The termination of the project led to a significant drop in Trekki NFT floor prices and sparked frustration among NFT holders and enthusiasts.

Ripple’s occasional sale of XRP tokens has always been pinpointed as one reason for XRP’s tepid price action. Once again, the crypto firm’s recent offloading of a significant amount of XRP has raised concerns about its negative effect on the crypto token.

On-chain data shows that Ripple transferred a total of 240 million XRP tokens to an unknown address in two separate transactions. The first transaction occurred on March 5, when it sent 100 million XRP to the address in question. Then, on March 13, the Ripple wallet again transferred 140 million XRP to this address.

These transactions have raised eyebrows, and members of the XRP community are contemplating whether these sales might have been the reason XRP’s price crashed recently. Notably, the crypto token rose to as high as $0.74 on March 11 before seeing a sharp correction.

It is worth mentioning that XRP’s price crashed on March 5, the day the first transaction was carried out. Data from CoinMarketCap shows that the crypto token, which was trading as high as $0.65 on the day, dropped to as low as $0.55 on the same day. However, it remains uncertain whether or not Ripple’s action was directly responsible for this price dip.

Meanwhile, XRP’s price was pretty stable on the day the second transaction occurred, although it was still declining from its weekly high of $0.7, recorded on March 11. The impact of Ripple’s XRP sales on the market continues to be heavily debated among those in the XRP community.

Pro-XRP crypto YouTuber Jerry Hall previously claimed that Ripple was suppressing XRP’s price with its monthly sales. However, there has also been a report that Ripple’s sale doesn’t impact prices on crypto exchanges.

Ripple’s price action defies logic, especially considering that the token’s fundamentals and technical analysis suggest it is well primed for a parabolic move. That is why talks about possible market manipulation continue to persist. It is also understandable that all fingers instantly point to Ripple since they are the largest XRP holders.

However, if Ripple is indeed not responsible for XRP’s stagnant price action, then there needs to be another explanation for why XRP has continued to underperform. Although the crypto token has continued to rank in the top 10 largest crypto tokens by market cap, it is worth mentioning that it is one of few tokens that has a negative year-to-date (YTD) gain.

At the time of writing, XRP is trading at around $0.61, up in the last 24 hours according to data from CoinMarketCap.

Token price at $0.6 | Source: XRPUSDT on Tradingview.com

Featured image from BitIRA, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Cryptocurrency analysts are abuzz with chatter surrounding NEAR Protocol (NEAR) as the token experiences a meteoric rise in value. The past month has been nothing short of phenomenal for NEAR, with its price leaping by an impressive 130%.

This surge, which translates to an impressive $7.91 per token at the time of writing, has not gone unnoticed, igniting a firestorm of interest and speculation within the investment community. But is this a genuine upswing or simply a fleeting fad?

Source: CoinMarketCap

While some analysts, like the prominent Rekt Capital, view this surge as a potential reversal of a multi-year downtrend, others urge caution. The cryptocurrency market, after all, is notorious for its wild fluctuations. A token’s price can reach dizzying heights only to come crashing down just as quickly.

Finally – Near Protocol has revisited its multi-year Macro Downtrend

Now #NEAR will try to break this to further build on its current bullish momentum

Breaking this Macro Downtrend would likely see price revisit the old All Time High resistance area

#BTC #NEARprotocol… pic.twitter.com/wboVljOJsc

— Rekt Capital (@rektcapital) March 11, 2024

Analysts have forecasted a bullish trend for NEAR in the immediate future. Their prediction suggests a 10% increase, placing the price at around $7.48 by March 13, 2024.

This projected increase comes with a market capitalization of $7.65 billion and a notable 24-hour trading volume of $2.2 billion. However, forecasts, as some experts point out, should be viewed with a critical eye. The market is an intricate web of factors, and unforeseen events can easily derail even the most meticulously crafted predictions.

