A former security engineer, who stole digital assets valued at more than $12 million from two decentralized exchanges, has received a three-year prison sentence. In what has been characterized as the “first-ever” conviction for a smart contract hack, the U.S. Judge also ordered the ex-engineer to forfeit roughly $12.3 million. Ex-Engineer Sentenced to Three Years […]

A former security engineer, who stole digital assets valued at more than $12 million from two decentralized exchanges, has received a three-year prison sentence. In what has been characterized as the “first-ever” conviction for a smart contract hack, the U.S. Judge also ordered the ex-engineer to forfeit roughly $12.3 million. Ex-Engineer Sentenced to Three Years […]

Source link

sentenced

Former FTX CEO Sam Bankman-Fried sentenced to 25 years in landmark fraud case

Sam Bankman-Fried, the former CEO of FTX, was sentenced to 25 years in jail today in a packed courtroom, marking a significant moment in the legal scrutiny of the crypto industry. He will be 57 years old when he is released. The sentencing, as detailed by Inner City Press, comes after a series of legal proceedings that shed light on the complexities and potential vulnerabilities within the digital asset space.

Bankman-Fried, dressed in a light brown jail uniform from MDC-Brooklyn, faced the judgment of Judge Lewis A. Kaplan, who, after considering the pre-sentence report and the guidelines disputes, delivered a sentence that reflects the gravity of the crimes committed. The courtroom, filled with prosecutors, defense lawyers, and an FBI agent, bore witness to the culmination of a case that has been closely followed by both the crypto community and the general public.

The legal proceedings highlighted the extensive financial losses incurred by investors, lenders, and customers, with Judge Kaplan rejecting the defense’s argument about the loss amount. The court found that investors lost $1.7 billion, lenders lost $1.3 billion, and customers faced an $8 billion shortfall. These figures underscore the scale of the fraud and the impact on the victims involved.

The defense had previously sought leniency, citing Bankman-Fried’s autism diagnosis and arguing for a reduced sentence of 63 to 78 months. However, the prosecution argued for a substantial prison term of 50 years.

Judge Kaplan’s decision to vary downward from the Guidelines range while still acknowledging the significant number of victims and the use of sophisticated means emphasizes the complexity of sentencing in cases involving emerging technologies and financial structures. The finding of obstruction of justice, including attempted witness tampering and perjury, further emphasized the deliberate actions taken by Bankman-Fried to mislead and defraud.

Human cost of FTX collapse

During the sentencing hearing, a poignant moment unfolded as victims were given the opportunity to address the court. One such victim, Sunil Kavuri, who traveled from London specifically for this purpose, shared his experiences and the impact of the FTX collapse on him and others. Kavuri highlighted the ongoing struggles faced by victims, challenging the narrative that the loss was zero and criticizing the handling of the bankruptcy estate. He pointed out the significant discrepancies in the valuation and sale of assets, including a token that significantly appreciated in value after being sold at a discount and the sale of Solana tokens at a 70% discount.

Kavuri’s testimony underscored the real and continuing harm suffered by those affected, including the tragic note that at least three individuals had committed suicide as a result of the fraud. Judge Kaplan acknowledged Kavuri’s points, reinforcing the gravity of the situation and the inaccuracies in claims that customers would be made whole. This victim’s statement added a deeply personal dimension to the proceedings, emphasizing the human cost of financial crimes and the need for accountability beyond the sentencing of Bankman-Fried.

SBF lawyer describes him as ‘misunderstood’

In a heartfelt defense of his client, Sam Bankman-Fried’s attorney, Mark Mukasey, presented a contrasting image of the former FTX CEO to the court. Mukasey argued that Bankman-Fried’s actions, while resulting in significant financial fallout, were not driven by the same malice or predatory intent that characterized other high-profile financial criminals, such as those who stole from Holocaust survivors. He emphasized that Bankman-Fried was not a “ruthless financial serial killer” but rather someone who made decisions based on mathematical calculations, not with the intention to cause personal pain.

Mukasey also relayed personal insights from Bankman-Fried’s mother, who described her son as misunderstood and not fitting the mold of a “greedy swindler.” According to Mukasey, Bankman-Fried did not abscond with funds but remained engaged until the end, with a genuine desire to see people repaid. This narrative was allowed to be presented in court partly due to Judge Kaplan’s decision to depart from the usual practice of enumerating the papers considered for sentencing, acknowledging the overwhelming volume of last-minute submissions from both the defense and the prosecution.

The defense’s portrayal of Bankman-Fried aimed to humanize him and differentiate his case from other financial frauds, suggesting that while the consequences of his actions were severe, his motivations were not inherently malicious. Mukasey’s statement also served as an acknowledgment of the victims’ suffering, expressing an understanding of their pain and a commitment to appeal, while maintaining respect for the jury’s verdict.

