A recent research paper on SSRN by legal scholars scrutinizes the ethical quandaries and potential conflicts of interest surrounding Sullivan & Cromwell LLP’s involvement in FTX’s Chapter 11 bankruptcy filing. Study Highlights Legal Ethics From FTX Bankruptcy Proceedings The SSRN research paper entitled “Conflicting Public and Private Interests in Chapter 11” meticulously explores the controversial […]

A recent research paper on SSRN by legal scholars scrutinizes the ethical quandaries and potential conflicts of interest surrounding Sullivan & Cromwell LLP’s involvement in FTX’s Chapter 11 bankruptcy filing. Study Highlights Legal Ethics From FTX Bankruptcy Proceedings The SSRN research paper entitled “Conflicting Public and Private Interests in Chapter 11” meticulously explores the controversial […]

Source link

Research

Bitcoin Will Reach A New All-Time High This Week, Matrixport Head Of Research Says

Bitcoin saw an incredible month in February, adding over $18,000 to its value in a single month. This outperformance has now carried on into the month of March, which has seen the Bitcoin price cross the $65,000 mark for the first time since 2021. As BTC trades in the green, expectations remain that the performance will continue.

Bitcoin Shows Strong Fundamentals

In a new report shared with NewsBTC via email, the head of research at Matrixport, Markus Thielen, put forward that the Bitcoin price was headed for another all-time high this week. This report highlighted the BTC price performance over the last year, as well as in February, in which the price rose a total of $18,615 in a single month. Additionally, the analyst pointed out that despite the slowdown in Bitcoin Spot ETFs that were seen toward the end of February, it hasn’t affected BTC’s bullishness by much.

The crypto analyst explains that institutional buying is not just happening in the United States either. There has also been a large uptick in buying volume across other countries, including the likes of Korea where volumes have reached near $8 billion for five consecutive days. Interestingly, the buying is not just limited to Bitcoin either as there are also inflows into altcoins and meme coins.

Furthermore, the anticipation of Hong Kong launching its own Spot Bitcoin ETF, as well as BlackRock taking the plunge and launching a Bitcoin ETF in Brazil, also proves that there is a lot of demand. So despite the decreased inflows that were seen last week, Thielen explains that if Grayscale’s outflows keep dropping, reaching between $0-$100 million, then he expects further rally for the Bitcoin price.

Thielen also pointed out that the Untied States debt is growing exponentially and Bitcoin now offers better macro upside compared to gold. This plays into the bullish potential of BTC going forth.

“ Previously we have shown that 30-40% of the Bitcoin ETF inflows appear to come out of Gold ETFs and with $80bn of assets-under-management, those re-allocation flows can continue. We have also shown numerous times that Bitcoin has become a better macro asset than Gold as Bitcoin’s reaction function towards changes in interest rate expectations, announcement of wars/conflicts, etc., has become superior (we backtested this).”

BTC Price Headed For New All-Time High

Among the factors driving the Bitcoin price identified by the analyst was a significant decrease in the amount of over-the-counter (OTC) BTC available for large institutions. Spot Bitcoin issuers such as BlackRock tend to utilize these OTC desks for purchases in order to reduce the impact of their buying on the price. However, these OTC sellers have reported that their balances have dropped 80% in the last year from around 10,000 BTC to less than 2,000 BTC.

Thielen also points out that the same trend is seen in exchanges where balances have declined across trading platforms such as Binance and Coinbase. Both of these, which are currently the Bitcoin trading powerhouses of the world, saw a total of 48,000 BTC leave their balances in a month.

Given these developments, the crypto analyst explains that investors are not price-sensitive at this time. So, the expectation for this week is that Bitcoin makes a new all-time high. If this happens, then the market could see BTC tap $70,000 this week.

BTC price surpasses $65,000 | Source: BTCUSD on Tradingview.com

Featured image from Capital.com, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

VanEck’s Head Of Research Says BlackRock Has $2 Billion In Investments Lined Up

VanEck’s Head of Research, Matthew Sigel, recently hinted that the Spot Bitcoin ETF of the world’s asset manager, BlackRock, could see a record-breaking amount of inflows upon launch. This comes as an approval order by the Securities and Exchange Commission (SEC) looks imminent.