Bitcoin is now trading at $73.319. Chart: TradingView

Technical indicators, while offering valuable insights, should not be the sole basis for investment decisions. The Fear and Greed Index, currently hovering at an “extreme greed” of 82 for NEAR, paints a picture of a market potentially fueled by euphoria rather than sound judgment.

Investors piling in solely based on such sentiment, with NEAR having already surged 8.06% in the last 24 hours, might be setting themselves up for disappointment if a correction were to occur.

However, dismissing NEAR’s potential entirely would be unwise. To understand this, we need to examine thoroughly. NEAR Protocol is a blockchain platform designed to address scalability issues that have plagued older blockchain technologies like Ethereum.

NEAR boasts features like sharding, a method for distributing processing power across a network of computers, to facilitate faster transaction speeds and lower fees.

This focus on scalability has attracted the attention of developers seeking to build decentralized applications (dApps) on a platform that can handle high volumes of traffic. Several promising dApps are already being built on NEAR, including DeFi (decentralized finance) protocols and NFT (non-fungible token) marketplaces.

A thriving ecosystem of dApps could be a key driver of long-term growth for NEAR. Crypto experts, drawing insights from the price fluctuations observed at the onset of 2023, have formulated an average projected NEAR rate of $10.06 for March 2024.

While this average is a benchmark, fluctuations within the market suggest potential variations, with the minimum expected price hovering around $9.8 and the maximum reaching $10.2. Considering these forecasts, investors may be enticed by the potential return on investment (ROI) of 35%, indicative of the promising growth prospects for Near Protocol in the coming months.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bill Ackman, a well-regarded investor and CEO of Pershing Square Capital Management, outlined a hypothetical scenario that has sparked intense debate among crypto enthusiasts, economists, and environmentalists.

Ackman’s comments touched on several critical issues, including the sustainability of Bitcoin mining, its implications for global energy consumption, and the broader economic consequences of a rising reliance on cryptocurrencies.

He tweeted:

“A scenario: Bitcoin price rise leads to increased mining and greater energy use, driving up the cost of energy, causing inflation to rise and the dollar to decline, driving demand for Bitcoin and increased mining, driving demand for energy and the cycle continues. Bitcoin goes to infinity, energy prices skyrocket, and the economy collapses. Maybe I should buy some Bitcoin.”

He added that this could also work in “reverse.”

Ackman’s “scenario” prompted a spectrum of responses, ranging from defensive retorts to calls for a more nuanced understanding of Bitcoin’s energy use. The debate was further catalyzed by a comment highlighting the considerable energy consumption attributed to Bitcoin mining, likened to that of an entire country’s worth — Greece.

Critics argue that Bitcoin’s energy usage is an undeniable problem with significant environmental implications. In contrast, proponents argue that skeptics need to engage more deeply with the crypto community to understand the complexities of mining and its potential benefits for the energy sector.

Experts in the field, including Michael Saylor, were cited for their views on the energy debate.

Saylor himself added to the debate and argued that Bitcoin mining could actually lead to more efficient energy solutions and drive the adoption of renewable energy sources by creating a demand for cheaper, more sustainable energy.

Alexander Leishman responded by emphasizing the competitive nature of Bitcoin mining, suggesting that the industry’s search for profitability naturally leads to the utilization of cheaper, often renewable, energy sources.

This perspective challenges the notion that Bitcoin mining exacerbates demand for conventional energy resources, arguing instead for its potential role in promoting energy efficiency and sustainability.

Troy Cross argued that increases in Bitcoin’s value do not necessarily lead to higher energy costs, pointing out the sophistication of mining technology and the strategic deployment of mining operations across the globe.

Cross said:

“The cheapest power is power no one else wants, stranded in time or space. Consuming that power is Bitcoin’s destiny. And while it may deviate in a short time frame during outrageous bitcoin price spikes, it will quickly and inevitably return to its rightful place as bottom feeder, not apex predator.”