In a plea to the court, speaking directly Bankman-Fried admitted,

“I made a lot of mistakes. But that’s not how the story ended. Customers weren’t paid back. FTX didn’t survive that. Yeah, customers have been given conflicting claims. That’s caused a lot of damage. They could have been paid back.”

In a moment of candor, Sam Bankman-Fried expressed a somber reflection on his future, acknowledging the likelihood that his ability to contribute meaningfully to society may be irreparably diminished. He admitted to the court that his capacity to make an impact is severely limited by incarceration and that the length of his sentence, whether it be 5 or 40 years, is beyond his control. He stated,

“My useful life is probably over. I’ve long since given what I had to give. I can’t do it from prison.”

Bankman-Fried also addressed the perception of his actions, recognizing the stark contrast between his alleged intentions and how prosecutors, the court, and the media interpreted them. He also said he now expects customers to be repaid. He commented, “I think I failed at that. I’m not sure why, but I do think I did.” He also referred to a specific instance involving a text to the general counsel, which he claimed was an attempt to assist, though it was not viewed as such by others. Even on the day of his sentencing, Bankman-Fried continues to assert that he did not steal user funds maliciously.

However, in his judgment, Judge Kaplan asserted that he believed much of Bankman-Fried’s public rhetoric “was an act” designed to obtain power and influence.

According to Inner City Press, before the sentence was issued, the government argued,

“The defendant is not a monster but he committed gravely serious crimes that harmed many people – and he would consider doing it again. So, 40 to 50 years.”

In announcing the sentence, Judge Kaplan proclaimed that Bankman-Fried was nothing short of a “performer.”

“When not lying, he was evasive, hair splitting, trying to get the prosecutors to rephrase questions for him. I’ve been doing this job for close for 30 years. I’ve never seen a performance like that.”

His sentencing was reported by Inner City Press as follows,

“It is the judgment of the court that you are sentenced to 240 months then consecutive 60 [etc] for a total of 300 months [25 years].”

The implications of today’s sentencing extend beyond the immediate legal consequences for Bankman-Fried. They touch on broader questions about the regulation of digital assets, the protection of investors, and the future of digital asset markets. As the industry grapples with these challenges, the outcome of this case will likely influence discussions and decisions on how best to navigate the complex intersection of technology, finance, and law.

This article will be updated with additional details as they become available.

Mentioned in this article

Latest Alpha Market Report

Owners of famous Philly cheesesteak chain sentenced in $8M tax fraud scheme

The owners of the famous Philadelphia Cheesesteak restaurant Tony Luke’s were sentenced to prison for tax fraud on Thursday after concealing over $8 million over the course of a decade.

The U.S. Department of Justice announced the owners, 57-year-old Nicholas Lucidonio, and 84-year-old Anthony Lucidonio Sr. were each sentenced to 20 months in prison plus three years of supervised release.

The Lucidonios owned and operated Tony Lukes, which is a popular cheesesteak and sandwich shop in South Philadelphia.

Between 2006 and 2016, court documents show, the two men hid over $8 million in cash receipts from the Internal Revenue Service (IRS), and only deposited a portion of the cash they received into restaurant business accounts.

MCDONALD’S SPINOFF COSMC’S SAW TWICE AS MANY VISITS AS REGULAR RESTAURANT IN FIRST MONTH: REPORT

By only depositing a portion of the cash, the DOJ said, the company’s accountant was provided incomplete information, resulting in the accountant filing false tax returns.

The DOJ also said the Lucidonios were also convicted of employment tax fraud, which was committed when the two men paid employees “off the books” in cash.

SOCIAL SECURITY RECIPIENTS COULD GET HIT WITH A SURPRISE TAX BILL THIS YEAR

Most employees were paid a portion of their wages on the books to evade being caught, and the rest of the wages were paid in cash without things like federal income tax, Social Security and Medicare taxes being paid to the IRS.

The Lucidonios did not report the cash wages to their accountant, the DOJ said, causing the accountant to prepare false quarterly employment tax returns with the IRS.

REMOTE WORKERS FACE A DOUBLE TAXATION THREAT

The issue became known in 2015, when the Lucidonios and another individual got into a dispute over Tony Luke’s franchising rights.

During the dispute, the Lucidonios became concerned their tax fraud scheme would be exposed, so they had the prior year’s tax returns be amended to show higher reported sales, the DOJ said.

Still, the two men continued hiding their payroll tax scheme, which resulted in a loss of $1,321,042 to the U.S.

