Bitcoin’s price on Bitmex plummeted to $8,900 in a flash crash late Monday, diverging significantly from the global average price of around $67,400, due to large sell orders on the XBT/USDT pair. Bitmex is investigating the incident, which involved over 850 BTC being sold, causing the dramatic price drop while other exchanges showed prices well […]

Bitcoin’s price on Bitmex plummeted to $8,900 in a flash crash late Monday, diverging significantly from the global average price of around $67,400, due to large sell orders on the XBT/USDT pair. Bitmex is investigating the incident, which involved over 850 BTC being sold, causing the dramatic price drop while other exchanges showed prices well […]

Source link

sends

MakerDAO Co-Founder Cashes Out, Sends MKR Wobbling After $4.5 Million Sell

Despite starting the year strong, MKR has encountered a choppy path in recent weeks, leaving investors with a mixed bag of signals to decipher. While the decentralized finance (DeFi) leader has maintained its position above key support levels, concerns have emerged surrounding a prominent wallet’s sizeable token sale and a declining trading volume.

Maker Resilience Faces Uncertain Shadows

On the bright side, Maker has demonstrated resilience amidst broader market downturns. After a notable surge on January 24th, the token has held its ground, defying predictions of a deeper correction. This steadfastness has fueled optimism among some analysts, who predict a continued upward trajectory for MKR throughout 2024.

However, a recent development has cast a shadow of uncertainty. Data from on-chain analytics firm Spot on Chain revealed that a well-known wallet, reportedly associated with a MakerDAO co-founder, unloaded a hefty 2,235 MKR over the past two days. This translates to a staggering $4.5 million at press time, sparking fears of a potential “whale dump” that could trigger a price slump.

Wallet 0xa58 (linked to @RuneKek, #MakerDAO cofounder) has sold 2,235 $MKR for 4.542M $DAI at $2,032 on average in the past 2 days.

Currently, the wallet still holds 2,430 $MKR ($4.92M), and may keep selling.

The $MKR price has been down ~3.39% (2D), since the first sale.

Want… pic.twitter.com/iW2A0pMLHx

— Spot On Chain (@spotonchain) January 28, 2024

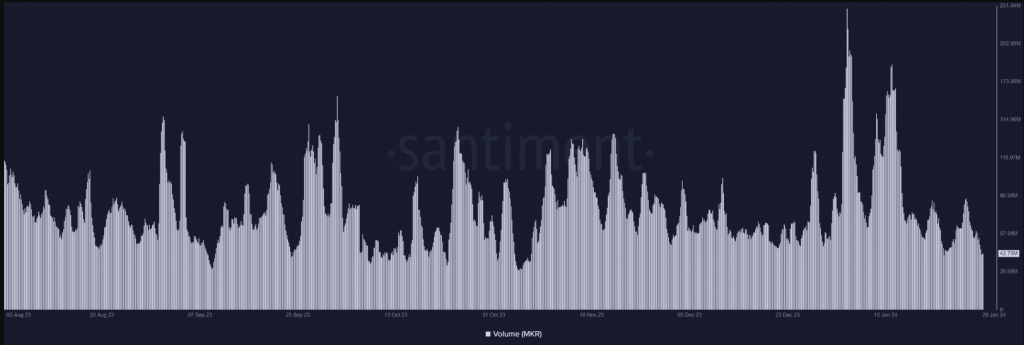

Adding to the mixed picture is a decline in trading volume. After reaching a high of $84 million on January 25th, activity has steadily dwindled, currently hovering around $43 million. This dampened trading enthusiasm could indicate waning investor confidence or simply be a temporary lull.

Source: Santiment

A glimmer of hope emerges when examining exchange netflow. Despite the sizable wallet sale, the overall flow of MKR has been dominated by inflows, suggesting that more tokens are being withdrawn from exchanges than sold. This trend, while not as pronounced as the previous outflow witnessed on January 25th, hints at potential accumulation by longer-term holders.

MKR market cap currently at $1.786 billion. Chart: TradingView.com

MKR Technical Struggles Ahead

On the technical front, Maker’s daily chart paints a picture of recent struggle. Following the January 24th gains, prices have embarked on a descent, shedding over 3% by January 27th. This marks the steepest decline since the downtrend began two days prior. The continuation of this selling pressure, particularly if fueled by further whale offloads, could pose a significant challenge for MKR’s immediate future.