Meanwhile, Alex Gladstein, known for his environmental advocacy, supported the argument that Bitcoin mining predominantly taps into excess or renewable energy sources. His stance reinforced the idea that the Bitcoin mining sector is contributing to the optimization of the global energy mix rather than detracting from it.

Industry voices like Hunter Horsley and Muneeb Ali projected a future where the Bitcoin network’s energy demand could potentially decrease. They highlighted the blockchain’s halving events and the eventual reliance on transaction fees as mechanisms that will reduce the incentive for energy-intensive mining operations.

A notable argument likened Bitcoin’s ecosystem to a “self-regulating organism” governed by precise mathematical laws that contribute to economic stability. This viewpoint illustrates the inherent predictability and systemic resilience of Bitcoin, contrasting it with traditional financial assets.

By framing Bitcoin and similar technologies as self-regulating organisms, proponents argue for the robustness, adaptability, and innovative potential of these systems. They suggest that, much like living organisms, these systems are capable of evolving and self-correcting in response to challenges, thereby ensuring their survival and relevance in a constantly changing environment.

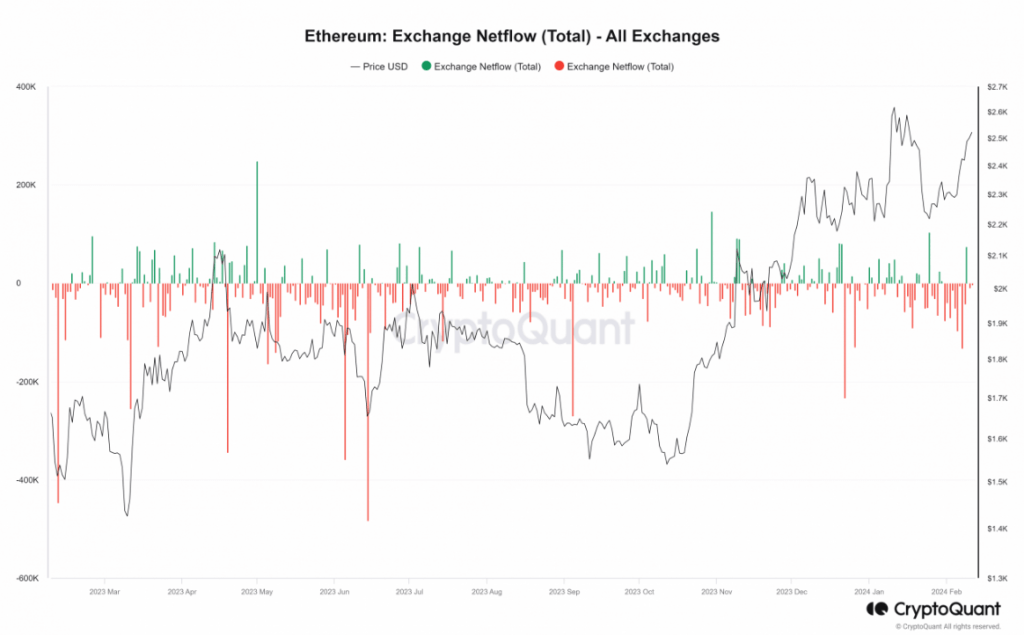

In a recent development, Ethereum [ETH] co-founder Jeffrey Wilcke’s wallet has made a notable deposit of 4,300 ETH to a cryptocurrency exchange.

The deposit made by Wilcke amounts to 22,000 ETH, valued at approximately $41.1 million at the time. With Ethereum’s current price standing at $2,500, this deposit has injected renewed interest and excitement into the market.

Despite this substantial deposit, the overall trend of Ethereum’s netflow remains unaffected. This deposit comes after a considerable hiatus, with the last recorded transaction from this wallet dating back to June 2023.

