Tim Draper, a venture capitalist famous for his bitcoin price predictions, has praised El Salvador’s vision of embracing this new technology and talked about the benefits of this decision for its people. According to Draper, bitcoin will make El Salvador one of the richest countries in the world in the next 30 or 40 years. […]

Tim Draper, a venture capitalist famous for his bitcoin price predictions, has praised El Salvador’s vision of embracing this new technology and talked about the benefits of this decision for its people. According to Draper, bitcoin will make El Salvador one of the richest countries in the world in the next 30 or 40 years. […]

Source link

richest

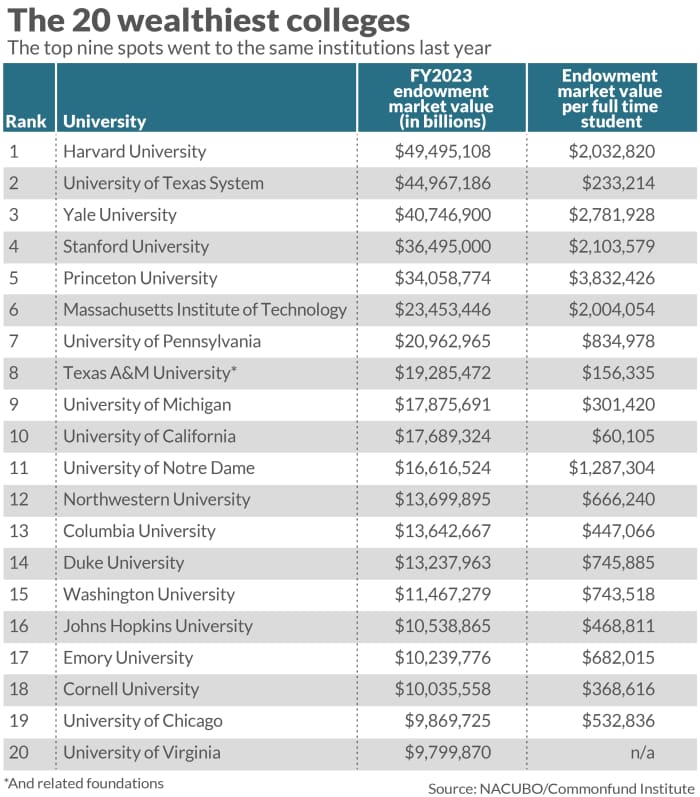

Harvard remains the nation’s richest school as college endowments keep growing

Harvard University’s endowment grew to more than $49.5 billion last year, making it once again the nation’s wealthiest college.

The University of Texas System wasn’t far behind with an endowment value of nearly $45 billion, while Yale University remained the third-richest school even as its endowment market value dropped slightly from last year.

The ranking of the nation’s largest college endowments is the result of a study of the financial assets of nearly 700 academic institutions, published Thursday by the National Association of College and University Business Officers and the Commonfund Institute.

Some institutions, like the University of California system, saw their fortunes swing over the last year. UC’s market value jumped 14.7% to nearly $17.7 billion, allowing the system to have the 10th-largest endowment and bumping the University of Notre Dame out of the No. 10 spot. The top nine university endowments by market value were unchanged from 2022. The average college endowment saw a 7.7% return in the last fiscal year ending June 30, 2023, according to the report.

The study showcased the significant wealth that some colleges have at their disposal. Harvard’s endowment, for example, is worth more than the annual gross domestic product of countries like Jordan, Bolivia and Paraguay.

The findings come amid continued debate over whether wealthy, tax-advantaged universities should receive more scrutiny. Following clashes on campuses across the country over topics like diversity, equity and inclusion and the Israel-Hamas war, conservative lawmakers have looked to target the endowments of rich, name-brand schools. In the past, college-access organizations and others have also questioned whether schools with large endowments should be spending more on making college financially viable for a larger swath of students.

“Whether the criticism is coming from the left or the right, there’s not a lot of people to stand up and defend the leaders of Ivy League institutions, and I think that’s in part because they’re not using their endowments to serve most Americans,” said Charlie Eaton, author of “Bankers in the Ivory Tower, The Troubling Rise of Financiers in U.S. Higher Education.”

The bulk of the money that universities drew down from their endowments last year was spent on financial aid. Schools used nearly 48% of their distributions, on average, for that purpose, according to the report. But there is an opportunity to do more, according to critics like Jennifer Bird-Pollan, associate dean of academic affairs at the University of Kentucky’s J. David Rosenberg College of Law.

