The U.S. Energy Information Administration (EIA), a statistics agency of the U.S. Energy Department, has sent letters to cryptocurrency miners requiring data related to energy consumption and configuration of their mining sites. According to one of the letters posted on social media, miners have until February 23 to report the info regarding the activities carried […]

The U.S. Energy Information Administration (EIA), a statistics agency of the U.S. Energy Department, has sent letters to cryptocurrency miners requiring data related to energy consumption and configuration of their mining sites. According to one of the letters posted on social media, miners have until February 23 to report the info regarding the activities carried […]

Source link

starts

Kraken Starts Requiring Info on Self-Custody Crypto Wallet Ownership in the UK

Kraken, a U.S.-based cryptocurrency exchange, has started requiring additional information in the U.K. regarding transactions of self-custody wallets made to and from its accounts. Kraken sent an email to some of its U.K. customers, stating that if the information required was not provided, it could result in an account lock until the required data is […]

Kraken, a U.S.-based cryptocurrency exchange, has started requiring additional information in the U.K. regarding transactions of self-custody wallets made to and from its accounts. Kraken sent an email to some of its U.K. customers, stating that if the information required was not provided, it could result in an account lock until the required data is […]

Source link

Bitcoin price is holding gains above the $41,500 zone. BTC is rising and might gain bullish momentum above the $43,200 resistance zone.

- Bitcoin is attempting a fresh increase above the $42,500 resistance zone.

- The price is trading above $42,200 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support near $42,280 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if there is a close above the $43,200 resistance zone.

Bitcoin Price Remains Supported

Bitcoin price declined and broke the $42,200 support zone. BTC formed a base above the $41,200 level and recently started a fresh increase.

A low was formed at $41,317 and the price is now rising. There was a move above the $42,000 resistance zone. The price climbed above the 50% Fib retracement level of the downward move from the $43,792 swing high to the $41,317 low.

Bitcoin is now trading above $42,200 and the 100 hourly Simple moving average. There is also a key bullish trend line forming with support near $42,280 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $42,800 level. It is close to the 61.8% Fib retracement level of the downward move from the $43,792 swing high to the $41,317 low. The first major resistance is $43,200. A close above the $43,200 level could send the price further higher.

Source: BTCUSD on TradingView.com

The main hurdle sits at $43,800. A close above the $43,800 resistance could start a decent move toward the $44,500 level. The next key resistance could be near $45,000, above which BTC could rise toward the $46,200 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $43,200 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $42,250 level and the trend line.

The next major support is near $41,620. If there is a move below $41,620, there is a risk of more losses. In the stated case, the price could drop toward the $40,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $42,250, followed by $41,620.

Major Resistance Levels – $42,800, $43,200, and $43,800.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

MP Materials Starts Shipping Rare Earth Metals — at the Worst Time Possible

Pity a commodities stock in a cyclical market even when the commodity in question is one of the hottest natural resources on the planet.