Jeffrey Wilcke, the Co-founder of #Ethereum, deposited 4,300 $ETH($10.7M) to #Kraken 7 hours ago. pic.twitter.com/ROG0evjirh

— Lookonchain (@lookonchain) February 10, 2024

Source: Lookonchain/X

According to an analysis of the Netflow metric on CryptoQuant conducted by NewsBTC, there has been a continued outflow of ETH from exchanges. In fact, more than 9,800 ETH left the exchanges at the end of trade on February 10th. However, it is worth noting that the previous day witnessed a significant inflow of over 75,000 ETH.

In the midst of these market movements, Ethereum’s price has been on an upward trajectory over the past three days. As of the time of this report, ETH is trading at over $2,500, indicating a strong positive trend.

The Short Moving Average and Relative Strength Index (RSI) further validate this bullish sentiment. The RSI has crossed the 60 mark and is moving towards the overbought zone, while the price remains above the yellow line, acting as a support level.

Furthermore, Ethereum has been making waves in the crypto world, surpassing even Bitcoin and signaling a robust bullish trend. All eyes are now on ETH, with growing expectations that it may soon hit the $3,000 milestone.

Ethereum currently trading at $2,501.5 on the daily chart: TradingView.com

Speculation is also building about a potential climb to $5,000, with rumors circulating about an upcoming upgrade referred to as “Dencun” next week. However, it is important to note that information regarding this specific upgrade is limited, and further research is required to verify its impact on Ethereum’s potential price surge.

As the market eagerly anticipates the future trajectory of Ethereum, investors and enthusiasts are advised to exercise caution and stay informed. Tracking official Ethereum community channels, developer blogs, and reputable cryptocurrency news sources will provide valuable insights into the latest developments and upgrades affecting ETH’s price movements.

Wilcke’s recent deposit, combined with Ethereum’s positive trend and the anticipation surrounding the rumored Dencun upgrade, has created an atmosphere of excitement and speculation within the cryptocurrency market. With ETH surpassing Bitcoin and eyeing new all-time highs, the future of Ethereum holds immense potential for investors and traders alike.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin (BTC) climbed back above $43,000 during Asian trading hours following news that BlackRock amended its spot exchange-traded fund (ETF) application to comply with the U.S. Securities and Exchange Commission (SEC).

Coinglass data shows that the price movement liquidated $206 million across all assets from more than 81,000 crypto traders during the past day. Long traders lost $107.82 million, while short traders were liquidated $98 million during the reporting period.

Across assets, speculators on BTC price accounted for roughly $68 million, or 32%, of the total losses incurred—$42 million were liquidated from traders betting against further BTC price increases. In comparison, about $26 million was liquidated from long-position holders.

Notably, Bitcoin has further reduced its low Liquidation Sensitivity Index (LSI) score of just $11.72 million USD/%, the lowest level recorded by CryptoSlate. This change suggests markets are further maturing with less leverage in the market betting against Bitcoin, with only $67.9 million liquidated from a 6% price swing.

Ethereum experienced liquidations across long and short positions, with $18.38 million and $16.6 million respectively.

Large-cap cryptocurrencies like Solana, XRP, and Dogecoin also witnessed notable liquidations totaling $7.66 million, $3.2 million, and $3.5 million, respectively.

Meanwhile, crypto traders using the embattled Binance platform accounted for more than 50% of the total losses suffered in the market. The exchange users lost $102.85 million during the past day, with the most significant single liquidation order being an $8.82 million long position BTC.

The current price performance represents a reversal of fortune for the top cryptocurrency that had begun the week meekly, falling to around $41,000 on Dec. 18 amid a broader market drawdown.

However, its price picked up following news that BlackRock, the world’s largest asset manager and one of the applicants for a spot ETF, revised its applications with the SEC.

BlackRock’s new amendment revealed an IBIT market ticker and that the relevant transactions will occur in exchange for cash.

In a recent note to investors, Markus Thielen, the head of research at Matrixport, asserted that BTC is the superior asset for this year, adding that more investors are pondering whether to allocate more capital next year.