“Where’s the growth going? What does that mean for the university? Or do you just sort of pat yourself on the back and say we had another banner year for the endowment?” she said.

Private foundations are required to spend at least 5% of their assets on charitable functions each year. Universities had an average endowment-spending rate of 4.7% last year, according to the survey. At universities with endowments over $1 billion, the average rate was 4.5%.

‘We don’t ever ask, how much is enough?’

Universities counter that endowments aren’t just piggy banks, but are rather meant to shore up the long-term future of the college. Additionally, schools are limited in the ways they can spend their endowment money because donors flag it for specific uses, colleges say. And institutions do use them to fund operations; on average, schools use their endowments to pay for 11% of their annual operating budgets, the study found. Schools with larger endowments said they funded 17% or more of their budgets.

Still, to Bird-Pollan, the focus on endowments’ growth and value highlights how disconnected they can be from universities’ priorities overall.

“We don’t ever ask, how much is enough? We just say more is always better,” she said. “I think it’s worth asking if that’s really true. What did the donors have in mind when they gave this huge amount of money to the university? Did they have in mind that it was going to go to some hotshot investment bank and not really be used for the functioning of the university?”

Part of that growth mindset is a result of the influence that the broader financial world’s strategies have had on endowment management over the past several years, Bird-Pollan said. Indeed, between fiscal years 1988 and 2023, the share of endowment assets allocated to alternative investments, like private equity and venture capital, went from less than 10% to more than 50%, the study found.

Typically, larger endowments perform better than smaller endowments — but that wasn’t the case last year. Schools with endowments valued at less than $50 million saw a 9.8% return, compared with 2.8% for schools with endowments over $5 billion and a 5.9% return for schools with endowments valued between $1 and $5 billion, per the study.

That’s because smaller endowments were more exposed to public equities, which performed better than these alternatives last year, Commonfund Institute Chief Executive Mark Anson told reporters on a conference call.

Still, the ability of larger endowments to withstand the kind of risk associated with alternative investments will probably allow them to fare better in the long term, said Eaton, an associate professor of sociology at the University of California, Merced. Smaller endowments may not be able to afford to subject themselves to the kind of short-term volatility associated with these kinds of assets, he noted.

That some schools’ endowments can weather swings in their investment performance indicates how disconnected the funds may be from some universities, Eaton said.

“When you’re endowment grows to be $50 billion a year, and it’s so large that it doesn’t really matter for the extent to which you can subsidize your university operations if you have a bad year, that’s kind of a sign that the old logic about endowments doesn’t really hold,” he said. That “old logic” is the idea that the endowment is there to ensure that each generation of students receive the same educational experience as their predecessors.

It’s not just the economic environment that can impact university endowments; the political environment may play a role, too. The survey indicated that culture-war politics may be having an influence on the approach of colleges’ investment managers.

About 35% of the universities featured in the study said they use some kind of responsible investing strategy, including ESG. That figure represents a “leveling off” after seeing growth in previous years, said George Suttles, executive director of the Commonfund Institute.

The “fraught” political climate may have caused some schools that were considering a responsible investing strategy to take pause, Suttles said.

For the third year in a row, the survey asked colleges about the share of gifts to their endowments that were tagged for diversity, equity and inclusion, or DEI. About two-thirds of schools said they received DEI-related gifts, a level similar to previous years. Overall, about 6.4% of gifts to colleges in fiscal year 2023 had a DEI purpose, according to the study.

But that may change. The period the survey covers ended just as the Supreme Court issued an opinion banning affirmative action at colleges — a ruling that some experts have said could impact gifts and financial aid. In addition, the reporting period ended before the recent donor backlash toward colleges’ approach to diversity, antisemitism and other issues.

NACUBO Chief Executive Kara Freeman called the issue of DEI “extremely important, as it gets to core mission,”

“Institutions of higher education must reflect both the students they serve and the communities that surround them,” she said in an email. “At the end of the day, our endowments must help leverage and enhance our teaching, research and service capabilities.”

‘The Richest Country In The World Is Now Bankrupt’ — Robert Kiyosaki Says The U.S. Can’t Pay The Interest On Its Debt. Here’s How He’s Protecting Himself

In a recent episode of “The Rich Dad Radio Show,” financial educator and author Robert Kiyosaki expressed grave concerns about the United States’ financial health.

“America is now bankrupt,” he said. “And the question I want to answer today is how [come] America, at one time reportedly the richest country in the world, is now bankrupt?”