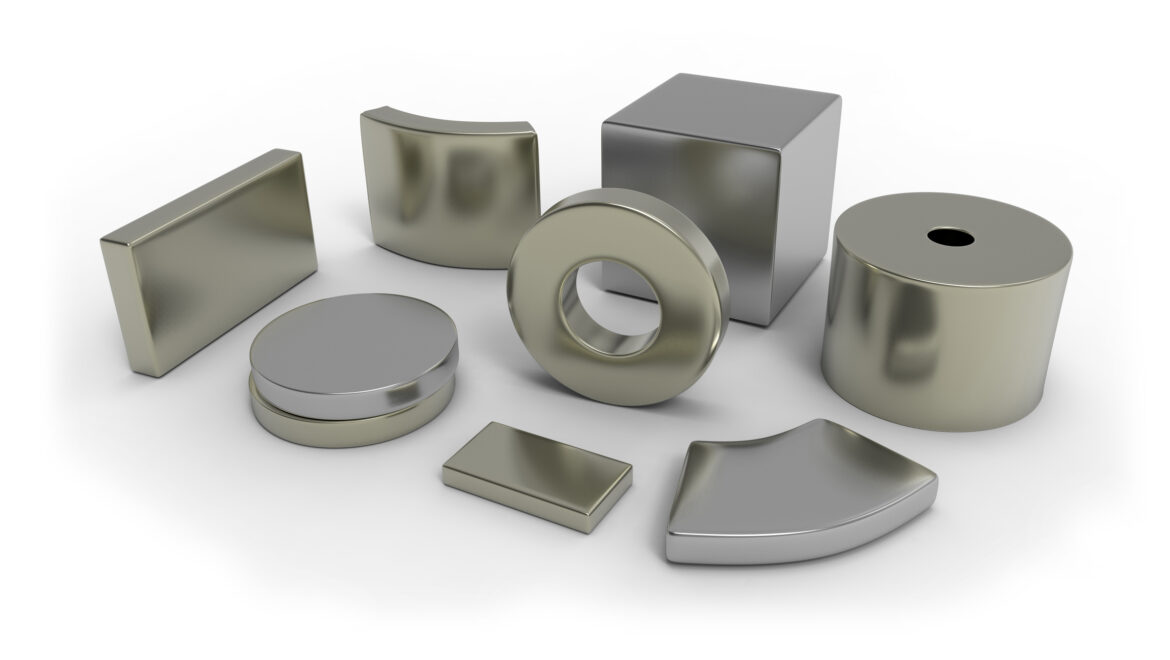

Ever since the green revolution got underway, and especially since the Biden administration got its green energy-friendly Inflation Reduction Act passed last year, with billions of dollars of subsidies for technologies such as electric cars and rechargeable batteries and wind turbines, investors have looked for ways to profit off the trend toward greater American investment in renewable energy. And one of the most obvious candidates to benefit from this trend (one would think) was MP Materials (MP 0.44%), the biggest American miner of rare earth elements used to make permanent magnets used in electric vehicles and wind turbines.

But here’s the thing: MP Materials reported its third- quarter 2023 earnings earlier this month, but instead of making bank, the company had to report a loss.

A loss by any other name is still a loss

MP’s numbers last quarter looked pretty miserable. On the one hand, MP sold and shipped 9,177 metric tons of unrefined rare earth oxides (REO, which is to say, rare earth metals) in the quarter, which was 14% less than it shipped in the prior year’s Q3.

That wasn’t the bad news, though. Despite high interest rates weighing on both sales of electric cars and installations of wind turbine projects, management noted that demand for REO was actually pretty steady year over year. In fact, the only reason shipments shrank at all was because MP has itself begun using some of the REO it produces — taking it and refining it into pure rare earth metals. (More on that in a moment.)

The really bad news was that REO prices continue to slide. The price per ton that MP was able to collect, in fact, fell by more than half. Thus, smaller shipments plus lower prices sent quarterly revenue down 58% year over year to $52.5 million and flipped MP from a $0.33 per-share quarterly profit to a $0.02 per-share loss.

(Admittedly, when calculated as a non-GAAP number, MP still “beat estimates” by reporting a $0.04 per-share non-GAAP profit. But another word for non-GAAP, in this instance, is a GAAP loss.)

Right place, wrong time

But wait! This bad news gets worse!

Q3 2023 wasn’t just a lousy quarter for selling rare earth oxides. It was also the first quarter that MP succeeded in executing Stage II of its three-part plan to bring back the production of rare earth magnets to U.S. shores (as opposed to exporting rare earth oxides to China, so they can refine the oxides there, turn them into magnets, and then… sell them back to the U.S.).

As MP advised, having now established its own refining capability, the company “produced separated NdPr” on U.S. soil, repatriating a critical national security capability in Q3. (NdPr is pure, separated neodymium praseodymium. So you can see why they use the less tongue-twisty chemical abbreviation.)

What’s next for MP Materials

MP intends to continue expanding Stage II production of pure NdPr. What’s more, despite falling prices, the company is forging ahead with a new “Upstream 60K” strategy to grow REO output by 50% over the next four years.

That might seem counterintuitive. Ordinarily, commodity companies respond to falling commodity prices by cutting production to bring supply and demand into better balance on the theory that this will boost prices and improve profits. In MP’s case, however, the more REO the company mines, the more pure NdPr it can produce, and eventually, the more rare earth magnets it can manufacture for its industrial customers. Just roughly calculating from the 1,499-ton fall in REO sales from Q3 2022 to Q3 2023, it appears that MP needs approximately 30 tons of REO to produce one ton of NdPr. So if MP wants to produce more than the 50 tons of NdPr it separated last quarter, it will need to mine a lot of REO.