Meanwhile, other top 10 cryptocurrencies, including XRP, Ethereum, Solana, and Avalanche, saw gains of between 3% and 9%, respectively.

Kaspa, a relatively recent entrant to the cryptocurrency market, has emerged as one of the top performers this weekend, experiencing a remarkable surge in value. This surge aligns with a broader trend, as the entire market capitalization of the crypto market has grown by over 5%, underscoring a substantial increase in overall value.

In the past week alone, Kaspa’s price has soared significantly, contributing to its standout performance in the dynamic cryptocurrency landscape.

The value of Kaspa (KAS) surged last week after it was added to the Coinbase Global platform, hitting a record high. This is frequently linked to the “Coinbase effect,” which gives the listed commodity a sense of legitimacy.

Also, following the announcement of possible expansion in the Bitcoin cloud mining phenomenon, the altcoin saw a sharp increase. In the next days, there will also be updates on KAS’s integration with the OKX wallet and a $1 million airdrop.

The sentiment gained steam when one of the biggest cryptocurrency exchanges in the world, Binance, declared that it would launch Kaspa for perpetual trading, Friday, drawing interest from investors.

The token’s price climbed by 15% in just one day as a result of this statement, while trading volume increased by 80% between Thursday and Friday. With better order execution and lively buyer-seller interaction, the increased activity indicates that the market is reacting favorably to the listing.

Source: Coingecko

At the time of writing, KAS was trading at $0.135, up nearly 6% in the last 24 hours, and commanding a solid 55% rally in the last seven days, data from crypto price aggregator Coingecko shows.

KAS market cap currently at $2.8 billion. Chart: TradingView.com

As November commenced, there was a notable positive turn of events as the price successfully breached the upper boundary, signaling a potential shift in market dynamics.

Subsequently, the Kaspa coin witnessed substantial price movement, attaining a fresh annual peak. However, it encountered resistance and was turned away at the $0.09732 mark, leading to a correction with a decline exceeding 10% in value.

KAS seven-day price action. Source: Coingecko

Despite this setback, Kaspa’s price regained traction, surpassing resistance levels and steadily appreciating. In more recent developments, the price confronted rejection at $0.137, setting the stage for an imminent retest of this level, the outcome of which remains uncertain.

On average, the price of a newly listed coin on the Coinbase exchange tends to increase by over 80% within the first five days of its listing. Notably, Kaspa has had a growth of more than 60% since reaching a low of $0.0800 on November 13.

The act of becoming publicly listed on the top cryptocurrency exchange in terms of trading volume is indicative of establishing credibility and authenticity.

Even while metrics like the Relative Strength Index (RSI) indicate that Kaspa might be overbought, upside is still possible. Long-term investors may have an opportunity if KAS can break above $0.140 and achieve a new range high of $0.148, according to market observers.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Pixabay

While the prospect of a Bitcoin ETF is undoubtedly exciting, it is essential to acknowledge the potential challenges and roadblocks that may surface.

The crypto community is abuzz with anticipation as the US Securities and Exchange Commission (SEC) considers multiple filings for spot Bitcoin (BTC) Exchange Traded Funds (ETFs). SEC Chair Gary Gensler recently revealed that the regulatory body has between eight to ten such filings on its plate for consideration.

The news has had a significant impact on the cryptocurrency market, with Bitcoin experiencing a 14% surge earlier this week, fueled by expectations of imminent SEC approval. However, as of early trading today, Bitcoin saw a 1.6% dip and is currently priced at $33,958.

Gensler was careful not to prejudge the applications’ outcomes, stating, “They’ll come potentially to the five-member commission. I’m not going to prejudge them but I don’t have anything on timing. They all have various different filing dates.”

This uncertainty leaves the crypto community on edge, eagerly awaiting further developments.

