The Magnificent Seven are not overvalued, but European cyclicals are, JPMorgan’s analysts said

Source link

rest

These 5 Wildly Popular High-Flying Stocks of 2023 Could Be Duds in the Rest of 2024, According to Wall Street

Over the long term, the S&P 500 has delivered an average annual return in the ballpark of 10%. When a given stock generates a return below that level it can be disappointing. That’s especially the case for growth stocks for which investors have great expectations.

Such growth stocks led the charge last year, helping the major market indexes achieve big gains. Many analysts don’t think you should look for a similar performance in the new year from all of them, though. These five wildly popular high-flying stocks of 2023 could be duds in the rest of 2024, according to Wall Street.

1. Microsoft

Thanks to a 57% return in 2023, Microsoft (MSFT 1.22%) ended the year just a hair away from becoming the most valuable company in the world based on market cap. The tech stock’s modest rise in recent weeks has allowed it to claim the title, albeit just barely.

However, Wall Street doesn’t expect much more from Microsoft. The average 12-month price target for the stock reflects an upside potential of less than 6%. The most pessimistic analyst thinks that Microsoft’s share price could fall nearly 22%.

Valuation is one key concern. Microsoft’s shares trade at a sky-high forward earnings multiple of 34.8.

2. Apple

You can probably guess which company Microsoft knocked out of the No. 1 spot. Apple (AAPL 1.55%) reigned as the largest company in the world for several years. But the stock’s 48% gain in 2023 wasn’t enough to keep it on top after losing ground a little this month.

Analysts expect Apple to continue to go neck-and-neck with Microsoft in the battle of market caps. The average 12-month price target for the stock is also less than 6% above its current price.

The main knock against Apple is its lack of growth. In its last reported quarter, the company’s revenue slipped 1% year over year. Even with services revenue reaching an all-time high, Apple simply isn’t delivering the growth that it has in the past.

3. Alphabet

Google parent Alphabet (GOOG 2.06%) (GOOGL 2.02%) is another “Magnificent Seven” stock that sizzled last year. Its shares skyrocketed 58% thanks in large part to the flurry of interest in generative AI.

Wall Street doesn’t expect Alphabet’s sizzle to completely fizzle in 2024. However, the consensus forecast is decidedly less enthusiastic than investors would like. The average 12-month price target for the stock reflects an upside potential of just over 7%.

Some investors could still be concerned about Google Cloud after Alphabet reported slowing growth for the unit in the third quarter of 2023. Others could worry that the U.S. economy won’t have the soft landing that many economists predict, which could dampen Alphabet’s advertising revenue growth.

4. Tesla

Tesla (TSLA 0.15%) wowed investors in 2023 with its share price more than doubling. The company ramped up production of its electric vehicles and launched its Cybertruck.

But Wall Street doesn’t predict nearly as big of a wow from Tesla this year. The average price target for the stock is nearly 8% above the current price. That’s not bad, but it’s a lot lower than investors would prefer. One especially bearish analyst even thinks that Tesla stock could plunge almost 90%.

Most of the analyst ratings came before Tesla CEO Elon Musk posted on X (the social media platform formerly known as Twitter) that he wants to gain around 25% voting control of the company. Whether or not Musk achieves his goal — and what it might mean for the stock — remains to be seen.

5. Eli Lilly

Eli Lilly (LLY 0.84%) is something of an outlier in this group. It isn’t part of the “Magnificent Seven.” The company doesn’t have a clear connection with AI. However, Lilly was without question a wildly popular stock last year with its shares jumping 59%.

Analysts aren’t looking for a wild performance from Lilly in 2024, though. The average 12-month price target reflects an upside potential of barely over 2%.

As was the case with Microsoft, valuation appears to be the primary issue for Wall Street with Lilly. The pharma stock’s forward earnings multiple tops 51. That’s a nosebleed level.

Is Wall Street right about these stocks?

I don’t know if these five stocks will beat analysts’ price targets or not. Wall Street could be right about the stocks’ near-term prospects. However, it doesn’t matter, in my opinion. What’s important are the long-term prospects for each company.

My view is that AI will provide a strong tailwind for Microsoft, Apple, Alphabet, and Tesla over the next decade and beyond. I think that the opportunities for Lilly’s diabetes drug Mounjaro, weight-loss drug Zepbound, and Alzheimer’s disease drug donanemab (which awaits an approval decision) put its valuation in a much more favorable light.

It wouldn’t surprise me one bit if analysts revise their price targets upward for several, if not all, of these stocks in the coming months. Whether they do or not, I predict that all five will remain wildly popular in 2024 and for years to come — for good reasons.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Alphabet, Apple, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Apple, Microsoft, and Tesla. The Motley Fool has a disclosure policy.

I’m 67 with $750K in a 401(k). How Can I Preserve This Money for the Rest of My Life?

I am in a quandary about how to invest $750,000 that’s in my 401(k). I’m 67 years old, retired and I have not started taking Social Security yet. What is the best way to preserve this money for the rest of my life that doesn’t have high fees?