Original article source: Owners of famous Philly cheesesteak chain sentenced in $8M tax fraud scheme

OneCoin lawyer sentenced to 10 years in prison over laundering $400 million

In a landmark judgment, Mark Scott, formerly a high-ranking lawyer at Locke Lord LLP, received a 10-year prison sentence on Jan. 25 for laundering $400 million derived from the infamous OneCoin Ponzi scheme.

The sentencing at the Southern District of New York followed Scott’s 2019 conviction on multiple counts of bank fraud and money laundering. Inner City Press first reported the sentencing from the courtroom.

The OneCoin lawyer

OneCoin, launched in 2014 and operated out of Sofia, Bulgaria, was initially marketed as a groundbreaking cryptocurrency. However, it soon emerged as a fraudulent multi-level-marketing (MLM) scheme, swindling over $4 billion from at least 3.5 million victims worldwide between 2014 and 2016.

OneCoin’s value was falsely represented as being driven by market supply and demand, but in reality, it was a valueless digital currency, its price manipulated and arbitrarily set by the scheme’s operators.

Scott, who joined the scheme after meeting OneCoin co-founder Ruja Ignatova in September 2015, played a pivotal role in the money laundering aspect of the fraud. Despite his defense’s claim of ignorance regarding OneCoin’s fraudulent nature, evidence and testimonies presented during the trial painted a different picture.

Prosecutors argued that Scott was deeply involved in the operations, setting up elaborate offshore fund structures to disguise the origin of the ill-gotten gains.

During the sentencing, the judge scrutinized Scott’s actions post-conviction, including selling his Porsche and transferring significant funds to the Cayman Islands rather than using them to compensate OneCoin victims. The judge said these actions showed his lack of remorse and unwillingness to aid the victims of the scheme he helped perpetuate.

OneCoin unravelling

Ruja Ignatova, known as the “Cryptoqueen,” remains at large and was added to the FBI’s Top 10 most wanted list in June 2022. The case continues to unravel as other associates of OneCoin face legal repercussions for their involvement in the scheme.

Scott’s sentencing is a stark reminder of the risks associated with unregulated digital currencies and the potential for their misuse in large-scale frauds. It serves as a cautionary tale for professionals in the legal and financial sectors about the consequences of facilitating or turning a blind eye to dubious financial operations.

The OneCoin case continues to be a touchstone in the discussion about the need for more stringent regulations and oversight in the cryptocurrency market.

Scott’s conviction and sentencing underscore the seriousness with which the U.S. justice system treats financial crimes, especially those involving emerging technologies like cryptocurrencies. It also highlights the ongoing efforts by law enforcement agencies worldwide to bring to justice those involved in one of the most notorious frauds in the realm of digital currencies.

YouTuber Trevor Daniel Jacob appears ready to jump from his plane, which later crashed.

TrevorJacob via YouTube

A California man was sentenced to six months in federal prison on Monday for allegedly lying to federal authorities when they were investigating an airplane he intentionally crashed to make a YouTube video.

The man, former Olympic snowboarder Trevor Daniel Jacob, filmed the YouTube video stunt to promote a wallet from a company that sponsored him, according to the plea agreement filed in the Central District of California. He pled guilty to destruction and concealment of a tangible object with intent to obstruct a federal investigation.

Jacob took off on a solo flight on Nov. 24, 2021, in Santa Barbara County, California, and parachuted out of the plane with a video camera and selfie stick. Upon landing, he hiked to the crash site in Los Padres National Forest. Two days later, he told the National Transportation Safety Board about the wreck.

The NTSB opened an investigation and notified Jacob that he was expected to preserve the plane wreckage and that the agency would need to see it, according to the plea agreement. Jacob allegedly agreed to inform the NTSB of the location, but lied multiple times when investigators asked over the next two months.

In December 2021, Jacob and a friend allegedly chartered a helicopter to take them to the crash site and bring the remains back to Santa Maria, California, where Jacob’s pickup truck awaited, after which Jacob cut up the plane and put it in the garbage in bits and pieces. Later that month, the defendant posted the video to YouTube with footage from the cameras he had put on the crashed plane and the camera he held when he parachuted.

Multiple federal agencies, including the U.S. Department of Transportation’s Office of Inspector General, the Federal Aviation Administration and the NTSB, worked with the U.S. Attorney’s Office.

Don’t miss these stories from CNBC PRO:

Jet-setting bogus exec sentenced to 17 ½ years in $40M trucking Ponzi scheme

He tried to ride off into the sunset with $40 million in ill-gotten gains, but all he got was a one-way trip to prison.