While the U.S. hasn’t legally declared bankruptcy, Kiyosaki’s point underscores the nation’s worsening debt crisis.

As of Nov. 24, the U.S. national debt had reached $33.8 trillion. Guest speaker Jim Clark, CEO of Republic Monetary Exchange, highlighted that actual liabilities, including entitlements, could be as high as $200 trillion.

Fiscal 2023 saw interest payments on this debt rise to $659 billion, marking a 39% increase from the previous year and nearly double the amount in fiscal 2020.

So, how is the famed author protecting his wealth? He’s a strong believer in physical assets. Here are two of his favorites.

Don’t Miss:

Gold and Silver

Kiyosaki, who believes America’s financial troubles began with the abandonment of the gold standard in 1971, advocates investing in gold and silver. He views the precious metals as safeguards against inflation and currency devaluation. The rising industrial demand for silver and the current low prices of gold and silver compared to historical highs make them particularly attractive. He also values the fact that physical gold and silver do not carry counterparty risks, unlike many other investments.

Real Estate

Beyond precious metals, Kiyosaki is a proponent of investing in real estate. He recently claimed to own 15,000 houses, which he leverages as an effective hedge against inflation. Historical data from the Federal Reserve Bank of St. Louis shows that while the consumer price index has risen by 896% since 1963, the median sales price of homes has increased by 2,353.93% and rent by 892%. This indicates that real estate not only keeps pace with inflation but can also exceed it.

Kiyosaki’s strategy aligns with the opportunities available to average investors through fractional real estate investing. This approach allows individuals to invest in shares of income-producing properties for as little as $100, enabling them to benefit from rental income and long-term appreciation without the traditional barriers of high costs and credit requirements.

For investors seeking to protect their wealth in uncertain economic times, Kiyosaki’s approach offers valuable insights into diversification and risk management. It’s important to understand that his investment strategies may not be the right approach for everyone. You should always do your own research and consult with a qualified financial adviser.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

This article ‘The Richest Country In The World Is Now Bankrupt’ — Robert Kiyosaki Says The U.S. Can’t Pay The Interest On Its Debt. Here’s How He’s Protecting Himself originally appeared on Benzinga.com

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bill Gates’ Former Assistant Is Now One Of The Richest People In The World And Could Even Surpass Him In Net Worth — But You Probably Have No Idea Who He Is

Steve Ballmer, once an assistant to Bill Gates at Microsoft, is now ranking just a few spots away from his former boss on the list of the world’s richest people. According to Bloomberg, Ballmer’s net worth soared to $117 billion in October 2023, placing him as the fifth-richest globally, just $5 billion short of Gates’ wealth. Gates has donated a substantial part of his fortune to charity since leaving Microsoft.

According to Forbes’ real-time billionaires list on Nov.8, 2023, Steve Ballmer’s net worth has recently decreased to $108.7 billion, with Bill Gates maintaining a narrow lead at $113.9 billion.

Don’t Miss:

Despite a dip reported by Forbes, Ballmer’s net worth surge earlier in the year positioned him alongside esteemed billionaires such as Elon Musk, Bernard Arnault and Jeff Bezos. He ranks just after tech giants Larry Page and Mark Zuckerberg in wealth. Among these titans of industry, Ballmer stands out as the sole individual in the top 10 who isn’t a company founder.

His journey began at Harvard University, where he crossed paths with Gates. After graduating in 1977, Ballmer joined Microsoft as its 24th employee. Starting as a business manager, he climbed the ranks to become president and later CEO, taking the reins from Gates himself.

Even after stepping down as CEO and purchasing the Los Angeles Clippers in 2014, Ballmer’s fortunes are still heavily invested in Microsoft, where he holds about a 4% stake. Microsoft’s stock has surged, particularly in 2023, thanks to an AI-driven boost in the tech sector, greatly benefiting Ballmer’s financial portfolio.

Trending: Until 2016 it was illegal for retail investors to invest in high-growth startups. Thanks to changes in federal law, this Kevin O’Leary-backed startup lets you become a venture capitalist with $100.

The strength of Ballmer’s wealth is significantly tied to Microsoft’s performance, with the company’s expansion into AI and cloud services boosting its market value and his personal net worth. His 4% stake in Microsoft is a testament to his enduring confidence in the company he helped elevate.

