Quick Take

Long-term holders (LTHs) are defined by Glassnode as investors holding Bitcoin (BTC) for 155 days or more. Renowned for their astute investment strategies, LTHs typically accumulate BTC during bear markets and sell during bull runs to generate profits.

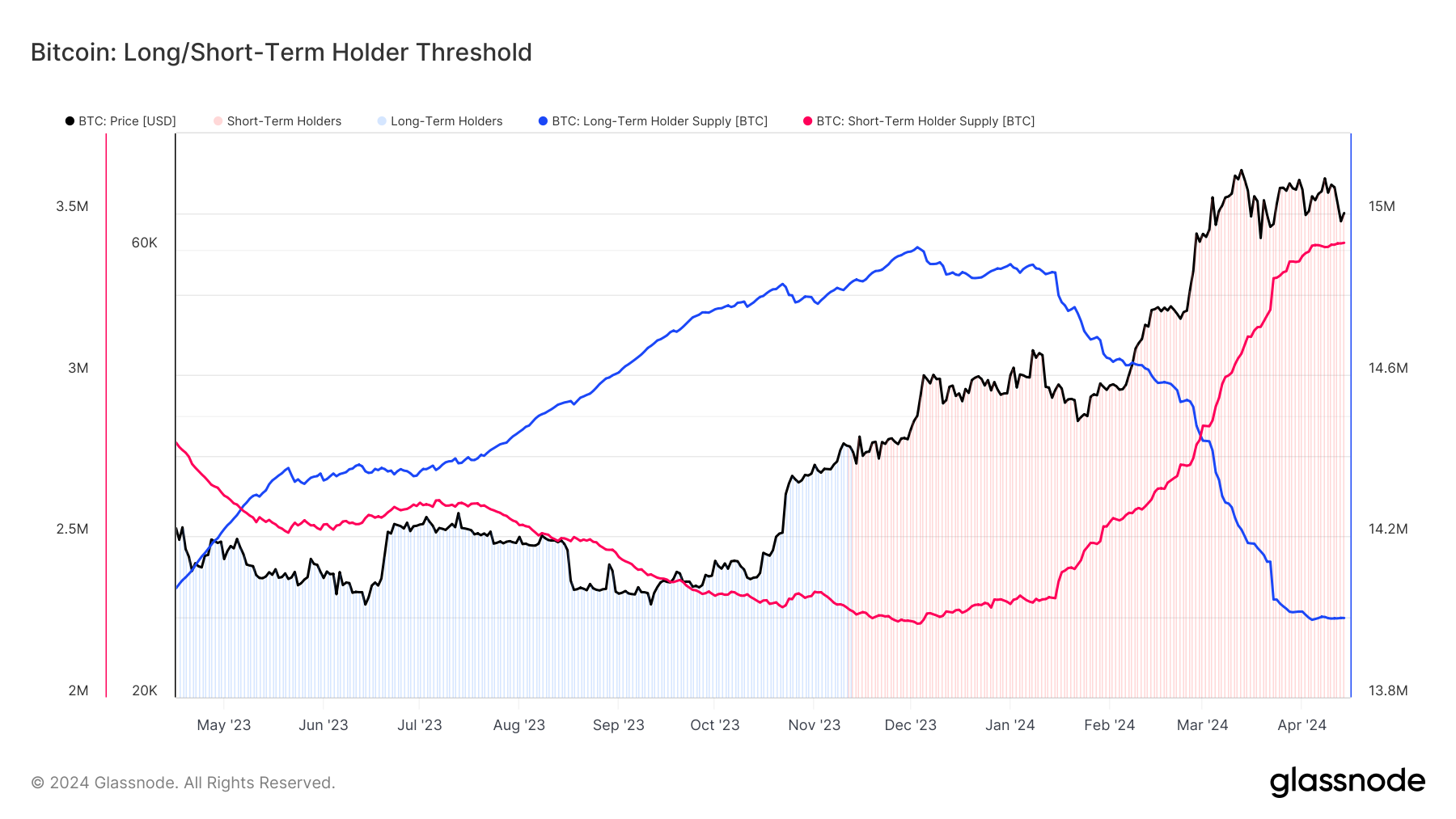

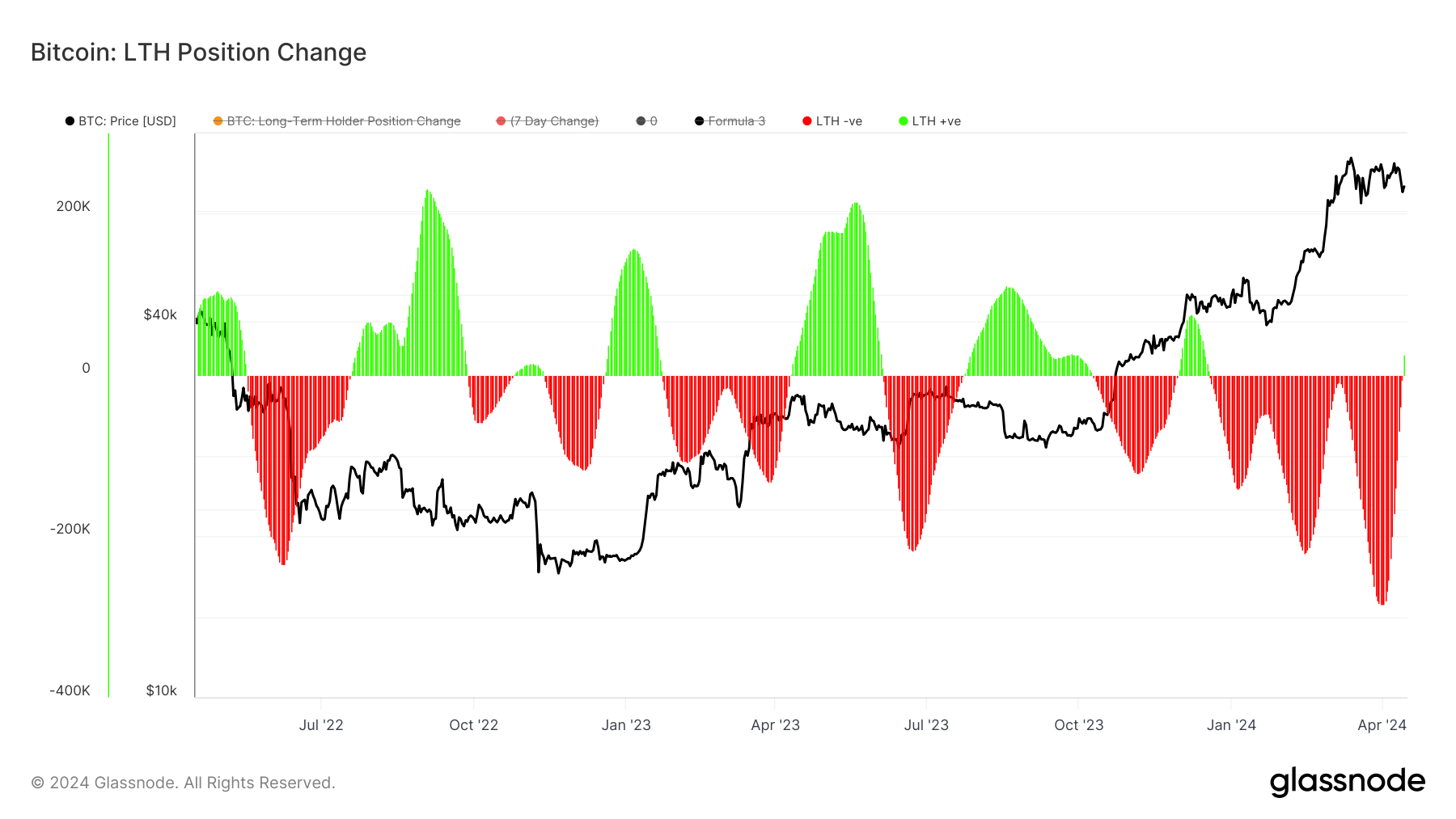

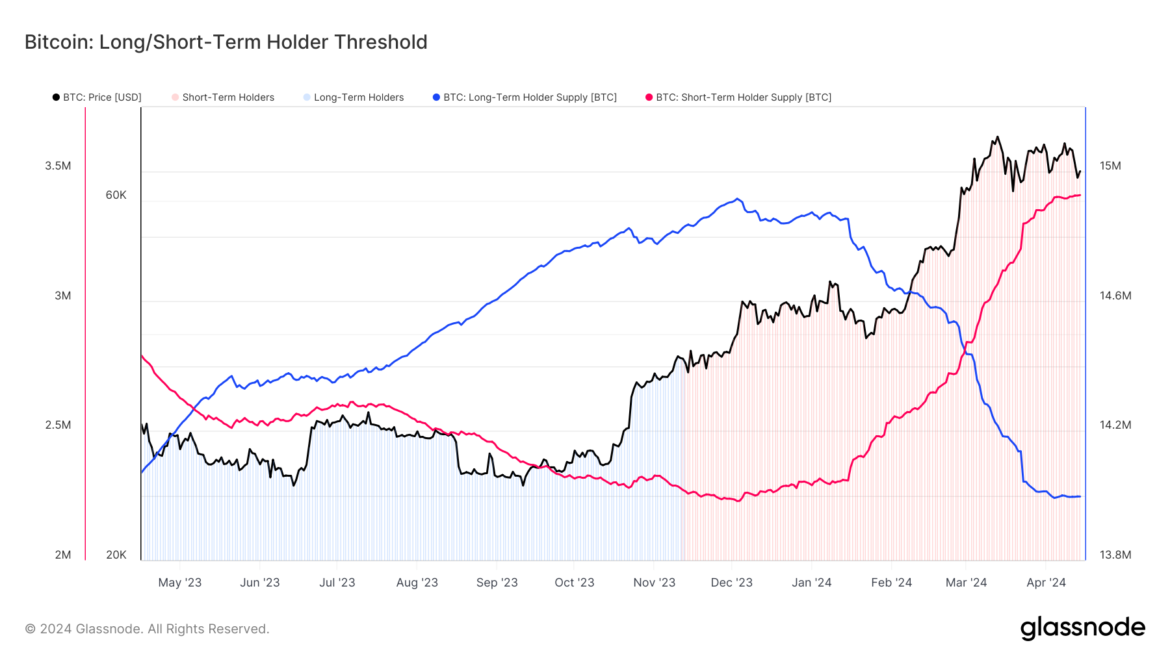

Glassnode data shows that since December, LTHs have offloaded around 1 million BTC; however, the recent GBTC sell-off has impacted Bitcoin’s long-term holder metrics. Excluding GBTC holdings, this accounts for roughly 700,000 Bitcoin sold by LTHs.

In contrast, short-term holders (STHs), those holding BTC for less than 155 days, persist in accumulating. During the period in which LTHs sold 1 million BTC, STHs have purchased approximately 1.2 million BTC, according to Glassnode data. While STHs have tapered their acquisition pace in the last 14 days, they remain active buyers. The interaction between LTHs and STHs indicates a promising outlook for short-term Bitcoin prices, with reduced sell pressure from LTHs.