BlackRock’s Bitcoin ETF Could See Inflows Of Over $2 Billion

Sigel mentioned on an X (formerly Twitter) space hosted by the media platform, The Block, that he heard from a reliable source that BlackRock has “more than $2 billion lined up in week one.”

This investment capital is said to be coming from existing Bitcoin holders who are looking to increase their exposure to the flagship cryptocurrency.

He quickly added that he couldn’t be 100% certain of this information. However, it is a possibility, considering that issuers would be looking to get investors that can inject huge sums into their respective ETFs.

Sigel went on to highlight how significant it could be if BlacRock’s ETF indeed saw $2 billion of inflows in the first week of trading, saying that it would “blow away” their initial projections. They estimate that the Spot Bitcoin ETFs could see $2.5 billion of inflows in the first quarter of trading. Meanwhile, they believe the market could grow to $40 billion in the next two years.

BTC price struggles to reclaim $44,000 | Source: BTCUSD on Tradingview.com

Not Out Of Place For BlackRock

Commenting on the possibility of BlackRock seeing this significant amount of inflows, Bloomberg analyst Eric Balchunas noted that such an occurrence isn’t unusual for the world’s largest asset manager. According to him, BlackRock is known for lining up and injecting big cash into new ETFs on the first day of trading. That way, it registers as volume for them.

Balchunas further noted that BlackRock’s Bitcoin ETF, seeing $2 billion of inflows, would shatter all records relating to first-day and week volume for an ETF. Interestingly, BlackRock already holds the record for the most successful ETF launch going by the amount of inflows recorded on day one.

The world’s asset manager further dominates the top 10 list of most successful ETF launches. Balchunas, however, clarified that those inflows were mainly lined up cash and not organic, as they were readily available before the ETF launched. He also mentioned that he got a second source to confirm Sigel’s claims that BlackRock has a big day one lined up.

Meanwhile, the Bloomberg analyst provided an update on when the approval order from the SEC was likely to come. Citing multiple sources, he stated that the SEC is lining up all issuers for a potential launch on January 11.

Featured image from Decrypt, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Omega Therapeutics stock more than doubles on Novo Nordisk obesity drug research pact

Novo Nordisk has entered research collaboration agreements with Omega Therapeutics Inc. and Cellarity Inc. on new treatments for obesity management, sending Omega’s stock up 109% on Thursday.

The stock was on track for its biggest one-day gain since it went public in 2021. Volume of more than 55 million shares traded compared with the daily average of 246,500 over the last 65 days.

The Danish developer of weight-loss drugs Ozempic and Wegovy said the agreements are the first to be drawn up under an existing partnership with Cambridge, Mass.-based biotech Flagship Pioneering.

The Omega

OMGA,

collaboration will leverage that company’s proprietary platform technology to develop an epigenomic controller that aims to enhance metabolic activity. Omega, which is also based in Cambridge, is a clinical-stage biotech specializing in programmable epigenomic mRNA medicines to treat or cure a range of diseases.

Read now: Five obesity-drug trends to watch in 2024: Who can compete with Eli Lilly and Novo Nordisk?

The Cellarity collaboration aims to discover biological drivers of metabolic dysfunction-associated steatohepatitis, or MASH, and will seek to develop a small molecule therapy against this disease. MASH is a chronic liver disease with a high unmet patient need for which there is currently no treatment.

Cellarity, based in Somerville, Mass., was created by Flagship Pioneering and launched in December 2019 with the aim of developing medicines by studying and altering the cellular signatures of disease.

Novo Nordisk

NVO,

NOVO.B,

will reimburse R&D costs for each company and Flagship’s Pioneering Medicines will be eligible to receive up to $532 million in upfront and milestone payments, along with tiered royalties.

“Novo Nordisk is committed to advancing new treatment options for people living with cardiometabolic diseases,” Novo Nordisk’s Chief Scientific Officer Marcus Schindler said in a statement.

“To that end, it is essential that we complement our internal research with external innovation and work with partners who are bringing forward cutting-edge technology.”