MKR price action today. Source: Coingecko

At the time of writing, MKR was trading at $1,939, down 2.6% and 0.7% in the last 24 hours and seven days, data from Coingecko shows.

Maker’s early 2024 journey has been characterized by both encouraging signs and potential pitfalls. While the token’s resilience and positive long-term outlook offer reasons for optimism, the recent whale sale and declining volume inject a dose of caution.

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Shiba Inu Team’s Record 9.35 Billion SHIB Burn Sends Burn Rate Soaring

The Shiba Inu burn rate is not slowing down, especially now that the SHIB team has officially joined the effort. This participation from the Shiba Inu team has led to some of the largest daily SHIB burns that have been recorded since the burn initiative started. And now, once again, the team has carried out another massive burn that sent the burn rate surging.

Shiba Inu Team Burns 9.35 Billion Tokens

In the latest iteration of the Shiba Inu team burn, a total of 9.35 billion SHIB have now been sent to the burn address. At the time of the transaction, the 9.35 billion SHIB was worth a total of $92,953.36. This makes it the largest burn that the team has carried out since it began burning tokens.

The token burn which took place on January 9 triggered a substantial surge in the daily SHIB burn rate. According to data from the Shiba Inu burn tracking website Shibburn, the team’s burn caused the burn rate to spike by 28,659% in the 24-hour period. This spike represents the highest spike in the burn rate in 2024 so far, suggesting a bullish start to the year for the token.

However, the burn rate has since taken a nosedive as the burn figures fell short of expectations between Wednesday and Thursday. Shibburn data shows a 99.94% decline in the burn rate at the time of writing, with only a little over 5.3 million SHIB tokens burned in the last day.

There have also been only four burn transactions carried out in the 24-hour period at the time of writing, following the same trend from the last few days.

SHIB price above $0.00001 | Source: SHIBUSD on Tradingview.com

SHIB Burn Gains Steam

Despite the decline in the burn rate in the last day, the community is still looking at more significant burns as time goes on. One of the developments that guarantee these burns is the fact that Shiba Inu burns are now being automated directly through the Shibarium network.

The burn automation was revealed by the Shiba Inu team which revealed that there will be a two-pronged approach to this process. The first, which is how the team has been burning tokens, is manually sending tokens from the deployer wallet to the burn address.

The second approach, which is the most significant, will see an automated SHIB burn system from Shibarium put in place in January. This automated burn mechanism has sparked excitement in the SHIB community as some expect as much as 9.25 trillion tokens to be burned monthly.

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

AMC CEO sends Taylor Swift ‘eternal gratitude’ as concert film makes history

AMC Entertainment Holdings Inc. CEO Adam Aron has expressed the movie-theater chain’s “eternal gratitude” to Taylor Swift as the singer-songwriter’s concert film breaks another record.

Variety reported Sunday that “Taylor Swift: The Eras Tour” has earned more than $261.6 million globally, making it the highest-grossing concert and documentary film in history, surpassing “Michael Jackson’s This Is It.”

“Now at $261.6 million globally, AMC’s first ever released film, TAYLOR SWIFT | THE ERAS TOUR just became the highest grossing concert film & highest grossing documentary film of all time,” Aron tweeted Sunday. “AMC sends our congratulations and eternal gratitude to Taylor Swift for being so remarkable.”

Related: AMC still riding a ‘Taylor Swift: The Eras Tour’ wave

AMC shares

AMC,

which recently hit record lows, have edged lower this week. The movie-theater chain and original meme-stock darling’s stock is down 85% in the past 52 weeks, compared with the S&P 500’s

SPX

gain of 20.9%.

In addition to showing “Taylor Swift: The Eras Tour” in its theaters, AMC is also the theatrical distributor for the movie. AMC Theatres Distribution, along with subdistribution partners Variance Films, Trafalgar Releasing, Cinepolis and Cineplex Inc.

CPXGF,

CGX,

clinched deals with movie-theater operators representing more than 8,500 venues globally to show the film, according to AMC.

“Taylor Swift: The Eras Tour” was breaking records even before its scheduled release on Oct. 13, prompting more showings to be added. On Oct. 11, Swift tweeted that early access showings would be held on Oct. 12, citing “unprecedented demand” for the movie.