Long story short, it appears that MP Materials is playing the long game here. Undeterred by crashing REO prices in the short term, it’s ramping up REO production in pursuit of its goal to become a major supplier of rare earth magnets to the American market — freeing U.S. companies from reliance on China as their magnet supplier.

This is good news for the U.S. from a national security perspective. As for whether it will be good news for investors in MP and result in the 20-times increase in profit (between now and 2027) that analysts polled by S&P Global Market Intelligence predict… this remains to be seen.

Novartis Completes Sandoz Spinoff, Sandoz Starts Trading at 24 Swiss Francs

Half of Sandoz’s revenue comes from Europe. Thus, it will be looking to leverage its brand presence in Europe for further growth.

Emerging reports suggest that Novartis has completed the spinoff of its Generics and Biosimilars division, Sandoz, on Wednesday, October 4.

The Swiss drug company first made its intention known in August 2022, commencing a strategic review to determine the fate of Sandoz. The review revealed a 100% spinoff was in the best interest of shareholders. Following that, Novartis shareholders approved this plan at the company’s Extraordinary General Meeting held in September.

Joerg Reinhardt, Chair of the Board of Directors of Novartis believes the step will allow both companies to optimize management focus and allocate capital on business priorities.

Novartis Priming for a Change with Sandoz Spinoff

CEO of Novartis International, Vasant Narasimhan highlighted the historicity of the moment for both companies. He noted that the spinoff was a culmination of the management’s effort in six years to reposition Novartis as a pure-play innovative medicines company.

“We exited consumer health to create one of the largest consumer health companies, exited Alcon in the largest public market spin in European capital markets, we exited our Roche stake”, told Narasimhan. With the spinoff complete, Novartis will now focus on R&D and bringing new medicinal products to markets around the world.

Following the announcement, the shares of the company climbed more than 3% in early trade in Zurich. Novartis also expects to grow its sales and core operating income.

Sandoz to Build on Growth Momentum

Meanwhile, Sandoz has a strong brand position in Biosimilars and Generics medicine. In 2021, it generated $9.6bn in sales across 100 markets. It has also continued to grow its sales quarterly.

Narasimhan expressed confidence in Sandoz’s ability. He said:

“With several consecutive quarters of sales growth, Sandoz starts out from a position of strength as a global leader in Generics and Biosimilars.”

Sandoz CEO Richard Saynor agrees with this, stating that the company has a broad aim to build on its sales momentum over the last seven quarters.

“By becoming an independent company, we can focus on how we grow that business, bring more products to patients and continue to build on the momentum that we’ve created over the last couple of years,” he added.

Already, half of Sandoz’s revenue comes from Europe. Thus, it will be looking to leverage its brand presence in Europe for further growth. Jefferies analysts have valued the Sandoz listing at between $12.3 billion and $16.2 billion.

next

Business News, Market News, News, Stocks

An experienced writer with practical experience in the fintech industry. When not writing, he spends his time reading, researching or teaching.

You have successfully joined our subscriber list.

Crypto exchange Binance, on Thursday, Aug. 3, announced that it would be opening trading for the Bitcoin/First Digital USD (BTC/FDUSD) and Ether/First Digital USD (ETH/FDUSD) trading pairs alongside an updated zero-fee Bitcoin (BTC) and Ether (ETH) trading, with newly added FDUSD stablecoin spot and margin pairs.

Per the announcement, starting from 08:00 UTC on Aug. 4, users will benefit from zero maker and taker fees for BTC/FDUSD spot and margin trades through the Zero-Fee Bitcoin Trading Program. Additionally, users can trade ETH/FDUSD with zero maker fee, while the standard taker fee will apply based on the user’s VIP level.

The trading volume for BTC/FDUSD spot and margin trading pairs is not included in the VIP tier volume calculation or the Liquidity Providers programs, enhancing the trading experience for users.

“BNB discounts, referral rebates, and any other adjustments will not apply to the BTC/FDUSD spot and margin trading pairs during the promotion.”