More than 800 million adults globally are living with obesity, according to Novo Nordisk. Most of the existing therapies focus on appetite regulation. The Omega platform seeks to use the body’s innate mechanisms to control cellular identity and gene expression and enhance thermogenesis, or the production of heat within tissues to raise body temperature, a natural metabolic function that regulates overall energy balance.

“Precision epigenomic control is an emerging approach to medicine that allows us to pre-transcriptionally modulate gene expression with an unparalleled level of specificity,” said Mahesh Karande, president and CEO of Omega Therapeutics.

Novo’s U.S.-listed shares were up 3%.

See now: Novo Nordisk, maker of Ozempic and Wegovy, to invest more than $6 billion to expand production

FTX and Alameda Research Move $10.8M in Cryptocurrencies to Binance, Coinbase, Wintermute

These asset shifts have also been constantly noticed ever since FTX filed for bankruptcy, leaving many to speculate about the rationale behind the moves.

According to a recent tweet by Spot on Chain, crypto accounts linked to the collapsed crypto exchange FTX and its sister trading firm Alameda Research executed over $10 million worth of token transfers across six currencies within a 12-hour span. These movements involve a part of the remaining digital assets still controlled by FTX bankruptcy administrators. The frequency and strategies behind the withdrawals have kept many wondering why it is happening.

In the tweet, Spot on Chain laid out the specifics of the transfers, which included over $2 million worth of tokens such as StepN (GMT) worth around $2.58M, Uniswap (UNI) of $2.41M, Synapse (SYN) of $2.25M, Klaytn (KLAY) with $1.64M, Fantom (FTM) worth $1.18M, Shiba Inu (SHIB) of around $644k and some Arbitrum (ARB) and Optimism (OP) moved to exchanges like Wintermute, Binance and Coinbase.

This is not the first time such large transfers have happened recently as it is part of a broader pattern since October 24th that has seen FTX and Alameda shift around $551 million worth of tokens across 59 digital assets. The scale and frequency of these transfers since the exchange collapsed last year have kept many crypto watchers speculating, as the purpose behind the huge money movements has not been made clear.

🚨 #FTX and #Alameda moved out $10.8M worth of 8 assets to #Wintermute, #Binance, and #Coinbase in the past 11 hrs:

10M $GMT ($2.58M)

407K $UNI ($2.41M)

5.23M $SYN ($2.25M)

8.76M $KLAY ($1.64M)

3.87M $FTM ($1.18M)

77.77B $SHIB ($644K)

and small amounts of $ARB and $OP.Note… pic.twitter.com/0jb5ZMHvC7

— Spot On Chain (@spotonchain) December 1, 2023

Speculations on Why FTX Administrators Are Moving Money

These asset shifts have also been constantly noticed ever since FTX filed for bankruptcy, leaving many to speculate about the rationale behind the moves. One possibility that concerns some is that it could be a way of improperly removing money from the accounts before any major action is taken around the company’s assets. Perhaps some insiders are trying to withdraw as much as they can while still having access.

As speculation about FTX rebranding and coming back alive under new leadership is also bubbling up, the money transfers could be a necessary part of the process to put some structural pieces in place or ensure the exchange wallets are not totally frozen.

In all, one thing is certain – FTX creditors likely remain anxious as they still seek repayments. Every sight of money leaving FTX addresses could pose trouble for them, as there has been no specific plan established yet for how their lost investments will be returned.

A Process to Recover Creditors’ Assets

In March as FTX and Alameda Research started working to recover assets for creditors, they reportedly sent around $145 million in stablecoins to various exchanges. Some funds were moved to custodial wallets while some were kept as stablecoins. So far, the troubled exchange has been able to claw back more than $5 billion in cash and crypto out of the over $8 billion in total outstanding liabilities. This could add some strength to the possible rebranding and recovery process.

next

Altcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

American Cancer Society leverages Gitcoin for decentralized open-source cancer research funding

In a move that blends innovation with philanthropy, the American Cancer Society (ACS) has embraced web3 technology by partnering with Gitcoin, a leading figure in open-source funding, according to a statement shared with CryptoSlate.

This strategic collaboration signifies a milestone for the ACS as it steps into the decentralized world of web3, leveraging Gitcoin’s expertise to drive its ACS Cares program and the Crisis Response Fund.