A slick-talking, phony-business executive has been sentenced to 17 ½ in prison for ripping off hundreds of investors in a sham trucking company that federal prosecutors say turned out to be a $40 million Ponzi scheme.

Franklin…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

OneCoin Co-founder Greenwood Sentenced to 20 Years in Prison as L.E Hunts Cryptoqueen

Karl Sebastian Greenwood pleaded guilty on December 16, 2022, to operating a multi-billion cryptocurrency pyramid scheme dubbed OneCoin.

In a bid to send a strong message to the cryptocurrency community around the world, Damian Williams, the United States Attorney for the southern district of New York, announced on Tuesday that Karl Sebastian Greenwood, a co-founder of the OneCoin project with Ruja Ignatova (cryptoqueen), has been sentenced to a 20-year prison term. According to the announcement, the sentencing was issued by US District Judge Edgardo Ramos.

Notably, Greenwood is said to have led the OneCoin global marketing structure dubbed MLM network that accrued approximately $300 million for him by 2016. Moreover, Greenwood earned about 5 percent of monthly OneCoin sales from anywhere in the world. Reportedly, the OneCoin crypto project duped nearly 3.5 million investors from around the world and stole over $4 billion.

“As a founder and leader of OneCoin, Karl Sebastian Greenwood operated one of the largest fraud schemes ever perpetrated. Greenwood and his co-conspirators, including fugitive Ruja Ignatova, conned unsuspecting victims out of billions of dollars with promises of a ‘financial revolution’ and claims that OneCoin would be the ‘Bitcoin killer.’ In fact, OneCoins were entirely worthless, and investors were left with nothing,” Williams noted.

Notably, Greenwood was arrested at his residence on the island of Koh Samui, Thailand, in July 2018 and was extradited to the United States to face fraud and money laundering charges in October 2018.

OneCoin Co-founder Greenwood Misuses Investors’ Money

According to the announcement, Greenwood used investors’ money to book luxury hotels all over the world and purchase expensive properties. For instance, Greenwood stayed in a five-star resort in Brazil and used about $10k back in December 2015. Later the same month, Greenwood used about $21k of fraud proceeds to stay at a luxury villa with a beach view in Koh Samui, Thailand. In early 2016, Greenwood went to Barcelona and stayed in a luxury five-star hotel in addition to renting a Range Rover during the same period.

Reportedly, Greenwood purchased designer clothes, shoes, and watches worth approximately $2 million. He is also believed to have paid a down payment of about $475k for a yacht. The announcement further noted that Greenwood had purchased various real estate in different countries including Dubai, Spain, and Thailand.

As a result, the court ordered Greenwood to pay approximately $300 million in forfeiture in addition to the 20-year prison sentence.

Closer Look at the OneCoin Project

The OneCoin project attracted most investors for promising hefty profits. Moreover, the OneCoin gained in price from about €0.5 to approximately €29.95 in less than five years. Founded in Sofia, Bulgaria back in 2014, the OneCoin project has been described as one of the largest pyramid schemes in the cryptocurrency market. Notably, the FBI has listed the cryptoqueen on the most wanted list and issued a $250k reward for any information that may lead to her arrest.

next

Blockchain News, Cryptocurrency News, News

Let’s talk crypto, Metaverse, NFTs, CeDeFi, and Stocks, and focus on multi-chain as the future of blockchain technology.

Let us all WIN!

You have successfully joined our subscriber list.

Thodex CEO sentenced to Turkish prison for failure to submit tax documents

Three months after Faruk Fatih Özer — the founder and former CEO of Thodex — was detained in Türkiye, he received a prison sentence of seven months and 15 days for failing to submit documents requested during the trial.

Thodex was once one of the biggest crypto exchanges in Türkiye before it suddenly shut down, and Özer fled to Albania. Following a Red Notice by Interpol, Özer was deported back to Türkiye to be held responsible for the investors’ roughly $2 billion worth of cryptocurrencies.

While Özer maintained innocence throughout the trial since Oct. 30, 2021, he failed to submit the requested documents to the Tax Inspection Board. He denied being Thodex’s official at the time, which prevented him from presenting the requested books. He further claimed that a trustee had been appointed to run the business on his behalf during the said timeframe.

ÖNEMLİ DUYURU pic.twitter.com/3aBeJjFSYQ

— THODEX (@thodexofficial) April 22, 2021

As reported by Hürriyet Daily News, Özer’s prosecutor initially sought a five-year prison sentence for “smuggling” under the Tax Procedure Law. The court initially sentenced the crypto entrepreneur to one year and six months of imprisonment, which was later reduced to seven months and 15 days. The reasons for the sentence reduction include Özer’s social relations, and overall behavior and conduct during the trial.

