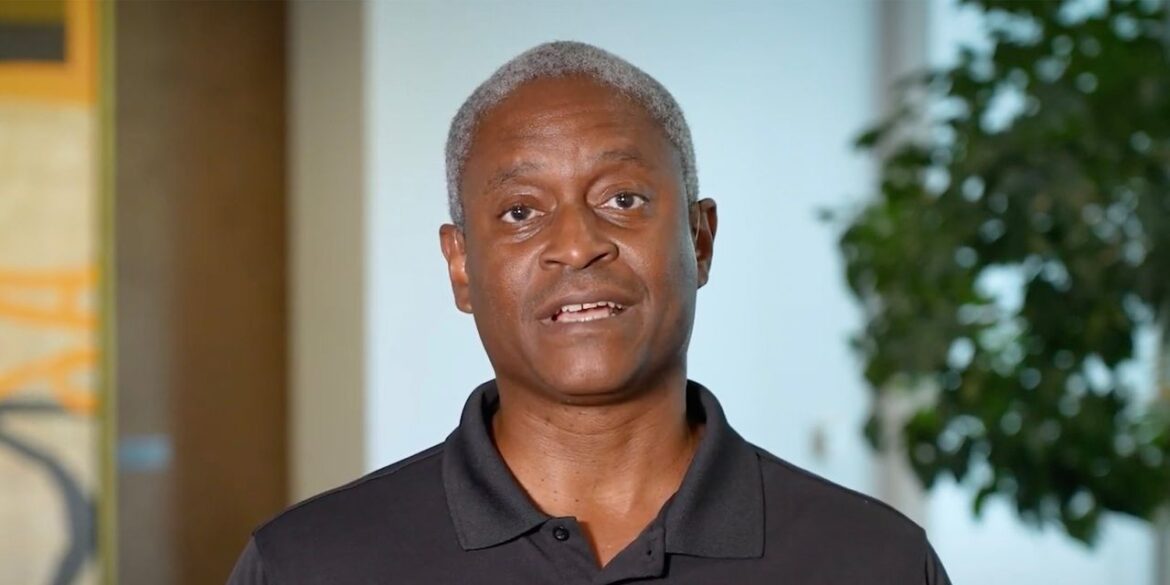

Atlanta Federal Reserve President Raphael Bostic on Wednesday says his baseline view is that the central bank should keep interest rates steady for the rest of the year and not cut them until well into 2024.

“My baseline is that we stay at this level for the rest of the year,” Bostic said, in an interview with Yahoo Finance.

In past cycles, the Fed has always gone “one or two steps further” than they needed to to fight inflation, and this is something he wants to be mindful of, Bostic said.

“I really want to try to do all I can to make sure that we avoid a significant economic downturn,” he added.

Bostic is one of only two of 18 Fed officials who did not pencil in an additional rate hike this year. Twelve of 18 Fed officials have forecast two 25 basis point hikes in the Fed funds rate over the next six months.

Bostic said the Fed can be patient because the economy is going to be hit by lags from prior rate hikes.

“Lags” is jargon for the time between when the Fed raises interest rates and the full impact of the hikes on the economy.

“I feel we have a little bit of time to play out and see exactly how much the economy is responding to our policy,” Bostic added.

“I do feel like we are in a position where some patience will do us well,” he said.

Fed Chair Jerome Powell said Wednesday that two more 25 basis point rate hikes this year was a “good guess” if the economy performs as expected.

Read: Powell tells Congress to expect more rate hikes

Bostic said he was open to changing his mind, especially if the economy does not slow down.

The Atlanta Fed president, who was a real estate professor at USC before joining the Atlanta Fed, said there is still some hidden credit risks in the sector.

There is tremendous uncertainty among his contacts over what’s going to happen in commercial real estate, especially offices.

“As those troubles start to bubble up, we’ll have to keep a very tight eye on what happens in terms of bank lending standards and how the sector, more broadly, starts to affect other types of economic activity,” he said.

Bostic said he expects inflation to come back to the 2% target “in a very measured way over the course of an extended period of time.” As a result, he doesn’t have a rate cut in his baseline forecast for the most part of 2024.

Stocks

DJIA,

SPX,

closed lower after Powell outlined his expectation of more rate hikes. The yield on the 10-year Treasury note

TMUBMUSD10Y,

inched down to 3.72%.