Notably, Cathie Wood’s ARK Invest has an application at the forefront of the SEC’s considerations, with a 240-day comment period expiring on January 10, 2024. The regulatory body will have to make a decision either to approve or reject the application by that date. Other prominent financial firms, including BlackRock Inc (NYSE: BLK), Bitwise, WisdomTree, Fidelity Investments, and Invesco, have also submitted applications for Bitcoin-related funds in the US.

While the prospect of a Bitcoin ETF is undoubtedly exciting, it is essential to acknowledge the potential challenges and roadblocks that may surface. In the past, the SEC has cited concerns related to market manipulation, fraud, and investor protection when rejecting Bitcoin ETF proposals. Addressing these concerns remains a significant hurdle for the SEC as it navigates the path to approval.

Furthermore, the recent court ruling instructing the SEC to reconsider Grayscale Investments’ application to convert its existing Bitcoin trust into a spot Bitcoin ETF adds an additional layer of complexity. While it is highly unlikely, some analysts believe the SEC could still reject spot Bitcoin ETF applications.

Analysts at JPMorgan Chase & Co (NYSE: JPM) believe that if the SEC decides to reject applications for spot Bitcoin ETFs, it could open the door to lawsuits from disappointed applicants. The analysts noted that “Any rejection could trigger lawsuits against the SEC, creating more legal troubles for the agency.”

The SEC suffered a significant setback in a case involving digital asset manager Grayscale Investments, which sued the commission for refusing its request to convert its flagship Bitcoin fund into a spot Bitcoin ETF. With the SEC’s decision not to appeal, the court ordered a re-evaluation of Grayscale’s application.

Additionally, JPMorgan analysts predict that multiple spot Bitcoin ETFs could launch within the coming months, as issuers are making adjustments in disclosure language and working diligently to navigate the market regulator’s requirements.

next

Bitcoin News, Blockchain News, Cryptocurrency News, Funds & ETFs, Market News

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

Gold prices climbed back above $1,900 an ounce on Friday to settle at their highest in three weeks, as Israel ordered over a million people to evacuate Gaza, lifting safe-haven demand for the precious metal.

“The events in the Middle East have taken center stage, vastly overshadowing market concerns and discussions,” Stephen Innes, managing director at SPI Asset Management, told MarketWatch. “The conflict and its implications have captured the world’s attention and become the primary focus of media and public discourse, temporarily diverting attention from financial and economic matters.”

The Israeli military told more than 1 million Palestinians, almost half of the population, on Friday to evacuate northern Gaza, raising expectations that a ground invasion is imminent against the ruling Hamas militant group.

“If Israel moves into Gaza with their modern-day military might, when considering the presence of hostile actors in the region and the fundamental nature of the conflict being rooted in religious differences, we could be on the cusp of something significant,” said Innes.

Given that, “I think it is fear of war driving gold,” he said. “I don’t think traders wanted to be short oil or gold…over the weekend, just in case multiple Middle East powder kegs explode.”

Against that backdrop, the December gold contract

GCZ23,

GC00,

climbed by $58.50, or 3.1%, to settle at $1,941.50 an ounce on Comex, up 5.2% for the week.

That was the highest most-active contract settlement since Sept. 22, and biggest daily percentage gain since early December, according to Dow Jones Market Data.

“You know what they say in the gold market is to never let a good crisis go to waste,” said Innes. “Indeed, geopolitical risk is starting to take charge across a swath of cross-assets where gold and oil bulls are doing the early victory laps.”

Gold prices had already moved up in recent days, with Thursday’s decline marking the first in five trading sessions.

Gold futures traded as low as $1,823.50 on Oct. 6, the lowest intraday level since March, then traded mostly higher in the wake of last Saturday’s Hamas attack on Israel.

Gold has gained more than 4% since hitting a multimonth low earlier in October, buoyed in part by declining bond yields as “investors increased bets on the end of the Federal Reserve’s hiking cycle,” said Ricardo Evangelista, senior analyst at ActivTrades, in emailed commentary.