Related: AMC shares rise as ‘Taylor Swift: The Eras Tour’ sets another record

The movie shattered the record for the biggest global opening weekend for a concert film, racking up $128 million in box-office returns, according to Comscore. Imax Corp.

IMAX,

announced that “Taylor Swift: The Eras Tour” had a $13 million global box-office debut, making it the largest Imax opening of a concert or a documentary film by a musical artist.

Oil prices rise as Iran sends warship to Red Sea after U.S. destroys Houthi vessels

Oil futures rose Tuesday to kick off the new year after an Iranian warship entered the Red Sea, heightening tensions and fears of crude supply disruptions sparked by attacks on shipping by Iran-backed Houthi rebels in Yemen.

Price action

-

West Texas Intermediate crude for February delivery

CL00,

+2.37% CL.1,

+2.37% CLG24,

+2.37%

rose $1.71, or 2.4%, to $73.36 a barrel on the New York Mercantile Exchange. -

March Brent crude

BRN00,

+2.19% BRNH24,

+2.19% ,

the global benchmark, was up $1.86, or 2.4%, at $78.90 a barrel on ICE Futures Europe. -

Back on Nymex, February gasoline

RBG24,

+2.52%

rose 2.4% to $2.156 a gallon, while February heating oil

HOG24,

+2.06%

was up 2% at $2.58 a gallon. -

February natural gas

NGG24,

+4.38%

rose 4% to $2.615 per million British thermal units.

Market drivers

News reports said Iran’s semiofficial Tasnim news agency on Monday reported that Iran’s Alborz warship had entered the Red Sea without providing details of the ship’s mission.

The U.S. military said Sunday that its forces opened fire on Houthi rebels after they attacked a cargo ship in the Red Sea, killing several of them and destroying three boats in an escalation of the maritime conflict linked to the war in Gaza.

Oil prices rose after the start of the Israel-Hamas war in October, but the risk premium attached to fears of a wider conflict in the region soon evaporated. Crude has seen periodic jumps in price around fears of potential escalation, but fell sharply over the course of the fourth quarter, with both Brent and WTI ending 2023 with a year loss, their first since 2020.

Uncertainty over the demand outlook, a rise in U.S. production to record levels above 13 million barrels a day and doubts about the unity of the Organization of the Petroleum Exporting Countries have served to undercut support for crude.

With demand “expected to remain subdued due to a global economic slowdown and U.S. crude production at record levels, the recovery may be destined to remain limited and short lived,” said Charalampos Pissouros, senior investment analyst at XM, in a note.

Fake News on BlackRock’s iShares XRP Trust Sends Price Briefly to $0.74 Leading to High Liquidation

For several hours, the iShares XRP Trust appeared on the ICIS Delaware website suggesting that BlackRock had filed to list an XRP ETF, which was confirmed to be fake.

Amid the ongoing Bitcoin (BTC) and Ethereum (ETH), exchange-traded funds (ETFs) in the United States, the crypto community has questioned why the Ripple Labs-backed XRP has not been included and it has legal clarity. On Monday, reports circulated on the X platform that BlackRock Inc (NYSE: BLK) had filed to list an XRP exchange-traded fund (ETF). Notably, BlackRock’s iShares XRP Trust appeared on the ICIS Delaware website, which was highlighted to be fake and market manipulative. Moreover, the XRP price rallied 15 percent and briefly reached 76 cents before retracing to the former levels after it was confirmed to be fake news. According to our latest market data, XRP price traded around 66 cents on Tuesday during the early Asian market.

This is false! Confirmed by BlackRock by me. Some whacko must have added using BlackRock executive name etc. Cmon man. pic.twitter.com/cDpnycYwjQ

— Eric Balchunas (@EricBalchunas) November 13, 2023

According to Jeremy Hogan, a crypto-friendly legal expert with Hogan & Hogan, it is possible that a criminal filed two documents needed to list an XRP ETF and paid the fee of $500. Arguably, Hogan suggested that the criminal proceeded to place a bet on the XRP leverage and quickly sold at 74 cents to make a higher profit. Moreover, Bitcoin and Ether ETF application news have impacted the underlying value with higher volatility.