The ACS round, distinct and independent from the regular seasonal Gitcoin Grants program, is designed to benefit the ACS Cares program and the Crisis Response Fund directly. This initiative is crucial, as donations will be channeled towards groundbreaking cancer research, advancing health equity initiatives, and bolstering patient support programs.

Additionally, it will aid in providing essential lodging for cancer patients undergoing treatment. This venture represents a crucial intersection of technology and philanthropy, where blockchain’s potential is harnessed for impactful healthcare outcomes.

The initiative represents a continued interest in decentralized open-source funding by a renowned non-profit organization utilizing Gitcoin technology. The first instance was a significant QF collaboration pilot with UNICEF in 2022.

Gitcoin and decentralized funding.

The significance of Gitcoin in the realm of open-source funding cannot be overstated. Since its inception, Gitcoin has played a pivotal role in the web3 ecosystem, mainly through its utilization of Quadratic Funding (QF). This innovative funding mechanism has enabled Gitcoin to disperse over $50 million across more than 100 rounds, empowering organizations like UNICEF and now the ACS in their mission-driven endeavors.

QF is central to Gitcoin’s strategy, a crowdfunding approach that values the number of contributors over the total donation amount. This method fosters widespread community involvement and ensures equitable allocation of funds to projects that resonate most with the public. In the case of the ACS round, this methodology promises to channel resources efficiently towards breakthrough cancer research, health equity initiatives, and patient support programs, all pivotal in the fight against cancer.

Azeem Khan, Head of Impact at Gitcoin, commented,

“By using Gitcoin, the American Cancer Society gains access to a vibrant community of technologists and crypto enthusiasts who are passionate about driving positive change.

This partnership combines Gitcoin’s expertise in blockchain with the American Cancer Society’s commitment to cancer research and prevention, creating a powerful synergistic effect in the fight against cancer.”

Azeem Khan added, “Participating in the ACS round powered by Grants Stack is a unique opportunity for individuals and organizations to contribute to the fight against cancer with blockchain technology.”

Kyle Weiss, Executive Director at the Gitcoin Foundation, and Nicole d’Avis, Protocol Lead at the Public Goods Network (PGN), have both expressed enthusiasm for these collaborative efforts. The PGN, an innovative project in the Gitcoin ecosystem, operates as a low-cost Layer 2 OP Chain, directing most of its net sequencer fees towards public goods. This initiative presents a cost-effective alternative to the Ethereum mainnet for users and developers, simultaneously generating funds for public goods through transactions.

While open-source funding may not have captured mainstream media attention, entities like Gitcoin and PGN have quietly revolutionized how public goods are supported. Their efforts are instrumental in creating sustainable and reliable funding sources for initiatives that serve the greater good.

The American Cancer Society’s venture into web3 with Gitcoin is more than a fundraising initiative; it is a beacon of innovation in the philanthropic world. By adopting blockchain technology and leveraging the power of community-driven funding, the ACS is furthering its mission to combat cancer and setting a precedent for other non-profits to explore the transformative potential of web3.

Nearly three years into the worst crash in the modern history of the U.S. bond market, ordinary investors hardly need to be told that bonds are far less “safe” and “secure” than many financial experts have claimed.

But bold new academic research, drawing on financial history going back to the 1890s, goes even further than that.

Bonds in general…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

On Nov. 8, the first-of-its-kind Institute of Crypto-Assets held a formal opening at the Léonard de Vinci Centre in the business district just outside of Paris.

The institute will support and conduct research related to blockchain technology and cryptocurrencies. Its scientific board includes 11 experts from major French educational institutions, such as the National Center for Scientific Research and École Polytechnique. A committee of six practitioners, including Ledger co-founder Nicolas Bacca, and Paymium founder Pierre Noizat will also oversee the work of the institute.

According to Cyril Grunspan, the director of the institute, it will focus primarily on educational goals:

“Our goal is not to lobby but to create a forum for discussion on cryptoassets.”

Two lectures accompanied the opening: Historian Jacques Favier spoke about the history of currencies up to Bitcoin (BTC), and cryptographer David Pointcheval ruminated on zero-knowledge proofs and anonymity. The institute will hold such public events regularly.