The opportunity to invest in promising AI or tech startups is accessible to anyone, not just wealthy investors. Take Kliken, for instance, which leverages GPT AI technology to offer small businesses top-tier digital marketing services at a significantly reduced cost, and it’s possible to invest in this potential with as little as $200.

Ballmer’s ownership of the Los Angeles Clippers adds a substantial non-tech asset to his portfolio. The Clippers’ valuation, combined with the NBA’s profitable broadcasting agreements, bolsters his financial standing.

In contrast, Bill Gates has shifted focus towards philanthropy and invested billions in health, education and climate change initiatives through his foundation. This philanthropic approach has redistributed a portion of Gates’ wealth, differing from Ballmer’s investment strategy.

While market changes and economic trends can affect the net worth of the world’s richest, Ballmer’s diversified investments and Microsoft’s ongoing success provide him with a stable position in the upper echelons of global wealth, showcasing the vast potential for growth among the tech elite.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

This article Bill Gates’ Former Assistant Is Now One Of The Richest People In The World And Could Even Surpass Him In Net Worth — But You Probably Have No Idea Who He Is originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The head of one of the biggest property developers in China was once Asia’s richest woman. But her wealth has plunged by 84% since mid-2021 — and now her company’s teetering on the brink of a crisis.

-

Yang Huiyan, the chair of the property giant Country Garden, has lost about $29 billion since 2021.

-

Huiyan lost $490 million on Tuesday as her company missed interest payments, according to Bloomberg.

-

Country Garden reported that sales plummeted by 30% year-on-year in the first six months of 2023.

Yang Huiyan — once Asia’s wealthiest woman — has lost more of her wealth than any billionaire since June 2021 as China’s top property developer, Country Garden, grapples with a debt crisis.

Yang’s net worth has plummeted by 84%, or $28.6 billion, since its peak in June 2021, Bloomberg reported. The 41-year-old’s net worth is now $5.5 billion, per Bloomberg’s Billionaires Index.

These losses come as Country Garden missed interest payments on two US-dollar-denominated bonds, according to various media reports, including a Reuters report on Wednesday. The company now has a 30-day grace period to avoid an official default.

The company’s Hong Kong-listed stocks have plunged by 20.4% since Monday. Yang derives much of her wealth from a 52.6% stake in the company, per a Monday report by the ratings agency Moody’s. She saw her wealth tank by about $490 million on Tuesday.

Before taking over as majority shareholder of the company from her father in 2007, Yang graduated from Ohio State University as part of the class of 2003 with a bachelor’s degree in marketing and logistics.

But Country Garden’s fortunes have waned since. The company remains China’s biggest property developer in sales, but its market value has more than halved since the start of the year, according to The New York Times.

In July, the company reported sales of 128.76 billion yuan, or about $17.8 billion, in the first six months of the year, marking a 30% decrease compared to the same period last year.

Yang, who became China’s richest woman at 25 after the company’s IPO, lost the spot of Asia’s richest woman in August 2022 to Savitri Jindal. Jindal, India’s richest woman, is the chairperson emeritus of the Indian conglomerate O.P. Jindal Group, per Bloomberg.

On July 30, Yang announced that she was giving away 55% of her shares in Country Garden to a charity founded by her younger sister in a payout valued at $826 million, per Bloomberg.

Country Garden and Yang Huiyan did not respond to requests for comment from Insider.

Read the original article on Business Insider

Short-seller Hindenburg has fueled a massive wealth wipeout for 3 of the world’s richest men this year

-

Short-seller Hindenburg Research has targeted three of the world’s wealthiest men this year.

-

It’s made high-profile bets against Adani Group, Block, and Icahn Enterprises.

-

Gautam Adani, Jack Dorsey, and Carl Icahn have seen their wealth plummet in 2023.

Short-seller Hindenburg Research’s big bets against Adani Group, Block, and Icahn Enterprises have fueled a massive wealth wipeout for three of the world’s richest men this year.

Indian magnate Gautam Adani, Twitter and Block founder Jack Dorsey, and activist investor Carl Icahn have all seen their personal fortunes plummet, according to data from the Bloomberg Billionaires Index.

Adani has suffered the largest losses of the three, with his wealth plunging $57 billion since Hindenburg published a report in January that accused him of “pulling the largest con in corporate history“, sparking major losses for his publicly-traded companies.

Dorsey lost a more modest $530 million after Hindenburg critiqued his payment firm Block – but Icahn has got nearly $16 billion poorer after the short-seller said in May that he used “Ponzi-like structures” to deceive investors.