The recently introduced stablecoin, First Digital USD (FDUSD), scheduled to be listed on Binance on July 26, 2023, at 8:00 am UTC, was postponed until 2:00 pm UTC on July 26 due to FDUSD pairs’ liquidity providers experiencing technical issues.

In March, Binance concluded its zero-fee Bitcoin trading program and Binance USD (BUSD) zero-maker fee promotion, shifting to the lesser-known TrueUSD (TUSD) stablecoin from BUSD. This change, along with the removal of Tether (USDT) from the zero-fee program, led to a significant drop in Binance’s market share and trading volumes by over 50%. Consequently, the prices of cryptocurrencies, such as BTC and ETH, remained under pressure after the alteration.

Related: Binance’s CZ warns crypto community about emerging scam

First Digital USD is backed by Hong Kong-based custodian and trust company First Digital. The group announced the launch of the United States dollar-pegged FDUSD on June 1. FDUSD’s market cap of $257 million is still low compared to other stablecoins, such as USDT, TUSD, BUSD and TerraClassicUSD (USTC). Thus, it will not have much impact on the crypto market now, but minting new FDUSD amid demand from Binance can cause a significant boost in market cap.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Multichain saga screws users, Binance fires 1,000 staff: Asia Express

Stocks could sink into a bear-market. Here are five signals on when it likely starts.

U.S. stock have been touching fresh yearly highs, but a recessionary bear market is still likely to hit, according to Tyler Richey, co-editor at Sevens Report Research.

The Dow Jones Industrial Average

DJIA,

and S&P 500 index

SPX,

on Monday closed at fresh 2023 highs, while ending less than 4.5% off their record levels, according to Dow Jones market data.

“We continue to respect the rally and acknowledge the trend in equities is still higher, but we remain ‘patient bears’ with regard to stocks given the deeply inverted yield curve,” Richey wrote in a Monday report.

“We view the fact that most Treasury spreads have inverted to levels not seen since the early 1980s as a clear warning sign that the more than 500 basis points of Fed rate hikes in less than 18 months was way too much for the economy to weather,” noted Richey.

There are five signs that could help investors identify the onset of a recessionary bear market for stocks, Richey said.

Read: The ‘narrow breadth’ chorus has fallen silent. What broadening participation in stock-market rally means for investors.

A bull steeper of the yield curve: Investors should watch for a sharp bull-steepening dynamic in the yield curve, especially if the spread between the 10-year

TMUBMUSD10Y,

and 2-year Treasury

TMUBMUSD02Y,

moves above -83 basis points, as it would be the first step toward a further steepening dynamic, said Richey. The 2-year Treasury yield was at 4.85% on Monday, while the 10-year was closer to 3.96%, according to FactSet.

A bull steepener refers to a shift in the yield curve caused by short-term interest rates falling faster than long-term rates, due to the expected Federal Reserve rate cuts to prop up a faltering economy.

A considerable widening of high yield spreads: It should be viewed as a warning sign if the ICE BofA U.S. High Yield Spread rises more than 100 basis points from its current levels toward 5%, noted Richey. The spread stood nearly 3.8% above the risk-free Treasury rate as of July 28, according to Federal Reserve Economic Data.

A meaningful rise in the VIX confirmed by a spike in the Put/Call Ratio in the derivatives market. A significant increase in the Cboe Volatility Index

VIX,

a measure of the level of implied volatility of a range of options based on the S&P 500

SPX,

would indicate a rising options demand. Meanwhile, a sudden rise in the put/call ratio would show that the demand is for puts suggesting downside protection, instead of calls. Put options give investors the right to sell a stock, while call options grant them the right to buy a stock.

Backwardation in the term structure of the VIX: If front month VIX futures rise above back month futures prices, it might be showing that sophisticated investors are increasing their hedging demand, Richey noted.

A sharp rise in the dollar index. “The timing of this one is a little trickier as a safe-haven bid in the dollar can develop after equities peak, but a firming dollar would offer clear confirmation of riskoff money flows gripping global markets,” Richey wrote. Investors should watch for a break above dollar’s

DXY,

late-May high of 104.2, against a basket of rival currencies, which could indicate further upside for the greenback, noted Richey.