Meanwhile, Adrian Ash, director of research at BullionVault, told MarketWatch that any talk of “safe haven” flows into gold “misses the fact” that most bullion-backed exchange-traded funds have actually continued to shrink so far this week, rather than expand.

Users of BullionVault have been net sellers since the weekend too, albeit very marginally after more chose to take profits in September, he said.

“With the stock market also continuing to rise despite the worsening regional tensions, it seems investors — for now at least — are watching what happens to interest-rate expectations more than they’re watching the dreadful news from the Middle East,” said Ash.

Buying gold as an investment in the face of uncertainty driven by geopolitical issues, however, isn’t always the best idea.

Brien Lundin, editor of Gold Newsletter, said he’s “always recommended against buying gold based on geopolitical crisis” because that’s “almost always a losing game.”

Gold is a hedge against monetary issues, specifically the ongoing depreciation of currencies, he said. “There’s no rationale for buying it due to a specific geopolitical event, other than a bet that one will be able to sell it at a higher price to someone else. And this rarely works.”

On the other hand, in the current situation, there is a “chance that this is the event that stops the Fed rate hikes,” said Lundin. “For this gold rally to continue, we’ll need this geopolitical driver to force a change in Fed policy.”

“ “For this gold rally to continue, we’ll need this geopolitical driver to force a change in Fed policy.” ”

— Brien Lundin, Gold Newsletter

He said he didn’t expect the next catalyst for gold to be something obvious like the banking system or a recession, but “something out of left field.”

“The Hamas attack fits that bill perfectly,” said Lundin.

As Jerome Powell, the Federal Reserve (Fed) Chair, prepares to return to Jackson Hole this Friday, the Bitcoin (BTC) market is experiencing a sense of anticipation due to the similarities in the current price action compared to the period leading up to last year’s speech.

Key moving averages have been tested and lost over the past two weeks, followed by a period of consolidation, reminiscent of previous events.

However, it is important to note that these similarities do not guarantee a repeat of the past, as market conditions and Powell’s stance have since evolved.

According to Keith Alan, co-founder of analysis and crypto research firm Material Indicator, last year, in the two weeks preceding Powell’s speech, BTC’s price broke through crucial technical support levels represented by the 21-day, 50-day, 100-day, and 200-week Moving Averages (MA).

Subsequently, a period of consolidation ensued, followed by a significant price drop in response to Powell’s hawkish tone during the speech. Alan stated:

Remember when Fed Chair Powell spoke from Jackson Hole last year and his hawkish tone triggered a 29% BTC dump that took 5 months to recover?

Notably, the recent price action in the Bitcoin market has displayed similarities to last year’s pattern. Over the past two weeks, Bitcoin has tested and lost these same key moving averages, and it is currently undergoing a phase of consolidation, mirroring the events leading up to Powell’s previous address.

Keith Alan emphasizes that since last year’s Jackson Hole event, there have been notable changes. Core inflation has decreased, and Powell’s approach to communication has become more “measured”.

It is uncertain whether Powell will adopt a hawkish or dovish stance in his upcoming speech, making it challenging to predict the market’s reaction with certainty. What is evident, however, is that the market is primed for a significant move.

Additionally, Alan suggests that the formation of a lower low in price increases the likelihood of an extension of the existing downtrend. Market participants should be prepared for the possibility of further testing of support levels.

As the Bitcoin market awaits Powell’s speech, market sentiment remains dynamic. Traders and investors are anticipating potential market-moving cues from the event.

As the date of Jerome Powell’s return to Jackson Hole approaches, Bitcoin has displayed a notable recovery of 2.1% within the past 24 hours, marking a positive upward movement that brings it closer to the $27,000 threshold.

However, it is crucial to note that if the outcome of Jerome Powell’s speech on Friday proves favorable for crypto investors and propels Bitcoin’s price to higher levels, the cryptocurrency may encounter a significant obstacle in the form of its 200-day moving average positioned at $27,200.

Featured image from iStock, chart from TradingView.com