In addition to tax-related charges, Özer has also been accused of defrauding Thodex investors and is awaiting a hearing on the claims. The entrepreneur continues to deny the allegations, claiming that he has been framed by the defendants.

Related: Turkey to use blockchain-based digital identity for online public services

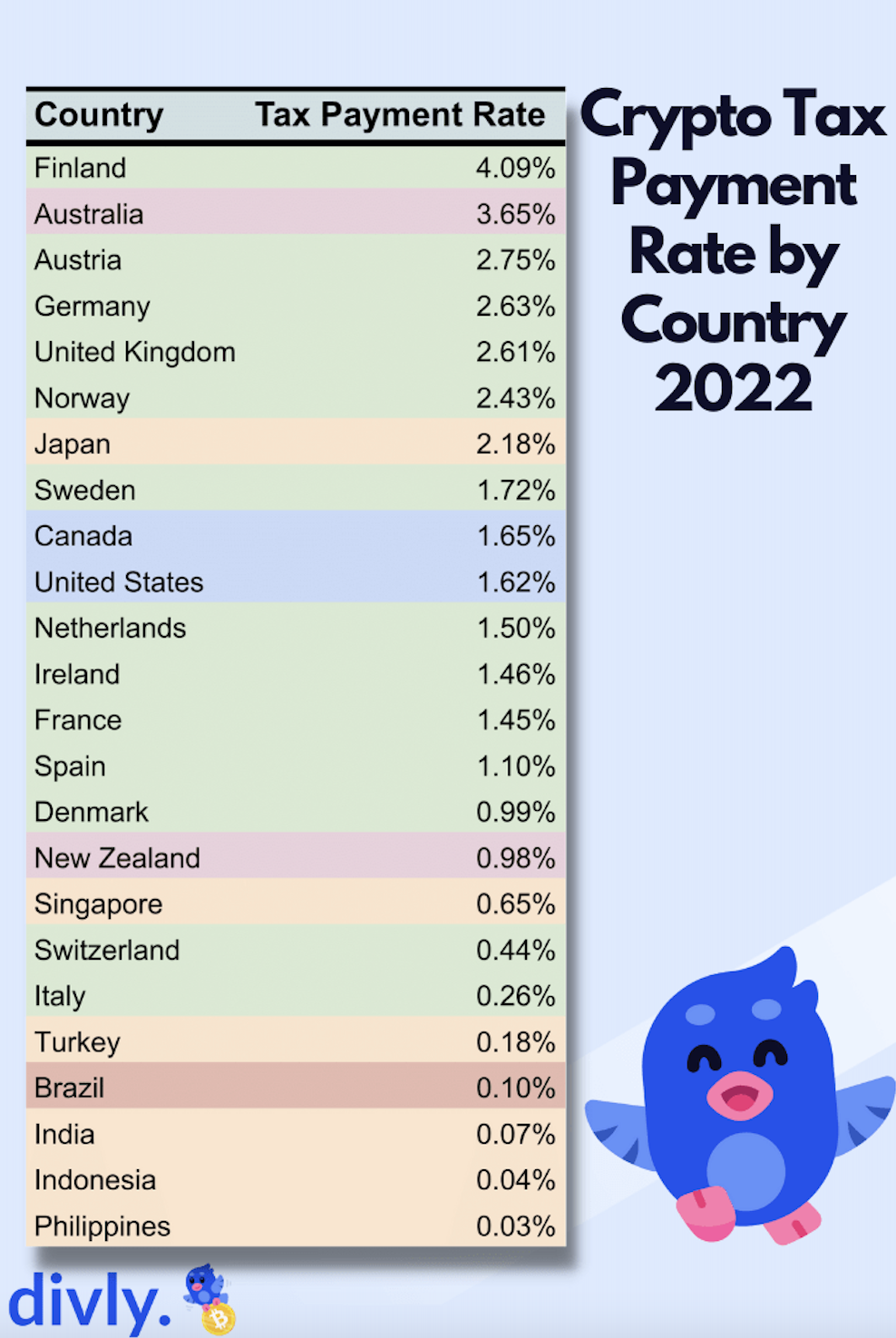

A recent study from Swedish crypto tax firm Divly shows that 99.5% of crypto investors did not pay taxes in 2022.

The report estimates that Finland has the highest proportion of crypto investors who paid the required taxes on crypto in 2022 at 4.09%, with Australia following closely behind with 3.65%.

However, the methodology used to arrive at the estimates remains questionable as the report notes that search volume data may not accurately reflect the actual number of crypto taxpayers, as not everyone who pays tax searches for crypto tax-related information online.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.