen modestly after the Oct. 7 Hamas attack on southern Israel on fears of a wider conflict, but soon gave up those gains to trade at roughly six-month lows early last week before seeing a modest bounce.

“As the holiday season approaches, a stable outcome for the region looks elusive,” said Stephen Innes, managing partner at SPI Asset Management, in market commentary. “The longer the war in Gaza rages on, the escalating humanitarian crisis may intensify political pressure on various actors, potentially leading to an expansion of the conflict.”

““The longer the war in Gaza rages on, the escalating humanitarian crisis may intensify political pressure on various actors, potentially leading to an expansion of the conflict.” ”

— Stephen Innes, SPI Asset Management

And “in the midst of rocket attacks and bombings, the fog of war increases the likelihood of unpredictable events and significant miscalculations, potentially resulting in further escalation,” said Innes.

Only two years ago, Nvidia‘s (NVDA -0.87%) biggest source of revenue was the sale of its graphics processing units (GPUs) to gamers, who use the chips to build high-powered gaming PCs.

However, a lot has changed for the company since the launch of ChatGPT’s OpenAI last November. The tech giant’s over-85% market share in GPUs saw it get a headstart in artificial intelligence (AI), becoming the primary chip supplier for countless companies.

As a result, Nvidia’s stock has skyrocketed about 230% year to date alongside soaring revenue that hit new heights quarter to quarter. The company is on a promising growth path and likely has much to offer investors over the long term. But its meteoric rise has also made its stock expensive compared to those of other AI-minded companies.

So before you go filling up on Nvidia stock, here is one green flag and one red flag for the chipmaker in 2023.

Green flag: Stellar growth that has shown no signs of slowing

Nvidia posted earnings last week for its third quarter of 2024 (which ended Oct. 29), reporting revenue growth of 206% year over year as it beat analysts’ expectations by more than $2 billion. Operating income rose more than 1,600%, with much of the company’s growth owed to its data center business. Nvidia’s data center segment grew 279%, profiting from increased chip sales.

Meanwhile, macroeconomic headwinds appear to be subsiding, as the company’s gaming segment posted an 81% rise in revenue.

Every part of Nvidia’s business is on a promising growth trajectory. Even gross margins are rising at an impressive rate, hitting 74% in Q3 2024, 20 points above the same metric a year ago.

Nvidia will face increased competition next year, with new product launches from Advanced Micro Devices and other chipmakers. However, Raymond James managing director Srini Pajjuri said last week, “GPU demand continues to outpace supply as Gen AI adoption broadens across industry verticals.”

Pajjuri believes Nvidia will retain its over-85% market share in AI, and is not “overly concerned” about its performance in 2024.

The company’s dominance will be a challenge for competitors to overcome, with Nvidia likely to see major gains from AI for years.

Red flag: There are cheaper AI stocks than Nvidia

Nvidia stock’s rapid rise has been lucrative for current investors, but has also made its shares expensive for new ones. The company will likely continue expanding financially over the next year, but much of its short-term growth might already be priced into its shares.

In fact, despite delivering legendary Q3 2024 results this month, Nvidia’s stock has actually fallen around 5% since its earnings release as Wall Street remains cautious about its growth potential over the next year. Consequently, those interested in investing in AI might be best off looking at cheaper options for now.

Data by YCharts

The chart above compares price-to-earnings ratios (P/E) and price-to-free cash flows of some of the biggest names in AI, including Nvidia, Amazon, Microsoft, and Alphabet. These are useful metrics in determining a stock’s value, with lower figures indicating better bargains.

In both metrics, Alphabet is by far the best value, and Microsoft is a not-too-distant second. These companies have similar earnings potential in AI over the long term compared to Nvidia, with potent brands that offer countless possibilities to monetize their AI offerings.

Nvidia’s stock has soared more than 1,000% in the last five years, and there’s no telling how far that figure could rise over the next half-decade with the power of AI. However, prospective investors should plan to hold the chipmaker’s stock for at least 10 years to ensure significant gains.

Alternatively, Alphabet or Microsoft could be excellent ways to invest in AI right now as you wait for Nvidia’s stock to come down to a more attractive price point.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

The American Red Cross has long been recognized as the universal symbol of humanitarian services —and it’s an expensive operation.

In 2022, the American Red Cross generated more than $3.2 billion in operating revenue and spent just over $3 billion in expenses the same year, according to its financial statements.

Contributions only make up about a third of the organization’s revenue.

“It’s really sort of the charity of choice,” according to Jake Johnston, a senior research associate at the Center for Economic and Policy Research. “When the White House starts raising money, when the big corporations, the NFL, Hollywood A-listers are raising money for the aftermath of a disaster, it’s most likely targeted toward the American Red Cross.”

But the majority of its revenue, just over $1.8 billion, comes from what its financial statements refer to as “Biomedical services.”

“The American Red Cross essentially collects blood from donors and then as part of the way it raises revenue to recover costs, then sells that blood to about 2,500 hospitals and medical facilities across the country,” said Laurie Styron, CEO and executive director of CharityWatch.

When CNBC inquired about the pricing of these products, the American Red Cross responded that “prices for a unit of red blood cells is proprietary information. The pricing is determined by purchase volumes by blood type, service levels, and delivery requirements as well as other agreed upon terms with a hospital.”

The American Red Cross further clarified that it “does not charge for the blood itself” but is “reimbursed by hospitals and transfusion centers for the costs associated with providing blood products.”