-Terry

As you know, the big challenge in your situation is choosing from the many investment options that are at your disposal given your 401(k) asset base and desire to remain fee-conscious. Of course, the optimal solution ultimately depends on your personal situation and goals in retirement, and possibly beyond. We will begin by outlining a framework you can follow to evaluate your current situation and then share some considerations to inform your actions. (And if you need more help with your finances in retirement, consider speaking to a financial advisor.)

Assess Your Personal Situation and Goals

Before you select an investment strategy, it is imperative that you have a complete understanding of your personal situation and goals for retirement. Knowing that you want to preserve the assets for the remainder of your life is a helpful start. But go a few steps deeper by asking yourself these questions:

-

Beyond Social Security and your 401(k), do you have any other assets (brokerage accounts, IRAs, etc.) that can further support your retirement and provide additional income streams?

There are many other questions you could ask yourself. However, the important point is that in answering questions such as these, you should be able to gain a better understanding of how the capital should be invested to support your needs and goals while preserving the funds throughout your retirement. (And if you need help assessing your personal situation or setting goals, a financial advisor can help.)

Consider Asset Location, Not Just Asset Allocation

In evaluating the costs of investing, you may find that asset location is just as important as asset allocation. “Asset location” refers to the account that your money is actually sitting in. Since the $750,000 that you’re asking about is currently in a 401(k), you’d want to first review the particulars of your plan. Does your plan give you the option of taking partial withdrawals, allowing you to use your savings as needed, or does it limit your withdrawal options to required minimum distributions (RMDs) and lump sums? If you’re not sure, refer to your plan’s summary plan description or reach out to the plan administrator.

If your plan does not allow partial withdrawals, your options are to roll the money into an IRA, convert it to a Roth IRA or withdraw the money outright. Please remember that the Roth IRA and outright withdrawal will be taxable events, but the rollover to an IRA is not taxable.

If your plan allows you to take partial withdrawals, you may want to evaluate whether to leave your assets there.

The positives of leaving assets in the 401(k) after retirement may be that you have lower-cost investment options than are typically available to retail investors. Some of these options may include target date funds, annuity contracts with pre-negotiated fees and institutional pricing on mutual funds. Furthermore, if your former employer works with a competent investment consultant who was specifically hired to advise the company on the plan’s investment lineup, the menu of options will be limited to a few closely monitored options that are believed to be the best-in-class based on factors such as fund manager tenure, returns, risk and investment expenses.

The advantages of moving your assets out of the 401(k) may be to consolidate your funds with other retirement savings, access a broader range of investment options than the plan offers and avoid administrative account fees that may or may not apply to you. (And if you need help with your plan for retirement, consider matching with a financial advisor.)

Consider the Risks You Face

A prudent approach to investing for and through retirement is to prioritize proper risk management. Your stated desire to preserve your money for the rest of your life succinctly identified the most common broad risks that retirees such as yourself will need to balance: longevity risk and investment risk.

Longevity risk is the risk that you will outlive your money. With Americans living longer and with inflation being an ever-present threat to the dollar’s purchasing power, this is an unfortunate reality many will face. Allocating some of your portfolio to equities will be your best defense against longevity risk. Many retirement-age investors shy away from equities, nervous about short-term market swings. However, the truth is that retirement is a long time (think 19 to 30+ years). Your equity allocation has a long time horizon to withstand short-term market fluctuations in favor of long-term growth.

Investment risk is the risk that your investments will lose value. As we just mentioned, you will want to have some allocation toward equities, but you’ll also want to include fixed-income investments, including bonds and cash equivalents that have characteristics of price stability and relative safety of principal. Today’s higher interest rate environment has even made modest investment income realistic from some of the safest fixed-income vehicles such as Treasurys, money market funds and certificates of deposit (CDs). (And if you need help picking the right mix of investments, let a financial advisor guide you through the process.)

How to Manage Risk

In order to further minimize disproportionate exposure to other types of risk such as interest rate risk, credit risk, exchange rate risk, market risk and business risk to name a few, you’ll want to diversify within your equity and fixed income allocations.

My suggestion here would be to utilize pooled investment vehicles such as mutual funds or exchange-traded funds (ETFs) which give you the ability to hold large baskets of underlying investments. Mutual funds and ETFs are generally available as either index (passive) strategies or as active strategies.

The index options will give you exposure to large segments of financial markets at a low cost. An S&P 500 index fund, for example, is a popular type of equity index fund. Active funds strive to beat their respective indices by seeking better investment returns and/or better managing downside risk. Of course, the active funds generally have higher expenses than index alternatives, and you as the investor will have to decide whether the additional expense justifies the active approach.

Finally, you will need to adjust your asset allocation to align with the risk/return profile you deem most appropriate given your personal situation and goals. Remember, more equity generally means more risk of investment loss, but without at least some, you run into greater longevity risk. (A financial advisor can help you navigate the various risks you’ll potentially face in retirement.)

Bottom Line

There is unfortunately no one-size-fits-all approach to investing with an eye towards capital preservation and cost minimization. However, there are many options to consider. The optimal solution will depend on your unique situation and goals for retirement, as these inform your risk tolerance and return requirements. Once you understand these components, it will be easier to decide where and how to invest your hard-earned savings.