Related: Bitcoin-centric AI language model aims to drive BTC education and adoption

France is actively pursuing a leadership role in Europe regarding digital economy and innovations. In September, local telecommunications group Iliad revealed an investment of 100 million euros ($106 million) to fund the creation of an “excellence lab” dedicated to AI research in Paris. In addition to the lab, Iliad has acquired what it deemed as “the most powerful cloud-native AI supercomputer deployed to date in Europe.”

Amid the market crisis of the first half of 2023, French crypto businesses grabbed 27% of all the new investment deals struck in the fintech sector.

Magazine: 2 years after John McAfee’s death, widow Janice is broke and needs answers

FTX and Alameda Research wallets send $13.1M in crypto to exchanges overnight

The crypto wallets linked to the now-defunct crypto exchange FTX and its sister trading firm, Alameda Research, have sent over $13 million in different altcoins to numerous crypto exchanges as of Nov. 1.

According to data from on-chain analysis firm Spotonchain, the FTX wallet first transferred $8.12 million worth of altcoins to Coinbase. The assets include 46.5 million of The Graph’s GRT (GRT) ($4.85 million), 972,073 Render (RNDR) ($2.3 million) and 708.1 Maker (MKR) ($967,000).

The wallet addresses of FTX and Alameda Research made another $5.49-million transfer after three hours to Binance and Coinbase. The top three assets with the highest value in this transaction are 1.14 million dYdX (DYDX) ($2.64 million), 192,888 Axie Infinity (AXS) ($1.05 million) and 5,858 Aave (AAVE) ($522,000).

#FTX and #Alameda Research further deposited $5.49M worth of 6 assets $AAVE, $ALICE $AXS, #C98, $DYDX, $ZRX, to #Binance and #Coinbase ~30 mins ago.

Top 3 include:

1.14M $DYDX ($2.64M)

192,888 $AXS ($1.05M)

5,858 $AAVE ($522K)Overall, #FTX and #Alameda Research have… pic.twitter.com/JPbIXZJPzv

— Spot On Chain (@spotonchain) November 1, 2023

Related: FTX’s Sam Bankman-Fried will testify at criminal trial, say defense lawyers

Prior to the movement of $13.1 million in funds on Nov. 1, crypto analytic firm Nansen flagged several FTX-linked wallet movements over the past week, which saw the deposit of millions in various cryptocurrencies on different crypto exchanges. First, a batch of $8.1 million worth of altcoins was moved to Binance; Nansen estimated that another $24.3 million worth of assets that have left wallets linked to FTX and Alameda were deposited into Binance and Coinbase.

Separate from the initial $8.6M moved:

– 2.2M USD LINK

– 1M USD AAVE

– 2M USD MKR

– 3.4M USD ETHWe have discovered a further $24.3M that has left wallets linked to FTX and Alameda which has been deposited into Binance and Coinbase

But that’s not all… pic.twitter.com/Dru4MysxfQ

— Nansen (@nansen_ai) October 27, 2023

On Oct. 31, FTX linked 1.6 million Solana’s SOL (SOL) tokens worth $56 million that were unstaked and sent to an unknown wallet. Another 930,000 SOL worth $32 million linked to FTX and Alameda were moved to another unknown wallet speculated to be linked to Galaxy Digital, the official firm designated for the liquidation process.

930k $SOL moves from @FTX_Official and @AlamedaResearch Solana wallets over last 3 days to wallet 5RAHK.

Is this @novogratz wallet at @galaxyhq Galaxy Investment Partners?

930k $SOL from FTX and Alameda passed through this wallet to wallets:

-3ADzk

-5sTQ5

-Ca469

-8CAAy… pic.twitter.com/LXecevHUqz— MartyParty (@martypartymusic) October 31, 2023

Data aggregated by Spotonchain suggests a total of $78 million worth of assets have been sent to crypto exchanges from FTX and Alameda wallets over the past week.

FTX-linked wallets have continued to send their stash of altcoins to crypto exchanges over the past month after a court-ordered phased liquidation process. The court order permits FTX to sell digital assets worth over $3 billion through an investment adviser in weekly batches in accordance with the pre-established rule.