A banner for the Mediterranean restaurant chain Cava is displayed outside of the New York Stock Exchange (NYSE) as the company goes public on June 15, 2023 in New York City.

Spencer Platt | Getty Images

Shares of Mediterranean restaurant chain Cava soared as much as 117% in its market debut Thursday.

The company’s stock closed at $43.78 per share, up from its opening trade of $42 per share. Its closing price gives it a market value of $4.88 billion and makes it the top-performing IPO this year for companies valued above $500 million.

Cava Group priced its IPO at $22 per share on Wednesday, above the expected range of $19 to $20. The company sold 14.4 million shares, raising nearly $318 million and initially valuing the restaurant chain at roughly $2.45 billion.

The stock trades on the New York Stock Exchange under the ticker symbol “CAVA.”

Although it was founded in 2006, Cava opened its first fast-casual location in 2011, modeling its build-your-own Mediterranean meals after the formula made popular by Chipotle Mexican Grill. The chain built a customer base by introducing some eaters to ingredients like harissa and tahini and positioning itself as a healthy and convenient option. The company also sells its dips, spreads and salad dressings in grocery stores.

Cava acquired Zoes Kitchen in 2018, taking the rival Mediterranean chain private for $300 million. It’s spent the last five years converting Zoes Kitchen locations into Cava restaurants, contributing to its footprint of 263 locations as of April 16.

Last year, Cava’s net sales climbed to $564.1 million, 12.8% higher than the year earlier.

“You’re seeing the inflection point in the business, and all of that robust structure we’ve invested in, the restaurant growth, starting to take hold and drive tailwinds to the business,” CEO Brett Schulman said on CNBC’s “Squawk on the Street.”

But its losses also widened from $37.4 million in 2021 to $59 million in 2022.Still, industry experts say that the chain has demonstrated a clear path to profitability, making it more attractive for investors looking for growth stocks. In the first quarter, it reported a net loss of $2.1 million, narrower than its $20 million net loss in the year-ago period.

The restaurant company plans to use the proceeds from its IPO for new location openings and general corporate purposes.

Cava adds to the growing number of publicly traded fast-casual chains. Sector leader Chipotle made its public market debut back in 2006 and has seen its market value grow to $56.9 billion.

More recently, salad chain Sweetgreen went public in November 2021. It now has a market value of $1.2 billion. Investors have dinged the stock for the company’s lack of profit, although shares have climbed more than 25% this year.

Cava’s debut could inspire other restaurant chains to follow its lead, helping to snap the IPO market’s drought. Brazilian steakhouse Fogo De Chao and Korean barbecue chain Gen Restaurant Group have both filed regulatory paperwork confidentially, while both Panera Bread and Fat Brands’ Twin Peaks have shared an intent to issue an initial public offering in the near future.

EU starts countdown to crypto legislation, adds MiCA to official journal

On June 9, the European Union’s Markets in Crypto-Assets (MiCA) legislation was published in the Official Journal of the European Union (OJEU). This triggers the countdown for the law to come into effect from Dec. 30, 2024.

The regulations, signed into law on May 31 after first being introduced in 2020, aim to create a consistent regulatory framework for crypto assets among European Union member states.

While the rules officially come into force within 20 days of publication, the rules will start to apply on Dec. 30, 2024, with some parts of the legislation coming into effect six months earlier, on June 30, 2024.

Cryptocurrency service providers and proponents alike have hailed the legislation for creating a single market environment across Europe in terms of regulatory requirements and operating procedures.

Key components of the MiCA legislation include registration and authorization requirements for issuers of cryptocurrencies, exchanges and wallet providers.

Related: EU to use blockchain for educational and professional credential verification

As per the rules, stablecoin issuers must meet certain security and risk mitigation requirements, while cryptocurrency custody services must ensure sufficient security and safety measures to address potential cybersecurity and operational failures.

The legislation also provides a framework to prevent market abuse, insider trading and manipulative behavior in the cryptocurrency space.

In the meantime, crypto markets and operators in the United States are coming under pressure after the Securities and Exchange Commission initiated regulatory action against crypto exchanges Binance and Coinbase.

Both exchanges are being sued on multiple counts, including failure to register as licensed brokers and offering unregistered securities.

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?