Are the BlackRock-related Rumors Signaling an Imminent XRP ETF in the United States?

The United States Securities and Exchange Commission (SEC) has been pushing for XRP to be regulated under securities law before the Ripple-backed instrument grows enormously amid the ongoing crypto mainstream adoption. However, the July summary judgment on the SEC vs Ripple lawsuit concluded that XRP exchange sales do not constitute investment contracts, thus resulting in more crypto firms relisting the instrument for trading.

The XRP trading volume and liquidity have since significantly improved as more investors doubled down on the instrument. As of this reporting, XRP had an average trading volume of about $3.1 billion, up approximately 230 percent in the past 24 hours following the ETF fake news. Notably, about $6.9 million in XRP was liquidated in the past 24 hours, according to market data from Coinglass.

Meanwhile, Yassin Mobarak, the founder of Dizer Capital, highlighted that it is peculiar that there is no XRP ETF application despite the notable legal clarity in the United States. The desire for crypto ETFs has been emanating from institutional investors’ demand to diversify their portfolios in digital assets to hedge against high fiat inflation.

Many applications for BTC spot ETF and now there’s a new ETH spot ETF application.

I find it peculiar that there’s no spot ETF application for the only crypto with actual legal clarity. That crypto is $XRP.

— Yassin Mobarak 🪝 (@Dizer_YM) November 11, 2023

Nonetheless, the XRP market will not be free until the ongoing SEC vs Ripple case is concluded, which is expected in early 2025, depending on the trial outcome in the first quarter of 2024.

next

Altcoin News, Blockchain News, Commodities & Futures, Cryptocurrency News, Market News

You have successfully joined our subscriber list.

Founder who suffered eye damage at Bored Ape Yacht Club event sends ‘formal legal notice’ to Yuga Labs

A founder who attended Yuga Labs’ recent Ape Fest in Hong Kong has sent legal notice to the company after suffering eye damage related to the event.

Asif Kamal, founder of the art-tech and NFT company Artfi, said that he fell ill to a “widespread eye infection outbreak” during the Bored Apes Yacht Club-themed event, which was held in Hong Kong between Nov. 3 and Nov. 5. In the hours following the event, several attendees reported eye pain, skin irritation, and other maladies associated with overexposure to UV light.

He also said that he was hospitalized after returning to Dubai after two days and added that the infection gradually spread to the skin on his face.

Kamal and ArtFi said in a press release:

“To ensure such an incident never repeats itself, Asif Kamal and his legal team have taken swift action by sending a formal legal notice to Yuga Labs, the organizers of the event. Mr. Kamal is dedicated to seeking justice for those who suffered and safeguarding the rights of the affected individuals.”

Kamal otherwise expressed concern and condemnation regarding Yuga Labs’ apparent failed security measures, as well as sympathy for other victims.

Condition is not infectious

Most other reports attribute the widespread eye condition to UV exposure from improper lighting. Several other attendees reported eye pain, vision problems, and burnt skin following the event.

In a petition on Change.org, Kamal similarly suggested that his condition was caused by exposure to UV radiation but maintained that this resulted in an infection.

Yuga Labs has acknowledged those reports. In a statement to Variety, the firm said that it was aware of “some attendees” reporting the above conditions (apart from infection). The company added that it was “distressed” by those reports and said that it was working with festival vendors and contractors to determine the cause of the incident.

In another statement to Verge, Yuga Labs said that 15 individuals, or less than 1% of the 2,250 people in attendance, had contacted it about the matter.

More Selling? Bankrupt Voyager Sends Millions In SHIB And ETH To Coinbase

Voyager Digital has been busy in recent months as it looks to sell its remaining crypto holdings on centralized exchanges. In its latest move, the bankrupt crypto brokerage has transferred millions in SHIB and ETH to Coinbase. According to on-chain data, Voyager moved SHIB and ETH tokens to Coinbase’s ledger on Friday, August 11.

Millions In SHIB And ETH Transferred To Coinbase By Voyager

Voyager has been selling off assets since the beginning of the year. Specifically, the latest on-chain transactions show that Voyager moved a total of $5.5 million in crypto to Coinbase. The transactions consisted of 1,500 ETH sent in two transactions.

Before being moved to Coinbase, 1,000 ETH and 500 ETH, with a combined value of $2.77 million, were sent to separate wallets. Another 250 billion SHIB valued at $2.7 million was then sent to Coinbase.