The phased-out liquidation process will allow FTX to sell $50 million worth of assets weekly, followed by a $100-million cap in the succeeding weeks. The cap can be increased up to $200 million per week with the previous written consent of the creditors’ committee and ad hoc committee after court approval.

Magazine: The truth behind Cuba’s Bitcoin revolution: An on-the-ground report

Bitcoin restarting 2023 uptrend after 26% Uptober BTC price gains — Research

Bitcoin (BTC) is due to finish 2023 as it started, on-chain analytics firm Glassnode said, as October gains near 30%.

In the latest edition of its weekly newsletter, “The Week On-Chain,” released Oct. 24, researchers argued that the past week “sets the foundation” for a BTC price uptrend.

BTC price “convincingly” beats out resistance levels

As it hit $35,200 this week, Bitcoin eclipsed various key trendlines, which had previously acted as support for months.

These included various moving averages (MA), among them the 200-week simple MA at $28,400 — the classic “bear market” support line.

“A cluster of long-term simple moving averages of price are located around $28k, and have provided market resistance through September and October,” Glassnode noted.

“After a month of the market grinding higher, the bulls found sufficient strength this week to convincingly break through the 111-day, 200-day, and 200-week averages.”

In so doing, the profitability of various investor cohorts improved considerably. The so-called cost basis of speculators and market newcomers also lies near $28,000.

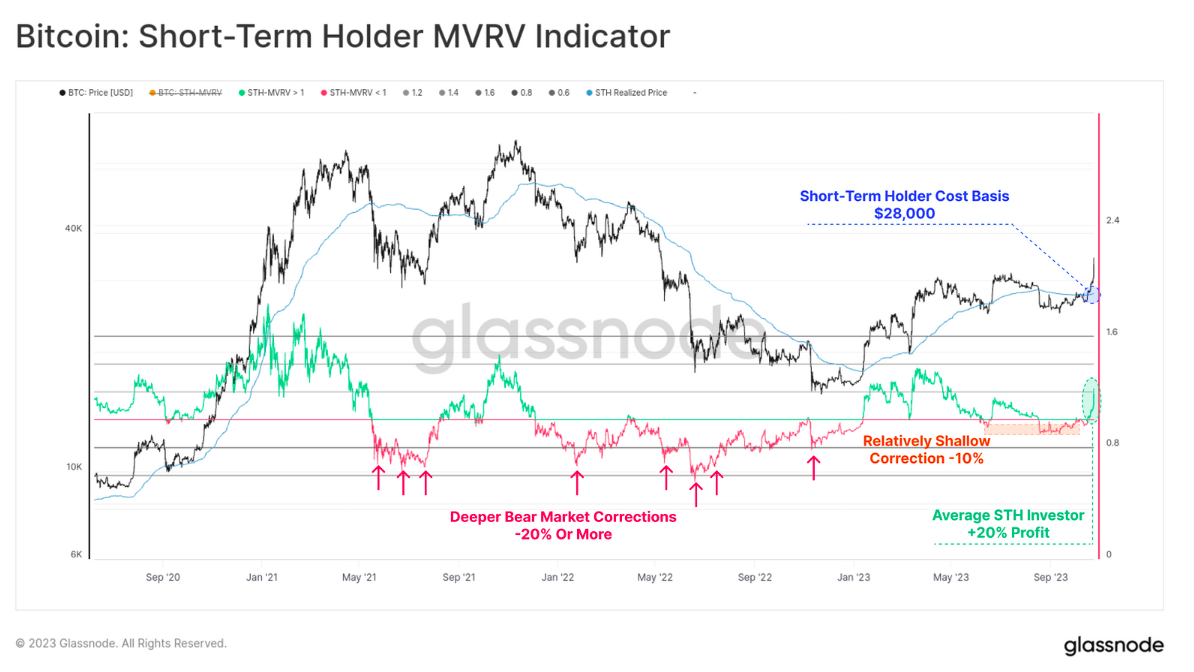

“The Short-Term Holder (STH) cost basis is also now in the rear view mirror at $28k, putting the average recent investor into an average profit of +20%,” “The Week On-Chain” continued.