On Friday alone, Icahn Enterprises’ stock plunged 23% after it slashed shareholders’ payouts from $2 to $1, which Icahn himself attributed to Hindenburg’s “misleading and self-serving” report.

Icahn’s wealth fell from $10.5 billion to $8 billion that day alone, per Bloomberg’s index.

Hindenburg, which achieved prominence in the past with big bets against EV corporation Nikola and the Chamath Palihapitiya-backed firm Clover Health, has hit headlines this year with its high-profile reports targeting the three billionaires’ companies.

Its attacks have erased $173 billion from the value of their publicly-traded companies, with the brunt of those losses borne by listed firms under the Adani Group umbrella, per Bloomberg.

Perhaps surprisingly, Hindenburg and its founder Nate Anderson probably only made tiny gains this year, according to the outlet, which cited data from S3 Partners showing the short-seller would have earned just $56 million from its bet against Icahn if it perfectly timed its exits.

Read the original article on Business Insider

Warren Buffett just gave away nearly $5 billion of his wealth again—he could have been the world’s richest man if that’s what he actually wanted

Warren Buffet is a staunch supporter of many things: the McMuffin, Diet Coke, and philanthropy. The Berkshire Hathaway CEO donated $4.6 billion of his Berkshire Hathaway stock (consisting of about 13.7 million B shares) to five charities in his annual donation on Wednesday. While the number of shares Buffett gives away decreases by 5% each year, it’s his largest in value yet thanks to the company’s climbing stock prices.

“Nothing extraordinary has occurred at Berkshire; a very long runway, simple, and generally sound decisions, the American tailwind and compounding effects produced my current wealth,” Buffett explained in a press release.

At this point, the investor continued, he’s given away $50 billion in shares based on the value of when they were received—worth $132 billion at today’s stock price. The majority of Buffett’s $118 billion fortune is tied up in stock; his remaining shares are worth about $112 billion. As Business Insider points out, if Buffett had held on to all the shares he’s given away, his net worth would top $250 billion. That would make him the world’s richest man, above Elon Musk, instead of his current status as the world’s sixth-richest man.

Having given away 54% of his Berkshire Hathaway stock, the “Oracle of Omaha” is well on his way to getting rid of the majority of his wealth. “My will provides that more than 99% of my estate is destined for philanthropic usage,” he wrote in the press release. In 2006, Buffett pledged to give away 85% of his stock in the company to charity, designating the majority of it to the Bill & Melinda Gates Foundation. Four years later, he vowed to redistribute 99% of his wealth to philanthropy during or after his lifetime when signing the Giving Pledge with friend and fellow billionaire Bill Gates, calling upon their billionaire peers to give up a large portion of their wealth to charity.

The Gates Foundation continues to be the prime beneficiary of Buffett’s donations, alongside the Susan Thompson Buffett Foundation, the Sherwood Foundation, Howard G. Buffett Foundation, and NoVo Foundation, whose collective goals range from social justice initiatives in Nebraska to empowering women and girls.

Buffett has long been vocal about his desire to give away his billions, telling Fortune’s Carol Loomis back in 2006 that he never planned to leave his entire fortune to his children. “A very rich person should leave his kids enough to do anything but not enough to do nothing,” he said.

He’s often bemoaned generational wealth as one of the main drivers of growing income inequality in the U.S. “Dynastic wealth, the enemy of a meritocracy, is on the rise,” he said in 2007. “Equality of opportunity has been on the decline. A progressive and meaningful estate tax is needed to curb the movement of a democracy toward plutocracy.”

Buffett, 92, reportedly wants his billions spent within 10 years of his death, according to a Wall Street Journal investigation from last year. While most will go to the five charities, namely the Gates Foundation, there are still unpledged shares left up in the air. He hasn’t yet disclosed the nitty-gritty of how that wealth will be split after his death; estate planning experts told the Journal his pledge letter was a bit ambiguous.

Gates Foundation staffers have been banking on receiving both the pledged and remaining unpledged shares, an employee told the Journal. One purported suggestion was to create a world children’s savings bank, they said, in which children would receive thousands of dollars that “sit on a shelf, like a battle plan” for baby beneficiaries.

For now, though, Buffett is still getting his McMuffin a day and chipping away at donating his amassed fortune to charity.

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

Looking to make extra cash? This CD has a 5.15% APY right now

Buying a house? Here’s how much to save

This is how much money you need to earn annually to comfortably buy a $600,000 home