A majority of the American Red Cross’ operating expenses, just over $2 billion, is also spent on collecting blood, according to its financial statements. That’s about $139 million more than the revenue it collects from selling the blood.

Michael Thatcher, CEO of Charity Navigator said, “drawing blood is actually a medical intervention that requires certain levels of certification by the people doing that work, the preservation of that blood, making sure that it stays clean and getting them to all these places. All of that costs money.”

Watch the video above to see how the American Red Cross makes and spends its billions.

Analyst Raises Red Flag On Bitcoin Rally, Predicts Imminent Retreat After 35% Spike

As Bitcoin (BTC) continues to consolidate above the $34,000 mark, aiming to surpass and reclaim its yearly high, theories suggest that a retracement may follow the current upward spike in the coming weeks.

On this matter, the renowned crypto analyst known by the pseudonym “Crypto Soulz” recently shared insights on the potential short-term retracement for Bitcoin in a recent post on X (formerly Twitter).

BTC’s Local Top At $36,000 Signals Potential Reversal

According to Crypto Soulz, a key resistance level for Bitcoin is identified at $37,370. The analyst suggests that this resistance level will not likely be retested from the current position.

Additionally, Soulz highlights that liquidity has been absorbed around $36,000, which he considers a “trigger” for taking short positions.

The analyst points out that the local top for BTC was observed at $36,000, where a long wick was formed, followed by a retracement. This price action is seen as a potential indication of a reversal.

Moreover, Crypto Soulz emphasizes using on-chain data as a confluence for BTC positions. Soulz highlights that the spot market showed an uptrend before the perpetual futures contracts followed suit.

The spot order book (OB) is stated to be increasing but expected to decrease, along with the perpetual market. If $36,000 indeed serves as a local top, the analyst suggests that both spot and perpetual should subsequently decrease.

Furthermore, Soulz highlighted that BTC successfully broke through key technical indicators, such as the 200-day simple moving average (SMA), the 200-week SMA, and the 365-day SMA, which is currently acting as support.

Ultimately, Soulz further states that there is no substantial liquidity available above $38,000. The analyst identifies two liquidity pools, as seen in the chart above: the first at $33,000, which he considers its initial target, and the second at $31,000, where a slight bounce may occur.

Bitcoin Potential As Store Of Value

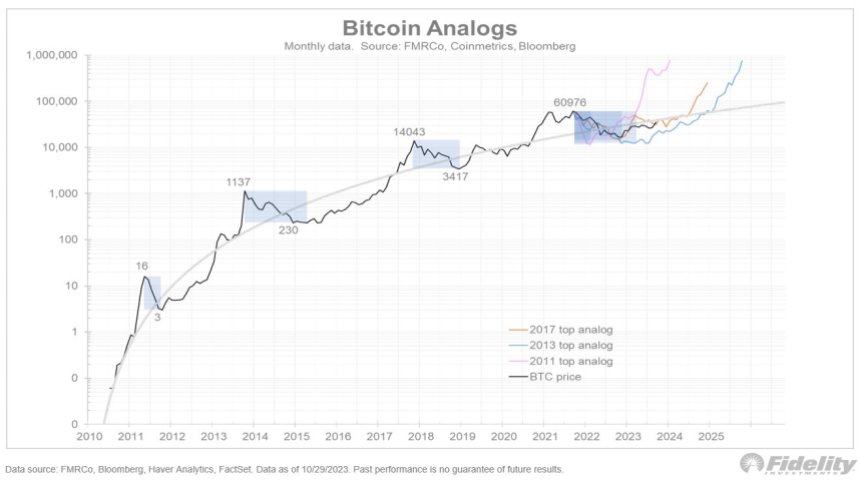

In another development, Jurrien Timmer, Fidelity’s Director of Global Macro, delved into the characteristics of Bitcoin and its potential to serve as a store of value and hedge against monetary debasement.

Drawing parallels to gold, Timmer highlighted Bitcoin’s “unique attributes” and its ability to potentially gain market share in times of inflation and excessive money supply growth.

Timmer acknowledged that Bitcoin had followed a pattern of “boom-bust cycles,” much like its previous market behavior. However, he also emphasized Bitcoin’s evolving role as a commodity currency that aspires to be a store of value.

Furthermore, Timmer described Bitcoin as “exponential gold,” suggesting that it shares similarities with gold but with additional growth potential.

While gold has traditionally been recognized as a store of value, Timmer noted its limitations as a medium of exchange due to its deflationary nature and lack of efficiency.

Timmer drew attention to historical periods, such as the 1970s and 2000s, when gold exhibited strength and gained market share. These periods coincided with structural regimes marked by high inflation, negative real rates, and excessive money supply growth.

Timmer hinted that Bitcoin, with its potential to serve as a hedge against inflation and debasement, could play a similar role in such environments.

Considering Bitcoin’s attributes and the changing macroeconomic landscape, Timmer expressed optimism about its potential to join the ranks of gold as a valuable asset.

While acknowledging the volatility and speculative nature of cryptocurrencies, Timmer believes that Bitcoin’s unique characteristics position it as a viable contender in the store of value space.

Currently, BTC is trading at $34,700, reflecting a 1.5% increase over the past 24 hours as it persists in reaching the $35,000 mark.

Featured image from Shutterstock, chart from TradingView.com