Researchers uploaded a chart of the short-term holder market-value-to-realized-value (STH-MVRV) ratio, which tracks the profitability of STH coins. They noted that even prior to the October upside, no major capitulatory behavior was visible.

“We can see instances in 2021-22 where STH-MVRV reached relatively deep corrections of -20% or more,” they explained.

“Whilst the August sell-off did reach a low of -10%, it is noteworthy how shallow this MVRV decline is by comparison, suggesting the recent correction found noteworthy support, being a precursor to this week’s rally.”

Bitcoin “sets the foundation” for green year

As Cointelegraph reported, the presence of STH entities versus their seasoned counterparts, the long-term holders (LTHs), is now historically low.

Related: Bitcoin price model expects $45K ‘phase’ to hit in November

Despite facing profitability issues of their own, LTHs now own more than three-quarters of the available BTC supply for the first time.

Their cost basis is lower, further toward $20,000 — and while some believe that Bitcoin could still return to that area, Glassnode is optimistic over how the year will end.

“A meaningful proportion of supply and investors now find themselves above the average break-even price, located around $28k,” it concluded.

“This sets the foundation for a resumption of the 2023 uptrend. At the very least, the market has crossed over several key levels where aggregate investor psychology is likely to be anchored, making the weeks that follow important to keep an eye on.”

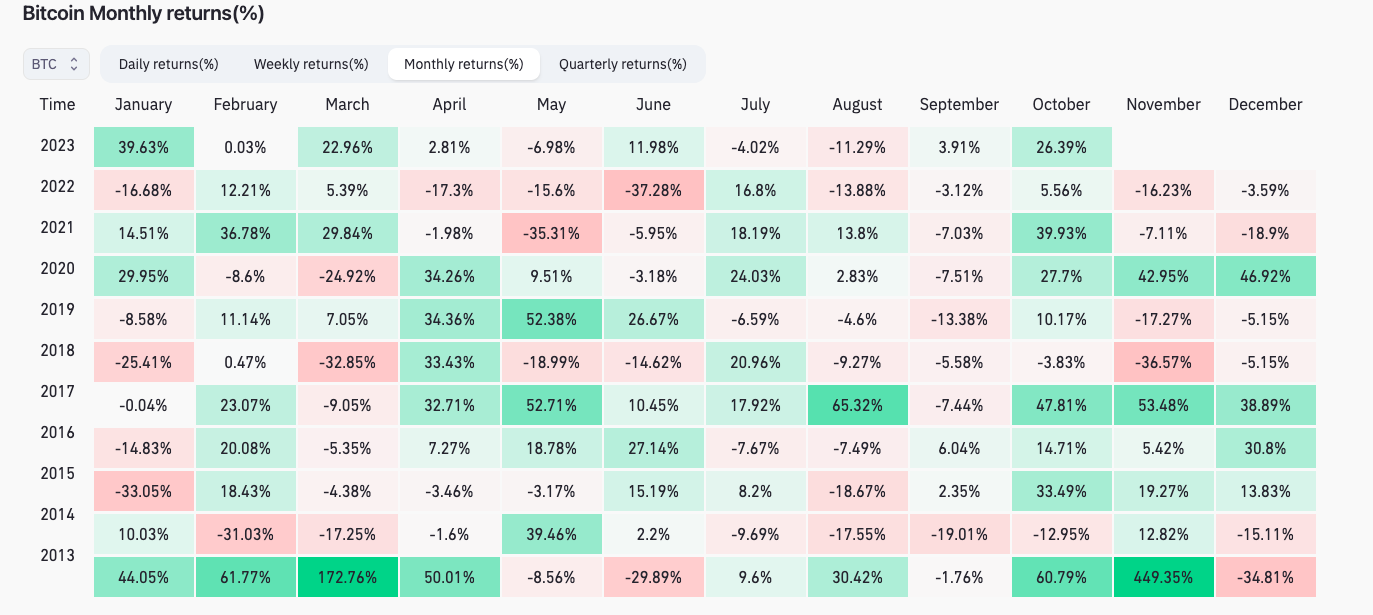

Per data from on-chain monitoring resource CoinGlass, BTC/USD is currently up 26% this month — by October standards, still relatively modest.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.