Tips for Finding a Financial Advisor

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have free introductory calls with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Loraine Montanye, CFP®, AIF® is a SmartAsset financial planning columnist and answers reader questions on personal finance topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Loraine is a senior retirement plan advisor at DBR & CO. She has been compensated for this article. Additional resources from the author can be found at dbroot.com.

Photo credit: ©iStock.com/simonkr, ©iStock.com/tdub303

The post Ask an Advisor: I’m 67 with $750K in a 401(k). How Can I Preserve This Money for the Rest of My Life? appeared first on SmartReads by SmartAsset.

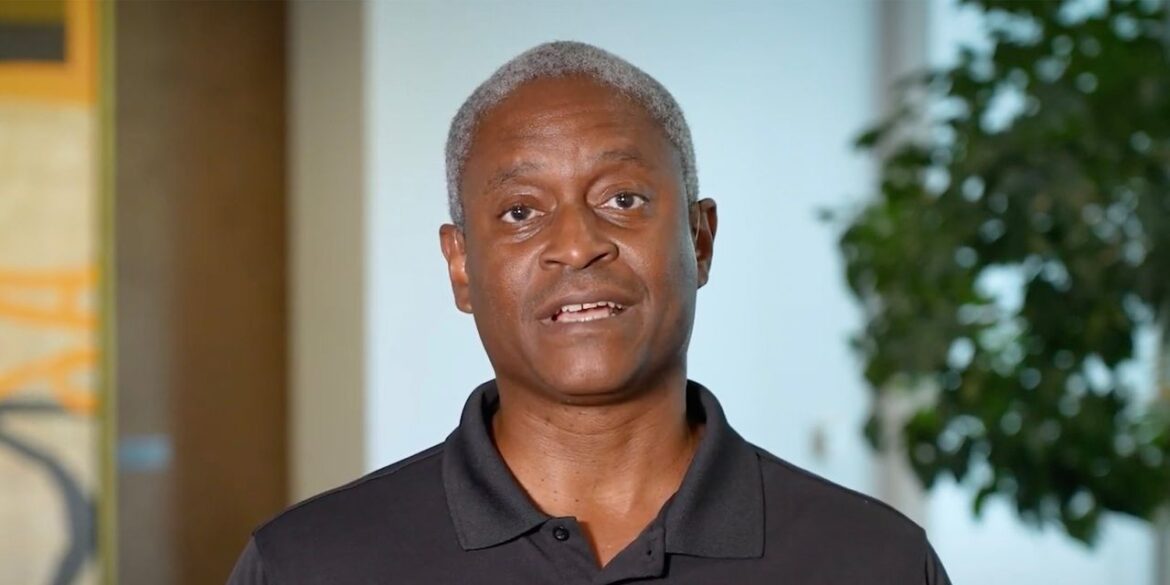

Fed should leave interest rates unchanged for the rest of the year, Bostic says

Atlanta Federal Reserve President Raphael Bostic on Wednesday says his baseline view is that the central bank should keep interest rates steady for the rest of the year and not cut them until well into 2024.

“My baseline is that we stay at this level for the rest of the year,” Bostic said, in an interview with Yahoo Finance.

In past cycles, the Fed has always gone “one or two steps further” than they needed to to fight inflation, and this is something he wants to be mindful of, Bostic said.

“I really want to try to do all I can to make sure that we avoid a significant economic downturn,” he added.

Bostic is one of only two of 18 Fed officials who did not pencil in an additional rate hike this year. Twelve of 18 Fed officials have forecast two 25 basis point hikes in the Fed funds rate over the next six months.

Bostic said the Fed can be patient because the economy is going to be hit by lags from prior rate hikes.

“Lags” is jargon for the time between when the Fed raises interest rates and the full impact of the hikes on the economy.

“I feel we have a little bit of time to play out and see exactly how much the economy is responding to our policy,” Bostic added.

“I do feel like we are in a position where some patience will do us well,” he said.

Fed Chair Jerome Powell said Wednesday that two more 25 basis point rate hikes this year was a “good guess” if the economy performs as expected.

Read: Powell tells Congress to expect more rate hikes

Bostic said he was open to changing his mind, especially if the economy does not slow down.

The Atlanta Fed president, who was a real estate professor at USC before joining the Atlanta Fed, said there is still some hidden credit risks in the sector.

There is tremendous uncertainty among his contacts over what’s going to happen in commercial real estate, especially offices.

“As those troubles start to bubble up, we’ll have to keep a very tight eye on what happens in terms of bank lending standards and how the sector, more broadly, starts to affect other types of economic activity,” he said.

Bostic said he expects inflation to come back to the 2% target “in a very measured way over the course of an extended period of time.” As a result, he doesn’t have a rate cut in his baseline forecast for the most part of 2024.

Stocks

DJIA,

SPX,

closed lower after Powell outlined his expectation of more rate hikes. The yield on the 10-year Treasury note

TMUBMUSD10Y,

inched down to 3.72%.