On-chain data also shows that Voyager has been moving all its token holdings to its primary address. This likely means the company is consolidating its crypto assets before moving them to crypto exchanges.

Bankrupt crypto firm Voyager transferred 1,500 ETH ($2.77 million) and 250 billion SHIB ($2.7 million) to Coinbase. Additionally, Voyager is moving all remaining tokens to the main address. There are currently about $81.63 million worth of cryptocurrency in Voyager addresses.…

— Wu Blockchain (@WuBlockchain) August 12, 2023

Looking To Pay Pack Customers

Voyager’s goal is to eventually reimburse all customer accounts, at least partially. The firm went bankrupt last year after the failure of crypto hedge fund Three Arrows Capital which failed to repay its $665 million Voyager loan. The company, however, received court approval in May 2023 to begin winding down its operations and start repaying customers a portion of their crypto assets that’s been locked for over a year.

According to court filings, Voyager had only about $630 million to pay back $1.8 billion in customer claims. As a result, Voyager users could only claim 35.72% of their tokens. They could either withdraw their claims immediately or choose to wait for 30 days to be paid in USD after Voyager sells the tokens.

VGX prices tanks as bankruptcy proceedings continue | Source: VGXUSDT on Tradingview.com

At the time, data from Arkham Intelligence showed that Voyager had $268 million in ETH, $236 million in USDC, and $77 million in SHIB. But now that the time for customer claims is over, Voyager seems to be consolidating its remaining assets into one address before selling them. According to Arkham Intel, there is currently about $81.63 million worth of cryptocurrency left in Voyager addresses.

What This Means For SHIB And ETH Prices

The recent transfers of millions of dollars in SHIB and ETH tokens from Voyager Digital to Coinbase could signal selling pressure is on the way for the two cryptocurrencies. If Coinbase unloads these tokens onto the open market, it may drive prices down further as supply outpaces demand.

SHIB is currently on a roll and is up by 15.55% in a 7-day timeframe. ETH, on the other hand, is currently ranging around $1,850 after the ETH ecosystem reached a milestone recently with the number of non-zero addresses reaching a new all-time high.

Featured image from Currency.com, chart from Tradingview.com

Aptos Labs, the developer of layer1 blockchain network Aptos (APT), has partnered with Microsoft to “unlock Web3,” according to an Aug. 9 press statement shared with CryptoSlate.

The blockchain network stated that the partnership would explore asset tokenization, payments, and Central Bank Digital Currencies (CBDCs).

Aptos integrates AI through Microsoft partnership

The network also introduced Aptos Assistant, a Web3 onboarding tool. The new AI tool would use Microsoft’s Azure OpenAI Service to “operate as a responsible, user-friendly and secure assistant bridging web2 to web3 for the everyday internet user and organization.”

On its official X handle, Aptos wrote:

“Natural language assistance will help users onboard Web3 fundamentals and beyond, and creators can use it to build smart contracts and decentralized apps.”

Speaking on the partnership, Mo Shaikh, Aptos Labs CEO, pointed out that artificial intelligence and blockchain technology are generational breakthroughs that have profoundly impacted society. According to Shaikh, the partnership between both firms would make these technologies more accessible to people.

Rashmi Misra, the general manager of AI & Emerging Technologies at Microsoft, also shares this view, adding that “the intersection of AI and blockchain is one of the most interesting combinations of emerging technologies and can generate transformational use cases.”

Meanwhile, Aptos stated that it would be running run validator nodes on Azure to enhance the reliability and security of its blockchain.

APT soars 17%, anticipates token unlock

Following news of the partnership, Aptos’ APT token rallied by more than 17% to as high as $7.33 before retracing to $7.34 as of press time, according to CryptoSlate’s data.

TokenUnlocks data show that the network will unlock 4.5 million APT tokens worth around $33.62 million by Aug. 11. The scheduled unlock represents around 2% of the token’s circulating supply.

Per the data aggregator dashboard, approximately 3.21 million tokens, equivalent to $23.76 million, will be allocated to the community, while the balance will be distributed to the Aptos Foundation.

The post Microsoft and Aptos Labs partnership sends APT token soaring appeared first on CryptoSlate.