As we can now discern from the data, because it takes 155 days to observe an LTH purchase, LTHs have capitalized on the opportunity amid the price surge from $25,000 in October 2023. Using a 14-day moving average, the LTH supply has experienced a slight increase, indicating accumulation. Currently, LTHs collectively hold approximately 14 million coins.

The post Bitcoin’s long-term holders shift to accumulation appeared first on CryptoSlate.

As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

This week, blockchain observers noticed that the “37X” wallet, once holding the title of the fifth-largest bitcoin wallet, was activated for the first time since 2019. This significant move involved the transfer of 94,504.03 bitcoin into three distinct addresses. One of these recipient wallets has now risen to become the sixth-largest bitcoin holder, showcasing a […]

This week, blockchain observers noticed that the “37X” wallet, once holding the title of the fifth-largest bitcoin wallet, was activated for the first time since 2019. This significant move involved the transfer of 94,504.03 bitcoin into three distinct addresses. One of these recipient wallets has now risen to become the sixth-largest bitcoin holder, showcasing a […]

Goldman Sachs is seeing more institutions diving into crypto, the global investment bank’s head of digital assets has revealed, noting that until now the bitcoin price action has been driven primarily by retail investors. “But it’s the institutions that we’ve started to see come in,” he stressed, adding that the appetite has “transformed.” Bitcoin ETFs […]

Goldman Sachs is seeing more institutions diving into crypto, the global investment bank’s head of digital assets has revealed, noting that until now the bitcoin price action has been driven primarily by retail investors. “But it’s the institutions that we’ve started to see come in,” he stressed, adding that the appetite has “transformed.” Bitcoin ETFs […]